DD

Diunggah oleh

Ahmed Raza Mir0 penilaian0% menganggap dokumen ini bermanfaat (0 suara)

12 tayangan3 halamanconsol

Judul Asli

dd

Hak Cipta

© © All Rights Reserved

Format Tersedia

PDF atau baca online dari Scribd

Bagikan dokumen Ini

Apakah menurut Anda dokumen ini bermanfaat?

Apakah konten ini tidak pantas?

Laporkan Dokumen Iniconsol

Hak Cipta:

© All Rights Reserved

Format Tersedia

Unduh sebagai PDF atau baca online dari Scribd

0 penilaian0% menganggap dokumen ini bermanfaat (0 suara)

12 tayangan3 halamanDD

Diunggah oleh

Ahmed Raza Mirconsol

Hak Cipta:

© All Rights Reserved

Format Tersedia

Unduh sebagai PDF atau baca online dari Scribd

Anda di halaman 1dari 3

chapter 9

(3) Total comprehensive income is then split as being attributable to parent

shareholders and NCI shareholders. The amount attributable to NCI

shareholders will be the profit for the year attributable to the NCI

{already calculated) plus/ minus the NCI share of the total exchange

gain/ loss. Total comprehensive income attributable to parent

shareholders can be calculated as a balancing figure,

Consolidated statement of changes in equity

(1) Add the comprehensive income from the statement of comprehensive

income split between parent and NCI shareholders.

(2) Deduct any dividends paid by the parent and the NCI share of any

subsidiary dividends.

(3) Prepare a working in the subsidiary's functional currency for its net

assets at the brought forward date i.e. similar to CSFP W2 but at the

prior reporting date

(4) Calculate NCI brought forward in a similar way to CSFP W4 i.e. in the

functional currency and then translating at the opening rate.

(5) Calculate equity attributable to parent shareholders brought forward in a

similar way to CSFP W5 adding the parent's share capital. Remember

to translate the subsidiary's post acquisition profits (up to the brought

forward date) at the opening rate. You will need to recalculate the

foreign exchange gain/ loss on the cost of investment by comparing it at

the acquisition rate to the opening rate.

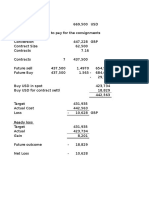

Test your understanding 4 - Paul and Simon

Paul is an entity whose functional and presentational currency is the

dollar ($).

On 1 January 20X7, Paul acquired 80% of the share capital of Simon,

an entity whose functional currency is the Franc. Simon's reserves at

this date showed a balance of Fr4,000. Paul paid Fr21,000 for the

investment in Simon.

Below are the financial statements of Paul and Simon for the year ended

31 December 20X8

345

Foreign currency translation

le

‘Statements of financial position

Paul Simon

$ Fr

Non-current assets 60,000 25,000

Investment in Simon 4,200

Current assets 35,800 15,000

100,000 40,000

Equity

Share capital 50,000 15,000

Reserves 20,000 14,000

70,000 29,000

Current liabilities 30,000 11,000

100,000 40,000

‘Statements of comprehensive income

Paul Simon

$ Fr

Revenue 25,000 10,000

Operating expenses (10,000) (4,000)

Operating profit 15,000 6,000

Finance costs (5,000) (1,500)

Profit before tax 10,000 4,500

Tax (3,000) (1,000)

Profit after tax 7,000 3,500

Other comprehensive income - -

Total comprehensive income 7,000 3,500

SJ. TW ~~’

346 AINE

chapter 9

lM

‘Statements of changes in equity

Simon

Fr

Equity brought forward 25,500

Comprehensive income 1,500

Dividends paid -

Equity carried forward 29,000

Exchanges rates have been as follows:

Fest

1 January 20X7 5

31 December 20X7 3

31 December 20X8 2

Average for the year ended 31 December 20X8 25

Itis Paul's policy to apply the gross goodwill method. As at 1 January

20X7, the fair value of the non-controlling interest in Simon was deemed

to be Fr4,500. Goodwill had been reviewed for impairment as at 31

December 20X7 but none had arisen. As at 31 December 20X8, it was

determined that goodwill should be impaired by Fr1,000.

Required:

Prepare the consolidated statement of financial position, consolidated

statement of comprehensive income and consolidated statement of

changes in equity for the year ended 31 December 20X8.

“eAPLAN PUBLISHING say

Anda mungkin juga menyukai

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)Dari EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Penilaian: 4.5 dari 5 bintang4.5/5 (119)

- Her Body and Other Parties: StoriesDari EverandHer Body and Other Parties: StoriesPenilaian: 4 dari 5 bintang4/5 (821)

- Rise of ISIS: A Threat We Can't IgnoreDari EverandRise of ISIS: A Threat We Can't IgnorePenilaian: 3.5 dari 5 bintang3.5/5 (137)

- Team of Rivals: The Political Genius of Abraham LincolnDari EverandTeam of Rivals: The Political Genius of Abraham LincolnPenilaian: 4.5 dari 5 bintang4.5/5 (234)

- The Little Book of Hygge: Danish Secrets to Happy LivingDari EverandThe Little Book of Hygge: Danish Secrets to Happy LivingPenilaian: 3.5 dari 5 bintang3.5/5 (399)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaDari EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaPenilaian: 4.5 dari 5 bintang4.5/5 (265)

- Grant Thornton Ifrs 10 Financial StatementsDokumen104 halamanGrant Thornton Ifrs 10 Financial StatementsAhmed Raza MirBelum ada peringkat

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeDari EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifePenilaian: 4 dari 5 bintang4/5 (5794)

- The Yellow House: A Memoir (2019 National Book Award Winner)Dari EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Penilaian: 4 dari 5 bintang4/5 (98)

- Shoe Dog: A Memoir by the Creator of NikeDari EverandShoe Dog: A Memoir by the Creator of NikePenilaian: 4.5 dari 5 bintang4.5/5 (537)

- On Fire: The (Burning) Case for a Green New DealDari EverandOn Fire: The (Burning) Case for a Green New DealPenilaian: 4 dari 5 bintang4/5 (73)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyDari EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyPenilaian: 3.5 dari 5 bintang3.5/5 (2219)

- The Emperor of All Maladies: A Biography of CancerDari EverandThe Emperor of All Maladies: A Biography of CancerPenilaian: 4.5 dari 5 bintang4.5/5 (271)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureDari EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FuturePenilaian: 4.5 dari 5 bintang4.5/5 (474)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryDari EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryPenilaian: 3.5 dari 5 bintang3.5/5 (231)

- Never Split the Difference: Negotiating As If Your Life Depended On ItDari EverandNever Split the Difference: Negotiating As If Your Life Depended On ItPenilaian: 4.5 dari 5 bintang4.5/5 (838)

- Grit: The Power of Passion and PerseveranceDari EverandGrit: The Power of Passion and PerseverancePenilaian: 4 dari 5 bintang4/5 (587)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersDari EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersPenilaian: 4.5 dari 5 bintang4.5/5 (344)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceDari EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RacePenilaian: 4 dari 5 bintang4/5 (894)

- The Unwinding: An Inner History of the New AmericaDari EverandThe Unwinding: An Inner History of the New AmericaPenilaian: 4 dari 5 bintang4/5 (45)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreDari EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You ArePenilaian: 4 dari 5 bintang4/5 (1090)

- IFRS 10 Consolidated Financial IFRS 11 Joint Arrangements and IFRS 13 Fair ValueDokumen24 halamanIFRS 10 Consolidated Financial IFRS 11 Joint Arrangements and IFRS 13 Fair ValueAhmed Raza MirBelum ada peringkat

- Advanced Accounting and Financial ReportingDokumen6 halamanAdvanced Accounting and Financial ReportingAhmed Raza MirBelum ada peringkat

- Ey Apply Rev TRG June 2016Dokumen598 halamanEy Apply Rev TRG June 2016Ahmed Raza MirBelum ada peringkat

- PST - Advanced Financial Reporting 2017Dokumen33 halamanPST - Advanced Financial Reporting 2017Ahmed Raza MirBelum ada peringkat

- Ifrs11 Joint ArrangementsDokumen1 halamanIfrs11 Joint ArrangementsAhmed Raza MirBelum ada peringkat

- Manuel Comptable IFRS Groupe SNCBDokumen1.516 halamanManuel Comptable IFRS Groupe SNCBAhmed Raza Mir100% (1)

- NPV-IRR NewDokumen39 halamanNPV-IRR NewAhmed Raza MirBelum ada peringkat

- As Nov Dec 2017Dokumen5 halamanAs Nov Dec 2017Ahmed Raza MirBelum ada peringkat

- Ifrs11 Joint Arrangements PDFDokumen15 halamanIfrs11 Joint Arrangements PDFAhmed Raza MirBelum ada peringkat

- Lecture4 Inv f06 604-InventoryDokumen63 halamanLecture4 Inv f06 604-InventoryRandy CavaleraBelum ada peringkat

- Practical Guide Ifrs10 and 12Dokumen33 halamanPractical Guide Ifrs10 and 12Ahmed Raza MirBelum ada peringkat

- Ifrs11 Joint Arrangements PDFDokumen15 halamanIfrs11 Joint Arrangements PDFAhmed Raza MirBelum ada peringkat

- p4 Summary BookDokumen35 halamanp4 Summary BookAhmed Raza MirBelum ada peringkat

- 289214169 عمرو اور سلیمانی خزانہ PDFDokumen235 halaman289214169 عمرو اور سلیمانی خزانہ PDFAhmed Raza MirBelum ada peringkat

- FAC2602 - Generally Accepted Accounting Stds Valuation of Financial InstrumentsDokumen32 halamanFAC2602 - Generally Accepted Accounting Stds Valuation of Financial InstrumentsAhmed Raza MirBelum ada peringkat

- WaccDokumen44 halamanWaccAhmed Raza MirBelum ada peringkat

- Financial AccountingDokumen42 halamanFinancial AccountingAhmed Raza MirBelum ada peringkat

- E Voting Guide (ICAP - Overseas Members)Dokumen10 halamanE Voting Guide (ICAP - Overseas Members)Ahmed Raza MirBelum ada peringkat

- FR 2 QuizDokumen14 halamanFR 2 QuizAhmed Raza MirBelum ada peringkat

- Aik Aur OptionDokumen35 halamanAik Aur OptionAhmed Raza MirBelum ada peringkat

- