Sreenivasa Degree College-Kalikiri: Ii Mid Examinations-2017

Diunggah oleh

Prince Mansoor AhmedJudul Asli

Hak Cipta

Format Tersedia

Bagikan dokumen Ini

Apakah menurut Anda dokumen ini bermanfaat?

Apakah konten ini tidak pantas?

Laporkan Dokumen IniHak Cipta:

Format Tersedia

Sreenivasa Degree College-Kalikiri: Ii Mid Examinations-2017

Diunggah oleh

Prince Mansoor AhmedHak Cipta:

Format Tersedia

SREENIVASA DEGREE COLLEGE-KALIKIRI

II MID EXAMINATIONS-2017

ACCOUNTING FOR SERVICE ORGANISATIONS

II B Com (CA)

Time: 3hrs Marks: 75

Section-A(15 marks)

1. Answer Any Five following questions, each question carries 3 marks 5X3=15

a) Subscriptions b) specific donations c) Double account system d) Capital account e) Non-Banking assets

f) Statutory reserve g) Bonus in reduction of premium h) insurance fund

i)Additional reserve for unexpired risk.

Section- B(60 marks)

Answer any one question from each unit, each question carries 12 marks 5X12=60

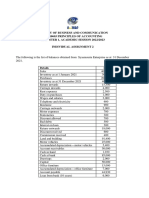

1. From the following Receipts and payments account of Krishna charitable Institution for the year

ending 31.3.2014,prepare income and expenditure account and Balance sheet as on that date.

Receipts amount payments amount

To Balance By Charities 14,500

Cash on deposit 5400 By salaries 2,600

Cash on current A/c2400 By rent and taxies 1,200

Cash in hand 300 7,700 By printing 300

To donation 8,000 By postage 100

To subscriptions 7,000 By Advertisement 250

To endowment fund receipts 15,000 BY furniture 750

To legacies 3,000 By insurance 750

To interest on investment 9,500 BY investment 14,000

To interest on deposit 150 By advance to building 5000

To Sales of old news papers 75 By balance

Cash on deposits 8000

cash in current account 2250

Cash in hand 725

_____ ______

50425 50425

Adjustments: Rent due: 2013-250; 2014-300

2.salaries due : 2013-150;2014-450

3. subscriptions due : 2013-200; 2014-400

4. subscription received in advanced :2013-400; 2014-500

Or

2. From the following Receipts and payments account of Krishna charitable Hospital for the year

ending 31.3.2014,prepare income and expenditure account and Balance sheet as on that date.

Receipts amount payments amount

To Balance B/d By Mess Expenses 85000

Cash 20000 By wages 40000

Bank 100000 120000 By Electricity and water 30000

To Room rent By Common room expenses 25000

2013-2000 By Repairs and maintenance 20000

2014-50000 BY indoor games materials 21000

2015-1000 53000 By Medical and First aid 9000

To Electricity and water 5000 BY construction Building 150000

To Mess collection 100000 By balance C/d 28000

To interest on Govt. Securities(50%) 20000

To sale of old furniture 10000

(Book value:12000)

To Donation received for Building 100000

______ ______

408000 408000

Additional information: 1. Room rent receivable 2013-10000;

2. Room rent received in advance : 2013-2000;2014-1000

3. Mess Expenses prepaid 2013-1000;2014-5000

4. Outstanding wages 2013-15000;2014-10000

UNIT-II

3. From the following information prepare Capital account and Revenue account and Net

Revenue account for the year ending 31.3.2016

Particulars debit credit

Equity shares 600000

Debentures 200000

Land on 31.3.215 150000 -

Land purchasing during the year 60000 -

Mains 31.3.2015 160000 -

Mains 31.3.2016 76000 -

Machinery on 31.3.2015 550000 -

Machinery purchased during the year 60000 -

Sundry creditors - 1000

Depreciation fund - 250000

Debtors for current supplied 40000 -

other book debts 500 -

Stores in hand 6000 -

cash in hand 4000 -

cost of generation of electricity 30000 -

cost of distribution of electricity 9000 -

sale of current - 150000

Meter rent - 5000

Rent, rates, taxes 12000 -

establishment expenses 21000 -

interest on Debentures 10000 -

interim dividend 20000 -

depreciation 20000 -

Net Revenue account 31.3.2015 - 28500

_______ _______

1234500 1234500

Or

4. From the following Trail balance of Social Electric lighting Co. Ltd. For the year ending March

31,2016, prepare Revenue account, capital account and Balance sheet as on that date.

