Eclerx Services LTD: Initiating Coverage

Diunggah oleh

Ajay AroraJudul Asli

Hak Cipta

Format Tersedia

Bagikan dokumen Ini

Apakah menurut Anda dokumen ini bermanfaat?

Apakah konten ini tidak pantas?

Laporkan Dokumen IniHak Cipta:

Format Tersedia

Eclerx Services LTD: Initiating Coverage

Diunggah oleh

Ajay AroraHak Cipta:

Format Tersedia

eClerx Services Ltd

Initiating coverage

Enhancing investment decisions

© CRISIL Limited. All Rights Reserved.

Explanation of CRISIL Fundamental and Valuation (CFV) matrix

The CFV Matrix (CRISIL Fundamental and Valuation Matrix) addresses the two important analysis of an investment making process –

Analysis of Fundamentals (addressed through Fundamental Grade) and Analysis of Returns (Valuation Grade) The fundamental

grade is assigned on a five-point scale from grade 5 (indicating Excellent fundamentals) to grade 1 (Poor fundamentals) The

valuation grade is assigned on a five-point scale from grade 5 (indicating strong upside from the current market price (CMP)) to

grade 1 (strong downside from the CMP).

CRISIL Assessment CRISIL Assessment

Fundamental Grade Valuation Grade

5/5 Excellent fundamentals 5/5 Strong upside (>25% from CMP)

4/5 Superior fundamentals 4/5 Upside (10-25% from CMP)

3/5 Good fundamentals 3/5 Align (+-10% from CMP)

2/5 Moderate fundamentals 2/5 Downside (negative 10-25% from CMP)

1/5 Poor fundamentals 1/5 Strong downside (<-25% from CMP)

Analyst Disclosure

Each member of the team involved in the preparation of the grading report, hereby affirms that there exists no conflict of interest

that can bias the grading recommendation of the company.

Additional Disclosure

This report has been sponsored by NSE - Investor Protection Fund Trust (NSEIPFT).

Disclaimer:

This Exchange-commissioned Report (Report) is based on data publicly available or from sources considered reliable by CRISIL

(Data). However, CRISIL does not guarantee the accuracy, adequacy or completeness of the Data / Report and is not responsible for

any errors or omissions or for the results obtained from the use of Data / Report. The Data / Report are subject to change without

any prior notice. Opinions expressed herein are our current opinions as on the date of this Report. Nothing in this Report constitutes

investment, legal, accounting or tax advice or any solicitation, whatsoever. The Report is not a recommendation to buy / sell or hold

any securities of the Company. CRISIL especially states that it has no financial liability, whatsoever, to the subscribers / users of this

Report. This Report is for the personal information only of the authorized recipient in India only. This Report should not be

reproduced or redistributed or communicated directly or indirectly in any form to any other person – especially outside India or

published or copied in whole or in part, for any purpose.

© CRISIL Limited. All Rights Reserved.

Polaris Software Limited

eClerx Services

Business momentum Ltd

remains intact March 28, 2011

A KPO prodigy in the making Fair Value Rs 692

CMP Rs 641

Fundamental Grade 4/5 (Strong fundamentals)

(Superior fundamentals)

Valuation Grade 5/5 (CMP has

3/5 strong upside)

is aligned)

CFV MATRIX

Excellent

Industry Information

IT Services technology Fundamentals

5

KPO player eClerx Services Limited (eClerx) caters to the financial services

Fundamental Grade

industry and offers sales and marketing support (SMS) across retail, 4

manufacturing and travel verticals. Having grown at a much faster pace than

the industry over the past three years, eClerx continues its growth momentum 3

due to strong domain focus and high client allegiance. We assign eClerx a

2

fundamental grade of ‘4/5’, indicating that its fundamentals are ‘superior’

relative to other listed securities in India. 1

Expected to continue to outperform the industry Poor 1 2 3 4 5

While the KPO industry is expected to grow at a 16% CAGR over the next five Fundamentals

years, we expect eClerx to continue to outperform the industry due to: (a) Valuation Grade

higher growth (23% CAGR) expected from business analytics where eClerx is

Downside

Strong

Strong

Upside

an established player with a niche service offering, (b) efficient internal

processes which have helped eClerx utilise resources better, provide process

control and systemise quality, and (c) the resultant client stickiness.

KEY STOCK STATISTICS

Efficient systems at operational level sets eClerx apart from its peers NIFTY 5654

A large and dedicated IT team enables reengineering of internal processes, NSE ticker ECLERX

leading to automation of repetitive tasks. This has resulted in a broader

Face value (Rs per share) 10

employee pyramid and lower average employee costs. Also, eClerx is open to

Shares outstanding (mn) 28.8

sharing the benefits of efficiency improvements with its clients which results in

Market cap (Rs mn)/(US$ mn) 18,481/411

increased client allegiance and higher share of annuity-based contracts.

Enterprise value (Rs mn)/(US$ mn) 18,008/401

Client concentration and currency exposure risks exist 52-week range (Rs) (H/L) 799/435

eClerx’s top five clients contribute ~85% of the company’s total revenues. This Beta 0.95

dependence exposes the company to the risk of client concentration - any loss Free float (%) 40.6%

(in part or whole) in any of its top client accounts could severely impact Avg daily volumes (30-days) 37,921

eClerx’s revenue growth and profitability. Further, ~100% offshore presence Avg daily value (30-days) (Rs mn) 24.8

exposes eClerx to currency volatility (US$ -75% and Euro - 20% of revenues).

SHAREHOLDING PATTERN

Expect three-year revenue CAGR of 29%

100%

We expect revenues to register a three-year CAGR of 29% to Rs 5.5 bn in 90% 18.1% 13.6% 15.1% 14.4%

FY13 driven by growth in the top five client accounts across verticals. EBITDA 80% 11.2% 10.1% 9.2%

7.8%

margin is expected to stabilise from ~39% in FY10 to ~35% in FY13 once the 70% 15.4% 15.3% 17.1%

14.2%

company ramps up its onsite presence. EPS is expected to rise at a three-year 60%

CAGR of 28% to Rs 53.2 in FY13. 50%

40%

Valuations – the current price is ‘aligned’ with fair value 30% 60.0% 59.8% 59.6% 59.4%

CRISIL Equities has used the price to earnings ratio (PER) method to value 20%

eClerx. Based on a PER of 13x FY13E EPS of Rs 53.2, we have arrived at a fair 10%

value of Rs 692 per share. We initiate coverage on eClerx with a valuation 0%

Mar-10 Jun-10 Sep-10 Dec-10

grade of ‘3/5’.

Promoter FII DII Others

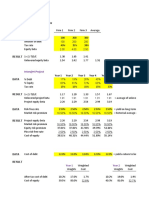

KEY FORECAST PERFORMANCE VIS-À-VIS MARKET

(Rs mn) FY09 FY10 FY11E FY12E FY13E Returns

Operating income 1,973 2,570 3,393 4,369 5,469 1-m 3-m 6-m 12-m

EBITDA 815 1,004 1,301 1,596 1,908 ECLERX -3% -6% 26% 81%

Adj Net income 618 735 1,230 1,399 1,535 NIFTY 7% -6% -6% 7%

Adj EPS-Rs 21.4 25.5 42.7 48.5 53.2

ANALYTICAL CONTACT

EPS growth (%) 38.6 19.0 67.2 13.8 9.7

Chetan Majithia (Head) chetanmajithia@crisil.com

PE (x) 29.9 25.1 15.0 13.2 12.0

Chinmay Sapre csapre@crisil.com

P/BV (x) 11.2 9.2 7.1 5.7 4.7

RoCE (%) Suresh Guruprasad sguruprasad@crisil.com

48.6 51.1 52.7 50.5 49.6

RoE (%) 41.4 40.2 53.3 47.8 42.8 Client servicing desk

EV/EBITDA (x) 13.6 10.9 12.9 10.2 8.2 +91 22 3342 3561 clientservicing@crisil.com

Sou rce: Com pan y, CR I SIL Equ it ies est im ate

NM: Not meaningful; CMP: Current Market Price

© CRISIL Limited. All Rights Reserved. CRISIL EQUITIES | 1

eClerx Services Ltd

Table 1: eClerx: Business environment

Product / Segment Financial Services Sales and Marketing support (SMS)

Revenue contribution (FY10) ~50% ~50%

Product / service offering • Capacity planning, business analysis and • Web and ecommerce operations support

process management • Data management services and business

• Trade life cycle management performance reporting

• Risk reporting and legal contract review • Competitive pricing and benchmarking

