Agricultural Development Bank Limited: Unaudited Financial Results (Quarterly) Provisional

Diunggah oleh

aJudul Asli

Hak Cipta

Format Tersedia

Bagikan dokumen Ini

Apakah menurut Anda dokumen ini bermanfaat?

Apakah konten ini tidak pantas?

Laporkan Dokumen IniHak Cipta:

Format Tersedia

Agricultural Development Bank Limited: Unaudited Financial Results (Quarterly) Provisional

Diunggah oleh

aHak Cipta:

Format Tersedia

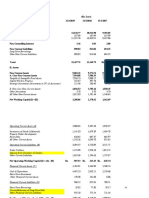

Agricultural Development Bank Limited

Ramshahpath, Kathmandu

Unaudited Financial Results (Quarterly) Provisional

As at Third Quarter of the Fiscal Year 2066/67

Rs in '000

This Previous

S. Corresponding Previous

Particulars Quarter Quarter

Year Quarter Ending

No. Ending Ending

1 Total Capital and Liabilities (1.1 to 1.7) 50,078,751 51,086,835 45,153,749

1.1 Paid Up Capital 10,777,500 10,777,500 10,777,500

1.2 Reserve and Surplus 353,271 159,294 (4,563,665)

1.3 Debenture and Bond - - -

1.4 Borrowings 1,110,951 545,937 201,633

1.5 Deposits (A+B) 30,897,748 33,437,942 33,087,598

A. Domestic Currency 30,897,748 33,437,942 33,087,598

B. Foreign Currency - - -

1.6 Income Tax Liability 763,590 751,686 459,114

1.7 Other Liabilities 6,175,691 5,414,476 5,191,569

2 Total Assets ( 2.1 to 2.7) 50,078,751 51,086,835 45,153,749

2.1 Cash and Bank Balance 3,646,774 3,523,241 3,736,147

2.2 Money at Call and Short Notice 967,048 853,547 734,391

2.3 Investment 2,569,253 4,338,452 3,971,918

2.4 Loans and Advances (Net of Provision) 34,311,849 34,370,261 30,468,250

a. Real Estate Loan 8,457 233

b. Home/Housing Loan 1,812,660 1,730,849

c. Margin Type Loan - -

d. Term Loan 8,429,570 10,398,920

e. Overdraft Loan/ TR Loan/WC Loan 19,677,971 18,975,129

f. Others 4,383,191 3,265,130

2.5 Fixed Assets 872,269 840,467 809,770

2.6 Non Banking Assets (Net of Provision) - - -

Non Banking Assets (Gross) 394,364 414,932 618,444

Provision for Non Banking Assets (394,364) (414,932) (618,444)

2.7 Other Assets 7,711,558 7,160,867 5,433,273

Up to This Up to Previous Corresponding Previous

3 Profit and Loss Account

Quarter Quarter Year Quarter

3.1 Interest Income 3,418,974 2,331,726 1,714,232

3.2 Interest Expense 994,550 679,076 750,797

A. Net Interest Income (3.1-3.2) 2,424,424 1,652,650 963,435

3.3 Fees, Commission and Discount 103,705 66,727 76,622

3.4 Other Operating Income 212,247 152,038 279,814

3.5 Foreign Exchange Gain/Loss (Net) 382 341 99

B. Total Operating Income(A+3.3+3.4+3.5) 2,740,758 1,871,756 1,319,970

3.6 Staff Expenses 1,465,589 1,000,905 1,403,526

3.7 Other Operating Expenses 176,460 104,512 163,537

C. Operating Profit before Provision (B-3.6-3.7) 1,098,709 766,339 (247,093)

3.8 Provision for Possible Losses 1,569,296 1,027,700 1,389,253

D. Operating Profit (C-3.8) (470,587) (261,361) (1,636,346)

3.9 Non Operating Income/Expenses (Net) 40,329 29,316 182,371

3.10 Write Back of Provision for Possible Loss 1,251,066 933,117 1,356,673

E. Profit from Regular Activities (D+3.9+3.10) 820,808 701,072 (97,302)

3.11 Extraordinary Income/Expense (Net) 232,970 135,710 1,145,562

F. Profit before Bonus and Taxes (E+3.11) 1,053,778 836,782 1,048,260

3.12 Provision for Staff Bonus 78,058 66,943 77,649

3.13 Provision for Income Tax 165,872 153,968 93,872

G. Net Profit/Loss (F-3.12-3.13) 809,848 615,871 876,739

At the End of

At the End of At the End of

4 Ratios This Quarter Previous Quarter

Corresponding Previous

Year Quarter

4.1 Capital Fund to RWE 16.95% 15.64% 10.44%

4.2 Non Performing Loan to Total Loan 8.97% 9.05% 10.77%

4.3 Total Loan Loss Provision to Total NPL 164.65% 156.70% 156.33%

4.4 Cost of Fund 4.94% 4.77%

4.5 C/D Ratio (As per NRB Directives) 101.86% 94.37%

Disclosure as required by Securities Registration and Issuance Regulation

2065 (Related to Rule 22(2) for the Third quarter of 2066/67)

