Money Times Magazine

Diunggah oleh

Harman MultaniDeskripsi Asli:

Hak Cipta

Format Tersedia

Bagikan dokumen Ini

Apakah menurut Anda dokumen ini bermanfaat?

Apakah konten ini tidak pantas?

Laporkan Dokumen IniHak Cipta:

Format Tersedia

Money Times Magazine

Diunggah oleh

Harman MultaniHak Cipta:

Format Tersedia

Caution: Please note that your copy/access to our website is for your exclusive use only.

Any attempt to share your access to our website or forwarding your copy to a

non-subscriber will disqualify your membership and we will be compelled to stop your supply and forfeit your subscription thereafter without any refund to you.

T I M E S

A TIME COMMUNICATIONS PUBLICATION

VOL XXVI No.31 Monday, 5 - 11 June 2017 Pgs.21 Rs.18

Nifty to test 9750 Now follow us on Instagram, Facebook &

By Sanjay R. Bhatia Twitter at moneytimes_1991 on a daily basis

to get a view of the stock market and the

The markets touched new historic highs amidst steady buying

happenings which many may not be aware of.

support last week on the back of the arrival of the monsoon in

parts of India. Occasional days of consolidation and index management were also witnessed as the markets struggled at

the higher levels due to lack of follow-up buying support.

The FIIs remained net sellers in the cash segment but were seen hedging their positions as net buyers in the derivatives

segment. The DIIs, however, were net sellers during the week. The breadth of the market remained positive amidst high

volumes, which is a positive sign for the markets. Crude prices traded lower between $48-52 on the back of stocking a

persistent glut in global supply. On the domestic front, the GDP data disappointed the Street while the earnings season

remained a mixed bag.

Technically, the prevailing positive technical

conditions helped the markets move higher. The Believe it or not!

MACD, KST and RSI are all placed above their

Munjal Auto Industries recommended at

respective averages on the daily and weekly charts.

Further, the Stochastic is placed above its average Rs.109.05 in TT last week, zoomed to Rs.116.80

on the weekly chart. Moreover, the Nifty is placed fetching 7% returns in just one week!

above its 50-day SMA, 100-day SMA and 200-day India Glycols recommended at Rs.181.6 in TT on

SMA. The Nifty’s 50-day SMA is placed above its 22 May 2017, zoomed to Rs.203.90 last week

100-day and 200-day SMA and its 100-day SMA is fetching 12% returns in just two weeks!

placed above its 200-day SMA indicating a ‘golden Premier Explosives recommended at Rs.400.35

cross’ breakout. These positive technical conditions

as EE on 1 May 2017, hit a high of Rs.510 last week

could lead to regular follow-up buying support.

fetching 27% returns in just one month!

The prevailing negative technical conditions,

Nath Bio-Genes (India) recommended at

however, still hold good. The Stochastic is placed

below its average on the daily chart. Further, the Rs.147.75 in TT on 3 April 2017, hit a high of

Stochastic and RSI are both placed in the Rs.298 last week fetching 102% returns in just two

overbought zone on the daily and weekly charts. months!

These negative technical conditions could lead to Escorts recommended at Rs.527.45 as BB on 27

intermediate bouts of profit-booking and selling March 2017, hit a high of Rs.718.90 last week

pressure especially at the higher levels. fetching 36% returns in about two months!

The ADX line is placed above the -DI line and is also

placed above the 28 level. The +DI line is placed (BB – Best Bet; EE – Expert Eye; TT – Tower Talk)

above the ADX line and the –DI line and is placed

above 31, which indicates that the buyers are This happens only in Money Times!

gaining strength and have an upper hand. Now in its 26th Year

A Time Communications Publication 1

EMISPDF us-eyintranet from 125.16.128.202 on 2017-06-09 13:37:44 BST. DownloadPDF.

Downloaded by us-eyintranet from 125.16.128.202 at 2017-06-09 13:37:44 BST. EMIS. Unauthorized Distribution Prohibited.

The benchmark indices touched new historic

highs last week. Rotational sector specific

correction is being witnessed while managing the

benchmark indices, which continue to touch new

highs without any major correction. The market

sentiment remains positive. The Nifty has

managed to sustain above the 9600 level and it is

important for it to sustain above this level for

increased buying support to be witnessed and

test the 9750 level. Follow-up buying support is

crucial at higher levels. The markets may

continue to witness index management amidst

rotational sectoral correction. 9500 and 9350

remain crucial support levels.

In the meanwhile, the markets could take cues

from the progress of the monsoon, Dollar-Rupee exchange rate, global markets and crude oil prices.

Technically on the upside, the Sensex faces resistance at the 31333, 31725 and 32000 levels and seeks support at the

31060, 30247 and 29800 levels. The resistance levels for the Nifty are placed at 9750, 9825 and 9900 while its support

levels are placed at 9500, 9350, 9275 and 9220.

BAZAR.COM

Pre-monsoon cloud burst

Last week ended on an optimistic note with the Sensex scaling 31332 and the Nifty at 9673. This makes a neat 17% rise

so far in Calendar 2017. All this coming in the midst of mid-week GDP blues came as a great relief to investors. The

shrunk GDP may not be purely due to demonetisation or decrease of cash under circulation. There was an upward

revision in commodity prices globally, which also contributed to the contraction in GDP.

With every negative news being absorbed, the pre-monsoon sentiment is at its best. Experience has taught us to ‘buy on

rumors and sell on news’ thereby giving a clue that the benchmarks could react when it rains cats and dogs! Both

Domestic and foreign inflows continue, which factor alone compels global brokerages to remain bullish on India and

upgrade their estimates and targets for the benchmarks and stocks.

But most fund managers and market pundits are a little cautious in the short-run. They find the market expensive today

due to the rising P/E multiples alone and not just earnings alone. Also, the monsoon factor and the unfolding of GST and

for it to overcome the teething troubles in execution is keeping the reins of the bulls under control. Although the market

looks expensive, the breadth of re-rating is extraordinary. The re-rating is slow and steady at the segment level but is

speedy at the company level individually.

Infrastructure, Power, Healthcare, Banking, NBFC and Metals may be the sectors looking up. But among them, there are

some companies that have gathered speed from the word ‘Go’. Thus for now, the game is to zero in on some specific

stocks that remain inelastic to momentary pressures.

If a cross section view of different foreign brokerages like CLSA, J.P. Morgan and Macquarie is taken, some classic names

emerge as potential mid-term winners. According to them, Maruti Suzuki India, Astral Poly Technik, Max Financial

Services, Prestige Estates Projects, Apollo Hospitals Enterprise, Fortis Healthcare, Hindalco Industries, Mahindra &

Mahindra, Aurobindo Pharma and Britannia Industries form the most sound investment proposals in the mid-range.

It is clearly evident that the proactive stance of SEBI and the exchange authorities has been successful in keeping penny

stocks from flying high. Little wonder on Friday itself, nearly 100 stocks hit fresh 52-week highs while as much as 35

stocks hit a fresh all-time highs. The difference between the previous boom and today is the quality of scrips scaling new

tops. Given here are a handful of participants of this select band which establishes the credentials of the rally. Hero

MotoCorp, Balkrishna Industries, IndusInd Bank, Birla Corporation, Escorts, Finolex Industries, Muthoot Finance, Rupa

Company, Visaka Industries, Crompton Greaves Consumer Electricals, DCB Bank and Lactose (India) are the few names

that give an insight into the strength of a rising market.

The corrections, if any, which occur due to hesitancy of the market pundits can be treated as a ‘buy on dips’ strategy. The

pressure on floating stock of a company has started to show in the scrips scaling new highs.

A Time Communications Publication 2

EMISPDF us-eyintranet from 125.16.128.202 on 2017-06-09 13:37:44 BST. DownloadPDF.

Downloaded by us-eyintranet from 125.16.128.202 at 2017-06-09 13:37:44 BST. EMIS. Unauthorized Distribution Prohibited.

The shift of the money (investible funds) from real estate and debts to equity (secondary market and MF route) is

happening. So this time, it is the sentiment working followed by the fundamentals and the rising demand due to liquidity

pouring is that makes all the difference.

TRADING ON TECHNICALS

Overall rise will continue

By Hitendra Vasudeo

Sensex Daily Trend DRV Weekly Trend WRV Monthly Trend MRV

Last Close 31273 Up 30351 Up 29657 Up 27633

Last week, the Sensex opened at 30944.38, attained a low at 30869.99 and moved to a high of 31332.56 before it closed

the week at 31273.28 and thereby showed a net rise of 245 points on a week-to-week basis.

Weekly

A positive candle was witnessed last week at closing with a higher high and higher low on the weekly chart.

The weekly uptrend on week-to-week closing basis is likely to continue with momentum in the near-to-short-term.

Expect a rally towards 34000-36000 in due course of time with volatility. The Yearly Levels based on the yearly chart,

which were mentioned at the beginning of Calendar year 2017, were at 29637 and 36220. The year 2016 closed at

26626.45 and the first level of 29637 was expected and indicated in our weekly reviews and updates on the market.

The Sensex appears be habituated to stay above 29637 after a few weeks of sideways movements and oscillation around

29637 over the last couple of months.

Expect the Sensex to test 36220 in due course of time.

Weekly support levels are placed at 31158-30984-30100.

Higher range for the week could be 31447-31909.

