Bonds - April 10 2018

Diunggah oleh

Tiso Blackstar Group0 penilaian0% menganggap dokumen ini bermanfaat (0 suara)

24 tayangan3 halamanBonds - April 10 2018

Judul Asli

Bonds - April 10 2018

Hak Cipta

© © All Rights Reserved

Format Tersedia

PDF, TXT atau baca online dari Scribd

Bagikan dokumen Ini

Apakah menurut Anda dokumen ini bermanfaat?

Apakah konten ini tidak pantas?

Laporkan Dokumen IniBonds - April 10 2018

Hak Cipta:

© All Rights Reserved

Format Tersedia

Unduh sebagai PDF, TXT atau baca online dari Scribd

0 penilaian0% menganggap dokumen ini bermanfaat (0 suara)

24 tayangan3 halamanBonds - April 10 2018

Diunggah oleh

Tiso Blackstar GroupBonds - April 10 2018

Hak Cipta:

© All Rights Reserved

Format Tersedia

Unduh sebagai PDF, TXT atau baca online dari Scribd

Anda di halaman 1dari 3

Markets and Commodity figures

10 April 2018

Total Market Turnover Statistics

Standard Turnover REPO 1 Turnover

Deals Nominal Consideration Deals Nominal Consideration

Current Day 1 326 25.65 bn Rbn 27.60 740 82.25 bn Rbn 85.00

Week to Date 1 944 44.58 bn Rbn 49.50 943 120.81 bn Rbn 124.24

Month to Date 7 260 159.17 bn Rbn 169.58 2 119 286.87 bn Rbn 296.06

Year to Date 85 516 2 740.11 bn Rbn 2 854.24 21 408 2 676.25 bn Rbn 2 726.06

Foreign Client Market Turnover Statistics

Standard Turnover REPO 1 Turnover

Party Deals Nominal Consideration Deals Nominal Consideration

Buy 74 3.65 bn Rbn 3.90 20 4.26 bn Rbn 4.13

Current Day Sell 57 2.71 bn Rbn 3.00 46 12.02 bn Rbn 13.07

Net 17 0.93 bn Rbn 0.90 -26 -7.76 bn Rbn -8.94

Buy 110 4.98 bn Rbn 5.26 28 4.45 bn Rbn 4.32

Week to Date Sell 98 4.62 bn Rbn 5.06 81 22.09 bn Rbn 23.57

Net 12 0.36 bn Rbn 0.20 -53 -17.64 bn Rbn -19.25

Buy 412 18.90 bn Rbn 19.97 98 12.93 bn Rbn 12.56

Month to Date Sell 368 20.11 bn Rbn 21.67 173 56.66 bn Rbn 60.65

Net 44 -1.21 bn Rbn -1.70 -75 -43.74 bn Rbn -48.09

Buy 6 076 352.05 bn Rbn 367.37 1 037 115.50 bn Rbn 110.57

Year to Date Sell 5 494 332.59 bn Rbn 350.23 1 356 420.47 bn Rbn 457.80

Net 582 19.46 bn Rbn 17.14 -319 -304.96 bn Rbn -347.23

Index Levels

Code Index Yield Index Previous Return MTD Return YTD

ALBI20 8.619%

All Bond Index Top 630.907

20 Composite 631.659 -0.70% 7.30%

GOVI 8.498%Split - 627.648

ALBI20 Issuer Class GOVI 628.403 -0.65% 7.00%

OTHI 8.927%

ALBI20 Issuer Class Split - 645.819

OTHI 646.570 -0.82% 8.11%

CILI15 2.309%

Composite Inflation 261.443

Linked Index Top 15 0.000 -0.63% 3.45%

ICOR 3.127%

CILI15 Issuer Class 281.523

Split - ICOR 0.000 -0.53% 3.94%

IGOV 2.269%

CILI15 Issuer Class 260.456

Split - IGOV 0.000 -0.65% 3.45%

