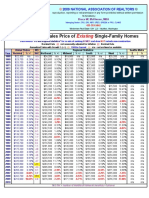

US National Association of Realtor Statistics: 1968-2008 Annual Home Appreciation Based On The Median Price of Homes Sold 6-25-08

Diunggah oleh

Bruce W. McKinnon MBAJudul Asli

Hak Cipta

Format Tersedia

Bagikan dokumen Ini

Apakah menurut Anda dokumen ini bermanfaat?

Apakah konten ini tidak pantas?

Laporkan Dokumen IniHak Cipta:

Format Tersedia

US National Association of Realtor Statistics: 1968-2008 Annual Home Appreciation Based On The Median Price of Homes Sold 6-25-08

Diunggah oleh

Bruce W. McKinnon MBAHak Cipta:

Format Tersedia

Bruce W.

McKinnon, MBA

Interest % USA : Annual % of Appreciation of Median Price of “ Existing ” Homes Associate Broker

CRS

CRS,, GRI

GRI,, ABR

ABR,, SRES

SRES,, e-PRO

PRO,, CLHMS

23.00 % Source: National Association of Realtors—Research ®

(425) 501 - 8625

“Nominal Price” Existing Home Appreciation: 1968 - 2007

22.00 % www.BruceMcKinnon.com

21.00 % Nothing down – pay what you want

20.00 % when you want = Foreclosures

Background: In order to reverse a recession in 2000,

19.00 % the FED began to drop the Federal Funds Rate (interest

18.00 % charged banks for overnight barrowing to comply with

Federal Reserve requirements). US Mortgage rates hit

17.00 % a 47 year low in June 2003. Household debt (as a % of

16.00 % income) rose to 130% in 2007 (100% a decade earlier).

Home ownership increased from 64% in 1994 to a peak

15.00 % of 69.2% in 2004 while home prices increased 124%

from 1997 to 2006. This resulted in a construction boom,

14.00 %

housing oversupply and a loosening of loan requirements

13.00 % coupled with an unprecedented volume of loans to high

risk borrowers with patchy credit histories (e.g., little or

12.00 %

no down payments, lower incomes and decreased credit

11.00 % scores from that of PRIME barrowers). Subprime

mortgages (5% of mortgage loans in 1994 - $35 billion)

10.00 % climbed to 20 % or $600 billion by 2006. The Result?

9.00 % A global financial CRISIS which burst the US Housing

9-11-2001 Bubble as new owners began to default on loans.

8.00 % NY Trade Center

Bombing Major Investments by financial institutions, foreign

7.00 % countries and corporations in historically conservative

low risk loans increased in volume from 54% in 2001

6.00 % to 75% in 2006. Subprime loan values climbed to

5.00 % $1.3 trillion in March 2007. Subprime ARM mortgages

(resetting at higher interest rates) were $400 billion in

4.00 % 2000 - $500 billion in 2008. While subprime ARM’s only

represented 6.8% of outstanding US home loans, they

3.00 %

were 43% of foreclosures that started during the 3rd

2.00 % quarter of 2007. The de-evaluation of once solid mort-

gage investments turned the global financial markets

1.00 % upside down (e.g., Bear Stearns). Given the increasing

.75 % price of oil and the increasing US national debt due to the

Iraq war and natural disasters (e.g., New Orleans), the

.50 % true negative impact of subprime lending on our economy

Nominal (not adjusted for inflation) yearly MEDIAN sale price (1/2 above—1/2 below) of existing US homes will only be measurable in the decades to come.

.25 %

Conclusion: For the first time since records were kept

0% in 1968, the median price of homes in 2007 decreased

from the year before. Given the tightening of credit due

Years ¨ 6 6 7 7 7 7 7 7 7 7 7 7 8 8 8 8 8 8 8 8 8 8 9 9 9 9 9 9 9 9 9 9 0 0 0 0 0 0 0 0 0 0 1 1 1 1 1 1 1 1 1 1

8 9 0 1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 to the subprime catastrophe, whether it takes a year or

two to reverse this housing trend is anybody’s guess.

