A Bridge Too Far

Diunggah oleh

Manraj Lidhar0 penilaian0% menganggap dokumen ini bermanfaat (0 suara)

21 tayangan8 halamanauditing

Hak Cipta

© © All Rights Reserved

Format Tersedia

PDF atau baca online dari Scribd

Bagikan dokumen Ini

Apakah menurut Anda dokumen ini bermanfaat?

Apakah konten ini tidak pantas?

Laporkan Dokumen Iniauditing

Hak Cipta:

© All Rights Reserved

Format Tersedia

Unduh sebagai PDF atau baca online dari Scribd

0 penilaian0% menganggap dokumen ini bermanfaat (0 suara)

21 tayangan8 halamanA Bridge Too Far

Diunggah oleh

Manraj Lidharauditing

Hak Cipta:

© All Rights Reserved

Format Tersedia

Unduh sebagai PDF atau baca online dari Scribd

Anda di halaman 1dari 8

contig ies es, 6... 1938208 9

A bridge too far: a common conceptual

framework for commercial and public

benefit entities

Sheila Ellwood and Sue Newbury*

Abstract — Writers ant standard seters have propounded the adoption of privat sector farmeworks forthe public

‘sector. Ellwood (2003) examined the appatent “bridge” between td acres the sectors provided by UK GAAP and,

© concluded that much work needed to be undertaken on the thearetical uaderpioning of Whole of Government

‘Accounts. bu WG is progressing presuring the commercial model. There has been recent debate in the Antipodes

‘as to whether concepttal frameworks can be commmon forthe private nd the public and not-for-profit sectors or

‘whether such claimed commoraly isa sham (Newberry, 2002)” In the UK, the Accounting Standards Boaid (ASB)

has produced a reinierpretation ofthe Statement of Prteipes for public benett entities This paper investigates the

‘proposed Statement of Principles fr public benefit entities (SoPpbe). There appeas fo bean inherent unasitbiliy

‘ofthe enstent private sector framework for wansference rouble benefit entities" The balance sheet foous ad che

assumed objective of wealth cieaion ave incomprehensibi ina public a no-ft-proitconext. Changes in publi

service management embodied within New Public Management (NPM) led to the ascendancy of accnials account

ing but this does not necessarily permit the adoption of (eintesprted) private sector canceplval fmework. Tis

concluded that the differences are so fnéanentl th

{i misleading celaim ihe adopsion af & common bridging

fremework and it is misguided to stugele o achieve one. The differences will aways make such an euvleavout

"bridge too fa,

1, Introduction

‘The adoption of private seetor financial frame-

‘works has been argued to be appropriate for public

sector entities (Likierman, 1998; McGregor, 1999)

and some countries e.g. Australia and New

Zealand have adopted one conceptual framework

aczoss the sectors. In the UK, the ASB issued a

raft interpretation of its Statement of Principles

on Financial Reporting for ‘public benefit entities’

in 2003 followed by an Exposure Draft in 2005.

Accounting standards developed for profit-ori-

centated entities have been applied in public sector

entities in the UK for several years (Ellwood,

2002) and the International Federation of

‘Accountants (IFAC) is currently adapting IASs for

the public sector. However, Ellwood (2003:119)

caiticised the diversity of approach and the lack of

«a clear underpinning framework in the UK public

sector

SUK GAAP may provide the basis for a bridge

‘cross the public sector (and between the public

and private sector) but the public sector perspec-

tive needs to be firmly incorporated and defin

The authors are, respectively, athe Univesiy of Warwick

‘and the Univesity of Syeney- They are indebted tow anany”

‘mous referees for helpful comments on earlier deft of tis

paper Correspondence should be adéressed to Dr Ellwood st

‘Warwick Business School, Univesity of Warwick, Coventry

CN4TAL UK. E-mail sheila eliwood @vbs ae.

The fil vision ofthis paper was accepted in snus 2006,

ns and principles reworked to provide an ap-

propriate conceptual framework for the diverse

UK public sector."

