Bab 19 Standard Costing Incorporating Standards PDF

Diunggah oleh

Sandi SetiawanJudul Asli

Hak Cipta

Format Tersedia

Bagikan dokumen Ini

Apakah menurut Anda dokumen ini bermanfaat?

Apakah konten ini tidak pantas?

Laporkan Dokumen IniHak Cipta:

Format Tersedia

Bab 19 Standard Costing Incorporating Standards PDF

Diunggah oleh

Sandi SetiawanHak Cipta:

Format Tersedia

Cost Accounting 13th ed, Carter and Usry. Bab 19 Standar Costing ….……….....

…… Hal 19 - 1

Supported by Nugraha Corporation

CHAPTER 19

STANDARD COSTING: INCORPORATING STANDARDS

INTO THE ACCOUNTING RECORDS

Standard Cost Accounting for Materials

Ilustrasi:

Standard unit purchase price $7,50

Purchased 10.000 pieces at $7,44

Requsitioned 9.500 pieces

Standard quantity allowed for actual production 9.336 pieces

1. Price variace dicatat ketika material diterima

Materials (10.000 x 7,50)a 75.000

Accounts Payable (10.000 x 7,44) b 74.400

Materials Purchases Price Variance (10.000 x [7,50-7,44] ) c 600

a actual unit purchase x standard price

b actual unit purchase x actual price

c actual unit purchase (standard price – actual price) – favorable kredit

Ketika ada permintaan untuk produksi

Work in Process (7,50 x 9.336) a 70.020

Materials Quantity Variance (7.50 x [9.500 – 9.336]) b 1.230

Materials (7,50 x 9.500) c 71.250

a standard price x standard quantity allowed

b standard price x (actual unit - standard quantity allowed) – unfavorable debit

c standard price x actual unit

2. Material dicatat pada harga actual ketika diterima; price variance dicatat ketika diminta

untuk produksi.

Saat dibeli:

Materials (10.000 x 7,44) a 74.400

Accounts Payable 74.400

a Actual unit purchase x actual price

Ketika diminta untuk produksi

Work in Process (7,50 x 9.336) a 70.020

Materials Quantity Variance (7.50 x [9.500 – 9.336]) b 1.230

Materials (7,44 x 9.500) c 70.680

Materials Price Usage Variance (9.500 x [7,50 – 7,44]) d 570

a dan b idem 1

c actual price x actual unit

d actual unit x (standard price – actual price) -- favorable

Supported by Nugraha Corporation

Cost Accounting 13th ed, Carter and Usry. Bab 19 Standar Costing ….……….....…… Hal 19 - 2

3. Price variance dicatat saat diterima, price usage variance dicatat ketika diminta untuk

produksi.

Pada waktu barang diterima idem 1

Pada waktu diminta untuk produksi: idem 1 + jurnal untuk mentransfer purchase price

variance ke price usage variance sebesar $570 (price usage variance)

Material Purchase Price Variance 570

Materials Price Usage Variance 570

Saldo material purchase price variance digunakan untuk menyesuaikan akun inventory ke

actual cost, seperti terlihat pada neraca:

Materials purchased (at standard cost) $75.000

Materials used during period (at standard cost) 71.250

Materials in ending inventory (at standard cost) $ 3.750

Materials purchase price variance (favorable) $(600)

Less materials price usage variance (favorable) (570) (30)

Materials in ending inventory (adjusted to actual cost) $3.720

Standard Cost Accounting for Labor

Ilustrasi:

Actual hours worked 1.632

Actual rate paid per hour $12,50

Standard hours allowed for actual produkction 1.504

Standard rate per hour $12,00

Mencatat actual payroll

Payroll (12,50 x 1.632)* 20.400

Accrued Payroll 20.400

* actual rate x actual hours worked

Distribusi payroll dan mencatat variance

Work in Process (12,00 x 1.504) a 18.048

Labor Rate Variance (1.632 x [12,50 – 12,00]) b 816

Labor Efficiency Variance (12,00 x (1.632 – 1.504]) c 1.536

Payroll (12,50 x 1.632) 20.400

a standard rate x standard hours allowed

b actual hours x unfavorable labor rate

c standard rate x unfavorable hours worked

Supported by Nugraha Corporation

Cost Accounting 13th ed, Carter and Usry. Bab 19 Standar Costing ….……….....…… Hal 19 - 3