Particulars amount amount

Nominal capital 10000 shares of Rs.50 each -

100000 subscribed -5000 shares, 25 paid - 125000

75000 Debentures,6% interest - 75000

5000 depreciation fund - 5000

Calls in arrears 5000 -

46500 free hold Land 46500 -

20000 buildings 25000 -

30000 machinery 50000 -

25000 Transformers 40000 -

5000 Mains 10000 -

2500 meters 7500 -

1500 Electrical instruments 2000 -

8000 general stores 11750 -

1250 office furniture 1250 -

coal and fuel 9500 -

oil, oil waste 3750 -

repairs 2500 -

coal, oil in stock 500 -

rates and taxes 1500 -

Wages 15000 -

salaries 7500 -

directors fee 5000 -

stationery 3000 -

incidental expenses 500 -

Law charges 1000 -

sales of meters - 43750

Sales by contracts - 25000

Meter rent - 1500

Sundry creditors - 5000

Sundry debtors 15000 -

cash in hand 16500 -

_______ ______

280250 280250

Provide depreciation on opening balances: on Buildings 2 ½%, Machinery 7 ½%.

UNIT-III

5. From the following balances prepare profit and loss account of Regional Bank Ltd. For the year

ending 31.3.2016

Interest and discount received 124500 Rent, Rates and Tax 12500

Interest on fixed deposits 12500 interest on recurring deposits 14250

Salaries and 12500 interest on saving bank deposits 17250

Rebate on bill discounted 1250 commission and exchange 37250

Advertising 14250 printing and stationary 1150

Postage and telegrams 1450 interest on borrowings 2250

Directors fee 5500 lockers rent 14750

Depreciation 6000 bad debts 2000

Interest on securities 15000 interest on bank over draft and cash

credits18500

Interim dividend paid 12000 transfers fee 12500

Rent received 6500 profit on sale of investments

Or

6. From the following information calculate Rebate on bill discount and prepare Discount account

on 31.12.2015 and pass necessary entries.

Discount received in during the year 67850

Rebate on bill discount on 1.4.2014 2500

Bill discounted 550000

The analysis of bill discounted as shown as follows

Date of the Bill value of the bill term % of discount

th

December 5 150000 4 months 9%

December 9th 225000 3 months 10%

th

December 17 275000 4 months 12%

December 25th 125000 5 months 10%”

UNIT-IV

7. From the following information prepare Revenue account of Sun life insurance company Ltd. For

the year ended 31.3.2014.

Claims by death 76140 commission 9574

Claims by maturity 30110 interest and dividend 97840

Premium 705690 income tax 35710

Transfer fee 2500 surrenders 13140

Consideration for annuity granted 82127 bonus in reduction of premium 980

Annuities paid 53461

Dividend paid to share holders 5500 expenses of Management 31920

Or

8. The Revenue account of Life insurance company showed the life fund 7317000 before taken the

following items.

a) Claims intimated but not admitted 98250

b) Bonus utilised in reduction premium 13750

c) Interest accrued on investments 29750

d) Outstanding premium 27000

e) Claims covered under re-insurance 40500

f) Provision for taxation 31500

Pass journal entries giving effect to the above adjustments and the life fund.

UNIT-V

9. Prepare a Revenue account in respect of Fire Business from the following details for the year

2015-2016.

