Preflight Checklist

Diunggah oleh

FasterscHak Cipta

Format Tersedia

Bagikan dokumen Ini

Apakah menurut Anda dokumen ini bermanfaat?

Apakah konten ini tidak pantas?

Laporkan Dokumen IniHak Cipta:

Format Tersedia

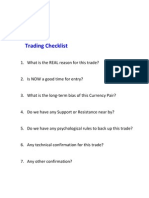

Preflight Checklist

Diunggah oleh

FasterscHak Cipta:

Format Tersedia

The Inner Circle Trader Trading Plan Preflight Checklist

Date: ___/___/___ Pair #1: _____/_____ ::Correlated With:: Pair #2: _____/_____

Trading Edge: __OTE __ Reflection __ ICT Stinger __ ICT Grail __ Turtle Soup __ MacdDiv __ _______

Kill Zone Trading: ___ Asian Session ___ London Open ___ New York Open ___ London Close

Macro Economic Perspective - Major Market

Interest Rate Cycle: ___ Higher ___ Lower Risk On ____ Risk Off ____

USDX Key S&R Levels: _______________________________________________________________________

Treasury & Note Key S&R Levels: ______________________________________________________________

Stock Index Key S&R Levels: __________________________________________________________________

CRB Index Key S&R Levels: ___________________________________________________________________

Gold & Oil Key S&R Levels: ___________________________________________________________________

Anticipatory Analysis -

Seasonal Tendencies This Quarter: ___ Bullish ___ Bearish _______________________________________

Yield SMT: ___ PosDiv ___ NegDiv Noted Failure Swing: ________________________________________

USDX SMT: ___ PosDiv ___ NegDiv Noted Failure Swing: ________________________________________

CorPair SMT: ___ PosDiv ___ NegDiv Noted Failure Swing: ________________________________________

StockIndex SMT: ___ PosDiv ___ NegDiv Noted Failure Swing: ________________________________________

COT Net Positions: ____ Net Long ____ Net Short ___________ 6-9 Month Trend: __ Bull __ Bear

Extreme COT Readings: ________ 4 Year Net Long: ______________ 12 Month Net Long: _____________

Extreme COT Readings: ________ 4 Year Net Short: ______________ 12 Month Net Short: _____________

Extreme COT Readings: ________ 4 Year Net Long: ______________ 12 Month Net Long: _____________

Extreme COT Readings: ________ 4 Year Net Short: ______________ 12 Month Net Short: _____________

Open Interest: ___ 20% or + Decrease [Commercial Short Covering] ___ 20% or + Increase [Commercial Shorting]

Premium Present: ___ Yes ___ No Current Market Sentiment: ___ Bullish ___ Bearish

Key S&R Levels: ____/____ __________________________________________________________________

Key S&R Levels: ____/____ __________________________________________________________________

Buy Program Protocol: ___ Buy The Dips - Stalk The Asian Range High Or Less For Entry Points

Sell Program Protocol: ___ Sell The Rallies - Stalk The Asian Range Low Or Higher For Entry Points

Execution Stage -

PreTrade Emotion-Psychological Pulse: ___ Calm ___ Anxious ___ Excitied ___ Sick ___ Tired

Risk % On Trade: ___ % Of Account Pair Traded: ____/____ Entry Price: ______ ProStop: ______ ____ Pips

First Profit Objective: ______ Second Profit Objective: ______ Remainders To Run: ____________________

Trade Lot Size: ___ __ Micro Lots __ Mini Lots Scaling Ratio: __ 70-30 __ 50-50 __ 30-70 __ 100%

5 Day ADR: _____ Pips Projected High Of The Day: ________ Projected Low Of The Day: ________

Reactionary Stage -

___ Time Of Day ___ Life Event ___ Illness ___ News - Report ___ Rejection ___ Wrong On Premise

Documentation Stage -

PostTrade Emotion-Psychological Pulse: ___ Calm ___ Anxious ___ Excitied ___ Sick ___ Tired

Trade Plan Followed: ___ Yes ___ No Trade Results: ___ Profitable ___ Loss ___ Breakeven

Trade Lessons: _____________________________________________________________________________

Trade Highlights: ___________________________________________________________________________

What Emotional Triggers Experienced: __________________________________________________________

Trade Results Documented: __ Recorded In Journal Goal Reflection: __ In Focus

Anda mungkin juga menyukai

- Opening Range Breakout - Weekly Bars: Sensitivity TestDokumen8 halamanOpening Range Breakout - Weekly Bars: Sensitivity TestOxford Capital Strategies LtdBelum ada peringkat

