EXAMREVISIONQUESTIONSBEO1105SEM32017

Diunggah oleh

Bolang chai0 penilaian0% menganggap dokumen ini bermanfaat (0 suara)

22 tayangan4 halamanJudul Asli

EXAMREVISIONQUESTIONSBEO1105SEM32017 (2).docx

Hak Cipta

© © All Rights Reserved

Format Tersedia

DOCX, PDF, TXT atau baca online dari Scribd

Bagikan dokumen Ini

Apakah menurut Anda dokumen ini bermanfaat?

Apakah konten ini tidak pantas?

Laporkan Dokumen IniHak Cipta:

© All Rights Reserved

Format Tersedia

Unduh sebagai DOCX, PDF, TXT atau baca online dari Scribd

0 penilaian0% menganggap dokumen ini bermanfaat (0 suara)

22 tayangan4 halamanEXAMREVISIONQUESTIONSBEO1105SEM32017

Diunggah oleh

Bolang chaiHak Cipta:

© All Rights Reserved

Format Tersedia

Unduh sebagai DOCX, PDF, TXT atau baca online dari Scribd

Anda di halaman 1dari 4

EXAMINATION REVISION QUESTIONS

TO BE PREPARED FOR THE EXAMINATION STUDENTS MUST BE ABLE TO ANSWER THE FOLLOWING

QUESTIONS.

WEEK 4: PRODUCTION AND COST

Explain the difference between implicit and explicit cost.

How does economic and accounting profit differ?

Explain the difference between the short run and long run.

Define Marginal cost.

Define Marginal Product.

Define increasing and decreasing marginal product of labor.

Define Marginal Returns.

Define diminishing marginal returns

Assume Labor is the only variable input. Explain the relationship between Marginal Product

of Labor, Marginal Returns and Marginal cost.

Explain the relationship between marginal cost and average total and variable cost.

What is the shape of the total fixed cost curve and why?

Why does total variable cost initially increase at a decreasing rate and later at an increasing

rate?

How is average total cost calculated?

When quantity is zero, how are total fixed and total cost related.

Explain the shape of the long run average cost curve

Use the long run average cost curve and explain the difference between economies,

diseconomies and constant returns to scale. Provide examples.

WEEK 5: PERFECT COMPETITION AND MONOPOLY.

Define the characteristics of a Perfect Competitive and Monopoly market structure.

What is the difference between a Price Maker and Price Taker?

Diagrammatically show and explain the demand, total, marginal and average revenue curves

of a price taker.

Diagrammatically show and explain the demand, total, marginal and average revenue curves

of a price maker.

Diagrammatically show and explain a firm’s profit maximising position using both total and

marginal analysis

Diagrammatically show and explain an economic profit, normal profit and economic loss of

both a perfect competitive and monopoly market structure.

If a firm is making an economic loss, what are the 2 options it has to minimise the loss?

Using diagrams, explain why a PC firm can only make normal profit in the long run.

WEEK 6: MONOPOLISTIC COMPETITION AND OLIGOPOLY

Explain the characteristics of a monopolistic competitive market structure.

Compare price and output decisions of a perfect competitive and monopolistic competitive

market structure

Compare price and output decisions of a monopolistic competitive and monopoly market

structure

What are the similarities and differences between a monopolistic competitive market

structure and a perfect competitive market structure?

What are the similarities and differences between a monopolistic competitive market

structure and an Oligopoly market structure?

What are the characteristics of an oligopolistic firm?

Define Mutual Interdependency and its implication.

What is game theory?

Using a numerical game theory matrix with the appropriate assumptions, explain why price

competition is uncommon in an oligopoly. If firms colluded will they be able to maintain

higher profit.

WEEK 7: GDP

Define GDP and explain the difference between a final and intermediate good.

What problem will occur if intermediate and final goods are both counted when measuring

GDP?

Explain the difference between Nominal and Real GDP. What is Real GDP used for?

Explain the 3 approaches used to measure GDP.

What are the shortcomings of GDP as a measure of economic welfare? Discuss 3 other

social indicators that can be used with GDP to measure welfare.

WEEK 8 BUS CYCLE AND ECONOMIC GROWTH

What is a Business Cycle?

