Post Budget Tax Training

Diunggah oleh

Rakesh MaharjanJudul Asli

Hak Cipta

Format Tersedia

Bagikan dokumen Ini

Apakah menurut Anda dokumen ini bermanfaat?

Apakah konten ini tidak pantas?

Laporkan Dokumen IniHak Cipta:

Format Tersedia

Post Budget Tax Training

Diunggah oleh

Rakesh MaharjanHak Cipta:

Format Tersedia

Post Budget - Applied Taxation:

Income TAX & VAT & TDS Management

Dear Sir/Madam,

We would like to bring to your kind attention that NIMe Pvt. Ltd. has organized a one-whole day -long

training program on Post Budget - Applied Taxation: Income TAX , VAT & TDS Management to be

held on 27th of Mangshir, Saturday i.e. 13th of December , 2014.

We would further like to request you to nominate the participants representing your organization and

help them understand Income TAX, VAT & TDS related issues in extensive manner so that your

organization functions in full compliance and safeguards itself from TAX related administrative hassles.

Background

Since the National Economy basically depends on Tax Policy and its implementation it is important for

every individual to understand Tax and Tax related issues. As far as the business organizations are

concerned Tax is one of the most important issues to be settled professionally and in timely manner.

With the motive of helping the tax professionals such as Accountants & Managers we have designed

this intensive Training Program- Applied Taxation: Income TAX, VAT & TDS Management.

As this course is structured by Senior CAs, RAs & Authorized Tax Professionals working for the same

institutions and will be delivered by the same professionals, we have a firm belief that it comes with a

high possibility of Professionalism.

Resource Persons:

• Mr. Paramananda Addhikari ( FCA : ICAN )

• Mr. Baburam Gautam ( Chief TAX Officer : Inland Revenue Department, Nepal )

• Mr. Khim Bdr. Kunwar ( Director : Department of Revenue Investigation )

• Mr. Arun Raut ( Senior CA : S. R. Pandey & Company )

Suitable for:

• Business Professionals, Accountants, Managers as well as would-be Accountants &

Managers

About Us

For your kind information National Institute of Management Excellence Pvt. Ltd. has been conducting

Capacity Building Trainings/ Seminars/ Workshops since its establishment and our database shows

that we have certified over 15,000 Participants so far. Furthermore, we have assisted a number of s by

providing expert knowledge on Effective Management Skills, Customer Care, Public Relation, Sales

&Marketing, Accounting, Income TAX & VAT, Human Resource Management and so on through

Customized Training Packages.

National Institute of Management Excellence Pvt. Ltd.

Putalisadak ( NewPlaza ), Kathmandu, Phone :4429329/4429330, E-mail : info@nime.com.np

Cell : 9841388125

Post Budget - Applied Taxation: Income Tax, VAT & TDS

Management

Program Outline

Contents & Sessions

Section – A Section - F

• Introduction of Taxation for Tax Purpose • Accounting and Control under VAT

• Registration Procedures: TAX,VAT, Excise Laws

• Taxable Income & Computation of Taxable Preparation and Issue of Invoices

Income From and Abbreviated Tax Invoices

Business Preparation and Issue of Debit

Employment Notes and Credit Notes

Investment Maintenance of Purchase Book,

Sales Book, Debit Notes and

• Introduction, Concept and Definition of VAT

Credit Notes, Stock Register

• Determination of VAT Chargeable Price and

Rate of VAT

Section - B Section - G

VAT Accounts and Reconciliation

• Fundamental changes made through Fiscal

with Financial Accounts

Budget 2071/72 on; Maintenance of VAT Accounts

Income TAX, VAT & TDS and Records under Computerized

Section - C System

• Self Assessment & Return Filing in Income Others: Treatment and Record of

TAX Used Assets and Free of Cost

TDS Return Receipts and Issues etc.