Standard Cost Accounting for Factory Overhead

Ilustrasi

Normal capacity in direct labor hours (DLH) 1.600

Total FOH at normal capacity:

Variable $ 4.800

Fixed 19.200 $24.000

FOH rate per DLH

Variable $ 3

Fixed 12 $ 5

Actual FOH $24.442

Actual DLH 1.632

Standard hours allowed for actual production 1.504

Mencatat FOH actual

Factory Overhead Control 24.422

Materials, Payroll, Accum. Depr, Cash, A/P, dll 24.422

Mencatat pembebanan FOH ke produksi

Work in Process (15 x 1.504)* 22.560

Applied Factory Overhead 22.560

* FOH rate x standard hours allowed

Pada akhir periode menutup akun Applied FOH

Applied Factory Overhead 22.560

Factory Overhead Control 22.560

FOH Control bersaldo $1.862 debit (underapplied) unfavorable

Two Variance Method

FOH Volume Variance (12 x [1.600 – 1.504])* 1.152

FOH Controllable Variance 710

FOH Control (24.422 – 22.560) 1.862

* fixed FOH rate x (normal capacity – standard hours allowed)

Three Variance Method

FOH Volume Variance (12 x [1.600 – 1.504]) 1.152

FOH Variable Efficiency Variance (3 x [1.632 – 1.504])* 384

FOH Spending Variance (710 – 384) 326

FOH Control (24.422 – 22.560) 1.862

* variable FOH rate x (actual hours – standard hours allowed)

Four Variance Method

FOH Fixed Efficiency Variance (12 x [1.632 – 1.504]) * 1.536

FOH Variable Efficiency Variance (3 x [1.632 – 1.504]) 384

FOH Spending Variance (710 – 384) 326

FOH Idle Capacity variance (12 x [1.632 – 1.600]) ** 384

FOH Control (24.422 – 22.560) 1.862

* fixed FOH rate x (actual hours – standard hours allowed)

** fixed FOH rate x (actual hours – normal capacity) favorable

Supported by Nugraha Corporation

Cost Accounting 13th ed, Carter and Usry. Bab 19 Standar Costing ….……….....…… Hal 19 - 4

Alternative Three Variance Method

FOH Efficiency Variance (15 x [1.632 – 1.504])* 1.920

FOH Spending Variance (710 – 384) 326

FOH Idle Capacity variance (12 x [1.632 – 1.600]) 384

FOH Control (24.422 – 22.560) 1.862

* FOH rate x (actual hours – standard hours allowed)

Standard Cost Accouting for Completed Products

Ilustrasi:

Unit Paxel yang ditransfer dari Dep. Cutting dan Molding ke Dep.Assembly 4.236 unit

Unit Paxel yang ditransfer ke finished good inv 4.200 unit

Standard cost:

Dep. Cutting $122,90

Dep. Molding 57,25

Dep. Assembly 24,00

Total $204,15

Jurnal untuk mentransfer dari Dep. Cutting dan Molding ke Dep.Assembly

WIP, Assembly Dept. 763.115,40

WIP, Cutting Dept (122,90 x 4.236) 520.604,40

WIP, Molding Dept (57,25 x 4.236) 242.511,00

Jurnal untuk mentransfer ke finished good inv

Finished Goods 857.430

WIP, Assembly Dept (204,15 x 4.200) 857.430

Disposition of Variances

Menjadi Period Expense: jika tidak material ditutup ke COGS (tanggung jawab bag. Produksi)/

income summary (dianggap bukan tanggung jawab bag produksi)

Ilustrasi:

Debit Credit

Materials purchase price variance $1.200

Labor efficiency variance 1.800

FOH controllable variance $600

FOH volume variance 1.300

Jurnal:

Cost of Goods Sold 3.700

FOH controllable variance 600

Materials purchase price variance 1.200

Labor efficiency variance 1.800

FOH volume variance 1.300

Supported by Nugraha Corporation

Cost Accounting 13th ed, Carter and Usry. Bab 19 Standar Costing ….……….....…… Hal 19 - 5

