Caltex Phils vs COA ruling on offsetting OPSF collections

Diunggah oleh

zahreenamolina0 penilaian0% menganggap dokumen ini bermanfaat (0 suara)

30 tayangan2 halamanhsgch

Judul Asli

23. Caltex vs COA Et Al

Hak Cipta

© © All Rights Reserved

Format Tersedia

DOCX, PDF, TXT atau baca online dari Scribd

Bagikan dokumen Ini

Apakah menurut Anda dokumen ini bermanfaat?

Apakah konten ini tidak pantas?

Laporkan Dokumen Inihsgch

Hak Cipta:

© All Rights Reserved

Format Tersedia

Unduh sebagai DOCX, PDF, TXT atau baca online dari Scribd

0 penilaian0% menganggap dokumen ini bermanfaat (0 suara)

30 tayangan2 halamanCaltex Phils vs COA ruling on offsetting OPSF collections

Diunggah oleh

zahreenamolinahsgch

Hak Cipta:

© All Rights Reserved

Format Tersedia

Unduh sebagai DOCX, PDF, TXT atau baca online dari Scribd

Anda di halaman 1dari 2

Title Caltex Phils vs COA, Commisioner

Fernandez and Commisioner Cruz Caltex filed an Omnibus Motion for

GR 92585 Reconsideration of the said decision but was

Date May 8, 1992 denied. Hence, petition.

Issue: WoN the amount due from Caltex to OPSF

KEYWORDS

may be offsetted against Caltex´s outstanding

OPSF cannot be offsetted, Unremitted

claims from said fund.

collections, General Welfare,

SC: NO. COA´s decision is affirmed except that

portion disallowing Caltex´s claim for

DOCTRINE reimbursement of underrecovery arising from

Taxation is no longer envisioned as a measure to sales to NAPOCOR.

raise revenue to support the existence of the

gov´t; taxes may be levied with a regulatory It is settled that a taxpayer may not offset taxes

purpose to provide means for the rehabilitation due from the claims that he may have against the

and stabilization of the threatened industry government. Taxes cannot be the subject of

which is affected with public interest as to be compensation because the gov´t and the taxpayer

within the police power of the state. No doubt are not mutually creditors and debtors of each

that the oil industry is greatly imbued with other and a claim for taxes is not such a debt,

public interest as it vitally affects the general demand, contract or judgment as is allowed to set-

welfare off.

CASE: In respect to the taxes for the OPSF, the oil

companies merely acts as a gents for the gov´t in

OPSF was created under Sec 8 of PD no. 1956 as the latter´s collection since taxes are, passed unto

amended by EO No. 137 wherein it will create a the end-users – the consuming public.

Trust Acct for the purpose of minimizing frequent

price changes brought about by exchange rate Caltex has the primary obligation to account for

adjustments and world market prices. and remit taxes collected to the administrator of

the OPSF. This duty stems from the fiduciary

COA sent a letter to Caltex directing it to remit to relationship between the two. Caltex cannot be

the OPSF its collection, excluding that unremitted considered merely as a debtor. In respect to its

for the years 1986 & 1988 of the add´tl tax on collection for the OPSF vis-a-vis its claim for

petroleum authorized under sec 8 of PD No 1956 reimbursement, no compensation is likewise legally

which amounted to P335, 037,000+ and informed feasible. RA 6952 does not authorize oil companies

that all pending claim claims for reimbursement to offset their claims against their OPSF

from OPSF will be withheld. contributions. It prohibits the gov´t from paying

any amount from the Petroleum Price Standby

The grand total of its unremitted collection is Fund to oil companies which have outstanding

P1,287,000+. Caltex submitted to COA a proposal obligations with the gov´t, without said obligation

for the payment of the collections and the recovery being offset first subject to the rules on

of the claims. COA accepted the proposal but compensation in the CC.

prohibited Caltex from further offsetting

remittances and reimbursements for the current Any unregulated increase in oil prices could hurt

and ensuing years. the lives of the majority of the people and cause

economic crisis of untold proportions. It would

have a chain reaction, hence, the stabilization of oil

prices is of prime concern which the state via its

police power, may properly address.

Anda mungkin juga menyukai

- Caltex v. COA DigestDokumen2 halamanCaltex v. COA Digestpinkblush717100% (1)

- Caltex v COA: No offsetting of taxes against claimsDokumen1 halamanCaltex v COA: No offsetting of taxes against claimsHarvey Leo RomanoBelum ada peringkat

- Caltex Philippines vs. COA tax offset disputeDokumen2 halamanCaltex Philippines vs. COA tax offset disputeStephanie Ann LopezBelum ada peringkat

- Caltex Philippines Vs COA, 208 SCRA 726, 05 - 08 - 1992Dokumen2 halamanCaltex Philippines Vs COA, 208 SCRA 726, 05 - 08 - 1992I took her to my penthouse and i freaked itBelum ada peringkat

- Caltex V COA DigestDokumen3 halamanCaltex V COA DigestCarlito HilvanoBelum ada peringkat

- Caltex Vs Commission On Audit 1992Dokumen1 halamanCaltex Vs Commission On Audit 1992Praisah Marjorey PicotBelum ada peringkat

- 016 Caltex Philippines Inc. v. Commission On AuditDokumen2 halaman016 Caltex Philippines Inc. v. Commission On AuditJuno GeronimoBelum ada peringkat

- (Taxation 1) Caltex vs. COADokumen1 halaman(Taxation 1) Caltex vs. COAthornapple25Belum ada peringkat

- Caltex Philippines V CoaDokumen1 halamanCaltex Philippines V CoaJL A H-Dimaculangan100% (3)

- Caltex v. COA - DigestDokumen2 halamanCaltex v. COA - DigestChie Z. Villasanta71% (7)

- Caltex Case StudyDokumen4 halamanCaltex Case StudyJoy YuBelum ada peringkat

- Caltex V COA DigestDokumen2 halamanCaltex V COA DigestMichael SanchezBelum ada peringkat

- CALTEX PHILIPPINES VS COA ON OIL PRICE STABILIZATION FUNDDokumen1 halamanCALTEX PHILIPPINES VS COA ON OIL PRICE STABILIZATION FUNDClaudine ArrabisBelum ada peringkat

- Caltex Vs COADokumen2 halamanCaltex Vs COAVladimir Sabarez LinawanBelum ada peringkat

- Caltex Philippines v COA Offset of Taxes Against ClaimsDokumen3 halamanCaltex Philippines v COA Offset of Taxes Against ClaimsJefferson NunezaBelum ada peringkat

- G.R. No. 92585 May 8, 1992 Davide, JR.,: Caltex Philippines, Inc. vs. Commission On AuditDokumen1 halamanG.R. No. 92585 May 8, 1992 Davide, JR.,: Caltex Philippines, Inc. vs. Commission On AuditDonna DumaliangBelum ada peringkat

- Caltex Philippines cannot offset tax obligations against claimsDokumen2 halamanCaltex Philippines cannot offset tax obligations against claimsKing Badong100% (1)

- Caltex Philippines, Inc. vs. Commission On AuditDokumen2 halamanCaltex Philippines, Inc. vs. Commission On AuditCecil MoriBelum ada peringkat

- Regulatory Purpose: Non-Revenue/ Special or RegulatoryDokumen6 halamanRegulatory Purpose: Non-Revenue/ Special or Regulatorykristel jane caldozaBelum ada peringkat

- Caltex Vs CoaDokumen1 halamanCaltex Vs CoaAnonymous 5MiN6I78I0Belum ada peringkat

- 010-Caltex Phil., Inc. v. COA, 208 SCRA 726Dokumen19 halaman010-Caltex Phil., Inc. v. COA, 208 SCRA 726Jopan SJBelum ada peringkat

- Caltex Vs Commission On AuditDokumen2 halamanCaltex Vs Commission On AuditHonorio Bartholomew ChanBelum ada peringkat

- Caltex Vs CoaDokumen22 halamanCaltex Vs CoaRoberto ValerioBelum ada peringkat

- Deductions From Gross Income, Lifeblood Doctrine, Benefits-Protection Theory (Symbiotic Relationship Doctrine)Dokumen12 halamanDeductions From Gross Income, Lifeblood Doctrine, Benefits-Protection Theory (Symbiotic Relationship Doctrine)Chester CaroBelum ada peringkat

- AKMA PTM v. COMELEC Ruling on Delegation of Legislative PowerDokumen2 halamanAKMA PTM v. COMELEC Ruling on Delegation of Legislative PowerDonn LinBelum ada peringkat

- FT 2Dokumen20 halamanFT 2Prime DacanayBelum ada peringkat

- Osmena V OrbosDokumen2 halamanOsmena V OrbosRalph Deric EspirituBelum ada peringkat

- Caltex Philippines v. Commission On Audit - Page 5Dokumen13 halamanCaltex Philippines v. Commission On Audit - Page 5Roma MicuBelum ada peringkat

- CIR Rulings on Tax Deductions and Offsetting ClaimsDokumen4 halamanCIR Rulings on Tax Deductions and Offsetting ClaimsAngela Marie AlmalbisBelum ada peringkat

- Digest NicaDokumen8 halamanDigest NicaDanica Irish RevillaBelum ada peringkat

- I. General Principles of Taxation A. Definition, Concept and Purpose of Taxation Caltex vs. CoaDokumen19 halamanI. General Principles of Taxation A. Definition, Concept and Purpose of Taxation Caltex vs. Coajehana usmanBelum ada peringkat

- Maceda vs. ErbDokumen1 halamanMaceda vs. ErbFrancis Coronel Jr.Belum ada peringkat

- Caltex Philippines v COA Offset Tax Claims ReimbursementsDokumen23 halamanCaltex Philippines v COA Offset Tax Claims ReimbursementsMachida AbrahamBelum ada peringkat

- Caltex vs. COADokumen12 halamanCaltex vs. COAGlads SarominezBelum ada peringkat

- Osmena Vs OrbosDokumen8 halamanOsmena Vs OrbossescuzarBelum ada peringkat

- Tax Rev - Case DigestDokumen12 halamanTax Rev - Case DigestCk Bongalos AdolfoBelum ada peringkat

- Consti Coa and LguDokumen26 halamanConsti Coa and LguWes ChanBelum ada peringkat

- Osmeña vs Orbos ruling on oil price fundDokumen8 halamanOsmeña vs Orbos ruling on oil price fundJMABelum ada peringkat

- Tax CasesDokumen39 halamanTax CasesLiz Matarong BayanoBelum ada peringkat

- Caltex Philippines, Inc Vs COA, GR No 92585, 8 May 1992Dokumen12 halamanCaltex Philippines, Inc Vs COA, GR No 92585, 8 May 1992Antonio Palpal-latocBelum ada peringkat

- Osmeña v. Orbos, 220 SCRA 703-Non - DelegationDokumen2 halamanOsmeña v. Orbos, 220 SCRA 703-Non - DelegationIVYJEAN LAGURABelum ada peringkat

- 13 Osmeña Vs OrbosDokumen2 halaman13 Osmeña Vs OrbosJpSocratesBelum ada peringkat

- Supreme Court Rules on Oil Price Stabilization Fund ClaimsDokumen29 halamanSupreme Court Rules on Oil Price Stabilization Fund ClaimsCheska VergaraBelum ada peringkat

- Oil Price Stabilization Fund reimbursement claimsDokumen16 halamanOil Price Stabilization Fund reimbursement claimsMarkBelum ada peringkat

- Osmeña vs. Orbos, 220 SCRA 703, G.R. No. 99886Dokumen2 halamanOsmeña vs. Orbos, 220 SCRA 703, G.R. No. 99886Rukmini Dasi Rosemary GuevaraBelum ada peringkat

- 41 Osmeña v. Orbos, G.R. No. 99886, March 31 1993 PDFDokumen8 halaman41 Osmeña v. Orbos, G.R. No. 99886, March 31 1993 PDFJeunice VillanuevaBelum ada peringkat

- C - 82 Osmena vs. OrbosDokumen11 halamanC - 82 Osmena vs. OrboscharmssatellBelum ada peringkat

- Oil Price Stabilization Fund RulingDokumen6 halamanOil Price Stabilization Fund Rulingabakada_kaye100% (1)

- 1 Lutz vs. AranetaDokumen35 halaman1 Lutz vs. AranetaColleen Fretzie Laguardia NavarroBelum ada peringkat

- Chanro Blesvirtua Lawlib Rary: Chanroble S Virtual Law Libra RyDokumen4 halamanChanro Blesvirtua Lawlib Rary: Chanroble S Virtual Law Libra RyAJ QuimBelum ada peringkat

- Nature - Tax V License V Regulatory FeeDokumen15 halamanNature - Tax V License V Regulatory Feegemao.jb1986Belum ada peringkat

- Prelim Cases TaxDokumen76 halamanPrelim Cases TaxPrincess Hazel GriñoBelum ada peringkat

- Caltex v. COADokumen6 halamanCaltex v. COAHappy Dreams PhilippinesBelum ada peringkat

- Mergers and Acquisitions DigestDokumen3 halamanMergers and Acquisitions DigestBless CarpenaBelum ada peringkat

- Osmena vs. OrbosDokumen9 halamanOsmena vs. Orboscmv mendozaBelum ada peringkat

- RANAY Taxrev Case1Dokumen12 halamanRANAY Taxrev Case1Erneylou RanayBelum ada peringkat

- Caltex Philippines, Inc. vs. Commission On AuditDokumen41 halamanCaltex Philippines, Inc. vs. Commission On AuditJayson Francisco100% (1)

- Caltex Philippines, Inc. V COA (1992)Dokumen3 halamanCaltex Philippines, Inc. V COA (1992)Anonymous wD8hMIPxJBelum ada peringkat

- 4 Osmena V Orbos DGSTDokumen2 halaman4 Osmena V Orbos DGSTMiguelBelum ada peringkat

- Republic VS Albios Molina G02 DlsuDokumen1 halamanRepublic VS Albios Molina G02 DlsuzahreenamolinaBelum ada peringkat

- 18 Tenchavez Vs EscanoDokumen1 halaman18 Tenchavez Vs EscanozahreenamolinaBelum ada peringkat

- 47 Grande Vs AntonioDokumen1 halaman47 Grande Vs AntoniozahreenamolinaBelum ada peringkat

- LTD - Compilation (Midterms)Dokumen50 halamanLTD - Compilation (Midterms)zahreenamolinaBelum ada peringkat

- Module 8B Compromise AbatementDokumen10 halamanModule 8B Compromise AbatementzahreenamolinaBelum ada peringkat

- Refusal to Consummate Marriage Sign of Psychological IncapacityDokumen1 halamanRefusal to Consummate Marriage Sign of Psychological IncapacityzahreenamolinaBelum ada peringkat

- GARCIA Vs RECIO Molina G02 DLSUDokumen1 halamanGARCIA Vs RECIO Molina G02 DLSUzahreenamolinaBelum ada peringkat

- LTD ReviewerDokumen9 halamanLTD ReviewerzahreenamolinaBelum ada peringkat

- Ongsiako-Reyes Vs ComelecDokumen1 halamanOngsiako-Reyes Vs Comeleczahreenamolina100% (1)

- COMELEC Ruling on Dual CitizenshipDokumen3 halamanCOMELEC Ruling on Dual CitizenshipzahreenamolinaBelum ada peringkat

- 20 IDEAL Vs PSALMDokumen2 halaman20 IDEAL Vs PSALMzahreenamolinaBelum ada peringkat

- Remedies Notes LTDDokumen4 halamanRemedies Notes LTDzahreenamolinaBelum ada peringkat

- 7 Part V (6, D-F)Dokumen21 halaman7 Part V (6, D-F)zahreenamolinaBelum ada peringkat

- 00 Labor2 Feb. 14Dokumen18 halaman00 Labor2 Feb. 14zahreenamolinaBelum ada peringkat

- Labor Law 2 SyllabusDokumen28 halamanLabor Law 2 SyllabuszahreenamolinaBelum ada peringkat

- Deed of Conditional SaleDokumen4 halamanDeed of Conditional SalezahreenamolinaBelum ada peringkat

- 00 Labor2 Feb. 21Dokumen25 halaman00 Labor2 Feb. 21zahreenamolinaBelum ada peringkat

- Labor Law 2 SyllabusDokumen28 halamanLabor Law 2 SyllabuszahreenamolinaBelum ada peringkat

- 1 Labor Part 1Dokumen11 halaman1 Labor Part 1zahreenamolinaBelum ada peringkat

- 4 Part 3 F-GDokumen39 halaman4 Part 3 F-GzahreenamolinaBelum ada peringkat

- 8 Part VIDokumen43 halaman8 Part VIzahreenamolinaBelum ada peringkat

- Union Representation StatusDokumen36 halamanUnion Representation StatuszahreenamolinaBelum ada peringkat

- 5 Part IVDokumen10 halaman5 Part IVzahreenamolinaBelum ada peringkat

- Legal OpinionDokumen6 halamanLegal OpinionzahreenamolinaBelum ada peringkat

- 8 Part VIDokumen43 halaman8 Part VIzahreenamolinaBelum ada peringkat

- Heirs of Juan Pinez vs. Dayrit dispute over land titleDokumen3 halamanHeirs of Juan Pinez vs. Dayrit dispute over land titlezahreenamolinaBelum ada peringkat

- 2 Labor Part 2Dokumen16 halaman2 Labor Part 2zahreenamolinaBelum ada peringkat

- Counsel For Ma. Jeanette S. Cervantes - AraoDokumen1 halamanCounsel For Ma. Jeanette S. Cervantes - AraoZahreena MolinaBelum ada peringkat

- Kopya NG 56. Del Prado vs. CaballeroDokumen1 halamanKopya NG 56. Del Prado vs. CaballeroZahreena MolinaBelum ada peringkat

- Manila Market Stall Fees Upheld for Public PurposeDokumen1 halamanManila Market Stall Fees Upheld for Public PurposezahreenamolinaBelum ada peringkat

- PO Delhi Metro CorpDokumen2 halamanPO Delhi Metro CorpagarwaalaaaaBelum ada peringkat

- CONWORLDDokumen3 halamanCONWORLDCollege DumpfilesBelum ada peringkat

- Top Hidden Screte of Stock Market PDFDokumen4 halamanTop Hidden Screte of Stock Market PDFAmb ReshBelum ada peringkat

- Worksheet - Rectification of ErrorsDokumen3 halamanWorksheet - Rectification of ErrorsRajni Sinha VermaBelum ada peringkat

- SFA Exam Notice FAQ Apr 2019Dokumen5 halamanSFA Exam Notice FAQ Apr 2019Lei JianxinBelum ada peringkat

- Strategic Plan 2016-2019: A Place for People to ProsperDokumen20 halamanStrategic Plan 2016-2019: A Place for People to ProsperKushaal SainBelum ada peringkat

- 20230SDGs English Report972018 FINALDokumen96 halaman20230SDGs English Report972018 FINALmaveryqBelum ada peringkat

- DBB2104 Unit-08Dokumen24 halamanDBB2104 Unit-08anamikarajendran441998Belum ada peringkat

- Securities and Exchange Commission: Sec Form 17-QDokumen3 halamanSecurities and Exchange Commission: Sec Form 17-QJamil MacabandingBelum ada peringkat

- Far-1 Revaluation JE 2Dokumen2 halamanFar-1 Revaluation JE 2Janie HookeBelum ada peringkat

- Southwest's Business Model and Competitive AdvantageDokumen4 halamanSouthwest's Business Model and Competitive AdvantageLina Levvenia RatanamBelum ada peringkat

- Catherine Austin Fitts Financial Coup D'etatDokumen10 halamanCatherine Austin Fitts Financial Coup D'etatStephanie White Tulip Popescu67% (3)

- Consolidated Balance Sheet of Steel Authority of India (In Rs. Crores) Mar-17 Mar-16 Mar-15 Equity and Liabilities Shareholder'S FundDokumen4 halamanConsolidated Balance Sheet of Steel Authority of India (In Rs. Crores) Mar-17 Mar-16 Mar-15 Equity and Liabilities Shareholder'S FundPuneet GeraBelum ada peringkat

- Executive SummaryDokumen49 halamanExecutive SummaryMuhsin ShahBelum ada peringkat

- Monetary and Fiscal Policy Review in Islamic Sharia Syahril ToonawuDokumen20 halamanMonetary and Fiscal Policy Review in Islamic Sharia Syahril ToonawuSyahril XtreelBelum ada peringkat

- Taxation: Far Eastern University - ManilaDokumen4 halamanTaxation: Far Eastern University - ManilacamilleBelum ada peringkat

- Chapter 1: Hospitality Spirit. An OverviewDokumen26 halamanChapter 1: Hospitality Spirit. An OverviewKhairul FirdausBelum ada peringkat

- Iobz - Syllabus Financial Accounting 11Dokumen2 halamanIobz - Syllabus Financial Accounting 11josemusi0% (1)

- Risk and Return 2Dokumen2 halamanRisk and Return 2Nitya BhakriBelum ada peringkat

- How Affiliate Marketing Impacts E-CommerceDokumen13 halamanHow Affiliate Marketing Impacts E-CommercePrecieux MuntyBelum ada peringkat

- India's Leading Infrastructure Companies 2017Dokumen192 halamanIndia's Leading Infrastructure Companies 2017Navin JollyBelum ada peringkat

- Ratio Name Interpretation Interpretation Current RatioDokumen4 halamanRatio Name Interpretation Interpretation Current Ratiotamanna rashid shime0% (1)

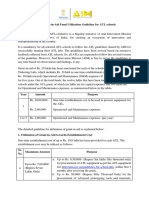

- Grant-In-Aid Fund Utilization GuidelineDokumen5 halamanGrant-In-Aid Fund Utilization GuidelineBiswambharLayekBelum ada peringkat

- Bsbfia401 2Dokumen2 halamanBsbfia401 2nattyBelum ada peringkat

- Chapter 2 - Consumer BehaviourDokumen95 halamanChapter 2 - Consumer BehaviourRt NeemaBelum ada peringkat

- Principles of Economics - 1 - 2Dokumen81 halamanPrinciples of Economics - 1 - 2KENMOGNE TAMO MARTIALBelum ada peringkat

- RM Unit 2Dokumen18 halamanRM Unit 2VickyBelum ada peringkat

- Article On Investors Awareness in Stock Market-1Dokumen10 halamanArticle On Investors Awareness in Stock Market-1archerselevatorsBelum ada peringkat

- Foreign Exchange Risk: Types of ExposureDokumen2 halamanForeign Exchange Risk: Types of ExposurepilotBelum ada peringkat

- Word Family ECONOMY - VežbeDokumen16 halamanWord Family ECONOMY - VežbeNevena ZdravkovicBelum ada peringkat