Trend based on Rate of Change (RoC)

Daily chart:

1-Day trend - Up

3-Day trend - Up

8-Day trend - Up

Weekly chart:

1-Week trend - Up

3-Week trend - Up

8-Week trend - Up

Monthly chart:

1-Month trend - Up

3-Month trend - Up

8-Month trend - Up

Quarterly chart:

1-Quarter trend - Up

3-Quarter trend - Up

8-Quarter trend - Up

Yearly chart:

1-Year trend - Up

3-Year trend - Up

8-Year trend - Up

BSE Mid-Cap Index

Weekly chart:

A Time Communications Publication 3

EMISPDF us-eyintranet from 125.16.128.202 on 2017-06-09 13:37:44 BST. DownloadPDF.

Downloaded by us-eyintranet from 125.16.128.202 at 2017-06-09 13:37:44 BST. EMIS. Unauthorized Distribution Prohibited.

1-Week trend - Up

3-Week trend - Down

8-Week trend - Up

A recovery from the low of 13995 to 14159 two weeks back Relative Strength (RS)

indicates that a further correction was likely below 13995. Signals a stock’s ability to perform in a

The same was indicated in last week‘s update. Last week, we dynamic market.

saw a follow-up rise with a bullish candle to the recovery Knowledge of it can lead you to profits.

from the low of 13995 two weeks back.

Expect the recent peak of 15122 to be tested in the near POWER OF RS - at Rs.3100 for 1 year:

term. After a deep correction in the BSE Mid-Cap index, in

relation to the Sensex two weeks back, it has now got back What you get

into upside movement. Most Important- Association for 1 year

A further breakout and close above 15122 is essential and it 1-2 buy / sell per day on a daily basis

may participate along with the Sensex to outperform. In the

1 buy per week

event of a breakout and close above 15122, expect a rally in

the BSE Mid-Cap index to 15813 and 16900. 1 buy per month

Expect support and buying in mid-caps as a result of the

1 buy per quarter

movement witnessed in the last two weeks. A further 1 buy per year

weakness will be seen below 13900. For more details, contact Money Times on

BSE Small-Cap Index 022-22616970/4805 or

1-Week trend - Up moneytimes.support@gmail.com.

3-Week trend - Down

8-Week trend - Up

A recovery in the BSE Small-Cap index appears to be similar to the Mid-Cap index as the correction two weeks back was

almost similar i.e. deep and hard.

A further weakness and correction could continue below 14500. Till then, intra-day and intra-week corrections can

prove to be opportunity to accumulate strong stocks from the small-cap index.

A further breakout and close above the recent peak of 15739 is essential as that would confirm the medium-term higher

top and higher bottom formation. In the event of a breakout and close above 15739, expect a rally to 16500 and 17700.

Expect participation of small-caps along with the index outperformance.

Strategy for the week

Hold long positions in index and index-related stocks with a stop loss of 30100. Traders can accumulate on intra-week

correction to 31158-30984 with a stop loss of 30100. Expect 31447-31900 to be tested with volatility.

WEEKLY UP TREND STOCKS

Let the price move below Center Point or Level 2 and when it move back above Center Point or Level 2 then buy with

whatever low registered below Center Point or Level 2 as the stop loss. After buying if the price moves to Level 3 or above

then look to book profits as the opportunity arises. If the close is below Weekly Reversal Value then the trend will change

from Up Trend to Down Trend. Check on Friday after 3.pm to confirm weekly reversal of the Up Trend.

Note: SA-Strong Above, DP-Demand Point, SP- Supply Point, SA- Strong Above

Weekly Up

Scrip Last Level Level Center Level Level Relative

Reversal Trend

Close 1 2 Point 3 4 Strength

Value Date

Weak Demand Demand Supply Supply

below point point point point

MOTHERSON SUMI SYSTE 453.30 438.7 442.0 450.0 461.3 480.5 76.8 434.1 27-01-17

HDFC BANK 1636.00 1617.0 1619.3 1633.7 1650.3 1681.3 74.7 1592.8 30-12-16

IBUL HSG FIN 1131.20 1089.8 1092.3 1128.7 1167.6 1242.8 73.6 1077.5 26-05-17

CHAMBAL FERTILISERS 124.40 115.8 117.8 122.4 129.0 140.3 73.2 122.8 24-03-17

HINDUSTAN UNILEVER 1087.00 1040.0 1051.0 1076.0 1112.0 1173.0 72.8 1029.0 28-04-17

A Time Communications Publication 4

EMISPDF us-eyintranet from 125.16.128.202 on 2017-06-09 13:37:44 BST. DownloadPDF.

Downloaded by us-eyintranet from 125.16.128.202 at 2017-06-09 13:37:44 BST. EMIS. Unauthorized Distribution Prohibited.

*Note: Up and Down Trend are based of set of moving averages as reference point to define a trend.

Close below averages is defined as down trend. Close above averages is defined as up trend. Volatility

(Up/Down) within Down Trend can happen/ Volatility (Up/Down) within Up Trend can happen. Relative

Strength (RS) is statistical indicator. Weekly Reversal is the value of the average.

WEEKLY DOWN TREND STOCKS

Let the price move above Center Point or Level 3 and when it move back below Center Point or Level 3 then sell with whatever

high registered above Center Point or Level 3 as the stop loss. After selling if the prices moves to Level 2 or below then look to

cover short positions as the opportunity arises. If the close is above Weekly Reversal Value then the trend will change from Down

Trend to Up Trend. Check on Friday after 3.pm to confirm weekly reversal of the Down Trend.

Note: SA-Strong Above, DP-Demand Point, SP- Supply Point, SA- Strong Above

Weekly Down

Scrip Last Level Level Center Level Level Relative

Reversal Trend

Close 1 2 Point 3 4 Strength

Value Date

Demand Demand Supply Supply Strong

point point point point above

ALEMBIC PHARMA 537.25 483.6 520.8 541.5 557.9 562.2 35.63 574.31 21-04-17

RIL COMMUNICATONS 20.65 9.8 17.3 21.5 24.8 25.7 22.32 27.36 13-04-17

FIRSTSOURCE SOLUTION 33.10 29.9 32.1 33.3 34.3 34.5 31.60 35.45 05-05-17

ECLERX SERVICES 1287.50 1196.8 1261.7 1300.9 1326.7 1340.0 37.53 1307.90 02-06-17

UCO BANK 34.50 30.1 33.1 34.6 36.0 36.1 40.13 37.38 19-05-17

*Note: Up and Down Trend are based of set of moving averages as reference point to define a trend.

Close below averages is defined as down trend. Close above averages is defined as up trend. Volatility

(Up/Down) within Down Trend can happen/ Volatility (Up/Down) within Up Trend can happen.

! Note: Momentum breakout trend of stocks value (volume*close) between 10-80 lakhs.

EXIT LIST

Note: SA-Strong Above, DP-Demand Point, SP- Supply Point, SA- Strong Above

Scrip Last Close Supply Point Supply Point Supply Point Strong Above Demand Point Monthly RS

- - - - - - - -

BUY LIST

Note: SA-Strong Above, DP-Demand Point, SP- Supply Point, SA- Strong Above

Scrip Last Close Demand point Demand point Demand Point Weak below Supply Point Monthly RS

INDIA CEMENTS 212.85 209.14 207.77 206.41 202.00 220.7 58.31

CADILA HEALTHCARE 494.55 489.33 484.55 479.77 464.30 529.8 57.98

UFLEX 366.95 360.12 356.97 353.83 343.65 386.8 55.53

IGARSHI MOTRS INDIA 889.00 880.87 876.50 872.13 858.00 917.9 54.4

BAYER (INDIA) 5003.00 4842.57 4778.50 4714.43 4507.00 5385.6 53.82

PUNTER PICKS

Note: Positional trade and exit at stop loss or target whichever is earlier. Not an intra-day trade. A delivery based trade for a

possible time frame of 1-7 trading days. Exit at first target or above.

Note: SA-Strong Above, DP-Demand Point, SP- Supply Point, SA- Strong Above, RS- Strength

Last Weak Supply RS-

Scrip BSE Code Demand Point Trigger Supply point

Close below point Strength

GPT INFRA PROJECTS 533761 261.30 260.20 263.00 250.00 271.03 284.03 53.23

PHOENIX MILLS 503100 430.55 415.20 433.00 406.00 449.69 476.69 53.01

PPAP AUTOMOTIVE LTD 532934 338.40 334.00 345.00 326.35 356.53 375.18 62.90

SUMEDHA FISCAL SERVI 530419 27.85 27.00 28.50 26.05 30.01 32.46 80.11

A Time Communications Publication 5

EMISPDF us-eyintranet from 125.16.128.202 on 2017-06-09 13:37:44 BST. DownloadPDF.

Downloaded by us-eyintranet from 125.16.128.202 at 2017-06-09 13:37:44 BST. EMIS. Unauthorized Distribution Prohibited.

TOWER TALK

Rushil Decor, makers of laminates and toughened wood products, posted excellent results for FY17 and is faring

equally well in the current quarter. The stock is poised to appreciate further.

Amrutanjan Health Care with its decades-old brand image is still a good buy. Its health drinks segment is likely to

contribute significantly this year onward.

Himadri Speciality Chemical’s profitability has improved on account of higher margins and it plans to prepay its

debts. Its current P/E of ~44x is likely to fall in the next few quarters. A good buy.

