Eco Survey 2017-18 Summary

Diunggah oleh

Rizwan Sheikh0 penilaian0% menganggap dokumen ini bermanfaat (0 suara)

11 tayangan2 halamanbest economic survey summary

Hak Cipta

© © All Rights Reserved

Format Tersedia

PDF, TXT atau baca online dari Scribd

Bagikan dokumen Ini

Apakah menurut Anda dokumen ini bermanfaat?

Apakah konten ini tidak pantas?

Laporkan Dokumen Inibest economic survey summary

Hak Cipta:

© All Rights Reserved

Format Tersedia

Unduh sebagai PDF, TXT atau baca online dari Scribd

0 penilaian0% menganggap dokumen ini bermanfaat (0 suara)

11 tayangan2 halamanEco Survey 2017-18 Summary

Diunggah oleh

Rizwan Sheikhbest economic survey summary

Hak Cipta:

© All Rights Reserved

Format Tersedia

Unduh sebagai PDF, TXT atau baca online dari Scribd

Anda di halaman 1dari 2

Report Summary

Economic Survey 2017-18

The Finance Minister, Mr Arun Jaitley tabled the network. 0.6% of firms meet both of the criteria,

Economic Survey 2017-18 on January 29, 2018. known as the hard core formal sector. 87% of firms

Some highlights of the survey are: are purely informal, 12% of firms are registered

under GST but do not provide social security. Less

1. Highlights of the macro economy

than 0.1% provide social security but are not

Gross Domestic Product (GDP): The Central registered under GST (usually GST exempted firms).

Statistics Office (CSO) has estimated the GDP growth

India’s formal sector non-farm payroll is greater than

to be 6.5% in 2017-18 as compared to 7% in 2016-17.

current perception. Formal non-farm payroll is 31%

The average GDP growth rate from 2014-15 till 2017-

of the non- agricultural workforce based on a social

18 is expected to be 7.3% as compared to the average

security defined formality, and 53% based on a tax

7.5% between 2014-15 and 2016-17.

definition formality.

Gross Value Added (GVA): The GVA (at constant

3. Fiscal Federalism

prices) is estimated at 6.1% in 2017-18 as compared

to 6.6% in 2016-17. The agriculture and industry In comparison to developed countries, India collects

sectors are expected to grow at 2.1% and 4.4% a lower share of direct taxes in total taxes. For

respectively, while the service sector is estimated to example, in India, states generate 6% of their

grow at 8.3%. revenue from direct taxes, as compared to 19% in

Brazil. Rural local governments, in India, raise 6%

Inflation: The Consumer Price Index (CPI) based of their total revenue from direct taxes as compared

inflation was 3.3% in 2017-18 (April- December). to 40% in Brazil. Urban local governments raise

The average food inflation was 1.2% for the same 44% of their revenue from their own sources.

period. CPI inflation was below 3% in the first

Several states have not devolved enough taxation

quarter of 2017-18, because of low food inflation, and

powers to local bodies. Further, local governments

marginally rose to 3% in the second quarter.

collect only a small fraction of their potential tax

Current Account Deficit (CAD) and fiscal deficit: revenue. For example, rural local bodies collect

India’s CAD increased from 0.4% of GDP in 2016-17 around one third of the potential property tax.

to 1.8% of GDP in the first half of 2017-18. This has Therefore, local governments rely heavily on

been attributed to an increase in merchandise imports devolved funds from central and state governments.

relative to exports. As of November 2017, the fiscal

These devolved funds are largely tied in nature, to

deficit stood at 112% of the budget estimate. The

either specific sectors or schemes. This constrains

fiscal deficit is 3.2% (budget estimate) of GDP in

the ability of local governments to spend on local

2017-18 as compared to 3.5% of GDP in 2016-17.

public good as per their own priorities.

2. Goods and Services Tax (GST)

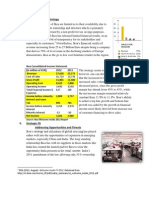

4. Ease of doing business

Increase in taxpayers: Under GST, the number of

India jumped 30 places and was ranked overall 100

unique indirect taxpayers increased by over 50% (3.4

in the World Bank’s Ease of Doing Business Report

million). Voluntary compliance also increased under

2018. However, on contract enforcement it was

GST, with 1.7 million voluntary registrants. 13% of

ranked at 164. Although the government has taken

the estimated 71 million non-agriculture enterprises

steps to improve contract enforcement, economic

were registered under the GST network.

activity is getting affected by high pendency and

GST and states: The distribution of GST base among delays across the legal system. The backlog in High

states is linked to their GSDP, with Maharashtra Courts by the end of 2017 was around 3.5 million

(16%), Tamil Nadu (10%), Karnataka (9%) having cases. Delays of economic cases (company cases,

the highest share. GST data shows that a state’s arbitration cases and taxation cases) in courts are

GSDP per capita has a high correlation with its leading to stalled projects, legal costs, contested tax

export share in the GSDP. Five states account for revenues, and consequently reduced investment.

70% of India’s exports - Maharashtra, Gujarat, Delays in in power, roads, and railways projects led

Karnataka, Tamil Nadu, and Telangana. to an increase in almost 60% of the project costs.

Informal economy: A firm is considered to be in the The government and the judiciary must coordinate to

formal sector if: (i) it provides social security to its introduce reforms to facilitate ease of doing business.

employees, or (ii) it is registered under the GST Judicial capacity should be strengthened in the lower

Sanat Kanwar January 31, 2018

sanat@prsindia.org

PRS Legislative Research Institute for Policy Research Studies

3rd Floor, Gandharva Mahavidyalaya 212, Deen Dayal Upadhyaya Marg New Delhi – 110002

Tel: (011) 43434035-36 www.prsindia.org

courts to reduce the burden on higher courts. The tax On account of good monsoon rainfall in 2016-17,

department must limit its appeals, given that their there was a rise in food grains and other crops

success rate is less than 30% at all three levels of production. As per the fourth advance estimates for

judiciary (Appellate Tribunals, High Courts, and 2016-17, production of food grains is estimated at

Supreme Courts). The government must increase its 275.7 million tonnes, higher by 10.6 million tonnes

expenditure on the judiciary, improve the courts case as compared to 2013-14.

management and court automation system, and

The agriculture sector has been witnessing a gradual

create subject specific benches.

structural change. The share of livestock in the GVA

5. Investment and saving in agriculture rose from 22% in 2011-12 to 26% in

2015-16. The share of crops in the GVA fell from

India saw high levels of investment and saving rates

65% in 2011-12 to 60% in 2015-16. The gross

in the mid 2000’s followed by a pronounced, gradual

capital formation in agriculture declined from 8.3%

decline, returning back to normal levels. The ratio of

in 2014-15 to 7.8% in 2015-16.

gross fixed capital formation to GDP was 26.5% in

2003, 35.6% in 2007 and 26.4% in 2017. The ratio 8. Industry and Infrastructure

of domestic saving to GDP, was 29.2% in 2003,

Industrial growth: The overall industrial sector

38.3% in 2007, and 29% in 2016. A fall in both

growth was 5.8% in the second quarter of 2017-18 as

private investment, and household, and government

compared to 1.6% in the first quarter. As per the

saving have contributed to such decline between

estimate of national income 2017-18, industrial

2007 and 2017.

sector grew at 4.4% and the manufacturing sector

There needs to be a focus on revival of investment. grew at 4.6%. The eight core industries (coal, crude

However, the decline in investment will be difficult oil, natural gas, petroleum refinery products,

to reverse because: (i) it stems from the balance sheet fertilizers, steel, cement, and electricity) grew by

stress of companies, and (ii) its large magnitude. 4.8% in 2016-17 as compared to 3% in 2015-16.

Easing the cost of doing business, creating a

Infrastructure: India requires around USD 4.5

transparent, stable tax and regulatory environment,

trillion worth of investments till 2040 to develop

and supporting small and medium industries will

infrastructure. As per the current trend, India can

help revive private investment.

raise around USD 3.9 trillion. The under investment

6. Climate change in the infrastructure sector has been due to: (i)

collapse of Public Private Partnerships, (ii) stressed

The data on rainfall, temperature, and crop

balance sheets of private companies, and, (iii) delays

production shows a long-term trend of rising

in acquisition of land and forest clearances.

temperature, declining average precipitation, and an

increase in extreme precipitation events. The 9. Services Sector

average decline in rainfall between 1970’s and

The services sector contributed 55.2% to India’s

2000’s is 26 mm in Kharif season and 33 mm in Rabi

GVA in 2017-18. As per the CSO the growth of the

season. This has significant implications on

services sector is expected to be 8.3% in 2017-18 as

agriculture, especially in unirrigated areas. Such

compared to 7.7% in 2016-17. In 15 states, services

changes in temperature and precipitation will result

contribute to more than half of the gross state value

in estimated overall farm income losses of 15% to

added (GSVA). With a share of 3.4%, India is the

18%, and further, 20% to 25% for unirrigated areas.

eighth largest exporter of commercial services.

Given the rising water scarcity, and depleting water

The share of real estate sector (including ownership

resources, there is a need to increase irrigation.

of dwellings) accounted for 7.7% of India’s overall

Technologies of drip irrigation, sprinklers, and water

GVA in 2015-16. Real estate and construction

management must be employed to meet this

together are the second largest providers of

challenge.

employment. As per projections, it is estimated to

7. Agriculture and food management employ 52 million by 2017, and 67 million by 2022.

Growth rates of agriculture and allied sectors have

been fluctuating: 1.5% in 2012-13, 5.6% in 2013-14,

-0.2% in 2014-15, 0.7% in 2015-16, and 4.9% in

2016-17. The uncertainty in growth in agriculture is

because 50% of agriculture is dependent on rainfall.

DISCLAIMER: This document is being furnished to you for your information. You may choose to reproduce or redistribute this report for non-

commercial purposes in part or in full to any other person with due acknowledgement of PRS Legislative Research (“PRS”). The opinions expressed

herein are entirely those of the author(s). PRS makes every effort to use reliable and comprehensive information, but PRS does not represent that the

contents of the report are accurate or complete. PRS is an independent, not-for-profit group. This document has been prepared without regard to the

objectives or opinions of those who may receive it.

Anda mungkin juga menyukai

- Shoe Dog: A Memoir by the Creator of NikeDari EverandShoe Dog: A Memoir by the Creator of NikePenilaian: 4.5 dari 5 bintang4.5/5 (537)

- The Yellow House: A Memoir (2019 National Book Award Winner)Dari EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Penilaian: 4 dari 5 bintang4/5 (98)

- Never Split the Difference: Negotiating As If Your Life Depended On ItDari EverandNever Split the Difference: Negotiating As If Your Life Depended On ItPenilaian: 4.5 dari 5 bintang4.5/5 (838)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceDari EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RacePenilaian: 4 dari 5 bintang4/5 (890)

- Grit: The Power of Passion and PerseveranceDari EverandGrit: The Power of Passion and PerseverancePenilaian: 4 dari 5 bintang4/5 (587)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeDari EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifePenilaian: 4 dari 5 bintang4/5 (5794)

- The Little Book of Hygge: Danish Secrets to Happy LivingDari EverandThe Little Book of Hygge: Danish Secrets to Happy LivingPenilaian: 3.5 dari 5 bintang3.5/5 (399)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureDari EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FuturePenilaian: 4.5 dari 5 bintang4.5/5 (474)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryDari EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryPenilaian: 3.5 dari 5 bintang3.5/5 (231)

- The Emperor of All Maladies: A Biography of CancerDari EverandThe Emperor of All Maladies: A Biography of CancerPenilaian: 4.5 dari 5 bintang4.5/5 (271)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersDari EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersPenilaian: 4.5 dari 5 bintang4.5/5 (344)

- On Fire: The (Burning) Case for a Green New DealDari EverandOn Fire: The (Burning) Case for a Green New DealPenilaian: 4 dari 5 bintang4/5 (73)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaDari EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaPenilaian: 4.5 dari 5 bintang4.5/5 (265)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyDari EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyPenilaian: 3.5 dari 5 bintang3.5/5 (2219)

- Team of Rivals: The Political Genius of Abraham LincolnDari EverandTeam of Rivals: The Political Genius of Abraham LincolnPenilaian: 4.5 dari 5 bintang4.5/5 (234)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreDari EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You ArePenilaian: 4 dari 5 bintang4/5 (1090)

- Rise of ISIS: A Threat We Can't IgnoreDari EverandRise of ISIS: A Threat We Can't IgnorePenilaian: 3.5 dari 5 bintang3.5/5 (137)

- The Unwinding: An Inner History of the New AmericaDari EverandThe Unwinding: An Inner History of the New AmericaPenilaian: 4 dari 5 bintang4/5 (45)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)Dari EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Penilaian: 4.5 dari 5 bintang4.5/5 (119)

- Her Body and Other Parties: StoriesDari EverandHer Body and Other Parties: StoriesPenilaian: 4 dari 5 bintang4/5 (821)

- The Effects of Changes in Foreign Exchange Rates: Solutions To Quiz 2Dokumen3 halamanThe Effects of Changes in Foreign Exchange Rates: Solutions To Quiz 2Cyrine Miwa RodriguezBelum ada peringkat

- Education Is The Foundation For Women Empowerment in IndiaDokumen111 halamanEducation Is The Foundation For Women Empowerment in IndiaAmit Kumar ChoudharyBelum ada peringkat

- Arthur Baxter Cartwright TotalDokumen4 halamanArthur Baxter Cartwright TotalSaoxalo OBelum ada peringkat

- Assignment: Fin 441 Bank ManagementDokumen11 halamanAssignment: Fin 441 Bank ManagementNazir Ahmed ZihadBelum ada peringkat

- Funds Flow AnalysisDokumen54 halamanFunds Flow AnalysisSriram DivyaBelum ada peringkat

- Accounting Information System I SEMESTER I 2010/2011: Group AssignmentDokumen9 halamanAccounting Information System I SEMESTER I 2010/2011: Group AssignmentxaraprotocolBelum ada peringkat

- Dow TheoryDokumen5 halamanDow TheoryChandra RaviBelum ada peringkat

- Ikea Strategy AssessmentDokumen6 halamanIkea Strategy Assessmentc.enekwe8981100% (1)

- Notes Payable Test Bank PDFDokumen5 halamanNotes Payable Test Bank PDFAB CloydBelum ada peringkat

- ICICI Future Perfect - BrochureDokumen11 halamanICICI Future Perfect - BrochureChandan Kumar SatyanarayanaBelum ada peringkat

- Cash and Receivables: True-FalseDokumen44 halamanCash and Receivables: True-FalseIzzy B100% (2)

- Acc 423 Advanced TaxationDokumen50 halamanAcc 423 Advanced Taxationkajojo joyBelum ada peringkat

- Measuring Performance PowerpointDokumen10 halamanMeasuring Performance PowerpointAzlina MizuanBelum ada peringkat

- FMR - Aug17 - Islamic NewwDokumen21 halamanFMR - Aug17 - Islamic NewwPradeep PerwaniBelum ada peringkat

- Rics Methods of ValuationDokumen18 halamanRics Methods of ValuationRicky Reung100% (1)

- Petroleum Accounting PDFDokumen18 halamanPetroleum Accounting PDFDania SuarezBelum ada peringkat

- ABM-11 FABM-1 Q3 W4 Module-4-V2Dokumen25 halamanABM-11 FABM-1 Q3 W4 Module-4-V2Marissa Dulay - Sitanos100% (3)

- CFA Level II Mock Exam 5 - Solutions (AM)Dokumen60 halamanCFA Level II Mock Exam 5 - Solutions (AM)Sardonna FongBelum ada peringkat

- National Income Accounting ExplainedDokumen10 halamanNational Income Accounting ExplainedExcel Joy Marticio100% (1)

- Kumari BankDokumen6 halamanKumari BankYogesh KatwalBelum ada peringkat

- Uniform CPA Examination May 1981-May 1985 Selected Questions &Dokumen647 halamanUniform CPA Examination May 1981-May 1985 Selected Questions &Abdelmadjid djibrineBelum ada peringkat

- NC III REVIEW c1Dokumen18 halamanNC III REVIEW c1Hannah Sophia Imperial100% (2)

- Consulting Bootcamp NotesDokumen16 halamanConsulting Bootcamp NotesPrashant Khorana100% (2)

- Sample Chart of AccountsDokumen3 halamanSample Chart of Accountsanah ÜBelum ada peringkat

- All About Franchising 2012Dokumen125 halamanAll About Franchising 2012Gio Gumban100% (3)

- 13-Page Legal Questionnaire MCQ & Essay QuestionsDokumen49 halaman13-Page Legal Questionnaire MCQ & Essay QuestionsJohnKyleMendozaBelum ada peringkat

- Appendix 18 - Saaodb by Oe - Far 1-ADokumen3 halamanAppendix 18 - Saaodb by Oe - Far 1-ARogie ApoloBelum ada peringkat

- CTG: Capital Gains Tax Rules for Real Property SalesDokumen11 halamanCTG: Capital Gains Tax Rules for Real Property SalesMylene SantiagoBelum ada peringkat

- MCS-Nurul Sari-Case 7.1 7.2 7.7Dokumen4 halamanMCS-Nurul Sari-Case 7.1 7.2 7.7Nurul Sari0% (3)

- Commissioner v. Michel J. Lhuillier Pawnshop Inc. (2003)Dokumen15 halamanCommissioner v. Michel J. Lhuillier Pawnshop Inc. (2003)KTBelum ada peringkat