Reserve for Un expired risk on 1.4.2015 @50% 180000

Additional reserve 36000

Estimated liability for claims intimated on 1.4.2015: 31000; 31.3.2016-42000

Claims paid 365000

Legal expenses 6000

Medical expenses 4000

Re-insurance recoveries 32000

Premium recovered 486000

Premium on re- insurance accepted 32000

Premium on re- insurance ceded 43000

Commission direct business 48600

Commission on re- insurance accepted 1600

Commission on re- insurance ceded 2150

Expenses of management 90000

Interest and dividend and rent 24000

Profit on sale of investments 3000

Bad debts 800

Create reserve on 31.3.2016 to the same extent as on 1.4.2015.

Or

10. Following balances are extracted from the books of Adarsha general insurance company in

respect of fire insurance for the year 2016

Premium less re insurance 8200000

Interest dividend les tax 200000

Commission on direct business 400000

Commission on re insurance ceded 100000

Commission on re insurance accepted 160000

Claims paid less re insurance 4100000

Expenses of management 540000

Reserve for unexpired risk on 1.1.2016 3000000

Reserve for unexpired risk to be maintained at 50% of net premium and additional reserve to

be increased by 10% of net premium income.

SREENIVASA DEGREE COLLEGE-KALIKIRI

II MID EXAMINATIONS-2017

FUNDAMENTALS OF ACCOUNTNG

I B Com (CA)

Time: 3hrs Marks: 75

Section-A(15 marks)

1. Answer Any Five following questions, each question carries 3 marks 5X3=15

a) Obsolescence b) Explain any two causes for depreciation c) Over riding commission

d) Account sales f) Secret reserve g) Capital reserve h) Joint venture account i) features of joint

venture j) Noting charges

Answer any One question from each unit, each question carries 12 marks. 5X12=60

UNIT-I

2. Ram Prasad purchased a Machinery worth of 137500 and paid 2500 for installation charges on

1.1.2013. and he purchased a second machinery on 1.7.2013 worth of 50000. On 30.9.2015 he

sold a machinery amounted to 32500 which was purchased on 1.7.2013 on the same date he

purchased a machinery worth of 25000.

Prepare Machinery account under Straight line method by providing 10% depreciation from

2013-2015.

Or

3. X Co. Ltd purchased Machinery on 1.4.2012 worth of 55000 and paid installation expenses

amounted to 3000. He purchased another machinery worth of 20000 on 1.7.2013. he sold a1/4 th

of the machinery on30.9.2014 amounted to 8750 which was purchased on 1.4.2012. on the

same day a machinery was purchased worth of 15000. Prepare machinery account by providing

10 % depreciation under written down value method.

UNIT-II

4. From the following information prepare bad debts account, provision for doubtful debts account

and discount on debtors account.

On 1.1.2015 provision for bad and doubtful debts 12750, provision for discount on debtors 3600

Bad debts during the year 30000

Discount allowed on debtors 500

Debtors at the end of the 31.12.2015 60000

Create new provision for bad and doubtful debts 5% on debtors,3% for discount on debtors.

Or

5. Anil create a provision for repair bill 15000 every year profits. He paid repairs bill in 2012-2850,

2013-4250, 2014-4750,2015-2875. Prepare provision for repair bill account from the above

information.

UNIT-III

6. Sruthi agencies sent 100 boxes of Bangles on consignment to their agent at cost of 2500. But

the invoice price 2850. They paid 2500 for packing expenses, 5000 for freight and insurance.

Consignee took delivery of goods and accepted and returned a 3 months bill amounted to 50000

as an advance. he paid 2500 for customs duties, 1500 unloading expenses, 5000 godown rent

and insurance. He sold 85 boxes of Bangles at 2950 each. He entitled 5% normal commission

on sales as per invoice price and 4% on excess on invoice price. Prepare consignment account

and consignee account in the books of consignor.

