Butuan Property Located at Rosales Street

Diunggah oleh

Anonymous EvbW4o1U70 penilaian0% menganggap dokumen ini bermanfaat (0 suara)

13 tayangan3 halamanghyu

Hak Cipta

© © All Rights Reserved

Format Tersedia

DOCX, PDF, TXT atau baca online dari Scribd

Bagikan dokumen Ini

Apakah menurut Anda dokumen ini bermanfaat?

Apakah konten ini tidak pantas?

Laporkan Dokumen Inighyu

Hak Cipta:

© All Rights Reserved

Format Tersedia

Unduh sebagai DOCX, PDF, TXT atau baca online dari Scribd

0 penilaian0% menganggap dokumen ini bermanfaat (0 suara)

13 tayangan3 halamanButuan Property Located at Rosales Street

Diunggah oleh

Anonymous EvbW4o1U7ghyu

Hak Cipta:

© All Rights Reserved

Format Tersedia

Unduh sebagai DOCX, PDF, TXT atau baca online dari Scribd

Anda di halaman 1dari 3

Butuan Property located at Rosales Street

Buyer : Mr. Terence Yu & wife Atty. Yu

( neighbour of the the property and senior partner of Atty. Carampatana, the lawyer

hired for the issuance of the lost titles. The couple offered the highest price for this

property at Php 11,000,000.00. Manoy Bembot offered at Php 6,000,000.00 and City

Mayor of Butuan Lagnada offered a price of Php 10,000,000.00

Agent : Yaya of Marle, wife of Bobet and confirmed by Atty. Carampatana through text msg.

Present status of the Certificate of title of the rosales property:

- Formal Notice from the court of Agusan del Norte, giving due notice that the petition for

issuance of lost title for the 4 properties has been granted. We wait for another 15 days

from the time we received the notice to be able to petition for finality of the said order

- We will asks Atty. Carampatana for the issuance of finality since it’s more than 15 days

already

- We then submit this finality order from the court to the Registry of Deeds of Butuan City for

the issuance of the new title

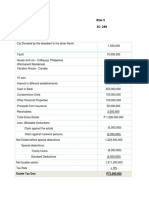

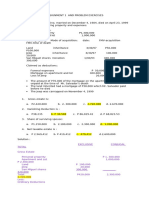

COMPUTATION OF ESTATE TAXES – ESTIMATED

Zonal Value of the property = P 6,500 per sqm.

( This zonal valuation is from year 2000 up to the present )

Area of the property = 1,227 sqm

Total zonal value of the property= P 7,975,000.00

GLORIA BUSA’S ESTATE ( 50% of the Total zonal value) = P 3,987,750.00

Allowable deductions: 1) Automatic = 1,000,000.00

2) Dwelling = 1,000,000.00

3) Hospital & Funeral = 300,000.00

Net Taxable for estate tax = P 1,687,750.00

Estate tax rate table : for 500,000.00 up but less than 2,000,000.00 = 15,000.00 plus 8% of the excess

of 500,000.00

Therefore, Gloria’s estate tax at the time of her death = 15,000.00 + 8% of P 1,187,750.00

= P 110,020.00

Present value of Gloria’s estate tax computation:

Date of Death : June 26, 2002

Date of payment : May 2017

No. of years : 16 yrs and 11 months or 16.92 yrs

Without compromise with compromise

Estate tax at the time of her death = P 110,020.00 = P 110,020.00

Plus: surcharge 25% of110,020 = 27,505.00 = 27,505.00

Sub – total = P 137,525.00 = P 137,525.00

Plus interest: 20% of 137,525/yr 16.92 = P 465,384.60 = 232,692.30 (1/2 of Int.)

Total estate tax w/o compromise = P 602,909.60

Plus compromise = 25,000.00

Total estate tax with compromise = P 395,217.30

URSO BUSA’S ESTATE (50% of the Total zonal value) = P 3,987,750.00

Allowable Deductions: 1) Automatic = 1,000,000.00

2) Dwelling = 1,000,000.00

3) Hospital & funeral = 300,000.00

Net taxable estate tax = P 1,687,750.00

Estate tax rate table: ( same as Gloria’s)

Therefore, Urso’s estate tax at the time of his death = 15,000.00 + 8% of P 1,187,750.00

= P 110,020.00

Present value of Urso’s estate tax computation:

Date of Death : July 31, 2008

Date of payment : May 20017

No. of yrs : 8 yrs. & 10 months or 8.83 yrs

Without compromise with compromise

Estate tax at the time of his death = P 110,020.00 = P 110,020.00

Plus: surcharge 25% of 110,20 = 27,505.00 = 27,505.00

Sub – total = P 137,525.00 = P 137,525.00

Plus interest: 20%of 137,525/yr 8.83 = P 242,869.15 = P121,434.55 (1/2 of Int.)

