Examples of Loan Transactions

Diunggah oleh

Vimal AnbalaganHak Cipta

Format Tersedia

Bagikan dokumen Ini

Apakah menurut Anda dokumen ini bermanfaat?

Apakah konten ini tidak pantas?

Laporkan Dokumen IniHak Cipta:

Format Tersedia

Examples of Loan Transactions

Diunggah oleh

Vimal AnbalaganHak Cipta:

Format Tersedia

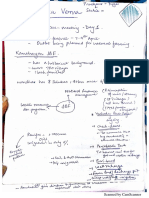

Loan transactions

EXAMPLE 1

A company borrows 100 @ 10% per annum on 1/4/2009. The loan is repayable

in 10 equal quarterly installments together with interest due. The first installment is due

on 30th June 2009.

Accounting entry on 1/4/2009:

A+E=L+OE+R Bank (current a/c) - asset 100

Loan - Liability 100

1. What is the total amount due/payable on 30th June 2009? How much is the

interest and principal?

2. What is the total interest expense for the period 1-4-2009 to 31-3-2010?

3. What is the outstanding loan amount as on 31-3-2010?

In order to answer the above questions, a loan repayment schedule is to be

prepared as shown below. As part of principal is being paid every quarter,

the amount of interest goes on reducing - "Reducing Balance Method".

Year Quarter Quarter Opening Interest Loan Total Closing

End Date Balance of for the Repayment Payment Balance of

Loan Quarter Loan

2009-10 1 30/06/09 100 2.50 10 12.50 90

2 30/09/09 90 2.25 10 12.25 80

3 31/12/09 80 2.00 10 12.00 70

4 31/03/10 70 1.75 10 11.75 60

Year Total 8.50 40.00

Answer 1: The total amount due/payable as on 30th June 2009 is 12.50, of which 2.50 is

interest and 10 is principal.

Accounting entry on 30/6/09:

A+E=L+OE+R Interest -Expense 2.5

Bank - asset -12.5

Loan - liability -10

Answer 2: The total interest expense for 2009-10 is 8.50

Answer 3: The outstanding loan amount as on 31/3/10 is 60.

EXAMPLE 2

A company borrows 100 @ 10% per annum on 1/1/2009. Its financial year is April to March.

The loan is repayable in 10 equal half-yearly installment together with interest. The first

installment is due on 30th June 2009.

1. Is there any interest entry for 2008-09 that would end on 31/3/09?

2. What is the amount payable on 30th June 2009?

3. What is the total interest for 2009-10?

4. What is interest payable and closing balance of loan on 31/3/2010?

Answer 1: The interest for the period 1-1-2009 to 31-3-2009 is accrued (under accrual concept)

on 31/3/09 but not due for payment till 30/6/2009 (in the next financial year).

The company needs to book interest expense for

this period and create a liability called "INTEREST ACCRUED BUT NOT DUE" which would

appear in the balance sheet as at 31/3/09.

Please note that in previous example interest was accrued and due for payment at the respective

quarter end dates.

Accounting entry on 31/3/09:

A+E=L+OE+R Interest -Expense 2.5 (100*0.1/4)

Interest accrued but not due (Liabi) 2.5

Answer 2: The amount payable on 30/6/09 includes interest for the period 1/1/09 to

31/3/09 of 2.50 (for which liability is already created) plus interest for the period 1/4/09 to 30/6/09 of 2.50

plus principal of 10. The total amount would be 15.

Accounting entry on 30/6/09:

A+E=L+OE+R Interest -Expense 2.5 for the period 1-4-09 to 30-6-09

Bank - asset -15

Interest accrued but not due (Liabi) -2.5 Liability is paid off

Loan - liability -10

Answer 3: The interest for 1/4/09 to 30/6/09 is 2.50. On this date, principal of 10 is paid and hence,

loan outstanding on 30/6/09 is 90. The interest for the period 1-7-09 to 31-12-09 would be on 90 @ 10% and

this would be (90*0.1)/2 i.e. 4.50. Another 10 would be paid on 31/12/09 and the loan balance would be 80.

