Overview

Diunggah oleh

Eng MohammedHak Cipta

Format Tersedia

Bagikan dokumen Ini

Apakah menurut Anda dokumen ini bermanfaat?

Apakah konten ini tidak pantas?

Laporkan Dokumen IniHak Cipta:

Format Tersedia

Overview

Diunggah oleh

Eng MohammedHak Cipta:

Format Tersedia

Overview

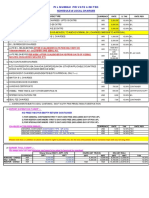

Strategy

for growth

Quality of Strong

earnings financial position

Gross profit from recurring revenues Debt management has been a key focal

was up 49% to AED 1.5 billion point for the Group over the last several

supported by the stabilisation of new years. Gross debt has reduced from

assets, predominantly Yas Mall and AED 13.8 billion two years ago to AED

the expanded residential portfolio. 6.0 billion as at 31 December 2015.

The increased contribution of recurring The balance sheet has been further

revenues also supported gross profit strengthened by collection of receivables

margins leading to a better underlying which has led to the further debt pay

quality of earnings. down and build up in cash, resulting in

a leaner and financially flexible balance

sheet today.

Gross profit from recurring revenues Debt paid down during 2015

+49%

TO AED 1.5 BN

3.1bn

AED

2 Aldar Annual Report 2015

Committed to Recurring revenue Demand for Aldar

shareholder returns assets reaching maturity developments

The 2015 proposed dividend was 10 fils, Our recurring revenue assets, Aldar announced three new

up from 9 fils in 2014, representing 11% which predominately include the development projects at CityScape

growth. From 2016, the Board has asset management business reached 2015, Meera, Mayan and West Yas.

approved a dividend policy based on stabilised, mature levels of occupancy These followed the successful sales

the underlying cash flow performance over the course of 2015. This launch of Al Merief in March 2015

of the business. This will be based on a stabilisation delivered 49% growth in which was fully sold off-market.

65-80% range of the distributable free recurring revenue gross profit during

cash flow from 100% owned investment the year. Off-plan sales were strong in 2015,

properties and operating businesses Aldar recorded AED 3.0 billion in

and a discretionary pay-out based on development sales across over 900

the realised cash profit of completed units. As at 31 December 2015, 73%

developments. This is a major change sold across all launched projects into

to the capital allocation strategy, the market.

demonstrating the groups ambition

to commit to shareholder returns.

2015 proposed dividend of 10 fils Occupancy reaching stable levels Development sales

+11%

FROM 2014

95% 98% 3bn

OFFICE RESIDENTIAL AED

96% 79%

YAS MALL HOTEL (2015 FY)

Annual Report 2015 Aldar 3

Anda mungkin juga menyukai

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryDari EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryPenilaian: 3.5 dari 5 bintang3.5/5 (231)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)Dari EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Penilaian: 4.5 dari 5 bintang4.5/5 (119)

- Never Split the Difference: Negotiating As If Your Life Depended On ItDari EverandNever Split the Difference: Negotiating As If Your Life Depended On ItPenilaian: 4.5 dari 5 bintang4.5/5 (838)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaDari EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaPenilaian: 4.5 dari 5 bintang4.5/5 (265)

- The Little Book of Hygge: Danish Secrets to Happy LivingDari EverandThe Little Book of Hygge: Danish Secrets to Happy LivingPenilaian: 3.5 dari 5 bintang3.5/5 (399)

- Grit: The Power of Passion and PerseveranceDari EverandGrit: The Power of Passion and PerseverancePenilaian: 4 dari 5 bintang4/5 (587)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyDari EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyPenilaian: 3.5 dari 5 bintang3.5/5 (2219)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeDari EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifePenilaian: 4 dari 5 bintang4/5 (5794)

- Team of Rivals: The Political Genius of Abraham LincolnDari EverandTeam of Rivals: The Political Genius of Abraham LincolnPenilaian: 4.5 dari 5 bintang4.5/5 (234)

- Rise of ISIS: A Threat We Can't IgnoreDari EverandRise of ISIS: A Threat We Can't IgnorePenilaian: 3.5 dari 5 bintang3.5/5 (137)

- Shoe Dog: A Memoir by the Creator of NikeDari EverandShoe Dog: A Memoir by the Creator of NikePenilaian: 4.5 dari 5 bintang4.5/5 (537)

- The Emperor of All Maladies: A Biography of CancerDari EverandThe Emperor of All Maladies: A Biography of CancerPenilaian: 4.5 dari 5 bintang4.5/5 (271)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreDari EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You ArePenilaian: 4 dari 5 bintang4/5 (1090)

- Her Body and Other Parties: StoriesDari EverandHer Body and Other Parties: StoriesPenilaian: 4 dari 5 bintang4/5 (821)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersDari EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersPenilaian: 4.5 dari 5 bintang4.5/5 (344)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceDari EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RacePenilaian: 4 dari 5 bintang4/5 (890)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureDari EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FuturePenilaian: 4.5 dari 5 bintang4.5/5 (474)