Period ¨ 60 1970-1979 1980-1989 1990-1999 2000-2009 2010-2019 But this chart demonstrates the historical significance of

home investments. We do know this appreciation trend

8 5 7 7 8 1 1 7 1 1 1 1 6 2 3 2 4 6 6 4 5 2 5 2 3 4 3 4 5 5 3 4 6 7 7 8 1 1 1

USA 0 0 2 3 4 1 2

will resume and that an investment in the American

“nominal” Dream is clearly more predictable then the stock market.

4 5 8 6 2 9 7 1 6 9 2 3 6 3 9 8 5 7 4 0 0 7 2 4 8 3 3 0 5 3 3 8

Annual ¨ 6 0 3 6 4 7 3 3 6 5 3 6 5 1 9 9 8 6 1 2 4 5 5 3 1 3 8 9 2 3 2 2 1 2 2 2 1 2 0 Lesson Learned

Growth % 3 1 0 2 7 7 9 -

We don’t get something for nothing.

Yearly Average % N/A 10 years — 142 % 10 years — 52 % 10 years — 45 % 8+ years — 47.8% ?? years — ?? % = 984.08 % appreciation in 39 years

Information believed to be accurate though not

Anda mungkin juga menyukai

- Bruce McKinnon PhotoDokumen1 halamanBruce McKinnon PhotoBruce W. McKinnon MBABelum ada peringkat

- Medicare Card ExampleDokumen1 halamanMedicare Card ExampleBruce W. McKinnon MBABelum ada peringkat

- Bruce McKinnon PhotoDokumen1 halamanBruce McKinnon PhotoBruce W. McKinnon MBABelum ada peringkat

- Super Systems Corporation LogoDokumen1 halamanSuper Systems Corporation LogoBruce W. McKinnon MBABelum ada peringkat

- 2-4-2013 The Super System With Cover - 40 PagesDokumen40 halaman2-4-2013 The Super System With Cover - 40 PagesBruce W. McKinnon MBABelum ada peringkat

- Nar / National Association of Realtors Code of Ethics - Pledge of PerformanceDokumen1 halamanNar / National Association of Realtors Code of Ethics - Pledge of PerformanceBruce W. McKinnon MBABelum ada peringkat

- 2-22-2013: The 1974 Superbill Book Publication Written by Bruce W. McKinnon in Hattiesburg, MS and Published by MGMADokumen55 halaman2-22-2013: The 1974 Superbill Book Publication Written by Bruce W. McKinnon in Hattiesburg, MS and Published by MGMABruce W. McKinnon MBABelum ada peringkat

- Logo: Snohomish County - Camano Association of RealtorsDokumen1 halamanLogo: Snohomish County - Camano Association of RealtorsBruce W. McKinnon MBABelum ada peringkat

- 9-1-2012 Thursaday Night 10-4-2012 Informal Tennis Team Talkathon - Map and LocationDokumen3 halaman9-1-2012 Thursaday Night 10-4-2012 Informal Tennis Team Talkathon - Map and LocationBruce W. McKinnon MBABelum ada peringkat

- Logo: Snohomish County - Camano Association of RealtorsDokumen1 halamanLogo: Snohomish County - Camano Association of RealtorsBruce W. McKinnon MBABelum ada peringkat

- Washington Association of Realtors LOGODokumen1 halamanWashington Association of Realtors LOGOBruce W. McKinnon MBABelum ada peringkat

- 10-4-5-6-2012 McKinnon E-Mail For HU Hall of Fame Inductee Program For Tennis Team and DignatariesDokumen2 halaman10-4-5-6-2012 McKinnon E-Mail For HU Hall of Fame Inductee Program For Tennis Team and DignatariesBruce W. McKinnon MBABelum ada peringkat

- The Superbill Rebisited - Chapter II (At Issure)Dokumen3 halamanThe Superbill Rebisited - Chapter II (At Issure)Bruce W. McKinnon MBABelum ada peringkat

- The Super SystemDokumen1 halamanThe Super SystemBruce W. McKinnon MBABelum ada peringkat