• Data management • Analytics and business intelligence

• Finance and accounting • Quality compliance and governance

• Systems migration, software design and • Digital business process consulting

development

Number of employees ~45% of the total of 3,527 employees ~55% of the total of 3,527 employees

(end of Q3FY11)

Geographic presence Serves clients in the US, UK and Asia-Pacific with service delivery from centres in India

Acquisitions -- FY08- Igentica, UK-based company operating

in the travel and hospitality vertical

Market position Tier I service provider

Demand drivers • Increased demand for outsourcing due to • Increasing demand for online business

cost pressures models from the traditional brick and

• Deeper client penetration leading to mortar businesses

outsourcing of other allied services • Increased demand for outsourcing due to

• With US moving out of recession and capital cost pressures

markets on the rebound, there will be • Penetrating large MNC clients in different

increased demand for KPO services geographies

• Offshore captives looking to outsource

complex processes

Key clients Large global investment banks Retail, travel, hi-tech manufacturing,

healthcare and media and entertainment

companies

Key competitors Wipro BPO, Infosys BPO, MNC captives MuSigma, Accenture, Capgemini, Wipro BPO,

MNC captives

Key risks • Advances in technology rendering some of the outsourced processes redundant

• Inability to attract and retain talent at an reasonable cost

• No effective business continuity (disaster management) plan in place for Eclerx

• Regulatory changes in the US, Europe affecting the outsourcing business

Sou rce: Com pan y, CR I SIL Equ it ies

© CRISIL Limited. All Rights Reserved. CRISIL EQUITIES | 2

eClerx Services Ltd

Grading Rationale

Consistently outperformed the industry

Having started as a small web-based developer in 2000, over the years eClerx

has metamorphosed into a big-league KPO (knowledge process outsourcing) Vertical: Financial services

player. It caters to the financial services vertical - conducts middle and back Horizontal: Sales and

office operations - and offers sales and marketing support - business analytics marketing support

and market research - to retail, travel and manufacturing clients worldwide.

Over the past three years, eClerx’s revenue growth of 44% CAGR was

significantly higher than 20% CAGR of Indian KPO industry. However, the

growth has been from a smaller base than for companies like Genpact (CY10

revenues of US$ 1,259 mn) and WNS Global (FY10 revenues of US$ 583 mn). In

FY10, when the industry logged 6% growth in the backdrop of the global

slowdown, eClerx clocked a robust top line growth of 30%.

Figure 1: Faster growth than that of peers over FY07-10

50%

Three-year

CAGR

40%

30%

44%

20% 39%

33%

27%

10% 19% 21% 20%

15% 18%

15%

0%

Genpact

Datamatics

Aditya Birla Minacs

eClerx Services

Infosys BPO

Firstsource

Wipro BPO share

EXL Services

WNS Global

Indian KPO industry

Source: CRISIL Research, CRISIL Equities

Growth maintained even after bankruptcy of top client

eClerx displayed strong resilience even after the bankruptcy of Lehman Undeterred by client

Brothers, its top financial services client, in FY09. Growth was affected for a bankruptcy amid high

couple of quarters but eClerx still managed to increase its revenues by ~40% in client concentration

FY09 while maintaining margins. eClerx continues to provide services to

Lehman’s acquirer. We believe this reflects the company’s strong domain

expertise, client stickiness and quality of service delivery.

© CRISIL Limited. All Rights Reserved. CRISIL EQUITIES | 3

eClerx Services Ltd

Figure 2: Growth back on track in just a couple of quarters

90% 20.0%

83% 84%

85% 81% 82%

77% 78% 15.0%

80% 15.5%

13.2%

75%

8.9% 10.0%

70%

65% 6.5% 5.0%

6.0%

60% 1.9%

0.0%

55% 58%

Lehman bankruptcy

50%

-5.0%

-4.5%

45%

40% -10.0%

Q2FY09 Q3FY09 Q4FY09 Q1FY10 Q2FY10 Q3FY10 Q4FY10

Top 5 client contribution q-o-q growth % (RHS)

Source: Company, CRISIL Equities

Well positioned to benefit from KPO segment growth

As per CRISIL Research, while demand for overall KPO services is expected to

grow at a 16% CAGR over the next five years, the analytics segment, where

eClerx is present, will grow at ~23% over the same period. The large and mid-

sized corporations’ focus on data analytics to accelerate revenue growth,

optimise costs and differentiate themselves from competitors is expected to

boost revenues from analytics to US$ 600 mn in 2014-15.

eClerx not only has a niche service offering for some of the large Fortune/FT 500

Has 19 Fortune/FT 500

companies but is also an established provider of analytical services for complex

companies as its

processes. Given its penetration into top investment banks (nine of the top 14

customers

banks as its clients) and large IT companies, manufacturers and online retailers,

we expect it to benefit from growth in this segment.

Figure 3: Indian knowledge services exports growth

US$ bn

Increasing demand from

2.5

16% CAGR market research, legal

2 processes outsourcing

and business analytics in

1.5

2.4

the retail and consumer

1

products, healthcare and

0.5 1.1 1.2 BFSI verticals likely to

0.9

0.7

boost growth

0

FY07 FY08 FY09 FY10E FY15P

Source: CRISIL Research

© CRISIL Limited. All Rights Reserved. CRISIL EQUITIES | 4

eClerx Services Ltd

KPO billing rates but BPO costs = higher profits

Thanks to technology

While the billing rates are the function of external environment, the key

profitability differentiator lies in managing the employee costs effectively. In a

competitive environment, the USP of eClerx lies not only in how it manages its

growth but also how efficiently it manages the operations.

• Information technology, a key differentiator: eClerx has been

successful in using IT not only as an enabler but as a differentiator too.

eClerx has an indigenous IT team of over 150 professionals (~ 5% of the

total workforce) exclusively for improving the efficiency of process delivery.

This team, much larger than some of its peers, develops in-house software

tools to re-engineer the delivery of services rather than follow the common

‘lift and shift’ of existing processes of its clients. eClerx automates

processes that are repetitive in nature and require minimal human ~80% of billable

intervention. employees are graduates

• Broad employee pyramid: The next layer of processes is handled by the

execution team consisting mostly of graduate analysts and senior analysts.

Client interaction for eClerx is at the process manager level unlike other

KPOs where the same is at the analyst level. This reduces the deployment

of high skilled employees and lowers average employee cost. At the

operational level, the company has an employee mix of 1:3:12 (figure 4) –

this mix results in about 80% of the employees with 0-2 years of

experience. The judgemental decisions remain within the smaller domain of

process managers. With 40% attrition at the lower levels, the company can

adeptly manage employee costs.

• Strong KM system and training plans to manage attrition: eClerx has

a dedicated knowledge management (KM) system, institutionalising the

Effective processes help

knowledge gained from internal experts, client programs and industry

tackle attrition and

initiatives into modular training programs. The company conducts ~1,800

deployment of resources

training courses and associated tests, administered and evaluated through a

quickly

managed training program. Thus, it is able to keep a check on attrition and

helps in quick deployment of billable human resources on live projects.

© CRISIL Limited. All Rights Reserved. CRISIL EQUITIES | 5

eClerx Services Ltd

Figure 4: Broader base of employee pyramid

High

Senior

A senior manager oversees 2

managers

Process managers

(MBAs from Tier I)

Skills required

Process managers and A process manager overlooks

Assistant process managers (APM) 2-3 APMs

(MBAs from Tier I and II)

An APM overlooks 10-12

analysts and senior

Low Senior Analysts and Analysts analysts

(Mostly graduates and undergraduates)

Source: Company, CRISIL Equities

Improving the efficiency of the internal systems has helped eClerx reduce

headcount at the managerial level, utilise resources better, provide process

control and systemise quality. Some of the tools have been adapted to service

the needs of multiple customers in a single industry allowing the company to

gain efficiencies of scale. eClerx has consistently operated at ~40% EBITDA

margin and a RoE of more than 40% over FY08-10. We expect the investment in

technology and reengineered processes will continue to hold the company in

good stead.

Figure 5: Efficient processes result in higher profitability

FY10 ROE

45% eClerx

Three-year revenue CAGR

10%

FY10 EBITDA 45%

margin

EXLService

Genpact

Firstsource

Solutions

WNS Global 0%

Source: Company, CRISIL Equities

© CRISIL Limited. All Rights Reserved. CRISIL EQUITIES | 6

eClerx Services Ltd

Sharing technology benefits leads to client

stickiness

eClerx, since its inception in 2000, has been associated with marquee clients.