Nevertheless, Whole of Government Accounts

(WGA) is progressing before the underlying con-

ceptual framework has been thoroughly addressed,

We take a UK perspective and examine whether

the reinterpreted commercial SoP, the Statement of

Principles for public benefit entities (SoPpbe) pro-

vides an appropriate bridge.

‘The UK Accounting Standards Board (ASB) ap-

pears to take the view that a transaction is atrans-

action and it should be accounted for in the same

way by all types of organisations. This view as-

serts that the nature of assets, liabilities, revenues,

‘and expenses, gains and losses does not change be-

cause they are held by the public, instead of by the

private, sector. The ASB proposes using basically

the same accounting rules and reporting model for

a business (‘the commercial model’) and non-prof-

it-making bodies or to use the ASB’s nomenclature

public benefit entities (PBESs).

We argue that public sector entities are different

from businesses. Business accounting standard-et-

ters do not consider the specific nature and role of

public service organisations. Business firms do not

levy taxes or provide goods freely to customers.

‘The accounting rules for public service organisa~

tions and their reporting model should be different

from those of cominereial firms, ‘There are no im-

mutable accounting or financial-reporting rales

‘The FASB (1978.2) defines a concept

work for accounting 35

3. The distinctiveness of public sector

‘accounting

‘There are many unique public sector

which a coneepe

‘Any re-expression, change of emphasis or ati-

‘ions othe principles are des

‘more releva

‘The SoP covees many facets of secountng: the Jefferson, as quoted by

EEE

2

ACCOUNTING AND BUSINESS RESEARCH

Ve 38. No 1205

Table

“The re-expreson of principles nthe SaF pe

Principle os expressed in SP

Sapty a ocr

event cf tees vena oe

‘ewan of management

asus intrest sited for ovperhip vest

‘Soualag panes subsite for owners

“Table contin)

‘The escxprsson of principles in the SePpbe

Procite as expensed in SOP

‘Chaptee§ Recogaition in Fnanclal statements

‘Chapter 6 Measurement in final statesents

ment’ duty tobe publicly ae

2 democrat sete)

36.801. 206

ACCOUNTING AND BUSINESS RESEARCH

aay Drab oral

1 1381 ee

Covering Tapas

Investor ana Ivesors Funders and

‘rettor vendor

Supplies

| Resouce provides Graves Unters Lenders Levtere

| Ovnighttecas Overnight

Coos Noes The poblic ‘The pie “The pubic

{

Bonsfiires’ ——Canonere

Brployees

‘oe bold ype azar the rimay clas of wet

Sones: Ashen (1978), Doane (1981), ASB (1859: 205 an 205)

haces

euos examining the

counting statements of 7

cst organetions. The SaPpoe recognises tht

That is notto say

soning dors a

4 decision-making ele

ACCOUNTING AND BUSINESS RESEARCH 36.1 206

Tables

1 is ules (electorate? taxpayere? or gover

(GASB Granda reporting objectives

meat

i gvemen' uy foe polly aeceamtble and shld ~

fon to detemine whether cue year eventes were

sous vce mnu wer cb nc in i

dye abou ase Semon

necessary 0 eatemine whee the en's petion

te yeas ope

sericea can be rode by he gover

igen a ay econo ae

bleed ses oles ‘he oppor

No

Courterprs, For examples an

oth the SoP andthe SoBpbe a6

* ACCOUNTING AND BUSINESS RESEARCH 2 3.e.1308

concepaual framework is appropriate tothe unique

MU ANU HUSINESS RESEARCH

Praspees Nes a7PEE fo Be te mes profitable © the objectives of Manca) aeounbi

enterpit in tho actin rots. ser needs. Likjecman

ends

Vl 35. Ne. aos

‘etated bythe IASB and inthe frameworks of

Aliviéval counties such as the SoP Ca

ey ate

ve, thee ate many ue pad.

tances Io whieh a conceptual

ste. Fundamental dite

ecogition’ when compared ith

‘The SoPpbe recognises

ferent, Arobus

Iramewesk ae

hes advanced remarkably

‘and there have been

Acovniog Stasdacs Booed. (200

doesnot peat to ave beh ae

4. Conclusions

Gn reworks purport provide s theo.

