(Vertical) Balance Sheet of Geo PPV at Dd/mm/yy (FA) Fixed Assets

Diunggah oleh

Harsh ChhatrapatiDeskripsi Asli:

Judul Asli

Hak Cipta

Format Tersedia

Bagikan dokumen Ini

Apakah menurut Anda dokumen ini bermanfaat?

Apakah konten ini tidak pantas?

Laporkan Dokumen IniHak Cipta:

Format Tersedia

(Vertical) Balance Sheet of Geo PPV at Dd/mm/yy (FA) Fixed Assets

Diunggah oleh

Harsh ChhatrapatiHak Cipta:

Format Tersedia

1-8 rdr02 - Profit/Loss or Income Statement

Recall from the last lecture, we had computed the balance sheet of Geo ppv at dd/mm/yy.

It looked something like this, (for transactions 01 - 06 only):

(Vertical) Balance Sheet of Geo ppv at dd/mm/yy

(FA) Fixed Assets Premises 2000

Equipment 2000

4000 (d)

(CA) Current Assets Stock 500

Debtors 1000

Cash 1500

Prepayments 500 3500 (a)

Less

(CL) Current Liabilities Creditors 1500 (b)

(NCA) Net Current Assets 2000 (a-b=c)

(NA) Net Assets 6000 (d+c)

Represented by:

(OE) Owner Equity 6000

(CE) Capital Employed 6000

Suppose now that geo ppv sells half the stock for £8250; £4250 represented a sale for cash, and

the balance, of £4000 was a sale on credit. In this situation, the business has sacrificed some of

its asset of stock (£500 x 0.5) £250, in return for cash (the cash sale of £4250) and debtors of

£4000 (the credit sale of £4000). Thus the transaction has generated a net gain in assets of:

Cash 4250 Asset increase

Debtors 4000 Asset increase

8250

Stock -250 Asset sacrifice

8000 Net gain

This net gain is a profit of course. Clearly geo ppv sold stock costing £250 for £8250. The result of

this is a profit of (£8250 less £250) £8000. Thus, after the transaction cash will increase by £4250,

the debtors will increase by £4000, and the stock will reduce by £250.

Although the firm geo ppv has made this profit, the net gain is ultimately due to the owners of geo

ppv. This is the case because it was the owners who "staked" geo ppv (not the staff employed, or

anyone else) with the initial £6000. Therefore it is the owners who (owning all assets less liabilities)

will finally benefit when some (their) the firm's assets are sacrificed in this transaction. Thus, the

ownership interest in the business has increased from £6000 (initial stake) to £6000 plus gains of

£8000 (or a total of £14000) to date.

In fact, had the owners been willing to sell geo ppv after it was set up, but before this transaction,

they would have contemplated a sale price of around £6000. But now the assets of the business

have been put to work and have generated a gain of £8000. So after this transaction, any price

discourse relating to a sale of the business would start at around the £14,000 level, since the

owners would wish to recover the cost of their initial stake AND their profits to date in any potential

sale of the business.

So the effect of this transaction is to increase net assets of geo ppv by £8000 (+£4250 (cash)

+ £4000 (debtors) - £250 (stock used up)), and to increase owner equity by the same amount.

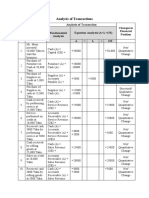

We post this transaction (no. 07) across the accounting equation proforma, in the usual way, as

shown below:

o'connor bs1108 2014-15

2-8 rdr02 - Profit/Loss or Income Statement

transaction 07 Assets = Liabilities + Equity

[entity geo ppv] £000 £000 £000

Cash rec'd +£4.25k

Debtors +£4.00k

Stock sacrifice -£0.25k

Owner equity (profits) ___ +£8.00k

+£8.00k +£8.00k

We can also update the balance sheet above to reflect the latest transaction:

(Vertical) Balance Sheet of Geo ppv at dd/mm/yy

(FA) Fixed Assets Premises 2000

Equipment 2000

4000 (d)

(CA) Current Assets Stock 250 [was 500, less 250 = 250]

Debtors 5000 [was 1000, plus 4000 = 5000]

Cash 5750 [was 1500, plus 4250 = 5750]

Prepayments 500 11500 (a)

Less

(CL) Current Liabilities Creditors 1500 (b)

(NCA) Net Current Assets 10000 (a-b=c)

(NA) Net Assets 14000 (d+c)

Represented by:

(OE) Owner Equity (capital introduced) 6000

(PL) Profit/Loss (to date) [ie 4250+4000-250 = 8000] 8000

(CE) Capital Employed 14000

We can see clearly here, that the net assets have increased from £6000 to £14000, an increase

of £8000, which is the profit to date. Also looking at the financing section we can see that both the

initial stake and the profits to date are now financing the business, and the owner equity has

increased to £14000.