Installment TAX Estimated Return Section – H

Income Return ( DO1 and DO3 ) • Penalty for Non- Compliance / Offenders

• Tax on gain from Non-business Chargeable Interest, Charges & Penalties in

Assets Income TAX

Section - D Interest, Additional Fees and

Records & Accounting Penalties in VAT

• Provisions as to Books of Accounts TAX Refund Process in VAT &

• Accounting under Income Tax Act Income TAX

• Allowable and Non Allowable Deductions Procedure of Administrative

Review and Appeal

Section - E

Open Discussion

• TDS on Employment, Contract, Services, NOTE: Complementary Class on Managerial

Investment Income & Others Leadership

• TAX on Retirement Benefits

• Characterization and quantification of Income

For: Nominations & Inquiries

Roshan Lamichhane: Cell: 9851018474, Phone: 4429329, Fax : 4429330 , E-mail info@nime.com.np

National Institute of Management Excellence Pvt. Ltd.

Putalisadak ( NewPlaza ), Kathmandu, Phone :4429329/4429330, E-mail : info@nime.com.np

Cell : 9841388125

National Institute of Management Excellence Pvt. Ltd. (NIMe)

Participants’ Registration Form

(Please, fill this form and mail or fax it to us)

Post Budget - Applied Taxation: Income TAX , VAT &

Course Title:

TDS Management

Duration: 1 Day ( 27th of Mangshir i.e. 13th of December , Saturday )

Time: 7 am - 5 pm ( Whole Day – Seminar Type)

Venue: NIMe Training Hall, Putalisadak (New Plaza)

2,500 /- Per Participant ( Inclusive of Reading Materials,

Training fee: Resource Persons’ Fee, Breakfast/Hi-Tea, Lunch, Certificate of

Participation and Exclusive of VAT)

Nomination Deadline: 25th of Mangshir i.e. 11th of December , Thursday

Name of the Organization: ---------------------------------------------------------------------------------

In accordance with your proposal we agree to send the following members of our

organization for the training program.

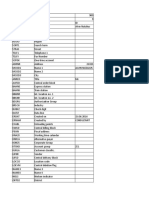

SN Name of Participants Contact No. Designation Qualification

1.

2.

3.

4.

_________________

Authorized Signature Date:

National Institute of Management Excellence Pvt. Ltd.

Putalisadak ( NewPlaza ), Kathmandu, Phone :4429329/4429330, E-mail : info@nime.com.np

Cell : 9841388125

Anda mungkin juga menyukai

- Small Business Accounting Guide to QuickBooks Online: A QuickBooks Online Cheat Sheet for Small Businesses, Churches, and NonprofitsDari EverandSmall Business Accounting Guide to QuickBooks Online: A QuickBooks Online Cheat Sheet for Small Businesses, Churches, and NonprofitsBelum ada peringkat

- SKF Price ListDokumen7 halamanSKF Price Listsenior section engineer Scly100% (2)

- Business Accounts Manager's Resume CV TemplateDokumen2 halamanBusiness Accounts Manager's Resume CV TemplateMike KelleyBelum ada peringkat

- Marketing PlanDokumen11 halamanMarketing PlanMritunjay KumarBelum ada peringkat

- IS-LM Model ExplainedDokumen36 halamanIS-LM Model ExplainedSyed Ali Zain100% (1)

- Bookkeeping And Accountancy Made Simple: For Owner Managed Businesses, Students And Young EntrepreneursDari EverandBookkeeping And Accountancy Made Simple: For Owner Managed Businesses, Students And Young EntrepreneursBelum ada peringkat

- Managing Tax Practice - Basic Theory & Practice Up Module 5Dokumen236 halamanManaging Tax Practice - Basic Theory & Practice Up Module 5Lesley ShiriBelum ada peringkat

- Innovation, Intellectual Property, and Development: A Better Set of Approaches For The 21st CenturyDokumen90 halamanInnovation, Intellectual Property, and Development: A Better Set of Approaches For The 21st CenturyCenter for Economic and Policy ResearchBelum ada peringkat

- Factors Contributing to Cost Overruns in Malaysian Construction ProjectsDokumen9 halamanFactors Contributing to Cost Overruns in Malaysian Construction ProjectsWaleed GaberBelum ada peringkat

- A. Name and General LocationDokumen11 halamanA. Name and General LocationJims Leñar CezarBelum ada peringkat

- L01-Introduction To Deregulation-1Dokumen28 halamanL01-Introduction To Deregulation-1sanajyBelum ada peringkat