Or

7. Swathi agencies send 500 sewing machines on consignment to Rohith agencies worth of 500000

at cost+25 profit on invoice price. They incurred 1500 for packing expenses,5000 for carriage

and insurance. Rohith agencies accepted a 3 months bill and returned amounted to 125000 as

advance. Rohith agencies incurred 6500 for other expenses. Roith agencies sold goods 450

machines at475000. They entitled 5% commission on sales as per invoice price,3% on sales as

per excess on invoice price. Prepare necessary accounts in the books of consignor.

UNIT-IV

8. Sudheer sold goods on credit to Mohith worth of 150000 on 1.4.2014. He drawn a 3 months bill

on Mohith . The bill was accepted and signed by Mohith send to Sudheer. The bill was endorsed

to Rohith by Sudheer. The bill was dishonoured on the due date. Journalize the above

transactions in the books of both parties.

Or

9. Sampath sold goods to Hemonth on credit basis on 1.4.2016. he drawn 3 months bill on

Hemanth for 150000. Hemanth accepted the bill and returned to him. Sampath discounted the

bill with his bank at 9% per annum. The bill was dishonoured on the due date. Pass necessary

journal entries in the books of both parties.

UNIT-V

10. A,B and C were entered in to a joint venture to sold the goods sharing the profits and losses in

the equal ratio. They contributed their capitals 175000,150000,125000 respectively. A was

appointed as working partner on the basis of 5% commission on sales. A purchased the goods

worth of 275000 and paid 95000 for wages. A supplied the goods worth 35000 from his own

stock and paid 1500 for carriage. B supplied the goods worth 35000 and paid 1500 for expenses.

A sold goods amounted to 475000. B agreed to take over the closing stock at 15000. Pass

necessary journal entries and prepare joint venture account and co-vnturers account.

Or

11. Ram and Syam entered in to a joint venture to construct a building worth of 1000000. The

contributed their capitals 550000 and 350000 and deposited in joint bank account. Ram

supplied materials worth of 65000 and paid 5000 for expenses. Syam agreed to pay architecture

fee amounted to 25000 and to bring plant worth of 100000. They purchased the materials worth

of 685000 and paid wages amounted to 115000. The contract was completed and the contract

price was received by cheque 800000 and the balance in shares. The un used stock taken over

by Ram worth of 25000. The shares taken over by Syam at an agreed value 180000. The plant

taken over by Ram at 85000. Prepare necessary accounts in the ledger.

Anda mungkin juga menyukai

- NTINDokumen28 halamanNTINAkanshaBelum ada peringkat

- Test TB Final Ac Single EntryDokumen2 halamanTest TB Final Ac Single EntryMegha BhargavaBelum ada peringkat

- Question 1: Prepare Income and Expenditure and Balance Sheet As On 31 3 09 From Following Receipts and Payment Account For The Year Ending 31 3 09Dokumen5 halamanQuestion 1: Prepare Income and Expenditure and Balance Sheet As On 31 3 09 From Following Receipts and Payment Account For The Year Ending 31 3 09Meeta GuptaBelum ada peringkat

- Remidial Assignment B.tech - Bbs n'22Dokumen9 halamanRemidial Assignment B.tech - Bbs n'22Ramagopal VemuriBelum ada peringkat

- DSR Mock Test - 1 - Ca FoundationDokumen5 halamanDSR Mock Test - 1 - Ca Foundationmaskguy001Belum ada peringkat

- Transaction Analysis (2424)Dokumen17 halamanTransaction Analysis (2424)AirForce ManBelum ada peringkat

- Banking 9 & 10 QuestionsDokumen2 halamanBanking 9 & 10 Questionssara.028279Belum ada peringkat

- Case - FRADokumen12 halamanCase - FRARAGHU MALLEGOWDABelum ada peringkat

- Webex 1 HomeworkDokumen20 halamanWebex 1 HomeworkRuchin ShahBelum ada peringkat

- Assignment ACC705 T2 2017Dokumen5 halamanAssignment ACC705 T2 2017babar zuberiBelum ada peringkat

- C - 11 Final Accounts WsDokumen16 halamanC - 11 Final Accounts Wskhushiarora3008officialBelum ada peringkat

