Sanlam Kenya Plc. - Audited Financial Statements For The Period Ended 31st Dec 2017

Diunggah oleh

Anonymous KAIoUxP7Judul Asli

Hak Cipta

Format Tersedia

Bagikan dokumen Ini

Apakah menurut Anda dokumen ini bermanfaat?

Apakah konten ini tidak pantas?

Laporkan Dokumen IniHak Cipta:

Format Tersedia

Sanlam Kenya Plc. - Audited Financial Statements For The Period Ended 31st Dec 2017

Diunggah oleh

Anonymous KAIoUxP7Hak Cipta:

Format Tersedia

Sanlam Kenya Results

AUDITED FINANCIAL STATEMENTS FOR THE PERIOD ENDED 31ST DECEMBER, 2017

1. Introduction GROUP STATEMENT OF COMPREHENSIVE INCOME

The Board of Directors of Sanlam Kenya PLC (“Sanlam”) is pleased to announce the Group’s audited results for the year ended 31st December 2017.

31 Dec 2017 31 Dec 2016

KShs. ‘000 KShs. ‘000

2. Key Features

Income

• Profit before tax at KShs. 247m (2016: KShs. 317m)

Gross premium income 6,369,847 5,224,546

• Total assets up by 5% to KShs. 29.8b (2016: KShs. 28.4b)

• Group Embedded Value is at KShs. 4.4b (2016: KShs. 4.7b) Outward reinsurance premium (953,632) (392,341)

• Value of New Business is at KShs. 45m (2016: KShs. -88m) Net written premium 5,416,215 4,832,205

• General Insurance Written Premium is at KShs. 2.15b (2016: KShs. 1b) Investment income 2,285,310 2,418,532

• General business underwriting profit is at KShs. 40m (2016: KShs. -38m) Fair value gains 368,951 (450,341)

Fee and commissions earned 300,092 175,068

3. Accounting Policies Other operating income 129,436 178,610

The Group’s accounting policies comply with International Financial Reporting Standards (IFRS) as well as the Kenyan Companies Act, 2015. These Total income 8,500,004 7,154,074

policies are consistent with those applied in prior years. Claims and expenses

Gross benefits and claims paid (5,408,384) (4,193,984)

4. The Economic Environment

Reinsurers’ share of claims 583,321 204,498

According to the National Treasury, Kenya’s economy remained resilient in 2017 despite adverse weather conditions, a prolonged electioneering period

Net change in investment and contract liabilities 290,581 (488,981)

as well as subdued credit growth to the private sector which combined to weaken growth in the first half of the year. Economic growth for 2017 is

Net claims and policyholders benefits (4,534,482) (4,478,467)

estimated at 4.8% from 5.8% in 2016. On the positive side, growth in 2017 was supported by the ongoing public infrastructure investments, improved

weather towards end of 2017, recovery in the tourism sector and a stable macroeconomic environment. Cost of sales (10,463) (28,009)

Commission expense (735,150) (660,731)

Despite the slowed economic growth recorded in the year, the insurance industry recorded a 10.7% growth in premiums during the period to September Operating and other expenses (1,843,601) (1,576,197)

2017 compared to a growth of 7.2% in a similar period in 2016. The growth was largely driven by accelerated growth in the life insurance segment Impairment of financial assets (1,125,243) (93,397)

which grew 16.9% compared to the general insurance segment that grew by 7.2%. Overall premiums are however still largely skewed towards general Total benefits, claims and other expenses (8,248,939) (6,836,801)

insurance which accounted for 62.3% of the KShs. 160.6b of premiums collected as at the end of September 2017. Profit before share of profit of an associate 251,065 317,273

Share of loss of an associate (4,107) (220)

The Kenya shilling remained stable in the year which depreciated by 0.7% against the US dollar. Inflation was relatively high resulting from rising food Profit before tax 246,958 317,053

prices but declined towards the end of the year to close at 4.5% as food inflation reduced. The Kenyan Capital Markets recorded strong growth despite Income tax expense (193,913) (246,430)

the prolonged electioneering period. This is evidenced by positive returns on all asset classes with the NASI gaining 28.4% compared to (8.5%) in 2016 Profit for the year after tax 53,045 70,623

and the FTSE bond index gaining 16.5% from (0.2%) in 2016.

Other comprehensive income;

Other comprehensive income net of tax 140 23,249

The insurance sector continues to be shaped by changes in the demographic profile of the population, macroeconomic conditions, industry

Total comprehensive income for the year 53,185 93,872

competition and regulatory reforms. Market players are particularly keen on monitoring their balance sheets to ensure compliance with the new Risk

Based Capital requirements which come into full effect in June 2020.