- The Unwinding: An Inner History of the New AmericaDari EverandThe Unwinding: An Inner History of the New AmericaPenilaian: 4 dari 5 bintang4/5 (45)

- The Yellow House: A Memoir (2019 National Book Award Winner)Dari EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Penilaian: 4 dari 5 bintang4/5 (98)

- Estatement 14147414747122Dokumen6 halamanEstatement 14147414747122bagalincur100% (1)

- On Fire: The (Burning) Case for a Green New DealDari EverandOn Fire: The (Burning) Case for a Green New DealPenilaian: 4 dari 5 bintang4/5 (73)

- Accounts Code K - U - K - 275 PagesDokumen277 halamanAccounts Code K - U - K - 275 PagesJayanti KumariBelum ada peringkat

- Risk and ReturnDokumen19 halamanRisk and ReturnLeny MichaelBelum ada peringkat

- Interface of Pandapos CounterDokumen63 halamanInterface of Pandapos CountersnadminBelum ada peringkat

- BLO Unit 1-1Dokumen24 halamanBLO Unit 1-1Mohammad MAAZBelum ada peringkat

- France: A Guide to its Geography, Government and CultureDokumen1 halamanFrance: A Guide to its Geography, Government and CultureEng MohammedBelum ada peringkat

- EmiratesDokumen1 halamanEmiratesEng MohammedBelum ada peringkat

- Google History: Founding and Growth of Tech GiantDokumen1 halamanGoogle History: Founding and Growth of Tech GiantEng MohammedBelum ada peringkat

- Energy Conversion and Management: G. Raveesh, R. Goyal, S.K. TyagiDokumen19 halamanEnergy Conversion and Management: G. Raveesh, R. Goyal, S.K. TyagiEng MohammedBelum ada peringkat

- Emirates Airline HistoryDokumen2 halamanEmirates Airline HistoryEng Mohammed0% (1)

- Applied Catalysis A: General: Masoud Zabeti, Wan Mohd Ashri Wan Daud, Mohamed Kheireddine ArouaDokumen6 halamanApplied Catalysis A: General: Masoud Zabeti, Wan Mohd Ashri Wan Daud, Mohamed Kheireddine ArouaMaria SiahaanBelum ada peringkat

- Citation NeededDokumen1 halamanCitation NeededEng MohammedBelum ada peringkat

- Burger King (BK) Is An American Global Insta-Burger King, ADokumen1 halamanBurger King (BK) Is An American Global Insta-Burger King, AEng MohammedBelum ada peringkat

- Renewable and Sustainable Energy Reviews: Namita Pragya, Krishan K. Pandey, P.K. SahooDokumen13 halamanRenewable and Sustainable Energy Reviews: Namita Pragya, Krishan K. Pandey, P.K. SahooEng MohammedBelum ada peringkat

- City-Region As 22.7 MillionDokumen1 halamanCity-Region As 22.7 MillionEng MohammedBelum ada peringkat

- Applied Catalysis A: General: Masoud Zabeti, Wan Mohd Ashri Wan Daud, Mohamed Kheireddine ArouaDokumen6 halamanApplied Catalysis A: General: Masoud Zabeti, Wan Mohd Ashri Wan Daud, Mohamed Kheireddine ArouaMaria SiahaanBelum ada peringkat

- Ijms 16 12871 PDFDokumen20 halamanIjms 16 12871 PDFEng MohammedBelum ada peringkat

- Biodiesel Production by Microalgal BiotechnologyDokumen9 halamanBiodiesel Production by Microalgal BiotechnologyMarina MondadoriBelum ada peringkat

- A Brief History of Money in Islam and Estimating The Value of Dirham and DinarDokumen17 halamanA Brief History of Money in Islam and Estimating The Value of Dirham and DinarEng MohammedBelum ada peringkat

- 1 s2.0 S0196890409000764 Main PDFDokumen7 halaman1 s2.0 S0196890409000764 Main PDFEng MohammedBelum ada peringkat

- Applied Catalysis A: General: Masoud Zabeti, Wan Mohd Ashri Wan Daud, Mohamed Kheireddine ArouaDokumen6 halamanApplied Catalysis A: General: Masoud Zabeti, Wan Mohd Ashri Wan Daud, Mohamed Kheireddine ArouaMaria SiahaanBelum ada peringkat

- 1Dokumen9 halaman1Eng MohammedBelum ada peringkat

- 1 s2.0 S0196890410002207 Main PDFDokumen12 halaman1 s2.0 S0196890410002207 Main PDFEng MohammedBelum ada peringkat

- ALD 25154 Annual Report 2015 enDokumen68 halamanALD 25154 Annual Report 2015 enEng MohammedBelum ada peringkat

- Applied Catalysis A: General: Masoud Zabeti, Wan Mohd Ashri Wan Daud, Mohamed Kheireddine ArouaDokumen6 halamanApplied Catalysis A: General: Masoud Zabeti, Wan Mohd Ashri Wan Daud, Mohamed Kheireddine ArouaMaria SiahaanBelum ada peringkat