- ANS - 1 (A, B, C)Dokumen5 halamanANS - 1 (A, B, C)Nazir AhmadBelum ada peringkat

- CA-Ipcc Old Course: Advanced AccountingDokumen125 halamanCA-Ipcc Old Course: Advanced AccountingAruna Rajappa100% (1)

- Instruction: Attempt Any 4 Questions. Each Question Carries Equal MarksDokumen3 halamanInstruction: Attempt Any 4 Questions. Each Question Carries Equal MarksSaurav KumarBelum ada peringkat

- Accounting PrinciplesDokumen4 halamanAccounting PrinciplesNazir AhmadBelum ada peringkat

- Single Entry (F. Y. B.com) Sem.1Dokumen13 halamanSingle Entry (F. Y. B.com) Sem.1Jignesh Togadiya0% (2)

- Assignment 1 Financial Accounting and Control Name: Roll No: 2016PGP380 Section: H Problem Statement Solution: Serial No. TransactionsDokumen16 halamanAssignment 1 Financial Accounting and Control Name: Roll No: 2016PGP380 Section: H Problem Statement Solution: Serial No. TransactionsSandesh SoniBelum ada peringkat

- FinanceDokumen22 halamanFinanceromit.jaink1Belum ada peringkat

- Unit Five: Final Accounts: Question-1: From The Following Information, Prepare TheDokumen11 halamanUnit Five: Final Accounts: Question-1: From The Following Information, Prepare TheBinod KhatriBelum ada peringkat

- Unit 2 WorksheetDokumen13 halamanUnit 2 WorksheetHhvvgg BbbbBelum ada peringkat

- New QuestionsDokumen5 halamanNew QuestionsmahadevaishwaryaBelum ada peringkat

- Worksheet AccountingDokumen5 halamanWorksheet AccountingDorinBelum ada peringkat

- 12 Accountancy 2018 Sample Paper 2Dokumen23 halaman12 Accountancy 2018 Sample Paper 2Sukhjinder SinghBelum ada peringkat

- Class Exercise Sheet FourDokumen9 halamanClass Exercise Sheet Fourcarol mohasebBelum ada peringkat

- Solution To Problem 1&2Dokumen5 halamanSolution To Problem 1&2Smriti singh0% (1)

- Assignment-2: MCA204 Financial Accounting and ManagementDokumen6 halamanAssignment-2: MCA204 Financial Accounting and ManagementrashBelum ada peringkat

- Null 33Dokumen6 halamanNull 33ranganaitinotenda1Belum ada peringkat

- Assignment ACC705 T2 2017Dokumen5 halamanAssignment ACC705 T2 2017babar zuberiBelum ada peringkat

- CFAS Module 3 ProblemsDokumen16 halamanCFAS Module 3 ProblemsChristen HerceBelum ada peringkat

- Journal Entry For Atkin AgencyDokumen4 halamanJournal Entry For Atkin AgencySamarth LahotiBelum ada peringkat

- Question IA 2 - Topic 4Dokumen2 halamanQuestion IA 2 - Topic 4YAANESHWARAN A/L CHANDRAN STUDENTBelum ada peringkat

- Bba Ii Semester Bba204B21: Financial Accounting Time: 2 Hours Max. Marks: 70Dokumen3 halamanBba Ii Semester Bba204B21: Financial Accounting Time: 2 Hours Max. Marks: 70S Sumaiya SamrinBelum ada peringkat

- Accounting Principles AbDokumen36 halamanAccounting Principles Absamson mutukuBelum ada peringkat

- FS Withoutadj QuesDokumen2 halamanFS Withoutadj QuesHimank SaklechaBelum ada peringkat

- AnswersDokumen4 halamanAnswersamitmehta29Belum ada peringkat

- Asset Liability Expenses Income Owner's CapitalDokumen4 halamanAsset Liability Expenses Income Owner's Capitalamitmehta29Belum ada peringkat

- 605701b41234414fbf70f2a0d6734ae1Dokumen3 halaman605701b41234414fbf70f2a0d6734ae1BabaBelum ada peringkat