- Income Tax and VAT (Vjune 2019) PDFDokumen318 halamanIncome Tax and VAT (Vjune 2019) PDFArthur DiselBelum ada peringkat

- CA Akash Maheshwari's Tax Expertise and ExperienceDokumen2 halamanCA Akash Maheshwari's Tax Expertise and ExperienceThe Cultural CommitteeBelum ada peringkat

- Contoh CV 1Dokumen10 halamanContoh CV 1BDE Eko PurmintoBelum ada peringkat

- Sa Tally Education BrochureDokumen6 halamanSa Tally Education BrochurePoojaMittalBelum ada peringkat

- Senior Accounts/Audit & Taxation Professional: Chetan KhambhaytaDokumen3 halamanSenior Accounts/Audit & Taxation Professional: Chetan Khambhaytalala habibiBelum ada peringkat

- Advance Taxation Fy 2076Dokumen340 halamanAdvance Taxation Fy 2076Anil ShahBelum ada peringkat

- MPA605 Taxation Course Outline-1Dokumen2 halamanMPA605 Taxation Course Outline-1Aminul Islam Rubel100% (1)

- Harshit Handa by CADokumen3 halamanHarshit Handa by CAThe Cultural CommitteeBelum ada peringkat

- ABS Business Services Corporate PresentationDokumen11 halamanABS Business Services Corporate PresentationAbs GrowthBelum ada peringkat

- Accounting 2 PagesDokumen2 halamanAccounting 2 PagesJade DiazBelum ada peringkat

- Financial Expert Suchendra N. ChandanDokumen4 halamanFinancial Expert Suchendra N. ChandanBhavesh PopatBelum ada peringkat

- Resume - CA Neha ShardaDokumen2 halamanResume - CA Neha Shardahimanshujagetiya91Belum ada peringkat

- Curriculum Vitae: Personal InformationDokumen4 halamanCurriculum Vitae: Personal InformationBăng KhiếtBelum ada peringkat

- EDUSE161121-Practical Accounting in The GST REgime For Acctg Staff-AnisDokumen4 halamanEDUSE161121-Practical Accounting in The GST REgime For Acctg Staff-AnisMahwiah JupriBelum ada peringkat

- Rahul Sharma ResumeDokumen5 halamanRahul Sharma ResumeggmdywzbngBelum ada peringkat

- Resume Ravi BansalDokumen2 halamanResume Ravi Bansalaasthapoddar155Belum ada peringkat

- CPP BROCHUREDokumen4 halamanCPP BROCHUREjosef.delacuestaBelum ada peringkat

- Society Profile With BylawDokumen65 halamanSociety Profile With BylawTax Co-operative CBEBelum ada peringkat

- Local Media1181068412465603613Dokumen13 halamanLocal Media1181068412465603613Ma. Trina AnotnioBelum ada peringkat

- Income Tax Procedure For PartnershipDokumen30 halamanIncome Tax Procedure For PartnershipAasmaa ChBelum ada peringkat

- Second Semester, AY 2014-2015Dokumen11 halamanSecond Semester, AY 2014-2015hyosungloverBelum ada peringkat

- Business Advisor's CV Template2Dokumen2 halamanBusiness Advisor's CV Template2Mike KelleyBelum ada peringkat

- Tax Manager Job Description ExpertiseDokumen1 halamanTax Manager Job Description Expertisetino mediamudaBelum ada peringkat

- Roadmap To Value Added Tax (VAT) Implementation Training: AppanageDokumen4 halamanRoadmap To Value Added Tax (VAT) Implementation Training: AppanageRafay IkramBelum ada peringkat

- Resume+Rupesh PrasharDokumen5 halamanResume+Rupesh PrasharabhishekatupesBelum ada peringkat

- NehaSharma (6 0)Dokumen2 halamanNehaSharma (6 0)Akhil GirijanBelum ada peringkat

- DanOwa VAT & ERP Services Proposal 2019 KeepersDokumen9 halamanDanOwa VAT & ERP Services Proposal 2019 KeepersMohamed EzzatBelum ada peringkat

- Japonica Payroll PresentationDokumen19 halamanJaponica Payroll Presentationoxeeco100% (1)

