Green Financing Program - DBP

Diunggah oleh

bioenergy0 penilaian0% menganggap dokumen ini bermanfaat (0 suara)

61 tayangan2 halamanGreen Financing Program - DBP

Hak Cipta

© © All Rights Reserved

Format Tersedia

PDF, TXT atau baca online dari Scribd

Bagikan dokumen Ini

Apakah menurut Anda dokumen ini bermanfaat?

Apakah konten ini tidak pantas?

Laporkan Dokumen IniGreen Financing Program - DBP

Hak Cipta:

© All Rights Reserved

Format Tersedia

Unduh sebagai PDF, TXT atau baca online dari Scribd

0 penilaian0% menganggap dokumen ini bermanfaat (0 suara)

61 tayangan2 halamanGreen Financing Program - DBP

Diunggah oleh

bioenergyGreen Financing Program - DBP

Hak Cipta:

© All Rights Reserved

Format Tersedia

Unduh sebagai PDF, TXT atau baca online dari Scribd

Anda di halaman 1dari 2

Loan Features

For more information, please contact:

Maximum Loanable Amount FVP PAUL D. LAZARO

Private corporations/enterprises/ Head, FIELD-Development Sector

cooperatives/associations Phone: (02) 818-9511 local 3310/3311

867-3233

- up to 80% of total project cost E-mail: pdlazaro@dbp.ph

LGUs/GOCCs/GA

- up to 90% of total project cost SAVP ANITA C. SALAYON

Head, Environment Unit-FIELD

Phone: (02) 819-1409 / 818-9511 local 2356

Equity Participation E-mail: acsalayon@dbp.ph

Private corporations/enterprises/

cooperatives/associations MGR. MARICHELLE F. CORACHEA

- minimum of 20% of total project cost Head, AWPPCS Team-Environment Unit

Phone: (02) 819-1409 / 818-9511 local 2356

LGUs/GOCCs/GA E-mail: mfcorachea@dbp.ph

- minimum of 10% of total project cost

MGR. JONA KRISTEL T. LUARDO

Interest Rate Head, SHWM Team-Environment Unit

Phone: (02) 893-3551 / 818-9511 local 2346

Prevailing market rate E-mail: jktluardo@dbp.ph

Repayment Terms

Up to fifteen (15) years with maximum of

five (5) years grace period

Basic Documentary Requirements

Letter of Intent

Company Information/Profile

Audited Financial Statements (past 3 years)

Feasibility Study or Project Proposal

Applicable Environmental Permits (e.g.

ECC/CNC)

Note: Additional documents may be required based on

the nature of the project.

Government Owned and Controlled

Corporations (GOCCs) Climate Change Adaptation and Mitigation and

Government Agencies (where allowed) Disaster Risk Reduction

Water Districts/Private Service Providers Greenhouse gas (GHG) emission

Cooperatives/Associations reduction/avoidance projects

Private Financial Institutions (PFIs)/ Disaster risk reduction projects

Microfinance Institutions (MFIs)

Other Environmental/ Green Projects/ Initiatives

Eligible Projects Technologies/systems/facilities/

Program Description ELIGIBLE BORROWERS INTEREST RATE

equipment/devices for environmental

Air Pollution

Participating Cooperatives

Prevention and NGOs

and Control Maximum of 8% p.a. for cooperatives

monitoring

The Green Financing Program is DBPs umbrella Green

MSME Transport/Green

members Mobility

of contributing Direct/retail

Environmental

lending laboratories

shall be based on

program to support the Banks strategic thrust of Cooperatives

Installationand

of equipment/devices/facilities that prevailing

Occupational

environmental protection and the countrys green NGOs interest rate and safety

health

prevent

Partnership or reduce air pollution improvement project

growth strategy. Urban greening (e.g. urban parks with

Corporation SECURITY

The CSF Program is a credit enhancement scheme Water Pollution Prevention and Control dense greenery)

The program was designed primarily to assist Sanitation Credit Surety Fund

Installation (CSF)technologies

of green cover

developed

strategic by theindustries

sectors, Bangko Sentral ng Pilipinas.

and local government

The program aims to increase the credit

TYPE OF FACILITYrehabilitation and maintenance of

Clean-up, Risk-Sharing

Eco-tourismRatio of 80:20 (Surety vs. DBP)

projects

units in adopting environment-friendly processes water bodies LetterRenewable

of Suretyenergy

Coverage shall be required

worthiness

and of micro,

technologies andsmall and medium

incorporating climate

1. For CSF

Installation/upgrading

Member Cooperative of wastewater onlyWater supply

prior to loan availment/ release

change adaptation

enterprises (MSMEs) and mitigation

which and disaster

are experiencing treatment systems/facilities

risk reduction measuresloans

by providing financing - Credit Line for Sub-Loan to Borrowers

difficulties in obtaining from banks due to, Eligible Expenditures

and technical assistance. REPAYMENT TERMS

among others, the lack of acceptable collaterals, Solid and Hazardous Waste Management

2. For Cooperative

Waste storage,or collection

Coop Members

and transport Based on the enterprises

Capital Investments cash flow, but in no case

credit knowledge

Program Objectivesand credit track records.