- Endngrsi - Akuntsi - Jurnal (2) NewDokumen10 halamanEndngrsi - Akuntsi - Jurnal (2) NewMirzanun Nurul WakhidahBelum ada peringkat

- ISSo FPDokumen6 halamanISSo FPabbeangedesireBelum ada peringkat

- MBA-Final AccountsDokumen4 halamanMBA-Final AccountskanikaBelum ada peringkat

- Company Final Accounts: Debit Rs. Credit RsDokumen5 halamanCompany Final Accounts: Debit Rs. Credit RsDebaditya SenguptaBelum ada peringkat

- Book 1Dokumen2 halamanBook 1geraldabubopaduaBelum ada peringkat

- Acc 607 Q Business Acc 2023Dokumen4 halamanAcc 607 Q Business Acc 2023Hadnigouran VincovichBelum ada peringkat

- Balance Sheet QuestionDokumen14 halamanBalance Sheet QuestionArooj ArshadBelum ada peringkat

- Accounting 1 ExerciseDokumen4 halamanAccounting 1 Exercisetam tamBelum ada peringkat

- Acc Quiz1 Nguyễn Hữu Nghĩa Hs180944 Mkt1831Dokumen4 halamanAcc Quiz1 Nguyễn Hữu Nghĩa Hs180944 Mkt1831nn27102004Belum ada peringkat

- Cash Book (Bank Column)Dokumen6 halamanCash Book (Bank Column)batmam7589Belum ada peringkat

- Assignment 1 The Following List of Balances of Shakya Enterprises As On 31 December 2014 Has Been Provided To YouDokumen2 halamanAssignment 1 The Following List of Balances of Shakya Enterprises As On 31 December 2014 Has Been Provided To YouSrijana adhikariBelum ada peringkat

- Final Acs - Sole Proprietor - Numerics-1Dokumen6 halamanFinal Acs - Sole Proprietor - Numerics-1KRISHA UDANIBelum ada peringkat

- Question Sheet - Non Profit OrganisationDokumen7 halamanQuestion Sheet - Non Profit OrganisationShivangi JhawarBelum ada peringkat

- PGDM (2021-23) Exercise On Final AccountsDokumen9 halamanPGDM (2021-23) Exercise On Final Accountspriyanshu guptaBelum ada peringkat

- Hot Qus Class 12thDokumen13 halamanHot Qus Class 12thNaveen ShahBelum ada peringkat

- Ash 1Dokumen6 halamanAsh 1Ashirbad SahuBelum ada peringkat

- Statement of Financial Position1 (Guided Practice)Dokumen4 halamanStatement of Financial Position1 (Guided Practice)alabmyselfBelum ada peringkat

- Activity #6Dokumen20 halamanActivity #6JEWELL ANN PENARANDABelum ada peringkat

- IGNOU MCA MCS-035 Free Solved Assignments 2010Dokumen11 halamanIGNOU MCA MCS-035 Free Solved Assignments 2010Deepti SainiBelum ada peringkat

- Assignment Final AccountsDokumen9 halamanAssignment Final Accountsjasmine chowdhary50% (2)

- Assignment 1 ACCOUNTANCYDokumen3 halamanAssignment 1 ACCOUNTANCYCHINMAY AGRAWALBelum ada peringkat

- Chaithanya Info SystemsDokumen5 halamanChaithanya Info SystemsMichael WellsBelum ada peringkat

- An Analysis of The Title Insurance Industry: Charles Nyce and M. Martin BoyerDokumen46 halamanAn Analysis of The Title Insurance Industry: Charles Nyce and M. Martin BoyerfsahraeiBelum ada peringkat

- Commodity PDFDokumen85 halamanCommodity PDFSuyash Kumar100% (2)

- Hoyle Advanced Accounting Powerpoint Slides Chapter 3Dokumen37 halamanHoyle Advanced Accounting Powerpoint Slides Chapter 3Sean75% (4)