Profit attributable to:

5. Financial Overview Equity holders of the parent 30,814 90,252

The Group’s profit before tax of KShs. 247m in the current year, decreased from KShs. 317m reported in December 2016. This is mainly attributable to Non-controlling interest 22,231 (19,629)

decline in performance of the life insurance, investments and property businesses in 2017. Earnings per share

The Group results are analysed as follows; Basic 0.21 0.63

Diluted 0.21 0.63

31 Dec 2017 31 Dec 2016

KShs.’ M KShs.’ M Shares used for calculating earnings per share 144,000,000 144,000,000

Operating profit 82 549 GROUP STATEMENT OF FINANCIAL POSITION

Investment income on shareholders' assets 165 (232) 31 Dec 2017 31 Dec 2016

Profit before tax 247 317 KShs. ‘000 KShs. ‘000

Tax (194) (246) Capital and reserves

Net profit for the period 53 71 Share capital 720,000 720,000

Other comprehensive income - 23 Revaluation reserve 15,904 15,809

Net profit and other comprehensive income 53 94 Statutory reserve 1,609,658 1,862,245

Retained earnings 1,459,314 1,172,154

Non-controlling interest 247,074 162,036

Comprehensive income attributable to:

Owners of the parent 31 106 Total capital and reserves 4,051,950 3,932,244

Non-controlling interests 22 (12) Assets

Intangible assets 109,035 116,661

Included in the operating profit are the results of our life insurance, general insurance, investments, property and loans businesses. The general Property and equipment 157,361 177,071

insurance and loan businesses exceeded the 2016 operating profit levels while the life insurance, investment management and property businesses Investment property 3,180,700 2,761,200

performance declined. The general insurance business continues to show significant growth and returned to profitability in 2017. Investments in associate 17,465 21,572

Deferred tax 192,843 182,721

Life Insurance Business: Gross written premium declined by 2% to KShs. 4.3b from KShs. 4.4b in 2016. Corporate business premium income grew Loans 758,234 930,564

by 28% while retail business premium income grew by 2% attributable to stabilizing distribution channels and marked improvement on our financial

Deferred acquisition costs 153,049 150,427

consultants’ production.

Held to maturity financial assets 9,463,228 8,836,392

Available for sale financial assets 104,793 104,653

General Insurance Business: The company returned an underwriting profit of KShs. 40m as gains from the business transformation program came

Fair value through profit or loss financial assets 9,934,526 10,566,547

through in 2017. Gross written premium grew by 115% from KShs. 1b to KShs. 2.15b buoyed by stronger engagement with our customers and business

Reinsurance assets 633,226 554,983

partners. Investment returns increased by 6,634% from KShs. 1m in 2016 to KShs. 61m in 2017. Prior year investment income was impacted negatively

Land and development (inventory) 118,734 127,366

by realized losses on property disposals. Policyholder benefits and claims closed at KShs. 770m, an increase of 474% from KShs. 134m posted in 2016

in line with growth in gross written premiums. The general business is well on track to become a major player in the general insurance market in Kenya. Insurance receivables 830,044 550,622

Income tax receivable 20,094 65,583

Asset Management: Fee income from our investment business decreased by 28% to KShs. 113m from KShs. 156m on account of lower outperformance Receivable and other financial assets 451,941 798,792

fees in 2017 and slower AUM growth. Deposits with financial institutions 2,239,644 2,033,481

Cash and bank balance 301,567 463,955

6. Dividends Assets held for sale 1,145,000 -

The introduction of the new Risk Based Capital regime in 2020 will significantly increase the capital requirement for the Group’s life and general Total assets 29,811,484 28,442,590

insurance businesses. This is over and above the impact of the revised guidelines on valuations of technical provisions for the life business on the back Liabilities

of the high prescribed margins used for reserving. The Board of Directors will not be recommending the payment of a dividend for the year ended

Borrowings 1,030,741 -

2017 (2016: Nil) at the forthcoming Annual General Meeting scheduled for Thursday 10th May 2018.

Insurance contract liabilities 13,561,183 12,704,048

Market linked insurance liabilities 6,568,158 7,653,977

7. Regulatory Developments

Payable under deposit administration contracts 1,433,027 1,489,407

The main regulatory development in the insurance sector was the gazettement of The Statute Law (Miscellaneous amendments) Act 2017, postponing

the effective date of complying with the new capital requirements to June 2020. The Group remains committed to ensuring full compliance with Provision for unearned premium 655,110 474,115

the regulations. Deferred tax 747,449 844,396

Provisions 51,925 51,925

8. Changes of Directors Current tax liabilities 230,684 8,668

Wikus Olivier resigns from the Boards of Sanlam Kenya Plc and Sanlam Life Insurance Limited to take up other roles within the wider Sanlam Group. Insurance payables 759,006 802,471

Mr Olivier was apponited a director on 16th May 2014 and also served as a member of the Audit Committee. The Board of Directors thanks Mr Olivier Payables and other charges 722,251 481,339

for his contribution to the growth of the business and wishes him the best in his future endeavours. Mugo Kibati resigned as the Sanlam Kenya Group Total liabilities 25,759,534 24,510,346

CEO to pursue personal and professional interests. The Board remains grateful to Mr. Kibati for his dedicated service to Sanlam Kenya, having assumed Net assets 4,051,950 3,932,244

the Group leadership role from February 2015.

