Acquisition of Net Assets

Diunggah oleh

Yella Mae Pariña RelosJudul Asli

Hak Cipta

Format Tersedia

Bagikan dokumen Ini

Apakah menurut Anda dokumen ini bermanfaat?

Apakah konten ini tidak pantas?

Laporkan Dokumen IniHak Cipta:

Format Tersedia

Acquisition of Net Assets

Diunggah oleh

Yella Mae Pariña RelosHak Cipta:

Format Tersedia

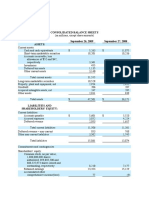

ACQUISITION OF NET ASSETS

The following Financial Position was prepared for ACT Corp and HBP Corp on January 1, 2016, just

before they entered into a business combination.

ACT Corp HBP Corp

Cash 210,000.00 5,000.00

Accounts Receivable 75,000.00 20,000.00

Inventory 200,000.00 50,000.00

Building and Equipment 400,000.00 100,000.00

Accumulated Depreciation (100,000.00) (25,000.00)

Goodwill 50,000.00

Accounts Payable 125,000.00 70,000.00

Bonds Payable 200,000.00 30,000.00

Common Stock

P30 par value 210,000.00

P20 par value 50,000.00

Additional Paid-in Capital 50,000.00 10,000.00

Retained Earnings 200,000.00 40,000.00

On that date, the fair market value of HBPs inventories and building and equipment were P78,000 and

P124,000 respectively, while bonds payable has a fair value of P42,000. The fair market value of all other

assets and liabilities of HBP (except for Goodwill) were equal to their book values. ACT Corp acquired the

net assets of HBP Corp by issuing 2,500 shares of its P30 par value common stock (current fair value P38

per share) and purchase price in cash amounting to P22,000. Contingent consideration that is

determinable (probable and reasonably estimated) amount to P3,000. Additional cash payments made

by ACT Corp in completing the acquisition were: Legal fees for contract for business combination,

P6,000; Accounting and Legal fees for SEC registration, P15,000; Printing costs of stock certificates,

P8,000; Finders fee, P7,000; Cost of maintaining a department, P2,000; General and Administrative,

P3,000.

Required:

Prepare journal entries in the books of ACT Corp and in the books of HBP Corp upon the

acquisition of net assets.

Prepare the balance sheet of ACT Corp after the acquisition of net assets.

Compute for the Total Assets, Total Liabilities and Total Stockholders Equity of ACT Corp

after the acquisition of net assets.

Anda mungkin juga menyukai

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)Dari EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Penilaian: 4.5 dari 5 bintang4.5/5 (121)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryDari EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryPenilaian: 3.5 dari 5 bintang3.5/5 (231)

- Grit: The Power of Passion and PerseveranceDari EverandGrit: The Power of Passion and PerseverancePenilaian: 4 dari 5 bintang4/5 (588)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaDari EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaPenilaian: 4.5 dari 5 bintang4.5/5 (266)

- Never Split the Difference: Negotiating As If Your Life Depended On ItDari EverandNever Split the Difference: Negotiating As If Your Life Depended On ItPenilaian: 4.5 dari 5 bintang4.5/5 (838)

- The Emperor of All Maladies: A Biography of CancerDari EverandThe Emperor of All Maladies: A Biography of CancerPenilaian: 4.5 dari 5 bintang4.5/5 (271)

- The Little Book of Hygge: Danish Secrets to Happy LivingDari EverandThe Little Book of Hygge: Danish Secrets to Happy LivingPenilaian: 3.5 dari 5 bintang3.5/5 (400)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeDari EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifePenilaian: 4 dari 5 bintang4/5 (5794)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyDari EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyPenilaian: 3.5 dari 5 bintang3.5/5 (2259)

- Shoe Dog: A Memoir by the Creator of NikeDari EverandShoe Dog: A Memoir by the Creator of NikePenilaian: 4.5 dari 5 bintang4.5/5 (537)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreDari EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You ArePenilaian: 4 dari 5 bintang4/5 (1090)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersDari EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersPenilaian: 4.5 dari 5 bintang4.5/5 (345)

- Team of Rivals: The Political Genius of Abraham LincolnDari EverandTeam of Rivals: The Political Genius of Abraham LincolnPenilaian: 4.5 dari 5 bintang4.5/5 (234)

- Her Body and Other Parties: StoriesDari EverandHer Body and Other Parties: StoriesPenilaian: 4 dari 5 bintang4/5 (821)

- Rise of ISIS: A Threat We Can't IgnoreDari EverandRise of ISIS: A Threat We Can't IgnorePenilaian: 3.5 dari 5 bintang3.5/5 (137)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceDari EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RacePenilaian: 4 dari 5 bintang4/5 (895)

- The Unwinding: An Inner History of the New AmericaDari EverandThe Unwinding: An Inner History of the New AmericaPenilaian: 4 dari 5 bintang4/5 (45)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureDari EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FuturePenilaian: 4.5 dari 5 bintang4.5/5 (474)