Total estate tax w/o compromise = P 380,394.15

Plus compromise = 25,000.00

Total estate tax with compromise = P 283,959.55

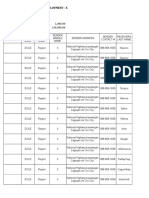

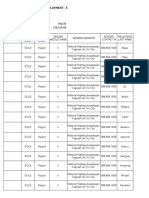

SHARE COMPUTATION OF THE 8 SIBLINGS

BUYING PRICE = P 11,000,000.00

Less Deductions:

1) Agent’s commission 5% of 11,000,000.00 = P 550,000.00

2) Capital Gain Tax 6% of 7,975,000.00 = 478,500.00

3) Docs Stamps 1.5% of 7,975,000.00 = 119,625.00

4) Gloria’s estate tax = 395,217.30

5) Urso’s estate tax = 283,959.55

6) Miscellaneous = 50,000.00

7) Tio Pacio = 600,000.00 ( for approval from the 8 siblings)

8) Manay Gracia = 100,000.00 ( for approval of the 8 siblings)

TOTAL DEDUCTIONS = P2,577,301.85

NET PROCEEDS = P 8,422,698.15

Share of each siblings = P 1,052,837.20

More or less

NOTE: THIS COMPUTATION DOES NOT INCLUDE YET THE EXPENSES FOR ISSUANCE OF NEW

TITLE

Anda mungkin juga menyukai

- BSMA Taxation of IndividualsDokumen32 halamanBSMA Taxation of IndividualsAngela CanayaBelum ada peringkat

- Taxation Cup SeriesDokumen5 halamanTaxation Cup SeriesGlaiza Atillo Batuto Orgino100% (1)

- Vanishing Deductions X Estate Tax ComputationDokumen2 halamanVanishing Deductions X Estate Tax ComputationShiela Mae OblanBelum ada peringkat

- Vanishing Deduction - Sample ComputationDokumen4 halamanVanishing Deduction - Sample ComputationKathyrn Ang-ZarateBelum ada peringkat

- 04chapter5estatetax 140813184942 Phpapp01Dokumen30 halaman04chapter5estatetax 140813184942 Phpapp01charlieaizaBelum ada peringkat

- MR Christopher OtabilDokumen4 halamanMR Christopher OtabilPrince Akonor AsareBelum ada peringkat

- Tax Assignment 4Dokumen5 halamanTax Assignment 4pfungwaBelum ada peringkat

- ACCTAX2 Business Case RecentDokumen5 halamanACCTAX2 Business Case RecentHazel Joy DemaganteBelum ada peringkat

- TrustsDokumen9 halamanTrustskayzmm99Belum ada peringkat

- Sample Computation (A & B Lots of 750 SQM.)Dokumen2 halamanSample Computation (A & B Lots of 750 SQM.)iquotientsolutionsBelum ada peringkat

- Description: BIR Form 1801Dokumen14 halamanDescription: BIR Form 1801Nicole TondoBelum ada peringkat

- Tutorial 10-PIT2 - Sample AnswerDokumen11 halamanTutorial 10-PIT2 - Sample AnswerĐào Huyền Trang 4KT-20ACNBelum ada peringkat

- Everything About EstateDokumen19 halamanEverything About EstateAlas OplasBelum ada peringkat

- Salary Tax FormatDokumen10 halamanSalary Tax Formathizbullah chandioBelum ada peringkat

- Tutorial 9 PIT1 Summer 2023 Sample AnswerDokumen6 halamanTutorial 9 PIT1 Summer 2023 Sample Answernewgen2173Belum ada peringkat

- Computation For Exercise 1Dokumen10 halamanComputation For Exercise 1Xyzra AlfonsoBelum ada peringkat