Flexible packaging major, Uflex, is implementing huge grass root expansions. The industry is also doing well. A good

buy at the current level.

The sugar industry is on a roll. With forecasts of a normal monsoon, fertiliser stocks, too, should perform well. It is

prudent to buy EID-Parry (India), which is into sugar and has a controlling interest in fertilisers company

Coromandel International.

Debt-ridden Videocon Industries is grappling with its woes with the bankers. It posted huge losses. Exit

immediately.

Tata Metaliks will benefit immensely by its merger with DI Pipes and with expected 100% capacities. Accumulate.

Indiabulls Housing Finance, which expects a Rs.2,00,000 crore balance sheet by 2020, is a potential bonus

candidate. A screaming buy for long-term investors.

L.G. Balakrishnan & Bros, with a near monopoly in off-

road tyres, is reportedly faring very well. A potential Profitrak Weekly

bonus candidate too. Accumulate. A complete guide for Trading and Investments based

Motherson Sumi Systems has declared 1:2 bonus and a on Technicals

dividend of Rs.2/share. The stock is likely to soar further

due to the proposed heavy investments in its domestic What you Get?

plants. Buy immediately. 1) Weekly Market Outlook of -

Sensex

Cyient, which has huge defence orders in hand, expects a

Nifty

double-digit growth rate.

Bank Nifty

Power Grid Corporation of India reported a heavy 2) Sectoral View of Strong/Weak/Market Perfomer

project pipeline of ~Rs.1,30,000 crore. With earnings and indices

dividend payout ratio being revised upwards, long-term 3) Weekly Trading Signals

investors will gain. 4) Stock Views and Updates every week

Bank of Baroda is likely to raise ~Rs.9000 crore by way 5) Winners for trading and investing for medium-

of additional equity, which may be offered to Indian to-long term till March 2018

investors partly via a rights issue. The bank is on a 6) Winners of 2017 with fresh Weekly Signals on

the same

comeback trail.

Reliance Communications is struggling to pay its huge Application of this product can be explained on the

debts. With major rating agencies downgrading the Telephone or via Skype or Team Viewer.

company, the stock is likely to fall further. It may be

prudent to exit the counter and stay away. For 1 full year with interaction,

Larsen & Toubro has declared 1:2 bonus. Its bulging rush and subscribe to Profitrak Weekly

order book, a chunk of which comes from the defence

sector, should boost its share price. A value buy. Subscription Rate: 1 month: Rs.2500; 1 year: Rs.12000

ONGC’s onshore production is on the rise. With the For more details, contact Money Times on

company monetising its new assets fast, it should scale 022-22616970/4805 or

new heights over the next few years. A good long-term moneytimes.support@gmail.com.

buy.

Escorts’ profitability has improved significantly on the back of robust sales and improving margins due to cost

reduction measures. The stock may rise further.

Bombay Rayon Fashions has obtained one of the largest loan recasts in recent times. This turnaround company is

likely to recover its lost glory and turn into a value buy.

A Time Communications Publication 6

EMISPDF us-eyintranet from 125.16.128.202 on 2017-06-09 13:37:44 BST. DownloadPDF.

Downloaded by us-eyintranet from 125.16.128.202 at 2017-06-09 13:37:44 BST. EMIS. Unauthorized Distribution Prohibited.

Volumes at the DCB Bank counter suggest a decisive breakout. The stock may jump by about Rs.50 soon. An

excellent buy for sure shot, short-term gains.

Realty major, Sunteck Realty, posted a consolidated EPS of Rs.34 for FY17 and is reportedly faring much better this

quarter. A good buy.

Kallam Spinning Mills posted excellent Q4 results with an EPS of Rs.2 (FV: Rs.2). The stock trades cheap at Rs.30

and can easily double from the current level.

Indian Metals & Ferro Alloys (IMFA) posted an EPS of Rs.65 for Q4FY17. The stock has corrected 50% from its 52-

week high and is ripe again for a 20% up-move with very limited downside.

Asahi Songwon Colors is slowly and steadily moving up the value chain, which is also reflected in its financials. A

good long-term buy.

Balasore Alloys posted good Q4 numbers. The promoters have increased their stake by 5% in the last quarter. Are

good days ahead for the company?

Sakuma Exports has posted an EPS of Rs.22.6 for FY17. A conservative P/E of 5x will take its share price to Rs.113

in the medium-term.

UFO Moviez India’s EPS is expected to rise to Rs.30 in FY18 from Rs.23 in FY17. A reasonable P/E of 20x will take

its share price to Rs.600 in the medium-term.

The Century Enka counter has witnessed active buying from discerning investors. The Company posted an EPS of

Rs.46 for FY17 excluding an exceptional write-off. A conservative P/E of 12.5x will take its share price to Rs.575 in

the medium turn.

KEI Industries may post an EPS of Rs.16 in FY18 v/s Rs.12.5 in FY17 based on its expansion initiatives. The stock

could touch Rs.280.

With an EPS of Rs.73 for FY17 and share book value of Rs.487, Vindhya Telelinks is on the list of discerning buyers.

Its holding in group companies (Birla Corp and Universal Cables) is worth ~Rs.2260 crore (Rs.1915/share). A

reasonable P/E of 15x will take its share price to Rs.1350 on FY18E EPS of Rs.90+.

An Ahmedabad-based analyst recommends Hilton Metal Forging, Nelcast and Pitti Laminations.

BEST BET

Manappuram Finance Ltd

(BSE Code: 531213) (CMP: Rs.88.90) (FV: Rs.2)

By Amit Kumar Gupta

Manappuram Finance Ltd is a non-banking financial company (NBFC) that offers gold loans, microfinance, housing loans

and commercial vehicle (CV) loans. It operates in the finance segment. Its activities include Gold Loan/Loan against Gold,

Money Transfer, Domestic Money Transfer, Foreign Exchange, SME & Loan Against Property (LAP), Depository Services

and CV Loans. It provides LAP to self-employed professionals/non-professionals and individuals/proprietorship,

partnership and limited companies. It provides CV Loans to first-time users/buyers, captive customers, fleet owners,

individuals/proprietorships, partnerships, limited companies and schools and colleges. Its securities available for

Dematerialization (Demat) include equity shares, debt instruments such as bonds and debentures (NCD) government

securities and mutual fund units.

MFL posted strong Q4 numbers with NII growth of 46% YoY (10% above our estimate) and PAT up 54% YoY (16%

above our estimate). However, AUM growth was 20% v/s 38% in Q4FY16. GNPA eased 30 bps to 2.2% as auctions due in

Q3FY17 were completed in Q4FY17. GNPA in the micro finance institution (MFI) book rose 450 bps to 4.7%. The

Company has not used the RBI dispensation on NPAs and has voluntarily shifted to a 90-day asset quality recognition

during the earlier quarters.

AUM grew 20% YoY (as against our estimate of 33%) and fell 6% QoQ. A large part of the slower growth is attributed to

higher auctions during the quarter. As a result, there was slower growth of 10% in the gold loan segment, which yet

forms 81% of AUM. Gold holding grew 3%, whereas per gram it rose 7%. MFI segment (Asirvad Microfinance) grew 80%

YoY and accounted for 13% of its overall loan book. Other segments (housing loan, CV loan and LAP) grew exponentially,

albeit on a lower base. The management has guided for 20% AUM growth in FY18. It has targeted the non-gold segment

to account for 25% of AUM by FY18 and expect it to touch 50% eventually.

A Time Communications Publication 7

EMISPDF us-eyintranet from 125.16.128.202 on 2017-06-09 13:37:44 BST. DownloadPDF.

Downloaded by us-eyintranet from 125.16.128.202 at 2017-06-09 13:37:44 BST. EMIS. Unauthorized Distribution Prohibited.

NIM expanded 197 bps YoY and 101 bps QoQ to 17.1%. The expansion in NIM can be largely attributed to the higher net

yield of 25.2%. Operating expenses grew 29% as higher expenses were incurred to beef up the security at branches. As a

result, cost-to-AUM deteriorated 20 bps to 7.5%. The management expects the cost-to-AUM ratio to ease to 5% over the

medium-term. Operating profit grew 64% YoY, which was 19% above our estimate. Credit costs (annualised) grew to

114 bps v/s 47 bps YoY due to accelerated provisioning in the MFI segment.

Valuation: For FY17/FY18, we have increased our GNPA estimates by 60bps/40bps to 2.2%/2.2% respectively. We

have cut our ABV estimates by 3% for FY19. We have retained a Buy rating on MFL with a price target of Rs.120, valuing

the stock at 2.5x P/ABV of FY19E financials.

Outlook: With the worst-case scenario behind, regulatory

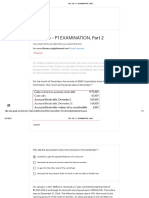

Financial summary: (Rs. in million)

environment turning favourable and stable gold prices, MFL is

Particulars FY15 FY16 FY17 FY18E FY19E

targeting healthy growth going forward. However, increase in

loan delinquency post demonetisation needs to be managed PAT 2715 3552 7585 7565 8184

well. The Company’s de-risking strategy has helped it to keep EPS (Rs.) 3.2 4.2 9 9 9.7

credit costs to low. Diversification into other segments will P/E (x) 27.6 21.1 9.9 9.9 9.2

enable faster utilisation of excess capital on its balance sheet RoA (%) 2.4 2.9 5.4 4.5 4

and avoid any undesirable treatment from the regulator for RoE (%) 10.6 13.2 24.8 21 19.8

being a single-product company. Tier-I capital of 22% ensures

unhindered growth and there is no need to raise capital for the next two years. MFL has the potential to deliver RoA of

~4% on a consistent basis.