The company has grown on the back of:

1. Ability to acquire such large clients

2. Retain them with superior delivery of non-discretionary services

3. Mining to grow them into large accounts.

eClerx has been transparent with its clients with regard to sharing the benefits

from increased used of automation. Generally, the tools developed by eClerx are Has been able to bag

deployed on client systems, giving them direct access to process results. annuity contracts

Increased efficiency has in some cases reduced the FTE (full-time equivalent

employee) requirement for certain tasks. Although this affects revenues in the

near term, it helps fetch more business from the customers improving

stickiness. As a result, the company has been able to bag new non-RFP based

contracts from them. This lends eClerx the ability to enter into two-three year

rolling contracts with its clients, offering high revenue visibility.

Figure 6: Geared up for growth

TECHNOLOGY

PEOPLE

1- Service

delivery with

increased

automation KNOWLEDGE

MANAGEMENT

2- Sharing

of benefits

with clients

improves

stickiness

3- Increased

orders form

existing large

cleints with

annuity

contracts

Source: Company, CRISIL Equities

But client concentration risk remains

Having mentioned that eClerx has an established relationship with its clients, we

cannot overlook the fact that its top five clients contributed more than 75% of

Collapse of one of its top

revenues in FY08-10. But dependence on large clients exposes the company to

clients could have been a

client concentration risks. The collapse of Lehman Brothers in 2008 (one of

potential roadblock

eClerx’s large clients) was a major threat to the company’s growth but it

managed to emerge unscathed.

Given the size of the company, the top five clients - in absolute terms - will still

provide a significant potential for additional business. While eClerx will try to

grow its smaller clients, the top five will continue to grow at a similar pace.

Considering the business model, we expect the client concentration to continue

© CRISIL Limited. All Rights Reserved. CRISIL EQUITIES | 7

eClerx Services Ltd

in the medium term. Thus, any loss (in part or whole) in any of its top five client

accounts could severely impact eClerx’s revenue growth and profitability.

Figure 7: Contribution of top five clients

90%

85%

Has always been above

75%; will continue to

80% remain at such high

87%

levels

82%

81%

75%

75%

70%

FY08 FY09 FY10 9MFY11

Source: Company, CRISIL Equities

Figure 8: Comparison with peers

Revenue contribution from Top 5 clients - FY10

100%

eClerx eClerx’s revenue

contribution from top five

Three-year revenue CAGR clients higher than peers

10% 45%

EXLservice

WNS Global

Firstsource

Solutions

Genpact

40%

Source: Company, CRISIL Equities

Cross-selling opportunities could provide an upside

With ample room to grow, eClerx is looking to garner more business from its

larger clients.

1- Across business units: eClerx provides operational support to clients in

MNC clients present

the financial services vertical and web-based sales analytics across verticals

opportunity for extension

in the SMS segment. The strong client relationships in both the verticals

of services

provide eClerx with cross-selling opportunities. It can draw upon its

experience in the financial services vertical to provide similar services to its

clients in the SMS business unit and vice-versa.

2- Across geographies: Most of eClerx’s clients are large multinational

companies which presents eClerx with opportunities to extend the services for

these clients across various geographies.

© CRISIL Limited. All Rights Reserved. CRISIL EQUITIES | 8

eClerx Services Ltd

Key risks

Offshore operations expose eClerx to currency risks

eClerx derives over 95% of its revenues from the US, Europe and the UK.

Rupee appreciation to

However, a majority of its costs are incurred from its offshore delivery centres in

impact EBITDA margin

India. This exposes a major portion of the company’s earnings to currency risks.

The company maintains a hedging strategy to enter into forward contracts to

cover forex risks. CRISIL Research expects the Indian rupee to appreciate to Rs

43.5-44.0 in FY11 and Rs 42.5-43.0 in FY12 against the dollar. Any further

appreciation of the Indian rupee could impact the expected improvement in

EBITDA margin. Our analysis indicates that every 1% appreciation in the

Indian rupee will lead to a ~50 bps decline in our FY12 EBITDA margin

forecast.

Figure 9: High offshore delivery share increases currency risk

100% 5% 4% 3%

90%

18% 23% 21%

80%

70%

60%

50%

40% 76% 73% 75%

30%

20%

10%

0%

FY09 FY10 9MFY11

USD EURO GBP

Source: Company, CRISIL Equities

Change in regulations

Recently, the US government enacted the Dodd-Frank Wall Street Reform and

Consumer Protection Act which propose an increase in regulations governing the

US financial markets. The impact of the act on ability to outsource middle and

back office work is uncertain. It may force clients in the BFSI vertical to modify

existing processes that eClerx currently manages. The implications of the

regulatory changes will remain a key monitorable in the near term.

ITes business susceptible to global economic cycles

eClerx derives ~60% of its revenues from the US and ~35% from Europe. Any

economic slowdown/slow recovery in these regions could act as a deterrent to

the company’s growth.

Exposed to industry-wide risk of attrition

eClerx has historically operated at attrition levels of ~35-40% which is at

average industry levels. Although such levels of attrition have helped the

company manage employee costs, tackling the same on a larger employee base

could be increasingly taxing for the management bandwidth. eClerx’s ability to

maintain attrition within tolerable limits will remain a key monitorable.

© CRISIL Limited. All Rights Reserved. CRISIL EQUITIES | 9

eClerx Services Ltd

Ability to integrate acquisition

eClerx has planned an acquisition over the next 12-18 months. The company is

looking at targets with revenues in the US$ 20-40 mn range and a purchase

price of US$ 50-80 mn. While the company has successfully integrated its

acquisition of Igentica in FY08, its ability to integrate relatively large acquisitions

remains a key monitorable.

© CRISIL Limited. All Rights Reserved. CRISIL EQUITIES | 10

eClerx Services Ltd

Financial Outlook

Revenues to grow at three-year CAGR of 29%

We expect eClerx’s revenues to grow at a CAGR of 29% to Rs 5.5 bn in FY13

from Rs 2.6 bn in FY10, driven by growth in the major client accounts across

both the financial services and SMS verticals.

Figure 10: Strong revenue growth trajectory

(Rs mn)

6,000 70%

62%

60%

5,000 Revenue growth driven by

50% growth in major client

4,000 41%

40%

accounts across both the

32%

3,000 30% 29%

25%

verticals

30%

2,000

20%

1,000

10%

1,217 1,973 2,570 3,393 4,369 5,469

0 0%

FY08 FY09 FY10 FY11E FY12E FY13E

Revenues growth % (RHS)

Source: Company, CRISIL Equities

To continue to operate at high EBITDA margin

The financial services as well as SMS business units operate at the company’s

Increase in onsite delivery

average EBITDA margin. eClerx has operated at EBITDA margins of over 40% in

along with pricing

the past on account of

pressures to stabilise

1. High-margin analytical services

EBITDA margin

2. Efficient delivery on account of technological capabilities

3. Nearly 100% offshoring

The company, to expand its service portfolio and provide end-to-end services,

plans to set up an onsite delivery team in addition to the existing offshore

delivery. This is likely to increase employee cost amid pricing pressure.

Accordingly, we expect the EBITDA margin to stabilise by FY13. However, the

company will still continue to operate at ~35% EBITDA margin which would be

still above average industry levels.

© CRISIL Limited. All Rights Reserved. CRISIL EQUITIES | 11

eClerx Services Ltd

Figure 11: EBITDA margin to stabilise over next two years

(Rs mn)

2,500 60%

2,000

50%

1,500 40% 41%

39% 38%

37% 40%

35%

1,000

30%

500

492 815 1,004 1,301 1,596 1,908

0 20%

FY08 FY09 FY10 FY11E FY12E FY13E

EBITDA EBITDA Margin (RHS)

Source: Company, CRISIL Equities

PAT to grow at a three-year CAGR of 28%, EPS to

increase from Rs 25.5 in FY10 to Rs 53.2 in FY13

eClerx’s PAT is expected to grow from Rs 735 mn in FY10 to Rs 1,535 mn in Forward contracts worth

FY13, primarily driven by a strong growth in revenues. Also, the company will US$ 37 mn at Rs 47.7

not raise debt as capex will be funded through internal accruals, eliminating over FY12

interest payments. We expect eClerx to benefit from the forward contracts it has

entered into over FY12 and to increase other income.

