Step-By-step Guide in Donation

Diunggah oleh

Anonymous uqBeAy8onDeskripsi Asli:

Hak Cipta

Format Tersedia

Bagikan dokumen Ini

Apakah menurut Anda dokumen ini bermanfaat?

Apakah konten ini tidak pantas?

Laporkan Dokumen IniHak Cipta:

Format Tersedia

Step-By-step Guide in Donation

Diunggah oleh

Anonymous uqBeAy8onHak Cipta:

Format Tersedia

Here’s a step-by-step guide in transferring properties to your loved one:

1. Secure certified copy of the Transfer Certificate of Title (TCT)

2. Have your property assessed to determine the current value of a property.

Significant home improvements boost a property’s appeal and can add market

value to your home.

Go to the City Assessor’s office of the city where the property is located. If

there are no improvements made on the property, the City Assessor’s office will

issue a “Certificate of No Improvement.”

3. Make sure that the taxes paid on the property is updated.

Paying your real property taxes on time will keep your donee free from the

obligations of paying for unpaid taxes and penalties. Moreover, the Tax

Declaration of the donated property and/or home improvement is required to

legalize to pay for Donor’s Tax (see #5).

You can get your property’s latest Tax Declaration from the City Assessor’s

office. The office may require you to present proper documentation such as

your valid ID and an old Tax Declaration or any proof of verification to

process your request.

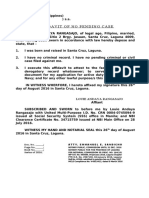

4. Put the donation in writing.

The Deed of Donation should contain the following terms:

the complete name of both the donor and the donee;

the detailed description of the property, including pertinent info such as

property title number and technical description of the property;

your intention and purpose why you are donating it to your loved one;

signature of the person who will stand as witness to the donation; and

notarial acknowledgement.

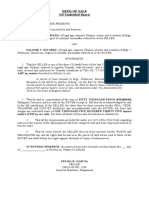

5. File and pay the right donor’s taxes.

Submit the following pertinent documents to any field office or branch of the BIR:

Deed of Donation

Proof of ownership of the property that you are going to donate

Certificate of No Improvement if applicable.

Per Republic Act 8424, the donation will be taxed at minimum 2% of the

excess over P100,000. If you will be donating more than once in a year, the

donor’s tax will be based on the net total amount of the gifts.

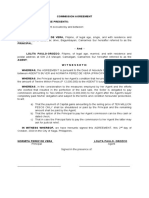

6. Get the Certificate Authorizing Registration (CAR) and Tax Clearance (TCL).

The CAR and the TCL are documented proof that you have paid the necessary

donated property’s taxes. These documents are required to process the title

transfer with the Registry of Deeds. Take note that these documents will be

released only by the correct BIR revenue office on where the property is located.

If you have submitted all documents as required by the regulator, the CAR and

the TCL will be ready in around two weeks.

Anda mungkin juga menyukai

- Spa - Apply Fencing Permit - JuatonDokumen1 halamanSpa - Apply Fencing Permit - JuatonDeil L. Navea100% (1)

- Deed of Donation: Katibayan NG Orihinal Na TituloDokumen3 halamanDeed of Donation: Katibayan NG Orihinal Na TitulomkabBelum ada peringkat

- Sample Waiver of Rights1Dokumen2 halamanSample Waiver of Rights1Kar75% (4)

- Sworn StatementDokumen2 halamanSworn StatementJohn Karlo P. Fernandez100% (1)

- Memorandum of AgreementDokumen4 halamanMemorandum of AgreementJoshuaLavegaAbrinaBelum ada peringkat

- Deed of Transfer of Rights - 1Dokumen2 halamanDeed of Transfer of Rights - 1Jane Marian100% (3)

- Affidavit of ParaphernalDokumen1 halamanAffidavit of ParaphernalKyle MondejarBelum ada peringkat

- Spa. CarloDokumen1 halamanSpa. CarlogiovanniBelum ada peringkat

- SPA For BIR Processing As RepresentativeDokumen1 halamanSPA For BIR Processing As Representativemiloo0o100% (1)

- Contract to Sell VehicleDokumen3 halamanContract to Sell VehicleRomeo Fernon Sto. DomingoBelum ada peringkat