The interest for the period 1-1-10 to 31-3-10 would be on 80 @ 10% and this would be (80*0.1)/4 i.e. 2.00

Thus, the total interest for 2009-10 would be 2.50+4.50+2.00 = 9.00.

Answer 4: The interest for the period 1-1-10 to 31-3-10 is again accrued but not due for payment.

Hence, interest payable as on 31/3/10 would be 2.00. The closing balance of loan as on 31/3/10 is 80.

Accounting entry on 31/12/09:

A+E=L+OE+R Interest -Expense 4.5

Bank - asset -14.5

Loan - liability -10

Accounting entry on 31/3/10:

A+E=L+OE+R Interest -Expense 2

Interest accrued but not due (Liabi) 2

Anda mungkin juga menyukai

- Basic Data EntryDokumen12 halamanBasic Data EntryVimal Anbalagan0% (1)

- Financial Modelling and Analysis Using Microsoft Excel - For Non Finance PersonnelDari EverandFinancial Modelling and Analysis Using Microsoft Excel - For Non Finance PersonnelBelum ada peringkat

- Financial MathematicsDokumen81 halamanFinancial MathematicsSharmishtha Saxena67% (3)

- Frankwood Question Bank DSEDokumen19 halamanFrankwood Question Bank DSEAu Tsz Man50% (4)

- Credit Profile Report: Product SheetDokumen8 halamanCredit Profile Report: Product SheetPendi AgarwalBelum ada peringkat

- Financial Risk Management: A Simple IntroductionDari EverandFinancial Risk Management: A Simple IntroductionPenilaian: 4.5 dari 5 bintang4.5/5 (7)

- Request LetterDokumen2 halamanRequest LetterprahladjoshiBelum ada peringkat

- High-Q Financial Basics. Skills & Knowlwdge for Today's manDari EverandHigh-Q Financial Basics. Skills & Knowlwdge for Today's manBelum ada peringkat

- OBLICON (Atty Rachel Castro)Dokumen23 halamanOBLICON (Atty Rachel Castro)KrisLarrBelum ada peringkat

- MATH1510 Financial Mathematics I: Jitse Niesen University of Leeds January - May 2012Dokumen20 halamanMATH1510 Financial Mathematics I: Jitse Niesen University of Leeds January - May 2012YoungJamesBelum ada peringkat

- CHAPTER 3 Financial Markets and InstitutionsDokumen13 halamanCHAPTER 3 Financial Markets and InstitutionsMichelle Rodriguez Ababa100% (4)

- Hull OFOD10e MultipleChoice Questions and Answers Ch07Dokumen7 halamanHull OFOD10e MultipleChoice Questions and Answers Ch07Kevin Molly KamrathBelum ada peringkat

- Judicial Foreclosure ExplainedDokumen10 halamanJudicial Foreclosure ExplainedJuris PoetBelum ada peringkat

- AccountStatement 3617454636 Jul16 124804 PDFDokumen3 halamanAccountStatement 3617454636 Jul16 124804 PDFVimal AnbalaganBelum ada peringkat

- AccountStatement 3617454636 Jul16 124804 PDFDokumen3 halamanAccountStatement 3617454636 Jul16 124804 PDFVimal AnbalaganBelum ada peringkat

- Enterprise TechDokumen4 halamanEnterprise TechNatalie Daguiam100% (2)

- Chapter 9 Test Bank PDFDokumen11 halamanChapter 9 Test Bank PDFCharmaine Cruz0% (1)

- Basic Ratemaking - Chapter 4 - Lesson 2Dokumen23 halamanBasic Ratemaking - Chapter 4 - Lesson 2djqBelum ada peringkat

- ACCT8144 - Accounting For ManagersDokumen4 halamanACCT8144 - Accounting For ManagersManoesia DjakartaBelum ada peringkat