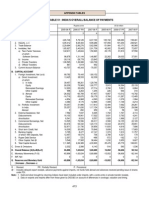

1. Financial Highlights (Unaudited figures of 2066.12.31)

Earning Per Market Price Net Return Liquidity

share Value Earning worth per on total Ratio

per share Ratio ordinary Assets

share

51.84 - - 117 1.62% 21.9%

(Annualized)

2. Management Analysis:

a. Details relating to the change in the Bank’s reserve, income,

liquidity in the quarter (if any) and its main reasons: Positive

changes in reserves, profitability and quality of loan portfolio have

been observed during the period. Reserve has increased due the

increment in profitability. Growth in income is mainly contributed by

the income in risk assets and treasury. Liquidity position was

satisfactory during the period.

b. Management’s analytical detail regarding future business Plan:

This year, the bank’s prime focus will be on effective investment as

well as portfolio management and augmentation of income from non

fund business.

c. Analytical details of the incidents that may have major impact on

reserve, profit or cash flow: During the period under review, there

were no such extra-ordinary incidents/events which have had impact on

the reserve, profit or cash flow position of the institution.

3. Details of Legal Action:

During the review period:

a. Case filled by the institution during the period:

Three cases have been filed against or by the bank. Of these cases, two

cases amounting Rs. 865 thousand are related with loan.

b. Case relating to disobedience of the prevailing laws or commission

of the criminal offence filed by or against the promoters or

directors of the Institution.

No such information has been received by the Institution

c. Case relating to the commission of financial crime filed against any

promoter or director.

No such information has been received by the institution

4. Details of the Share Transaction

Not applicable. ADBL share has not yet been listed.

5. Problems and Challenges:

a. Internal Problems & Challenges

i. Decrease in deposit.

ii. Managing non-performing loans

iii Increasing cost of employees

Strategy to manage the internal problems and challenges:

i. Adoption of competitive pricing and effective marketing measures

to augment deposit.

ii. Extensive monitoring and follow-up activities are being launched

to enhance quality of loan portfolio.

iii. Enhance employees' productivity through training employees in

various technical areas including computer literacy. Moreover, the

bank is adopting a policy to consistently reduce the number of

employees through normal as well as voluntary retirement.

iv. Under the Rural Finance Sector Development Cluster Program

financed by Asian Development Bank, the bank is in the process of

procuring of core banking system for enhancing its overall

efficiency and productivity.

b. External Problems & Challenges:

i. Liquidity crunch in the market.

ii Changes in political economic situation

iii Increasing competition.

Strategy to manage the external problems and challenges:

i. The bank is controlling credit expansion and focusing on deposit

marketing to reduce the affect of liquidity crunch.

ii The bank is consistently monitoring the existing political economic

situation of the country and reshaping strategies to minimize its

negative effects on business.

iii. To manage the increasing competition, the management is adopting

various measures related to competitive pricing, effective

marketing, manpower development and conversion of lending

branches into commercial banking branches.

6. Corporate Governance:

Corporate governance is the focal point of the institution. The institution has

taken the following steps to strengthen the corporate governance:

a. The bank is complying with corporate governance provisions of NRB

directives. The Corporate Governance Committee consisting non-

executive directors oversees overall corporate governance aspects of

the bank.

b. The Audit Committee headed by the non-executive directors review

management reports and reports from external as well as internal

auditors, and provides the feedback to the board of directors as

required.

c. The Asset and Liability Committee (ALCO) and Loan Portfolio

Management Committee (LPMC) at head office and regional offices

deal with related issues concerning credit and other risk management.

7. Disclosure of the Chief Executive Officer:

I am personally responsible for the correctness of the facts and figures

disclosed in this report. Also, to the extent of my knowledge, the facts and

figures disclosed in this report are correct and comprehensive and all the

material information relevant to take proper investment decision for the

investors are disclosed properly in this statement.

