Labour Law Syllabus

Diunggah oleh

Akshay RamHak Cipta

Format Tersedia

Bagikan dokumen Ini

Apakah menurut Anda dokumen ini bermanfaat?

Apakah konten ini tidak pantas?

Laporkan Dokumen IniHak Cipta:

Format Tersedia

Labour Law Syllabus

Diunggah oleh

Akshay RamHak Cipta:

Format Tersedia

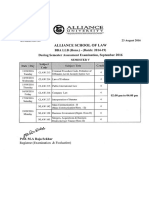

LABOUR & INDUSTRIAL LAWS-II

Subject Name (SOCIAL SECURITY AND WAGE

LEGISLATION)

Subject Code 81 CLAW 226

Subject Credit 4

The Labour laws in our country impose certain responsibilities on the

employer and the government so as to provide support to the working

class. The best form of support that can be offered to the workmen, by

both the employer and the government, is providing financial support

Object of the Course:

in situations of need like accident, retirement, death, etc. In India such

social security and other welfare measures have been statutorily

recognized and are being implemented. In the present course the

students are required to do an extensive study on some social security

and other economic and welfare legislations.

Course contents:

No. of

Module Session Topic

Hours

UNIT- I – Labour Welfare:

1.1 Philosophy of Labour Welfare; Historical Development of Labour

welfare legislation; 1.2 Health, Safety and welfare measures under

I. Factories Act, 1948;

1.3 Welfare of women and child labour: Protective provisions under

Equal Remuneration Act & Maternity Benefit Act.

Unit II: Law relating to wages and bonus:

Theories of wages: marginal productivity, subsistence, wage fund,

supply and demand, residual claimant, standard of living Concepts of

wages (minimum wage, fair wage, living wage, need-based minimum

wage); Constitutional provisions; components of wages:

2.1 Minimum Wages Act, 1948: Objectives and constitutional validity

2.

of the Act; procedure for fixation and revision of minimum rates of

wages – exemptions and exceptions;

2.2 Payment of Wages Act, 1936: Regulation of payment of wages;

Authorized Deductions, 2.3 Payment of Bonus Act; Bonus - Its

historical background, present position and exemptions ; Payment of

Bonus (Amendment) Act, 2007.

UNIT III:Social security against employment injury and other

contingencies:

3.1 Concept and development of social security measures;

3.2 Employers liability to pay compensation for employment injury;

Legal protection: Workmen’s Compensation Act, 1923 –

3.1.1 Concept of ‘accident arising out of’ and ‘in the course of the

employment’; Doctrine of notional extension and doctrine of added

peril;

3. 3.1.2 Total and partial disablement;

3.1.2 Quantum and method of distribution of compensation.

3.3 Employees State Insurance Act, 1948

3.2.1 Benefits provided under the Act; 3.2.2 Employees State

Insurance Fund and Contributions;

3.2.3 Machinery for the implementation of the Act;

3.2.3 ESI court and appeal to High Court.

UNIT IV: Law relating to retirement benefits:

4.1 Employees Provident Fund and Miscellaneous Provisions Act,

1952; Family Pension Scheme 1971 and Employees’ Pension Scheme

1995;

4. 4.1.1 The changing rules regarding Employees Provident Fund and

Pension Schemes;

4.2 Payment of Gratuity Act, 1972 – Concept of gratuity; Eligibility

for payment of gratuity; Determination of gratuity; Forfeiture of

gratuity.

UNIT V: Contract Labour:

5.1 Problems of contract labour; Process of contractualisationof labour;

5. 5.2 Legal protection: Contract Labour (Regulation and Abolition) Act,

1970; Controversy regarding Abolition of contract labour and their

absoption; Land mark cases: Air India Statutory Corpn. V. United

Labour Union, (1997) & SAIL case (2002);

5.3 proposed amendment and its impact on the contract labour.

UNIT VI: Unorganized Sector:

6.1 Problem of Definition and Identification; Unionization problems

6. 6.2 Historical backdrop of proposed bills on social security for

unorganized sector (2004, 2005 & 2007);

6.3 Unorganized Sector Workers’ Social Security Act, 2008

UNIT VII: Protection of Weaker Sections of Labour:

7.1 Problems of bonded labour, bidi workers, domestic workers,

construction workers inter-state migrant workmen;

7.

