Capital One Case Study On CRM

Diunggah oleh

ashishJudul Asli

Hak Cipta

Format Tersedia

Bagikan dokumen Ini

Apakah menurut Anda dokumen ini bermanfaat?

Apakah konten ini tidak pantas?

Laporkan Dokumen IniHak Cipta:

Format Tersedia

Capital One Case Study On CRM

Diunggah oleh

ashishHak Cipta:

Format Tersedia

CRM AT CAPITAL ONE (UK): CASE STUDY

Introduction:

Capital One is a US based financial corporation founded in November 1994. In 1998 Capital One

opened its first overseas service at Nottingham, UK. Within a span of 6 years of its inception, its

stock price increased by 1000 percent with an average annual growth of 40 percent.

Success behind such a phenomenal growth is through the vision of its leader Richard Fairbank

and Nigel Forris.

Vision that transcends myopia: To develop a information-based company rather than a

financial company.

Core strategy: To tailor their service and product as per individual customer requirement so

that the “right product (credit card) can be provided to customers at right time and right

price”. Such an offer was a unique proposition in a market which lacked customisation and

one to one marketing.

KEY DIVISION

Marketing & Analysis Operations Information Technology Human Resources

Segmentation Processing Supports Business issues Managing associate

Proposal Testing Customer Relations and decision through selection

Analysing data Sales application & software Supporting and

Collections engineering developing culture

Drivers of success:

CRM is viewed as a key strategic process in Capital One. Capital One show cased that CRM can be

translated into strategy, organizational design, hiring, marketing processes, and IT infrastructure

of a company .Different depts. work in an integrated fashion towards understanding and

satisfying customer.

Intensive Primary research:

− Pre purchase: Information based strategy (IBS) facilitated collecting information and

utilising it to understand customers need and risk profile for tailoring the offering.

− Post Purchase: It facilitates to reactivate dormant customer through customised

benefits or incentives design. This provide base to frame retention strategies.

Proper Segmentation:

− Clearly categorised each customer under Low Risk Transactor or High Risk Revolver

groups.

− Targeting all types of risk profiles and offering different prices and products.

Beta testing: Full proofing the offer before launch by test running it on 36000 -40000 odd

customer. This further helps in fine –tuning the offer for better acceptability (Test and

Learn).

Aggressive pricing: Offered lowered interest rate, low fees and low-cost balance transfer

deals.

Effective upward communication: Inputs from front end associates are given due

importance in crafting strategy for customers.

CRM CASE STUDY EMBA 2015-2016 SOHAM PRADHAN (UEMF15027)

Efficient Associate Man-power management: Providing training to associates (not linked to

customer interface) inorder to handle customer during peak time (flexibility). This negates

the inefficiencies during exigencies.

Assuring associate satisfaction: It is done through weekly review and feedback, rewards

recognition and highlight for good performance, personal development action plan (DAP)

coaching and mentoring. This instils motivation and sense of responsibility.

IT enabling cohesion: In house IT provision provided the competitive edge for quick

customisation and sustain data secrecy. It is an enabling departments to improve their

efficiencies like

− Maintaining real time data of each customer so that each employee can deal with

customer at any time without any repeat propositions.

− Provide immediate statistics of customer transaction for facilitating cross –selling or re-

structuring the offer without wasting time. (Known as SALSA system).

− Automated decision algorithms has helped in making quick and decision and alarming

future fraud probability.

Capital One as Adviser during adversities: A fraudulent customer is also treated with

sensitivity. It analyses the root cause and support through revised terms, patching them with

recruiting agency etc.

Potential Threats:

Individual based customisation is a hurdle for revenue forecasting and sustenance.

Entering new markets will be time taking as most of the activities self-driven and developing

same type of infrastructure for each market will not be economically viable.

With increasing consumer base, also demands for higher capital investments in IT in

managing the data. This will affect the profitability in the risk driven market.

Customer may get confused if somebody starts comparing offering with other customers. A

feeling of differentiation may arise which may lead to distraction.

Recommendations:

Should try to avoid customisation for low profitable customer, otherwise it leads to over

expenditure on manpower and technology cost in handling such customers.

Must outsource few of the activities related to fraudulent customers which consumes more

time with least return.

Should to look for new avenues for attracting customers other than just revising plans,

incentives and rewards.

Must refrain from regular mailings about new products which usually leads to customer

irritation.

Should look for a set of standardised products that will be applicable to a cluster, which

indeed could reduce their transaction cost. Attending all may not be sustainable.