Technical Outlook: The Manappuram Finance Ltd stock looks good on the daily chart for medium-term investment. The

stock is moving in a strong uptrend with higher high and higher low on the daily chart. The stock trades above all

important DMA levels like 200.

Start accumulating at this level of Rs.88.90 and on dips to Rs.80 for medium-to-long-term investment and a possible

price target of Rs.110+ in the next 6 months.

GURU SPEAK

No deep correction likely

Last week, I had observed that the market seems to have peaked for a while amid forward calls

by brokerages and technical experts of Nifty target between 10300 and 10500 in the so-called

next rally. Several experts came on TV channels giving quick calls of Nifty to hit the 10000 mark

soon. Although I am a staunch bull but looking at the movement of stocks made me cautious.

The last ‘Guru Speak’ column stated that the Nifty will now head for consolidation before it

crosses 9650 or Sensex 31400. To cross both these levels, much consolidation will be witnessed.

It is not their case that the market is ready to run straight way at fancy targets as narrated

By G. S. Roongta above, which is what the operators or speculators would have you believe as they make quick

money by befooling you. I had clearly stated that this time the bulls are playing a very safe and

cautions game and are in no hurry to press the accelerator to run fast but are trading safely by booking the needed profit

at every stage of the next rally because in a good bull run, consolidation is a must instead of running ahead fast without

looking left or right.

The Sensex, which had gained 563 points in the week before last ended Friday, 26 May 2017, closing at a new all-time

high at 31028 while hitting 31074, followed by the Nifty closing higher at 9595 after crossing the 9600 mark in intraday

trades. The rise in the benchmarks so fast in the previous week was on account of the FIIs, which had built a bull spread

in Nifty Futures and Bank Nifty while creating short positions in Stock Futures or in high-priced mid-cap stocks in the

May 2017 F&O expiry. The May F&O expiry is over and so is their game-plan and the outstanding position of May 2017

also stands to be fully adjusted and is reflected in the price movement of the stocks concerned.

Now we should look at the June 2017 expiry and the speculators’ strategy for the month.

If you look at their ploughing of funds after the May 2017 F&O contracts, it appears that they were net sellers on Friday,

26 May by Rs.316 crore, net short by Rs.808 crore on Monday, 29 May and again net short by Rs.217 crore on Tuesday,

30 May, which cautions us to tread slow and hope for a smart rally in the near-term. Besides, if we go through the details

of rise/fall of stocks, we notice that the number of stocks on the selling side has been rising constantly for over week or

A Time Communications Publication 8

EMISPDF us-eyintranet from 125.16.128.202 on 2017-06-09 13:37:44 BST. DownloadPDF.

Downloaded by us-eyintranet from 125.16.128.202 at 2017-06-09 13:37:44 BST. EMIS. Unauthorized Distribution Prohibited.

so. The ratio of advances v/s declines has fallen from 80:20 to 60:40, which is also not a good sign going forward in the

near-term.

The Business Line issue of 31 May 2017 on page 14 published the details of NSE stocks in circuit filters in which upper

circuit stocks were 45 in number while declines were 54. This means the ratio has gone down from the earlier 60:40 to

45:55 while in the earlier periods, the ratio of bullish stocks was considerably higher.

The list of stocks that hit 20% lower circuit is indeed quite long. For example, Electrotherm (India) fell from Rs.270 to

Rs.243, HUB Town from Rs.150 to Rs.135, Mandhana Industries from Rs.16 to Rs.14, Goldstone from Rs.78 to Rs.74,

Uttam Sugar Mills from Rs.121 to Rs.116.

This is also borne by the fact that mid-cap and small-cap stocks were under pressure right from week before last but

moved smartly by 190 points on Wednesday, 30 May while the Nifty gained hardly 20 points.

Corporate Performance: The

earnings season i.e. corporate MID-CAP TWINS

results for Q4 and FY17 was

almost over last week as far as

A Performance Review

large and mid-sized companies Have a look at the grand success story of ‘Mid-Cap Twins’ launched on 1 August 2016

are concerned. Hence, the Sr. Stocks Recomm. Recomm. Highest % Gain

volatility and performance No. Date Price (Rs.) since (Rs.)

related sensitivity performance 1 Mafatlal Industries 01-08-16 332.85 374.40 12

will be this week onwards. The 2 The Great Eastern Shipping Co. 01-08-16 335.35 477 42

Q4 results, as a whole, improved 3 India Cements 01-09-16 149.85 226 51

compared to Q3 despite worries 4 Tata Global Beverages 01-09-16 140.10 161.60 15

of cash crunch on account of 5 Ajmera Realty & Infra India 01-10-16 137 251.90 84

demonetisation. 6 Transpek Industry 01-10-16 447 975 118

GDP Growth: The GDP growth, 7 Greaves Cotton 01-11-16 138.55 178 28

which the opposition had forecast 8 APM Industries 01-11-16 67.10 76.85 15

to decline by 2%, is expected to 9 OCL India 01-12-16 809.45 1269.50 57

end up at 7.2% as per the latest 10 Prism Cement 01-12-16 93.25 129.10 38

forecast made by C.S.O (Central 11 Mahindra CIE Automotive 01-01-17 182.50 258 41

Statistics Office) while pegging 1st 12 Swan Energy 01-01-17 154.10 203.45 32

and 2nd advance estimates for 13 Hindalco Industries 01-02-17 191.55 203.85 6

GDP growth at 7.1% for the fiscal 14 Century Textiles & Industries 01-02-17 856.50 1218.20 42

ended 31 March 2017. 15 McLeod Russel India 01-03-17 171.75 196.25 14

IIP Production & Retail 16 Sonata Software 01-03-17 191 195 2

Consumer CPI Index: Likewise, 17 ACC 01-04-17 1446.15 1753.85 21

RBI, too, had expressed worries of 18 Walchandnagar Industries 01-04-17 142.25 191.80 35

rising WPI and CPI on account of 19 Oriental Veneer Products 01-05-17 222.30 334.20 50

a weak monsoon expected this 20 Tata Steel 01-05-17 448.85 514.80 15

year followed by rural demand to Thus ‘Mid-Cap Twins’ has delivered excellent results since its launch within 10 months

be impacted due to with majority of stocks gaining over 30%.

demonetisation. But RBI’s

worries, like the opposition, may Latest edition of ‘Mid-Cap Twins’ was released on 1st June 2017.

prove wrong. This will lead the

RBI Governor to think afresh to Attractively priced at Rs.2000 per month, Rs.11000 half yearly and Rs.20,000 annually,

reduce interest rate in the next ‘Roongta’s Mid-cap Twins’ will be available both as print edition or online delivery.

scheduled Monetary Policy

review. If that happens, the market will witness another rally.

Monsoon: Early arrival of the monsoon with it having already arrived in Kerala on Tuesday, 29 May 2017 and ready to

advance towards the North East side soon. Widespread rainfall along with clouds all over in the southern part formed

the favourable monsoon before time. This is likely to boost the market sentiment going forward this week.

Stocks to view: After FY17 results, I am of the opinion that investors must pay attention to stocks that have really

performed well instead of chasing market tops and rumours. According to me, investors must select one stock from each

sector and follow it consistently. In my view, the following five stocks look good for good returns in FY18.

Sugar sector: I consider Andhra Sugars among the best. It is a diversified company with

Sugar/Chemicals/Pharma/Power it has earned Rs.45 per Rs.10 paid-up share in FY17. At the CMP of Rs.315, the stock

A Time Communications Publication 9

EMISPDF us-eyintranet from 125.16.128.202 on 2017-06-09 13:37:44 BST. DownloadPDF.

Downloaded by us-eyintranet from 125.16.128.202 at 2017-06-09 13:37:44 BST. EMIS. Unauthorized Distribution Prohibited.

trades at a P/E of 7x, which is amongst the lowest as against 16x of the Sensex and between 30-40x of fast moving

stocks. The Company has recommended a dividend of Rs.10/share i.e. 20-25% of retained profit, which is good. Its

price:book value ratio is also a close 1:1, which according to me should be twice or more of book value. If my forecast

turns true, the Andhra Sugars stock should cross Rs.500 soon. It may also be noted that this stock was recommended by

me in Money Times about a year back at around Rs.141 and has already more than doubled delivering around 150%

returns to those who honestly invested in it.

Aluminium Sector: Hindalco Industries posted

excellent results on 30 May 2017, with 27% higher

revenue at Rs.11747 crore on a standalone basis.

What TF+ subscribers say:

EBIDTA is up by 13.2% at Rs.1570 crore while PAT “Think Investment… Think TECHNO FUNDA PLUS”

is up by 25.6% at Rs.502 crore. PAT and EBIDTA

growth is just the beginning with Q4 and likely to Techno Funda Plus is a superior version of the Techno Funda

jump in FY18 considerably as the Company will column that has recorded near 90% success since launch.

benefit on account of Interest/Depreciation Every week, Techno Funda Plus identifies three fundamentally

because of early payment of its loan by Rs.4000 sound and technically strong stocks that can yield handsome

crore domestically and equally by IES Novelli. It returns against their peers in the short-to-medium-term.

will benefit by over Rs.500 crore next year on the

interest front alone. Besides, there will be higher Most of our recommendations have fetched excellent returns to

realization, our subscribers. Of the 156 stocks recommended between 11

lower cost and higher production due to capacity January 2016 and 2 January 2017 (52 weeks), we booked profit in

expansion going into commercial production. 124 stocks, 27 triggered the stop loss while 5 are still open and are

Going forward, the Company’s profit will be in nominal red.

nothing less than Rs.2500 crore for FY18. Of the 57 stocks recommended between 9 January 2017 and 15

Cement sector: Overall, I am bullish on this sector May 2017 (19 weeks), we booked 6-32% profit in 42 stocks, 5

but one stock in which I am extremely bullish is triggered the stop loss while 10 are still open.

India Cements. Recently, the stock was heavily

beaten due to its presence in the F&O segment. But If you want to earn like this, subscribe to

the stock recovered as fast as it lost its valuation TECHNO FUNDA PLUS today!

which itself speaks about its strength going

forward. The stock was recommended by me at For more details, contact Money Times on

Rs.150 in ‘Mid-Cap Twins’, where-after it hit a high 022-22616970/4805 or moneytimes.support@gmail.com.

of Rs.265 before it was beaten down by Subscription Rate: 1 month: Rs.2500; 3 months: Rs.6000;

speculators. It already recovered to Rs.210 and 6 months: Rs.11000; 1 year: Rs.18000.

soon will recover all its lost ground.

India Cements is a South-based company headed by Mr. Srinivasan, Managing Director. In an interview with Business

Line Bureau, he said -

a) India Cements has expanded its product portfolio and market to insulate from regional markets fluctuations.

b) Of the 375 MMTPA cement production capacity available with the industry, ~150 mn tonnes is concentrated in the

South against a demand of about 80-90 mn tonnes. This is why cement prices were lower in Q4 on account of excess

supply in South market alone.

c) India Cements has also started manufacturing special cement such as ‘Oil Well’ cement for supply to Railway

sleepers.

d) This year, India Cements expects excess demand against capacity, which is likely to improve by 70-72% out of the 16

mn capacity.

e) The Company has reduced its debt by Rs.500 crore over the last two years and is considering reducing it further,

which will help to improve its bottom-line further.

f) The Company has merged with two of its cement subsidiaries - Trinethra Cement and Trishul Concrete Products.

The other two stocks are SAIL and Berger Paints India, which I cannot outline in detail due to space constraints.

The stock market remained range-bound till Thursday, 1 June 2017, without making much headway in the week while

closing at 31137 as against last week’s closing at 31028, which means a gain of just 109 points in four days which is

nothing great Hence we may call it consolidation of the previous week's rise of 563 points.

A Time Communications Publication 10

EMISPDF us-eyintranet from 125.16.128.202 on 2017-06-09 13:37:44 BST. DownloadPDF.

Downloaded by us-eyintranet from 125.16.128.202 at 2017-06-09 13:37:44 BST. EMIS. Unauthorized Distribution Prohibited.

If we look at the stock-specific rise and fall, we realize that there was massive profit-booking in several mid-cap and

small-cap stocks because FIIs and speculators find the valuation of mid-cap stocks high compared to large-caps and

index stocks. So they preferred profit-booking to even the valuation of mid-cap stocks.

On Friday, 2 June 2017, although the market opened strong by nearly 140 points, it did not move higher while trading in

the range of 100-150 points. However, the sentiment looked better giving an impression that downward risk is

minimum while chances for an up-move look bright. So, any deep rooted correction seems to be ruled out.

Besides, corporate results for Q4 and FY17 as a whole are factored in by now. In view of this, stock-specific volatility on

the basis of performance will be over and the market will start going forward based on merit.

On Friday, the market rallied with the Sensex gaining 136 points to close at 31273 while the Nifty closed higher by 37

points at 9653. Pharma, two-wheeler and selected banking stocks like Yes Bank, IndusInd Bank and HDFC were

distinctly strong. There were laggards, too, but not too many. Eicher Motors was a star performer so also UltraTech

Cement and several others.

The market sentiment is definitely bullish and as such short-selling for any reason might prove dangerous while

systematic buying in panic is the need of the hour. Going forward, there are no negative reasons in the pipeline. On the

contrary, a good start to the monsoon, RBI’s next monetary policy and lower consumer inflation data are the big triggers

according to me.

STOCK WATCH

By Amit Kumar Gupta

ITC Ltd

(BSE Code: 500875) (CMP: Rs.319.15) (FV: Re.1) (TGT: Rs.670+)

ITC Ltd is a holding company engaged in the marketing of fast moving consumer goods (FMCG). It operates through four

segments: FMCG; Hotels; Paperboards, Paper and Packaging; and Agri. The FMCG segment includes Cigarettes

(cigarettes and cigars) and branded packaged foods businesses (Staples, Snacks and Meals, Dairy and Beverages,

Confections); Apparel; Education and Stationery Products; Personal Care Products; Safety Matches; and Agarbattis. The

Hotels segment includes Hoteliering. The Paperboards, Paper and Packaging segment includes paperboards; paper

including speciality paper and packaging including flexibles. The Agri business segment includes Agri commodities such

as soya, spices, coffee and leaf tobacco. Its brands include Aashirvaad, Sunfeast Dark Fantasy, Bingo!, Yumitos, YiPPee!,

Candyman, GumOn, Classmate, Fiama Di Wills, Vivel, Superia, Engage, Wills Lifestyle, John Players, Mangaldeep and Aim

among others.

Following a 20% decline in Q3FY17, ITC’s cigarette

For the busy investor

volumes are estimated to have remained flat in Q4FY17.

Segmental gross revenues grew 4.8% YoY to Rs.8950 Fresh One Up Trend Daily

crore. Overall quarterly Excise Duty outgo for the Fresh One Up Trend Daily is for investors/traders who are

quarter declined 11%, which indicates a change in keen to focus and gain from a single stock every

product-mix in favour of DSFT cigarettes. Recent price

trading day.

hikes in response to moderate excise duty hike aided a

110 bps YoY improvement in segmental margins to With just one daily recommendation selected from

36.4%. Segmental EBIT was higher by 8% YoY at stocks in an uptrend, you can now book profit the same

Rs.3260 crore. day or carry over the trade if the target is not met. Our

Revenue from the Company’s non-cigarette FMCG review over the next 4 days will provide new exit levels

business grew 6.5% YoY to Rs.2890 crore in Q4FY17. while the stock is still in an uptrend.

However, quarterly segmental EBIT margins fell by 100 This low risk, high return product is available for online

bps YoY to 1.9% mainly due to higher input costs and subscription at Rs.2500 per month.

heightened trade promotions. Its Hotels business, too,

posted 6.5% YoY growth in sales at Rs.390 crore while Contact us on 022-22616970 or email us at

segmental profits soared 57% YoY to Rs.66.9 crore, as moneytimes.suppport@gmail.com for a free trial.

margins improved by 560 bps YoY to 17.3% due to the

favourable base effect. The Agri business posted 6% YoY growth in revenues to Rs.1920 crore but segmental profits

declined 21% YoY to Rs.130 crore. Revenues from the paperboard segment grew 4.3% YoY to Rs.1370 crore with

segmental margins improving by 210 bps YoY to 17.5% on the back of benign input costs and improved product mix.

A Time Communications Publication 11

EMISPDF us-eyintranet from 125.16.128.202 on 2017-06-09 13:37:44 BST. DownloadPDF.

Downloaded by us-eyintranet from 125.16.128.202 at 2017-06-09 13:37:44 BST. EMIS. Unauthorized Distribution Prohibited.

Valuation: We estimate ITC to post net sales of Rs.44940 crore and Rs.50790 crore with net profit of Rs.11820 crore

and Rs.13580 crore in FY18E and FY19E respectively. Based on the expected EPS of Rs.11.2, the stock currently trades at

27.6x its FY19E earnings. Although the stock currently trades at 20% discount to the FMCG sector multiples (ex-ITC), we

believe that greater clarity on GST rates coupled with no major change in the tax structure augurs well for ITC, which

should narrow down current discount, going forward. Hence, we have a Buy on the stock with a price target of Rs.360.

Technical Outlook: The ITC Ltd stock looks very good on the daily chart for medium-term investment. It has formed a

rounding pattern and trades above all important DMA levels on the daily chart.

Start accumulating at this level of Rs.319.15 and on dips to Rs.290 for medium-to-long-term investment and a possible

price target of Rs.670+ in the next 12 months.

******

Jamna Auto Industries Ltd

(BSE Code: 520051) (CMP: Rs.257.40) (FV: Rs.5) (TGT: Rs.290+)

Jamna Auto Industries Ltd (JAIL) provides automotive suspension solutions for commercial vehicles. It is engaged in the

business of manufacturing and selling of parabolic and tapered leaf springs. Its products include Suspension Products

including Rear Air Suspension-Cow Horn Style; Lift Axle-Steerable/Non Steerable and Bogie Suspension-Tandem Axle;

and Multileaf and Parabolic Springs. Its Rear Air Suspension-Cow Horn Style features include upper v-link for lateral

positioning, manageable axle thrust and pinion angle. It is designed to be serviceable using common tools. Its Lift Axle-

Steerable/Non Steerable features include auto load sensing system; lift over ride in cab; steer lock system; and reverse

caster shocks. Its manufacturing plants are located at Yamuna Nagar in Haryana, Bhind in Madhya Pradesh, Kharsawan

in Jharkhand, Krishnagiri and Sriperumbudur in Tamil Nadu and Pune in Maharashtra.

Net revenue grew 5.1% to Rs.385 crore in Q4FY17 from Rs.366.4 crore in Q4FY16 led by healthy commercial vehicles

volumes on account of the BS IV pre-buying that happened during the quarter. We expect H1FY18 to remain subdued

due to the weakness in the commercial vehicles space but expect the overall volume to grow 10-12% in FY18 and FY19.

Operational profit declined 3.8% to Rs.55.8 crore from

Rs.58 crore in Q4FY16. EBITDA margin stood at 14.5% Free 2-day trial of Live Market Intra-day Calls

v/s 15.8% on YoY basis led by a rise in material cost (up

A running commentary of intra-day trading

7.7% YoY), power and fuel cost (up 46.2% YoY) and

recommendations with buy/sell levels, targets, stop loss on

higher stores and spares cost (up 8.8% YoY). We expect

your mobile every trading day of the moth along with pre-

the operational margin to decline marginally to 13.8%

in FY18 (v/s 14.1% in FY17) due to the rising material market notes via email for Rs.4000 per month.

and fuel costs. However, we expect it to improve to Contact Money Times on 022-22616970 or

14.3% in FY19 with the rising share of parabolic leaf moneytimes.support@gmail.com to register for a free trial.

springs and operational leverage benefits.

ITC’s net profit climbed 26.7% to Rs.35.4 crore from Rs.27.9 crore in Q4FY16 on account of higher other income (up

214.1% YoY), lower depreciation cost (down 21.8% YoY) and lower interest cost (down 12.5% YoY). As a result, net

profit margin improved from 7.6% in Q4FY16 to 9.2% in Q4FY17.

Technical Outlook: The Jamna Auto Industries Ltd stock looks very good on the daily chart for medium-term

investment. It has formed an elongated pattern and trades above all important DMA levels on the daily chart.

Start accumulating at this level of Rs.257.40 and on dips to Rs.232.40 for medium-to-long-term investment and a

possible price target of Rs.290+ in the next 12 months.

SMART PICKS

Market heading towards new highs

By Rohan Nalavade

In the last issue, we had rightly stated that the market is ‘buy on dips’ and that is exactly what happened last week as the

Nifty moved to 9670 from 9560 to make a new lifetime high. This indicates that the market is not ready to go down and

is getting stronger and moving up steadily gaining strength. The Nifty may touch the 9800 level in the June 2017 F&O

series and 10300 thereafter. It has formed a good base at 9563 making 9590 the higher low of level. Next week, we have

an important Gann date which will indicate the future short-term trend.

A Time Communications Publication 12

EMISPDF us-eyintranet from 125.16.128.202 on 2017-06-09 13:37:44 BST. DownloadPDF.

Downloaded by us-eyintranet from 125.16.128.202 at 2017-06-09 13:37:44 BST. EMIS. Unauthorized Distribution Prohibited.

Overall, the market is good as every month we are making new highs. So technically, the weekly candle chart as well as

the monthly chart show good strength and Gann theory always advises investors to follow the overall trend to make

good profits. Week before last, the Nifty closed at 9595 and it closed at 9653.5, last week, which is a positive sign.

The monsoon is set for arrival this week and a good monsoon will cheer up the economy. As GST will be implemented

next month, stocks and sectors benefiting from the GST and monsoon are gaining strength and momentum. Buying was

seen in the counters of fertilizer stocks, banking stocks as well as auto stocks like Mahindra & Mahindra, Maruti Suzuki

(India) and Tata Motors.

Global markets are also steady. The year 2017 looks good for the market. It is prudent to buy on every big dip as the

market is rewarding those who buy at the bottom and book profits regularly. Those trying to create short positions are

getting trapped and missing good trades. Always follow Gann’s principle which is, the market will give hints when it

reverses. Overall, it is a steady market and will move up slowly.

Among stocks,

Bharat Heavy Electricals looks good around Rs.140 for a price target of Rs.153-164-172.

L&T Finance Holdings looks good around Rs.127 for a price target of Rs.154-165-178.

Ashok Leyland looks good around Rs.92 for a price target of Rs.101-105.

State Bank of India looks good around Rs.287 for a price target of Rs.310-320.

Learn SWING TRADING to trade at tops and bottoms with Gann’s Square of 9 Tool in our upcoming W.D. Gann Price Trading

session on Saturday, 17 June 2017, at Dadar, Mumbai. To know more, register on our website - http://wdganncycle.com/ or

contact us on 9619047123.

MARKET REVIEW

FIIs lead Sensex record closing high

By Devendra A Singh

The BSE Sensex advanced 245.08 points to settle at 31273.29 while the CNX Nifty closed at 9653.5 (a record closing

high) by rising 58.4 points for the week ending Friday, 2 June 2017.

On the macro-economic data, Indian firms’ External Commercial Borrowings (ECBs) in April 2017 rose more than three-

fold to $1.3 billion from $304.57 mn in April 2016. The borrowings by Indian companies included $1.27 bn through the

automatic route and $39.26 mn via the approval route. During April 2017, Indian firms also made additional borrowing

of $394.53 mn through rupee denominated bonds (RDBs), which is permitted since September 2016.

Under the automatic route, JSW Steel took a loan of $500 mn while HPCL-Mittal Energy raised $372 mn. Under the

approval route, Essar Shipping was the only company that raised $39.26 mn for import of capital goods. The following

firms floated rupee denominated bonds overseas - $310 mn by NTPC, $62 mn by Nissan Renault Financial Services and

$22.48 mn by UCWeb Mobile.

Further, Nomura’s latest report stated that the new series of industrial production (IP) and wholesale prices suggest that

the GDP numbers for FY17 could be revised up from 6.7% to 7.4%. The Central Statistical Office (CSO) revised India’s

wholesale price index (WPI) and IP series last week, changing the base year to 2011-12 from 2004-05.

“We estimate that GVA growth will be revised up to 8.2% from 7.8% for 2015-16 and to 7.4% from 6.7% for 2016-17”,

Nomura said in a research note. The report further said that 2016-17 GDP growth may also be revised up to 7.8% from

7.1% in the second estimate, with both consumption and investment growth likely to see upward revisions. The

revisions will also impact the quarterly growth profile.

Moody’s said, “India’s economic growth will accelerate to 7.5% in the current fiscal year and the government’s reform

push will help achieve a GDP growth rate of 8% in about 4 years”.

Moody’s, however, cautioned that persistent banking sector weakness from a high proportion of delinquent loans on

bank balance sheets will weigh on growth if not resolved by constraining credit for investment related activities. It

further said that the negative impact of demonetisation on the economy was limited in size and duration.

The World Bank projects India to clock 7.2% growth rate in the current fiscal on the back of reforms momentum and the

improved investment scenario.

“The government has been successful in pushing through several key reforms including liberalisation of FDI rules in a

number of key sectors such as defence, railway infrastructure, civil aviation and insurance. Besides, the Direct Benefit

A Time Communications Publication 13

EMISPDF us-eyintranet from 125.16.128.202 on 2017-06-09 13:37:44 BST. DownloadPDF.

Downloaded by us-eyintranet from 125.16.128.202 at 2017-06-09 13:37:44 BST. EMIS. Unauthorized Distribution Prohibited.

Transfer scheme for food, fertiliser and kerosene subsidies, the rollout of GST in July 2017 and a national bankruptcy

code are among other reforms undertaken by the government. Together, these will help reduce inefficiencies and

improve the growth trend over the long run Moody’s added.

“The inflation rate has steadily

declined to 3% as of April due to

weaker food price inflation. We

believe that the inflation rate will

rise to around 5% by the end of

this year, once the effect of this

temporary factor fades”, the report

added.

Moody’s expects the RBI to hold the

policy repo rate steady, holding a

neutral stance in this growth

environment.

On China, Moody’s said its GDP

growth will decelerate over the

year due to reduced property-

related investment as liquidity-

tightening measures of the central

bank and regulatory measures

intended to limit the growth rate of

shadow banking take effect.

“We expect that real GDP will grow

at 6.6% in 2017 in line with the

target of at least 6.5% and higher if

possible, falling to 6.3% in 2018”, it

said.

Revenue Secretary, Hasmukh

Adhia, has said that inflation will

fall by 2% on implementation of

the GST and create buoyancy in the

economy.

The India Meteorological

Department (IMD) has forecast this

year’s monsoon rains at 96% of the

50-year average of 89 cm. The

monsoon delivers about 70% of the

nation’s annual rainfall.

Key index ended higher on

Monday, 29 May 2017, on positive

buying. The Sensex gained 81.07

points (+0.26%) to settle at

31109.28.

Key index moved higher on

Tuesday, 30 May 2017, on

extended buying of equities. The

Sensex gained 50.12 points

(+0.16%) to settle at record closing

high at 31159.4.

Key index edged lower on Wednesday, 31 May 2017, on selling. The Sensex was down by 13.60 points (-0.04%) to close

at 31145.8.