We expect the company’s tax rate to increase as eClerx will have to start paying

Increasing tax rates to

MAT on SEZ revenues as per the new budget guidelines. We have not factored in

impact PAT margin

any favourable gains from forex hedges in FY13. Accordingly, the PAT margin is

expected to decline to 28.1% in FY13 from ~36% in FY11. In line with the PAT

growth, EPS is expected to increase from Rs 25.5 in FY10 to Rs 53.2 in FY13.

Figure 12: PAT margin to decline to 28% in FY13 Figure 13: EPS to increase at a CAGR of 28%

(Rs mn) (Rs)

1,800 50% 60 80%

67%

1,600 70%

50

1,400 37% 60%

36% 40%

1,200 40

31% 32% 50%

39%

1,000 29% 28%

30% 30 40%

800

30%

600 20

20% 20%

400 14% 10%

10 19%

10%

200

446 618 735 1,230 1,399 1,535 15.5 21.4 25.5 42.7 48.5 53.2

0 10% 0 0%

FY08 FY09 FY10 FY11E FY12E FY13E FY08 FY09 FY10 FY11E FY12E FY13E

PAT PAT Margin (RHS) EPS growth % (RHS)

Source: Company, CRISIL Equities Source: Company, CRISIL Equities

© CRISIL Limited. All Rights Reserved. CRISIL EQUITIES | 12

eClerx Services Ltd

High dividend paying stock with high RoE

Historically, eClerx has been a high dividend paying stock with a payout ratio of

above 40%. In July 2010, eClerx also declared a 2:1 bonus for its shareholders.

It would also out pay excess cash as dividend if acquisition plans do not

materialise over the next 12-18 months. High PAT margins along with high

dividend payouts would continue to result in RoEs of over 40% over the next

three years.

Figure 14: High dividend payout contributing to... Figure 15: ... high RoE over the years

(Rs) 60%

35 70%

30 50%

60%

25 55% 55% 40%

53%

20

30%

50% 55%

45% 50% 53%

15 43% 48%

20% 41% 40% 43%

10

40%

10%

5

6 10 14 21 27 29

0 30% 0%

FY08 FY09 FY10 FY11E FY12E FY13E FY08 FY09 FY10 FY11E FY12E FY13E

Dividend per share Dividend payout (RHS)

Source: Company, CRISIL Equities Source: Company, CRISIL Equities

© CRISIL Limited. All Rights Reserved. CRISIL EQUITIES | 13

eClerx Services Ltd

Management Overview

CRISIL's fundamental grading methodology includes a broad assessment of

management quality, apart from other key factors such as industry and business

prospects, and financial performance.

Demonstrated significant growth despite adverse

environment

eClerx management have demonstrated strong growth despite adverse market

Promoted by Mr P. D.

conditions. eClerx has grown at a CAGR of 57% over the last five years. This

Mundhra and Mr Anjan

was mainly due to strong management team headed by Mr P. D. Mundhra, co-

founder and executive director, and Mr Anjan Malik, co-founder and director. Mr

Malik

Mundhra has entrepreneurial experience in material handling products and has

set up the consumer products manufacturing plant for Hindustan Unilever Ltd.

Both of them have worked with Lehman Brothers in the past which was one of

the first major clients acquired by the company. Mr Malik was involved in the

Lehman-Wharton partnership that created the Wharton India Economic forum.

Senior management ramped up at onsite locations

eClerx utilised the slowdown during FY09-10 to ramp up its onsite senior

management team. eClerx now plans to invest a significant portion of its

management bandwidth in scaling up its sales and marketing activities. The

increased focus on acquiring/growing an existing client outside the top five will

also help the company mitigate client concentration risk. The onsite senior

management team includes personnel who have over 15 years of core domain

experience in Fortune 500 companies.

Entrepreneurial setup with strong second line

The management has adopted a professional approach towards managing the

company. eClerx has a fairly strong and experienced second line of management

with 8-10 years of relevant work experience. Based on our interaction, we feel

the management is capable and has been given reasonable autonomy to take

independent decisions.

© CRISIL Limited. All Rights Reserved. CRISIL EQUITIES | 14

eClerx Services Ltd

Corporate Governance

CRISIL’s fundamental grading methodology includes a broad assessment of

corporate governance and management quality, apart from other key factors

such as industry and business prospects, and financial performance. In this

context, CRISIL Equities analyses the shareholding structure, board composition,

typical board processes, disclosure standards and related-party transactions.

Any qualifications by regulators or auditors also serve as useful inputs while

assessing a company’s corporate governance.

Overall, corporate governance at eClerx conforms to regulatory requirements

Corporate governance

supported by reasonably good board practices and an independent board.

practices are good

Board composition

eClerx’s board consists of eight members, of whom four are independent

directors, as per the requirement under Clause 49 of SEBI’s listing guidelines.

The directors have strong industry experience and are highly qualified. Given the

background of directors, we believe the board is well experienced. The

independent directors have a fairly good understanding of the company’s

business and its processes.

Board’s processes

The company’s quality of disclosure can be considered good judged by the level

of information and details furnished in the annual report, websites and other

publicly available data. The company has all the necessary committees – audit,

remuneration, and investor grievance - in place to support corporate governance

practices. All the committees are chaired by independent directors.

© CRISIL Limited. All Rights Reserved. CRISIL EQUITIES | 15

eClerx Services Ltd

Valuation Grade: 3/5

We have used the price to earnings ratio (PER) method to value eClerx. We have

assigned a fair value of Rs 692 per share based on a PER of 13x on FY13E Fair value Rs 692 per

earnings of Rs 53.2 per share. The stock is currently trading at Rs 641 per share

share. Consequently, we initiate coverage on eClerx with a valuation grade of

‘3/5’, indicating that the current market price is ‘aligned’ with the fair value.

Undergone a re-rating

The stock has traded at an average P/E multiple of 7.8x post its listing in 2008.

However, it has gone through a re-rating after recovering from the bankruptcy

of its top client (Lehman Brothers). eClerx has traded at an average P/E multiple

of 12x in FY11.

We expect the discount with peers to narrow down further

eClerx is currently trading at a discount to larger global peers like Genpact and

EXL Service, who are trading at 15-16x FY12 earnings. While the discount has

narrowed down (it was ~80% in FY08, ~60% in FY10 and now ~20%) over the

years due to faster earnings growth along with sustainable margins, we believe

the current discount factors in the following concerns:

1. Sustainability of margins as the company grows in size

2. The tax rate for the company in FY11 is ~12% and expected to increase to

~20% over FY12-13. Going forward, with increasing tax rates, PAT growth

is expected to lag behind revenue growth. The same is not true for the

peers as most of them are already paying higher taxes

3. eClerx has a greater proportion of offshore employees compared to its

peers, exposing the company to higher currency risks

However, there is potential for eClerx’s multiple to expand (or discount to

narrow), albeit scarcely, due to following:

1. eClerx has a higher RoE (~50%) compared to peers’ ~12-15%

2. Better earnings growth expected (28% three-year CAGR) compared to

peers’ ~12%

3. More importantly, we expect the company to clock US$ 100 mn in revenues

by FY12 which would provide comfort to existing clients and help tap newer

clients due to stronger balance sheet.

Accordingly, we believe eClerx would continue to trade at a discount to its larger

peers and have assigned a P/E multiple of 13x.