- Credit

includingLine for Working

collection Capital

vehicles and related shall repayment be moreconstruction,

- Installation, than five (5) years.

equipment

- Term Loan for: maintenance, rehabilitation,

Under the program, ainFund

To contribute shall be

improving pooled from

environmental a. Construction of sanitary landfills including expansion, improvement or upgrading

quality forof a cleaner and healthier Building/Plant Construction LOAN REQUIREMENTS

the contributions participating cooperatives acquisition of equipment for waste disposal of physical assets and facilities

environment by helpingfromthe private and b. Acquisition of Equipment

and counterpart contributions the Local Closure and rehabilitation of existing - Acquisition of equipment

public sectors finance investments that 1. Credit Line for Cooperatives

Government Units (LGUs) and financial dumpsites Initial Working Capital

enable them to comply with AMOUNT OF CREDIT

Materials LINEfacility/composting

recovery FOR COOPERATIVES facility/ - Prototype design, testing and

institutions including DBP

environmental and

laws, Industrialand

regulations AND ITSrecycling

MEMBERS facility a. Certificate of Registration from the

production

Guarantee Loan Fund (IGLF). This will serve as

standards; Hazardous

Shall not exceed / Health

ten (10)care waste

times management

the amount of its -Cooperative

Marketing and promotion

Development activities

Authority (CDA),

To

security forcontribute

loans extended by banks

in reducing to MSMEs,

the carbon facilities (treatment/processing/disposal) (e.g. participation in Green Trade

total contribution to CSF or the maximum amount By-Laws & Articles of Cooperation including

in lieu offootprint

acceptable of industrial operations and

collaterals. Waste-to-energy/Waste-to-fuel Shows andifExhibitions)

projects of both the private and eligible for CSF surety cover, whichever is lower. Amendments, any

- Financing production of booked sales

government sectors; and b. List of Incumbent Board of Directors,

DBP CREDIT SURETY FUND (CSF) Resource Conservation, Resource Efficiency and orders/purchase order financing

To contribute in improving adaptive AMOUNT OF LOAN TO MEMBERS

Cleaner Production addresses

Consulting&Services

contactsuch

numbers

as cost of eco-

CREDITcapacities

FACILITY of human communities to

The DBP-Credit Surety Fund with

Facility supports the Green

Shall not exceed ten (10) times the amount of his/

building/construction/property c. Certificate of Good Standing

design, preparation fromstudy

of feasibility CDA

enable them to cope environmental managementto the cooperative or the

her contribution d. and detailed

Financial engineering

Statements (pastdesign

3 years)

CSF Program

hazards ofincluding

BSP. It isclimate-related

a loan facility that

risks Energyamount

maximum efficiency

eligible for CSF surety cover, e. Transaction

Copy of the Costs for CDM

Guidelines or cooperatives

of the other

provides while in pursuitneeds

the financing of green growth.

of the CSF members whichever

Installation of systems/equipment to conserve carbon crediting mechanism

is lower. credit process and sub-borrower loan

for the conduct of economic and gainful activities. resources such as energy, water and raw Refinancing of eligible existing operational

Eligible Borrowers availment procedures, duly certified by the

materials projects, provided that it is in addition to

Installation of cleaner production Secretary

a new loanofproposal

the Cooperative

for an eligible project

Private Corporations/Enterprises technologies/facilities/equipment

Local Government Units (LGUs)

Anda mungkin juga menyukai

- Securities and Exchange Commission: Sec Form 17-A, As AmendedDokumen4 halamanSecurities and Exchange Commission: Sec Form 17-A, As AmendedbioenergyBelum ada peringkat

- AWS vs. Azure vs. Google: Cloud Comparison (2019 Update)Dokumen16 halamanAWS vs. Azure vs. Google: Cloud Comparison (2019 Update)bioenergy67% (3)

- CMCC Technology Vision 2020 Plus White PaperDokumen28 halamanCMCC Technology Vision 2020 Plus White PaperbioenergyBelum ada peringkat