- Special Power of Attorney - LandDokumen2 halamanSpecial Power of Attorney - LandIpe Closa100% (3)

- Affidavit of No Pending CaseDokumen1 halamanAffidavit of No Pending CaseManny SandichoBelum ada peringkat

- Sample Quitclaim and Waiver of Rights Market StallDokumen1 halamanSample Quitclaim and Waiver of Rights Market StallRex Traya100% (1)

- Affidavit of No Sale - SampleDokumen1 halamanAffidavit of No Sale - SampleIpe Closa100% (1)

- Deed of Extra-Judicial Settlement - Cash Deposits of YyyyyyyyyyyyyyDokumen3 halamanDeed of Extra-Judicial Settlement - Cash Deposits of YyyyyyyyyyyyyyGian Lozada BorataBelum ada peringkat

- Affidavit SupplierDokumen1 halamanAffidavit SupplierEduard Ferrer0% (1)

- Affidavit for Out of Town Birth RegistrationDokumen1 halamanAffidavit for Out of Town Birth RegistrationDon SalaBelum ada peringkat

- Revised MOA Paul Andrew Pilapil Lot 1181-BDokumen3 halamanRevised MOA Paul Andrew Pilapil Lot 1181-BttunacaoBelum ada peringkat

- Deed of Sale Stall Angono MarketDokumen1 halamanDeed of Sale Stall Angono MarketRahul HumpalBelum ada peringkat

- Affidavit of Discrepancy - Meralco - GAVINODokumen1 halamanAffidavit of Discrepancy - Meralco - GAVINONK MndzaBelum ada peringkat

- Affidavit of Change of BeneficiaryDokumen2 halamanAffidavit of Change of BeneficiaryJovic Catabona100% (1)

- Deed of Conditional Assignment SampleDokumen2 halamanDeed of Conditional Assignment SampleEarl CopeBelum ada peringkat

- Demand Letter-Exec of Deed of SaleDokumen1 halamanDemand Letter-Exec of Deed of SaleElijahBactolBelum ada peringkat

- Special Power of Attorney SettlementDokumen2 halamanSpecial Power of Attorney SettlementGodofredo Cualteros67% (3)

- Deed of Sale PadyakDokumen2 halamanDeed of Sale PadyakGleamy Soria100% (1)

- Deed of Absolute Sale Property TransferDokumen2 halamanDeed of Absolute Sale Property TransferAianna Bianca Birao (fluffyeol)0% (1)

- Special Power of Attorney: Attorneys-in-FactDokumen1 halamanSpecial Power of Attorney: Attorneys-in-FactElle Woods100% (1)

- Special Power of Attorney: HEREBY GIVING AND GRANTING, Unto My Said Attorney-In-FactDokumen2 halamanSpecial Power of Attorney: HEREBY GIVING AND GRANTING, Unto My Said Attorney-In-FactArgel Joseph CosmeBelum ada peringkat

- Heirship With SPA - TemplateDokumen2 halamanHeirship With SPA - TemplateMarie Nickie Bolos100% (1)

- Request Letter - OccDokumen1 halamanRequest Letter - OccYssa De Leon LeeBelum ada peringkat

- Deed of Real Estate MortgageDokumen6 halamanDeed of Real Estate MortgageCristopher ReyesBelum ada peringkat

- ABC Cooperative land agreementDokumen3 halamanABC Cooperative land agreementBetsy Maria ZalsosBelum ada peringkat

- Affidavit of Quitclaim With Indemnity Agreement With SPADokumen1 halamanAffidavit of Quitclaim With Indemnity Agreement With SPAArchie Osuna33% (3)

- Acknowledgment Receipt: Page 1 of 2Dokumen2 halamanAcknowledgment Receipt: Page 1 of 2Gracelle Mae Oraller100% (2)

- Monthly Report FebDokumen3 halamanMonthly Report Febmanzanillamarielle21Belum ada peringkat

- Compromise Agreement With Waiver, Release and Quitclaim-AvesDokumen2 halamanCompromise Agreement With Waiver, Release and Quitclaim-AvesChristopher JuniarBelum ada peringkat

- ACKNOWLEDGEMENT RECEIPT - Marie Dominique PerfectoDokumen1 halamanACKNOWLEDGEMENT RECEIPT - Marie Dominique PerfectoLizanne GauranaBelum ada peringkat