ISOE 2.956%

CILI15 Issuer Class 258.286

Split - ISOE 0.000 0.01% 3.08%

MMI JSE Money Market Index

0 236.662 236.616 0.23% 2.10%

ALBI Constituent Bonds

Bond Issuer Maturity MTM Previous YTD Low YTD High

R159 REPUBLIC OF SOUTH

Jan 2020

AFRICA 6.940% 6.915% 6.58% 7.31%

R203 REPUBLIC OF SOUTH

Feb 2020

AFRICA 8.180% 8.155% 7.69% 8.40%

ES18 ESKOM HOLDINGS

MarLIMITED

2021 7.165% 7.145% 6.87% 7.59%

R204 REPUBLIC OF SOUTH

Jan 2023

AFRICA 8.630% 8.605% 8.35% 8.98%

R207 REPUBLIC OF SOUTH

Feb 2023

AFRICA 8.870% 8.845% 8.57% 9.19%

R208 REPUBLIC OF SOUTH

Feb 2023

AFRICA 7.520% 7.495% 7.24% 7.94%

ES23 ESKOM HOLDINGSAprLIMITED

2026 9.375% 9.355% 9.17% 9.85%

DV23 DEVELOPMENT DecBANK

2026

OF SOUTHERN

8.095% AFRICA 8.075% 7.88% 8.64%

R2023 REPUBLIC OF SOUTH

Jan 2030

AFRICA 8.485% 8.465% 8.28% 9.19%

ES26 ESKOM HOLDINGSFebLIMITED

2031 8.555% 8.535% 8.36% 9.25%

R186 REPUBLIC OF SOUTH

Mar 2032

AFRICA 8.665% 8.645% 8.46% 9.39%

R2030 REPUBLIC OF SOUTH

Sep 2033

AFRICA 10.190% 10.170% 9.96% 10.76%

R213 REPUBLIC OF SOUTH

Feb 2035

AFRICA 8.830% 8.810% 8.61% 9.58%

R2032 REPUBLIC OF SOUTH

Mar 2036

AFRICA 8.860% 8.840% 8.62% 9.52%

ES33 ESKOM HOLDINGSJanLIMITED

2037 8.925% 8.910% 8.69% 9.68%

R209 REPUBLIC OF SOUTH

Jan 2040

AFRICA 8.985% 8.970% 8.76% 9.77%

R2037 REPUBLIC OF SOUTH

Feb 2041

AFRICA 8.970% 8.955% 8.73% 9.74%

R214 REPUBLIC OF SOUTH

Apr 2042

AFRICA 10.365% 10.350% 10.13% 11.05%

R2044 REPUBLIC OF SOUTH

Jan 2044

AFRICA 9.035% 9.020% 8.80% 9.82%

R2048 REPUBLIC OF SOUTH

Feb 2048

AFRICA 9.000% 8.980% 8.76% 9.77%

Other Rates

Code Description Rate Previous YTD Low YTD High

SAFEX SAFEX Overnight Deposit Rate6.320% 6.320% 6.32% 6.56%

JIBAR1 JIBAR 1 Month 6.675% 6.675% 6.63% 6.92%

JIBAR3 JIBAR 3 Month 6.900% 6.900% 6.87% 7.16%

JIBAR6 JIBAR 6 Month 7.400% 7.400% 7.38% 7.60%

RSA 2 year retail bond 6.75% 0 0 0

RSA 3 year retail bond 7.00% 0 0 0

RSA 5 year retail bond 7.75% 0 0 0

RSA 3 year inflation linked retail

3.00%

bond 0 0 0

RSA 5 year inflation linked retail

3.25%

bond 0 0 0

RSA 10 year inflation linked retail

3.50%

bond 0 0 0

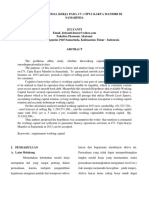

Nominal Bond Curves (NACS)

9.62

9.12

8.62

8.12

7.62

7.12 Zero

6.62 Par/Swap

6.12

5.62

5.12

4.62

2015 2020 2026 2031 2037 2042 2048 2053 2059

DATA DISCLAIMER

To the extent allowed by law, JSE Limited (the JSE) does not (expressly, tacitly or implicitly) guarantee or warrant the availability,

sequence, accuracy, completeness, reliability or any other aspect of any of the data (Data), or that any Data is up to date.