7.2 Legal protection: Bonded Labour System (Abolition) Act, 1976;

Inter State Migrant Workmen (Regulation of Employment and

Conditions of Service) Act, 1979

Total Sessions 45

Acts

1. Workmen’s Compensation Act, 1923

2. Maternity Benefit Act, 1961

3. Payment of Wages Act, 1936

4. Minimum Wages Act, 1948

5. Payment of Gratuity Act, 1972

6. Employees State Insurance Act, 1948.

Books

1. K.D.Srivastava, Commentaries on Minimum Wages Act, 1995, Eastern Book Co.

2. K.D.Srivastava, Commentaries on Payment of Wages Act, 1998, Eastern Book Co.

3. S.B.Rao, Law and Practice on Minimum Wages, 1999

Anda mungkin juga menyukai

- Solved Pacific Coast Fisheries Corporation Issued More Than 5 Percent ofDokumen1 halamanSolved Pacific Coast Fisheries Corporation Issued More Than 5 Percent ofAnbu jaromiaBelum ada peringkat

- Labour Legislation: Labour Laws in IndiaDokumen95 halamanLabour Legislation: Labour Laws in IndiaUJJWAL100% (1)

- Labour Law Syllabus BreakdownDokumen9 halamanLabour Law Syllabus BreakdownDeepak Ramesh100% (1)

- TpaDokumen40 halamanTpadeepankarkatBelum ada peringkat

- Pellets TechnologyDokumen8 halamanPellets TechnologyRajesh Chaudary ABelum ada peringkat

- Labour Laws NotesDokumen251 halamanLabour Laws NotesnadeemBelum ada peringkat

- Election LawDokumen13 halamanElection LawAkshay RamBelum ada peringkat

- Election LawDokumen13 halamanElection LawAkshay RamBelum ada peringkat

- SBLC Monetizing MOUDokumen9 halamanSBLC Monetizing MOUDinni Resa75% (4)

- Labor Laws of India CapsuleDokumen97 halamanLabor Laws of India CapsuleVrajlal SapovadiaBelum ada peringkat

- Stockholm and Rio ConventionDokumen21 halamanStockholm and Rio ConventionAkshay RamBelum ada peringkat

- Paint Application Standard No. 2Dokumen13 halamanPaint Application Standard No. 2ceroride100% (2)

- Dcom207 Labour Laws PDFDokumen252 halamanDcom207 Labour Laws PDFshwetamolly04Belum ada peringkat

- Labor LawDokumen138 halamanLabor LawJed Mendoza0% (1)

- Tax 1 (Reviewer)Dokumen15 halamanTax 1 (Reviewer)Lemuel Angelo M. Eleccion100% (1)

- Chapter 8 Entry Strategies in Global BusinessDokumen3 halamanChapter 8 Entry Strategies in Global BusinessMariah Dion GalizaBelum ada peringkat

- Pre-production process overviewDokumen7 halamanPre-production process overviewsanyaBelum ada peringkat

- Employees Compensation ActDokumen25 halamanEmployees Compensation Actsairishikesh999Belum ada peringkat

- 2labour Law IIDokumen3 halaman2labour Law IIShweta ShiradonBelum ada peringkat

- Tamil Nadu National Law University: B.A. LL.B. (Hons) and B. Com. LL. B. (Hons)Dokumen7 halamanTamil Nadu National Law University: B.A. LL.B. (Hons) and B. Com. LL. B. (Hons)Ranjani RajkumarBelum ada peringkat

- Teaching Plan - Labour LawsDokumen16 halamanTeaching Plan - Labour Lawsram rajaBelum ada peringkat

- Assignment MS-28 Course Code: MS - 28 Course Title: Labour Laws Assignment Code: MS-28/TMA/SEM - II /2012 Coverage: All BlocksDokumen27 halamanAssignment MS-28 Course Code: MS - 28 Course Title: Labour Laws Assignment Code: MS-28/TMA/SEM - II /2012 Coverage: All BlocksAnjnaKandariBelum ada peringkat

- Jurisprudence Notes LLB PDFDokumen17 halamanJurisprudence Notes LLB PDFkrrish0786Belum ada peringkat

- PhysicsDokumen11 halamanPhysicsMinhaj KhurshidBelum ada peringkat

- Labour Law BbaDokumen11 halamanLabour Law BbaMinhaj KhurshidBelum ada peringkat

- 841409574429labour LegislationDokumen11 halaman841409574429labour LegislationArun KumarBelum ada peringkat

- Unit - 1 - LAIRDokumen65 halamanUnit - 1 - LAIRsreevalliBelum ada peringkat

- Labour Law IIDokumen2 halamanLabour Law IITaraChandraChouhanBelum ada peringkat

- LL.M Social Security Law SyllabusDokumen334 halamanLL.M Social Security Law SyllabusshubhamBelum ada peringkat

- Labour ProtectionDokumen4 halamanLabour ProtectionHawk2011Belum ada peringkat

- Social Security Legislation: Chapter - 29Dokumen26 halamanSocial Security Legislation: Chapter - 29surajBelum ada peringkat

- Labour Law - LLB - IV SemesterDokumen98 halamanLabour Law - LLB - IV Semestershiv0307Belum ada peringkat

- Labour Law IIDokumen2 halamanLabour Law IIHemantVerma100% (1)

- IV SEMESTER Short QuestionsDokumen6 halamanIV SEMESTER Short QuestionsWatsun ArmstrongBelum ada peringkat

- HRM Unit 4Dokumen43 halamanHRM Unit 4Deepa SelvamBelum ada peringkat

- Topic1 Social Security Meaning and ConceptDokumen16 halamanTopic1 Social Security Meaning and Conceptkanishk tyagiBelum ada peringkat

- 8 - 29 35 Dr. Minal H. Upadhyay PDFDokumen7 halaman8 - 29 35 Dr. Minal H. Upadhyay PDFVinod NannawareBelum ada peringkat

- Law550:Labour and Industrial Laws-Ii: Session 2020-21 Page:1/1Dokumen1 halamanLaw550:Labour and Industrial Laws-Ii: Session 2020-21 Page:1/1Mansi MalikBelum ada peringkat

- 8.3 Labour Law-II - Jagdish KhobragadeDokumen9 halaman8.3 Labour Law-II - Jagdish KhobragadeAkanksha BohraBelum ada peringkat

- Syllabus July' 22 Labour LawsDokumen3 halamanSyllabus July' 22 Labour Lawssurya prakashBelum ada peringkat

- IR unit -4 Notes UPTO CT-2 (1)Dokumen50 halamanIR unit -4 Notes UPTO CT-2 (1)Khushi SinghBelum ada peringkat

- Labour Law SyllabusDokumen5 halamanLabour Law Syllabustanu yadavBelum ada peringkat

- Unit 23 Social Security Legislation: An Overview: ObjectivesDokumen4 halamanUnit 23 Social Security Legislation: An Overview: ObjectivesAnonymous Udy9PDBelum ada peringkat

- Human Resource Development, Labour Laws & Industrial RelationsDokumen2 halamanHuman Resource Development, Labour Laws & Industrial Relationsravneet jatanaBelum ada peringkat

- DocumentDokumen1 halamanDocumentTannu SinghBelum ada peringkat

- Labour Law - II: Wages, Social Security & WelfareDokumen4 halamanLabour Law - II: Wages, Social Security & Welfareaswin donBelum ada peringkat

- Labour Law (CIA 1)Dokumen18 halamanLabour Law (CIA 1)SIMRAN GUPTA 19213232Belum ada peringkat

- Labourlegislation 150712042955 Lva1 App6891Dokumen16 halamanLabourlegislation 150712042955 Lva1 App6891radhapunnaBelum ada peringkat

- Articles Group 2 The Right To Work and Rights at Work Child Labour and The Institutional Treatment of Hiv Aids Indias Laws As Briefly ComparDokumen32 halamanArticles Group 2 The Right To Work and Rights at Work Child Labour and The Institutional Treatment of Hiv Aids Indias Laws As Briefly ComparvigilindiaBelum ada peringkat

- Labour Laws 2Dokumen194 halamanLabour Laws 2Prateek SharmaBelum ada peringkat

- Labour Law-II Syllabus KGDokumen3 halamanLabour Law-II Syllabus KGABHIJEETBelum ada peringkat

- Labour Code II, LW 5013, 9th SemDokumen8 halamanLabour Code II, LW 5013, 9th SemsoumyaBelum ada peringkat

- Unit 2 - LAIR-1Dokumen142 halamanUnit 2 - LAIR-1sreevalliBelum ada peringkat

- Human Resource Management: K.S.PrasadDokumen27 halamanHuman Resource Management: K.S.PrasadDhaval BariaBelum ada peringkat

- Labour and Industrial Law IIDokumen4 halamanLabour and Industrial Law IIVinayak PuriBelum ada peringkat

- An Overview of Labour Laws in IndiaDokumen10 halamanAn Overview of Labour Laws in IndiaAarya ThhakkareBelum ada peringkat

- Industrial Relations and Labour EnactmentsDokumen34 halamanIndustrial Relations and Labour EnactmentsTechboy9100% (1)

- ID ACT 1947. CompleteDokumen62 halamanID ACT 1947. CompleteAkash KapoorBelum ada peringkat

- Labour Law II Kle Notes PDFDokumen191 halamanLabour Law II Kle Notes PDFmanjushree100% (1)

- Cs FLW PG Diploma Labour LawDokumen9 halamanCs FLW PG Diploma Labour LawMohd ArhamBelum ada peringkat

- Labour LegislationDokumen103 halamanLabour LegislationPrasanth BattuBelum ada peringkat

- Social SecurityDokumen5 halamanSocial SecuritySiddhartha Singh RoyBelum ada peringkat

- 08 - Chapter 1Dokumen39 halaman08 - Chapter 1vigneshBelum ada peringkat

- Labor PoquizDokumen21 halamanLabor PoquizJune MondejarBelum ada peringkat

- Rename Q&aDokumen320 halamanRename Q&aRen MagallonBelum ada peringkat

- Lecture 1-2023Dokumen32 halamanLecture 1-2023akashBelum ada peringkat

- Social Security: A Fresh Look at Policy AlternativesDari EverandSocial Security: A Fresh Look at Policy AlternativesBelum ada peringkat

- THE LABOUR LAW IN UGANDA: [A TeeParkots Inc Publishers Product]Dari EverandTHE LABOUR LAW IN UGANDA: [A TeeParkots Inc Publishers Product]Belum ada peringkat

- Older Persons' Right to Work and Productive ResourcesDari EverandOlder Persons' Right to Work and Productive ResourcesBelum ada peringkat

- IN BAD FAITH: The Republican Plan to Destroy Social SecurityDari EverandIN BAD FAITH: The Republican Plan to Destroy Social SecurityBelum ada peringkat

- Marine Insurance: Legal PerspectiveDokumen17 halamanMarine Insurance: Legal PerspectiveAkshay RamBelum ada peringkat

- FORM 37 Pharmaceutical License AgreementDokumen9 halamanFORM 37 Pharmaceutical License AgreementIeva KisieliuteBelum ada peringkat

- Ravas Monea David PDFDokumen8 halamanRavas Monea David PDFAkshay RamBelum ada peringkat

- Sl. No. ID No. Project Topic: National Law School of India University, BengaluruDokumen3 halamanSl. No. ID No. Project Topic: National Law School of India University, BengaluruPreyashi ShrivastavaBelum ada peringkat

- Notice To Minority Shareholders - Takeover: Companies RegistryDokumen4 halamanNotice To Minority Shareholders - Takeover: Companies RegistryAkshay RamBelum ada peringkat

- Law of Insurance Eighth SemesterDokumen8 halamanLaw of Insurance Eighth SemesterGaurav KrBelum ada peringkat

- Aviation IndiaDokumen11 halamanAviation IndiaAkshay RamBelum ada peringkat

- Ravas Monea David PDFDokumen8 halamanRavas Monea David PDFAkshay RamBelum ada peringkat

- Labour Law ProjectDokumen1 halamanLabour Law ProjectAkshay RamBelum ada peringkat

- Application challenging arbitral award and seeking contempt actionDokumen29 halamanApplication challenging arbitral award and seeking contempt actionGurjinder SinghBelum ada peringkat

- 14 B 308Dokumen3 halaman14 B 308Akshay RamBelum ada peringkat

- Labour Law ProjectDokumen20 halamanLabour Law ProjectAkshay RamBelum ada peringkat

- Income From House Property KarthikDokumen56 halamanIncome From House Property KarthikCorey PageBelum ada peringkat

- Income From HPDokumen36 halamanIncome From HPjidnyasabhoirBelum ada peringkat

- Income From House Property KarthikDokumen56 halamanIncome From House Property KarthikCorey PageBelum ada peringkat

- Intra Moot Problem PDFDokumen3 halamanIntra Moot Problem PDFAkshay Ram88% (8)

- Income From House Property KarthikDokumen56 halamanIncome From House Property KarthikCorey PageBelum ada peringkat

- Academic Calendar For July 2016 (August)Dokumen1 halamanAcademic Calendar For July 2016 (August)Akshay RamBelum ada peringkat

- Dealing With Minority Shareholders 9416104 - 3Dokumen5 halamanDealing With Minority Shareholders 9416104 - 3Akshay RamBelum ada peringkat

- BBA LLB - 2014-19 - SEM V - Dsa Schedule-Sep 2016Dokumen1 halamanBBA LLB - 2014-19 - SEM V - Dsa Schedule-Sep 2016Akshay RamBelum ada peringkat

- 03.03 NV-FL PDFDokumen3 halaman03.03 NV-FL PDFRoibu MarcelBelum ada peringkat

- Your Tickets.: OnlineDokumen1 halamanYour Tickets.: OnlineManpreetBelum ada peringkat

- Report Sample-Supplier Factory AuditDokumen24 halamanReport Sample-Supplier Factory AuditCarlosSánchezBelum ada peringkat

- Ifrs & PFRSDokumen74 halamanIfrs & PFRSRey ArellanoBelum ada peringkat

- PT Karya Mandri Accounts SummaryDokumen2 halamanPT Karya Mandri Accounts SummaryFerdi PutraBelum ada peringkat

- CHAPTER 4 Creating and Conducting Structured InterviewsDokumen3 halamanCHAPTER 4 Creating and Conducting Structured InterviewsJonah FortunaBelum ada peringkat

- GSM Based Smart Irrigation Systems PDFDokumen7 halamanGSM Based Smart Irrigation Systems PDFMohamed RafiBelum ada peringkat

- ITC LimitedDokumen16 halamanITC LimitedSANJANA BHAVNANIBelum ada peringkat

- Bizhub 40P: Designed For ProductivityDokumen4 halamanBizhub 40P: Designed For ProductivityionutkokBelum ada peringkat

- Unit-Department IT DRPDokumen22 halamanUnit-Department IT DRPllm oodBelum ada peringkat

- Dremer Corporation: On June 1, 20X5, The Books of Dremer Corporation Show Assets With BookDokumen1 halamanDremer Corporation: On June 1, 20X5, The Books of Dremer Corporation Show Assets With BookLouiza Kyla AridaBelum ada peringkat

- Module 2 Introduction To Cost Terms and ConceptsDokumen52 halamanModule 2 Introduction To Cost Terms and ConceptsChesca AlonBelum ada peringkat

- BTC - AUTOPILOT - METHOD - Make 700$-1000$Dokumen4 halamanBTC - AUTOPILOT - METHOD - Make 700$-1000$john renoldBelum ada peringkat

- CosmoEye BrandbookDokumen104 halamanCosmoEye BrandbookJakub PiaszczyńskiBelum ada peringkat

- HR 71Dokumen134 halamanHR 71freak badBelum ada peringkat

- Lecture One Introduction To Management Summarised NotesDokumen14 halamanLecture One Introduction To Management Summarised NotesMburu KaranjaBelum ada peringkat

- Comparative Valuation of Strides With Its Competitors Using Relative Valuation TechniqueDokumen26 halamanComparative Valuation of Strides With Its Competitors Using Relative Valuation TechniqueVipin ChandraBelum ada peringkat

- Linear Example DataDokumen7 halamanLinear Example DataSanjay S RayBelum ada peringkat

- Current Scenario and Future Prospect of Supply Chain Management in UTAH Composite Garments, Bangladesh.Dokumen19 halamanCurrent Scenario and Future Prospect of Supply Chain Management in UTAH Composite Garments, Bangladesh.Zahin Azad MoslemBelum ada peringkat

- Las Tendencias Pedagógicas en América Latina. NassifDokumen51 halamanLas Tendencias Pedagógicas en América Latina. NassifDora MuñozBelum ada peringkat

- Splicing Bar Resources: Additional Information On Lap Splices Can Be Found HereDokumen5 halamanSplicing Bar Resources: Additional Information On Lap Splices Can Be Found HereLiyakhat aliBelum ada peringkat

- FDI Advantages DisadvantagesDokumen4 halamanFDI Advantages DisadvantagesRaja Ahsan TariqBelum ada peringkat

- InvestmentDokumen16 halamanInvestmentChristie JonesBelum ada peringkat

![THE LABOUR LAW IN UGANDA: [A TeeParkots Inc Publishers Product]](https://imgv2-1-f.scribdassets.com/img/word_document/702714789/149x198/ac277f344e/1706724197?v=1)