Key index fell on Thursday, 1 June 2017. The Sensex lost 8.21 points (-0.03%) to close at 31137.59.

A Time Communications Publication 14

EMISPDF us-eyintranet from 125.16.128.202 on 2017-06-09 13:37:44 BST. DownloadPDF.

Downloaded by us-eyintranet from 125.16.128.202 at 2017-06-09 13:37:44 BST. EMIS. Unauthorized Distribution Prohibited.

Key index advanced on Friday, 2 June 2017, on buying of equities. The Sensex registered strong gains of 135.7 points

(+0.44%) to settle at 31273.29, a historic closing high.

National and global macro-economic figures will surely dictate global markets movements and influence investor

sentiment in the near future.

The RBI’s monetary policy meeting is scheduled on Wednesday, 7 June 2017.

The government is scheduled to release data based on WPI and CPI for urban and rural India for May 2017 by mid-June

2017. USA’s macro-economic data for May 2017 is scheduled for release in the first week of June 2017.

EXPERT EYE

By Vihari

Winsome Textile Industries Ltd: Spinning success

(BSE Code: 514470)

(CMP: Rs.83.90) (FV: ‘BEAT THE STREET 6’

Rs.10) A Performance Review

Winsome Textile

Steady returns from the 16th edition of ‘Beat the Street 6’ published on 06/03/17

Industries Ltd (WTIL) is

engaged in the Scrip Name Recomm. Highest % Gain

manufacture of yarn and Rate (Rs.) since (Rs.)

allied activities. Its Ajmera Realty & Infra 190 251.9 33

Larsen & Toubro 1482 1799.15 21

products include cotton

Kalyani Steels 370 435 18

yarn containing 85% or

Super Crop Safe 145 163.95 13

more of cotton, cotton

Sarda Energy & Minerals 245 279 14

yarn containing less than

IOL Chemicals & Pharmaceuticals 91 SL -

85% of cotton and yarn

of synthetic staple fibre

containing 85% or more Bumper returns from the 15th edition of ‘Beat the Street 6’ published on 07/12/16

of acrylic. The Company Scrip Name Recomm. Highest % Gain

Rate (Rs.) since (Rs.)

has been associated with

Datamatics Global Services 87 164.85 89

250+ customers across

Chennai Petroleum Corporation 265 424.8 60

50 countries and over

Deep Industries 251 343.7 37

600 customers in India

Adani Ports 272 361.6 33

over the last 3 years.

Alkem Laboratories 1695 2238 32

Exports constituted

Power Grid Corporation 183 213.8 17

~32% of sales in FY17. It

had 1,992 permanent Steady returns from the 14th edition of ‘Beat the Street 6’ published on 06/09/16

employees as on 31

March 2016. Scrip Name Recomm. Highest % Gain

Rate (Rs.) since (Rs.)

Considering the bright PPAP Automotive 159 361 127

prospects of the textile Reliance Industries 1020 1465 44

industry, WTIL Indiabulls Housing Finance 833 1135 36

established a spinning Exide Industries 190 249.7 31

unit at Baddi in NCC 88 103.75 18

Himachal Pradesh in Mahindra & Mahindra 1490 SL -

1980. Its spinning units

are equipped with the The Indian stock market offers an excellent opportunity to grow your investments. We are in the

latest machinery from middle of a bull run and the recent correction gives a good opportunity to enter or reshuffle your

Reiter, Lakshmi, portfolio. Some companies have posted fantastic Q4 numbers while some have continued their

Schlafhorst and Murata. poor performance. This is the right time to pick quality stocks before the next leg of the rally.

In order to minimise The next issue of ‘Beat the Street 6’ will be published on 12 June 2017. We will select 6 strong

contamination at the stocks that will yield handsome returns in coming days.

pre-spinning and post- So don’t wait, subscribe to ‘Beat the Street 6’ today.

spinning stages, it has For subscription & payment details, refer to the subscription form.

A Time Communications Publication 15

EMISPDF us-eyintranet from 125.16.128.202 on 2017-06-09 13:37:44 BST. DownloadPDF.

Downloaded by us-eyintranet from 125.16.128.202 at 2017-06-09 13:37:44 BST. EMIS. Unauthorized Distribution Prohibited.

installed machines like Vision Shield in Blow Room and Schlafhorst-338 with LOEPFE - 9001 (SIRO CLEANER)

Contamination Control Channel at the winding stage. Its dye house is a fully imported plant with precision winder from

SSM, dyeing vessels from Cubotex, hydro extractor from Galvanin and R/F dryer from Stalam.

During FY14, WTIL increased the total number of spindles by 63% by installing 41,088 additional spindles. Its upcoming

3.5 MW Hydro Power Project at Dharamshala in Himachal Pradesh has been commissioned in March 2017. The

Company plans to explore more Hydro Power opportunities in Himachal Pradesh for which discussions are underway

and necessary steps are being taken.

WTIL is amongst the largest

producers of Melange yarn in India

and a leading exported of processed

yarn. It provides the finest quality of

melange yarn in 100% cotton as well

as cotton blends with Viscose,

Polyester, Bamboo and Modal of

count range from Ne 12’s to Ne 60’s

both carded and combed, single and

folded for circular knitting, socks,

weaving, knitwear and various other

fabrics.

WTIL is well-equipped with state-of-

the-art machinery to produce the

finest quality of yarn. It creates

customised shades and uses Azo free

dyes and pantone colour card for

quick shade matching and reference.

It manufactures 100% cotton raw

white yarn in the count range NE 12s

to NE 40s both carded and combed,

single and folded with the use of

optimum quality cotton available in

India processed on modern plant and

machinery.

To take full advantage of the industry

value chain, WTIL has set up a

knitting segment to produce

specialized knitted products with the

latest technology of Auto striper,

which is a niche category in the

Indian market. The Company could

increase its overall margin on each

product due to the integration of

knitting production. It started

offering knitted products in FY14 and

within two years, its production has

grown at 51% CAGR.

For FY17, WTIL’s net profit climbed 25% to Rs.25.6 crore on 8% higher sales of Rs.715 crore fetching an EPS of Rs.12.9.

During Q4FY17, it incurred a net loss of Rs.4.2 crore mainly due to higher provision of tax and deferred tax of Rs.12.6

crore on 18% higher sales of Rs.197 crore.

With an equity capital of Rs.19.8 crore and reserves of Rs.163.5 crore, WTIL’s share book value works out to Rs.92.6.

Total debt is Rs.359 crore. With Cash of Rs.16 crore, loans and advances of Rs.41 crore and current assets of Rs.7 crore,

its net DER works out to 1.6:1 v/s 1.75:1 in FY16. The promoters hold 33.8% of the equity capital, Institutions hold

53.9% and FIIs hold 4.9% stake, which leaves 7.3% stake with the investing public.

The $60 bn Textile industry plays a major role in the Indian economy and contributes about 11% to industrial

production, 12% to export earnings and around 4% to the GDP of the country. The textile industry has been growing at

A Time Communications Publication 16

EMISPDF us-eyintranet from 125.16.128.202 on 2017-06-09 13:37:44 BST. DownloadPDF.

Downloaded by us-eyintranet from 125.16.128.202 at 2017-06-09 13:37:44 BST. EMIS. Unauthorized Distribution Prohibited.

10% CAGR over the last several years. Further, the Government of India has initiated a number of export promotion

policies for the Textile sector. In addition, Gujarat, Maharashtra and Madhya Pradesh offer special incentives for the

textile industry. Thus, the Indian textile industry is expected to grow to $140 bn by 2025 thereby providing huge growth

opportunities.

Overall, the outlook for the Indian textile industry looks positive. In the 12th Five Year Plan, the government has set an

export target of $65 bn at 15% CAGR along with creation of 25 mn additional jobs. The inherent strengths and cost

competitiveness of the Indian textile industry is attracting major retailers and global brands such as Wal-Mart, Target

Gap, Marks & Spencer and Tesco to set up their sourcing hubs, which augurs well for this sector.

WTIL’s margins have improved significantly with its efficient integrated model which allows it to reduce costs. It

continues to develop and modernize its infrastructure with the latest machines and also expand its skilled manpower

accordingly. It is investing in power saving programs at different levels for conservation of energy because of which its

power cost has come down significantly. It is constantly looking for new opportunities in the domestic as well as

overseas markets. It is investing in marketing to create a brand value for Winsome in the domestic as well as export

markets.

At the CMP of Rs.83.90, the stock trades at a P/E of 6.50x on FY17 earnings. A conservative P/E of 8.5x will take its share

price to Rs.110 in the medium-term fetching over 31% returns.

SPOTLIGHT

Aditya Birla Fashion & Retail Ltd: Sharp turnaround

(BSE Code: 535755) (CMP: Rs.170.30) (FV: Rs.10)

By Nehar Sakaria

Aditya Birla Fashion and Retail Ltd emerged after the consolidation of the branded apparel businesses of the Aditya Birla

group comprising Aditya Birla Nuvo’s (ABNL) Madura Fashion division and ABNL's subsidiaries Pantaloons Fashion and

Retail (Pantaloons) and Madura Fashion & Lifestyle (Madura) in May 2015. Post the consolidation, Pantaloons was

renamed as Aditya Birla Fashion and Retail Ltd (ABFRL).