- Fuel Processing Technology: Masoud Zabeti, Wan Mohd Ashri Wan Daud, Mohamed Kheireddine ArouaDokumen6 halamanFuel Processing Technology: Masoud Zabeti, Wan Mohd Ashri Wan Daud, Mohamed Kheireddine ArouaEng MohammedBelum ada peringkat

- The Student, The Private and The Professional Role: Students ' Social Media UseDokumen13 halamanThe Student, The Private and The Professional Role: Students ' Social Media UseEng MohammedBelum ada peringkat

- Sleep and Academic Performance HK Adolscents MAK Et Al. 2012 PDFDokumen7 halamanSleep and Academic Performance HK Adolscents MAK Et Al. 2012 PDFEng MohammedBelum ada peringkat

- IR Annual Report 2011-EnDokumen58 halamanIR Annual Report 2011-EnEng MohammedBelum ada peringkat

- 2910 11231 1 PB PDFDokumen7 halaman2910 11231 1 PB PDFAnjooBelum ada peringkat

- Social Media Social Media: Students Behaving Badly: by Meg HazelDokumen6 halamanSocial Media Social Media: Students Behaving Badly: by Meg HazelEng MohammedBelum ada peringkat

- 6 12Dokumen2 halaman6 12Eng MohammedBelum ada peringkat

- Social Media Social Media: Students Behaving Badly: by Meg HazelDokumen6 halamanSocial Media Social Media: Students Behaving Badly: by Meg HazelEng MohammedBelum ada peringkat

- Declaration On Cultural DiversityDokumen3 halamanDeclaration On Cultural DiversityW8Belum ada peringkat

- Invoice 2Dokumen1 halamanInvoice 2Dd GargBelum ada peringkat

- The Functions of Bangladesh BankDokumen10 halamanThe Functions of Bangladesh BankMd. Rakibul Hasan Rony93% (14)

- Pil Mumbai Private Limited: Schedule of Local ChargesDokumen1 halamanPil Mumbai Private Limited: Schedule of Local ChargesANMOL SUKHDEVEBelum ada peringkat

- Macro OoDokumen10 halamanMacro OoAitanaBelum ada peringkat

- 2024 ItsbaDokumen7 halaman2024 ItsbaNyesha GrahamBelum ada peringkat

- STMT 19680100009011 1673186518787Dokumen11 halamanSTMT 19680100009011 1673186518787prabha sureshBelum ada peringkat

- Review Exercises - Chapter 4Dokumen2 halamanReview Exercises - Chapter 4Jaskiràt NagraBelum ada peringkat

- 1) History: Evolution of Indian Banking SectorDokumen8 halaman1) History: Evolution of Indian Banking SectorPuneet SharmaBelum ada peringkat

- Global IME BankDokumen29 halamanGlobal IME BankSujan Bajracharya100% (2)

- Multiplier Effect ExplanationDokumen5 halamanMultiplier Effect Explanationfreaky mintyBelum ada peringkat

- PT Arwana Citramulia Tbk Consolidated Financial Statements 1H 2020Dokumen76 halamanPT Arwana Citramulia Tbk Consolidated Financial Statements 1H 2020hendraBelum ada peringkat

- Module Handbook 2020/2021: Banking Academy of Vietnam Finance FacultyDokumen9 halamanModule Handbook 2020/2021: Banking Academy of Vietnam Finance FacultyVõ Lê Khánh HuyềnBelum ada peringkat

- Card ConfirmationDokumen1 halamanCard Confirmationkilo6954Belum ada peringkat

- Economics of Pakistan BC214-Course Outline 2022Dokumen7 halamanEconomics of Pakistan BC214-Course Outline 2022Ahmad AkramBelum ada peringkat

- Tax invoice bill of supply cash memoDokumen1 halamanTax invoice bill of supply cash memoGhhhBelum ada peringkat

- Motilal OswalDokumen12 halamanMotilal OswalRajesh SharmaBelum ada peringkat

- Accounts Receivable and Estimation of AFBDDokumen1 halamanAccounts Receivable and Estimation of AFBDeia aieBelum ada peringkat

- F3 - Financial Strategy Practice Test AnswersDokumen5 halamanF3 - Financial Strategy Practice Test AnswersAtif RehmanBelum ada peringkat

- Sample Illustration Financial StatementDokumen3 halamanSample Illustration Financial StatementJuvy Jane DuarteBelum ada peringkat

- Test 10 - Problem 1Dokumen4 halamanTest 10 - Problem 1YhamBelum ada peringkat

- International Portfolio Investment Q & ADokumen7 halamanInternational Portfolio Investment Q & AaasisranjanBelum ada peringkat

- Chapter 5 QuizDokumen3 halamanChapter 5 QuizShannah100% (1)

- Name: - Section: - Schedule: - Class Number: - DateDokumen6 halamanName: - Section: - Schedule: - Class Number: - Datefelix felixBelum ada peringkat

- Company Introduction of Punjab Sind BankDokumen9 halamanCompany Introduction of Punjab Sind BankHarsh GogiaBelum ada peringkat

- Capitalized CostDokumen10 halamanCapitalized CostadvikapriyaBelum ada peringkat