To the extent allowed by law, neither the JSE nor any of its directors, officers, employees, contractors, agents or representatives are

liable in any way to the reader or to any other natural or juristic person (Person) for any loss or damage as a result of (i) the display

of any Data in this bulltetin, or (ii) any Data being unavailable in this bulletin at any time and for any reason, or (iii) any delay,

inaccuracy, error, or omission in relation to any Data, or (iv) any actions taken or not taken by or on behalf of any Person in reliance

on any Data. The JSE is entitled to terminate the production of any Data at any time, without notice and without liability to any Person.

These figures are supplied by parties external to Business Day. Business Day will not warrant the accuracy of the figures.

Anda mungkin juga menyukai

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeDari EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifePenilaian: 4 dari 5 bintang4/5 (5794)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreDari EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You ArePenilaian: 4 dari 5 bintang4/5 (1090)

- Never Split the Difference: Negotiating As If Your Life Depended On ItDari EverandNever Split the Difference: Negotiating As If Your Life Depended On ItPenilaian: 4.5 dari 5 bintang4.5/5 (838)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceDari EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RacePenilaian: 4 dari 5 bintang4/5 (895)

- Grit: The Power of Passion and PerseveranceDari EverandGrit: The Power of Passion and PerseverancePenilaian: 4 dari 5 bintang4/5 (588)

- Shoe Dog: A Memoir by the Creator of NikeDari EverandShoe Dog: A Memoir by the Creator of NikePenilaian: 4.5 dari 5 bintang4.5/5 (537)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersDari EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersPenilaian: 4.5 dari 5 bintang4.5/5 (345)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureDari EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FuturePenilaian: 4.5 dari 5 bintang4.5/5 (474)

- Her Body and Other Parties: StoriesDari EverandHer Body and Other Parties: StoriesPenilaian: 4 dari 5 bintang4/5 (821)

- The Emperor of All Maladies: A Biography of CancerDari EverandThe Emperor of All Maladies: A Biography of CancerPenilaian: 4.5 dari 5 bintang4.5/5 (271)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)Dari EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Penilaian: 4.5 dari 5 bintang4.5/5 (121)

- The Little Book of Hygge: Danish Secrets to Happy LivingDari EverandThe Little Book of Hygge: Danish Secrets to Happy LivingPenilaian: 3.5 dari 5 bintang3.5/5 (400)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyDari EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyPenilaian: 3.5 dari 5 bintang3.5/5 (2259)

- The Yellow House: A Memoir (2019 National Book Award Winner)Dari EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Penilaian: 4 dari 5 bintang4/5 (98)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaDari EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaPenilaian: 4.5 dari 5 bintang4.5/5 (266)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryDari EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryPenilaian: 3.5 dari 5 bintang3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnDari EverandTeam of Rivals: The Political Genius of Abraham LincolnPenilaian: 4.5 dari 5 bintang4.5/5 (234)

- The Convergent Parallel DesignDokumen8 halamanThe Convergent Parallel Designghina88% (8)

- On Fire: The (Burning) Case for a Green New DealDari EverandOn Fire: The (Burning) Case for a Green New DealPenilaian: 4 dari 5 bintang4/5 (74)

- The Unwinding: An Inner History of the New AmericaDari EverandThe Unwinding: An Inner History of the New AmericaPenilaian: 4 dari 5 bintang4/5 (45)

- Danmachi Volume 15Dokumen319 halamanDanmachi Volume 15Muhammad Fazrul Rahman100% (1)

- Open Letter To President Ramaphosa - FinalDokumen3 halamanOpen Letter To President Ramaphosa - FinalTiso Blackstar GroupBelum ada peringkat

- Rise of ISIS: A Threat We Can't IgnoreDari EverandRise of ISIS: A Threat We Can't IgnorePenilaian: 3.5 dari 5 bintang3.5/5 (137)

- Shoprite Food Index 2023Dokumen19 halamanShoprite Food Index 2023Tiso Blackstar GroupBelum ada peringkat

- Ramaphosa's Letter To MkhwebaneDokumen1 halamanRamaphosa's Letter To MkhwebaneTiso Blackstar GroupBelum ada peringkat

