Case 7 - An Introduction To Debt Policy and Value

Diunggah oleh

Anthony Kwo100%(2)100% menganggap dokumen ini bermanfaat (2 suara)

1K tayangan5 halamanJudul Asli

Case 7 - An Introduction to Debt Policy and Value.xlsx

Hak Cipta

© © All Rights Reserved

Format Tersedia

XLSX, PDF, TXT atau baca online dari Scribd

Bagikan dokumen Ini

Apakah menurut Anda dokumen ini bermanfaat?

Apakah konten ini tidak pantas?

Laporkan Dokumen IniHak Cipta:

© All Rights Reserved

Format Tersedia

Unduh sebagai XLSX, PDF, TXT atau baca online dari Scribd

100%(2)100% menganggap dokumen ini bermanfaat (2 suara)

1K tayangan5 halamanCase 7 - An Introduction To Debt Policy and Value

Diunggah oleh

Anthony KwoHak Cipta:

© All Rights Reserved

Format Tersedia

Unduh sebagai XLSX, PDF, TXT atau baca online dari Scribd

Anda di halaman 1dari 5

Problem 1: Value of Assets

0% Debt/ 25% Debt/ 50% Debt/

100% Equity 75% Equity 50% Equity

Book Value of Debt - $ 2,500.00 $ 5,000.00

Book Value of Equity $10,000.00 $ 7,500.00 $ 5,000.00

Market Value of Debt - $ 2,500.00 $ 5,000.00

Market Value of Equity $10,000.00 $ 8,350.00 $ 6,700.00

Pretax Cost of Debt 0.07 0.07 0.07

After-Tax Cost of Debt 0.0462 0.0462 0.0462

Market Value Weights of

Debt 0% 23.04% 42.74%

Equity 100% 76.96% 57.26%

Unlevered Beta 0.80 0.80 0.80

Levered Beta 0.80 0.96 1.19

Risk-Free Rate 0.07 0.07 0.07

Market Premium 0.086 0.086 0.086

Cost of Equity 0.14 0.15 0.17

Cost of Debt 0.05 0.05 0.05

Weighted-Average Cost of Capital 0.14 0.13 0.12

EBIT $ 2,103.00 $ 2,103.00 $ 2,103.00

Taxes (@ 34%) $ 715.02 $ 715.02 $ 715.02

EBIAT $ 1,387.98 $ 1,387.98 $ 1,387.98

+ Depreciation $ 500.00 $ 500.00 $ 500.00

- Capital exp. $ (500.00) $ (500.00) $ (500.00)

+ Change in net working capital - - -

Free Cash Flow $ 1,387.98 $ 1,387.98 $ 1,387.98

Value of Assets (FCF/WACC) $ 9,999.86 $10,849.84 $11,699.83

Problem 2: Value of Equity and Debt

0% Debt/ 25% Debt/ 50% Debt/

100% Equity 75% Equity 50% Equity

Cash flow to creditors:

Interest $ - $ 175.00 $ 350.00

Pretax cost of debt 0.07 0.07 0.07

Value of debt: (CF/rd) $ - $ 2,500.00 $ 5,000.00

Cash flow to shareholders:

EBIT $ 2,103.00 $ 2,103.00 $ 2,103.00

- Interest - $175 $350

Pretax profit $ 2,103.00 $ 1,928.00 $ 1,753.00

Taxes (@ 34%) $ 715.02 $ 655.52 $ 596.02

Net income $ 1,387.98 $ 1,272.48 $ 1,156.98

+ Depreciation $ 500.00 $ 500.00 $ 500.00

- Capital exp. $ (500.00) $ (500.00) $ (500.00)

+ Change in net working capital - - -

- Debt amortization - - -

Residual cash flow $ 1,387.98 $ 1,272.48 $ 1,156.98

Cost of equity 0.14 0.15 0.17

Value of equity (CF/re) $ 9,999.86 $ 8,349.87 $ 6,699.88

Value of equity plus value of debt $ 9,999.86 $10,849.87 $11,699.88

Problem 3: Business Flows and Financing Effects

0% Debt/ 25% Debt/ 50% Debt/

100% Equity 75% Equity 50% Equity

Pure Business Cash Flows:

EBIT $ 2,103 $ 2,103 $ 2,103

Taxes (@ 34%) $ (715) $ (715) $ (715)

EBIAT $ 1,388 $ 1,388 $ 1,388

+ Depreciation $ 500 $ 500 $ 500

- Capital exp. $ (500) $ (500) $ (500)