- Waiver of RightsDokumen2 halamanWaiver of Rightsmichael lumboy100% (1)

- Self-Adjudication AffidavitDokumen1 halamanSelf-Adjudication AffidavitMark Buncio Leonar100% (2)

- Philippines affidavit no mortgage land titleDokumen1 halamanPhilippines affidavit no mortgage land titleKristine JanBelum ada peringkat

- Declare Estate Ownership with Self-Adjudication AffidavitDokumen1 halamanDeclare Estate Ownership with Self-Adjudication AffidavitmagnoliadlxBelum ada peringkat

- Deed of Sale Undivided ShareDokumen2 halamanDeed of Sale Undivided ShareEarl Magbanua50% (2)

- Petition For Dropping LTFRBDokumen3 halamanPetition For Dropping LTFRBMegan Camille SanchezBelum ada peringkat

- Revenue Code of Las Pinas City PDFDokumen105 halamanRevenue Code of Las Pinas City PDFKriszan ManiponBelum ada peringkat

- Affidavit of income sourceDokumen1 halamanAffidavit of income sourceLucille O. SeneresBelum ada peringkat

- Deed of Absolute Sale TitleDokumen3 halamanDeed of Absolute Sale TitleVilma PabinesBelum ada peringkat

- Philippines Corp Affidavit Support TravelDokumen1 halamanPhilippines Corp Affidavit Support TravelManny SandichoBelum ada peringkat

- Computation Details: Ali Hassan M. Lucman Jr. Hermeno A. PalamineDokumen1 halamanComputation Details: Ali Hassan M. Lucman Jr. Hermeno A. PalamineKobi SaibenBelum ada peringkat

- Sample Board ResolutionDokumen1 halamanSample Board ResolutionDats FernandezBelum ada peringkat

- Cancellation of Deed of Absolute SaleDokumen3 halamanCancellation of Deed of Absolute SaleKen DG CBelum ada peringkat

- Special Power of AttorneyDokumen1 halamanSpecial Power of AttorneyBa Nognog100% (1)

- Special power of attorney for transactionsDokumen1 halamanSpecial power of attorney for transactionsHarold Mape100% (5)

- Moa - Sanglaan NG LupaDokumen2 halamanMoa - Sanglaan NG LupaVon Baysan100% (1)

- Letter Request CANADokumen1 halamanLetter Request CANATumasitoe Bautista Lasquite100% (1)

- Special Power of Attorney: Know All Men by These PresentsDokumen2 halamanSpecial Power of Attorney: Know All Men by These PresentsJade Roxas ArnesBelum ada peringkat

- Land Sale Contract by Attorney-in-FactDokumen2 halamanLand Sale Contract by Attorney-in-FactJohari Forcadas100% (1)

- Commission Agreement SaleDokumen2 halamanCommission Agreement SaleSanson OrozcoBelum ada peringkat

- (Joint) Loss of Land TitleDokumen1 halaman(Joint) Loss of Land TitleAndrew Belgica100% (1)

- TRANSFER OF LAND TITLEDokumen8 halamanTRANSFER OF LAND TITLEAnonymous uMI5BmBelum ada peringkat

- Sharing Expenses When Transferring Real Estate TitleDokumen2 halamanSharing Expenses When Transferring Real Estate TitlePogi akoBelum ada peringkat

- Act No. 3753: Law On Registry of Civil StatusDokumen5 halamanAct No. 3753: Law On Registry of Civil StatusAnonymous uqBeAy8onBelum ada peringkat

- Philippines Marriage Law EssentialsDokumen1 halamanPhilippines Marriage Law EssentialsPayie PerezBelum ada peringkat

- Symbols Chart PDFDokumen4 halamanSymbols Chart PDFAnonymous uqBeAy8onBelum ada peringkat

- 2016 Bar ResultsDokumen74 halaman2016 Bar ResultsAnonymous uqBeAy8onBelum ada peringkat

- Any Form of Violence Against Women and Their Children Is Illegal - The Manila Times OnlineDokumen5 halamanAny Form of Violence Against Women and Their Children Is Illegal - The Manila Times OnlineAnonymous uqBeAy8onBelum ada peringkat