Radford Manufacturing Company

Cost of Goods Sold

For The Year Ending Dec 31, 20A

Materials (at standard) $16.000

Direct labor (at standard) 10.000

Applied factory overhead (at standard) 18.000

Total cost added to WIP $44.000

Add beginning work in process inv 14.000

$58.000

Deduct ending work in process inv 16.000

Cost of goods manufactured $42.000

Add beginning finished goods inv 23.000

Cost of goods available for sale $65.000

Deduct ending finished goods inv 25.000

Cost of goods sold (at standard) $40.000

Adjustment for standard cost variances:

Materials purchase price variance $1.200

Labor efficiency variance 1.800

FOH controllable variance (600)

FOH volume variance 1.300 3.700

Cost of goods sold $43.700

Variance ditutup ke income summary

Income Summary 3.700

FOH controllable variance 600

Materials purchase price variance 1.200

Labor efficiency variance 1.800

FOH volume variance 1.300

Radford Manufacturing Company

Income Statement (partial)

For The Year Ending Dec 31, 20A

Sales $78.000

Cost of goods sold (at standard)—Schedule 1 40.000

Gross profit (at standard) $38.000

Adjustment for standard cost variances:

Materials purchase price variance $1.200

Labor efficiency variance 1.800

FOH controllable variance (600)

FOH volume variance 1.300 3.700

Gross profit (adjusted) $34.300

Supported by Nugraha Corporation

Cost Accounting 13th ed, Carter and Usry. Bab 19 Standar Costing ….……….....…… Hal 19 - 6

Alternatif: Materials purchase price variance ada yang dialokasikan ke ending material

inventory.

Saldo material akhir $4.000 (20% dari total pembelian)

Variance ditransfer ke material (20% x $1.200) 240 (20% dari total mateial

purchase price variance)

Jurnal:

Income Summary 3.460

Materials 240

FOH controllable variance 600

Materials purchase price variance 1.200

Labor efficiency variance 1.800

FOH volume variance 1.300

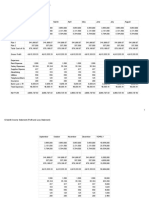

Variances dialokasikan ke COGS dan Ending Inventories

Ilustrasi:

Materials Labor FOH

Account Amount % Amount % Amount %

WIP $6.000 37,5 $2.000 20 $7.200 40

Finished Goods 2.000 12,5 2.000 20 1.800 10

COGS 8.000 50,0 6.000 60 9.000 50

Total $16.000 100,0 $10.000 100 $18.000 100

Alokasi

Account Jumlah WIP FG COGS

Material Purchase Price Variance* $ 960 $ 360 $120 $ 480

Labor Efficiency Variance 1.800 360 360 1.080

FOH Controllable Variance (600) (240) (60) (300)

FOH Volume Variance 1.300 520 130 650

Total $3.460 $1.000 $550 $1.910

*Alokasi materials purchase price variance:

WIP 37,5% X $960 = $ 360

Finished Goods 12,5% X $960 = 120

COGS 50,0% X $960 = 480

Jurnal

COGS 1.910

Materials 240

WIP 1.000

Finished Goods 550

FOH controllable variance 600

Materials purchase price variance 1.200

Labor efficiency variance 1.800

FOH volume variance 1.300

Supported by Nugraha Corporation

Cost Accounting 13th ed, Carter and Usry. Bab 19 Standar Costing ….……….....…… Hal 19 - 7

P19-2 Journal Entries; Variances analysis; Three Overhead Variances

Maxx Co. memproduksi Maxitech, dengan standard cost:

Materials 5 unit @ $6 $30

Labor ¾ jam @ 12 9

FOH (berdasarkan kapasitas normal 5.000 jam mesin) 2 jam @ 14 28

Total $67

Informasi untuk bulan Juli:

a. WIP awal 300 unit (material 100%, labor 2/3 dan mesin ½) dan WIP akhir 200 unit

(material 100%, labor ½, dan mesin ¼. Unit yang selesai 2.400.

b. Membeli 11.000 unit material secara kredit dengan harga $67.000. Materials price

variance dicatat ketika dibeli.

c. 12.000 unit material digunakan untuk produksi.

d. Direct labor cost total $20.570 untuk jam kerja actual 1.700 jam. Asumsikan

kewajiban sudah dicatat.

e. Jam mesin actual 4.900 jam.

f. FOH actual $69.000. FOH ditutup tiap akhir bulan.

g. 20% FOH yang dianggarkan merupakan variable cost dan sisanya fixed cost.