- On Fire: The (Burning) Case for a Green New DealDari EverandOn Fire: The (Burning) Case for a Green New DealPenilaian: 4 dari 5 bintang4/5 (74)

- The Yellow House: A Memoir (2019 National Book Award Winner)Dari EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Penilaian: 4 dari 5 bintang4/5 (98)

- Advanced Analysis and Appraisal of PerformanceDokumen7 halamanAdvanced Analysis and Appraisal of PerformanceAnn SalazarBelum ada peringkat

- Ch09 Tool KitDokumen45 halamanCh09 Tool KitNino NatradzeBelum ada peringkat

- Module Title: International Finance: Module Handbook 2020/21 Module Code: BMG704 (86966)Dokumen19 halamanModule Title: International Finance: Module Handbook 2020/21 Module Code: BMG704 (86966)Osman IqbalBelum ada peringkat

- Depreciation AccountingDokumen42 halamanDepreciation AccountingGaurav SharmaBelum ada peringkat

- BE2 Good Governance and Social ResponsibilityDokumen25 halamanBE2 Good Governance and Social ResponsibilityYella Mae Pariña RelosBelum ada peringkat

- Accountin 07-07 Cost Acctg 1Dokumen11 halamanAccountin 07-07 Cost Acctg 1Yella Mae Pariña RelosBelum ada peringkat

- Advanced Financial Accounting and Reporting (Partnership)Dokumen5 halamanAdvanced Financial Accounting and Reporting (Partnership)Mike C Buceta100% (1)

- TAX 1 - Income Tax - 1Dokumen8 halamanTAX 1 - Income Tax - 1Yella Mae Pariña RelosBelum ada peringkat

- Cost Behavior: Analysis and Use: Management Accounting (Volume I) - Solutions ManualDokumen19 halamanCost Behavior: Analysis and Use: Management Accounting (Volume I) - Solutions ManualYella Mae Pariña RelosBelum ada peringkat

- The Database AdministratorDokumen18 halamanThe Database AdministratorYella Mae Pariña RelosBelum ada peringkat

- This Is The Parts of Air Compressor After DismantlingDokumen5 halamanThis Is The Parts of Air Compressor After DismantlingYella Mae Pariña RelosBelum ada peringkat

- Derivatives & Hedging: RequiredDokumen1 halamanDerivatives & Hedging: RequiredYella Mae Pariña RelosBelum ada peringkat

- This Is The Parts of Air Compressor After DismantlingDokumen5 halamanThis Is The Parts of Air Compressor After DismantlingYella Mae Pariña RelosBelum ada peringkat

- MARE 201A Auxiliary Machinery 1Dokumen22 halamanMARE 201A Auxiliary Machinery 1Yella Mae Pariña RelosBelum ada peringkat

- Scientific Management: Scientific Management Studies and Tests Methods To Identify The Best, Most Efficient WaysDokumen20 halamanScientific Management: Scientific Management Studies and Tests Methods To Identify The Best, Most Efficient WaysYella Mae Pariña RelosBelum ada peringkat

- That Is The Casing of The Gear PumpDokumen3 halamanThat Is The Casing of The Gear PumpYella Mae Pariña RelosBelum ada peringkat

- Aline Aprille C. Mendez, MBA: Bachelor of Science in Business Administration Department Fairview, Quezon CityDokumen9 halamanAline Aprille C. Mendez, MBA: Bachelor of Science in Business Administration Department Fairview, Quezon CityYella Mae Pariña RelosBelum ada peringkat

- Business Administration Department: National College of Business and Arts Aline Aprille C. Mendez, MbaDokumen2 halamanBusiness Administration Department: National College of Business and Arts Aline Aprille C. Mendez, MbaYella Mae Pariña RelosBelum ada peringkat

- Mary Elijah P. Relos Vi-Matatag MR - Romando Vedra Math TeacherDokumen1 halamanMary Elijah P. Relos Vi-Matatag MR - Romando Vedra Math TeacherYella Mae Pariña RelosBelum ada peringkat

- Mary Elijah P. Relos VI-Matatag Q1 Q2 Q3 Q4 Q5 Total 20% First 10 7 8 6 10 41 8.2 Second 9 10 7 10 7 43 8.6 Third 7 8 6 9 10 40 8 Fourth 8 9 6 10 9 42 8.4Dokumen2 halamanMary Elijah P. Relos VI-Matatag Q1 Q2 Q3 Q4 Q5 Total 20% First 10 7 8 6 10 41 8.2 Second 9 10 7 10 7 43 8.6 Third 7 8 6 9 10 40 8 Fourth 8 9 6 10 9 42 8.4Yella Mae Pariña RelosBelum ada peringkat

- If I Were A VoiceDokumen1 halamanIf I Were A VoiceYella Mae Pariña Relos100% (1)

