Prof Ruiz Naive Bayes Handout Credit History

Diunggah oleh

Zack VaughanHak Cipta

Format Tersedia

Bagikan dokumen Ini

Apakah menurut Anda dokumen ini bermanfaat?

Apakah konten ini tidak pantas?

Laporkan Dokumen IniHak Cipta:

Format Tersedia

Prof Ruiz Naive Bayes Handout Credit History

Diunggah oleh

Zack VaughanHak Cipta:

Format Tersedia

Learning Naive Bayes Classifiers - An Example Department of Computer Science

Prof. Carolina Ruiz WPI

Dataset:

@relation credit-data

@attribute credit_history {bad, unknown, good}

@attribute debt {low, high}

@attribute collateral {none, adequate}

@attribute income {0-15, 15-35, >35}

@attribute risk {low, moderate, high}

@data

bad, low, none, 0-15, high

unknown, high, none, 15-35, high

unknown, low, none, 15-35, moderate

bad, low, none, 15-35, moderate

unknown, low, adequate, >35, low

unknown, low, none, >35, low

unknown, high, none, 0-15, high

bad, low, adequate, >35, moderate

good, low, none, >35, low

good, high, adequate, >35, low

good, high, none, 0-15, high

good, high, none, 15-35, moderate

good, high, none, >35, low

bad, high, none, 15-35, high

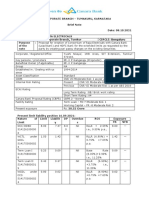

Naïve Bayes Model Construction:

Constructing a Naïve Bayes model over the above credit-data, where risk is the target attribute.

RISK: low moderate high

probability: (5+1)/17 (4+1)/17 (5+1)/17

Risk COLLATERAL

CREDIT-HISTORY RISK none adequate

RISK bad unknown good low (3+1)/7 (2+1)/7

low (0+1)/8 (2+1)/8 (3+1)/8 moderate (3+1)/6 (1+1)/6

moderate (2+1)/7 (1+1)/7 (1+1)/7 high (5+1)/7 (0+1)/7

high (2+1)/8 (2+1)/8 (1+1)/8

Credit Debt Collateral Income

DEBT CPT INCOME

RISK low high RISK 0-15 15-35 >35

low (3+1)/7 (2+1)/7 low (0+1)/8 (0+1)/8 (5+1)/8

moderate (3+1)/6 (1+1)/6 moderate (0+1)/7 (3+1)/7 (1+1)/7

high (1+1)/7 (4+1)/7 high (3+1)/8 (2+1)/8 (0+1)/8

Classification using the Naïve Bayes Model:

Using the above Naïve Bayes model to classify a new instance:

Credit-History Debt Collateral Income Risk

good low adequate 0-15 ?

predicted v = argmax P(Risk=v)

* P(Credit-History=good | Risk=v)

* P(Debt=low | Risk=v)

* P(Collateral=adequate | Risk=v)

* P(Income=0-15 | Risk=v)

v = low: P(Risk=low)

* P(Credit-History=good | Risk=low)

* P(Debt=low | Risk=low)

* P(Collateral=adequate | Risk=low)

* P(Income=0-15 | Risk=low)

= (6/17)*(4/8)*(4/7)*(3/7)*(1/8)

= 288/53312 = 0.0054

v = moderate: P(Risk=moderate)

* P(Credit-History=good | Risk=moderate)

* P(Debt=low | Risk=moderate)

* P(Collateral=adequate | Risk=moderate)

* P(Income=0-15 | Risk=moderate)

= (5/17)*(2/7)*(4/6)*(2/6)*(1/7)

= 80/29988 = 0.0027

v = high: P(Risk=high)

* P(Credit-History=good | Risk=high)

* P(Debt=low | Risk=high)

* P(Collateral=adequate | Risk=high)

* P(Income=0-15 | Risk=high)

= (6/17)*(2/8)*(2/7)*(1/7)*(4/8)

= 96/53312 = 0.0018

Hence, the predicted value by the Naïve Bayes classifier is Risk=low.