Diminta: buat jurnal untuk tiap informasi yang tersedia termasuk dua variances untuk

materials dan labor serta tiga variances untuk FOH.

P19-7 Journal Entries; Variances analysis; Three Overhead Variances; Income Statement

Grindle Co. menggunakan standard cost berikut:

Materials 3 liters @ $4 $12,0

Direct labor ½ jam @ 7 3,5

Variable FOH ½ jam @ 6 3,5

Fixed FOH ½ jam @ 9 4,5

Total $23,0

Informasi untuk bulan Juli:

Fixed FOH dianggarkan $49.500 per bulan. Kegiatan actual bulan November adalah sebagai

berikut:

a. Membeli 40.000 liter material secara kredit dengan harga $159.200. Price variance

yang terkait dicatat pada waktu pembelian.

b. 10.000 unit diproduksi.

c. Tidak ada WIP awal maupun akhir.

d. 31.000 liter material digunakan untuk produksi.

e. Direct labor payroll $35.616 untuk 4.800 jam.

f. FOH actual $81.500.

g. 8.000 unit dijual secara kredit dengan harga $40 per unit.

h. Marketing dan administrative expenses $50.000.

Diminta:

1. Buat jurnal untuk mencatat transaksi-transaksi di atas (abaikan FOH variances)

2. Buat analisis 3 variances FOH

3. Buat income statement (semua varian ditutup ke COGS)

Supported by Nugraha Corporation

Cost Accounting 13th ed, Carter and Usry. Bab 19 Standar Costing ….……….....…… Hal 19 - 8

P19-8 Allocating Variances

Curtis Co memulai usaha tanggal 1 Desember dan memproduksi Hamex dengan standar cost:

Materials 10 kg @ $0,70 $7

Direct labor 1 jam @ 8 8

FOH 1 jam @ 2 2

Total $17

Data untuk bulan Desember:

Units Debit Credit

Budgeted production 3.000

Units sold 1.500

Sales $45.000

Sales discounts $500

Materials price usage variance 1.500

Materials quantity variance 660

Direct labor rate variance 250

FOH spending variance 300

Discounts lost 120

Pembelian material dicatat net of discount. Data inventori tanggal 31 Desember:

Units

Finished Goods 900

WIP (material 100%, conversion cost 50%) 1.200

Materials None

Variance dialokasikan ke COGS dan ending inventories.

Diminta:

1. Alokasikan variance dan discounts lost

2. Hitung COGM dengan standard cost dan actual cost.

3. Hitung actual cost material, labor, dan FOH yang ada pada WIP akhir dan finished good.

Supported by Nugraha Corporation

Anda mungkin juga menyukai

- Ch09 Inventory Costing and Capacity AnalysisDokumen13 halamanCh09 Inventory Costing and Capacity AnalysisChaituBelum ada peringkat

- Finance Notes SifdDokumen104 halamanFinance Notes SifdSuresh KumarBelum ada peringkat

- Programmazione e Controllo Esercizi Capitolo 9Dokumen32 halamanProgrammazione e Controllo Esercizi Capitolo 9Azhar SeptariBelum ada peringkat

- Joint and By-Products Costing MethodsDokumen11 halamanJoint and By-Products Costing MethodsDudes IconBelum ada peringkat

- Reigis Steel CompanyDokumen3 halamanReigis Steel CompanyDesy BodooBelum ada peringkat

- M1 - Introduction To Valuation HandoutDokumen6 halamanM1 - Introduction To Valuation HandoutPrince LeeBelum ada peringkat

- Finals Conceptual Framework and Accounting Standards AnswerkeyDokumen7 halamanFinals Conceptual Framework and Accounting Standards AnswerkeyMay Anne MenesesBelum ada peringkat

- Chap 017 AccDokumen47 halamanChap 017 Acckaren_park1Belum ada peringkat

- Chapter 1 - Introduction ToDokumen30 halamanChapter 1 - Introduction ToCostAcct1Belum ada peringkat

- Ob7e Ge Imchap015Dokumen25 halamanOb7e Ge Imchap015Hemant Huzooree100% (1)

- CH 4 Job Order CostingDokumen20 halamanCH 4 Job Order CostingNivin mBelum ada peringkat