GROUP STATEMENT OF CHANGES IN EQUITY

31 Dec 2017 31 Dec 2016

KShs. ‘000 KShs. ‘000

9. Looking ahead

Share capital and share premium 720,000 720,000

Building on the foundation already set to accelerate our corporate business growth and stabilize our retail business, the Board remains confident that

further gains will be achieved this year. We have streamlined our processes significantly with a potential to realize key gains on customer experience Opening reserves 3,050,208 2,996,074

and overall growth on our range of non-bank financial services. Income attributable to shareholders 30,909 106,061

Transactions with minorities 3,759 (51,927)

The year 2018, will also see us moving to our new home at the Sanlam Tower, along Waiyaki Way, providing further benefits to our unified Non controlling interest 247,074 162,036

business strategy. Balance at end of the year 4,051,950 3,932,244

ABRIDGED GROUP CASH FLOW STATEMENT

The financial statements presented are extracts from the books of Sanlam Kenya Plc for the year ended 31st December, 2017. The financial statements 31 Dec 2017 31 Dec 2016

were audited by PricewaterhouseCoopers who expressed an unqualified audit opinion. KShs. ‘000 KShs. ‘000

Cash flow from operating activities (1,903,215) (2,337,432)

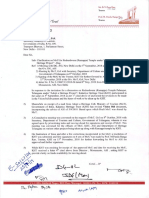

For and on behalf of the Board Cash from investing activities 850,669 882,375

Cash flows from financing activities 1,096,321 36,325

Net increase in cash resources 43,775 (1,418,732)

Cash resources at the beginning of the year 2,497,436 3,916,168

Dr. John P.N.Simba, OGW,MBS,EGH (Chairman) Mr. G. Kuria (Ag Group Chief Executive Officer)

Cash resources at the end of the year 2,541,211 2,497,436

Directors

Dr. J.P.N. Simba, G. Kuria, J. Magabe***, S. Mudhune, R. Patel, T. Botha*, J.A. Burbidge**

South African* | British** | Tanzanian***

Date:

Life Insurance | General Insurance | Investments

Sanlam Kenya Results

AUDITED FINANCIAL STATEMENTS FOR THE PERIOD ENDED 31ST DECEMBER, 2017

GROUP EMBEDDED VALUE SANLAM LIFE - STATEMENT OF FINANCIAL POSITION

The embedded value represents an estimate of the value of the Group. It excludes the value attributable to 31 Dec 2017 31 Dec 2016

minority interests and goodwill attributable to future new business. KShs. ‘000 KShs. ‘000

Equity

The embedded value comprises:

Share capital 200,000 200,000

a) The value of the shareholders’ equity net of the cost of the Capital Adequacy Requirement (CAR); and Share premium 30,260 30,260

b) The value of the in-force business. Statutory reserve 1,609,660 1,862,245

The value of the in-force is the present value of future profits arising from business in force at the valuation date, Retained earnings 560,253 -

discounted at the risk discount rate. Shareholders’ funds 2,400,173 2,092,505

Assets

31 Dec 2017 31 Dec 2016

Intangible assets 86,160 100,481

KShs. ‘000 KShs. ‘000

Property and equipment 126,521 138,418

Embedded Value Results

Investment properties 2,664,000 2,244,500

Shareholders’ equity, excluding goodwill 3,804,883 3,770,208

Held to maturity financial assets 9,217,653 8,596,592

Fair value adjustments to net assets (926,708) (652,883)

At fair value through profit and loss 8,971,191 9,492,205

Net value of in-force 1,564,567 1,572,946

Mortgage loans 190,182 339,445

Gross value in-force 2,931,951 2,760,199

Reinsurance assetts 153,572 134,296

Tax provision (879,585) (828,060)

Income tax receivable - 18,182

Cost of CAR (487,799) (359,193)

Insurance receivable 209,064 206,058

Embedded value at end of period 4,442,742 4,690,271

Other receivables 222,534 888,699

Embedded value earnings

Defered acquisition costs 98,814 104,423

Embedded value at end of period 4,442,742 4,690,271

Cash at bank and in hand 205,428 333,674

Embedded value at beginning of period 4,690,271 5,220,391

Deposits with financial institutions 2,161,434 1,876,823

Change in embedded value (247,529) 530,120

Assets held for sale 605,000 -

Dividends paid - -

Total assets 24,911,553 24,473,796

Embedded value earnings (247,529) 530,120

Liabilities

These earnings can be analysed as follows:

Insurance contract liabilities 12,123,092 11,289,106

Adjustment to fair value of subsidiary (273,825) (17,972)

Market linked insurance contract liabilities 6,568,158 7,653,977

Roll forward 559,011 501,687

Payable under deposit administration contracts 1,433,027 1,489,410

Investment return on free assets 190,301 59,770

Deferred tax 747,449 844,395

Expected return on life business in force 368,710 441,917

Insurance payable 695,588 724,629

Change over the period (532,715) (1,013,835)

Income tax payable 222,530 -

Value of new business 45,099 (88,203)

Other payables 721,536 379,774

Change in assumptions and methodology (147,165) (466,316)

Total liabilities 22,511,380 22,381,291

Experience variations (157,669) (15,242)

Net assets 2,400,173 2,092,505

Increase in NAV for other subsidiaries & associates (272,980) (444,074)

Total earnings (247,529) (530,120) KEY RATIOS

Value of new business 31 Dec 2017 31 Dec 2016

Value at point of sale (gross of tax) 101,829 (82,541) KShs. ‘000 KShs. ‘000

Tax on value at point of sale (30,549) 24,762 Capital adequacy ratio (capital available/required minimum capital) 133% 133%

Cost of CAR at point of sale (26,181) (30,424) Claims ratio (claims incurred/net written premium) 103% 86%

Value of new business 45,099 (88,203) Expense ratio (total management expenses/gross written premium) 20% 18%

Assumptions Retention ratio (net written premium/gross written premium) 91% 95%

The main assumptions used are as follows: Commission ratio (gross commission/gross written premium) 12% 13%

1. Economic assumptions % p.a % p.a Solvency ratio (actual solvency/required solvency) 178% 148%

Risk discount rate 17.5 17.8

Overall investment return 13.4 13.5

Expense inflation rate 9.5 9.8

2. Other assumptions SANLAM GENERAL INSURANCE LIMITED

The assumptions for future mortality, persistency and premium escalation were based on recent experience adjusted for

STATEMENT OF COMPREHENSIVE INCOME

anticipated future trends.