+ Change in net working capital $ - $ - $ -

Cash Flow $ 1,388 $ 1,388 $ 1,388

Unlevered Beta 0.8 0.8 0.8

Risk-Free Rate 0.07 0.07 0.07

Market Premium 0.086 0.086 0.086

Unlevered WACC 13.88% 13.88% 13.88%

Value of Pure Business Flows:

(FCF/Unlevered WACC) $ 9,999.86 $ 9,999.86 $ 9,999.86

Financing Cash Flows

Interest $ - $ 175.00 $ 350.00

Tax Reduction $ - $ 59.50 $ 119.00

Pretax Cost of Debt 0.07 0.07 0.07

Value of Financing Effect:

(Tax Reduction/Pretax Cost of Debt) $ - $ 850.00 $ 1,700.00

Total Value (Sum of Values of

Pure Business Flows and Financing Effects $ 9,999.86 $10,849.86 $11,699.86

0% Debt/ 25% Debt/ 50% Debt/

100% Equity 75% Equity 50% Equity

Value of Asset $ 9,999.86 $ 10,849.86 $ 11,699.86

Cash Paid Out $ - $ 2,500.00 $ 5,000.00

Total Market Value of Equity $ 9,999.86 $ 8,349.86 $ 6,699.86

Number of Original Shares 1,000 1,000 1,000

Total Value Per Share $ 10.00 $ 10.85 $ 11.70

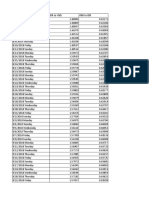

Exhibit 1

Koppers Company, Inc.

Before After

Recapitalization Recapitalization

Book Value Balance Sheets

Net working capital $ 212,453.00 $ 1,778,139.00

Fixed assets $ 601,446.00 $ 601,446.00

Total assets $ 813,899.00 $ 2,379,585.00

Additional debt $ 1,565,686.00

Long-term debt $ 172,409.00 $ 1,738,095.00

Deferred taxes, etc. $ 195,616.00 $ 195,616.00

Preferred stock $ 15,000.00 $ 15,000.00

Common equity $ 430,874.00 $ 430,874.00

Total capital $ 813,899.00 $ 2,379,585.00

Market-Value Balance Sheets

Net working capital $ 212,453.00 $ 1,778,139.00

Fixed assets $ 1,618,081.00 $ 1,618,081.00

PV debt tax shield $ 58,619.00 $ 590,952.30

Total assets $ 1,889,153.00 $ 3,987,172.30

Long term debt $ 172,409.00 $ 1,738,095.00

Deferred taxes, etc. $ - $ -

Preferred stock $ 15,000.00 $ 15,000.00

Common equity $ 1,701,744.00 $ 2,234,077.30

Total capital $ 1,889,153.00 $ 3,987,172.30

Number of shares $ 28,128.00 $ 28,128.00

Price per share $ 60.50 $ 79.43

Value to Public Shareholders

Cash received $ - $ 1,565,686.00

Value of shares $ 1,701,744.00 $ 2,234,077.30

Total $ 1,701,744.00 $ 3,799,763.30

Total per share $ 60.50 $ 135.09

Anda mungkin juga menyukai

- AN INTRODUCTION TO DEBT POLICY AND VALUE Case Syndicate 1 Cliff, Uri, Ary, KevinDokumen7 halamanAN INTRODUCTION TO DEBT POLICY AND VALUE Case Syndicate 1 Cliff, Uri, Ary, KevinAntonius CliffSetiawanBelum ada peringkat

- Case 26 An Introduction To Debt Policy ADokumen5 halamanCase 26 An Introduction To Debt Policy Amy VinayBelum ada peringkat

- An Introduction to the Impact of Debt on Firm ValueDokumen9 halamanAn Introduction to the Impact of Debt on Firm ValueBernadeta PramudyaWardhaniBelum ada peringkat

- Investment Detective CaseDokumen3 halamanInvestment Detective CaseWidyawan Widarto 闘志50% (2)

- Developing Financial Insight - Tugas MBA ITB Syndicate 2 CCE58 2018Dokumen5 halamanDeveloping Financial Insight - Tugas MBA ITB Syndicate 2 CCE58 2018DenssBelum ada peringkat

- Fonderia Di Torino's Case - Syndicate 5Dokumen20 halamanFonderia Di Torino's Case - Syndicate 5Yunia Apriliani Kartika0% (1)

- Finance Detective - Rizqi Ghani Faturrahman - 29120382 - YP-64BDokumen4 halamanFinance Detective - Rizqi Ghani Faturrahman - 29120382 - YP-64BrizqighaniBelum ada peringkat

- The Investment Detective (Answer)Dokumen2 halamanThe Investment Detective (Answer)Eddy ErmanBelum ada peringkat

- An Introduction To Debt Policy and Value - Syndicate 4Dokumen9 halamanAn Introduction To Debt Policy and Value - Syndicate 4Henni RahmanBelum ada peringkat

- Syndicate 3 - Analisa Ratio IndustriDokumen5 halamanSyndicate 3 - Analisa Ratio IndustriMarkus100% (1)

- 29116520Dokumen6 halaman29116520Rendy Setiadi MangunsongBelum ada peringkat

- Fonderia Di Torino (Final)Dokumen4 halamanFonderia Di Torino (Final)Tracye Taylor100% (2)

- Nike CaseDokumen7 halamanNike CaseNindy Darista100% (1)

- (DMN GM 10) Mid-Term Exam - Bianda Puspita SariDokumen6 halaman(DMN GM 10) Mid-Term Exam - Bianda Puspita SariBianda Puspita SariBelum ada peringkat

- Negotiation Agreement (Hollyville) - SellerDokumen3 halamanNegotiation Agreement (Hollyville) - SellerDimas FathurBelum ada peringkat

- Fonderia DI TorinoDokumen19 halamanFonderia DI TorinoA100% (3)

- Mm0057 Financial Management Midterm Exam: No. 1 - Track Software, IncDokumen15 halamanMm0057 Financial Management Midterm Exam: No. 1 - Track Software, Incnavier funtabulousBelum ada peringkat

- Fonderia Di Torino SDokumen15 halamanFonderia Di Torino SYrnob RokieBelum ada peringkat

- Identifying ZOPA: The Potential Zone of AgreementDokumen2 halamanIdentifying ZOPA: The Potential Zone of AgreementFadhila Hanif100% (1)

- List of Case Questions: Case #5: Fonderia Di Torino S.P.A Questions For Case PreparationDokumen4 halamanList of Case Questions: Case #5: Fonderia Di Torino S.P.A Questions For Case Preparationdd100% (2)

- This Study Resource Was: Integrative Case 7: Casa de DisenoDokumen5 halamanThis Study Resource Was: Integrative Case 7: Casa de DisenoFikri N SetyawanBelum ada peringkat

- Financial Performance Analysis of Three Steel CompaniesDokumen8 halamanFinancial Performance Analysis of Three Steel CompaniesTegar BabarunggulBelum ada peringkat

- Kota Fibres IncDokumen20 halamanKota Fibres IncMuhamad FudolahBelum ada peringkat

- TN6 The Financial Detective 2005Dokumen14 halamanTN6 The Financial Detective 2005Thomas Lydon100% (15)

- Casa de DisenoDokumen8 halamanCasa de DisenoMarilou Broñosa-PepañoBelum ada peringkat

- The Financial DetectiveDokumen7 halamanThe Financial DetectivearifhafiziBelum ada peringkat

- Film Tragedy and Beautiful Mind Group AssignmentDokumen3 halamanFilm Tragedy and Beautiful Mind Group AssignmentFadhila HanifBelum ada peringkat

- Dell's Working Capital v0.2Dokumen6 halamanDell's Working Capital v0.2MrDorakonBelum ada peringkat

- Investment DetectiveDokumen16 halamanInvestment Detectiveabhilasha_yadav_1100% (2)

- Calculating the Present Value of Cash Flows from a Potential AcquisitionDokumen3 halamanCalculating the Present Value of Cash Flows from a Potential AcquisitionIsmaeel TarBelum ada peringkat

- Fonderia TorinoDokumen3 halamanFonderia TorinoMatilda Sodji100% (1)

- O'Grady Apparel Company WACC Ranges BreakdownDokumen5 halamanO'Grady Apparel Company WACC Ranges BreakdownIndra ZulhijayantoBelum ada peringkat

- This Spreadsheet Supports Analysis of The Case, "The Investment Detective" (Case 18)Dokumen5 halamanThis Spreadsheet Supports Analysis of The Case, "The Investment Detective" (Case 18)Chittisa Charoenpanich100% (1)

- Final Exam Financial Management Antonius Cliff Setiawan 29119033Dokumen20 halamanFinal Exam Financial Management Antonius Cliff Setiawan 29119033Antonius CliffSetiawan100% (4)