Peer comparison

Companies Currency M cap Price/earnings (x) EV/EBITDA (x) RoE (%)

(Rs mn) FY10 FY11E FY12E FY10 FY11E FY12E FY10 FY11E FY12E

eClerx Services Ltd Rs 18,481 25.1 15.0 13.2 10.9 12.9 10.2 40.2 53.3 47.8

Genpact US $ 3,013 18.5 17.5 15.1 11.1 9.8 8.4 12.0 23.2 9.0

WNS Global services US $ 465 9.1 10.4 9.3 7.0 8.7 7.9 2.1 3.8 3.7

EXL Service Ltd US $ 589 19.0 18.3 15.8 11.1 9.4 7.9 11.0 10.3 10.8

Firstsource Solutions Ltd Rs 7,076 6.8 6.4 5.1 7.2 6.8 5.7 8.2 9.0 10.3

Sou rce: CR ISIL Equ it ies

© CRISIL Limited. All Rights Reserved. CRISIL EQUITIES | 16

eClerx Services Ltd

Figure 16: Would continue to trade at a discount despite a

narrower gap

35

30

25

20

15

10

0

Nov-08

Jan-09

Nov-09

Jan-10

Nov-10

Jan-11

May-09

May-10

Jul-08

Mar-09

Jul-09

Mar-10

Jul-10

Mar-11

Sep-08

Sep-09

Sep-10

Genpact Ltd Exlservice Holdings Inc

Firstsource Solutions Ltd Eclerx Services Ltd

Source: NSE, CRISIL Equities

One-year forward P/E band One-year forward EV/EBITDA band

(Rs) (Rs mn)

800 14,000

700 12,000

600

10,000

500

8,000

400

6,000

300

4,000

200

100 2,000

0 0

May-08

Feb-09

Feb-10

Feb-11

May-08

Feb-09

Feb-10

Feb-11

Mar-08

Jul-08

Dec-08

Dec-09

Dec-10

Mar-08

Jul-08

Dec-08

Dec-09

Dec-10

Oct-08

Jun-09

Aug-09

Oct-09

Jun-10

Aug-10

Oct-10

Oct-08

Jun-09

Aug-09

Oct-09

Jun-10

Aug-10

Oct-10

Apr-09

Apr-10

Apr-09

Apr-10

eClerx Services 3x 6x 9x 12x 15x EV 2x 4x 6x 8x

Source: NSE, CRISIL Equities Source: NSE, CRISIL Equities

P/E – premium / discount to NIFTY P/E movement

40% 18

16

20%

14

0% 12

+1 std dev

-20% 10

8

-40%

6

-60%

4 -1 std dev

-80% 2

-100% 0

Jun-09

Jun-10

May-08

Feb-09

Feb-10

Feb-11

Mar-08

Jul-08

Oct-08

Dec-08

Aug-09

Oct-09

Dec-09

Aug-10

Oct-10

Dec-10

Apr-09

Apr-10

Jun-09

Jun-10

May-08

Feb-09

Feb-10

Feb-11

Mar-08

Jul-08

Oct-08

Dec-08

Aug-09

Oct-09

Dec-09

Aug-10

Oct-10

Dec-10

Apr-09

Apr-10

Premium/Discount to NIFTY Median of premium discount to NIFTY 1yr Fwd PE (x) Average PE

Source: NSE, CRISIL Equities Source: NSE, CRISIL Equities

© CRISIL Limited. All Rights Reserved. CRISIL EQUITIES | 17

eClerx Services Ltd

Company Overview

Mumbai-based eClerx Services Ltd is a KPO company that services its global

clients through two major segments – financial services and sales and marketing

support. It serves over 50 active customers of which 19 are Fortune/FT 500

companies. Its clients include nine of the 12 Federal Reserve banks, nine of the

top 14 global investment banks and five of the top 15 retailers. Most of the

operations are executed out of the six delivery centres in India, where it

employs ~3,500 people. It has sales offices in London, New York, Austin, Dublin

and Singapore. Real-time support is provided to clients in the Americas, Europe

and Asia Pacific.

Services across the two verticals include:

1. Financial services: Services are provided to support financial transactions

from trade closing through to settlement, clearing and exposure

management, reference data and risk management. Services also include

financial control, accounting and reporting and consulting related to

efficiency improvement, risk reduction and regulatory compliance.

2. Sales and marketing support: eClerx specialises in supporting digital

activities through content development, online performance optimisation

and customer experience management. It also provides operational,

reporting data management, pricing, quality compliance and analytics

outsourcing solutions for sales and marketing managers managing online

operations and marketing campaigns.

Table 2: Service lines

Capital markets Sales and marketing support

Consulting: Process review, capacity planning, project Web and ecommerce operations support: Content

management, business analysis management, ecommerce product-price management,

customer experience management, online advertising support,

social media support

Front, middle, back office services: Full trade life cycle Data management services and reporting: Lead and bid

management including trade booking, documentation, asset management, sales and CRM data enrichment, production data

servicing, clearing, settlement and exposure management management, order support and business performance

reporting

Risk management: Legal contract review and reconciliation, risk Competitive pricing and benchmarking: Price and catalogue

benchmarking, product matching and category analysis,

reporting and compliance related services

competitor benchmarking and pricing recommendations

Reference data management: Management of sourcing, Analytics and business support: Web and market analytics,

normalizing, regulatory compliance, product and pricing data channel and vendor management, customer analytics and

campaign management, customer segmentation and scoring

Finance and accounting: Basel‐II compliance, expense Quality compliance: Quality assurance program, brand

management, accounts payable management and reporting compliance , vendor funding compliance and rebate

management

Ancillary services: Specialised services such as systems migration, Digital business process consulting: Process discovery analysis,

metrics design and management, software design, software process transition management and process recommendations

development

Sou rce: Com pan y, CR I SIL Equ it ies

© CRISIL Limited. All Rights Reserved. CRISIL EQUITIES | 18

eClerx Services Ltd

Table 3: Client profile

Segment Clients

IT hardware, software & services distribution Three of the world’s largest distributors

Investment banking Nine of the top 14 investment banks

High tech manufacturing One of the world’s largest computer manufacturers

Computer hardware Two of top six computer hardware manufacturers

Pharmacies & general merchandise retail Five of the largest bricks & mortar and online retailers in UK & US

Travel & leisure Two of the world’s top 5 integrated travel companies

Maintenance, repair, operations Market leading North American distributor of MRO supplies

Media & entertainment Two of the world’s largest top media / entertainment companies

Sou rce: Com pan y, CR I SIL Equ it ies

Milestones

2000 Incorporated as eClerx Services Ltd

2001 Sales office established in Austin, USA

2004 Offshore delivery centre established in Sewri (Mumbai)

2006 Obtained ISO 27001 certification

Started second delivery centre in Ghatkopar (Mumbai)

2007 Acquired Igentica group

Third delivery centre established in Ghatkopar, Mumbai

2008 Became a public-listed company and the first KPO to be listed on the NSE

and BSE

Fourth delivery centre set up in Pune

Listed among ‘Top 200 under a billion’ companies by Forbes magazine

2009 Set up sales office in New York, USA

Ranked as one of the ‘100 fastest growing companies in India’ by The

Economic Times

2010 Fifth delivery centre set up in Navi Mumbai.

Featured in the ‘Business Today 500’ list of India’ s largest public

companies

Among top 20 global outsourcing firms in Black Book of Outsourcing

2011 Joined the WAA (Web Analytics Association) as a corporate member

© CRISIL Limited. All Rights Reserved. CRISIL EQUITIES | 19

eClerx Services Ltd

Annexure: Financials

Income statement Balance Sheet

(Rs mn) FY09 FY10 FY11E FY12E FY13E (Rs mn) FY09 FY10 FY11E FY12E FY13E

Operating income 1,973 2,570 3,393 4,369 5,469 Liabilities

EBITDA 815 1,004 1,301 1,596 1,908 Equity share capital 189 190 288 288 288

EBITDA margin 41.3% 39.1% 38.3% 36.5% 34.9% Reserves 1,467 1,809 2,325 2,955 3,646

Depreciation 79 70 85 118 123 Minorities - - - - -

EBIT 735 934 1,216 1,477 1,785 Net worth 1,657 1,999 2,614 3,243 3,934

Interest 91 160 - - - C onvertible debt - - - - -

Operating PBT 644 774 1,216 1,477 1,785 Other debt - - - - -

Other income 50 54 181 250 134 Total debt - - - - -

Exceptional inc/(exp) - - - - - Deferred tax liability (net) (7) (7) (7) (7) (7)

PBT 694 828 1,397 1,728 1,918 Total liabilities 1,649 1,992 2,606 3,236 3,927

Tax provision 77 93 168 328 384 Assets

Minority interest - - - - - Net fixed assets 187 183 173 280 231

PAT (Reported) 618 735 1,230 1,399 1,535 C apital WIP 1 22 19 19 19

Less: Exceptionals - - - - - Total fixed assets 188 205 193 299 251

Adjusted PAT 618 735 1,230 1,399 1,535 Investments - - - - -

Current assets

Ratios Inventory - - - - -

FY09 FY10 FY11E FY12E FY13E Sundry debtors 451 392 564 757 969

Growth Loans and advances 289 492 577 699 820

Operating income (%) 62.2 30.3 32.0 28.7 25.2 C ash & bank balance 213 472 978 1,381 2,030

EBITDA (%) 65.6 23.2 29.6 22.7 19.6 Marketable securities 851 775 775 775 775

Adj PAT (%) 38.6 19.0 67.2 13.8 9.7 Total current assets 1,804 2,132 2,894 3,611 4,595