It's not always clear how the balance sheet has changed from before the profit making transaction

to after it, so traditionally we enclose another statement, the profit and loss account to highlight

any trading changes that have taken place.

Consider the event horizon…

----->---… trading events…------------> time -->

[disclosed in P/L]

B/S before trading [P/L = 8000] B/S after trading

events…. events….

[usually referred to as [usually referred to as

the opening B/S] the closing B/S]

[NA=6000] [NA=6000+P/L]

[ie Opening NA] [NA=6000+8000 = 14000]

[ie Closing NA]

It is the Profit/Loss account which connects the opening B/S with the closing B/S. We therefore

describe the Profit/Loss account as "...Profit/Loss for the period ending…" The P/L account of Geo

ppv accompanying the above B/S would disclose the trading events as follows:

Profit/Loss Account of Geo ppv for P/E dd/mm/yy

o'connor bs1108 2014-15

3-8 rdr02 - Profit/Loss or Income Statement

Sales [ie 4250 cash sales+4000 credit sales] 8250

Less

Cost of Sales [ie stock consumed or 'used up of 250] 250

Profit (for the Period) 8000

Turning now to the prepaid rent. This was an asset in the last accounting period because it was

rent paid in advance. We are now in the second accounting period, and so, the rent is used up

merely with the passage of time; it changes from prepaid rent , to rent expense . The effect of

this transaction is to reduce profits from £8000 to (£8000 less £500) £7500.

Putting this transaction (08) across the accounting equation proforma, we have:

transaction 08 Assets = Liabilities + Equity

[entity geo ppv] £000 £000 £000

Rent pia (used up) -£0.5k

Owner equity (rent expense) ___ -£0.5k

Updating Geo ppv's P/L for transaction (08) we have:

Profit/Loss Account of Geo ppv for P/E dd/mm/yy 1

Sales ( or Turnover) [as before] 8250

Less

Cost of Sales [as before] 250

Gross Profit 8000

Less

Expenses Rent [new item] 500

Net Profit (for the Period) 7500

The net assets on Geo ppv's B/S will be reduced by £500 due to the consumption (using up) of the

asset Rent pia, as follows:

Balance Sheet of Geo ppv at dd/mm/yy 1

(FA) Fixed Assets Premises 2000

Equipment 2000

4000 (d)

(CA) Current Assets Stock 250

Debtors 5000

Cash 5750

Prepayments 0 11000 (a)

Less

(CL) Current Liabilities Creditors 1500 (b)

(NCA) Net Current Assets 9500 (a-b=c)

(NA) Net Assets 13500 (d+c)

Represented by:

(OE) Owner Equity (capital introduced) 6000

(PL) Profit/Loss (to date) 7500

(CE) Capital Employed 13500

We can now introduce a new form of current liability called the accrual . Suppose we had

o'connor bs1108 2014-15

4-8 rdr02 - Profit/Loss or Income Statement

incurred telephone expenses in this second period of account, amounting to £300. Further suppose

that the telephone company had not actually sent us the bill. We knew we'd incurred the cost,

because we contacted the 'phone company who confirmed the amount owing, but said that they

would bill us next month. This form of transaction is known as an accrual, and is the reverse of a

prepayment.