Anda mungkin juga menyukai

- Schaum's Outline of Basic Business Mathematics, 2edDari EverandSchaum's Outline of Basic Business Mathematics, 2edPenilaian: 5 dari 5 bintang5/5 (1)

- Discounted Cash Flow: A Theory of the Valuation of FirmsDari EverandDiscounted Cash Flow: A Theory of the Valuation of FirmsBelum ada peringkat

- Ashwin 2070Dokumen2 halamanAshwin 2070nayanghimireBelum ada peringkat

- Unaudited Financial Results (Quarterly) : CF J @) &&÷& SF) T) F) Q) DFL S ljj/0fDokumen1 halamanUnaudited Financial Results (Quarterly) : CF J @) &&÷& SF) T) F) Q) DFL S ljj/0fjth55936zwohocomBelum ada peringkat

- Rastriya Banijya Bank Limited Singhdurbar Plaza, Kathmandu Unaudited Financial Results (Quarterly) As at 1St Quarter of Fiscal Year 2008-09Dokumen1 halamanRastriya Banijya Bank Limited Singhdurbar Plaza, Kathmandu Unaudited Financial Results (Quarterly) As at 1St Quarter of Fiscal Year 2008-09gonenp1Belum ada peringkat

- Agricultural Development Bank Limited: Unaudited Financial Results (Quarterly)Dokumen3 halamanAgricultural Development Bank Limited: Unaudited Financial Results (Quarterly)sanjiv sahBelum ada peringkat

- 91invuf 2Dokumen1 halaman91invuf 2Mahamadali DesaiBelum ada peringkat

- Financial Statement AnalysisDokumen1.179 halamanFinancial Statement AnalysisSYEDWASIQABBAS RIZVIBelum ada peringkat

- Unaudited Financial Results (Quarterly)Dokumen1 halamanUnaudited Financial Results (Quarterly)Rubin PoudelBelum ada peringkat

- Takaful Companies - Overall: ItemsDokumen6 halamanTakaful Companies - Overall: ItemsZubair ArshadBelum ada peringkat

- Takaful Companies - Overall: ItemsDokumen6 halamanTakaful Companies - Overall: ItemsZubair ArshadBelum ada peringkat

- Share Capital Other Equity: B. Non-Core Non-Current AssetsDokumen17 halamanShare Capital Other Equity: B. Non-Core Non-Current AssetsAksa DindeBelum ada peringkat

- Dows ExcelDokumen18 halamanDows ExcelJaydeep SheteBelum ada peringkat

- Chapter 2Dokumen32 halamanChapter 2AhmedBelum ada peringkat

- Financial Statement Analysis of Masan Company Masan GroupDokumen24 halamanFinancial Statement Analysis of Masan Company Masan GroupTammy DaoBelum ada peringkat

- Balance Sheet (December 31, 2008)Dokumen6 halamanBalance Sheet (December 31, 2008)anon_14459Belum ada peringkat

- Zensar Standalone Clause 33 Results Mar2023Dokumen3 halamanZensar Standalone Clause 33 Results Mar2023Pradeep KshatriyaBelum ada peringkat

- 63 Moon Q3 ResultsDokumen16 halaman63 Moon Q3 Resultsdownloads.xaBelum ada peringkat

- Chapter III - Developments in Commercial Banking: (Amount in Rs. Crore)Dokumen59 halamanChapter III - Developments in Commercial Banking: (Amount in Rs. Crore)Modi SinghBelum ada peringkat

- Audited - Balance - Sheet - of Integrated PheripheralsDokumen6 halamanAudited - Balance - Sheet - of Integrated PheripheralsP VENKATA HARSHA VARDHAN REDDYBelum ada peringkat

- Trade and PaymentsDokumen17 halamanTrade and PaymentsmazamniaziBelum ada peringkat

- ' in LakhsDokumen53 halaman' in LakhsParthBelum ada peringkat

- Love Verma Ceres Gardening SubmissionDokumen8 halamanLove Verma Ceres Gardening Submissionlove vermaBelum ada peringkat

- Pakistan Synthetic... AssignmentDokumen6 halamanPakistan Synthetic... AssignmentArooj IqbalBelum ada peringkat

- Swedish Match 9 212 017Dokumen6 halamanSwedish Match 9 212 017Karan AggarwalBelum ada peringkat

- Standalone Financial ResultsDokumen4 halamanStandalone Financial ResultsMD AbdulMoid MukarramBelum ada peringkat