- Arena Holdings Pty LTD - BBBEE Certificate - 2023Dokumen2 halamanArena Holdings Pty LTD - BBBEE Certificate - 2023Tiso Blackstar GroupBelum ada peringkat

- Anti Corruption Working GuideDokumen44 halamanAnti Corruption Working GuideTiso Blackstar GroupBelum ada peringkat

- Ramaphosa's Letter To MkhwebaneDokumen1 halamanRamaphosa's Letter To MkhwebaneTiso Blackstar GroupBelum ada peringkat

- Letter From Reuel Khoza Chairman of The Eskom Board 1999Dokumen2 halamanLetter From Reuel Khoza Chairman of The Eskom Board 1999Tiso Blackstar GroupBelum ada peringkat

- Collective InsightDokumen10 halamanCollective InsightTiso Blackstar GroupBelum ada peringkat

- Statement From The SA Tourism BoardDokumen1 halamanStatement From The SA Tourism BoardTiso Blackstar GroupBelum ada peringkat

- Ramaphosa's Letter To MkhwebaneDokumen1 halamanRamaphosa's Letter To MkhwebaneTiso Blackstar GroupBelum ada peringkat

- Letter From Reuel Khoza Chairman of The Eskom Board 1999Dokumen2 halamanLetter From Reuel Khoza Chairman of The Eskom Board 1999Tiso Blackstar GroupBelum ada peringkat

- JP Verster's Letter To African PhoenixDokumen2 halamanJP Verster's Letter To African PhoenixTiso Blackstar GroupBelum ada peringkat

- Sanlam Stratus Funds - June 1 2021Dokumen2 halamanSanlam Stratus Funds - June 1 2021Lisle Daverin BlythBelum ada peringkat

- FairbairnDokumen2 halamanFairbairnTiso Blackstar GroupBelum ada peringkat

- BondsDokumen3 halamanBondsTiso Blackstar GroupBelum ada peringkat

- JudgmentDokumen30 halamanJudgmentTiso Blackstar GroupBelum ada peringkat

- Tobacco Bill - Cabinet Approved VersionDokumen41 halamanTobacco Bill - Cabinet Approved VersionTiso Blackstar GroupBelum ada peringkat

- LibertyDokumen1 halamanLibertyTiso Blackstar GroupBelum ada peringkat

- Collective Insight September 2022Dokumen14 halamanCollective Insight September 2022Tiso Blackstar GroupBelum ada peringkat

- BondsDokumen3 halamanBondsTiso Blackstar GroupBelum ada peringkat

- The ANC's New InfluencersDokumen1 halamanThe ANC's New InfluencersTiso Blackstar GroupBelum ada peringkat

- Critical Skills List - Government GazetteDokumen24 halamanCritical Skills List - Government GazetteTiso Blackstar GroupBelum ada peringkat

- Forward Rates - June 30 2022Dokumen2 halamanForward Rates - June 30 2022Tiso Blackstar GroupBelum ada peringkat

- Forward Rates - June 28 2022Dokumen2 halamanForward Rates - June 28 2022Tiso Blackstar GroupBelum ada peringkat

- Fuel Prices - June 30 2022Dokumen1 halamanFuel Prices - June 30 2022Tiso Blackstar GroupBelum ada peringkat

- Forward Rates - June 29 2022Dokumen2 halamanForward Rates - June 29 2022Tiso Blackstar GroupBelum ada peringkat

- Fuel Prices - June 28 2022Dokumen1 halamanFuel Prices - June 28 2022Tiso Blackstar GroupBelum ada peringkat

- 12 Biology CBSE Sample Papers 2018Dokumen5 halaman12 Biology CBSE Sample Papers 2018Sakshi GodaraBelum ada peringkat

- Topic 4 Qualitative Lectures 3Dokumen28 halamanTopic 4 Qualitative Lectures 3JEMABEL SIDAYENBelum ada peringkat

- Aditya Man BorborahDokumen4 halamanAditya Man BorborahAditya BorborahBelum ada peringkat

- India: Labor Market: A Case Study of DelhiDokumen4 halamanIndia: Labor Market: A Case Study of DelhiHasnina SaputriBelum ada peringkat