- Syndicate 1 - An Introduction To Debt Policy and ValueDokumen11 halamanSyndicate 1 - An Introduction To Debt Policy and ValueAntonius Cliff Setiawan100% (1)

- Krakatau Steel A ReportDokumen6 halamanKrakatau Steel A ReportSoniaKasellaBelum ada peringkat

- KT 1@syndicate4Dokumen12 halamanKT 1@syndicate4Reynaldo Dimas FachriBelum ada peringkat

- LBO Valuation of Cheek ProductsDokumen4 halamanLBO Valuation of Cheek ProductsEfri Dwiyanto100% (2)

- Syndicate 5 - Krakatau Steel ADokumen19 halamanSyndicate 5 - Krakatau Steel AEdlyn Valmai Devina SBelum ada peringkat

- Mid Exam BSEM - BLEMBA 25 - 29318428 - Aditya Tri SudewoDokumen3 halamanMid Exam BSEM - BLEMBA 25 - 29318428 - Aditya Tri SudewoAditya Tri Sudewo100% (1)

- Analyze Capital Projects Using NPV, IRR, Payback for Highest ReturnDokumen10 halamanAnalyze Capital Projects Using NPV, IRR, Payback for Highest Returnwiwoaprilia100% (1)

- Eastboro Machine Tools - Class (Version 1)Dokumen12 halamanEastboro Machine Tools - Class (Version 1)Shriniwas Nehete100% (1)

- Licensing Fee/episode Financial Terms Year 0 Year 1 Year 2 Year 3 Runs/Episode Runs/Episode Adjustment Other Pieces of AgreementDokumen9 halamanLicensing Fee/episode Financial Terms Year 0 Year 1 Year 2 Year 3 Runs/Episode Runs/Episode Adjustment Other Pieces of AgreementVenp PeBelum ada peringkat

- Flybaboo - Business Strategy ManagementDokumen12 halamanFlybaboo - Business Strategy ManagementAzwimar PutranusaBelum ada peringkat

- Birdie Golf Inc Has Been in Merger Talks With HybridDokumen2 halamanBirdie Golf Inc Has Been in Merger Talks With HybridAmit PandeyBelum ada peringkat

- Fonderia Di Torina SpADokumen10 halamanFonderia Di Torina SpARoberta AyalingoBelum ada peringkat

- Final Exam - Manfin - EMBA61 - 2020Dokumen12 halamanFinal Exam - Manfin - EMBA61 - 2020NurIndah100% (1)

- Nike Cost of Capital AnalysisDokumen9 halamanNike Cost of Capital AnalysisKunal KumarBelum ada peringkat

- Dividend Policy Case (Gainesboro Machine Tools) - Session 2-Group 8Dokumen19 halamanDividend Policy Case (Gainesboro Machine Tools) - Session 2-Group 8api-2001200071% (7)

- Mini Case: Bethesda Mining Company: Disusun OlehDokumen5 halamanMini Case: Bethesda Mining Company: Disusun Olehrica100% (2)

- G6 Electronic Timing, Inc.Dokumen18 halamanG6 Electronic Timing, Inc.Sylvia MiraBelum ada peringkat

- Al' DunlapDokumen8 halamanAl' DunlapMani Kanth0% (1)

- Dell's Working CapitalDokumen20 halamanDell's Working Capitalapi-371968795% (21)

- Nike, IncDokumen19 halamanNike, IncRavi PrakashBelum ada peringkat

- Debt Policy and ValueDokumen7 halamanDebt Policy and ValueMuhammad Nabil EzraBelum ada peringkat

- How leverage affects firm valueDokumen5 halamanHow leverage affects firm valuevinneBelum ada peringkat

- Debt and Policy Value CaseDokumen6 halamanDebt and Policy Value CaseUche Mba100% (2)

- Introduction To Debt PolicyDokumen8 halamanIntroduction To Debt PolicyRatnesh DubeyBelum ada peringkat

- How debt policy affects asset value and shareholder valueDokumen7 halamanHow debt policy affects asset value and shareholder valueMochamad Arief RahmanBelum ada peringkat

- Case Study 2Dokumen5 halamanCase Study 2Tabish Iftikhar SyedBelum ada peringkat

- Analytic Hierarchy ProcessDokumen2 halamanAnalytic Hierarchy ProcessAnthony KwoBelum ada peringkat

- Covariance CorrelationDokumen14 halamanCovariance CorrelationAnthony KwoBelum ada peringkat