ABFRL is India’s first billion dollar pure play fashion powerhouse with the widest distribution in the fashion space. Its

brands are present in ~4,500 Multi Brand Outlets (MBOs) and across all department stores through ~3,300 SISs (shop

in shop). Its brands are also available on all leading e-commerce websites in India.

Performance Review: ABFRL’s revenues have grown at

Financial Highlights: (Rs. in crore)

27% CAGR from Rs.1251 crore in FY10 to Rs.6633 crore in

FY17 while EBITDA has grown at 23% CAGR from a negative Particulars Q4FY17 Q4FY16 FY17 FY16

EBITDA of Rs.4 crore to Rs.476 crore over the same period. Revenue 1625.12 1436.23 6632.98 6034.58

PBT 21.83 -108.97 53.5 -109.75

The Company witnessed a sharp recovery post

demonetisation. For FY17, its revenue grew 10% to Rs.6633 Tax - - - -

crore. EBITDA after incorporating the costs of the new PAT 21.83 -108.97 53.5 -109.75

businesses grew 18% to Rs.476 crore while EBIT grew to EPS (Rs.) 0.28 -1.41 0.69 -1.42

Rs.233 crore from Rs.67 crore in FY16. It posted PAT of Rs.54 crore as against a loss of Rs.110 crore in FY16. During

Q4FY17, its revenue grew 13% to Rs.1625 crore from Rs.1436 crore in Q4FY16. EBITDA grew 37% to Rs.131 crore from

Rs.96 crore. It posted PAT of Rs.22 crore as against a loss of Rs.109 crore in FY16.

Outlook: After acquiring Pantaloons in FY13, ABFRL acquired Forever21 (India) rights in FY17. Pantaloons’ aggressive

expansion plans are bound to spur the Company’s top-line as new stores in cities sans branded apparel presence provide

a humungous growth opportunity. Also, targeting the currently fragmented women’s wear segment and the fast growing

fast fashion segment entails significant long-term benefits.

In May 2017, ABFRL and Khadi and Village Industries Commission (KVIC), Ministry of MSME, GoI, announced a

collaboration to strengthen the synergies between the two Indian brands. As a part of this strategic partnership, Peter

England, menswear brand from the fashion brands portfolio of ABFRL will be among the leading brands to develop an

exclusive product line branded as 'Khadi by Peter England'. The Khadi and Village Industries sale crossed the Rs.50000

crore mark during FY17. Khadi has witnessed growth in double figures over the last three years. Khadi by Peter England

will be available across ~700 Peter England stores across the country and KVIC outlets besides leading e-commerce

portals. Thus, the collaboration will significantly boost ABFRL’s top-line.

A Time Communications Publication 17

EMISPDF us-eyintranet from 125.16.128.202 on 2017-06-09 13:37:44 BST. DownloadPDF.

Downloaded by us-eyintranet from 125.16.128.202 at 2017-06-09 13:37:44 BST. EMIS. Unauthorized Distribution Prohibited.

Further, improving macros and rising brand consciousness offer a humungous growth opportunity. The domestic

branded apparel segment is set to catapult manifold riding: 1) shift from fabrics to readymade garments; 2) favourable

demographics; 3) higher discretionary spends; 4) low GDP per capita spend on apparel; and 5) increasing spends on

branded products due to growing fashion consciousness and aspirations.

Conclusion: We believe ABFRL is best placed among branded apparel peers to reap significant benefits of the improving

macroeconomic situation due to its pole position, presence in the fastest growing segments such as value and fast

fashion and an unparalleled distribution network. We have a Buy on the stock with a price target of Rs.225 for the

medium-to-long-term.

PRESS RELEASE

ECGC reduces insurance cost for exporters

ECGC Ltd, in its 60th year of operations, reduced its premium rate by ~17% for its whole turnover policy covers. The

average rate of premium under short term exporters' business has come down to 25.46 paise per Rs.100 in FY17 from

28.19 paise per Rs.100 in FY16.

ECGC is a premier Export Credit Agency (ECA) of the GoI that provides credit insurance to exporters against non-

payment risks by overseas buyers. It provides insurance covers to banks against risks in export credit lending to

exporter borrowers. Its net worth stands at Rs.3619 crore as at 31 March 2017. The value of business covered during

FY17 is over Rs.141000 crore. It currently underwrites risk on 237 countries and maintains records of about 1,25,000

active buyers all over the world.

*****

Power Grid Q4 net jumps 26%

Power Grid Corporation of India Ltd, a ‘Navratna’ Company under Ministry of Power, GoI, has posted a net profit of

Rs.7520 crore (up 26% YoY) on a turnover of Rs.26581 crore (up 25% YoY) for FY17. It crossed Rs.25000 turnover and

Rs.7500 crore PAT for the first time. For Q4FY17, its net profit climbed 22% to Rs.1916 crore from Rs.1569 crore in

Q4FY16. The Board proposed a final dividend of 33.5% for FY17 in addition to the 10% interim dividend already paid.

STOCK BUZZ

By Subramanian Mahadevan

REVIEW: Motherson Sumi Systems

GNFC Ltd: Harvest the crop! recommended at Rs.240.15 on 7

March 2016, hit a high of Rs.457.90

(BSE Code: 500670) (CMP: Rs.302.90) (FV: Rs.10) last week fetching 91% returns!

Gujarat Narmada Valley Fertilizers & Chemicals Ltd (GNFC), a joint sector

enterprise promoted by the Government of Gujarat and GSFC, was set up in Bharuch, Gujarat in 1976. It has an excellent

marketing and distribution network with pan India presence. In 1982, it set up one of the world's largest single-stream

ammonia-urea fertilizer complexes. Thereafter, it successfully commissioned projects in the fields of chemicals,

fertilizers and electronics. It has extended its product profile much beyond fertilizers through a process of horizontal

integration with the latest additions being Chemicals/Petrochemicals, Energy, Electronics/Telecommunications and

Information Technology. Its product portfolio includes Ammonia, Urea, Ammonium Nitrophosphate, Methanol, Formic

Acid and Nitric Acid, among others. Prominent shareholders of the Company include GSFC (19.82%), Gujarat State

Investments Ltd (21.39%), LIC of India (9.07%), General Insurance Corporation of India (2.92%), New India Assurance

(1.35%) and Fidelity Fund (10.91%).

GNFC is on a high growth trajectory since it aims to emerge debt-free (current outstanding debt is Rs.500 crore) by the

end of FY18, even as it plans to foray into the FMCG segment through its ‘neem’ project. Also, the Company achieved

stabilization at the Toluene Di-Isocyanate (TDI) plant with the highest ever production of TDI in its history at 52,000

tonnes and exported 22,000 tonnes of TDI to 55 countries. For FY17, its net profit zoomed 201% to Rs.521 crore

from Rs.173 crore in FY16 on a flat top-line. The Company plans to launch its neem products including hand-wash, face-

wash, shampoo and hair oil in the next two months and expects to generate ~Rs.50 crore income from this FMCG

vertical this fiscal. The stock has given phenomenal returns of over 165% since our recommendation in May 2016. It is

prudent to book profits for now and re-enter post some meaningful correction for solid returns in the years to come.

A Time Communications Publication 18

EMISPDF us-eyintranet from 125.16.128.202 on 2017-06-09 13:37:44 BST. DownloadPDF.

Downloaded by us-eyintranet from 125.16.128.202 at 2017-06-09 13:37:44 BST. EMIS. Unauthorized Distribution Prohibited.

TECHNO FUNDA

By Nayan Patel

REVIEW:

Patspin India Ltd Weizmann Forex recommended at Rs.524.20 on 17

April 2017, hit a high of Rs.658.75 last week!

(BSE Code: 514326) (CMP: Rs.22.75) (FV: Rs.10) Talbros Engineering recommended at Rs.257.90 on 12

Incorporated in 1991, Mumbai-based Patspin India Ltd (PIL) September 2016 and once again at Rs.305.85 on 27

manufactures and sells combed cotton yarns. It offers yarns February 2017, hit a high of Rs.399.6 last week!

of various counts. It also exports its products. The Company

has an equity capital of Rs.30.92 crore. The promoters hold 65% stake, which leaves 35% stake with the investing

public.

For FY17, its net profit skyrocketed 1183% to Rs.10.01 crore from Financial Performance: (Rs. in crore)

Rs.0.78 crore in FY16 on higher sales of Rs.531.54 crore fetching

Particulars Q4FY17 Q4FY16 FY17 FY16

an EPS of Rs.3.12.

Sales 138.42 116.36 531.54 496.3

For Q4FY17, ita posted sales of Rs.138.42 crore v/s Rs.116.36 PBT 8.47 0.08 13.13 0.57

crore in Q4FY16 while net profit skyrocketed 2297% to Rs.6.95

Tax 1.52 -0.21 3.12 -0.21

crore from Rs.0.29 crore fetching an EPS of Rs.2.22.

PAT 6.95 0.29 10.01 0.78

Currently, the stock trades at a P/E of just 7x and is a value buy at EPS (in Rs.) 2.22 0.06 3.12 0.07

the current level. Investors can buy this stock with a stop loss of

Rs.18.5. On the upper side, it could zoom to Rs.32-34 levels in the medium-to-long-term.

*******

Hisar Metal Industries Ltd

(BSE Code: 590018) (CMP: Rs.50) (FV: Rs.10)