Medical Expense Claim Form - 13!6!2017

Diunggah oleh

sachinsaklani230 penilaian0% menganggap dokumen ini bermanfaat (0 suara)

0 tayangan2 halamanhi

Judul Asli

Medical Expense Claim Form_13!6!2017

Hak Cipta

© © All Rights Reserved

Format Tersedia

PDF atau baca online dari Scribd

Bagikan dokumen Ini

Apakah menurut Anda dokumen ini bermanfaat?

Apakah konten ini tidak pantas?

Laporkan Dokumen Inihi

Hak Cipta:

© All Rights Reserved

Format Tersedia

Unduh sebagai PDF atau baca online dari Scribd

0 penilaian0% menganggap dokumen ini bermanfaat (0 suara)

0 tayangan2 halamanMedical Expense Claim Form - 13!6!2017

Diunggah oleh

sachinsaklani23hi

Hak Cipta:

© All Rights Reserved

Format Tersedia

Unduh sebagai PDF atau baca online dari Scribd

Anda di halaman 1dari 2

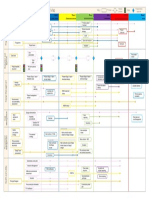

MEDICAL EXPENSE CLAIM FORM FOR TAX BENEFIT

Employee Code

Employee Name

Location

Date of Joining

Financial Year

‘Sr. | Name of the Patient Fela ‘Aitending Doctor] Amount

No.

Total Claim Amount

Verification:

Hl do hereby certity that all expenses have been actually incurred

by me for the medical treatment for self and family members as mentioned above. In the event the details provided

above is found to be false or untrue and as a consequence, if any liabilly in the form of tax, interest ar penalty

arises then I would be fully responsible for the same and | would reimburse the same to the company with any

other cost / expenses incurred by the company.

Date:

INSTRUCTIONS:

1) Tax Benefit on Medical Allowance

* Medical allowance received by the employee in monthly salary is fully taxable unless claimed

‘exemption with supporting documents. Exemption can be availed up to a maximum of Rs.15,000 per

annum for medical expenses incurred during the financial year.

* Exemption is given to the employee only if the medical expense is actually incurred on his medical

treatment or his family members. Family members include spouse, children and dependent parents,

brothers or sisters of the employee.

2) Original copy of Bills, Receipts, etc, for the amount claimed to be submitted with details to be updated in

statement overleat.

3) This form is to be submitted to Payroll Team on or before January 15 2018 or before leaving the organization

in the event of discontinuation of services.

oF

No

BINS

Bil Date

Name (Chemist

Hospital)

Doctor

Pathology Lab

Bil

Amount

Total Claim Amount

Anda mungkin juga menyukai

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryDari EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryPenilaian: 3.5 dari 5 bintang3.5/5 (231)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)Dari EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Penilaian: 4.5 dari 5 bintang4.5/5 (119)

- Never Split the Difference: Negotiating As If Your Life Depended On ItDari EverandNever Split the Difference: Negotiating As If Your Life Depended On ItPenilaian: 4.5 dari 5 bintang4.5/5 (838)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaDari EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaPenilaian: 4.5 dari 5 bintang4.5/5 (265)

- The Little Book of Hygge: Danish Secrets to Happy LivingDari EverandThe Little Book of Hygge: Danish Secrets to Happy LivingPenilaian: 3.5 dari 5 bintang3.5/5 (399)

- Grit: The Power of Passion and PerseveranceDari EverandGrit: The Power of Passion and PerseverancePenilaian: 4 dari 5 bintang4/5 (587)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyDari EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyPenilaian: 3.5 dari 5 bintang3.5/5 (2219)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeDari EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifePenilaian: 4 dari 5 bintang4/5 (5794)

- Team of Rivals: The Political Genius of Abraham LincolnDari EverandTeam of Rivals: The Political Genius of Abraham LincolnPenilaian: 4.5 dari 5 bintang4.5/5 (234)

- Rise of ISIS: A Threat We Can't IgnoreDari EverandRise of ISIS: A Threat We Can't IgnorePenilaian: 3.5 dari 5 bintang3.5/5 (137)

- Shoe Dog: A Memoir by the Creator of NikeDari EverandShoe Dog: A Memoir by the Creator of NikePenilaian: 4.5 dari 5 bintang4.5/5 (537)

- The Emperor of All Maladies: A Biography of CancerDari EverandThe Emperor of All Maladies: A Biography of CancerPenilaian: 4.5 dari 5 bintang4.5/5 (271)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreDari EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You ArePenilaian: 4 dari 5 bintang4/5 (1090)

- Her Body and Other Parties: StoriesDari EverandHer Body and Other Parties: StoriesPenilaian: 4 dari 5 bintang4/5 (821)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersDari EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersPenilaian: 4.5 dari 5 bintang4.5/5 (344)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceDari EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RacePenilaian: 4 dari 5 bintang4/5 (890)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureDari EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FuturePenilaian: 4.5 dari 5 bintang4.5/5 (474)