Recall that, with a prepayment we pay in advance now, & the expense is consumed in a later

accounting period. With an accrual , we incur the expense now, but will pay in a later

accounting period. So, an accrual for expenses incurred but not paid in the present period is just

like a creditor (a dated obligation of the biz)

Putting this transaction (09) across the accounting equation proforma, we have:

transaction 09 Assets = Liabilities + Equity

[entity geo ppv] £000 £000 £000

Accrual (or creditors) +£0.3k

Owner equity ('phone expense) ___ -£0.3k

Updating Geo ppv's P/L for transaction (09) we have:

Profit/Loss Account of Geo ppv for P/E dd/mm/yy 2

Sales ( or Turnover) [as before] 8250

Less

Cost of Sales [as before] 250

Gross Profit 8000

Less

Expenses Rent expense [as before] 500

Telephone expense [new item] 300

800

Net Profit (for the Period) 7200

Note that on a P/L account we distinguish between Gross and Net profits. Gross profits are the

intrinsic profits from the firm's prime activity, ie, Sales less the related Cost of Sales incurred in

generating those sales. The prime activity for Geo ppv is buying and selling pork pies. Does the

basic operation make a profit? This question is answered by the existence or otherwise of a

gross profit (or loss). In this case the basic operation is profitable.

The Net profit considers the profits after deduction of (operating) expenses. These are expenses

necessarily incurred to sustain the business operation. Are the expenses too large, and is there a

net profit or loss after operating expenses are questions answered by the size of the net profit.

After net profits come charges which depend upon the size of the net profit, eg taxation, drawings

(dividends for companies). We cannot know the tax bill until we know the net profit figure. Such

charges are known as appropriations of profit .

So the P/L account comes in three sections; Sales down to Gross Profit is called the Trading

Account , Gross Profit down to Net Profit is called the Profit and Loss Account , and Net profit

down to profits kept within the business (ie after taxes and drawings or dividends) or Retained

Profit is called the Appropriation Account . The whole is referred to formally as the Trading and

Profit and Loss Account , but we also refer to it informally as the Profit and Loss Account , or

the Income Statement .

Much of accounting nomenclature comes from manufacturing industry. Clearly in a service

o'connor bs1108 2014-15

5-8 rdr02 - Profit/Loss or Income Statement

industry we would have to determine the key indicators by inspection and knowledge of the

business sector. So descriptions such as Gross Fee Income and Net Fee Income , depend upon

the firm and would be different for (say) a firm of lawyers and a firm of property speculators.

After transaction (09), the net assets on Geo ppv's B/S will be reduced by a further £300 due to the

recognition of additional expenses (incurred but not yet paid for) of telephone charges as follows:

Balance Sheet of Geo ppv at dd/mm/yy 2

(FA) Fixed Assets Premises 2000

Equipment 2000

4000 (d)

(CA) Current Assets Stock 250

Debtors 5000

Cash 5750

Prepayments 0 11000 (a)

Less

(CL) Current Liabilities Creditors 1500

Accruals 300 1800 (b)

(NCA) Net Current Assets 9200 (a-b=c)

(NA) Net Assets 13200 (d+c)

Represented by:

(OE) Owner Equity (capital introduced) 6000

(PL) Profit/Loss (to date) 7200

(CE) Capital Employed 13200

We can take up accruals for any form of foreseen liability. For instance we may be heading for a

legal dispute with a customer, and we know there will be legal fees to pay before we are through.

Assume potential legal fees will be £1000. We can accrue, or (as it's sometimes called) make

provisions for pending legal fees (see transaction 10):

transaction 10 Assets = Liabilities + Equity

[entity geo ppv] £000 £000 £000

Provisions, or accrual (or creditors) +£1.0k

OE (legal fees provision) ___ -£1.0k

Updating Geo ppv's P/L for transaction (10) we have:

Profit/Loss Account of Geo ppv for P/E dd/mm/yy 3

Sales ( or Turnover) [as before] 8250

Less

Cost of Sales [as before] 250

Gross Profit 8000

Less

Expenses Rent expense 500

Telephone expense [as before] 300

Legal Fees [new item] 1000

1800

Net Profit (for the Period) 6200

After transaction (10), net assets on Geo ppv's B/S will be reduced by a further £1000 due to the

o'connor bs1108 2014-15

6-8 rdr02 - Profit/Loss or Income Statement

recognition of pending legal expenses (incurred but not yet paid for).

Assume we are now at the year end (dd/mm/yy4). We must recognise that we have consumed

one year of the leased premises (say it was a lease of 5 years duration); we can now no longer

disclose it on the balance sheet at £2000, for this represents a leased premise with 5 years left.