- Notes-All Session 1Dokumen12 halamanNotes-All Session 1datcu2802Belum ada peringkat

- FA1 Chapter 1 EngDokumen21 halamanFA1 Chapter 1 EngYong ChanBelum ada peringkat

- Discounting of Bills بعد التعديلDokumen9 halamanDiscounting of Bills بعد التعديلAhmed GemyBelum ada peringkat

- Financial MathematicsDokumen81 halamanFinancial MathematicsMuhammad Shifaz MamurBelum ada peringkat

- Long Term Liabilities Exercise - PR 1Dokumen4 halamanLong Term Liabilities Exercise - PR 1Freya EvangelineBelum ada peringkat

- DiscfacDokumen3 halamanDiscfacapi-3855915Belum ada peringkat

- Borrowing CostsDokumen8 halamanBorrowing CostsgadlampumeBelum ada peringkat

- Calculating Default RatesDokumen7 halamanCalculating Default RatesLori WhitakerBelum ada peringkat

- A Note On DurationDokumen3 halamanA Note On Durationpriyank0407Belum ada peringkat

- Reporting and Analyzing Long-Term Liabilities: © The Mcgraw-Hill Companies, Inc., 2010 Mcgraw-Hill/IrwinDokumen47 halamanReporting and Analyzing Long-Term Liabilities: © The Mcgraw-Hill Companies, Inc., 2010 Mcgraw-Hill/IrwinYvonne Teo Yee VoonBelum ada peringkat

- Government and NFP Accounting Assignment IIDokumen3 halamanGovernment and NFP Accounting Assignment IIeferemBelum ada peringkat

- Government and NFP Accounting Assignment IIDokumen3 halamanGovernment and NFP Accounting Assignment IIeferemBelum ada peringkat

- Acc Ch-7 Average Due Date SaDokumen15 halamanAcc Ch-7 Average Due Date SaShivaSrinivas100% (3)

- Seminar 10 PrepQDokumen6 halamanSeminar 10 PrepQAlim OsmanBelum ada peringkat

- Riddhi Ca 2Dokumen8 halamanRiddhi Ca 2Umar KardameBelum ada peringkat

- CH 10 Accruals and PrepaymentsDokumen8 halamanCH 10 Accruals and PrepaymentsBuntheaBelum ada peringkat

- W2 Time Value of MoneyDokumen20 halamanW2 Time Value of Moneyasif rahanBelum ada peringkat

- FCS5510 Unit07 Selected Problems and AnswersDokumen1 halamanFCS5510 Unit07 Selected Problems and AnswersTonie NascentBelum ada peringkat

- Analyzing Cash Flows & NPV of Projects S & RDokumen10 halamanAnalyzing Cash Flows & NPV of Projects S & RUsama HakeemBelum ada peringkat

- Monetary Theory AnalysisDokumen109 halamanMonetary Theory Analysismspandey2000Belum ada peringkat

- FINS2624 Final Exam 2010 Semester 2Dokumen22 halamanFINS2624 Final Exam 2010 Semester 2AnnabelleBelum ada peringkat

- 644 - Corporate Finance SolutionDokumen7 halaman644 - Corporate Finance Solutionrayan.wydouwBelum ada peringkat

- Sir Eric Module 1Dokumen10 halamanSir Eric Module 1Joshua Cedrick DicoBelum ada peringkat

- Past Exam QuestionsDokumen8 halamanPast Exam QuestionsKelvin ChenBelum ada peringkat

- Yield To Maturity Accrued Interest Quoted Price Invoice PriceDokumen28 halamanYield To Maturity Accrued Interest Quoted Price Invoice PriceHenry ChouBelum ada peringkat