- EstateDokumen6 halamanEstateJAYAR MENDZBelum ada peringkat

- Year Note For P 1,100,000 Plus Interest 10% Compounded AnnuallyDokumen7 halamanYear Note For P 1,100,000 Plus Interest 10% Compounded AnnuallyIvory ClaudioBelum ada peringkat

- Name of BuyerDokumen4 halamanName of Buyerapi-25886697Belum ada peringkat

- Guide To CW QnsDokumen12 halamanGuide To CW QnsMwebembezi Mark EricBelum ada peringkat

- Task Performance 1Dokumen1 halamanTask Performance 1JanixxxBelum ada peringkat

- Interest Calculation For IncometaxDokumen8 halamanInterest Calculation For IncometaxamarlaxmiBelum ada peringkat

- 2dd3c613 1670283438180Dokumen8 halaman2dd3c613 1670283438180Kyla Gacula NatividadBelum ada peringkat

- Real Estate Mathematics SAMPLE PROBLEMS (REF: 0505) W/ SolutionDokumen11 halamanReal Estate Mathematics SAMPLE PROBLEMS (REF: 0505) W/ SolutionGeorge Poligratis Rico100% (2)

- Tutorial 9 - PIT1-Summer 2023-Sample AnswerDokumen4 halamanTutorial 9 - PIT1-Summer 2023-Sample Answerkien tran100% (1)

- BUSITAX (Final Output)Dokumen5 halamanBUSITAX (Final Output)Ivan AnaboBelum ada peringkat

- Estate Tax (Single) ReportDokumen18 halamanEstate Tax (Single) ReportPatricia RodriguezBelum ada peringkat

- Acc151 Sas7Dokumen3 halamanAcc151 Sas7Jessa Honey Rose Laid BacadonBelum ada peringkat

- Inctax A Distance Learning Activity - 3 SOURCE: RR3-98Dokumen4 halamanInctax A Distance Learning Activity - 3 SOURCE: RR3-98Jhuliane RalphBelum ada peringkat

- Income Tax (Santos)Dokumen1 halamanIncome Tax (Santos)Ian SantosBelum ada peringkat

- Answer in The Activity-Property RelationsDokumen4 halamanAnswer in The Activity-Property RelationsjenBelum ada peringkat

- HITDokumen16 halamanHITSIRUI DINGBelum ada peringkat

- P Tax ExamplesDokumen4 halamanP Tax Examplespankaj kumarBelum ada peringkat

- Estate Tax - Bureau of Internal RevenueDokumen15 halamanEstate Tax - Bureau of Internal RevenueKristarah HernandezBelum ada peringkat

- Estate TaxDokumen1 halamanEstate TaxGerald SantosBelum ada peringkat

- Rosas Payroll CalculatorDokumen15 halamanRosas Payroll Calculatoracctg2012Belum ada peringkat

- 8.2 Assignment - Regular Income Tax For IndividualsDokumen8 halaman8.2 Assignment - Regular Income Tax For Individualssam imperialBelum ada peringkat

- Vat Math 2021Dokumen83 halamanVat Math 2021Fakharuddin Ahmed ShahBelum ada peringkat

- Property Exclusive Total DeductionsDokumen6 halamanProperty Exclusive Total DeductionsRiann DevereuxBelum ada peringkat

- Eva StatisticsDokumen3 halamanEva StatisticsBaron Mumo MuiaBelum ada peringkat

- 9.1 INCOME FROM PROPERTY Notes Questions With SolutionsDokumen5 halaman9.1 INCOME FROM PROPERTY Notes Questions With SolutionsHASNAT SABIRBelum ada peringkat

- Estate Tax SummaryDokumen9 halamanEstate Tax SummaryRb BalanayBelum ada peringkat

- Compilation of MCQDokumen34 halamanCompilation of MCQDaphnie Bolo100% (1)

- Pingol TAX11Dokumen2 halamanPingol TAX11Kristyl Ivy PingolBelum ada peringkat

- Week 4 Co Ownership 2023 241 2Dokumen67 halamanWeek 4 Co Ownership 2023 241 2Arellano Rhovic R.Belum ada peringkat