31 Dec 2017 31 Dec 2016

Notes 31 Dec 2017 31 Dec 2016 KShs. ‘000 KShs. ‘000

KShs. ‘000 KShs. ‘000 Income

a) Changes in assumptions and methodology Gross written premium 2,154,915 1,002,200

Expenses (125,364) (227,970) Gross earned premium 2,042,914 828,207

Mortality 14,312 4,899 Less: Reinsurance premium ceded to reinsurers (554,307) (180,266)

Persistency (76,586) 21,458 Net earned premium 1,488,607 647,941

Commission 95,076 (13,567) Investment income 61,472 901

Bonus rates 287,668 (150,993) Commissions earned 133,096 34,709

Premium collection - - Total income 1,683,175 683,551

Total operational 195,106 (366,173) Outgos

Modelling changes (247,033) (80,045) Claims and policyholder benefits 769,876 134,653

Investment return (112,357) (120,168) Operating and other expenses 616,370 481,613

Risk discount rate 17,119 100,070 Commissions payable 194,561 91,592

Total (147,165) (466,316) Total outgos 1,580,807 707,858

b) Experience variations Profit/(loss) before income tax 102,368 (24,307)

Mortality and morbidity 42,416 (17,242) Income tax (expense)/credit (33,668) (12,485)

Persistency (5,228) 835 Profit/(loss) for the year 68,700 (36,792)

Expenses and commission 51,517 3,942 Other comprehensive income:

Tax Variations (25,232) (61,983) Net gains on available for sale financial assets 140 23,249

Other (75,092) 205,053 Total comprehensive income/(loss) for the year 68,840 (13,543)

Total operational (11,619) 130,605 STATEMENT OF FINANCIAL POSITION

Investment variances (146,050) (145,847) 31 Dec 2017 31 Dec 2016

Total (157,669) (15,242) KShs. ‘000 KShs. ‘000

c) Fair value adjustments Equity

Adjustment to fair value of subsidiary (926,708) (652,883) Share capital 788,600 600,284

d) Increase in NAV for other subsidiaries Share premium 102,760 102,760

NAV Increase for other subsidiaries & associates (272,980) (444,074) Revaluation reserve 77,751 77,611

Accumulated losses (205,593) (274,293)

SANLAM LIFE INSURANCE LIMITED Total equity 763,518 506,362

STATEMENT OF COMPREHENSIVE INCOME Assets

31 Dec 2017 31 Dec 2016 Property and equipment 19,123 23,604

KShs. ‘000 KShs. ‘000 Intangible assets 20,279 11,739

Income Deferred income tax 96,589 117,296

Gross written premium 4,326,932 4,396,339 Investment property 516,700 516,700

Outward reinsurance premium (399,323) (212,075) Held for sale investment property 540,000 540,000

Net written premium 3,927,609 4,184,264 Unquoted equity investments – available for sale 104,102 104,095

Investment income 2,161,523 2,267,133 Quoted equity investments – available for sale 691 558

Fair value gains/(losses) 553,661 (91,843) Receivables arising out of reinsurance arrangements 283,782 72,612

Fee and commissions earned 117,159 40,246 Receivables arising out of direct insurance arrangements 337,753 272,021

Other operating income (1,122,529) (67,497) Reinsurers’ share of insurance contract liabilities 479,653 420,687

Total income 5,637,423 6,332,303 Other receivables 159,622 28,898

Outgos Deferred acquisitions cost 54,235 46,004

Gross benefits and claims paid (4,165,753) (3,685,952) Government securities held to maturity 225,575 224,800

Reinsurers’ share of claims 130,037 90,054 Government securities available for sale 163,335 -

Gross change in contract liabilities 251,833 (789,009) Secured loans to employees 8,022 9,578

Change in contract liabilities ceded to reinsurers 19,276 41,091 Current income tax asset - 9,605

Net claims and policyholders benefits (3,764,607) (4,343,816) Corporate bonds held to maturity 20,000 15,000

Commission payable (540,589) (569,139) Deposits with financial institutions 78,210 154,759

Operatinq and other expenses (855,018) (789,408) Cash and bank balances 61,348 71,276

Total outgo (5,160,214) (5,702,363) Total assets 3,169,019 2,639,232

Profit for the year before tax 477,209 629,940 Liabilities

Income tax expense (169,541) (217,707) Insurance contract liabilities 1,438,092 1,414,942

Profit for the year after tax 307,668 412,233 Unearned premium reserve 655,110 474,114

Other comprehensive income Creditors arising from reinsurance arrangements 63,418 77,844

Total other comprehensive income for the period - - Current income tax payable 3,358 -

Total comprehensive income for the year 307,668 412,233 Other payables 245,130 165,577