- Hhtfa8e ch01 SMDokumen67 halamanHhtfa8e ch01 SMharryBelum ada peringkat

- Nanyang Business School AB1201 Financial Management Tutorial 4: Bonds and Their Valuation (Common Questions)Dokumen3 halamanNanyang Business School AB1201 Financial Management Tutorial 4: Bonds and Their Valuation (Common Questions)asdsadsaBelum ada peringkat

- ENG233 Ch2Dokumen34 halamanENG233 Ch2Mikaela PadernaBelum ada peringkat

- CH 10Dokumen87 halamanCH 10Chang Chan ChongBelum ada peringkat

- L T +liabilitiesDokumen18 halamanL T +liabilitiesTaha EjazBelum ada peringkat

- vW3 bb4EEemddAqBQMk Og Module-6-Example-Cases-SolutionsDokumen53 halamanvW3 bb4EEemddAqBQMk Og Module-6-Example-Cases-SolutionsSonali AgarwalBelum ada peringkat

- Long-Term Liabilities SummaryDokumen18 halamanLong-Term Liabilities SummaryMustafa Bin ShakeelBelum ada peringkat

- Finance Case 1Dokumen2 halamanFinance Case 1jessevanderendeBelum ada peringkat

- Accounting Chapter 10Dokumen11 halamanAccounting Chapter 10Andrew ChouBelum ada peringkat

- Answers To L 20Dokumen6 halamanAnswers To L 20api-261894355Belum ada peringkat

- Accounting For RevenuesDokumen7 halamanAccounting For Revenuesvijayranjan1983Belum ada peringkat

- MIT Sloan School of Management: Saving 2Dokumen4 halamanMIT Sloan School of Management: Saving 2junaid1626Belum ada peringkat

- Corporate Finance Course Problem Set SolutionsDokumen3 halamanCorporate Finance Course Problem Set Solutionsa12021017Belum ada peringkat

- Test Your Knowledge - Ratio AnalysisDokumen29 halamanTest Your Knowledge - Ratio AnalysisMukta JainBelum ada peringkat

- Mock Board Fin Acctg Vol 2Dokumen24 halamanMock Board Fin Acctg Vol 2Allen Fey De Jesus67% (3)

- P10Dokumen7 halamanP10auliciBelum ada peringkat

- Investment Accounts: Basic ConceptsDokumen13 halamanInvestment Accounts: Basic ConceptsDebasis KarBelum ada peringkat

- Ois XDokumen27 halamanOis XlalitamesurBelum ada peringkat

- 2019 - Final Exam Corporate ValuationDokumen11 halaman2019 - Final Exam Corporate ValuationShivam SharmaBelum ada peringkat

- Financial Analyst P8nov09exampaperDokumen20 halamanFinancial Analyst P8nov09exampaperNhlanhla2011Belum ada peringkat

- Mathematics of Finance FormulasDokumen29 halamanMathematics of Finance FormulasTareq IslamBelum ada peringkat

- Chapter 10 PowerPointDokumen89 halamanChapter 10 PowerPointcheuleeeBelum ada peringkat

- Long-Term LiabilitiesDokumen20 halamanLong-Term Liabilitiesshanky1124Belum ada peringkat

- GR12 Business Finance Module 9-10Dokumen7 halamanGR12 Business Finance Module 9-10Jean Diane JoveloBelum ada peringkat

- Latihan Soal Ia - Week 6Dokumen3 halamanLatihan Soal Ia - Week 6esterBelum ada peringkat

- Tracking ToolkitDokumen1 halamanTracking ToolkitVimal AnbalaganBelum ada peringkat

- Open Ended QuestionsDokumen1 halamanOpen Ended QuestionsVimal AnbalaganBelum ada peringkat

- Questions For Non-User Questions For UserDokumen5 halamanQuestions For Non-User Questions For UserVimal AnbalaganBelum ada peringkat

- Aravind TechDokumen1 halamanAravind TechVimal AnbalaganBelum ada peringkat

- AccountStatement 3617454636 Jun15 112814Dokumen2 halamanAccountStatement 3617454636 Jun15 112814Vimal AnbalaganBelum ada peringkat