- ToppingDokumen37 halamanToppingRojim Asio DilaoBelum ada peringkat

- Problem 1 Summary 35 Problem 1 Solution 21 Problem 2 Jes 60 Problem 2 Worksheet 116 Grand TotalDokumen23 halamanProblem 1 Summary 35 Problem 1 Solution 21 Problem 2 Jes 60 Problem 2 Worksheet 116 Grand TotalAngelica DizonBelum ada peringkat

- Commissioner of Internal Revenue, Petitioner, vs. The Estate of Benigno P. Toda, JR., Represented byDokumen8 halamanCommissioner of Internal Revenue, Petitioner, vs. The Estate of Benigno P. Toda, JR., Represented byChrystelle Gail LiBelum ada peringkat

- Activity 2 Income TaxationDokumen5 halamanActivity 2 Income TaxationEd HernandezBelum ada peringkat

- Republic of The Philippines Department of Finance Revenue Region No. 08 Revenue District Office No. 049 North MakatiDokumen2 halamanRepublic of The Philippines Department of Finance Revenue Region No. 08 Revenue District Office No. 049 North MakatiHanabishi RekkaBelum ada peringkat

- Exercise 3 Basic Acctg. TemplateDokumen6 halamanExercise 3 Basic Acctg. TemplateKiana FernandezBelum ada peringkat

- Agri 2Dokumen16 halamanAgri 2Md. Rajib MiaBelum ada peringkat

- Answer To Assignment No. 2Dokumen1 halamanAnswer To Assignment No. 2Sophia Angelica Marie MarasiganBelum ada peringkat

- Problem 6-36Dokumen8 halamanProblem 6-36blahblahblueBelum ada peringkat

- Answers To Assignment 1 and Problem Exercises Taxation2Dokumen4 halamanAnswers To Assignment 1 and Problem Exercises Taxation2Dexanne BulanBelum ada peringkat

- Santiago LindaDokumen2 halamanSantiago LindaJoel ReyesBelum ada peringkat

- CIR vs. Estate of Toda September 14, 2004Dokumen12 halamanCIR vs. Estate of Toda September 14, 2004Clarinda MerleBelum ada peringkat

- CIR v. Estate of Benigno Toda - G.R. No. 147188Dokumen9 halamanCIR v. Estate of Benigno Toda - G.R. No. 147188Ash SatoshiBelum ada peringkat

- FinanceDokumen2 halamanFinancemaybellinemangosan1805Belum ada peringkat

- Visual Financial Accounting for You: Greatly Modified Chess Positions as Financial and Accounting ConceptsDari EverandVisual Financial Accounting for You: Greatly Modified Chess Positions as Financial and Accounting ConceptsBelum ada peringkat

- A) B) C) D) : Which Is Not A Measure of Central Tendency?Dokumen5 halamanA) B) C) D) : Which Is Not A Measure of Central Tendency?Anonymous EvbW4o1U7Belum ada peringkat

- NOR - SSS Personal - Record - 3476382113 PDFDokumen1 halamanNOR - SSS Personal - Record - 3476382113 PDFAnonymous EvbW4o1U7Belum ada peringkat

- Tupad Project Proposal I. Project Profile: (Name of Brgy Captain or Mayor of ACP)Dokumen2 halamanTupad Project Proposal I. Project Profile: (Name of Brgy Captain or Mayor of ACP)Anonymous EvbW4o1U7Belum ada peringkat

- Functions and Responsibilities / Key Projects and ActivitiesDokumen4 halamanFunctions and Responsibilities / Key Projects and ActivitiesAnonymous EvbW4o1U7Belum ada peringkat

- Exit Interview FormDokumen2 halamanExit Interview FormAnonymous EvbW4o1U7Belum ada peringkat

- 13 Full CSE Reviewer With AnswersDokumen72 halaman13 Full CSE Reviewer With AnswersAnonymous EvbW4o1U7Belum ada peringkat

- Ic Contract of Service - AcpDokumen5 halamanIc Contract of Service - AcpAnonymous EvbW4o1U7Belum ada peringkat

- Sapad Contract of Service - AcpDokumen5 halamanSapad Contract of Service - AcpAnonymous EvbW4o1U7Belum ada peringkat

- Choosing A Theme and Redesign The LogoDokumen2 halamanChoosing A Theme and Redesign The LogoAnonymous EvbW4o1U7Belum ada peringkat