Now we only have 4 years left. Merely through the passage of time we have consumed 1 years

worth of the life of the lease. This is reflected in the balance sheet by writing the lease down to

£1600, (ie £2000 less 2000x1/5). This writing down is referred to as lease amortisation . In the

same way, equipment and other fixed assets would also be reduced as we have consumed some

of their productive capacity. No asset has an infinite life, they all get used up (older) over time.

Assume the equipment has a life of 10 years. Thus by the year end we will have consumed

1 years worth of the productive capacity of the equipment. Again we reflect this consumption of

assets in the balance sheet by writing the equipment down to £1800, (ie £2000 less 2000x 1/10).

This writing down effect in the case of equipment is called depreciation .

Putting these last two transactions (11 & 12) across the accounting equation proforma, we have:

transaction 11 Assets = Liabilities + Equity

[entity geo ppv] £000 £000 £000

Lease amortisation -£0.4k

OE (amortisation charge) ___ -£0.4k

transaction 12 Assets = Liabilities + Equity

[entity geo ppv] £000 £000 £000

Equipment depreciation -£0.2k

OE (depreciation charge) ___ -£0.2k

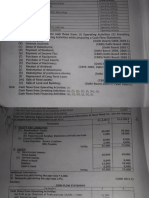

Updating Geo ppv's B/S and P/L for transactions (11 & 12) we have:

Balance Sheet of Geo ppv at dd/mm/yy 4

(FA) Fixed Assets Premises [2000 less 400] 1600

Equipment [2000 less 200] 1800

3400 (d)

(CA) Current Assets Stock 250

Debtors 5000

Cash 5750

Prepayments 0 11000 (a)

Less

(CL) Current Liabilities Creditors 1500

Accruals/Provisions 1300 2800 (b)

(NCA) Net Current Assets 8200 (a-b=c)

(NA) Net Assets 11600 (d+c)

Represented by:

(OE) Owner Equity (capital introduced) 6000

(PL) Profit/Loss (to date) 5600

(CE) Capital Employed 11600

The related Profit/Loss account for Geo ppv at the year end will be:-

Profit/Loss Account of Geo ppv for Y/E dd/mm/yy 4

o'connor bs1108 2014-15

7-8 rdr02 - Profit/Loss or Income Statement

Sales ( or Turnover) [as before] 8250

Less

Cost of Sales [as before] 250

Gross Profit 8000

Less

Expenses Rent expense [as before] 500

Telephone expense [as before] 300

Legal Fees expense [as before] 1000

Lease Amortisation expense [new item] 400

Equipment Depreciation expense [new item] 200

2400

Net Profit (for the year) 5600

We recorded these transactions in a 3-column array (assets = liabilities + equity) as summarised

below:

transactions 07 - 12 (A)ssets = (L)iabilities + (E)quity Tran

[entity geo ppv] £000 £000 £000 No

Cash rec'd +£4.25k 07

Debtors +£4.00k 07

Stock sacrifice -£0.25k 07

Owner equity (profits) +£8.00k 07

Rent pia (used up) -£0.5k 08

Owner equity (rent expense) -£0.5k 08

Accrued (or creditors) +£0.3k 09

Owner equity ('phone expense) -£0.3k 09

Provisions, or accrual (or creditors) +£1.0k 10

OE (legal fees provision) -£1.0k 10

Lease amortisation -£0.4k 11

OE (amortisation charge) -£0.4k 11

Equipment depreciation -£0.2k 12

OE (depreciation charge) -£0.2k 12

It's more usual to split the Equity column into 3 sub-columns, one for the true equity movements,

(ie capital introduced or withdrawn), one for revenues (which increase profits, and therefore

increase equity), and one for expenses (which decrease profits, and so decrease equity).