‘etal underpinning for Fnac eoporting sn)

of theo, meget an sana’, Prile Money ond

in

ACCOUNTING AND BUSINESS RESEARCH

Earnings management within Europe: the

effects of member state audit environment,

audit firm quality and international capital

markets

Steven J. Majjoor and Ann Vanstraelen*

Anda mungkin juga menyukai

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryDari EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryPenilaian: 3.5 dari 5 bintang3.5/5 (231)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)Dari EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Penilaian: 4.5 dari 5 bintang4.5/5 (121)

- Grit: The Power of Passion and PerseveranceDari EverandGrit: The Power of Passion and PerseverancePenilaian: 4 dari 5 bintang4/5 (588)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaDari EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaPenilaian: 4.5 dari 5 bintang4.5/5 (266)

- The Little Book of Hygge: Danish Secrets to Happy LivingDari EverandThe Little Book of Hygge: Danish Secrets to Happy LivingPenilaian: 3.5 dari 5 bintang3.5/5 (399)

- Never Split the Difference: Negotiating As If Your Life Depended On ItDari EverandNever Split the Difference: Negotiating As If Your Life Depended On ItPenilaian: 4.5 dari 5 bintang4.5/5 (838)

- Shoe Dog: A Memoir by the Creator of NikeDari EverandShoe Dog: A Memoir by the Creator of NikePenilaian: 4.5 dari 5 bintang4.5/5 (537)

- The Emperor of All Maladies: A Biography of CancerDari EverandThe Emperor of All Maladies: A Biography of CancerPenilaian: 4.5 dari 5 bintang4.5/5 (271)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeDari EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifePenilaian: 4 dari 5 bintang4/5 (5794)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyDari EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyPenilaian: 3.5 dari 5 bintang3.5/5 (2259)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersDari EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersPenilaian: 4.5 dari 5 bintang4.5/5 (344)

- Rise of ISIS: A Threat We Can't IgnoreDari EverandRise of ISIS: A Threat We Can't IgnorePenilaian: 3.5 dari 5 bintang3.5/5 (137)

- Team of Rivals: The Political Genius of Abraham LincolnDari EverandTeam of Rivals: The Political Genius of Abraham LincolnPenilaian: 4.5 dari 5 bintang4.5/5 (234)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreDari EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You ArePenilaian: 4 dari 5 bintang4/5 (1090)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceDari EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RacePenilaian: 4 dari 5 bintang4/5 (895)

- Her Body and Other Parties: StoriesDari EverandHer Body and Other Parties: StoriesPenilaian: 4 dari 5 bintang4/5 (821)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureDari EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FuturePenilaian: 4.5 dari 5 bintang4.5/5 (474)

- The Unwinding: An Inner History of the New AmericaDari EverandThe Unwinding: An Inner History of the New AmericaPenilaian: 4 dari 5 bintang4/5 (45)

- The Yellow House: A Memoir (2019 National Book Award Winner)Dari EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Penilaian: 4 dari 5 bintang4/5 (98)

- On Fire: The (Burning) Case for a Green New DealDari EverandOn Fire: The (Burning) Case for a Green New DealPenilaian: 4 dari 5 bintang4/5 (73)

- Assignment 1Dokumen10 halamanAssignment 1Manraj Lidhar100% (5)

- NotesDokumen4 halamanNotesManraj LidharBelum ada peringkat

- Lecture Notes - Hedge AccountingDokumen5 halamanLecture Notes - Hedge AccountingManraj LidharBelum ada peringkat

- L Tutorial QuestionDokumen2 halamanL Tutorial QuestionManraj LidharBelum ada peringkat