- Social Amelioration and Welfare Program (SAWP) Presentation - 21 July 2017Dokumen38 halamanSocial Amelioration and Welfare Program (SAWP) Presentation - 21 July 2017Anonymous EvbW4o1U7100% (1)

- Gip Accomplishment Report FormDokumen1 halamanGip Accomplishment Report FormAnonymous EvbW4o1U767% (3)

- Dearest Union Raffle May 18, 2017: Control Number Name SignatureDokumen5 halamanDearest Union Raffle May 18, 2017: Control Number Name SignatureAnonymous EvbW4o1U7Belum ada peringkat

- Department of Labor and EmploymentDokumen1 halamanDepartment of Labor and EmploymentAnonymous EvbW4o1U7100% (1)

- Gip Accomplishment Report FormDokumen1 halamanGip Accomplishment Report FormAnonymous EvbW4o1U70% (1)

- DATE July 24, 2017 Batch No. Total TRXN Count (Php/Usd) 1,000.00 Total Principal (Php/Usd) 158,000.00Dokumen6 halamanDATE July 24, 2017 Batch No. Total TRXN Count (Php/Usd) 1,000.00 Total Principal (Php/Usd) 158,000.00Anonymous EvbW4o1U7Belum ada peringkat

- Dileep: DOLE Integrated Livelihood and Emergency Employment ProgramDokumen7 halamanDileep: DOLE Integrated Livelihood and Emergency Employment ProgramAnonymous EvbW4o1U7Belum ada peringkat

- Department of Labor and Employment - X Mlhuillier TransactionDokumen6 halamanDepartment of Labor and Employment - X Mlhuillier TransactionAnonymous EvbW4o1U7Belum ada peringkat

- Dole Regional Office 10: Government Internship Program (Gip) Application FormDokumen2 halamanDole Regional Office 10: Government Internship Program (Gip) Application FormAnonymous EvbW4o1U7Belum ada peringkat

- Gip Accomplishment Report FormDokumen1 halamanGip Accomplishment Report FormAnonymous EvbW4o1U7Belum ada peringkat

- Tupad Orientation Presentation 2017Dokumen54 halamanTupad Orientation Presentation 2017Anonymous EvbW4o1U7100% (5)

- AR - June 3027Dokumen1 halamanAR - June 3027Anonymous EvbW4o1U7Belum ada peringkat

- Republic of The Philippines Tupad Name of Assured: Dole X Tupad Address: Cagayan de Oro CityDokumen4 halamanRepublic of The Philippines Tupad Name of Assured: Dole X Tupad Address: Cagayan de Oro CityAnonymous EvbW4o1U7Belum ada peringkat

- GroupingsDokumen4 halamanGroupingsAnonymous EvbW4o1U7Belum ada peringkat

- Date Batch No. Total TRXN Count (Php/Usd) 940.00 Total Principal (Php/Usd) 148,520.00Dokumen6 halamanDate Batch No. Total TRXN Count (Php/Usd) 940.00 Total Principal (Php/Usd) 148,520.00Anonymous EvbW4o1U7Belum ada peringkat

- Department of Labor and Employment Tupad Work Program: Iligan City Social Community ProjectsDokumen1 halamanDepartment of Labor and Employment Tupad Work Program: Iligan City Social Community ProjectsAnonymous EvbW4o1U7Belum ada peringkat

- Dileep Focal Person Meting Proposal Cy 2017Dokumen1 halamanDileep Focal Person Meting Proposal Cy 2017Anonymous EvbW4o1U7Belum ada peringkat

- Record KeepingDokumen11 halamanRecord Keepingr.jeyashankar9550Belum ada peringkat

- Australia OriginDokumen5 halamanAustralia OriginhienvvuBelum ada peringkat

- International Payment SystemsDokumen2 halamanInternational Payment SystemsPrerna SharmaBelum ada peringkat

- CompressedDokumen60 halamanCompressedshivaprasadssBelum ada peringkat

- Invoice No. 8032017603: Bayer Cropscience Inc. 3rd Flr. Bayer House PO Box 4600 4028 Calamba Laguna PhilippinesDokumen2 halamanInvoice No. 8032017603: Bayer Cropscience Inc. 3rd Flr. Bayer House PO Box 4600 4028 Calamba Laguna PhilippinesGlezilda LoberianoBelum ada peringkat