- CA Akash Maheshwari's Tax Expertise and ExperienceDokumen2 halamanCA Akash Maheshwari's Tax Expertise and ExperienceDivya NinaweBelum ada peringkat

- KamakshiDokumen10 halamanKamakshiDRACOBelum ada peringkat

- BMC InfoDokumen2 halamanBMC InfoNahid BinBelum ada peringkat

- ABUL HASAN MIAH'S 21-YEAR CAREER IN ACCOUNTS AND FINANCEDokumen5 halamanABUL HASAN MIAH'S 21-YEAR CAREER IN ACCOUNTS AND FINANCEAbul Hasan MiahBelum ada peringkat

- "Pansha Consultants": Outsourcing A Unique Opportunity Finance, Taxation and AccountingDokumen7 halaman"Pansha Consultants": Outsourcing A Unique Opportunity Finance, Taxation and AccountingPankaj JoshiBelum ada peringkat

- Resume of Hasin SadmanDokumen3 halamanResume of Hasin Sadmancitfhatil2017Belum ada peringkat

- STD VATDokumen2 halamanSTD VATRage EzekielBelum ada peringkat

- Ashita VarshneyDokumen2 halamanAshita VarshneyThe Cultural CommitteeBelum ada peringkat

- Taxation Accountants 3-Month Training PlanDokumen3 halamanTaxation Accountants 3-Month Training PlanAhmed NaguibBelum ada peringkat

- Accounting Hounours 2nd Year SyllabusDokumen11 halamanAccounting Hounours 2nd Year Syllabusmd shahriar samirBelum ada peringkat

- CV Sakrt Arora 2107 TDokumen3 halamanCV Sakrt Arora 2107 Tashishkaura8Belum ada peringkat

- Nstitute Of: Accounting, Taxation and FinanceDokumen2 halamanNstitute Of: Accounting, Taxation and FinanceNaresh SuryavanshiBelum ada peringkat

- Certified Payroll Technician Certified VAT TechnicianDokumen6 halamanCertified Payroll Technician Certified VAT TechnicianKubBelum ada peringkat

- Indirect Tax Laws Seminar for SCM ExecutivesDokumen2 halamanIndirect Tax Laws Seminar for SCM ExecutivesvirendradhumalBelum ada peringkat

- JD - SR Financial Analyst - Indirect TaxDokumen3 halamanJD - SR Financial Analyst - Indirect Taxbipin ggnkBelum ada peringkat

- Course Plan BTP 2079 ACE CollegeDokumen3 halamanCourse Plan BTP 2079 ACE Collegenabin shiwakotiBelum ada peringkat

- CV Format For CanadaDokumen1 halamanCV Format For Canadaomanbapa10Belum ada peringkat

- CV Shahzad Ali - 20220409 PDFDokumen4 halamanCV Shahzad Ali - 20220409 PDFAli AyubBelum ada peringkat

- Business Accounting With PastelDokumen2 halamanBusiness Accounting With PastelBoogy GrimBelum ada peringkat

- Assessable income and tax deductions essentialsDokumen4 halamanAssessable income and tax deductions essentialsBharathi AmmuBelum ada peringkat

- Reduction of Trade BarriersDokumen6 halamanReduction of Trade BarriersdogradeepikaBelum ada peringkat

- Corp Financial ReportingDokumen7 halamanCorp Financial ReportingJustin L De ArmondBelum ada peringkat

- Real Tax Service (RTS)Dokumen19 halamanReal Tax Service (RTS)JayaBelum ada peringkat

- Branches-of-AccountingDokumen21 halamanBranches-of-AccountingRhona Primne ServañezBelum ada peringkat

- Q8101 Accounts ExecutiveDokumen12 halamanQ8101 Accounts ExecutiveRoshan JainBelum ada peringkat

- Course Title: Corporate Tax Planning & Management Course Code: ACCT801 Credit Units:03 Level: PGDokumen5 halamanCourse Title: Corporate Tax Planning & Management Course Code: ACCT801 Credit Units:03 Level: PGAkash Singh RajputBelum ada peringkat

- QuickBooks Online for Beginners: The Step by Step Guide to Bookkeeping and Financial Accounting for Small Businesses and FreelancersDari EverandQuickBooks Online for Beginners: The Step by Step Guide to Bookkeeping and Financial Accounting for Small Businesses and FreelancersBelum ada peringkat

- One Page SummaryDokumen38 halamanOne Page SummaryRakesh MaharjanBelum ada peringkat

- I JM MR June 2011 PublicationDokumen16 halamanI JM MR June 2011 PublicationNikitaBelum ada peringkat

- Final Project Report on Model-Based System Development and Scheduling ProblemsDokumen73 halamanFinal Project Report on Model-Based System Development and Scheduling ProblemsMarius CojocaruBelum ada peringkat

- Income Tax Act 2058 67 NDokumen156 halamanIncome Tax Act 2058 67 NKul RijalBelum ada peringkat

- Mini Project Report: Submitted byDokumen30 halamanMini Project Report: Submitted byAnubhav ShrivastavaBelum ada peringkat

- HospitalityDokumen2 halamanHospitalityRakesh MaharjanBelum ada peringkat

- Group 1 LenovoDokumen17 halamanGroup 1 LenovoGULAM GOUSHBelum ada peringkat

- WestsideDokumen10 halamanWestsideBhaswati PandaBelum ada peringkat

- Midterm Examination in Public FinanceDokumen2 halamanMidterm Examination in Public FinanceNekki Joy LangcuyanBelum ada peringkat

- A Dollarization Blueprint For Argentina, Cato Foreign Policy Briefing No. 52Dokumen25 halamanA Dollarization Blueprint For Argentina, Cato Foreign Policy Briefing No. 52Cato InstituteBelum ada peringkat

- MANDT Client DetailsDokumen13 halamanMANDT Client DetailsEdo SilvaBelum ada peringkat

- Jawapan ACC116 Week 6-Nahzatul ShimaDokumen2 halamanJawapan ACC116 Week 6-Nahzatul Shimaanon_207469897Belum ada peringkat

- Managerial Accounting II - Exam: Problem 1Dokumen3 halamanManagerial Accounting II - Exam: Problem 1NGOC HOANG PHAM YENBelum ada peringkat

- Dealer ManualDokumen85 halamanDealer ManualLakelands CyclesBelum ada peringkat

- NestleDokumen60 halamanNestlesara24391Belum ada peringkat

- International MarketingDokumen433 halamanInternational MarketingSenthilNathanBelum ada peringkat

- RevenueDokumen5 halamanRevenueTanya AroraBelum ada peringkat

- South Central Africa Top CompaniesDokumen16 halamanSouth Central Africa Top CompaniesaddyBelum ada peringkat

- US Treasury and Repo Markt ExerciseDokumen3 halamanUS Treasury and Repo Markt Exercisechuloh0% (1)

- Consumers Equilibrium & DemandDokumen76 halamanConsumers Equilibrium & DemandAumkarBelum ada peringkat

- History of Mergers and AcquisitionsDokumen23 halamanHistory of Mergers and AcquisitionsZeeshan AliBelum ada peringkat

- Break Even Analysis Guide for ProfitabilityDokumen4 halamanBreak Even Analysis Guide for ProfitabilitymichaelurielBelum ada peringkat

- Financial Reeporting: February 2022 EditionDokumen169 halamanFinancial Reeporting: February 2022 EditionAnu GraphicsBelum ada peringkat

- Week 10 Economics Seminar ExercisesDokumen2 halamanWeek 10 Economics Seminar ExercisesElia LozovanuBelum ada peringkat

- bài tập ôn MA1Dokumen34 halamanbài tập ôn MA1Thái DươngBelum ada peringkat

- McDonald's PresentationDokumen21 halamanMcDonald's PresentationAli75% (4)

- Capital Budteting JainDokumen56 halamanCapital Budteting JainShivam VermaBelum ada peringkat

- Central Excise Act valuation methodsDokumen6 halamanCentral Excise Act valuation methodsChandu Aradhya S RBelum ada peringkat

- ACTG22a Midterm B 1Dokumen5 halamanACTG22a Midterm B 1Kimberly RojasBelum ada peringkat

- How Prevailing Wage Works in Kane County, ILDokumen10 halamanHow Prevailing Wage Works in Kane County, ILFrank Manzo IVBelum ada peringkat