- Traders ChecklistDokumen17 halamanTraders Checklistafonso26Belum ada peringkat

- Key Takeaways: Chart Types To Depict Market BehaviorDokumen1 halamanKey Takeaways: Chart Types To Depict Market BehaviorCr HtBelum ada peringkat

- YTC Effective Session ReviewDokumen13 halamanYTC Effective Session ReviewelisaBelum ada peringkat

- Institutional Trading UrviDokumen4 halamanInstitutional Trading UrviSunil JatharBelum ada peringkat

- USD/JPY - Long Trade Called at 27/09/2011. HIGH RISK TRADE! James FournierDokumen5 halamanUSD/JPY - Long Trade Called at 27/09/2011. HIGH RISK TRADE! James Fournierapi-100874888Belum ada peringkat

- Example of Tradin PlanDokumen5 halamanExample of Tradin PlanRobbie Aleksander0% (1)

- Bid and Ask in Day TradingDokumen9 halamanBid and Ask in Day TradingFZ FxBelum ada peringkat

- High Probability Trading RulesDokumen1 halamanHigh Probability Trading RulesStephen ShekwonuDuza HoSeaBelum ada peringkat

- TPDS 1 - Key Insights for Developing a Successful Trading PlanDokumen20 halamanTPDS 1 - Key Insights for Developing a Successful Trading PlanDanielaBelum ada peringkat

- Asian Ses123321 StrasfDokumen3 halamanAsian Ses123321 StrasfSteve SmithBelum ada peringkat

- Jan L Arps - Surfing The Market Waves - The Swing Trader'sDokumen37 halamanJan L Arps - Surfing The Market Waves - The Swing Trader'sapi-3776228100% (3)

- Trading ChecklistDokumen1 halamanTrading ChecklistniatsanBelum ada peringkat

- My Trading Ideas For The Forex and Fkli Spot Market 05022011Dokumen63 halamanMy Trading Ideas For The Forex and Fkli Spot Market 05022011faizan ahmadBelum ada peringkat

- Multiple Time Frame Analysis for Beginner TradersDari EverandMultiple Time Frame Analysis for Beginner TradersPenilaian: 1 dari 5 bintang1/5 (1)

- Tape ReadingDokumen3 halamanTape ReadingPratik Chheda0% (2)

- Inner Circle Trader - WENT 02Dokumen3 halamanInner Circle Trader - WENT 02David Alc CBelum ada peringkat

- The Empowered Forex Trader: Strategies to Transform Pains into GainsDari EverandThe Empowered Forex Trader: Strategies to Transform Pains into GainsBelum ada peringkat

- Profitable Forex Trading Using High and Low Risk Strategies: Book 1, #4Dari EverandProfitable Forex Trading Using High and Low Risk Strategies: Book 1, #4Belum ada peringkat

- A Pattern You Can Trade Using Nothing But A Price ChartDokumen9 halamanA Pattern You Can Trade Using Nothing But A Price ChartKoti Reddy100% (1)

- Stop-Limit Order: High-Frequency TradingDokumen5 halamanStop-Limit Order: High-Frequency TradingPeter KwagalaBelum ada peringkat

- Forex Seasonal PatternsDokumen21 halamanForex Seasonal PatternsUj GumilarBelum ada peringkat

- Tape Reading 10 TipsDokumen4 halamanTape Reading 10 TipsAnupam Bhardwaj100% (1)

- The Where, When and How of Successful TradingDokumen37 halamanThe Where, When and How of Successful Tradingmohamed hamdallah0% (1)

- ChartSpots ES Daytrading Statistics 2022 SampleDokumen10 halamanChartSpots ES Daytrading Statistics 2022 SampleJoão TrocaBelum ada peringkat

- Schaff Trend Cycle Indicator - Forex Indicators GuideDokumen3 halamanSchaff Trend Cycle Indicator - Forex Indicators Guideenghoss77100% (1)

- High Probability Trading Setups For The Currency Market PDFDokumen100 halamanHigh Probability Trading Setups For The Currency Market PDFDavid VenancioBelum ada peringkat

- Trend Definition - Applying SubjectivityDokumen1 halamanTrend Definition - Applying Subjectivitybowaval0% (1)

- Trading Triads: Unlocking the Secrets of Market Structure and Trading in Any MarketDari EverandTrading Triads: Unlocking the Secrets of Market Structure and Trading in Any MarketBelum ada peringkat

- Jacko Trading StyleDokumen25 halamanJacko Trading StyleMohammed NizamBelum ada peringkat