- The Perfect Tenses ShortenedDokumen14 halamanThe Perfect Tenses ShortenedAnonymous uqBeAy8onBelum ada peringkat

- !!! Family Cover Large Blank-Fillable PDFDokumen1 halaman!!! Family Cover Large Blank-Fillable PDFAnonymous uqBeAy8onBelum ada peringkat

- SyllabusDokumen4 halamanSyllabusAnonymous uqBeAy8onBelum ada peringkat

- Adobe Photoshop CS3 Keyboard Shortcuts PCDokumen4 halamanAdobe Photoshop CS3 Keyboard Shortcuts PCHDevolution100% (1)

- House Wl200 Blank-FillableDokumen1 halamanHouse Wl200 Blank-FillableAnonymous uqBeAy8onBelum ada peringkat

- Bar 2016 Petition FormDokumen6 halamanBar 2016 Petition FormRoxan Desiree T. Ortaleza-TanBelum ada peringkat

- Requirements for Repeaters and RefreshersDokumen6 halamanRequirements for Repeaters and RefreshersTugonon M Leo RoswaldBelum ada peringkat

- Mfaq TaxDokumen5 halamanMfaq TaxEL Janus GarnetBelum ada peringkat

- Passport Applicationform 2015Dokumen2 halamanPassport Applicationform 2015genesisrdomingoBelum ada peringkat

- TaxDokumen12 halamanTaxCherry DuldulaoBelum ada peringkat

- Up SpitDokumen102 halamanUp SpitEnakinBelum ada peringkat

- TAX by DomondonDokumen70 halamanTAX by DomondonCherry ZapantaBelum ada peringkat

- Remedies Under NIRCDokumen14 halamanRemedies Under NIRCcmv mendoza100% (3)

- BIR Ruling Our Lady of NazarethDokumen2 halamanBIR Ruling Our Lady of NazarethAnonymous uqBeAy8onBelum ada peringkat

- Lastminute TaxationDokumen11 halamanLastminute TaxationVilma Tabermejo LomaniogBelum ada peringkat

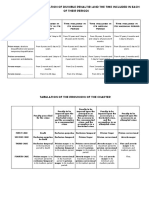

- Penalty TableDokumen3 halamanPenalty TableAnonymous uqBeAy8onBelum ada peringkat

- Donor's Tax OutlineDokumen4 halamanDonor's Tax OutlineAnonymous uqBeAy8onBelum ada peringkat

- Criminal Law UPRevised Ortega Lecture Notes IDokumen115 halamanCriminal Law UPRevised Ortega Lecture Notes Itwocubes95% (21)

- Review Books1Dokumen1 halamanReview Books1Anonymous uqBeAy8onBelum ada peringkat

- Penalty TableDokumen3 halamanPenalty TableAnonymous uqBeAy8onBelum ada peringkat

- UP-Revised Ortega Lecture Notes IIDokumen187 halamanUP-Revised Ortega Lecture Notes IIAnonymous uqBeAy8onBelum ada peringkat

- Review BooksDokumen3 halamanReview BooksAnonymous uqBeAy8onBelum ada peringkat

- Revised Ortega Lecture Notes On Criminal Law: Title I. Crimes Against National Security and The Law of NationsDokumen191 halamanRevised Ortega Lecture Notes On Criminal Law: Title I. Crimes Against National Security and The Law of NationsAnonymous uqBeAy8onBelum ada peringkat

- Revised Criminal Law Lecture NotesDokumen93 halamanRevised Criminal Law Lecture NotesAnonymous uqBeAy8onBelum ada peringkat

- List of Purpose Codes 1: (For Use in Forms P/R Only)Dokumen25 halamanList of Purpose Codes 1: (For Use in Forms P/R Only)Siti CleaningBelum ada peringkat

- FESCO GST Electricity bill detailsDokumen2 halamanFESCO GST Electricity bill detailsSidraBelum ada peringkat

- Tax Problems Questin and Answer CH 21Dokumen8 halamanTax Problems Questin and Answer CH 21DoreenBelum ada peringkat

- Music Tech Magazine 2015-04Dokumen116 halamanMusic Tech Magazine 2015-04Anonymous 7mJFgWyIqT100% (2)