Dividends payable 393 393

STATEMENT OF MOVEMENT IN DEPOSIT ADMINISTRATION & INVESTMENT CONTRACT LIABILITIES

FOR THE YEAR ENDED 31ST DECEMBER, 2017 Total liabilities 2,405,501 2,132,870

31 Dec 2017 31 Dec 2016 Net assets 763,518 506,362

Amounts payable under deposit administration contract KShs. 000 KShs. 000 KEY RATIOS

At 1 January 1,489,410 1,434,575 31 Dec 2017 31 Dec 2016

Pension Fund deposits received 411,798 273,305 KShs. ‘000 KShs. ‘000

Surrenders & annuities paid (580,520) (416,858)

Capital adequacy ratio (capital available/required minimum capital) 155% 93%

Interest payable to policyholders 112,339 198,388

As at 31 December 1,433,027 1,489,410 Claims ratio (claims incurred/net written premium) 52% 21%

Expense ratio (total management expenses/gross written premium) 29% 48%

31 Dec 2017 31 Dec 2016

Solvency ratio (actual solvency/required solvency) 108% 93%

Amounts payable under investmetns contract liabilities KShs. 000 KShs. 000

At 1 January 7,653,977 8,269,515 Retention ratio (net written premium/gross written premium) 74% 82%

Deposits received 910,276 1,039,814 Commission ratio (gross commission/gross written premium) 9% 9%

Maturities/payments to policyholders (2,159,987) (2,339,102)

Interest payable to policyholders 163,892 683,750

As at 31 December 6,568,158 7,653,977

Life Insurance | General Insurance | Investments

Sanlam Kenya Results

AUDITED FINANCIAL STATEMENTS FOR THE PERIOD ENDED 31ST DECEMBER 2017

SANLAM INVESTMENTS LIMITED

STATEMENT OF COMPREHENSIVE INCOME

31 Dec 2017 31 Dec 2016

KShs. ‘000 KShs. ‘000

Income

Fund management fees 113,366 155,848

Other income - 299

Total income 113,366 156,147

Expenses

Direct expenses 14,642 15,962

Legal and professional fees 2,471 100

Personnel costs 66,703 51,717

Rent expenses 1,311 1,258

Operational and administration expenses 41,809 39,085

Depreciation expense 1,081 1,980

Total expenses 128,017 110,102

(Loss)/Profit before tax (14,651) 46,045

Income tax expense (2,086) (14,949)

(Loss)/Profit after tax (16,737) 31,096

Other comprehensive income

Total other comprehensive income for the period - -

Total comprehensive (loss)/income for the year (16,737) 31,096

STATEMENT OF FINANCIAL POSITION

31 Dec 2017 31 Dec 2016

KShs. ‘000 KShs. ‘000

Assets

Non-current assets

Equipment 4,140 5,221

Intangible assets 2,577 2,936

Deferred tax 2,049 4,135

Total non-current assets 8,766 12,292

Current assets

Cash and cash equivalents 1,777 50,549

Receivables and prepayments 97,465 81,964

Total current assets 99,242 132,513

Total assets 108,008 144,805

Equity and liabilities

Share capital 20,000 20,000

Retained earnings 15,403 32,140

Total equity 35,403 52,140

Current liabilities

Payables and accrued expenses 67,811 50,494

Proposed dividends - 36,000

Current income tax 4,794 6,171

Total current liabilities 72,605 92,665

Total liabilities 72,605 92,665

Total equity and liabilities 108,008 144,805

OTHER DISCLOSURES

31 Dec 2017 31 Dec 2016

KShs. ‘000 KShs. ‘000

1. Capital strength

a. Paid up capital 20,000 20,000

b. Minimum capital required 10,000 10,000

(a-b) Excess shareholders’ funds 10,000 10,000

2. Shareholders’ funds

a. Total shareholders’ funds 35,403 52,140

b. Minimum shareholders’ funds required 10,000 10,000

(a-b) Excess shareholders’ funds 25,403 42,140

3. Liquidity

a. Working capital (33,791) 75,849

b. Minimum working capital required 5,808 5,000

(a-b) Excess working capital (39,599) 70,849

4. Ratio of unsecured advances to shareholders’ funds

a. Ratio as computed - -

b. Maximum allowable limit 10% 10%

5. Ratio of borrowings to paid up capital

a. Ratio as computed - -

b. Maximum allowable limit 20% 20%

Life Insurance | General Insurance | Investments

Anda mungkin juga menyukai

- Https Iiprd - MetavanteDokumen5 halamanHttps Iiprd - MetavanteShahab HussainBelum ada peringkat

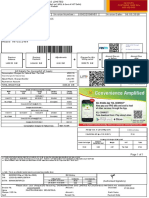

- November Bill Detail Acc 23343348 PDFDokumen35 halamanNovember Bill Detail Acc 23343348 PDFLisan AbebeBelum ada peringkat

- Account Statement: (Company Name) (Street Address, City, ST ZIP Code) (Phone) (Fax) (Email)Dokumen1 halamanAccount Statement: (Company Name) (Street Address, City, ST ZIP Code) (Phone) (Fax) (Email)mr batmanBelum ada peringkat

- E-Bill# 003045008 Dated June 2020 For Account# 00000693168Dokumen2 halamanE-Bill# 003045008 Dated June 2020 For Account# 00000693168Keisha MussingtonBelum ada peringkat

- State Bank of IndiaDokumen1 halamanState Bank of IndiaAnjusha NairBelum ada peringkat