- Intermediate Accounting HWDokumen6 halamanIntermediate Accounting HWbossman890% (1)

- CA5 Accounting For Factory OverheadDokumen15 halamanCA5 Accounting For Factory OverheadhellokittysaranghaeBelum ada peringkat

- Understand Cost Concepts, Behavior and FlowDokumen36 halamanUnderstand Cost Concepts, Behavior and FlowYunita LalaBelum ada peringkat

- Balanced Scorecard and Responsibility AccountingDokumen7 halamanBalanced Scorecard and Responsibility AccountingMonica GarciaBelum ada peringkat

- Acct 203 - CH 6 DqsDokumen2 halamanAcct 203 - CH 6 Dqsapi-340301334100% (1)

- Chapter 10 Plant Assets, Natural Resources, and Intangible Assets (13 E)Dokumen18 halamanChapter 10 Plant Assets, Natural Resources, and Intangible Assets (13 E)Raa100% (1)

- Product Costing: Job and Process Operations: Learning Objectives - Coverage by QuestionDokumen45 halamanProduct Costing: Job and Process Operations: Learning Objectives - Coverage by QuestionJoeBelum ada peringkat

- CH 12 Intangible AssetsDokumen57 halamanCH 12 Intangible AssetsSamiHadadBelum ada peringkat

- Peter Senen overhead calculations and journal entriesDokumen5 halamanPeter Senen overhead calculations and journal entriesAccounting Files0% (1)

- Review Problems Managerial AccountingDokumen3 halamanReview Problems Managerial Accountingukandi rukmanaBelum ada peringkat

- Redesigning Cost Systems: Is Standard Costing Obsolete?Dokumen10 halamanRedesigning Cost Systems: Is Standard Costing Obsolete?SillyBee1205Belum ada peringkat

- Price Level Accounting by Rekha - 5212Dokumen30 halamanPrice Level Accounting by Rekha - 5212Khesari Lal YadavBelum ada peringkat

- 2 - Basic Management Accounting ConceptsDokumen27 halaman2 - Basic Management Accounting ConceptsTheresia MariaBelum ada peringkat

- CH 11Dokumen48 halamanCH 11Pham Khanh Duy (K16HL)Belum ada peringkat

- Chap 3 SolutionDokumen33 halamanChap 3 SolutionAleena AmirBelum ada peringkat

- Government Accounting Manual Updates PPSAS StandardsDokumen22 halamanGovernment Accounting Manual Updates PPSAS StandardsAira TantoyBelum ada peringkat

- Standard CostingDokumen18 halamanStandard Costingpakistan 123Belum ada peringkat

- Operations Management: For Competitive AdvantageDokumen47 halamanOperations Management: For Competitive AdvantagedurgaselvamBelum ada peringkat

- Basic Notes For Borrowing CostDokumen5 halamanBasic Notes For Borrowing CostIqra HasanBelum ada peringkat

- Study Guide SampleDokumen154 halamanStudy Guide SampleBryan Seow0% (1)

- Quiz Finman Invty MNGTDokumen4 halamanQuiz Finman Invty MNGTZoey Alvin EstarejaBelum ada peringkat

- Chapter08 BudgetingDokumen19 halamanChapter08 Budgetinglyn0490Belum ada peringkat

- Makerere University College of Business and Management Studies Master of Business AdministrationDokumen15 halamanMakerere University College of Business and Management Studies Master of Business AdministrationDamulira DavidBelum ada peringkat

- Cost Management: Don R. Hansen Maryanne M. MowenDokumen80 halamanCost Management: Don R. Hansen Maryanne M. MowenNurul Meutia SalsabilaBelum ada peringkat

- Inventory MGMT ComprehensiveDokumen4 halamanInventory MGMT ComprehensivebigbaekBelum ada peringkat

- CVP Question 6Dokumen1 halamanCVP Question 6Humphrey OsaigbeBelum ada peringkat

- Cost Accounting: Cost Systems and Cost AccumulationDokumen20 halamanCost Accounting: Cost Systems and Cost AccumulationErika Nafatul Ula100% (1)

- Ias 2Dokumen23 halamanIas 2Syed Salman Sajid100% (4)