Rearranging the above array into 5 columns we have the usual arrangement which we discussed

and used in the tutorials:

+ (E)quity + -

transactions 07 - 12 (A)ssets = (L)iabilities (R)evenue (E)xpense Tran

[entity geo ppv] £000 £000 £000 £000 £000 No

Cash rec'd +£4.25k 07

Debtors +£4.00k 07

Sales +£8.25k 07

Stock (used up) -£0.25k 07

Cost of Sales -£0.25k 07

Rent pia -£0.5k 08

Rent expense -£0.5k 08

+ (E)quity + -

transactions 07 - 12 (A)ssets = (L)iabilities (R)evenue (E)xpense Tran

o'connor bs1108 2014-15

8-8 rdr02 - Profit/Loss or Income Statement

[entity geo ppv] £000 £000 £000 £000 £000 No

Accruals +£0.3k 09

Telephone expense -£0.3k 09

Accruals +£1.0k 10

Legal expense provision -£1.0k 10

Lease amortisation -£0.4k 11

Amortisation charge -£0.4k 11

Equip. depreciation -£0.2k 12

Depreciation charge -£0.2k 12

(A) (L) (E) (R) (Ex)

Totals +£6.9k +£1.3k +£8.25k -£2.65k

Add Trans (01 - 06) +£7.5k +£1.5k +£6k ___ ___

+£14.4k +£2.8k +£6k +£8.25k -£2.65k

Per financial a/cs at

dd/mm/yy4 above:

Fixed Assets +£3.4k

Current Assets +£11.0k

+£14.4k

Current Liabilities +£2.8k

Owner Equity +£6k

Revenues +£8.25k

less Expenses -£2.65k

Net Profit (for the year) +£5.60k

[Accounting Equation] +£14.4k = +£2.8k +£6.0k +£5.6k

Again, for completeness we could re-draft the above balance sheet of Geo ppv (mk4) in

an "international accounting standards" (IAS) format, and also the Profit/Loss account

known under IAS as the Income Statement

[IAS format] Geo ppv SoFP at dd/mm/yy 4 Geo ppv Inc. Sta. Ye dd/mm/yy 4

Premises 1600 Sales Revenue 8250

Equipment 1800 Cost of Sales 250

Non-current assets (e) 3400 Gross Profit 8000

Stock/Inventory 250 Less

Debtors/Rec'bles 5000 Expenses 2400

Cash 5750 Profit for the Year 5600

Current assets (f) 11000

Total assets (e+f) 14400

Owner equity 6000

Profit for the Year 5600

Equity (g) 11600

Creditors/Pay'bles 1500

Accruals & Provisions 1300

Current liabilities (h) 2800

Total equity and liabilities (g+h) 14400

o'connor bs1108 2014-15

Anda mungkin juga menyukai

- Trial Balance and Financial Statements for a Small BusinessDokumen4 halamanTrial Balance and Financial Statements for a Small Businessshaza jocarlosBelum ada peringkat

- S1 SDokumen7 halamanS1 SROHIT PANDEYBelum ada peringkat

- Analyzing Financial Statements and Cash Flows of CompaniesDokumen56 halamanAnalyzing Financial Statements and Cash Flows of CompaniesAditi AgrawalBelum ada peringkat

- Answer Sheet U10 1 NewDokumen7 halamanAnswer Sheet U10 1 Newrasem alessaBelum ada peringkat

- Transaction Analysis-Ch-1 Session 2, 3 4Dokumen17 halamanTransaction Analysis-Ch-1 Session 2, 3 4Parvej ahmedBelum ada peringkat

- The Balance Sheet of Bharat LTD As at 31st MarchDokumen4 halamanThe Balance Sheet of Bharat LTD As at 31st Marchsunny_masand1990Belum ada peringkat

- 3.7 Cash Flow Practice QuestionsDokumen2 halaman3.7 Cash Flow Practice QuestionsJavi MartinezBelum ada peringkat

- Fund Flow StatementDokumen41 halamanFund Flow StatementMahima SinghBelum ada peringkat

- Net Income 38000 Non Cash ItemsDokumen8 halamanNet Income 38000 Non Cash ItemsHuu LuatBelum ada peringkat

- Transaction Analysis-Ch-1 Session 2, 3 4Dokumen17 halamanTransaction Analysis-Ch-1 Session 2, 3 4rj OpuBelum ada peringkat

- Weller Company Cash FlowDokumen3 halamanWeller Company Cash Flowsuske.uchiha2000Belum ada peringkat

- Ans 31 To 41Dokumen2 halamanAns 31 To 41Mallet S. GacadBelum ada peringkat

- CHAPTER 3 (Accounting Equation)Dokumen5 halamanCHAPTER 3 (Accounting Equation)lcBelum ada peringkat