- Carasa 0808Dokumen17 halamanCarasa 0808thefranknessBelum ada peringkat

- Í - (+È NAILSÂDOTÂGLOWÂPH ÂÂÂ Â Ç+&' 5+Î Nails Dot Glow Phils., IncDokumen2 halamanÍ - (+È NAILSÂDOTÂGLOWÂPH ÂÂÂ Â Ç+&' 5+Î Nails Dot Glow Phils., IncRACELLE ACCOUNTINGBelum ada peringkat

- Bill PageDokumen2 halamanBill PageadsfasdfkjBelum ada peringkat

- Sep-11Dokumen2 halamanSep-11Binay PradhanBelum ada peringkat

- Statement May 21 XXXXXXXX1414Dokumen2 halamanStatement May 21 XXXXXXXX1414Adithya MalnadBelum ada peringkat

- Í Qdo - È Hayco Loveâfaithâââââ P Çrâ'54Eî Ms. Love Faith Pasetes HaycoDokumen5 halamanÍ Qdo - È Hayco Loveâfaithâââââ P Çrâ'54Eî Ms. Love Faith Pasetes HaycoLove Faith HopeBelum ada peringkat

- Account Change Notice: Keep This Statement For Your Records. No Additional Action Is RequiredDokumen2 halamanAccount Change Notice: Keep This Statement For Your Records. No Additional Action Is RequiredCristian MoldovanBelum ada peringkat

- 24jan2011Dokumen8 halaman24jan2011Sanusi KasimBelum ada peringkat

- Bank Statement Template 1 - TemplateLabDokumen1 halamanBank Statement Template 1 - TemplateLabJosé PlasenciaBelum ada peringkat

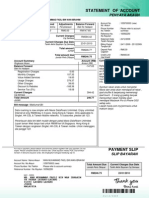

- Statement of Account: Penyata AkaunDokumen5 halamanStatement of Account: Penyata AkaunAzizul HakimBelum ada peringkat

- Indraprastha Gas Limited bill details and customer care numbersDokumen1 halamanIndraprastha Gas Limited bill details and customer care numbersashishBelum ada peringkat

- Eb Bill Apr - May21Dokumen1 halamanEb Bill Apr - May21Ananth DesikanBelum ada peringkat

- 1-3686823325 1-3686823325 20120101Dokumen5 halaman1-3686823325 1-3686823325 20120101Kuria Kang'etheBelum ada peringkat

- Better Internet at A Better Value. Upgrade Today.: Special Off Er For Valued Internet CustomersDokumen5 halamanBetter Internet at A Better Value. Upgrade Today.: Special Off Er For Valued Internet Customersgmoney55Belum ada peringkat

- Seven Generations Energy LTD.: Canada ResearchDokumen27 halamanSeven Generations Energy LTD.: Canada ResearchAnonymous m3c6M1Belum ada peringkat

- 00094853-XXXXXXXXX160XXX3194-110015-20112019 2 PDFDokumen3 halaman00094853-XXXXXXXXX160XXX3194-110015-20112019 2 PDFunsa siddiquiBelum ada peringkat

- Veronica Atieno OpiyoDokumen1 halamanVeronica Atieno OpiyoChuck FenderBelum ada peringkat

- GSTIN DetailsDokumen6 halamanGSTIN DetailsMohammedRafficBelum ada peringkat

- Statement of AccountDokumen18 halamanStatement of AccountKalsom MahatBelum ada peringkat

- Zintis Zuševics: 3dndosrmxpdvdƽɲpɲmv 0dnvɨwɨmvDokumen1 halamanZintis Zuševics: 3dndosrmxpdvdƽɲpɲmv 0dnvɨwɨmvKris TheVillainBelum ada peringkat

- 12345Dokumen9 halaman12345Sudhanshu KotliaBelum ada peringkat

- Coop Bank Kenya Tariff-GuideDokumen1 halamanCoop Bank Kenya Tariff-GuideSamuel Kamau100% (1)

- Statement NewDokumen2 halamanStatement NewabhiramBelum ada peringkat

- LT Bill 48000348869 201602Dokumen2 halamanLT Bill 48000348869 201602प्रतीक प्रकाशBelum ada peringkat

- Mobile Services: Tax InvoiceDokumen4 halamanMobile Services: Tax InvoiceAnonymous zwCV8ZBelum ada peringkat

- Eveready kOLKATA 27112012Dokumen39 halamanEveready kOLKATA 27112012animesh8672777Belum ada peringkat

- Sdcap0011095735Dokumen3 halamanSdcap0011095735fazal ahmedBelum ada peringkat

- Fastag E-Statement: Customer Details Bank DetailsDokumen2 halamanFastag E-Statement: Customer Details Bank DetailsKunjemy EmyBelum ada peringkat

- Electricity BillDokumen2 halamanElectricity BillsirisinghoBelum ada peringkat

- Variable Direct Debit Guide PDFDokumen2 halamanVariable Direct Debit Guide PDFosman taşBelum ada peringkat

- Your Koodo Bill: Account SummaryDokumen6 halamanYour Koodo Bill: Account SummaryMark SloanBelum ada peringkat

- Your Account Summary: F-240 Telephone Number: MultipleDokumen4 halamanYour Account Summary: F-240 Telephone Number: MultipleAaron CruzBelum ada peringkat