- Trading With VantagePoint-Brandon JonesDokumen113 halamanTrading With VantagePoint-Brandon Jonesdrkwng100% (1)

- The Market Makers (Review and Analysis of Spluber's Book)Dari EverandThe Market Makers (Review and Analysis of Spluber's Book)Belum ada peringkat

- Resource Tutorial Price ActionDokumen1 halamanResource Tutorial Price ActionpositivezeroBelum ada peringkat

- Trend-following winners are not lucky monkeysDokumen5 halamanTrend-following winners are not lucky monkeysArvind KothariBelum ada peringkat

- Fx Insider: Investment Bank Chief Foreign Exchange Trader with More Than 20 Years’ Experience as a MarketmakerDari EverandFx Insider: Investment Bank Chief Foreign Exchange Trader with More Than 20 Years’ Experience as a MarketmakerPenilaian: 4 dari 5 bintang4/5 (3)

- Rob Booker's Favorite Ways to Predict Market TurnsDokumen7 halamanRob Booker's Favorite Ways to Predict Market TurnsPiet NijstenBelum ada peringkat

- Silo - Tips Michael J HuddlestonDokumen29 halamanSilo - Tips Michael J HuddlestonThai Multari100% (1)

- Self Sabotage Reexamined: by Van K. Tharp, PH.DDokumen8 halamanSelf Sabotage Reexamined: by Van K. Tharp, PH.DYashkumar JainBelum ada peringkat

- Scientificscalper Com PDFDokumen13 halamanScientificscalper Com PDFDinesh MishraBelum ada peringkat

- Deep Thought on Quant StrategiesDokumen1 halamanDeep Thought on Quant Strategiespatar greatBelum ada peringkat

- Winning the Day Trading Game: Lessons and Techniques from a Lifetime of TradingDari EverandWinning the Day Trading Game: Lessons and Techniques from a Lifetime of TradingPenilaian: 3.5 dari 5 bintang3.5/5 (2)

- Personal Trading Rules Hk-001Dokumen9 halamanPersonal Trading Rules Hk-001Lestijono LastBelum ada peringkat

- Lifespan Investing: Building the Best Portfolio for Every Stage of Your LifeDari EverandLifespan Investing: Building the Best Portfolio for Every Stage of Your LifeBelum ada peringkat

- Thelcoin WhitepaperDokumen19 halamanThelcoin WhitepapervchsrikanthBelum ada peringkat

- Supply & Demand Day Trading for Futures: Brand New ETF's,Forex, Futures, Stocks Day Trader Series, #2Dari EverandSupply & Demand Day Trading for Futures: Brand New ETF's,Forex, Futures, Stocks Day Trader Series, #2Belum ada peringkat

- YTC Traders-Checklist PDFDokumen17 halamanYTC Traders-Checklist PDFAnonymous z4JjEdBJul100% (2)

- MPDokumen4 halamanMPJohn BestBelum ada peringkat

- Day Trader'S Manual: The CMC Markets Trading Smart SeriesDokumen4 halamanDay Trader'S Manual: The CMC Markets Trading Smart Seriesdavid louisBelum ada peringkat

- Acd 2Dokumen15 halamanAcd 2KumaraRajaBelum ada peringkat

- Day 1 Session 1Dokumen72 halamanDay 1 Session 1msamala09Belum ada peringkat

- Intra-Day Momentum: Imperial College LondonDokumen53 halamanIntra-Day Momentum: Imperial College LondonNikhil AroraBelum ada peringkat

- ICT CurriculumDokumen1 halamanICT CurriculumLetea GeorgeBelum ada peringkat

- Business Summaries - N - SDokumen32 halamanBusiness Summaries - N - SLetea GeorgeBelum ada peringkat

- TS Data FeedDokumen9 halamanTS Data FeedLetea GeorgeBelum ada peringkat

- MT4 Navigational Tips and TechniquesDokumen8 halamanMT4 Navigational Tips and TechniquesLetea GeorgeBelum ada peringkat

- ManagerDokumen1 halamanManagerLetea GeorgeBelum ada peringkat

- (Ebook - PDF) - Military - Us Army Survival Manual FM 21-76Dokumen564 halaman(Ebook - PDF) - Military - Us Army Survival Manual FM 21-76hikari70100% (1)

- Dezv Pers - TipsDokumen2 halamanDezv Pers - TipsLetea GeorgeBelum ada peringkat

- 6th Central Pay Commission Salary CalculatorDokumen15 halaman6th Central Pay Commission Salary Calculatorrakhonde100% (436)