- MULTIPLE CHOICE. Choose The One Alternative That Best Completes The Statement or Answers The QuestionDokumen19 halamanMULTIPLE CHOICE. Choose The One Alternative That Best Completes The Statement or Answers The QuestionKang ChulBelum ada peringkat

- Chapter 11 QuestionsDokumen5 halamanChapter 11 QuestionsZic ZacBelum ada peringkat

- Chap 010Dokumen107 halamanChap 010sucusucu3Belum ada peringkat

- Intellectual Property The Law of Trademarks Copyrights Patents and Trade Secrets 5th Edition Bouchoux Test BankDokumen7 halamanIntellectual Property The Law of Trademarks Copyrights Patents and Trade Secrets 5th Edition Bouchoux Test Banka506127125Belum ada peringkat

- MULTIPLE CHOICE. Choose The One Alternative That Best Completes The Statement or Answers The QuestionDokumen9 halamanMULTIPLE CHOICE. Choose The One Alternative That Best Completes The Statement or Answers The QuestionCHAU Nguyen Ngoc BaoBelum ada peringkat

- Chap 019Dokumen62 halamanChap 019Husein GraphicBelum ada peringkat

- C. Update Valid Vendor File: Multiple-Choice Questions 1Dokumen8 halamanC. Update Valid Vendor File: Multiple-Choice Questions 1DymeBelum ada peringkat

- FAT MCQsDokumen3 halamanFAT MCQsnajane100% (1)

- Distributions To Shareholders: Dividends and Share RepurchasesDokumen33 halamanDistributions To Shareholders: Dividends and Share RepurchasesPrincess EngresoBelum ada peringkat

- 13 x11 Financial Management ADokumen7 halaman13 x11 Financial Management AamirBelum ada peringkat

- Accounting Information Systems: Fourteenth EditionDokumen15 halamanAccounting Information Systems: Fourteenth EditionAUDEH AHMADBelum ada peringkat

- Graph Theory PresentationDokumen32 halamanGraph Theory PresentationVinod LahireBelum ada peringkat

- Chapter 9 - Inventory Costing and Capacity AnalysisDokumen40 halamanChapter 9 - Inventory Costing and Capacity AnalysisBrian SantsBelum ada peringkat

- Standard Costing and Variance Analysis FormulasDokumen5 halamanStandard Costing and Variance Analysis FormulasKaran OberoiBelum ada peringkat

- Backflush Costing & Lean Accounting-EditDokumen3 halamanBackflush Costing & Lean Accounting-EditsafiraBelum ada peringkat

- ACTIVITY-BASED COSTING SOLUTIONS MANUALDokumen14 halamanACTIVITY-BASED COSTING SOLUTIONS MANUALlooter198100% (1)

- 8MAS 08 ABC Balanced Scorecard ModuleDokumen4 halaman8MAS 08 ABC Balanced Scorecard ModuleKathreen Aya ExcondeBelum ada peringkat

- Tugas 5 Akuntansi Manajemen - Standar Costing - 109 - Muhammad Zikri Fajar - 4DDokumen23 halamanTugas 5 Akuntansi Manajemen - Standar Costing - 109 - Muhammad Zikri Fajar - 4DMuhammad zikri FajarBelum ada peringkat

- Activity 3.2Dokumen4 halamanActivity 3.2Diana Mae DabuBelum ada peringkat

- Standard CostingDokumen137 halamanStandard CostingMuhammad azeem100% (1)

- Standard Costing or Variance AnalysisDokumen11 halamanStandard Costing or Variance Analysisgull skBelum ada peringkat

- Bab 20 Direct Costing PDFDokumen7 halamanBab 20 Direct Costing PDFSandi Setiawan100% (1)

- Bab 18 Standard Costing PDFDokumen8 halamanBab 18 Standard Costing PDFSandi SetiawanBelum ada peringkat

- Bab 8 Costing by Product and Joint ProductDokumen4 halamanBab 8 Costing by Product and Joint Productammara_786Belum ada peringkat

- Bab 5 Job Order Costing PDFDokumen4 halamanBab 5 Job Order Costing PDFSandi SetiawanBelum ada peringkat

- Bab 4 Cost System and Cost Accumulation PDFDokumen6 halamanBab 4 Cost System and Cost Accumulation PDFSandi SetiawanBelum ada peringkat

- Accounting Concepts ApplicationDokumen2 halamanAccounting Concepts Applicationmarygrace carbonelBelum ada peringkat