Anda mungkin juga menyukai

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeDari EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifePenilaian: 4 dari 5 bintang4/5 (5794)

- The Yellow House: A Memoir (2019 National Book Award Winner)Dari EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Penilaian: 4 dari 5 bintang4/5 (98)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryDari EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryPenilaian: 3.5 dari 5 bintang3.5/5 (231)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceDari EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RacePenilaian: 4 dari 5 bintang4/5 (895)

- The Little Book of Hygge: Danish Secrets to Happy LivingDari EverandThe Little Book of Hygge: Danish Secrets to Happy LivingPenilaian: 3.5 dari 5 bintang3.5/5 (400)

- Shoe Dog: A Memoir by the Creator of NikeDari EverandShoe Dog: A Memoir by the Creator of NikePenilaian: 4.5 dari 5 bintang4.5/5 (537)

- Never Split the Difference: Negotiating As If Your Life Depended On ItDari EverandNever Split the Difference: Negotiating As If Your Life Depended On ItPenilaian: 4.5 dari 5 bintang4.5/5 (838)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureDari EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FuturePenilaian: 4.5 dari 5 bintang4.5/5 (474)

- Grit: The Power of Passion and PerseveranceDari EverandGrit: The Power of Passion and PerseverancePenilaian: 4 dari 5 bintang4/5 (588)

- The Emperor of All Maladies: A Biography of CancerDari EverandThe Emperor of All Maladies: A Biography of CancerPenilaian: 4.5 dari 5 bintang4.5/5 (271)

- On Fire: The (Burning) Case for a Green New DealDari EverandOn Fire: The (Burning) Case for a Green New DealPenilaian: 4 dari 5 bintang4/5 (74)

- Team of Rivals: The Political Genius of Abraham LincolnDari EverandTeam of Rivals: The Political Genius of Abraham LincolnPenilaian: 4.5 dari 5 bintang4.5/5 (234)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaDari EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaPenilaian: 4.5 dari 5 bintang4.5/5 (266)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersDari EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersPenilaian: 4.5 dari 5 bintang4.5/5 (344)

- Rise of ISIS: A Threat We Can't IgnoreDari EverandRise of ISIS: A Threat We Can't IgnorePenilaian: 3.5 dari 5 bintang3.5/5 (137)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyDari EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyPenilaian: 3.5 dari 5 bintang3.5/5 (2259)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreDari EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You ArePenilaian: 4 dari 5 bintang4/5 (1090)

- The Unwinding: An Inner History of the New AmericaDari EverandThe Unwinding: An Inner History of the New AmericaPenilaian: 4 dari 5 bintang4/5 (45)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)Dari EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Penilaian: 4.5 dari 5 bintang4.5/5 (121)

- Her Body and Other Parties: StoriesDari EverandHer Body and Other Parties: StoriesPenilaian: 4 dari 5 bintang4/5 (821)

- Banking InnovationDokumen85 halamanBanking InnovationJaya DasBelum ada peringkat

- Tavant Mortgage Brochure PDFDokumen4 halamanTavant Mortgage Brochure PDFRavikumar YadavBelum ada peringkat

- Mistake As Ground For Vitiated ConsentDokumen3 halamanMistake As Ground For Vitiated ConsentkdescallarBelum ada peringkat

- The Impact of International Financial Reporting Standards On Financial Statements and RatiosDokumen15 halamanThe Impact of International Financial Reporting Standards On Financial Statements and RatiosNanda SafrizalBelum ada peringkat

- CFA Sector Analysis BankingDokumen10 halamanCFA Sector Analysis BankingTai NguyenBelum ada peringkat

- Nunez v. GSIS Family Bank-Later ProvisionDokumen16 halamanNunez v. GSIS Family Bank-Later ProvisionbrownboomerangBelum ada peringkat

- #28214435 28749065 NamairDokumen4 halaman#28214435 28749065 NamairFathin Ulfah Rianda KarimahBelum ada peringkat