- CH 14 - Translation SolutionDokumen3 halamanCH 14 - Translation SolutionJosua PranataBelum ada peringkat

- 2020 Sem 1 ACC10007 Discussion Questions (And Solutions) - Topic 2 (Part 2)Dokumen5 halaman2020 Sem 1 ACC10007 Discussion Questions (And Solutions) - Topic 2 (Part 2)Renee WongBelum ada peringkat

- Chapter 14 Business CombinationDokumen5 halamanChapter 14 Business CombinationAshNor Randy0% (1)

- Statement of Cashflows For The Year Ended XYZ Cash Flows From Operating ActivitiesDokumen27 halamanStatement of Cashflows For The Year Ended XYZ Cash Flows From Operating ActivitieszeeshanBelum ada peringkat

- Cash Flow Statement ProblemsDokumen19 halamanCash Flow Statement ProblemsSubbu ..Belum ada peringkat

- Problem 3.18 Liabilities and Shareholders' Equity $: Expense (Cogs) - 32000Dokumen4 halamanProblem 3.18 Liabilities and Shareholders' Equity $: Expense (Cogs) - 32000Hendra RidwandhanaBelum ada peringkat

- Assignment 9Dokumen10 halamanAssignment 9Jerickho JBelum ada peringkat

- Sloved Questions Financial AnalysisDokumen12 halamanSloved Questions Financial AnalysisMurad KhanBelum ada peringkat

- AFA Tut 3Dokumen19 halamanAFA Tut 3Đỗ Kim ChiBelum ada peringkat

- Transactions Assets Liabilities + Patent $120,000 + Cash 80,000 - Cash $2,500Dokumen10 halamanTransactions Assets Liabilities + Patent $120,000 + Cash 80,000 - Cash $2,500abhishauryaBelum ada peringkat

- Accounting TaskDokumen10 halamanAccounting TaskSamuel Amon OkumuBelum ada peringkat

- Chapter 1-Problem 1 To 5: Charles Company Balance Sheet As On 31st Dec AssetsDokumen9 halamanChapter 1-Problem 1 To 5: Charles Company Balance Sheet As On 31st Dec AssetsSimran HarchandaniBelum ada peringkat

- Chữa đề NLKT thầy Cường và đề EBBADokumen12 halamanChữa đề NLKT thầy Cường và đề EBBATiêu Vân GiangBelum ada peringkat

- Funko - Versiã N Avanzada - SOLUCIÃ NDokumen11 halamanFunko - Versiã N Avanzada - SOLUCIÃ Nlucia guoBelum ada peringkat

- FA-Lecture - 15 (Comprehensive Example)Dokumen14 halamanFA-Lecture - 15 (Comprehensive Example)agaBelum ada peringkat

- Business Combination Stock AcquisitionDokumen2 halamanBusiness Combination Stock AcquisitionTEOPE, EMERLIZA DE CASTROBelum ada peringkat

- Cashflow - SolutionDokumen24 halamanCashflow - SolutionSamaira DubeyBelum ada peringkat

- HO and Branches Combined StatmentDokumen5 halamanHO and Branches Combined Statmentmmh771984Belum ada peringkat

- Accounts HomeworkDokumen9 halamanAccounts HomeworkSasha KingBelum ada peringkat

- Act201 AssignmentDokumen4 halamanAct201 Assignmentmahmud100% (1)

- CH 7Dokumen7 halamanCH 7qjtxBelum ada peringkat

- Chapter 3 Exercises and Problems AnswersDokumen6 halamanChapter 3 Exercises and Problems AnswersIskaBelum ada peringkat

- Chapter 12 ExcelDokumen6 halamanChapter 12 Excelnidal charaf eddineBelum ada peringkat

- Hapsburg SDokumen3 halamanHapsburg SMunir Muhammad Shafi, ACA, ACCABelum ada peringkat

- Analysis of Transactions Using Fundamental Accounting EquationDokumen4 halamanAnalysis of Transactions Using Fundamental Accounting EquationAlavy RayhanBelum ada peringkat

- CFS Class ProblemsDokumen2 halamanCFS Class ProblemsPranav MishraBelum ada peringkat