- The SuperbillDokumen8 halamanThe SuperbillBruce W. McKinnon MBABelum ada peringkat

- 3-12-2010 NAR Average and Median Sale Prices For Single Family Homes and Condos 1968-2009Dokumen4 halaman3-12-2010 NAR Average and Median Sale Prices For Single Family Homes and Condos 1968-2009Bruce W. McKinnon MBABelum ada peringkat

- 10-5-7-2012 HU Alumni Weekend Schedule With Hall of Fame Induction and Thursday TalkathonDokumen1 halaman10-5-7-2012 HU Alumni Weekend Schedule With Hall of Fame Induction and Thursday TalkathonBruce W. McKinnon MBABelum ada peringkat

- 9-1-2012 Final Appendix C - With Cover Page - For 18 Nomination Letters From 62, 64 & 65 HU Tennis Team Members For Hall of Fame ApplicationDokumen20 halaman9-1-2012 Final Appendix C - With Cover Page - For 18 Nomination Letters From 62, 64 & 65 HU Tennis Team Members For Hall of Fame ApplicationBruce W. McKinnon MBABelum ada peringkat

- 1950-2010 Federal Funds Rate and 30 Year FRM Graphs 5-5-09Dokumen1 halaman1950-2010 Federal Funds Rate and 30 Year FRM Graphs 5-5-09Bruce W. McKinnon MBABelum ada peringkat

- 9-1-2012 Appendix B, Pages 1-9 Proof That Hamline Was The 1965 MIAC Tennis Conference Champions.Dokumen10 halaman9-1-2012 Appendix B, Pages 1-9 Proof That Hamline Was The 1965 MIAC Tennis Conference Champions.Bruce W. McKinnon MBABelum ada peringkat

- 9-1-2012 Appendix A Cover + Pages 1-16 From HU Liner Yearbook - Hamline Tennis Hall of Fame ApplicationDokumen17 halaman9-1-2012 Appendix A Cover + Pages 1-16 From HU Liner Yearbook - Hamline Tennis Hall of Fame ApplicationBruce W. McKinnon MBABelum ada peringkat

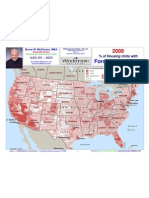

- 2008 Realty Trac Foreclosure Stats Heatmap by StateDokumen1 halaman2008 Realty Trac Foreclosure Stats Heatmap by StateBruce W. McKinnon MBABelum ada peringkat

- The Superbill-Guide To A Uniform Billing And-Or Claims System-IsBN 0685033295Dokumen1 halamanThe Superbill-Guide To A Uniform Billing And-Or Claims System-IsBN 0685033295Bruce W. McKinnon MBA100% (2)

- 9-1-2012 Rev-Years 2011-2012 HU Hall of Fame Nomination PacketDokumen17 halaman9-1-2012 Rev-Years 2011-2012 HU Hall of Fame Nomination PacketBruce W. McKinnon MBABelum ada peringkat

- 3-11-2010 Bruce McKinnon's Medical Administration Cirriculum Vitae 1964-1998Dokumen4 halaman3-11-2010 Bruce McKinnon's Medical Administration Cirriculum Vitae 1964-1998Bruce W. McKinnon MBABelum ada peringkat

- 02-10-2010 McKinnon Mini Resume 1960-To DateDokumen1 halaman02-10-2010 McKinnon Mini Resume 1960-To DateBruce W. McKinnon MBABelum ada peringkat

- 8-5-09 The Superbill - November-December 1972 Issue of MGMA JournalDokumen7 halaman8-5-09 The Superbill - November-December 1972 Issue of MGMA JournalBruce W. McKinnon MBABelum ada peringkat

- 4-03-09 History of Interest Rates-30 Year Fixed Rate Mortgages - Freddie Mac SurveyDokumen3 halaman4-03-09 History of Interest Rates-30 Year Fixed Rate Mortgages - Freddie Mac SurveyBruce W. McKinnon MBABelum ada peringkat