CRM CASE STUDY EMBA 2015-2016 SOHAM PRADHAN (UEMF15027)

Anda mungkin juga menyukai

- Learn) .: CRM Case Study EMBA 2015-2016 Soham Pradhan (Uemf15027)Dokumen2 halamanLearn) .: CRM Case Study EMBA 2015-2016 Soham Pradhan (Uemf15027)ashishBelum ada peringkat

- Bank InterDokumen6 halamanBank Intermsethi2684Belum ada peringkat

- Bancaja: Developing Customer Intelligence Case Analysis ReportDokumen12 halamanBancaja: Developing Customer Intelligence Case Analysis ReportDheeraj singh100% (1)

- Siemens CerberusEco in ChinaDokumen8 halamanSiemens CerberusEco in ChinaHarun Rasheed100% (1)

- Product Line Management A Complete Guide - 2019 EditionDari EverandProduct Line Management A Complete Guide - 2019 EditionBelum ada peringkat

- The Fashion Channel CaseDokumen2 halamanThe Fashion Channel CaseHimanshu ChauhanBelum ada peringkat

- GINO SA:Distribution Channel ManagementDokumen9 halamanGINO SA:Distribution Channel ManagementVidya Sagar KonaBelum ada peringkat

- Answer DashDokumen2 halamanAnswer Dashreshma thomasBelum ada peringkat

- Channel Conflict & PowerDokumen33 halamanChannel Conflict & Powerchetan100% (1)

- Psi Case SolutionDokumen3 halamanPsi Case Solutionsantiago bernal torresBelum ada peringkat

- Product Proliferation and Preemption Strategy SupplementsDokumen22 halamanProduct Proliferation and Preemption Strategy SupplementstantanwyBelum ada peringkat

- Brand Management Term 5 End Term ExamDokumen9 halamanBrand Management Term 5 End Term ExamRahulSamaddarBelum ada peringkat

- MICROFRIDGEDokumen3 halamanMICROFRIDGEAchal GuptaBelum ada peringkat

- Group5 - B 3rd CaseDokumen2 halamanGroup5 - B 3rd CaseRisheek SaiBelum ada peringkat

- BEST BuyDokumen16 halamanBEST BuyPurna WayanBelum ada peringkat

- About SamsoniteDokumen4 halamanAbout Samsonitepriyanksingh1986Belum ada peringkat

- Microfridge Case Analysis - Group 8Dokumen5 halamanMicrofridge Case Analysis - Group 8SALONI CHOUDHARYBelum ada peringkat

- B2B Group8 Centra SoftwareDokumen3 halamanB2B Group8 Centra SoftwareSabyasachi SahuBelum ada peringkat

- HP Cso Team2Dokumen23 halamanHP Cso Team2shreesti11290100% (2)

- Ebo VS MboDokumen4 halamanEbo VS MbotdarukaBelum ada peringkat

- Answer To Tru Juice Case Talking PointsDokumen5 halamanAnswer To Tru Juice Case Talking PointsTest 2100% (1)

- Case Study 1Dokumen13 halamanCase Study 1Phương TrangBelum ada peringkat

- Social Media at Maersk LineDokumen3 halamanSocial Media at Maersk LinePOONAM PARMARBelum ada peringkat

- Case Study QuestionsDokumen3 halamanCase Study QuestionsGaurav RajBelum ada peringkat

- Sales Force Training at Arrow ElectronicsDokumen7 halamanSales Force Training at Arrow ElectronicsVibhav RoyBelum ada peringkat

- Vanguard Case Analysis - Group 2Dokumen10 halamanVanguard Case Analysis - Group 2Rishabh GuptaBelum ada peringkat

- Grp5 B2B HPDokumen11 halamanGrp5 B2B HPSurya Kant100% (1)

- Giant Consumer ProductsDokumen3 halamanGiant Consumer ProductsRamandeep Singh100% (1)

- Downloadable Solution Manual For Services Marketing 7th Edition Lovelock - IM - Section - 05 - Case - 02a 1Dokumen11 halamanDownloadable Solution Manual For Services Marketing 7th Edition Lovelock - IM - Section - 05 - Case - 02a 1Mubashir ZiaBelum ada peringkat

- UnMe Jeans Social Media CaseDokumen7 halamanUnMe Jeans Social Media CasejeremightBelum ada peringkat

- Group09 CliquepensDokumen1 halamanGroup09 CliquepensAkshay Mehta100% (1)

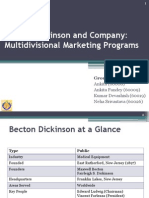

- Becton Dickinson and CompanyDokumen19 halamanBecton Dickinson and CompanyAmitSinghBelum ada peringkat

- Overview of SignodeDokumen19 halamanOverview of Signodesabihkhan90Belum ada peringkat

- MathSoft b2b Case SolutionDokumen8 halamanMathSoft b2b Case SolutionsankalpgargmdiBelum ada peringkat

- CRM of TowngasDokumen6 halamanCRM of TowngasBrijesh PandeyBelum ada peringkat

- B2B Term PaperDokumen8 halamanB2B Term PaperSamyukt AgrawalBelum ada peringkat

- Marketing Strategy - Hong Nhung Nguyen 119163928Dokumen34 halamanMarketing Strategy - Hong Nhung Nguyen 119163928Tít Thò LòBelum ada peringkat

- Capstone Project - Launching A Premium Category Smartphone For The Indian Market PDFDokumen11 halamanCapstone Project - Launching A Premium Category Smartphone For The Indian Market PDFSudip Issac SamBelum ada peringkat

- CFL FinalDokumen3 halamanCFL FinalAnonymous nfLFi1q1Belum ada peringkat

- Case I The Teacher With Tough Standards: HonestyDokumen1 halamanCase I The Teacher With Tough Standards: HonestyshreeprakashvkBelum ada peringkat

- A Market Analysis of BritanniaDokumen10 halamanA Market Analysis of Britanniaurmi_patel22Belum ada peringkat

- Key Account Management - MSM 6409: Case AnalysisDokumen4 halamanKey Account Management - MSM 6409: Case AnalysisAsanga Kumar0% (1)

- Asclepius ConsultingDokumen8 halamanAsclepius ConsultingKshitij JindalBelum ada peringkat

- Bankinter Sample AssignmentDokumen6 halamanBankinter Sample AssignmentAdrienn Zs.Belum ada peringkat

- Dell Computers: Field Service For Corporate Clients: Group - 8Dokumen6 halamanDell Computers: Field Service For Corporate Clients: Group - 8satyander malwalBelum ada peringkat

- Group 3 WhirlpoolDokumen8 halamanGroup 3 WhirlpoolSumit VakhariaBelum ada peringkat

- B2B - Group4 - Signode Industries IncDokumen14 halamanB2B - Group4 - Signode Industries IncTanmay YadavBelum ada peringkat

- How Do Klaschka's Actions Relate To His Development As An Innovative LeaderDokumen5 halamanHow Do Klaschka's Actions Relate To His Development As An Innovative LeaderFadhila Nurfida HanifBelum ada peringkat

- Boise Automation Lost OrderDokumen13 halamanBoise Automation Lost OrderAntony LawrenceBelum ada peringkat

- Commerce Bank SectionC Group5Dokumen11 halamanCommerce Bank SectionC Group5Tajeshwar100% (2)

- 02 The Three Faces of Consumer PromotionsDokumen21 halaman02 The Three Faces of Consumer PromotionshiteshthaparBelum ada peringkat

- Industrial Analysis: By: Akanxa Singh Reg No. 1927 MBA (2019-21)Dokumen51 halamanIndustrial Analysis: By: Akanxa Singh Reg No. 1927 MBA (2019-21)anand pandeyBelum ada peringkat

- The Company Needs To Earn The Original Investment of $2.54 Million The Company Needs To Approximately 250,000 Paying CustomersDokumen2 halamanThe Company Needs To Earn The Original Investment of $2.54 Million The Company Needs To Approximately 250,000 Paying CustomersSounakBelum ada peringkat

- Case Study - Inter IIT Tech Meet - Ghee Market Entry StrategyDokumen2 halamanCase Study - Inter IIT Tech Meet - Ghee Market Entry StrategyShailja SharmaBelum ada peringkat

- Sec A - Group 3 - TiVoDokumen13 halamanSec A - Group 3 - TiVoPoojitha SaranyaBelum ada peringkat

- IBM-Managing Brand EquityDokumen78 halamanIBM-Managing Brand EquityTry Lestari Kusuma Putri0% (1)

- Case Analysis Managing The Competition: Category Captaincy On The Frozen Food AisleDokumen9 halamanCase Analysis Managing The Competition: Category Captaincy On The Frozen Food AisleEina GuptaBelum ada peringkat

- Capital One Case Study On CRMDokumen3 halamanCapital One Case Study On CRMSoham PradhanBelum ada peringkat

- Customer Relationship Management: A powerful tool for attracting and retaining customersDari EverandCustomer Relationship Management: A powerful tool for attracting and retaining customersPenilaian: 3.5 dari 5 bintang3.5/5 (3)

- What Is A Customer Relationship Management (CRM) System?Dokumen5 halamanWhat Is A Customer Relationship Management (CRM) System?San Lizas AirenBelum ada peringkat

- CH 13 PDFDokumen29 halamanCH 13 PDFashishBelum ada peringkat

- CH 13 PDFDokumen29 halamanCH 13 PDFashishBelum ada peringkat

- Capital One Case Study On CRMDokumen2 halamanCapital One Case Study On CRMashish100% (1)

- Capital One Case Study On CRMDokumen2 halamanCapital One Case Study On CRMashish100% (1)

- HRM in IDBI BankDokumen75 halamanHRM in IDBI BankAkshayBorgharkar80% (5)

- Covid-19 Pandemic: Challenges On Micro, Small and Medium Enterprises of The City of Dapitan, Philippines Background of The StudyDokumen2 halamanCovid-19 Pandemic: Challenges On Micro, Small and Medium Enterprises of The City of Dapitan, Philippines Background of The StudyShein Batal BayronBelum ada peringkat

- Sample Negotiation PlanDokumen3 halamanSample Negotiation PlanNikhil Srivastava100% (1)

- Project Report VE Commercial Vehicle LTD SparesDokumen29 halamanProject Report VE Commercial Vehicle LTD Spareskapilpgdm100% (3)

- Kenneth Arrow EconDokumen4 halamanKenneth Arrow EconRay Patrick BascoBelum ada peringkat

- BaysaJadzMeric IT 225 RequirementsDokumen3 halamanBaysaJadzMeric IT 225 RequirementsGrace TVBelum ada peringkat

- Public Health Engineering Department, Haryana Public Health Engineering Division No.2, Panipat Notice Inviting TenderDokumen17 halamanPublic Health Engineering Department, Haryana Public Health Engineering Division No.2, Panipat Notice Inviting Tenderpmcmbharat264Belum ada peringkat

- Government BorrowingDokumen19 halamanGovernment BorrowingMajid AliBelum ada peringkat

- European Cybersecurity Implementation Overview Res Eng 0814Dokumen26 halamanEuropean Cybersecurity Implementation Overview Res Eng 0814Gabriel ScaunasBelum ada peringkat

- Value Stream MappingDokumen40 halamanValue Stream Mappingjinyue7302Belum ada peringkat

- MS Preweek QuizzerDokumen23 halamanMS Preweek QuizzerJun Guerzon PaneloBelum ada peringkat

- Assignment 1 2019 PDFDokumen2 halamanAssignment 1 2019 PDFAlice LaiBelum ada peringkat

- Santosh Resume 2022-2Dokumen1 halamanSantosh Resume 2022-2Santosh KumarBelum ada peringkat

- How To Become A For-Profit Social Enterprise (FOPSE)Dokumen12 halamanHow To Become A For-Profit Social Enterprise (FOPSE)FreeBalanceGRP100% (1)

- SAP Archiving StrategyDokumen36 halamanSAP Archiving StrategyHariharan ChoodamaniBelum ada peringkat

- Business Process ReengineeringDokumen14 halamanBusiness Process ReengineeringFaisal AzizBelum ada peringkat

- 07jul2016Dokumen3 halaman07jul2016enjay_578Belum ada peringkat

- B2B PDFDokumen343 halamanB2B PDFSagar AnsaryBelum ada peringkat

- Project Finance CaseDokumen15 halamanProject Finance CaseDennies SebastianBelum ada peringkat

- Practical Tips & Considerations For Subcontract Negotiations - A Subcontractor's PerspectiveDokumen20 halamanPractical Tips & Considerations For Subcontract Negotiations - A Subcontractor's PerspectivemtaufanBelum ada peringkat

- Monge Nicole ResumeDokumen2 halamanMonge Nicole Resumeapi-215924355Belum ada peringkat

- Fundamentals of Product and Service Costing: Mcgraw-Hill/IrwinDokumen17 halamanFundamentals of Product and Service Costing: Mcgraw-Hill/IrwinMarie Frances SaysonBelum ada peringkat

- Magic Quadrant For Content-Aware Data Loss PreventionDokumen16 halamanMagic Quadrant For Content-Aware Data Loss PreventionpfvBelum ada peringkat

- EDU31E5Y - Project Billing OverviewDokumen66 halamanEDU31E5Y - Project Billing Overviewosmaaziz44100% (1)

- As One of Barilla's Customer, What Would Your Response To JITD Be? Why?Dokumen4 halamanAs One of Barilla's Customer, What Would Your Response To JITD Be? Why?Samuel MosesBelum ada peringkat

- Lease Renewal Policy 12.12.2012Dokumen57 halamanLease Renewal Policy 12.12.2012pkkothari83% (6)

- UCV Session 1 Introduction IMDokumen29 halamanUCV Session 1 Introduction IMLuis GarciaBelum ada peringkat

- Authorization For Entering Manual ConditionsDokumen15 halamanAuthorization For Entering Manual ConditionsSushil Sarkar100% (2)

- Corporate Social Responsibility Practices in Garments Sector of Bangladesh, A Study of Multinational Garments, CSR View in Dhaka EPZDokumen11 halamanCorporate Social Responsibility Practices in Garments Sector of Bangladesh, A Study of Multinational Garments, CSR View in Dhaka EPZAlexander DeckerBelum ada peringkat

- SignedfinalDokumen2 halamanSignedfinalALL ABOUT INDIABelum ada peringkat