- Benefit Illustration For HDFC Life Sanchay Par AdvantageDokumen3 halamanBenefit Illustration For HDFC Life Sanchay Par AdvantageLaviBelum ada peringkat

- Form DVAT 24: Notice of Default Assessment of Tax and Interest Under Section 32Dokumen2 halamanForm DVAT 24: Notice of Default Assessment of Tax and Interest Under Section 32hhhhhhhuuuuuyyuyyyyyBelum ada peringkat

- Assam Budget Analysis 2022-23Dokumen7 halamanAssam Budget Analysis 2022-23Guwahati RangeBelum ada peringkat

- Tax Evasion Through SharesDokumen5 halamanTax Evasion Through SharesPrashant Thakur100% (1)

- Semester "FALL 2021": Taxation Management (Fin623)Dokumen2 halamanSemester "FALL 2021": Taxation Management (Fin623)Ali Raza NoshairBelum ada peringkat

- Vidal-de-Roces-vs.-PosadasDokumen9 halamanVidal-de-Roces-vs.-PosadasChristle CorpuzBelum ada peringkat

- Unemployment: Unemployment Rate (Unemployed Persons / Labour Force) X 100Dokumen9 halamanUnemployment: Unemployment Rate (Unemployed Persons / Labour Force) X 100slimhippolyte91% (22)

- Deposit Interest Certificate 40903908Dokumen2 halamanDeposit Interest Certificate 40903908adityaBelum ada peringkat

- Understanding MacroeconomicsDokumen36 halamanUnderstanding Macroeconomicsrahul191991Belum ada peringkat

- Polytechnic University of the Philippines Taguig Branch Income Taxation Module 4 and Chapter 1 & 2 Written ReportDokumen6 halamanPolytechnic University of the Philippines Taguig Branch Income Taxation Module 4 and Chapter 1 & 2 Written ReportMarie Lyne AlanoBelum ada peringkat

- GST S4HANA Master Data ConfigurationDokumen6 halamanGST S4HANA Master Data ConfigurationAkshay GuptaBelum ada peringkat

- Auditor General's Report 2011 - Synopsis (English)Dokumen100 halamanAuditor General's Report 2011 - Synopsis (English)openid_OtVX6n9hBelum ada peringkat

- Notes FMDokumen42 halamanNotes FMSneha JayalBelum ada peringkat

- Solved Citron Enters Into A Type C Restructuring With Ecru Ecru PDFDokumen1 halamanSolved Citron Enters Into A Type C Restructuring With Ecru Ecru PDFAnbu jaromiaBelum ada peringkat

- PD 1530, Eo 538Dokumen4 halamanPD 1530, Eo 538givemeasign24Belum ada peringkat

- Monthly Current Affairs and GK Capsule July 2018 - Download in PDFDokumen47 halamanMonthly Current Affairs and GK Capsule July 2018 - Download in PDFsagrvBelum ada peringkat

- PHD Thesis On Environmental AccountingDokumen6 halamanPHD Thesis On Environmental Accountingkimstephenswashington100% (2)

- Project Report (ABBOTT)Dokumen29 halamanProject Report (ABBOTT)MohsIn IQbalBelum ada peringkat

- Annual Report Zee Television PDFDokumen176 halamanAnnual Report Zee Television PDFNeel PrasantBelum ada peringkat

- McDonald's Globalization in India's MarketDokumen4 halamanMcDonald's Globalization in India's MarketNuzhat TasnimBelum ada peringkat

- Chapter 26Dokumen8 halamanChapter 26Mae Ciarie YangcoBelum ada peringkat

- Crossborder Tax Leasing Finances InfrastructureDokumen4 halamanCrossborder Tax Leasing Finances InfrastructureDuncan_Low_4659Belum ada peringkat

- PESTEL Analysis (External) : PoliticalDokumen3 halamanPESTEL Analysis (External) : PoliticalWasif AzimBelum ada peringkat

- Major AssumptionsDokumen3 halamanMajor AssumptionsChristian VillaBelum ada peringkat

- Barangay Revenue CodeDokumen16 halamanBarangay Revenue Codeleng11mher21Belum ada peringkat

- 221 Figuerres v. CADokumen14 halaman221 Figuerres v. CAJai HoBelum ada peringkat