- 2008 Totals - Realty Trac Foreclosure Count Stats by StateDokumen1 halaman2008 Totals - Realty Trac Foreclosure Count Stats by StateBruce W. McKinnon MBABelum ada peringkat

- 4-03-09 History of Interest Rates-15 Year Fixed Rate Mortgages - Freddie Mac SurveyDokumen2 halaman4-03-09 History of Interest Rates-15 Year Fixed Rate Mortgages - Freddie Mac SurveyBruce W. McKinnon MBABelum ada peringkat

- Shoe Dog: A Memoir by the Creator of NikeDari EverandShoe Dog: A Memoir by the Creator of NikePenilaian: 4.5 dari 5 bintang4.5/5 (537)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeDari EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifePenilaian: 4 dari 5 bintang4/5 (5794)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceDari EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RacePenilaian: 4 dari 5 bintang4/5 (890)

- The Yellow House: A Memoir (2019 National Book Award Winner)Dari EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Penilaian: 4 dari 5 bintang4/5 (98)

- The Little Book of Hygge: Danish Secrets to Happy LivingDari EverandThe Little Book of Hygge: Danish Secrets to Happy LivingPenilaian: 3.5 dari 5 bintang3.5/5 (399)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryDari EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryPenilaian: 3.5 dari 5 bintang3.5/5 (231)

- Never Split the Difference: Negotiating As If Your Life Depended On ItDari EverandNever Split the Difference: Negotiating As If Your Life Depended On ItPenilaian: 4.5 dari 5 bintang4.5/5 (838)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureDari EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FuturePenilaian: 4.5 dari 5 bintang4.5/5 (474)

- Rise of ISIS: A Threat We Can't IgnoreDari EverandRise of ISIS: A Threat We Can't IgnorePenilaian: 3.5 dari 5 bintang3.5/5 (137)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersDari EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersPenilaian: 4.5 dari 5 bintang4.5/5 (344)

- Grit: The Power of Passion and PerseveranceDari EverandGrit: The Power of Passion and PerseverancePenilaian: 4 dari 5 bintang4/5 (587)

- On Fire: The (Burning) Case for a Green New DealDari EverandOn Fire: The (Burning) Case for a Green New DealPenilaian: 4 dari 5 bintang4/5 (73)

- The Emperor of All Maladies: A Biography of CancerDari EverandThe Emperor of All Maladies: A Biography of CancerPenilaian: 4.5 dari 5 bintang4.5/5 (271)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaDari EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaPenilaian: 4.5 dari 5 bintang4.5/5 (265)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreDari EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You ArePenilaian: 4 dari 5 bintang4/5 (1090)

- Team of Rivals: The Political Genius of Abraham LincolnDari EverandTeam of Rivals: The Political Genius of Abraham LincolnPenilaian: 4.5 dari 5 bintang4.5/5 (234)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyDari EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyPenilaian: 3.5 dari 5 bintang3.5/5 (2219)

- The Unwinding: An Inner History of the New AmericaDari EverandThe Unwinding: An Inner History of the New AmericaPenilaian: 4 dari 5 bintang4/5 (45)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)Dari EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Penilaian: 4.5 dari 5 bintang4.5/5 (119)

- Her Body and Other Parties: StoriesDari EverandHer Body and Other Parties: StoriesPenilaian: 4 dari 5 bintang4/5 (821)

- Macroeconomics: Ninth Canadian EditionDokumen48 halamanMacroeconomics: Ninth Canadian EditionUzma KhanBelum ada peringkat

- Mba Dissertation Employee RetentionDokumen8 halamanMba Dissertation Employee RetentionCustomPaperWritingUK100% (1)

- Unsettling Race and Language Toward A RaDokumen27 halamanUnsettling Race and Language Toward A Ra1dennys5Belum ada peringkat

- Soal Pas SMKDokumen3 halamanSoal Pas SMKsofiBelum ada peringkat

- The Bilderberg GroupDokumen35 halamanThe Bilderberg GroupTimothy100% (2)