Explain the phases of the Business Cycle. In your explanation highlight how the variables of

unemployment, business confidence, interest rate, consumer confidence and retail sales will

change during the different phases

What are durable and non-durable goods? How are they affected by the business cycle?

What is the difference between leading, coincident and lagging indicators? Provide examples

Define economic growth?

What are the determinants of economic growth?

Using a diagram and relevant assumptions explain the production possibility frontier.

What is the GDP gap?

How is change in the size of the economy measured?

How is change in the standard of living measured?

WEEK 9: UNEMPLOYMENT AND INFLATION

Define employed, unemployed and the labour force.

How is the unemployment rate and participation rate calculated?

What are the criticisms associated with the unemployment rate.

Define the participation rate.

How is the participation rate calculated?

Why is the participation rate important?

Explain the three types of unemployment.

What is full employment?

Define Inflation.

What is the relationship between real income, nominal income and inflation?

What is the relationship between real interest rate, nominal interest rate and inflation?

Define and explain the criticisms of the CPI measure

Using a numerical example, explain how a change in the inflation rate is measured.

Unanticipated inflation will result in winners and losers in the labour and financial market.

Who will win/lose if actual inflation is greater than anticipated inflation? WHY?

What is aggregate demand?

What is aggregate supply?

Using the aggregate demand and supply diagrams, explain the difference between demand

pull and supply push inflation

WEEK 10: MONETARY POLICY

What are the three functions of money?

Why do people demand money?

How is money demand related to interest rate?

What is Money Supply?

How is money supply related to interest rate?

Explain money market equilibrium

Explain what is meant by Open Market Operations

Explain the cash rate

Explain the exchange settlement account.

What is the RBA aim in regards to inflation?

Using the correct terminology and diagram(s), explain how the RBA can use MP to prevent a

recession from occurring.

Using the correct terminology and diagram(s), explain how the RBA can use MP to control

inflation.

Explain the time lag problems of MP.

WEEK 11: FISCAL POLICY

What is meant by a balance budget, a budget deficit and a budget surplus?

What is Fiscal Policy?

What are discretionary measures?

Explain how automatic stabilisers can affect the federal budget’s deficit or surplus?

What is meant by the crowding out effect?

Using the correct terminology and diagram(s), explain how the Federal Government can use

FP to prevent a recession from occurring. Will the “crowding out effect” impact on such a

policy.

Using the correct terminology and diagram(s), explain how the Federal Government can use

FP to control inflation.

What are the time lags associated with FP?

Anda mungkin juga menyukai

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryDari EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryPenilaian: 3.5 dari 5 bintang3.5/5 (231)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)Dari EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Penilaian: 4.5 dari 5 bintang4.5/5 (120)

- Grit: The Power of Passion and PerseveranceDari EverandGrit: The Power of Passion and PerseverancePenilaian: 4 dari 5 bintang4/5 (588)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaDari EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaPenilaian: 4.5 dari 5 bintang4.5/5 (266)

- The Little Book of Hygge: Danish Secrets to Happy LivingDari EverandThe Little Book of Hygge: Danish Secrets to Happy LivingPenilaian: 3.5 dari 5 bintang3.5/5 (399)

- Never Split the Difference: Negotiating As If Your Life Depended On ItDari EverandNever Split the Difference: Negotiating As If Your Life Depended On ItPenilaian: 4.5 dari 5 bintang4.5/5 (838)

- Shoe Dog: A Memoir by the Creator of NikeDari EverandShoe Dog: A Memoir by the Creator of NikePenilaian: 4.5 dari 5 bintang4.5/5 (537)

- The Emperor of All Maladies: A Biography of CancerDari EverandThe Emperor of All Maladies: A Biography of CancerPenilaian: 4.5 dari 5 bintang4.5/5 (271)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeDari EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifePenilaian: 4 dari 5 bintang4/5 (5794)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyDari EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyPenilaian: 3.5 dari 5 bintang3.5/5 (2259)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersDari EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersPenilaian: 4.5 dari 5 bintang4.5/5 (344)

- Rise of ISIS: A Threat We Can't IgnoreDari EverandRise of ISIS: A Threat We Can't IgnorePenilaian: 3.5 dari 5 bintang3.5/5 (137)