- Ec 005Dokumen43 halamanEc 005abdulraufhccBelum ada peringkat

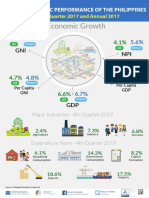

- PH Econ Performance Infographic 2017 - PSADokumen1 halamanPH Econ Performance Infographic 2017 - PSAbioenergyBelum ada peringkat

- DIgital Silk RoadDokumen19 halamanDIgital Silk RoadbioenergyBelum ada peringkat

- PH National Organic Agri Program - NOAP 2012-2016Dokumen79 halamanPH National Organic Agri Program - NOAP 2012-2016bioenergyBelum ada peringkat

- Nutritionally Adequate Menu For FilipinosDokumen12 halamanNutritionally Adequate Menu For Filipinosbioenergy100% (1)

- Smart Contracts and Distributed Ledger A Legal Perspective PDFDokumen23 halamanSmart Contracts and Distributed Ledger A Legal Perspective PDFMatías José Vukusic WilliamsBelum ada peringkat

- RA - 10173-Data - Privacy - Act - of - 2012 IRR - v.072716 PDFDokumen40 halamanRA - 10173-Data - Privacy - Act - of - 2012 IRR - v.072716 PDFbioenergyBelum ada peringkat

- Government Procurement Reform Act SummaryDokumen24 halamanGovernment Procurement Reform Act SummaryAnonymous Q0KzFR2i0% (1)

- The Billionaire of Bodog - Living The DreamDokumen4 halamanThe Billionaire of Bodog - Living The DreambioenergyBelum ada peringkat

- MLN PPT V1.0 OfficialDokumen46 halamanMLN PPT V1.0 OfficialbioenergyBelum ada peringkat

- A Man Whose Vision Changed The World: Seymour CrayDokumen4 halamanA Man Whose Vision Changed The World: Seymour CraybioenergyBelum ada peringkat

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeDari EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifePenilaian: 4 dari 5 bintang4/5 (5794)

- The Little Book of Hygge: Danish Secrets to Happy LivingDari EverandThe Little Book of Hygge: Danish Secrets to Happy LivingPenilaian: 3.5 dari 5 bintang3.5/5 (399)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceDari EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RacePenilaian: 4 dari 5 bintang4/5 (890)

- Shoe Dog: A Memoir by the Creator of NikeDari EverandShoe Dog: A Memoir by the Creator of NikePenilaian: 4.5 dari 5 bintang4.5/5 (537)

- Grit: The Power of Passion and PerseveranceDari EverandGrit: The Power of Passion and PerseverancePenilaian: 4 dari 5 bintang4/5 (587)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureDari EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FuturePenilaian: 4.5 dari 5 bintang4.5/5 (474)

- The Yellow House: A Memoir (2019 National Book Award Winner)Dari EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Penilaian: 4 dari 5 bintang4/5 (98)

- Team of Rivals: The Political Genius of Abraham LincolnDari EverandTeam of Rivals: The Political Genius of Abraham LincolnPenilaian: 4.5 dari 5 bintang4.5/5 (234)

- Never Split the Difference: Negotiating As If Your Life Depended On ItDari EverandNever Split the Difference: Negotiating As If Your Life Depended On ItPenilaian: 4.5 dari 5 bintang4.5/5 (838)

- The Emperor of All Maladies: A Biography of CancerDari EverandThe Emperor of All Maladies: A Biography of CancerPenilaian: 4.5 dari 5 bintang4.5/5 (271)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryDari EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryPenilaian: 3.5 dari 5 bintang3.5/5 (231)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaDari EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaPenilaian: 4.5 dari 5 bintang4.5/5 (265)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersDari EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersPenilaian: 4.5 dari 5 bintang4.5/5 (344)

- On Fire: The (Burning) Case for a Green New DealDari EverandOn Fire: The (Burning) Case for a Green New DealPenilaian: 4 dari 5 bintang4/5 (72)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyDari EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyPenilaian: 3.5 dari 5 bintang3.5/5 (2219)

- Rise of ISIS: A Threat We Can't IgnoreDari EverandRise of ISIS: A Threat We Can't IgnorePenilaian: 3.5 dari 5 bintang3.5/5 (137)

- The Unwinding: An Inner History of the New AmericaDari EverandThe Unwinding: An Inner History of the New AmericaPenilaian: 4 dari 5 bintang4/5 (45)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreDari EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You ArePenilaian: 4 dari 5 bintang4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)Dari EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Penilaian: 4.5 dari 5 bintang4.5/5 (119)

- Her Body and Other Parties: StoriesDari EverandHer Body and Other Parties: StoriesPenilaian: 4 dari 5 bintang4/5 (821)