Adj EPS (%) 38.6 19.0 67.2 13.8 9.7 Total current liabilities 465 463 597 792 1,036

Net current assets 1,339 1,669 2,296 2,820 3,559

Profitability Intangibles/Misc. expenditure 123 117 117 117 117

EBITDA margin (%) 41.3 39.1 38.3 36.5 34.9 Total assets 1,649 1,992 2,606 3,236 3,927

Adj PAT Margin (%) 31.3 28.6 36.2 32.0 28.1

RoE (%) 41.4 40.2 53.3 47.8 42.8 Cash flow

RoC E (%) 48.6 51.1 52.7 50.5 49.7 (Rs Mn) FY09 FY10 FY11E FY12E FY13E

RoIC (%) 58.7 63.9 89.2 94.3 88.6 Pre-tax profit 694 828 1,397 1,728 1,918

Total tax paid (81) (93) (168) (328) (384)

Valuations Depreciation 79 70 85 118 123

Price-earnings (x) 29.9 25.1 15.0 13.2 12.0 Working capital changes (50) (147) (122) (120) (90)

Price-book (x) 11.2 9.2 7.1 5.7 4.7 Net cash from operations 643 659 1,193 1,398 1,568

EV/EBITDA (x) 13.6 10.9 12.9 10.2 8.2 Cash from investments

EV/Sales (x) 5.6 4.3 4.9 3.7 2.9 C apital expenditure (127) (82) (72) (225) (75)

Dividend payout ratio (%) 44.8 53.0 50.0 55.0 55.0 Investments and others (197) 76 - - -

Dividend yield (%) 2.3 3.2 3.3 4.2 4.6 Net cash from investments (324) (6) (72) (225) (75)

Cash from financing

B/S ratios Equity raised/(repaid) 1 5 98 - -

Inventory days - - - - - Debt raised/(repaid) (40) - - - -

Creditors days 73 51 52 54 56 Dividend (incl. tax) (277) (390) (615) (770) (844)

Debtor days 83 56 61 63 65 Others (incl extraordinaries) (13) (9) (98) - -

Working capital days 46 50 52 50 47 Net cash from financing (329) (393) (615) (770) (844)

Gross asset turnover (x) 7.2 6.9 7.8 7.5 7.4 C hange in cash position (11) 259 506 403 649

Net asset turnover (x) 13.4 13.9 19.0 19.3 21.4 C losing cash 213 472 978 1,381 2,030

Sales/operating assets (x) 10.8 13.1 17.1 17.8 19.9

Current ratio (x) 3.9 4.6 4.8 4.6 4.4 Quarterly financials

Debt-equity (x) - - - - - (Rs Mn) Q3FY10 Q4FY10 Q1FY11 Q2FY11 Q3FY11

Net debt/equity (x) (0.6) (0.6) (0.7) (0.7) (0.7) Net Sales 691 713 771 823 872

Interest coverage 8.1 5.8 NM NM NM C hange (q-o-q) 3% 8% 7% 6%

EBITDA 278 261 283 298 364

Per share* C hange (q-o-q) -6% 8% 5% 22%

FY09 FY10 FY11E FY12E FY13E EBITDA margin 40.3% 36.6% 36.7% 36.2% 41.8%

Adj EPS (Rs) 21.4 25.5 42.7 48.5 53.2 PAT 213 242 292 271 352

CEPS 24.2 27.9 45.6 52.6 57.5 Adj PAT 213 242 292 271 352

Book value 57.5 69.3 90.7 112.5 136.5 C hange (q-o-q) 14% 21% -7% 30%

Dividend (Rs) 9.6 13.5 21.3 26.7 29.3 Adj PAT margin 30.8% 34.0% 37.9% 32.9% 40.4%

Actual o/s shares (mn) 18.9 19.0 28.8 28.8 28.8 Adj EPS 7.4 8.4 10.1 9.4 12.2

* adjusted for bonus issue in FY11

Sou rce: CR ISIL Equ it ies

© CRISIL Limited. All Rights Reserved. CRISIL EQUITIES | 20

eClerx Services Ltd

Focus Charts

FTE-based revenues on the rise Share of revenues from SEZ have increased

100% 65%

13%

90% 24% 60%

25% 27%

33%

80% 55%

70%

50%

60%

45%

50%

40% 62%

87% 58%

40% 76% 75% 73% 52%

67% 35%

30% 46% 45%

20% 30% 40%

34%

10% 25%

0% 20%

FY07 FY08 FY09 FY10 9MFY11 Q1FY10 Q2FY10 Q3FY10 Q4FY10 Q1FY11 Q2FY11 Q3FY11

FTE contribution Fixed price

Source: Company, CRISIL Equities Source: Company, CRISIL Equities

Total employee count Geographic distribution of revenues

4,000 100% 3% 4% 5% 6% 7% 7% 8%

90%

3,500

80% 33% 31%

37% 35% 30% 33%

3,000 34%

70%

2,500 60%

2,000 50%

3,527 40%

3,331

1,500 3,124

2,863 64% 63% 63%

2,577 30% 57% 60% 60% 58%

2,194 2,353

1,000

20%

500 10%

0%

-

Q1FY10 Q2FY10 Q3FY10 Q4FY10 Q1FY11 Q2FY11 Q3FY11

Q1FY10 Q2FY10 Q3FY10 Q4FY10 Q1FY11 Q2FY11 Q3FY11

North America Europe Rest of the world

Source: Company, CRISIL Equities Source: Company, CRISIL Equities

Comparison with NIFTY Stock performance

300 (Rs) FY08* FY09 FY10

Shares Bought 10

250

Price per share 210

200 Investment made 2,100

Dividend per share 9.0 14.6 20.5

150

Total dividend income 90 146 205

100

C urrent market price 641

50

Total return 4,661

0 Total return (%) 222%

Holding period - Years 3.2

Jan-09

Jan-10

Jan-11

Dec-07

Mar-08

Jul-08

Jul-09

Jul-10

Oct-08

Apr-09

Oct-09

Apr-10

Oct-10

Yearly return 44%

eClerx NIFTY *Post listing on NSE

Source: NSE, CRISIL Equities Source: NSE, CRISIL Equities

© CRISIL Limited. All Rights Reserved. CRISIL EQUITIES | 21

CRISIL Independent Equity Research Team

Mukesh Agarwal Director +91 (22) 3342 3035 magarwal@crisil.com

Tarun Bhatia Director, Capital Markets +91 (22) 3342 3226 tbhatia@crisil.com

Chetan Majithia Head, Equities +91 (22) 3342 4148 chetanmajithia@crisil.com

Sudhir Nair Head, Equities +91 (22) 3342 3526 snair@crisil.com

Nagarajan Narasimhan Director, Research +91 (22) 3342 3536 nnarasimhan@crisil.com

Ajay D'Souza Head, Research +91 (22) 3342 3567 adsouza@crisil.com

Aparna Joshi Head, Research +91 (22) 3342 3540 apjoshi@crisil.com

Manoj Mohta Head, Research +91 (22) 3342 3554 mmohta@crisil.com

Sridhar C Head, Research +91 (22) 3342 3546 sridharc@crisil.com

CRISIL’s Equity Offerings

The Equity Group at CRISIL Research provides a wide range of services including:

) Independent Equity Research

) IPO Grading

) White Labelled Research

) Valuation on companies for use of Institutional Investors, Asset Managers, Corporate

Other Services by the Research group include

) CRISINFAC Industry research on over 60 industries and Economic Analysis

) Customised Research on Market sizing, Demand modelling and Entry strategies

) Customised research content for Information Memorandum and Offer documents

© CRISIL Limited. All Rights Reserved

About CRISIL

CRISIL is India's leading Ratings, Research, Risk and Policy Advisory Company.

About CRISIL Research

CRISIL Research is India's largest independent, integrated research house. We leverage our unique, integrated

research platform and capabilities spanning the entire economy-industry-company spectrum to deliver superior

perspectives and insights to over 750 domestic and global clients, through a range of subscription products and

customised solutions.