- Anova CompetitorsDokumen22 halamanAnova CompetitorsVimal AnbalaganBelum ada peringkat

- Key Words For Each Problem StatementDokumen1 halamanKey Words For Each Problem StatementVimal AnbalaganBelum ada peringkat

- Aravind TechDokumen1 halamanAravind TechVimal AnbalaganBelum ada peringkat

- Questions For Non-User Questions For UserDokumen5 halamanQuestions For Non-User Questions For UserVimal AnbalaganBelum ada peringkat

- Chennai JigarthanthaDokumen10 halamanChennai JigarthanthaVimal AnbalaganBelum ada peringkat

- Assumption of Problem StatementsDokumen1 halamanAssumption of Problem StatementsVimal AnbalaganBelum ada peringkat

- Tracking ToolkitDokumen1 halamanTracking ToolkitVimal AnbalaganBelum ada peringkat

- Assumption of Problem StatementsDokumen1 halamanAssumption of Problem StatementsVimal AnbalaganBelum ada peringkat

- Chennai JigarthanthaDokumen10 halamanChennai JigarthanthaVimal AnbalaganBelum ada peringkat

- Assumption of Problem StatementsDokumen1 halamanAssumption of Problem StatementsVimal AnbalaganBelum ada peringkat

- AccountStatement 3617454636 Jun15 112814Dokumen2 halamanAccountStatement 3617454636 Jun15 112814Vimal AnbalaganBelum ada peringkat

- Anova CompetitorsDokumen22 halamanAnova CompetitorsVimal AnbalaganBelum ada peringkat

- Mango Pulp Manufacturing Unit: Group 7 Ashwin - Madhumitha - Neha - Seshadri - VimalDokumen16 halamanMango Pulp Manufacturing Unit: Group 7 Ashwin - Madhumitha - Neha - Seshadri - VimalVimal AnbalaganBelum ada peringkat

- Open Ended QuestionsDokumen1 halamanOpen Ended QuestionsVimal AnbalaganBelum ada peringkat

- Key Words For Each Problem StatementDokumen1 halamanKey Words For Each Problem StatementVimal AnbalaganBelum ada peringkat

- 5 ANBALAGAN Vimal - Manmade Diamonds CaseDokumen12 halaman5 ANBALAGAN Vimal - Manmade Diamonds CaseVimal AnbalaganBelum ada peringkat

- 2014-15 Pulses Production Arhar/Tur Chana Lentil Moong Urad Matar Assam 20 420Dokumen9 halaman2014-15 Pulses Production Arhar/Tur Chana Lentil Moong Urad Matar Assam 20 420Vimal AnbalaganBelum ada peringkat

- RIM Phase 1 NotesDokumen18 halamanRIM Phase 1 NotesVimal AnbalaganBelum ada peringkat

- Indian Institute of Management Ahmedabad Mail - FW - Booking Confirmation On IRCTC, Train - 22692, 26-Apr-2019, 3A, NZM - SBCDokumen2 halamanIndian Institute of Management Ahmedabad Mail - FW - Booking Confirmation On IRCTC, Train - 22692, 26-Apr-2019, 3A, NZM - SBCVimal AnbalaganBelum ada peringkat

- Aditya Et Al-2017-Asia & The Pacific Policy StudiesDokumen13 halamanAditya Et Al-2017-Asia & The Pacific Policy StudiesVimal AnbalaganBelum ada peringkat

- Process Flow Chart for Canned Alphonso Mango Pulp (39 charactersDokumen2 halamanProcess Flow Chart for Canned Alphonso Mango Pulp (39 charactersCassie BooBelum ada peringkat

- NORWEGIAN SCHOOL OF ECONOMICS CONTACT AND PROGRAM DETAILSDokumen2 halamanNORWEGIAN SCHOOL OF ECONOMICS CONTACT AND PROGRAM DETAILSVimal AnbalaganBelum ada peringkat