- La Salle Charter School: Statement of Assets, Liabilities and Net Assets - Modified Cash BasisDokumen5 halamanLa Salle Charter School: Statement of Assets, Liabilities and Net Assets - Modified Cash BasisF. O.Belum ada peringkat

- The Works of Samuel Johnson, Volume 04 The Adventurer The Idler by Johnson, Samuel, 1709-1784Dokumen297 halamanThe Works of Samuel Johnson, Volume 04 The Adventurer The Idler by Johnson, Samuel, 1709-1784Gutenberg.orgBelum ada peringkat

- PTA Requests Funds for School ImprovementsDokumen6 halamanPTA Requests Funds for School ImprovementsJoan DalilisBelum ada peringkat

- Tritium - Radioactive isotope of hydrogenDokumen13 halamanTritium - Radioactive isotope of hydrogenParva KhareBelum ada peringkat

- Active Directory Infrastructure DesigndocumentDokumen6 halamanActive Directory Infrastructure Designdocumentsudarshan_karnatiBelum ada peringkat

- Development of Financial Strategy: Chapter Learning ObjectivesDokumen6 halamanDevelopment of Financial Strategy: Chapter Learning ObjectivesDINEO PRUDENCE NONG100% (1)

- Group 2 - Liham Na Sinulat Sa Taong 2070 - SanggunianDokumen5 halamanGroup 2 - Liham Na Sinulat Sa Taong 2070 - SanggunianDominador RomuloBelum ada peringkat

- Astm d4921Dokumen2 halamanAstm d4921CeciliagorraBelum ada peringkat

- Law 113 (Legal Techniques and Logic) : Atty. Annabelle B. Cañazares-Mindalano, RCH, RcheDokumen2 halamanLaw 113 (Legal Techniques and Logic) : Atty. Annabelle B. Cañazares-Mindalano, RCH, RcheJhoBelum ada peringkat

- Directory-Of-Doctors UNEPDokumen34 halamanDirectory-Of-Doctors UNEPPerera KusalBelum ada peringkat

- AccountancyDokumen18 halamanAccountancyMeena DhimanBelum ada peringkat

- LP DLL Entrep W1Q1 2022 AujeroDokumen5 halamanLP DLL Entrep W1Q1 2022 AujeroDENNIS AUJERO100% (1)

- FM AssignmentDokumen10 halamanFM AssignmentPrashant KumarBelum ada peringkat

- PW Show Daily at Frankfurt Day 1Dokumen68 halamanPW Show Daily at Frankfurt Day 1Publishers WeeklyBelum ada peringkat

- General Math Second Quarter Exam ReviewDokumen5 halamanGeneral Math Second Quarter Exam ReviewAgnes Ramo100% (1)

- GonorrhoeaDokumen24 halamanGonorrhoeaAtreyo ChakrabortyBelum ada peringkat

- G.R. No. 172242Dokumen2 halamanG.R. No. 172242Eap Bustillo67% (3)

- Operational Auditing Internal Control ProcessesDokumen18 halamanOperational Auditing Internal Control ProcessesKlaryz D. MirandillaBelum ada peringkat

- PATHFINDER On Aquaculture and FisheriesDokumen114 halamanPATHFINDER On Aquaculture and FisheriesLIRMD-Information Service DevelopmentBelum ada peringkat

- Airtel A OligopolyDokumen43 halamanAirtel A OligopolyMRINAL KAUL100% (1)

- Gabon (Law No. 26 - 2018 of 22 October 2018)Dokumen2 halamanGabon (Law No. 26 - 2018 of 22 October 2018)Katrice ObreroBelum ada peringkat

- ASAP Current Approved Therapists MDokumen10 halamanASAP Current Approved Therapists MdelygomBelum ada peringkat

- Forex Risk ManagementDokumen114 halamanForex Risk ManagementManish Mandola100% (1)

- Education Secretaries 10Dokumen6 halamanEducation Secretaries 10Patrick AdamsBelum ada peringkat

- Ebook Service Desk vs. Help Desk. What Is The Difference 1Dokumen18 halamanEbook Service Desk vs. Help Desk. What Is The Difference 1victor molinaBelum ada peringkat