To know more about CRISIL IER, please contact our team members:

Vinaya Dongre – Head, Business Development Ashish Sethi – Head, Business Development

Email : vdongre@crisil.com I Phone : 9920225174 Email : asethi@crisil.com I Phone : 9920807575

Sagar Sawarkar – Senior Manager, Business Development

Email : ssawarkar@crisil.com I Phone : 9821638322

Regional Contacts:

Ahmedabad / Mumbai / Pune Kolkata

Vishal Shah - Manager, Business Development Priyanka Agarwal - Manager, Business Development

Email : vishah@crisil.com I Phone : 9820598908 Email : priyagarwal@crisil.com I Phone : 9903060685

Bengaluru / Chennai New Delhi

Anand Krishnamoorthy - Manager, Business Development Vipin Saboo - Manager, Business Development

Email : ankrishnamoorthy@crisil.com I Phone : 9884704111 Email : vsaboo@crisil.com I Phone : 9820779873

Hyderabad

Kaliprasad Ponnuru - Manager, Business Development

Email : kponnuru@crisil.com I Phone : 9642004668

Head Office: CRISIL House, Central Avenue, Hiranandani Business Park,

Powai, Mumbai - 400 076

Phone : 91-22-3342 3000

Web: www.crisil.com

Download reports from: www.ier.co.in

© CRISIL Limited. All Rights Reserved

Anda mungkin juga menyukai

- Test Bank Chapter 3+4 Investment BodieDokumen87 halamanTest Bank Chapter 3+4 Investment BodieTami DoanBelum ada peringkat

- Book 3 - Financial Markets & Products PDFDokumen383 halamanBook 3 - Financial Markets & Products PDFSandesh SinghBelum ada peringkat

- Hikal ResearchNote 09oct2012Dokumen15 halamanHikal ResearchNote 09oct2012equityanalystinvestorBelum ada peringkat

- Investment Banking Chapter 1Dokumen27 halamanInvestment Banking Chapter 1ravindergudikandulaBelum ada peringkat

- Leland 1994Dokumen36 halamanLeland 1994pedda60100% (1)

- Quiz1 PDFDokumen45 halamanQuiz1 PDFShami Khan Shami KhanBelum ada peringkat

- Eco-Elasticity of DD & SPDokumen20 halamanEco-Elasticity of DD & SPSandhyaAravindakshanBelum ada peringkat

- Guide to Contract Pricing: Cost and Price Analysis for Contractors, Subcontractors, and Government AgenciesDari EverandGuide to Contract Pricing: Cost and Price Analysis for Contractors, Subcontractors, and Government AgenciesBelum ada peringkat

- Tactical Equity Derivatives StrategyDokumen9 halamanTactical Equity Derivatives StrategyAvid HikerBelum ada peringkat

- JP Morgan DCF and Merger Model PDFDokumen100 halamanJP Morgan DCF and Merger Model PDFP WinBelum ada peringkat

- Chapter 21. LEASING 21.1types of Leases The BasicsDokumen4 halamanChapter 21. LEASING 21.1types of Leases The BasicsAimé RandrianantenainaBelum ada peringkat

- Analysis Financial RatioDokumen24 halamanAnalysis Financial RatioQamar Mughal100% (1)

- Havells Equity ResearchDokumen9 halamanHavells Equity ResearchRicha P SinghalBelum ada peringkat

- Chapter 21 - LeasingDokumen87 halamanChapter 21 - LeasingCorey Sobers-Smith100% (1)

- Overview of Financial SystemDokumen50 halamanOverview of Financial SystemshahyashrBelum ada peringkat

- Fundamental Mechanical Properties: FatigueDokumen11 halamanFundamental Mechanical Properties: Fatigueaap1Belum ada peringkat

- FRT - HM Research-Report V.finalDokumen47 halamanFRT - HM Research-Report V.finalANH PHAM QUYNHBelum ada peringkat

- Research Report CowenDokumen14 halamanResearch Report CowenzevioBelum ada peringkat

- Performance ApppraidDokumen81 halamanPerformance ApppraidManisha LatiyanBelum ada peringkat

- 1332567100research Report On Pharmaceutical Sector of BD-Initiation, June 28, 2011Dokumen23 halaman1332567100research Report On Pharmaceutical Sector of BD-Initiation, June 28, 2011Rayhan AtunuBelum ada peringkat

- Creating Value For ShareholdersDokumen8 halamanCreating Value For Shareholders18ITR028 Janaranjan EBelum ada peringkat

- Valuation and Deals Structuring Concepts and TrendsDokumen114 halamanValuation and Deals Structuring Concepts and TrendsBulent InanBelum ada peringkat

- MSS SP Stds Reference ListDokumen1 halamanMSS SP Stds Reference ListMadhu BediguthuBelum ada peringkat

- Basic Financial AccountingDokumen118 halamanBasic Financial AccountingSaleem Javed100% (1)

- Stock Market Index Final 12 March 2016Dokumen69 halamanStock Market Index Final 12 March 2016Anu DaveBelum ada peringkat

- Full Analysis of Dell - 9pm 3rd OctDokumen33 halamanFull Analysis of Dell - 9pm 3rd Octhoang-anh-dinh-7688Belum ada peringkat

- Business Economics ICFAIDokumen20 halamanBusiness Economics ICFAIDaniel VincentBelum ada peringkat

- Philips Corporate Valuation Project PDFDokumen13 halamanPhilips Corporate Valuation Project PDFNariman MamadoffBelum ada peringkat

- Indian Capital Goods - HSBC Jan 2011Dokumen298 halamanIndian Capital Goods - HSBC Jan 2011didwaniasBelum ada peringkat

- Initiating Coverage Maruti SuzukiDokumen13 halamanInitiating Coverage Maruti SuzukiAditya Vikram JhaBelum ada peringkat

- Phase 3 - Porter's Five Forces AnalysisDokumen3 halamanPhase 3 - Porter's Five Forces AnalysistheBelum ada peringkat

- 09 JAZZ Equity Research ReportDokumen9 halaman09 JAZZ Equity Research ReportAfiq KhidhirBelum ada peringkat

- Financiam Modling FileDokumen104 halamanFinanciam Modling FileFarhan khanBelum ada peringkat

- Financial Ratios2Dokumen72 halamanFinancial Ratios2Junel Alapa100% (1)

- Reading 31 Slides - Private Company ValuationDokumen57 halamanReading 31 Slides - Private Company ValuationtamannaakterBelum ada peringkat

- Elasticity EconomicsDokumen14 halamanElasticity EconomicsYiwen LiuBelum ada peringkat

- Bharti Airtel Motilal ReportDokumen18 halamanBharti Airtel Motilal ReportpayalBelum ada peringkat

- Financial Econometrics-Mba 451F Cia - 1 Building Research ProposalDokumen4 halamanFinancial Econometrics-Mba 451F Cia - 1 Building Research ProposalPratik ChourasiaBelum ada peringkat

- ACCT3563 Issues in Financial Reporting Analysis Part A S12013 1 PDFDokumen13 halamanACCT3563 Issues in Financial Reporting Analysis Part A S12013 1 PDFYousuf khanBelum ada peringkat

- HCL Tech Q3 FY22 Investor ReleaseDokumen28 halamanHCL Tech Q3 FY22 Investor Releaseashokdb2kBelum ada peringkat

- A Parry Electronics Is A Regional Electronics Wholesaler and Distributor That PDFDokumen1 halamanA Parry Electronics Is A Regional Electronics Wholesaler and Distributor That PDFHassan JanBelum ada peringkat

- Mobil UsmrDokumen2 halamanMobil UsmrSiddharth SrivastavaBelum ada peringkat

- Comparable Companies: Inter@rt ProjectDokumen9 halamanComparable Companies: Inter@rt ProjectVincenzo AlterioBelum ada peringkat

- Assignment 3 - Financial Case StudyDokumen1 halamanAssignment 3 - Financial Case StudySenura SeneviratneBelum ada peringkat

- JPR 54079 DailmerAG EquityResearch Report 1303Dokumen35 halamanJPR 54079 DailmerAG EquityResearch Report 1303André Fonseca100% (1)

- Free Cash Flow Valuation: Wacc FCFF VDokumen6 halamanFree Cash Flow Valuation: Wacc FCFF VRam IyerBelum ada peringkat

- 1acca f9 Atc June 2012 Study Text PDFDokumen358 halaman1acca f9 Atc June 2012 Study Text PDFJoud H Abu Hashish100% (1)

- Financial Cash Flow Determinants of Company Failure in The Construction Industry (PDFDrive) PDFDokumen222 halamanFinancial Cash Flow Determinants of Company Failure in The Construction Industry (PDFDrive) PDFAnonymous 94TBTBRksBelum ada peringkat