- Diokno v. RFCDokumen1 halamanDiokno v. RFCKat Dela Paz100% (2)

- Securitization ProcessDokumen62 halamanSecuritization Processbablu991Belum ada peringkat

- Internal Rate of Return - Wikipedia, The Free EncyclopediaDokumen8 halamanInternal Rate of Return - Wikipedia, The Free EncyclopediaOluwafemi Samuel AdesanmiBelum ada peringkat

- Valuation and Depreciation Public Sector PDFDokumen186 halamanValuation and Depreciation Public Sector PDFcorneliu100% (1)

- PESTLE AnalysisDokumen3 halamanPESTLE AnalysisSneha Agarwal100% (1)

- Application Portfolio RationalizationDokumen8 halamanApplication Portfolio RationalizationgirishmadiwalaBelum ada peringkat

- PWC Client IFRS Update 2016 PDFDokumen143 halamanPWC Client IFRS Update 2016 PDFteddy matendawafaBelum ada peringkat

- Tocqueville Gold Investor Letter - Third Quarter 2012Dokumen18 halamanTocqueville Gold Investor Letter - Third Quarter 2012Gold Silver WorldsBelum ada peringkat

- Digest LIM TONG LIM Vs Phil FishingDokumen1 halamanDigest LIM TONG LIM Vs Phil FishingMalolosFire Bulacan100% (4)

- Airlines IndustryDokumen17 halamanAirlines IndustryRITIKABelum ada peringkat

- Balance Sheet OptimizationDokumen32 halamanBalance Sheet OptimizationImranullah KhanBelum ada peringkat

- Break-Even Analysis: Break-Even Point (Units) 2,000 Break-Even Point ($'S) $10,000Dokumen8 halamanBreak-Even Analysis: Break-Even Point (Units) 2,000 Break-Even Point ($'S) $10,000barakkat72Belum ada peringkat

- Samsung WayDokumen8 halamanSamsung WayWilliam WongBelum ada peringkat

- Test BankDokumen14 halamanTest BankJi YuBelum ada peringkat

- Pump Up The Volume: BOOM LogisticsDokumen8 halamanPump Up The Volume: BOOM LogisticsNicholas AngBelum ada peringkat

- BAI2 Transmission File Format GuideDokumen13 halamanBAI2 Transmission File Format Guideirfanusa0% (1)

- PWC Strategic Portfolio Management Governance Financial DisciplineDokumen11 halamanPWC Strategic Portfolio Management Governance Financial DisciplineahmaddddlmBelum ada peringkat

- Living A Dream! The Journey of A Call Centre Employee To A Successful TraderDokumen8 halamanLiving A Dream! The Journey of A Call Centre Employee To A Successful TraderSivaramSubramanianBelum ada peringkat

- Dealing With Monopolistic and Distorted Supply ChainsDokumen20 halamanDealing With Monopolistic and Distorted Supply ChainsPratyasha PattanaikBelum ada peringkat

- Single Member LLC Operating AgreementDokumen10 halamanSingle Member LLC Operating Agreementadidas100% (2)

- Ch03 Beams12ge SMDokumen22 halamanCh03 Beams12ge SMWira Moki50% (2)

- Financial Reporting in The Mining IndustryDokumen192 halamanFinancial Reporting in The Mining IndustryerlanggaherpBelum ada peringkat

- Adani Enterprises PresentationDokumen75 halamanAdani Enterprises PresentationPoonam AggarwalBelum ada peringkat

- JayDokumen18 halamanJayangelo_guzman_14Belum ada peringkat

- Compensation in A Knowledge-Based Global EconomyDokumen21 halamanCompensation in A Knowledge-Based Global EconomyManoar HossainBelum ada peringkat

- Monaco Estate White PaperDokumen22 halamanMonaco Estate White PaperSujoy SikderrBelum ada peringkat

- Khan Muttakin Siddiqui 2013Dokumen17 halamanKhan Muttakin Siddiqui 2013Rahman AnshariBelum ada peringkat