- Accountancy Sample Paper Class 11 PDFDokumen6 halamanAccountancy Sample Paper Class 11 PDFAnkit JhaBelum ada peringkat

- Capstone ProjectDokumen10 halamanCapstone ProjectinxxxsBelum ada peringkat

- CURRICULUM VITAE-FP SPV Tax Widasa Group Update 2Dokumen11 halamanCURRICULUM VITAE-FP SPV Tax Widasa Group Update 2febrikafitriantiBelum ada peringkat

- GST: Boon or Bane for BusinessesDokumen63 halamanGST: Boon or Bane for BusinessesNITIKABelum ada peringkat

- Dispensers of CaliforniaDokumen4 halamanDispensers of CaliforniaShweta GautamBelum ada peringkat

- Kar Asia Vs KoronaDokumen2 halamanKar Asia Vs KoronaChristelle Ayn BaldosBelum ada peringkat

- CapgeminiOfferLetter 29122011 PDFDokumen23 halamanCapgeminiOfferLetter 29122011 PDFsreeharivaleti100% (1)

- 12-Month Income Statement Profit-And-Loss Statement - Sheet1Dokumen2 halaman12-Month Income Statement Profit-And-Loss Statement - Sheet1api-462952636100% (1)

- Agrarian Crisis and Farmer SuicidesDokumen38 halamanAgrarian Crisis and Farmer SuicidesbtnaveenkumarBelum ada peringkat

- Incorporating The Venture Backed LLCDokumen30 halamanIncorporating The Venture Backed LLCRoger RoyseBelum ada peringkat

- EM Equal Weighted FactsheetDokumen2 halamanEM Equal Weighted FactsheetRoberto PerezBelum ada peringkat

- VAT and SD Rules 2016 EnglishDokumen59 halamanVAT and SD Rules 2016 EnglishSadia Yasmin100% (3)

- Case 2 (1-4)Dokumen6 halamanCase 2 (1-4)zikril94Belum ada peringkat

- Chapter 17 Flashcards - QuizletDokumen34 halamanChapter 17 Flashcards - QuizletAlucard77777Belum ada peringkat

- NJ India Invest ProjectDokumen52 halamanNJ India Invest ProjectPrakash Rathor100% (1)

- Toby Crabel - Opening Range Breakout (Part1-8)Dokumen39 halamanToby Crabel - Opening Range Breakout (Part1-8)saisonia75% (8)

- Choose Business Structure GuideDokumen32 halamanChoose Business Structure Guideczds6594Belum ada peringkat

- Chapter 2 and 3 Lopez BookDokumen4 halamanChapter 2 and 3 Lopez BookSam CorsigaBelum ada peringkat

- Pete Reilly's ResumeDokumen2 halamanPete Reilly's ResumepetereillyBelum ada peringkat

- Optimize General Ledger TitleDokumen1 halamanOptimize General Ledger TitleMinn TunBelum ada peringkat

- Blueprint DocumentDokumen17 halamanBlueprint DocumentZirukKhan0% (1)

- Unit 3 - Discussion Assignment (Final)Dokumen2 halamanUnit 3 - Discussion Assignment (Final)LeslieBelum ada peringkat

- Taxation I-P1 - (NOV-08), ICABDokumen2 halamanTaxation I-P1 - (NOV-08), ICABgundapolaBelum ada peringkat

- The Nature and Scope of Cost & Management AccountingDokumen17 halamanThe Nature and Scope of Cost & Management Accountingfreshkidjay100% (5)

- Please Sign PPP Origination Application - PDF BDokumen12 halamanPlease Sign PPP Origination Application - PDF BpayneBelum ada peringkat

- BE14e Exercise 12.8 - Solution Under Both MethodsDokumen6 halamanBE14e Exercise 12.8 - Solution Under Both MethodsJayMandliyaBelum ada peringkat

- Dallas Police and Fire Pension BriefingDokumen85 halamanDallas Police and Fire Pension BriefingTristan HallmanBelum ada peringkat

- Interview Question Senior AuditorDokumen4 halamanInterview Question Senior AuditorSalman LeghariBelum ada peringkat

- Indian Taxation LawDokumen22 halamanIndian Taxation LawEngineerBelum ada peringkat