- Team of Rivals: The Political Genius of Abraham LincolnDari EverandTeam of Rivals: The Political Genius of Abraham LincolnPenilaian: 4.5 dari 5 bintang4.5/5 (234)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreDari EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You ArePenilaian: 4 dari 5 bintang4/5 (1090)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceDari EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RacePenilaian: 4 dari 5 bintang4/5 (895)

- Her Body and Other Parties: StoriesDari EverandHer Body and Other Parties: StoriesPenilaian: 4 dari 5 bintang4/5 (821)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureDari EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FuturePenilaian: 4.5 dari 5 bintang4.5/5 (474)

- The Unwinding: An Inner History of the New AmericaDari EverandThe Unwinding: An Inner History of the New AmericaPenilaian: 4 dari 5 bintang4/5 (45)

- The Yellow House: A Memoir (2019 National Book Award Winner)Dari EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Penilaian: 4 dari 5 bintang4/5 (98)

- Algorithmic Trading Directory 2010Dokumen100 halamanAlgorithmic Trading Directory 201017524100% (4)

- On Fire: The (Burning) Case for a Green New DealDari EverandOn Fire: The (Burning) Case for a Green New DealPenilaian: 4 dari 5 bintang4/5 (73)

- Tutorial Letter 103/0/2023: FAC4862/NFA4862/ZFA4862Dokumen112 halamanTutorial Letter 103/0/2023: FAC4862/NFA4862/ZFA4862THABO CLARENCE MohleleBelum ada peringkat

- Problems of Job Order Costing SystemDokumen16 halamanProblems of Job Order Costing SystemAasim Shakeel100% (1)

- SWOT Analysis TemplatesDokumen10 halamanSWOT Analysis Templatesshubham agarwalBelum ada peringkat

- Case Analysis For Alpen BankDokumen7 halamanCase Analysis For Alpen BankKhalil AhmadBelum ada peringkat

- What Is BusinessDokumen7 halamanWhat Is BusinessGeeta KumariBelum ada peringkat

- Workbook Answers: AQA AS/A-level BusinessDokumen32 halamanWorkbook Answers: AQA AS/A-level BusinessSteven FowlerBelum ada peringkat

- Main Copy IM AssignmentDokumen25 halamanMain Copy IM AssignmentBolang chaiBelum ada peringkat

- IM Final ProjectDokumen25 halamanIM Final ProjectBolang chaiBelum ada peringkat

- Mrphase 1 Combine EditedDokumen10 halamanMrphase 1 Combine EditedBolang chaiBelum ada peringkat

- Senior IM ReportDokumen32 halamanSenior IM ReportBolang chaiBelum ada peringkat

- Globalisation A Converging Commanality CS 3Dokumen2 halamanGlobalisation A Converging Commanality CS 3Bolang chaiBelum ada peringkat

- BHO3439 Marketing Services and Experiences Outline S1 2017Dokumen16 halamanBHO3439 Marketing Services and Experiences Outline S1 2017Bolang chaiBelum ada peringkat

- 1105ASSGNSUMMER2016-2017 With InstructionsDokumen3 halaman1105ASSGNSUMMER2016-2017 With InstructionsBolang chaiBelum ada peringkat

- Final ReportDokumen23 halamanFinal ReportBolang chaiBelum ada peringkat

- IM Group AssignmentDokumen28 halamanIM Group AssignmentBolang chaiBelum ada peringkat

- Tutorial Questions For Studetns 2017Dokumen10 halamanTutorial Questions For Studetns 2017Bolang chaiBelum ada peringkat

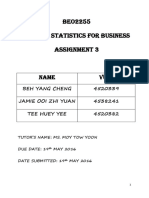

- BEO2255 Applied Statistics For Business Assignment 3: Name Vu IdDokumen42 halamanBEO2255 Applied Statistics For Business Assignment 3: Name Vu IdBolang chaiBelum ada peringkat

- BE 1st AssignmentDokumen6 halamanBE 1st AssignmentBolang chaiBelum ada peringkat

- IM Assignment 2Dokumen4 halamanIM Assignment 2Bolang chaiBelum ada peringkat

- UNITGUIDEBEO2202SEM12017SUNWAYDokumen22 halamanUNITGUIDEBEO2202SEM12017SUNWAYBolang chaiBelum ada peringkat

- SITO ResearchPlan Alvin 4404807Dokumen2 halamanSITO ResearchPlan Alvin 4404807Bolang chaiBelum ada peringkat