- One Tequila, Two Tequila, Three Tequila, Floor!: The Science Behind A HangoverDokumen3 halamanOne Tequila, Two Tequila, Three Tequila, Floor!: The Science Behind A Hangoverkristal eliasBelum ada peringkat

- Tle9cookery q1 m7 Presentingandstoringarangeofappetizer v2Dokumen30 halamanTle9cookery q1 m7 Presentingandstoringarangeofappetizer v2Almaira SumpinganBelum ada peringkat

- 3D Picture: The Acts of The Apostles: A Miraculous EscapeDokumen6 halaman3D Picture: The Acts of The Apostles: A Miraculous EscapeMyWonderStudio100% (7)

- Syllabus GEd 107 Accountancy 2018 19Dokumen10 halamanSyllabus GEd 107 Accountancy 2018 19Naty RamirezBelum ada peringkat

- Towards (De-) Financialisation: The Role of The State: Ewa KarwowskiDokumen27 halamanTowards (De-) Financialisation: The Role of The State: Ewa KarwowskieconstudentBelum ada peringkat

- сестр главы9 PDFDokumen333 halamanсестр главы9 PDFYamikBelum ada peringkat

- MLOG GX CMXA75 v4.05 322985e0 UM-EN PDFDokumen342 halamanMLOG GX CMXA75 v4.05 322985e0 UM-EN PDFGandalf cimarillonBelum ada peringkat

- Al-Arafah Islami Bank Limited: Prepared For: Prepared By: MavericksDokumen18 halamanAl-Arafah Islami Bank Limited: Prepared For: Prepared By: MavericksToabur RahmanBelum ada peringkat

- Online Gaming and Social BehaviorDokumen13 halamanOnline Gaming and Social BehaviorPave Llido100% (1)

- Kebutuhan Modal Kerja Pada Cv. Cipta Karya Mandiri Di SamarindaDokumen7 halamanKebutuhan Modal Kerja Pada Cv. Cipta Karya Mandiri Di SamarindaHerdi VhantBelum ada peringkat

- EARTH SCIENCE NotesDokumen8 halamanEARTH SCIENCE NotesAlthea Zen AyengBelum ada peringkat

- The Watchmen Novel AnalysisDokumen10 halamanThe Watchmen Novel AnalysisFreddy GachecheBelum ada peringkat

- MSPM Clark UniversityDokumen27 halamanMSPM Clark Universitytushar gargBelum ada peringkat

- Fish Immune System and Vaccines-Springer (2022) - 1Dokumen293 halamanFish Immune System and Vaccines-Springer (2022) - 1Rodolfo Velazco100% (1)

- 12 Angry Men AnalysisDokumen9 halaman12 Angry Men AnalysisShubhpreet Singh100% (1)

- Students' Rights: Atty. Mabelyn A. Palukpok Commission On Human Rights-CarDokumen15 halamanStudents' Rights: Atty. Mabelyn A. Palukpok Commission On Human Rights-Cardhuno teeBelum ada peringkat

- RMK Akl 2 Bab 5Dokumen2 halamanRMK Akl 2 Bab 5ElineBelum ada peringkat

- HVAC Installation ManualDokumen215 halamanHVAC Installation Manualmeeng2014100% (5)

- Analyzing Text - Yuli RizkiantiDokumen12 halamanAnalyzing Text - Yuli RizkiantiErikaa RahmaBelum ada peringkat

- Lipoproteins in Diabetes Mellitus: Alicia J. Jenkins Peter P. Toth Timothy J. Lyons EditorsDokumen468 halamanLipoproteins in Diabetes Mellitus: Alicia J. Jenkins Peter P. Toth Timothy J. Lyons EditorsFELELBelum ada peringkat

- Kumpulan Soal UPDokumen16 halamanKumpulan Soal UPTriono SusantoBelum ada peringkat

- How To Perform A Financial Institution Risk Assessment: Quick Reference GuideDokumen15 halamanHow To Perform A Financial Institution Risk Assessment: Quick Reference GuideYasmeen AbdelAleemBelum ada peringkat

- Begc133em20 21Dokumen14 halamanBegc133em20 21nkBelum ada peringkat

- Natureview Case StudyDokumen3 halamanNatureview Case StudySheetal RaniBelum ada peringkat