- Bop PDFDokumen1 halamanBop PDFLoknadh ReddyBelum ada peringkat

- U Microfinance Bank Limited Condensed Interim Financial Statements (Un-Audited) For The PeriodDokumen20 halamanU Microfinance Bank Limited Condensed Interim Financial Statements (Un-Audited) For The PeriodHayue MemonBelum ada peringkat

- Balance Sheet - Assets: Period EndingDokumen3 halamanBalance Sheet - Assets: Period Endingvenu54Belum ada peringkat

- Askari Bank Limited Financial Statement AnalysisDokumen16 halamanAskari Bank Limited Financial Statement AnalysisAleeza FatimaBelum ada peringkat

- Audited Financials Dec 2022Dokumen1 halamanAudited Financials Dec 2022EdwinBelum ada peringkat

- Ain 20201025074Dokumen8 halamanAin 20201025074HAMMADHRBelum ada peringkat

- Case 2 - Q5 Group 5Dokumen4 halamanCase 2 - Q5 Group 5Shaarang Begani0% (2)

- 2018 Quarter 1 Financials PDFDokumen1 halaman2018 Quarter 1 Financials PDFKaystain Chris IhemeBelum ada peringkat

- IEX Standalone and Consolidated Unaudited Financial Results For The Quarter & Half Year Ended September 30, 2021Dokumen13 halamanIEX Standalone and Consolidated Unaudited Financial Results For The Quarter & Half Year Ended September 30, 2021seena_smile89Belum ada peringkat

- Rafiki MFB Audited Financials FY 2022 31.03.2023Dokumen1 halamanRafiki MFB Audited Financials FY 2022 31.03.2023EdwinBelum ada peringkat

- Cakes Inside: Biratnagar, NepalDokumen23 halamanCakes Inside: Biratnagar, NepalDenimBelum ada peringkat

- AnalysisDokumen20 halamanAnalysisSAHEB SAHABelum ada peringkat

- A. Currents Assets 29,760,685 24,261,892: I. II. Iii. IV. V. I. II. Iii. IV. V. VIDokumen32 halamanA. Currents Assets 29,760,685 24,261,892: I. II. Iii. IV. V. I. II. Iii. IV. V. VITammy DaoBelum ada peringkat

- The Catholic Syrian Bank LimitedDokumen2 halamanThe Catholic Syrian Bank Limitedsaravanan aBelum ada peringkat

- Standalone Financial Results, Limited Review Report For December 31, 2016 (Result)Dokumen3 halamanStandalone Financial Results, Limited Review Report For December 31, 2016 (Result)Shyam SunderBelum ada peringkat

- Mahindra & Mahindra Limited: Rs. in CroresDokumen4 halamanMahindra & Mahindra Limited: Rs. in CroresGeorge Chalissery RajuBelum ada peringkat

- Gma FSDokumen13 halamanGma FSMark Angelo BustosBelum ada peringkat

- Standalone Financial Statements of Nagarro SE: (For The Financial Year 2021 in Accordance With German Gaap)Dokumen20 halamanStandalone Financial Statements of Nagarro SE: (For The Financial Year 2021 in Accordance With German Gaap)PolloFlautaBelum ada peringkat

- Ebl 2016 Is BSDokumen3 halamanEbl 2016 Is BSAasim Bin BakrBelum ada peringkat

- Audit - QuestionsDokumen6 halamanAudit - Questionsnaveen pragashBelum ada peringkat

- Balance Sheet As at December 31, 2009Dokumen19 halamanBalance Sheet As at December 31, 2009pradeepkallurBelum ada peringkat

- Appendices: Appendix - 1 Balance Sheet of Parabhu Bank LTD Balance SheetDokumen7 halamanAppendices: Appendix - 1 Balance Sheet of Parabhu Bank LTD Balance SheetSocialist GopalBelum ada peringkat

- Ameritrade Case SolutionDokumen39 halamanAmeritrade Case SolutionShivani KarkeraBelum ada peringkat

- Icici 2009Dokumen4 halamanIcici 2009Anudeep ReddyBelum ada peringkat

- Tesla FSAPDokumen20 halamanTesla FSAPSihongYanBelum ada peringkat

- Boston Chicken CaseDokumen7 halamanBoston Chicken CaseDji YangBelum ada peringkat