- Derivatives AccountingDokumen28 halamanDerivatives Accountingkotha123Belum ada peringkat

- Money MarktDokumen2 halamanMoney MarktMariyam AbbasiBelum ada peringkat

- Axis Bank - WikipediaDokumen68 halamanAxis Bank - Wikipediahnair_3Belum ada peringkat

- Determinants of Interest Rate Spreads in Sub-Saharan African Countries A Dynamic Panel AnalysisDokumen26 halamanDeterminants of Interest Rate Spreads in Sub-Saharan African Countries A Dynamic Panel AnalysisEdson AlmeidaBelum ada peringkat

- K.P.rm. Kuppan Chettiar Alias ... Vs Sp.R.M.rm. Ramaswami Chettiar ... On 15 January, 1946Dokumen9 halamanK.P.rm. Kuppan Chettiar Alias ... Vs Sp.R.M.rm. Ramaswami Chettiar ... On 15 January, 1946Karthik KannappanBelum ada peringkat

- ACC 4041 Tutorial - Corporate Tax 2Dokumen3 halamanACC 4041 Tutorial - Corporate Tax 2Atiqah DalikBelum ada peringkat

- Part I Interest Rates and Their Role in FinanceDokumen52 halamanPart I Interest Rates and Their Role in FinanceHanako100% (1)

- Raja Electricals Consortium Brief Note 08 10 2021Dokumen3 halamanRaja Electricals Consortium Brief Note 08 10 2021MSME SULABH TUMAKURUBelum ada peringkat

- EBL FinalDokumen31 halamanEBL FinalAbdul KaderBelum ada peringkat

- Guingona vs. Carague Case DigestDokumen2 halamanGuingona vs. Carague Case Digestbern_alt100% (4)

- Principles of Working Capital Management - Lecture 3Dokumen40 halamanPrinciples of Working Capital Management - Lecture 3AMAYA.K.P 18BCO406Belum ada peringkat

- Smart Contracts UnderstandingDokumen1 halamanSmart Contracts UnderstandingCao Ngoc Anh100% (3)

- PS3SDFSDFDokumen3 halamanPS3SDFSDFsillBelum ada peringkat

- Timeline: The Failure of The Royal Bank of ScotlandDokumen7 halamanTimeline: The Failure of The Royal Bank of ScotlandFailure of Royal Bank of Scotland (RBS) Risk Management100% (1)

- Mohamed - The Effect of Capital Structure On Stock Returns at Nairobi Securities Exchange A Sectoral AnalysisDokumen53 halamanMohamed - The Effect of Capital Structure On Stock Returns at Nairobi Securities Exchange A Sectoral AnalysisdeimamhambaliBelum ada peringkat

- Fundamentals of TaxationDokumen36 halamanFundamentals of TaxationAyesha Pahm100% (1)

- Questions in BCLTE 2019Dokumen3 halamanQuestions in BCLTE 2019mabel carmen100% (2)

- University of Cambridge International Examinations General Certificate of Education Ordinary LevelDokumen20 halamanUniversity of Cambridge International Examinations General Certificate of Education Ordinary LevelMERCY LAWBelum ada peringkat

- PNB V AndradaDokumen1 halamanPNB V AndradaXander 4thBelum ada peringkat

- Recent SARFAESI Caselaws SummaryDokumen3 halamanRecent SARFAESI Caselaws SummaryAASHISH GUPTABelum ada peringkat

- Accounting For Partnership - Basic ConceptsDokumen19 halamanAccounting For Partnership - Basic ConceptsAashutosh PatodiaBelum ada peringkat

- Pretest - Lesson 2 Fabm 1Dokumen1 halamanPretest - Lesson 2 Fabm 1robelyn veranoBelum ada peringkat

- Action Standard Manufacturing Company Report FinalDokumen16 halamanAction Standard Manufacturing Company Report FinalNirab BhattaraiBelum ada peringkat