- Sucorinvest Maxi Fund ValuationDokumen16 halamanSucorinvest Maxi Fund ValuationAnthony KwoBelum ada peringkat

- Covariance CorrelationDokumen14 halamanCovariance CorrelationAnthony KwoBelum ada peringkat

- BBTN and INCO ValuationDokumen36 halamanBBTN and INCO ValuationAnthony KwoBelum ada peringkat

- Ethcis in FinanceDokumen23 halamanEthcis in FinanceAnthony KwoBelum ada peringkat

- Case 9 - Honeywell Inc and Integrated Risk ManagementDokumen18 halamanCase 9 - Honeywell Inc and Integrated Risk ManagementAnthony KwoBelum ada peringkat

- History Exchange ReportDokumen14 halamanHistory Exchange ReportAnthony KwoBelum ada peringkat

- Syndicate 4 - Value at RiskDokumen8 halamanSyndicate 4 - Value at RiskAnthony KwoBelum ada peringkat

- Hedging Techniques to Manage Financial RiskDokumen57 halamanHedging Techniques to Manage Financial RiskAnthony Kwo0% (2)

- Ethical Climate: By: Syndicate 7Dokumen12 halamanEthical Climate: By: Syndicate 7Anthony KwoBelum ada peringkat

- Case Development Investment AnalysisDokumen9 halamanCase Development Investment AnalysisAnthony KwoBelum ada peringkat

- Foreign Exchange Hedging Strategies at General MotorsDokumen7 halamanForeign Exchange Hedging Strategies at General MotorsYun Clare Yang0% (1)

- Case 10 FinanceDokumen15 halamanCase 10 FinanceRendy Setiadi MangunsongBelum ada peringkat

- Swaps and Interest Rate Options: OutlineDokumen57 halamanSwaps and Interest Rate Options: OutlineAnthony KwoBelum ada peringkat

- Republic of Indonesia: An Emerging Economic Powerhouse in AsiaDokumen35 halamanRepublic of Indonesia: An Emerging Economic Powerhouse in AsiaAnthony KwoBelum ada peringkat

- Topic Hedging BRVCDokumen34 halamanTopic Hedging BRVCAnthony KwoBelum ada peringkat

- GO-JEK's Diversification StrategyDokumen10 halamanGO-JEK's Diversification StrategyAnthony KwoBelum ada peringkat

- Forward, Futures&OptionsDokumen43 halamanForward, Futures&OptionsAnthony KwoBelum ada peringkat

- Capital Market Analysis - Warren BuffettDokumen10 halamanCapital Market Analysis - Warren BuffettAnthony KwoBelum ada peringkat

- Financial Futures MarketsDokumen48 halamanFinancial Futures MarketsAnthony KwoBelum ada peringkat

- Swaps & Interest Rate OptionsDokumen42 halamanSwaps & Interest Rate OptionsAnthony KwoBelum ada peringkat

- Syndicate 7 - Nike Inc. Cost of CapitalDokumen8 halamanSyndicate 7 - Nike Inc. Cost of CapitalAnthony Kwo100% (1)

- The Asian Financial Crisis - Syndicate 10Dokumen12 halamanThe Asian Financial Crisis - Syndicate 10Anthony KwoBelum ada peringkat

- Nike Inc - Cost of Capital - Syndicate 10Dokumen16 halamanNike Inc - Cost of Capital - Syndicate 10Anthony KwoBelum ada peringkat

- Syndicate 1 - China and Its NeighborsDokumen13 halamanSyndicate 1 - China and Its NeighborsAnthony KwoBelum ada peringkat

- Corruption in Indonesia - Syndicate 10Dokumen16 halamanCorruption in Indonesia - Syndicate 10Anthony KwoBelum ada peringkat

- Business Ethics - GOJEK CaseDokumen5 halamanBusiness Ethics - GOJEK CaseAnthony KwoBelum ada peringkat

- Euroland CaseDokumen3 halamanEuroland CaseAnthony KwoBelum ada peringkat

- PSC Leverage Buy OutDokumen10 halamanPSC Leverage Buy OutAnthony KwoBelum ada peringkat

- Systems & Trading Fundamentals - Van Tharp-5Dokumen66 halamanSystems & Trading Fundamentals - Van Tharp-5Roberto Medino100% (3)

- Goldman Sachs Abacus 2007 Ac1 An Outline of The Financial CrisisDokumen14 halamanGoldman Sachs Abacus 2007 Ac1 An Outline of The Financial CrisisAkanksha BehlBelum ada peringkat

- ParCor Corpo EQ Set ADokumen3 halamanParCor Corpo EQ Set AMara LacsamanaBelum ada peringkat

- Digital Marketing Management in B2B MarketsDokumen3 halamanDigital Marketing Management in B2B Marketsradwa.talaatBelum ada peringkat

- Computron Industries Ratio Analysis For ClassDokumen8 halamanComputron Industries Ratio Analysis For ClassRishabh JainBelum ada peringkat

- ADL 55 - Management of Financial Services Study MaterialDokumen218 halamanADL 55 - Management of Financial Services Study MaterialSnehasis PanditBelum ada peringkat

- Candle PatternsDokumen16 halamanCandle Patternsjai vanamalaBelum ada peringkat

- Volatility Seminar Notes on Variance SwapsDokumen12 halamanVolatility Seminar Notes on Variance SwapsanuragBelum ada peringkat

- CHAPTER IV - Bond and Sock Valuations and Cost of CapitalDokumen73 halamanCHAPTER IV - Bond and Sock Valuations and Cost of CapitalMan TKBelum ada peringkat

- Senior Trader Portfolio Manager in Baltimore MD Resume Jeffrey BecksDokumen2 halamanSenior Trader Portfolio Manager in Baltimore MD Resume Jeffrey BecksJeffreyBecksBelum ada peringkat

- Financial Statement Analysis 11th Edition Subramanyam Solutions Manual 1Dokumen55 halamanFinancial Statement Analysis 11th Edition Subramanyam Solutions Manual 1shaina100% (31)

- Equity Valuation Short NotesDokumen8 halamanEquity Valuation Short NotesImran AnsariBelum ada peringkat

- WARREN BUFFET - MergedDokumen15 halamanWARREN BUFFET - MergedvipinpanickerBelum ada peringkat

- Rmb-Tracker October-2023 Final AstDokumen10 halamanRmb-Tracker October-2023 Final AstJabbarKaddemBelum ada peringkat

- Computation of Impact On EPS and Market Price3.3Dokumen16 halamanComputation of Impact On EPS and Market Price3.3Shailav SahBelum ada peringkat

- MSCI Vietnam Index (USD)Dokumen3 halamanMSCI Vietnam Index (USD)AlezNgBelum ada peringkat

- Financial Statement Analysis MBA 6thDokumen4 halamanFinancial Statement Analysis MBA 6thShahzad MalikBelum ada peringkat

- Bharti AirtelDokumen37 halamanBharti AirtelBandaru NarendrababuBelum ada peringkat

- SBI PSU Fund NFO Application FormDokumen16 halamanSBI PSU Fund NFO Application Formrkdgr87880Belum ada peringkat

- Keene, Andrew - Ichimoku Cloud, World's Best Technical IndicatorDokumen17 halamanKeene, Andrew - Ichimoku Cloud, World's Best Technical IndicatorihaiBelum ada peringkat

- The Delta of An Option or Simply The Option DeltaDokumen14 halamanThe Delta of An Option or Simply The Option DeltaMehul J VachhaniBelum ada peringkat

- My MPRDokumen58 halamanMy MPRVasundhara BansalBelum ada peringkat

- FA RatiosDokumen3 halamanFA Ratiosnath.sandipBelum ada peringkat

- Chapter 8 Saving Investment and The Financial System Test ADokumen3 halamanChapter 8 Saving Investment and The Financial System Test Aminh leBelum ada peringkat

- Risk and Return: Lessons From Market HistoryDokumen24 halamanRisk and Return: Lessons From Market Historyphuphong777Belum ada peringkat

- 4 FIN555 Chap 4 Prings Typical Parameters For Intermediate Trend (Recovered)Dokumen16 halaman4 FIN555 Chap 4 Prings Typical Parameters For Intermediate Trend (Recovered)Najwa SulaimanBelum ada peringkat

- Chapter 1 IntroductionDokumen31 halamanChapter 1 IntroductionAnil SharmaBelum ada peringkat

- Tau Fu Fa PresentationDokumen9 halamanTau Fu Fa PresentationTanusia ArumugamBelum ada peringkat

- Galanida, Lagumbay & Mendez - 09 TP 1 - GovernanceDokumen3 halamanGalanida, Lagumbay & Mendez - 09 TP 1 - GovernanceKate GalanidaBelum ada peringkat

- FINANCIAL INSTITUTION REGULATORSDokumen31 halamanFINANCIAL INSTITUTION REGULATORSManish KumarBelum ada peringkat