- SCB BursaAnnFSNotes 4th Quarter Ended 30.6.2022Dokumen13 halamanSCB BursaAnnFSNotes 4th Quarter Ended 30.6.2022kimBelum ada peringkat

- Balance Sheet As at March 31, 2010: Sources of FundsDokumen15 halamanBalance Sheet As at March 31, 2010: Sources of FundszalaksBelum ada peringkat

- Standalone & Consolidated Financial Results, Limited Review Report For December 31, 2016 (Result)Dokumen7 halamanStandalone & Consolidated Financial Results, Limited Review Report For December 31, 2016 (Result)Shyam SunderBelum ada peringkat

- Axis Bank - AR21 - Consolidated Financial StatementsDokumen48 halamanAxis Bank - AR21 - Consolidated Financial StatementsRakeshBelum ada peringkat

- Ameritrade Case SolutionDokumen39 halamanAmeritrade Case SolutiondoiBelum ada peringkat

- Blackstone 22Q1 Press Release and PresentationDokumen41 halamanBlackstone 22Q1 Press Release and Presentation魏xxxappleBelum ada peringkat

- Chapter 5Dokumen12 halamanChapter 5Arjun Singh ABelum ada peringkat

- Gita AgricultureDokumen20 halamanGita AgriculturemrigendrarimalBelum ada peringkat

- RolesDokumen1 halamanRolesaBelum ada peringkat

- Custody in 2025 PDFDokumen8 halamanCustody in 2025 PDFaBelum ada peringkat

- ISO 20022 Data Source Schemes (DSS)Dokumen15 halamanISO 20022 Data Source Schemes (DSS)aBelum ada peringkat

- Opportunities Challenges of New Technologies For AML CFTDokumen76 halamanOpportunities Challenges of New Technologies For AML CFTaBelum ada peringkat

- What Is A Japanese Trust and Who Can Conduct Trust Banking in Japan? The Nature of A Japanese TrustDokumen7 halamanWhat Is A Japanese Trust and Who Can Conduct Trust Banking in Japan? The Nature of A Japanese TrustaBelum ada peringkat

- Custody in 2025 PDFDokumen8 halamanCustody in 2025 PDFaBelum ada peringkat

- Comesa Clearing HouseDokumen23 halamanComesa Clearing HouseaBelum ada peringkat

- Safekeeping Empowered: Reimagining The Us Custody Business: A Tabb Group Research ReportDokumen19 halamanSafekeeping Empowered: Reimagining The Us Custody Business: A Tabb Group Research ReportaBelum ada peringkat

- African Payment SystemDokumen6 halamanAfrican Payment SystemaBelum ada peringkat

- 2017 10 24 Huge Sponsored Investor Conference at WBS Walter Volker PASA PresentationDokumen24 halaman2017 10 24 Huge Sponsored Investor Conference at WBS Walter Volker PASA PresentationaBelum ada peringkat

- John Sebabi Bosco REPSSDokumen26 halamanJohn Sebabi Bosco REPSSaBelum ada peringkat

- ACT 2010 Training BrochureDokumen28 halamanACT 2010 Training BrochureaBelum ada peringkat

- PERISA Case Study Private Sector: SADC Payment Integration SystemDokumen7 halamanPERISA Case Study Private Sector: SADC Payment Integration SystemaBelum ada peringkat

- BennieDokumen3 halamanBennieaBelum ada peringkat

- RBI/2008-09/122 A.P. (DIR Series) Circular No. 05 August 06, 2008Dokumen8 halamanRBI/2008-09/122 A.P. (DIR Series) Circular No. 05 August 06, 2008aBelum ada peringkat

- Bfsibap PDFDokumen6 halamanBfsibap PDFaBelum ada peringkat

- TOB - Adviser Introduced - April 2011 - For ClientDokumen4 halamanTOB - Adviser Introduced - April 2011 - For ClientaBelum ada peringkat

- Sandra Lippert Law Definitions and CodificationDokumen14 halamanSandra Lippert Law Definitions and CodificationЛукас МаноянBelum ada peringkat

- Visual Impairments in Young Children: Fundamentals of and Strategies For Enhancing DevelopmentDokumen13 halamanVisual Impairments in Young Children: Fundamentals of and Strategies For Enhancing Developmentfadil ahmadiBelum ada peringkat

- D78846GC20 sg2Dokumen356 halamanD78846GC20 sg2hilordBelum ada peringkat

- RECAP Lecture 7: FA of EVEN EVEN, FA Corresponding To Finite Languages (Using Both Methods), Transition GraphsDokumen23 halamanRECAP Lecture 7: FA of EVEN EVEN, FA Corresponding To Finite Languages (Using Both Methods), Transition GraphsMuhammad EahteshamBelum ada peringkat