- Determinants of Audit Quality in The Public Sector On JSTORDokumen2 halamanDeterminants of Audit Quality in The Public Sector On JSTORHaryadi BudiBelum ada peringkat

- Comparative Ratio Analysis of Two Companies: Bata & Apex 2011-14Dokumen21 halamanComparative Ratio Analysis of Two Companies: Bata & Apex 2011-14Arnab Upal100% (2)

- GAIL - Current Business StratgeyDokumen55 halamanGAIL - Current Business Stratgeyshailendra choudhary100% (1)

- NTPC ReportDokumen15 halamanNTPC ReportKaushal Jaiswal100% (1)

- Valuation Q&A McKinseyDokumen4 halamanValuation Q&A McKinseyZi Sheng NeohBelum ada peringkat

- Numericals On Stock Swap - SolutionDokumen15 halamanNumericals On Stock Swap - SolutionAnimesh Singh GautamBelum ada peringkat

- Derivatives OptionDokumen21 halamanDerivatives OptionSuresh Kumar NayakBelum ada peringkat

- Ed - 16wchap07sln For 30 Jan 2018Dokumen7 halamanEd - 16wchap07sln For 30 Jan 2018MarinaBelum ada peringkat

- Business Valuation ManagementDokumen42 halamanBusiness Valuation ManagementRakesh SinghBelum ada peringkat

- Axis Enam MergerDokumen9 halamanAxis Enam MergernnsriniBelum ada peringkat

- BP Stock Valuation DashboardDokumen1 halamanBP Stock Valuation DashboardOld School ValueBelum ada peringkat

- Adidas Group Equity Valuation Thesis - João Francisco Menezes - 152114017-1 PDFDokumen43 halamanAdidas Group Equity Valuation Thesis - João Francisco Menezes - 152114017-1 PDFNancy NanBelum ada peringkat

- Segment AnalysisDokumen53 halamanSegment AnalysisamanBelum ada peringkat

- APL Apollo Stock PitchDokumen10 halamanAPL Apollo Stock Pitchplv360Belum ada peringkat

- Critical Financial Review: Understanding Corporate Financial InformationDari EverandCritical Financial Review: Understanding Corporate Financial InformationBelum ada peringkat

- Brave New World For India Real EstateDokumen56 halamanBrave New World For India Real EstateurvashiakshayBelum ada peringkat

- THINK AGAIN Discussion Guide: Individual RethinkingDokumen1 halamanTHINK AGAIN Discussion Guide: Individual RethinkingAjay AroraBelum ada peringkat

- BayerAG DetailedAnnouncement 10.1.14-SOR 000Dokumen11 halamanBayerAG DetailedAnnouncement 10.1.14-SOR 000Ajay AroraBelum ada peringkat

- Indian Food Retail Industry An Overview PDFDokumen21 halamanIndian Food Retail Industry An Overview PDFMi ZanBelum ada peringkat

- First Source AR 2014 15Dokumen168 halamanFirst Source AR 2014 15Ajay AroraBelum ada peringkat

- CII - JLL Report On Real Estate SectorDokumen32 halamanCII - JLL Report On Real Estate SectorAvik SarkarBelum ada peringkat

- The Role of IT in Supporting Mergers and AcquisitionsDokumen7 halamanThe Role of IT in Supporting Mergers and AcquisitionsAjay AroraBelum ada peringkat

- Digital PaymentsDokumen36 halamanDigital PaymentsHarsh VoraBelum ada peringkat

- Application Form For New Cadre - Distributors PDFDokumen5 halamanApplication Form For New Cadre - Distributors PDFAjay AroraBelum ada peringkat

- Employment Agreement New PDFDokumen3 halamanEmployment Agreement New PDFAjay AroraBelum ada peringkat

- Combined Brokerage StructureDokumen55 halamanCombined Brokerage StructureRakeshBelum ada peringkat

- Valuing Firms in Distress - Aswath DamodranDokumen25 halamanValuing Firms in Distress - Aswath DamodranAjay AroraBelum ada peringkat

- Ey Mutual Funds Ready For The Next LeapDokumen52 halamanEy Mutual Funds Ready For The Next LeapAjay AroraBelum ada peringkat

- Employment AgreementDokumen6 halamanEmployment AgreementiculasiBelum ada peringkat

- Arshiya Int. AR - 2009-10Dokumen121 halamanArshiya Int. AR - 2009-10Ajay AroraBelum ada peringkat

- Financial Risk AnalysisDokumen9 halamanFinancial Risk AnalysisPrashant UjjawalBelum ada peringkat

- CompleteSyllabus CFPDokumen42 halamanCompleteSyllabus CFPKaustubh PatelBelum ada peringkat

- Short Term Call: Company Name: HG Infra Engineering LTDDokumen4 halamanShort Term Call: Company Name: HG Infra Engineering LTDVishnu RaoBelum ada peringkat

- International Financing Review Asia April 11 2020 PDFDokumen44 halamanInternational Financing Review Asia April 11 2020 PDFLêTrọngQuangBelum ada peringkat

- CurrentDokumen12 halamanCurrentAnthony CabonceBelum ada peringkat

- Rangkuman KLMPK 8 PPT Chapter 16Dokumen17 halamanRangkuman KLMPK 8 PPT Chapter 16Safitri Eka LestariBelum ada peringkat

- Strictly ConfidentialDokumen19 halamanStrictly ConfidentialwajihcBelum ada peringkat

- Bank Sakhi Revised Guideline May 2020Dokumen6 halamanBank Sakhi Revised Guideline May 2020chandraBelum ada peringkat

- Financial Institutions: A Financial Institution (FI) Is A Company Engaged in The BusinessDokumen20 halamanFinancial Institutions: A Financial Institution (FI) Is A Company Engaged in The BusinessDirection SketchingBelum ada peringkat

- Malaysian Financial SystemDokumen20 halamanMalaysian Financial SystemLi Jean TanBelum ada peringkat

- Lesson 4: Lending and Borrowing in The Financial System (Part II)Dokumen6 halamanLesson 4: Lending and Borrowing in The Financial System (Part II)Mark Angelo BustosBelum ada peringkat

- Energy Services & Equipment Sector ReportDokumen52 halamanEnergy Services & Equipment Sector ReportSaad AliBelum ada peringkat

- Financial InstitutionsDokumen19 halamanFinancial InstitutionsSunako NakaharaBelum ada peringkat

- Yash Singhal PGSF 2136 - FSA Valuation RatiosDokumen3 halamanYash Singhal PGSF 2136 - FSA Valuation RatiosYash SinghalBelum ada peringkat

- Tugas 6 - Vania Olivine Danarilia (486211)Dokumen5 halamanTugas 6 - Vania Olivine Danarilia (486211)Vania OlivineBelum ada peringkat

- MORB 2010 Vol. 2Dokumen856 halamanMORB 2010 Vol. 2Kristina LayugBelum ada peringkat

- Tutorial 3: Bonds/Fixed Income SecuritiesDokumen14 halamanTutorial 3: Bonds/Fixed Income Securities1 KohBelum ada peringkat

- Some Tips For Writing Your EssayDokumen2 halamanSome Tips For Writing Your EssayHồng TtmBelum ada peringkat

- Credorax DM (Mar 2021)Dokumen29 halamanCredorax DM (Mar 2021)csh011235Belum ada peringkat

- Volume1 gv1Dokumen702 halamanVolume1 gv1WikusBelum ada peringkat

- Case#14 Analysis Group10Dokumen7 halamanCase#14 Analysis Group10Mohammad Aamir100% (1)

- Toluwalope Professional ResumeDokumen1 halamanToluwalope Professional Resumeapi-511631721Belum ada peringkat

- CV Valuation Approaches InfographicDokumen4 halamanCV Valuation Approaches InfographicNAZREEN SHAHAL 2227536Belum ada peringkat

- Spring NewsletterDokumen5 halamanSpring NewsletterkatiedempsterBelum ada peringkat

- How To Breakinto Real Estate Private EquityDokumen19 halamanHow To Breakinto Real Estate Private Equityaa100% (1)

- Financial CareersDokumen92 halamanFinancial CareersPradeep ChowdaryBelum ada peringkat

- The Enron ScandalDokumen15 halamanThe Enron ScandalBatool DarukhanawallaBelum ada peringkat

- NK Bagrodia Public School Holiday HomeworkDokumen9 halamanNK Bagrodia Public School Holiday Homeworkert2jg31100% (1)