- Consumer DisidentificationDokumen1 halamanConsumer DisidentificationBolang chaiBelum ada peringkat

- International Business Challenge BPD2100 Edited FinalDokumen8 halamanInternational Business Challenge BPD2100 Edited FinalBolang chaiBelum ada peringkat

- KL Summer School S3 2017 BHO3373 Supplementary AssessmentDokumen1 halamanKL Summer School S3 2017 BHO3373 Supplementary AssessmentBolang chaiBelum ada peringkat

- Tutorial Questions For Studetns 2017Dokumen10 halamanTutorial Questions For Studetns 2017Bolang chaiBelum ada peringkat

- Asb Assignment 2Dokumen17 halamanAsb Assignment 2Bolang chaiBelum ada peringkat

- Mse Report and Diary FinalizeDokumen8 halamanMse Report and Diary FinalizeBolang chaiBelum ada peringkat

- Part A FinalDokumen13 halamanPart A FinalBolang chaiBelum ada peringkat

- MKT1ADD Slides Week1 Sm1 2019Dokumen299 halamanMKT1ADD Slides Week1 Sm1 2019Đạt ThànhBelum ada peringkat

- 11th Accountancy 80 MarksDokumen5 halaman11th Accountancy 80 Marksyuktaagrawal017Belum ada peringkat

- Inventories TheoryDokumen3 halamanInventories Theoryinfo4chaituBelum ada peringkat

- Fruit Punch VRDokumen11 halamanFruit Punch VRkarampal singhBelum ada peringkat

- Daraz Seller CenterDokumen2 halamanDaraz Seller CenterhanzalaBelum ada peringkat

- Decision Analysis ch3Dokumen2 halamanDecision Analysis ch3Mohan BishtBelum ada peringkat

- Working Capital AssignmentDokumen2 halamanWorking Capital Assignmentsifatic183Belum ada peringkat

- CHAPTER 2 - Partnership OperationsDokumen10 halamanCHAPTER 2 - Partnership OperationsRominna Dela RuedaBelum ada peringkat

- Malomatia Internal AnalysisDokumen10 halamanMalomatia Internal AnalysisHatem OmarBelum ada peringkat

- SCM AMAZON FINAL PresentationDokumen16 halamanSCM AMAZON FINAL Presentationshashank jaiswalBelum ada peringkat

- Pantene Case StudyDokumen21 halamanPantene Case StudyMuhammad AreebBelum ada peringkat

- Cash FlowsDokumen3 halamanCash FlowsYsabel ApostolBelum ada peringkat

- MADM Study Sheet - GDADokumen2 halamanMADM Study Sheet - GDAJoyal ThomasBelum ada peringkat

- Oracle Inventory and Costing Cloud EbookDokumen11 halamanOracle Inventory and Costing Cloud Ebooksingh_indrajeetkumarBelum ada peringkat

- Intermediate Accounting Practice HandoutsDokumen8 halamanIntermediate Accounting Practice HandoutspolxrixBelum ada peringkat

- Introduction To Entrepreneurship Writing A Business PlanDokumen13 halamanIntroduction To Entrepreneurship Writing A Business PlandevBelum ada peringkat

- Problems: Vu Dinh Nghiem Hung School of Economics and ManagementDokumen6 halamanProblems: Vu Dinh Nghiem Hung School of Economics and ManagementVu Dinh Nghiem Hung100% (1)

- Uts Asistensi Pengantar Akuntansi 2Dokumen5 halamanUts Asistensi Pengantar Akuntansi 2Falhan AuliaBelum ada peringkat

- Accounting MS1 2022Dokumen18 halamanAccounting MS1 2022Faaz SheriffdeenBelum ada peringkat

- Review of OreoDokumen4 halamanReview of OreoNaincy Chhabra0% (1)

- Readings On The Anthropology of Financial MarketsDokumen5 halamanReadings On The Anthropology of Financial MarketsJuKaschuBelum ada peringkat

- Benchmarking Internal Audit MaturityDokumen44 halamanBenchmarking Internal Audit MaturityMajdiBelum ada peringkat

- Economics: Elasticity and Its ApplicationDokumen49 halamanEconomics: Elasticity and Its ApplicationAsif Bin LatifBelum ada peringkat