- Neurolinguistic ProgrammingDokumen9 halamanNeurolinguistic ProgrammingMartin MontecinoBelum ada peringkat

- RI Prelims GP H1 Paper 2 Ans KeyDokumen18 halamanRI Prelims GP H1 Paper 2 Ans Keyjaylynn6100% (1)

- APARICIO Frances Et Al. (Eds.) - Musical Migrations Transnationalism and Cultural Hybridity in Latino AmericaDokumen218 halamanAPARICIO Frances Et Al. (Eds.) - Musical Migrations Transnationalism and Cultural Hybridity in Latino AmericaManuel Suzarte MarinBelum ada peringkat

- Mejia V Reyes - DumaguingDokumen1 halamanMejia V Reyes - DumaguingRonalyn GaculaBelum ada peringkat

- He Didnt Die in Vain - Take No GloryDokumen2 halamanHe Didnt Die in Vain - Take No GloryDagaerag Law OfficeBelum ada peringkat

- Course-Outline EL 102 GenderAndSocietyDokumen4 halamanCourse-Outline EL 102 GenderAndSocietyDaneilo Dela Cruz Jr.Belum ada peringkat

- Solution Manual For Management A Focus On Leaders Plus 2014 Mymanagementlab With Pearson Etext Package 2 e Annie MckeeDokumen24 halamanSolution Manual For Management A Focus On Leaders Plus 2014 Mymanagementlab With Pearson Etext Package 2 e Annie MckeeAnnGregoryDDSemcxo100% (90)

- Adobe Voice Assessment Tool-FinalDokumen1 halamanAdobe Voice Assessment Tool-Finalapi-268484302Belum ada peringkat

- BS Assignment Brief - Strategic Planning AssignmentDokumen8 halamanBS Assignment Brief - Strategic Planning AssignmentParker Writing ServicesBelum ada peringkat

- Questionnaire HRISDokumen4 halamanQuestionnaire HRISAnonymous POUAc3zBelum ada peringkat

- A Financial History of The United States PDFDokumen398 halamanA Financial History of The United States PDFiztok_ropotar6022Belum ada peringkat

- Design and Implementation of Computerized Hospital Database MNT SystemDokumen13 halamanDesign and Implementation of Computerized Hospital Database MNT SystemOgidiolu Temitope EbenezerBelum ada peringkat

- SpreadsheetDokumen8 halamanSpreadsheetSMBelum ada peringkat

- ART 6 LEARNING PACKET Week2-3Dokumen10 halamanART 6 LEARNING PACKET Week2-3Eljohn CabantacBelum ada peringkat

- An Equivalent Circuit of Carbon Electrode SupercapacitorsDokumen9 halamanAn Equivalent Circuit of Carbon Electrode SupercapacitorsUsmanSSBelum ada peringkat

- Hinog vs. MellicorDokumen11 halamanHinog vs. MellicorGreta VilarBelum ada peringkat

- 001 Ipack My School BagDokumen38 halaman001 Ipack My School BagBrock JohnsonBelum ada peringkat

- Examination of Conscience Ten Commandments PDFDokumen2 halamanExamination of Conscience Ten Commandments PDFAntonioBelum ada peringkat

- Deception With GraphsDokumen7 halamanDeception With GraphsTanmay MaityBelum ada peringkat

- History Paper 2 IB Study GuideDokumen6 halamanHistory Paper 2 IB Study Guidersuresh1995100% (4)

- EmTech TG Acad v5 112316Dokumen87 halamanEmTech TG Acad v5 112316Arvin Barrientos Bernesto67% (3)

- Student Handbook MCCDokumen32 halamanStudent Handbook MCCeyusuf74Belum ada peringkat

- Aleister Crowley Astrological Chart - A Service For Members of Our GroupDokumen22 halamanAleister Crowley Astrological Chart - A Service For Members of Our GroupMysticalgod Uidet100% (3)

- GK-604D Digital Inclinometer System PDFDokumen111 halamanGK-604D Digital Inclinometer System PDFKael CabezasBelum ada peringkat

- Ingles Nivel 2Dokumen119 halamanIngles Nivel 2Perla Cortes100% (1)

- Reaction PaperDokumen4 halamanReaction PaperCeñidoza Ian AlbertBelum ada peringkat