- 6018-P1-SPK-AKUNTANSI-Data Mentah SoalDokumen20 halaman6018-P1-SPK-AKUNTANSI-Data Mentah Soaliqbal kamilBelum ada peringkat

- Substitute Form W-8BEN: (Certificate of Foreign Status of Beneficial Owner For United States Tax Withholding)Dokumen1 halamanSubstitute Form W-8BEN: (Certificate of Foreign Status of Beneficial Owner For United States Tax Withholding)Manuel Aguilar100% (1)

- Topic Iv - Local Taxation and Fiscal MattersDokumen48 halamanTopic Iv - Local Taxation and Fiscal MattersJean Ashley Napoles AbarcaBelum ada peringkat

- Auditing Practice Problem 6Dokumen2 halamanAuditing Practice Problem 6Jessa Gay Cartagena TorresBelum ada peringkat

- Individual Taxpayers Tax Filing ExercisesDokumen3 halamanIndividual Taxpayers Tax Filing ExercisesKIM RAGABelum ada peringkat

- Schedule of Fees & Charges November 2021 (English)Dokumen1 halamanSchedule of Fees & Charges November 2021 (English)Tabish JazbiBelum ada peringkat

- Use The Data For The Next Four QuestionsDokumen8 halamanUse The Data For The Next Four QuestionsNo FaceBelum ada peringkat

- Amway India Money PlanDokumen16 halamanAmway India Money PlanSoumitra RoyBelum ada peringkat

- CP575Notice 1236280154390Dokumen2 halamanCP575Notice 1236280154390slyakhBelum ada peringkat

- Tax Card TY 2022Dokumen8 halamanTax Card TY 2022princecharming14Belum ada peringkat

- VIII. CIR vs. St. Luke's Medical Center, Inc. G.R. No. 203514Dokumen10 halamanVIII. CIR vs. St. Luke's Medical Center, Inc. G.R. No. 203514Stef OcsalevBelum ada peringkat

- ONEASSIST InvoiceDokumen1 halamanONEASSIST InvoiceJeeva STRBelum ada peringkat

- CDokumen1 halamanCAakash GuptaBelum ada peringkat

- Cash ReceiptDokumen40 halamanCash ReceiptAneesh ChandranBelum ada peringkat

- Memory Aid - COMMLDokumen100 halamanMemory Aid - COMMLvoitjon100% (5)

- Penyata Akaun: Tarikh Date Keterangan Description Terminal ID ID Terminal Amaun (RM) Amount (RM) Baki (RM) Balance (RM)Dokumen1 halamanPenyata Akaun: Tarikh Date Keterangan Description Terminal ID ID Terminal Amaun (RM) Amount (RM) Baki (RM) Balance (RM)ElsaChanBelum ada peringkat

- Gregory L Carlo Francesco Shaw - e OnDokumen3 halamanGregory L Carlo Francesco Shaw - e OnMOHAMMAD NAZRUL ISLAMBelum ada peringkat

- Gul BargaDokumen916 halamanGul BargaShihan Ali KhanBelum ada peringkat

- SCC Welcome PDFDokumen4 halamanSCC Welcome PDFfibiro9231Belum ada peringkat

- Gmail - GCash Bills Pay ReceiptDokumen1 halamanGmail - GCash Bills Pay ReceiptShi Yuan ZhangBelum ada peringkat

- Tax ScriptDokumen4 halamanTax Scriptpierre-benoit.alaisBelum ada peringkat

- Cta 00 CV 03475 D 1987may20 Ass PDFDokumen12 halamanCta 00 CV 03475 D 1987may20 Ass PDFjjbbrrBelum ada peringkat

- WBGST Rules 2017 - Amended Upto 18.10.2017 PDFDokumen411 halamanWBGST Rules 2017 - Amended Upto 18.10.2017 PDFAdesh KumarBelum ada peringkat

- Remittance Transfers: Small Entity Compliance GuideDokumen46 halamanRemittance Transfers: Small Entity Compliance GuideAnomieBelum ada peringkat

- User Manual J1icovendDokumen8 halamanUser Manual J1icovendOmar Giovanni Puin Montenegro100% (1)