- Financial Statement Analysis of Habib BankDokumen87 halamanFinancial Statement Analysis of Habib Bankhelperforeu56% (9)

- Documentary Stamp TaxDokumen6 halamanDocumentary Stamp TaxchrizBelum ada peringkat

- Business Finance Chapter 1Dokumen23 halamanBusiness Finance Chapter 1Cresca Cuello Castro100% (1)

- Bankruptcy Outline - Pottow 2011Dokumen125 halamanBankruptcy Outline - Pottow 2011LastDinosaur1100% (2)

- Home Loan Project Final (Arun)Dokumen64 halamanHome Loan Project Final (Arun)Munjaal RavalBelum ada peringkat

- Accounting Standard Notes by Anand R. BhangariyaDokumen96 halamanAccounting Standard Notes by Anand R. BhangariyaSanjana SharmaBelum ada peringkat

- Study GuideDokumen80 halamanStudy Guidefatin batrisyiaBelum ada peringkat

- Power Grid AGM Notice and Annual Report for FY 2018-19Dokumen361 halamanPower Grid AGM Notice and Annual Report for FY 2018-19Uday KumarBelum ada peringkat

- 4C 1Dokumen9 halaman4C 1lalalololalaBelum ada peringkat

- Francia vs. Intermediate Appellate Court (G.R. No. 67649, June 28,1988)Dokumen1 halamanFrancia vs. Intermediate Appellate Court (G.R. No. 67649, June 28,1988)Kent UgaldeBelum ada peringkat

- What Distinguishes Money From Other Assets in The Economy?: Week 3 QuestionsDokumen6 halamanWhat Distinguishes Money From Other Assets in The Economy?: Week 3 QuestionsWaqar AmjadBelum ada peringkat

- Dark Sister, The 4.7.5Dokumen88 halamanDark Sister, The 4.7.5Irina AprioteseiBelum ada peringkat

- Jan Notices Q 12 15 09Dokumen200 halamanJan Notices Q 12 15 09TRISTARUSABelum ada peringkat

- Bab 14Dokumen83 halamanBab 14Dias Farenzo PuthBelum ada peringkat

- Bibliography Financial CrisisDokumen41 halamanBibliography Financial CrisisaflagsonBelum ada peringkat

- Financial Crisis. Frederic MishkinDokumen24 halamanFinancial Crisis. Frederic MishkinLuciano VillegasBelum ada peringkat

- Question No 02: Calculate Market Value of Equity For A 100% Equity Firm, Using Following Information Extracted From ItsDokumen7 halamanQuestion No 02: Calculate Market Value of Equity For A 100% Equity Firm, Using Following Information Extracted From ItsrafianazBelum ada peringkat

- Financial Education Workbook-IX - RemovedDokumen46 halamanFinancial Education Workbook-IX - RemovedDaksh ChapadiyaBelum ada peringkat

- The Cost of CollegeDokumen12 halamanThe Cost of Collegeapi-284073874Belum ada peringkat

- PD 198 Provincial Water Utilities Act of 1973 CompleteDokumen96 halamanPD 198 Provincial Water Utilities Act of 1973 CompleteCatherine Marie ReynosoBelum ada peringkat

- November 15Dokumen16 halamanNovember 15MLastTryBelum ada peringkat

- Case Analyses Direction: Discuss The Given Cases Thoroughly. (40 Points: 8 Items X 5 Points) 1. Flow of FundsDokumen4 halamanCase Analyses Direction: Discuss The Given Cases Thoroughly. (40 Points: 8 Items X 5 Points) 1. Flow of FundsAsh kaliBelum ada peringkat

- Court rules conjugal partnership not liable for husband's surety agreement as debt not for benefit of partnershipDokumen393 halamanCourt rules conjugal partnership not liable for husband's surety agreement as debt not for benefit of partnershipQuennie Jane SaplagioBelum ada peringkat