- L-Hedge Accounting Example - Lecture IllustrationDokumen1 halamanL-Hedge Accounting Example - Lecture IllustrationManraj LidharBelum ada peringkat

- AssignmentDokumen4 halamanAssignmentManraj Lidhar100% (1)

- Course OutlineDokumen15 halamanCourse OutlineManraj LidharBelum ada peringkat

- L FinancialinstrumentsDokumen38 halamanL FinancialinstrumentsManraj LidharBelum ada peringkat

- Financial StatementDokumen2 halamanFinancial StatementManraj LidharBelum ada peringkat

- Professional Level - Essentials ModuleDokumen6 halamanProfessional Level - Essentials Modulesteve_ottoman6997Belum ada peringkat

- DR Subhash Appana - Public Sector Reforms and Democracy The Case of FijiDokumen14 halamanDR Subhash Appana - Public Sector Reforms and Democracy The Case of FijiIntelligentsiya HqBelum ada peringkat

- Acc 811 PaperDokumen15 halamanAcc 811 PaperManraj LidharBelum ada peringkat

- p1 2007 Dec QDokumen6 halamanp1 2007 Dec QTeeluck VickyBelum ada peringkat

- CapaDokumen2 halamanCapaManraj LidharBelum ada peringkat

- HRM 703 Ii, 2012Dokumen7 halamanHRM 703 Ii, 2012Manraj LidharBelum ada peringkat

- A Conceptual Framework For Not-For-profit Sustainability Renovation or ReconstructionDokumen20 halamanA Conceptual Framework For Not-For-profit Sustainability Renovation or ReconstructionManraj LidharBelum ada peringkat

- Department of Management, Industrial Relations and OHS HRM703 - Human Resource Management and Development Final Exam: Trimester I, 2012Dokumen8 halamanDepartment of Management, Industrial Relations and OHS HRM703 - Human Resource Management and Development Final Exam: Trimester I, 2012Manraj LidharBelum ada peringkat

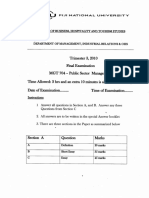

- College of Business, Hospitality and Tourism Studies: Question PaperDokumen4 halamanCollege of Business, Hospitality and Tourism Studies: Question PaperManraj LidharBelum ada peringkat

- A Conceptual Framework For Not-For-profit Sustainability Renovation or ReconstructionDokumen20 halamanA Conceptual Framework For Not-For-profit Sustainability Renovation or ReconstructionManraj LidharBelum ada peringkat

- Question Paper: InstructionsDokumen5 halamanQuestion Paper: InstructionsManraj LidharBelum ada peringkat

- HRM 703 Human Resource Management & DevelopmentDokumen4 halamanHRM 703 Human Resource Management & DevelopmentManraj LidharBelum ada peringkat

- MGT 704 - T3-2010Dokumen4 halamanMGT 704 - T3-2010Manraj LidharBelum ada peringkat

- Hrm703: Human Resource Management & Development T3 2015 Page 1 Turn OverDokumen5 halamanHrm703: Human Resource Management & Development T3 2015 Page 1 Turn OverManraj LidharBelum ada peringkat

- MGT 704 - T2-2010Dokumen3 halamanMGT 704 - T2-2010Manraj LidharBelum ada peringkat

- CapaDokumen2 halamanCapaManraj LidharBelum ada peringkat

- Audits Internal Control and Record KeepingDokumen4 halamanAudits Internal Control and Record KeepingManraj LidharBelum ada peringkat

- Civil Services ReformDokumen13 halamanCivil Services ReformKartika JoshiBelum ada peringkat

- DR Subhash Appana - Public Sector Reforms and Democracy The Case of FijiDokumen14 halamanDR Subhash Appana - Public Sector Reforms and Democracy The Case of FijiIntelligentsiya HqBelum ada peringkat

- Legal System in Diff CountriesDokumen1 halamanLegal System in Diff CountriesManraj LidharBelum ada peringkat