- The Unwinding: An Inner History of the New AmericaDari EverandThe Unwinding: An Inner History of the New AmericaPenilaian: 4 dari 5 bintang4/5 (45)

- The Yellow House: A Memoir (2019 National Book Award Winner)Dari EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Penilaian: 4 dari 5 bintang4/5 (98)

- Project Process MapDokumen1 halamanProject Process MapShahrirBelum ada peringkat

- On Fire: The (Burning) Case for a Green New DealDari EverandOn Fire: The (Burning) Case for a Green New DealPenilaian: 4 dari 5 bintang4/5 (73)

- Deliverable ListDokumen7 halamanDeliverable Listsachinsaklani23Belum ada peringkat

- Static Pressure Calculations V1.1Dokumen1 halamanStatic Pressure Calculations V1.1sachinsaklani23Belum ada peringkat

- PipingDokumen34 halamanPipingsachinsaklani23Belum ada peringkat

- Sachin SaklaniDokumen1 halamanSachin Saklanisachinsaklani23Belum ada peringkat

- Admission Form: Registration Class - Age Chart (In Years) On 1 AprilDokumen2 halamanAdmission Form: Registration Class - Age Chart (In Years) On 1 Aprilsachinsaklani23Belum ada peringkat

- Item Rate Boq: Sac Code Basic Price (RS.) Rate of GST (In %)Dokumen1 halamanItem Rate Boq: Sac Code Basic Price (RS.) Rate of GST (In %)sachinsaklani23Belum ada peringkat

- CLCV - Sachin Saklani - 20210613-1Dokumen4 halamanCLCV - Sachin Saklani - 20210613-1sachinsaklani23Belum ada peringkat

- Speaking sample task - Car and clothing status symbolsDokumen1 halamanSpeaking sample task - Car and clothing status symbolsAnamika DhillonBelum ada peringkat

- A Small Piece of AdviceDokumen1 halamanA Small Piece of Advicesachinsaklani23Belum ada peringkat

- Future For 3D Laser Scanning Services in ConstructionDokumen3 halamanFuture For 3D Laser Scanning Services in Constructionsachinsaklani23Belum ada peringkat

- Delhi Public School Maruti Kunj Post Mid Term 1 (2020-21)Dokumen1 halamanDelhi Public School Maruti Kunj Post Mid Term 1 (2020-21)sachinsaklani23Belum ada peringkat

- A Small Piece of AdviceDokumen1 halamanA Small Piece of Advicesachinsaklani23Belum ada peringkat

- Section 1: Questions 1 - 8Dokumen3 halamanSection 1: Questions 1 - 8fagasgBelum ada peringkat

- The Rocket - From East To WestDokumen3 halamanThe Rocket - From East To Westmukaddes12199757Belum ada peringkat

- Important Notice: Product Return: RewardDokumen2 halamanImportant Notice: Product Return: RewardRodrigo MoraesBelum ada peringkat

- Ideal Logic HIU Design GuideDokumen24 halamanIdeal Logic HIU Design Guidesachinsaklani23Belum ada peringkat

- Planning Underfloor Heat in 40 CharactersDokumen8 halamanPlanning Underfloor Heat in 40 CharactersNataLeeBelum ada peringkat

- Guide B1 Appendix LTHW SizingDokumen28 halamanGuide B1 Appendix LTHW Sizingsachinsaklani23Belum ada peringkat

- S.NO. Floor Area Name Area Tag Ac/Heating/VentilationDokumen29 halamanS.NO. Floor Area Name Area Tag Ac/Heating/Ventilationsachinsaklani23Belum ada peringkat

- Report On Under-Floor Heating Design: Prepared By: Prepared For: Contract Number: DateDokumen11 halamanReport On Under-Floor Heating Design: Prepared By: Prepared For: Contract Number: Datesachinsaklani23Belum ada peringkat

- Modine - comuserdataLEEDGBMyDocumentsshardyDocumentsTherm-X HR85 Technical Manual PDFDokumen40 halamanModine - comuserdataLEEDGBMyDocumentsshardyDocumentsTherm-X HR85 Technical Manual PDFsachinsaklani23Belum ada peringkat

- 2D/3D Polylines & FacesDokumen38 halaman2D/3D Polylines & Facessachinsaklani23Belum ada peringkat

- 10 General PDFDokumen283 halaman10 General PDFsachinsaklani23Belum ada peringkat

- Sample Hydraulic Calculation PDFDokumen5 halamanSample Hydraulic Calculation PDFsachinsaklani23Belum ada peringkat

- 10 General PDFDokumen283 halaman10 General PDFsachinsaklani23Belum ada peringkat

- HiDokumen40 halamanHisachinsaklani23Belum ada peringkat

- Estates Projects Design BriefDokumen2 halamanEstates Projects Design Briefsachinsaklani23Belum ada peringkat

- 3 Pipe Sizing 2013 3Dokumen34 halaman3 Pipe Sizing 2013 3siva anand100% (1)

- Coil LoadDokumen13 halamanCoil LoadMakarand DeshpandeBelum ada peringkat