- KundimanDokumen1 halamanKundimanYella Mae Pariña RelosBelum ada peringkat

- Resignation Letter: To: Mr. Arden CabigasDokumen1 halamanResignation Letter: To: Mr. Arden CabigasYella Mae Pariña RelosBelum ada peringkat

- Nfjpia Mockboard 2011 p1 - With AnswersDokumen12 halamanNfjpia Mockboard 2011 p1 - With AnswersRhea SamsonBelum ada peringkat

- Approaches in Estimating National Income (Group 4)Dokumen6 halamanApproaches in Estimating National Income (Group 4)Yella Mae Pariña RelosBelum ada peringkat

- TAX 1 - 2nd Sem Income TaxDokumen8 halamanTAX 1 - 2nd Sem Income TaxYella Mae Pariña RelosBelum ada peringkat

- Cpa1 Financial Accounting Mock1Dokumen11 halamanCpa1 Financial Accounting Mock1Enos NyaosiBelum ada peringkat

- SYBCOM Management AccDokumen266 halamanSYBCOM Management AccVishnu Maya RaiBelum ada peringkat

- Tesda Accounting WorksheetDokumen4 halamanTesda Accounting WorksheetWinzkie Dumdumaya100% (1)

- Balance SheetDokumen25 halamanBalance SheetImran AhmedBelum ada peringkat

- Chapter 2 Capital Structure and Financial LeverageDokumen59 halamanChapter 2 Capital Structure and Financial Leverageabdirahman mohamedBelum ada peringkat

- Monitoring and Evaluating Business Operations Quarter 4-WEEK 1 EntrepreneurshipDokumen37 halamanMonitoring and Evaluating Business Operations Quarter 4-WEEK 1 EntrepreneurshipKristel Acordon100% (2)

- ACTSC 372 Assignment 4 S 2018Dokumen2 halamanACTSC 372 Assignment 4 S 2018shuBelum ada peringkat

- Financial Statement Analysis of Suzuki MotorsDokumen21 halamanFinancial Statement Analysis of Suzuki MotorsMuhammad AliBelum ada peringkat

- Contra AccountsDokumen10 halamanContra AccountsYara AzizBelum ada peringkat

- Temenos T24 IA: User GuideDokumen70 halamanTemenos T24 IA: User GuideVincentBelum ada peringkat

- University of Makati J.P. Rizal Ext. West Rembo, City of Makati College of Business and Financial ScienceDokumen16 halamanUniversity of Makati J.P. Rizal Ext. West Rembo, City of Makati College of Business and Financial ScienceKarla OñasBelum ada peringkat

- Model Exam 1Dokumen25 halamanModel Exam 1rahelsewunet0r37203510Belum ada peringkat

- AssignmentDokumen6 halamanAssignmentItsMaJGC37 CerezoBelum ada peringkat

- Exercises For Unit 4 Inventory ValuationDokumen3 halamanExercises For Unit 4 Inventory ValuationDr. Mohammad Noor AlamBelum ada peringkat

- Company A and Company B - Full and Partial Goodwill: RequiredDokumen3 halamanCompany A and Company B - Full and Partial Goodwill: RequiredKristine Esplana ToraldeBelum ada peringkat

- Parrino Corp Fin 5e PPT Ch16Dokumen51 halamanParrino Corp Fin 5e PPT Ch16astridBelum ada peringkat

- Assets: Tamala & Estrabilla Tuna Fish Buy and Sell Statement of Financial Position As of July 1, 20ADokumen2 halamanAssets: Tamala & Estrabilla Tuna Fish Buy and Sell Statement of Financial Position As of July 1, 20AAdam CuencaBelum ada peringkat

- Correcting The Trial Balance 2022Dokumen3 halamanCorrecting The Trial Balance 2022Charlemagne Jared RobielosBelum ada peringkat

- IFRS 13 Fair Value Measurement FCPA Dr. James McFie 2017Dokumen59 halamanIFRS 13 Fair Value Measurement FCPA Dr. James McFie 2017Rafik BelkahlaBelum ada peringkat

- Template 16 4 30 21Dokumen85 halamanTemplate 16 4 30 21Ahmad Juma SuleimanBelum ada peringkat

- LVMH 2020 Consolidated Financial StatementDokumen99 halamanLVMH 2020 Consolidated Financial StatementGEETIKA PATRABelum ada peringkat

- MSQ 1801 Introduction PDFDokumen4 halamanMSQ 1801 Introduction PDFmia uyBelum ada peringkat

- Erp PDF Mini 5Dokumen17 halamanErp PDF Mini 5Pedro DuarteBelum ada peringkat

- MOP-Capital Theory Assignment-020310Dokumen4 halamanMOP-Capital Theory Assignment-020310charnu1988Belum ada peringkat

- Test 2 SolutionDokumen8 halamanTest 2 SolutionFelicia ChinBelum ada peringkat