- E Learning AKL 1Dokumen11 halamanE Learning AKL 1Silvia IstimeiriantiBelum ada peringkat

- Probablity Distribution SolutionDokumen4 halamanProbablity Distribution Solutionabdul mateenBelum ada peringkat

- Examination Question and Answers, Set C (Problem Solving), Chapter 2 - Analyzing TransactionsDokumen3 halamanExamination Question and Answers, Set C (Problem Solving), Chapter 2 - Analyzing TransactionsJohn Carlos DoringoBelum ada peringkat

- Net Income 17,000: Account Receivable - 45,000Dokumen3 halamanNet Income 17,000: Account Receivable - 45,000Rock RoseBelum ada peringkat

- Raine SDokumen6 halamanRaine Sapi-664248097Belum ada peringkat

- Allan Gray Groups and InventoryDokumen8 halamanAllan Gray Groups and InventorykateBelum ada peringkat

- Final AccountsDokumen15 halamanFinal AccountsHammadBelum ada peringkat

- Ratios Test Class 11Dokumen2 halamanRatios Test Class 11AdeenaBelum ada peringkat

- Bracknell Cash Flow QuestionDokumen3 halamanBracknell Cash Flow Questionsanjay blakeBelum ada peringkat

- Book-Keeping Form ThreeDokumen182 halamanBook-Keeping Form ThreeChizani MnyifunaBelum ada peringkat

- CASH FLOW AND INCOME STATEMENT PROBLEMSDokumen17 halamanCASH FLOW AND INCOME STATEMENT PROBLEMSIris MnemosyneBelum ada peringkat

- Statement of Profit Loss and Financial PositionDokumen4 halamanStatement of Profit Loss and Financial Positionbbang bbyBelum ada peringkat

- Cash Flow Statement Important QuestionsDokumen20 halamanCash Flow Statement Important QuestionsSatinder SinghBelum ada peringkat

- Mock Exam 2 Suggested SolutionsDokumen10 halamanMock Exam 2 Suggested SolutionsAna-Maria GhBelum ada peringkat

- Worldwide Paper Company Woodyard Investment AnalysisDokumen1 halamanWorldwide Paper Company Woodyard Investment AnalysisKritikaPandeyBelum ada peringkat

- Spreadsheet Chapter 01 AnsDokumen13 halamanSpreadsheet Chapter 01 AnsLe Hong Phuc (K17 HCM)Belum ada peringkat

- Pizzanut Enterprises - For ClassDokumen3 halamanPizzanut Enterprises - For ClassB VaidehiBelum ada peringkat

- Visual Financial Accounting for You: Greatly Modified Chess Positions as Financial and Accounting ConceptsDari EverandVisual Financial Accounting for You: Greatly Modified Chess Positions as Financial and Accounting ConceptsBelum ada peringkat

- The Gone Fishin' Portfolio: Get Wise, Get Wealthy...and Get on With Your LifeDari EverandThe Gone Fishin' Portfolio: Get Wise, Get Wealthy...and Get on With Your LifeBelum ada peringkat

- Double-Entry and T AccountsDokumen7 halamanDouble-Entry and T AccountsHarsh ChhatrapatiBelum ada peringkat

- Live Round Challenge 1Dokumen2 halamanLive Round Challenge 1Harsh ChhatrapatiBelum ada peringkat

- Energy Performance Certificate: Energy Efficiency Rating Environmental Impact (CO) RatingDokumen5 halamanEnergy Performance Certificate: Energy Efficiency Rating Environmental Impact (CO) RatingHarsh ChhatrapatiBelum ada peringkat

- MSC Course ContentsDokumen4 halamanMSC Course ContentsHarsh ChhatrapatiBelum ada peringkat

- A Study of Impact of Household Savings & Investment On Economic Growth of UttarkhandDokumen20 halamanA Study of Impact of Household Savings & Investment On Economic Growth of UttarkhandHarsh ChhatrapatiBelum ada peringkat

- IB Bm2tr 5 Resources Answers3Dokumen5 halamanIB Bm2tr 5 Resources Answers3Gabriel FungBelum ada peringkat

- Aud 4 - BPO Industry 2022Dokumen32 halamanAud 4 - BPO Industry 20229nh9xfrkqyBelum ada peringkat

- Small Business Project Report on Idea Generation and AnalysisDokumen24 halamanSmall Business Project Report on Idea Generation and AnalysisAjay SahBelum ada peringkat

- Unit 1 Material Financial AccountingDokumen88 halamanUnit 1 Material Financial AccountingKeerthanaBelum ada peringkat

- Issuance of Par Value ShareDokumen12 halamanIssuance of Par Value SharejudesamaiBelum ada peringkat

- Operations and Supply Chain Management 15th Edition Jacobs Solutions ManualDokumen11 halamanOperations and Supply Chain Management 15th Edition Jacobs Solutions Manualhangnhanb7cvf100% (34)

- KAMMPIL Inc. 2022 Financial Statements Audit Representation LetterDokumen10 halamanKAMMPIL Inc. 2022 Financial Statements Audit Representation LetterJOHN MARK ARGUELLESBelum ada peringkat

- Ch08 PricingDokumen69 halamanCh08 PricingDaniel KangBelum ada peringkat

- AE23 - Strategic Cost Management Ch 6Dokumen18 halamanAE23 - Strategic Cost Management Ch 6Ayana Janica100% (3)

- DDP PC 1 2019 1 Caso Rosatel PlantillaDokumen4 halamanDDP PC 1 2019 1 Caso Rosatel PlantillaAntony CoroBelum ada peringkat

- ReportDokumen21 halamanReportrpBelum ada peringkat

- 2010-10-22 003512 Yan 8Dokumen19 halaman2010-10-22 003512 Yan 8Natsu DragneelBelum ada peringkat

- Actividad 3. Evidencia 6Dokumen3 halamanActividad 3. Evidencia 6Lina González0% (2)

- Lecture 6 - Pricing DecisionDokumen30 halamanLecture 6 - Pricing DecisionRaeka AriyandiBelum ada peringkat

- Standard Operating Procedures Assessment of Accounting QualificationsDokumen14 halamanStandard Operating Procedures Assessment of Accounting QualificationschiaraferragniBelum ada peringkat

- Sales Forecasting Techniques ExplainedDokumen20 halamanSales Forecasting Techniques ExplainedLAUWA LUM DAUBelum ada peringkat

- Financial InfoDokumen23 halamanFinancial InfojohnsolarpanelsBelum ada peringkat

- Exposure To Currency Risk Definition and Measurement PDFDokumen2 halamanExposure To Currency Risk Definition and Measurement PDFTaraBelum ada peringkat

- Demand Analysis Question BankDokumen3 halamanDemand Analysis Question BanknisajamesBelum ada peringkat

- Montego Bay Community College Variance Analysis WorksheetDokumen8 halamanMontego Bay Community College Variance Analysis WorksheetLeigh018Belum ada peringkat

- Profile - Power Root MalaysiaDokumen2 halamanProfile - Power Root MalaysiaMuhamad SyafiqBelum ada peringkat

- Senka Dindic - CV EnglishDokumen2 halamanSenka Dindic - CV EnglishAntonela ĐinđićBelum ada peringkat

- 2009-10-29 201418 MarcusDokumen2 halaman2009-10-29 201418 MarcusShailene DavidBelum ada peringkat

- Termeni Contabili in Engleza PDFDokumen11 halamanTermeni Contabili in Engleza PDFDo Minh DucBelum ada peringkat

- Aileron Market Balance: Issue 22Dokumen6 halamanAileron Market Balance: Issue 22Dan ShyBelum ada peringkat

- MBA Case StudiesDokumen123 halamanMBA Case StudiesMariell Joy Cariño-TanBelum ada peringkat

- The Customer Has EscapedDokumen11 halamanThe Customer Has EscapedChiranjibi DalabeharaBelum ada peringkat

- BMC TemplateDokumen2 halamanBMC TemplateVlad AlvazBelum ada peringkat

- Audi and BMW Operational Strategies to Gain Market ShareDokumen6 halamanAudi and BMW Operational Strategies to Gain Market ShareNazmus SaifBelum ada peringkat

- Arens Auditing16e Irm 01Dokumen8 halamanArens Auditing16e Irm 01qiBelum ada peringkat