- Historia de la Lengua Inglesa Prof. Dr. J.L. Martínez-Dueñas Espejo TERMINOLOGICAL GLOSSARY OF HISTORICAL LINGUISTICSDokumen8 halamanHistoria de la Lengua Inglesa Prof. Dr. J.L. Martínez-Dueñas Espejo TERMINOLOGICAL GLOSSARY OF HISTORICAL LINGUISTICSLaura Rejón LópezBelum ada peringkat

- Salary Slip (30864740 April, 2019)Dokumen1 halamanSalary Slip (30864740 April, 2019)Hassan RanaBelum ada peringkat

- Chapter Three: Business Plan PreparationDokumen26 halamanChapter Three: Business Plan PreparationwaqoleBelum ada peringkat

- 01) Nordic Asia V CADokumen2 halaman01) Nordic Asia V CAAlfonso Miguel LopezBelum ada peringkat

- Nicmar - Project Formulation and AppraisalDokumen38 halamanNicmar - Project Formulation and Appraisalmansi shahBelum ada peringkat

- Executive Summary: 1.1 ObjectivesDokumen14 halamanExecutive Summary: 1.1 ObjectivesDo Minh TamBelum ada peringkat

- Tata Steel Reference SpreadsheetDokumen38 halamanTata Steel Reference SpreadsheetDeep Shikhar100% (1)

- Preparing Matching and Processing Receipts PDFDokumen52 halamanPreparing Matching and Processing Receipts PDFnigus90% (21)

- Group 2 Financing The Mozal ProjectDokumen10 halamanGroup 2 Financing The Mozal ProjectYohan100% (1)

- Basic Sample of Board of Directors Meeting MinutesDokumen2 halamanBasic Sample of Board of Directors Meeting MinutesGray House100% (1)

- Proposed Order Statement of Uncontroverted Facts and Conclusions of Law On LexisNexis Defendant's Motion For Summary Judgement Doc 491-2Dokumen26 halamanProposed Order Statement of Uncontroverted Facts and Conclusions of Law On LexisNexis Defendant's Motion For Summary Judgement Doc 491-2nocompromisewtruthBelum ada peringkat

- Investment PolicyDokumen10 halamanInvestment PolicyAvani SisodiyaBelum ada peringkat

- Channel Tunnel Project: Connecting England and FranceDokumen29 halamanChannel Tunnel Project: Connecting England and FranceKarthik ReddyBelum ada peringkat

- VP Finance CFO Controller in Los Angeles CA Resume Mark RussellDokumen3 halamanVP Finance CFO Controller in Los Angeles CA Resume Mark RussellMark RussellBelum ada peringkat

- Accounting For LeasingDokumen36 halamanAccounting For LeasingAKSHAJ GOENKABelum ada peringkat

- Rule 16-33 - Case DigestsDokumen38 halamanRule 16-33 - Case DigestsAldrich JoshuaBelum ada peringkat

- Contract 2017 ProjectDokumen16 halamanContract 2017 ProjectSuvarna RekhaBelum ada peringkat

- Agri Tools: Company Name - Live Life Produce-Areca Nut Shell Remover (Betel Nut)Dokumen8 halamanAgri Tools: Company Name - Live Life Produce-Areca Nut Shell Remover (Betel Nut)Sripad AtriBelum ada peringkat

- Syllabus Financial ManagemDokumen8 halamanSyllabus Financial ManagemNour LyBelum ada peringkat

- Role of e-Choupal in Rural MarketingDokumen72 halamanRole of e-Choupal in Rural MarketingAkshay MadharBelum ada peringkat

- QuizDokumen51 halamanQuizIndu GuptaBelum ada peringkat

- ABC Restaurant Income StatementDokumen3 halamanABC Restaurant Income StatementKAVYA GUPTABelum ada peringkat

- SGV and Co Presentation On TRAIN LawDokumen48 halamanSGV and Co Presentation On TRAIN LawPortCalls100% (8)

- ch15Dokumen45 halamanch15ChrohimeBelum ada peringkat

- Press On Kitchen IncubatorsDokumen21 halamanPress On Kitchen IncubatorsLucrece BorregoBelum ada peringkat

- Personal Training Terms &: ConditionsDokumen2 halamanPersonal Training Terms &: ConditionsAakash KoulBelum ada peringkat

- PassbookDokumen42 halamanPassbookCharles OkwalingaBelum ada peringkat

- Projected Year-End Financial Results - Third QuarterDokumen7 halamanProjected Year-End Financial Results - Third QuarterpkGlobalBelum ada peringkat

- NBFCDokumen17 halamanNBFCsagarg94gmailcom100% (1)

- Revenue Recognition – Franchise AccountingDokumen12 halamanRevenue Recognition – Franchise AccountingJhency Masim100% (1)