- February 01, 2020 Through February 29, 2020Dokumen4 halamanFebruary 01, 2020 Through February 29, 2020Jimario SullivanBelum ada peringkat

- BillDokumen4 halamanBilldeepakbshettyBelum ada peringkat

- KCB Internet Banking Application Form For IndividualsDokumen5 halamanKCB Internet Banking Application Form For IndividualsCharles MugeshBelum ada peringkat

- Standard Checking Summary PDFDokumen2 halamanStandard Checking Summary PDFBobby BakerBelum ada peringkat

- Atria Convergence Technologies PVT - LTD, Due Date: 15/01/2017Dokumen2 halamanAtria Convergence Technologies PVT - LTD, Due Date: 15/01/2017RaHul FindmeBelum ada peringkat

- Statement 01312019Dokumen8 halamanStatement 01312019Marcus GreenBelum ada peringkat

- Pay SlipDokumen1 halamanPay Slipraj Kumar Thapa chhetriBelum ada peringkat

- PDFDokumen4 halamanPDFMark Christian CruzBelum ada peringkat

- SCB Deposit StatementDokumen1 halamanSCB Deposit StatementIrfan AhmedBelum ada peringkat

- Order Execution Only GRSP Statement (CDN$) APR. 30 2020: Local CallsDokumen4 halamanOrder Execution Only GRSP Statement (CDN$) APR. 30 2020: Local CallsAndy HuffBelum ada peringkat

- MEDITECH - MEDITECH Statement 20191128 PDFDokumen49 halamanMEDITECH - MEDITECH Statement 20191128 PDFLion Micheal OtitolaiyeBelum ada peringkat

- Philippines The Manila Electric Company Electricity CompanyDokumen1 halamanPhilippines The Manila Electric Company Electricity CompanyPiyushBelum ada peringkat

- MCG Mall Power Plant Electricity BillDokumen2 halamanMCG Mall Power Plant Electricity Billlino fornollesBelum ada peringkat

- September 2019 EBill-VodafoneDokumen9 halamanSeptember 2019 EBill-VodafoneAshish Jha100% (1)

- PTCL Bill For The Month of May-2021Dokumen1 halamanPTCL Bill For The Month of May-2021Muhammad Riaz, 0092-3138432432Belum ada peringkat

- ElectricityAndMaintenance Bill PDFDokumen1 halamanElectricityAndMaintenance Bill PDFRaja VasdevanBelum ada peringkat

- Lenox Supplies Accounts Statement Jan 2016 To August 2016Dokumen7 halamanLenox Supplies Accounts Statement Jan 2016 To August 2016nobleconsultantsBelum ada peringkat

- Your Basic Banking Plan Account Summary: Here's What Happened in Your Account This Statement PeriodDokumen2 halamanYour Basic Banking Plan Account Summary: Here's What Happened in Your Account This Statement PeriodMichael FissehaBelum ada peringkat

- Pay Your Meralco Bill of ₱2 by Feb 14Dokumen1 halamanPay Your Meralco Bill of ₱2 by Feb 14البرنس اليمنيBelum ada peringkat

- CardStatement 2016-11-19Dokumen6 halamanCardStatement 2016-11-19manjuBelum ada peringkat

- BillingStatement - LOLITA P. AREVALO - 2Dokumen2 halamanBillingStatement - LOLITA P. AREVALO - 2Franco Evale YumulBelum ada peringkat

- Eligible For Protection by PIDM: Entry Date Transaction Description Debit Credit Statement BalanceDokumen4 halamanEligible For Protection by PIDM: Entry Date Transaction Description Debit Credit Statement BalanceSabarita MohamadBelum ada peringkat

- A. Explanatory Notes Pursuant To Financial Reporting Standard 134Dokumen8 halamanA. Explanatory Notes Pursuant To Financial Reporting Standard 134Ilham Afifi Haji AyobBelum ada peringkat

- Diamond Trust Bank Kenya LTD - Audited Group and Bank Results For The Year Ended 31st December 2017Dokumen6 halamanDiamond Trust Bank Kenya LTD - Audited Group and Bank Results For The Year Ended 31st December 2017Anonymous KAIoUxP7100% (1)

- Umeme LTD - Audited Results For The Year Ended 31st December 2017Dokumen3 halamanUmeme LTD - Audited Results For The Year Ended 31st December 2017Anonymous KAIoUxP7Belum ada peringkat

- Carbacid Investments PLC - Interim Financial Statements PDF 2018Dokumen6 halamanCarbacid Investments PLC - Interim Financial Statements PDF 2018Anonymous KAIoUxP7Belum ada peringkat

- NIC Group PLC Audited Financial Results For The Period Ended 31st December 2017Dokumen3 halamanNIC Group PLC Audited Financial Results For The Period Ended 31st December 2017Anonymous KAIoUxP7Belum ada peringkat

- Longhorn Publishers LTD - Unaudited Results For The Half Year Ended 31st Dec 2017Dokumen2 halamanLonghorn Publishers LTD - Unaudited Results For The Half Year Ended 31st Dec 2017Anonymous KAIoUxP7100% (1)

- NSE LTD - Audited Group Results For The Year Ended 31-Dec-2016Dokumen1 halamanNSE LTD - Audited Group Results For The Year Ended 31-Dec-2016Anonymous KAIoUxP7100% (1)

- Kenya Re LTD - Annual Report & Group Financial Statements For The Year Ended 31-Dec-2016Dokumen96 halamanKenya Re LTD - Annual Report & Group Financial Statements For The Year Ended 31-Dec-2016Anonymous KAIoUxP7Belum ada peringkat

- New Gold ETF Final ProspectusDokumen108 halamanNew Gold ETF Final ProspectusAnonymous KAIoUxP7Belum ada peringkat

- Deacons (East Africa) PLC - Information MemorandumDokumen138 halamanDeacons (East Africa) PLC - Information MemorandumAnonymous KAIoUxP7Belum ada peringkat

- IVSC Global Regulatory Convergence and The Valuation Profession May 2014Dokumen6 halamanIVSC Global Regulatory Convergence and The Valuation Profession May 2014Vishwajeet UjhoodhaBelum ada peringkat

- MFRS 108Dokumen22 halamanMFRS 108Yeo Chioujin0% (1)

- FABM 1 Module by L. DimataloDokumen109 halamanFABM 1 Module by L. Dimataloseraphinegod267Belum ada peringkat

- Evolution of Corporate Reporting and Emerging Trends-JCAF-publishedDokumen7 halamanEvolution of Corporate Reporting and Emerging Trends-JCAF-publishedSathishKumar ArumugamBelum ada peringkat

- CA B. Hari Gopal: AS 17 - Segment ReportingDokumen54 halamanCA B. Hari Gopal: AS 17 - Segment Reportingvarunmonga90Belum ada peringkat

- Implementation Guide Sa705 PDFDokumen216 halamanImplementation Guide Sa705 PDFLalit TambiBelum ada peringkat

- Fin Text MapDokumen28 halamanFin Text MapChaucer19Belum ada peringkat

- MBA ProjectDokumen59 halamanMBA ProjectRahul GordeBelum ada peringkat

- Sfac No 4Dokumen36 halamanSfac No 4Riza Febrian100% (1)

- Amana Takaful PLC 2015Dokumen172 halamanAmana Takaful PLC 2015Boobalan SuppiahBelum ada peringkat

- Criminal Liability of Directors Under Company Law in IndiaDokumen11 halamanCriminal Liability of Directors Under Company Law in IndiaRajeBelum ada peringkat

- Ramappa 1Dokumen35 halamanRamappa 1Priyank GuptaBelum ada peringkat

- Platinum 2004 ASX Release FFH Short PositionDokumen36 halamanPlatinum 2004 ASX Release FFH Short PositionGeronimo BobBelum ada peringkat

- Interim Financial Reporting RequirementsDokumen4 halamanInterim Financial Reporting RequirementsJoyce Anne GarduqueBelum ada peringkat

- Insurance Bill 2016 GuyanaDokumen82 halamanInsurance Bill 2016 GuyanaRocky HanomanBelum ada peringkat

- Assessing Accounting Systems of Micro BusinessesDokumen16 halamanAssessing Accounting Systems of Micro BusinessesChryshelle LontokBelum ada peringkat

- Solution Manual For Auditing A Business Risk Approach 8th Edition by Rittenburg Complete Downloadable File atDokumen35 halamanSolution Manual For Auditing A Business Risk Approach 8th Edition by Rittenburg Complete Downloadable File atmichelle100% (1)

- 4.2 Financial Statement Basics Exercises1Dokumen24 halaman4.2 Financial Statement Basics Exercises1Carlos Vincent OliverosBelum ada peringkat

- Commission On Audit: Republic of The Philippines Commonwealth Avenue, Quezon City, PhilippinesDokumen2 halamanCommission On Audit: Republic of The Philippines Commonwealth Avenue, Quezon City, PhilippinesKathrine Cruz100% (1)

- International Financial Reporting StandardsDokumen12 halamanInternational Financial Reporting StandardsViraja GuruBelum ada peringkat

- Technical Interview Questions Prepared by Fahad Irfan - PDF Version 1Dokumen4 halamanTechnical Interview Questions Prepared by Fahad Irfan - PDF Version 1Muhammad Khizzar KhanBelum ada peringkat

- Arens Auditing C13e PPT Ch01Dokumen17 halamanArens Auditing C13e PPT Ch01MeowBelum ada peringkat

- April 26, 2019 ROBS Board PacketDokumen20 halamanApril 26, 2019 ROBS Board PacketBreitbart NewsBelum ada peringkat

- Manchester Financial AnalysisDokumen11 halamanManchester Financial AnalysisMunkbileg MunkhtsengelBelum ada peringkat

- MCA R13 SyllabusDokumen121 halamanMCA R13 SyllabusRanjith KumarBelum ada peringkat

- The Development of Good Governance Model For Performance ImprovementDokumen17 halamanThe Development of Good Governance Model For Performance Improvementarga baswaraBelum ada peringkat

- How To Read Finanacial ReportsDokumen48 halamanHow To Read Finanacial ReportsdeepakBelum ada peringkat

- Impairment, Credit Losses and Onerous CommitmentsDokumen29 halamanImpairment, Credit Losses and Onerous CommitmentsNara L GogoBelum ada peringkat

- Placement DocumentDokumen292 halamanPlacement DocumentZero Squad LimitedBelum ada peringkat

- BP Annual Report and Form 20f Financial Statements 2018Dokumen160 halamanBP Annual Report and Form 20f Financial Statements 2018Jennifer DabalosBelum ada peringkat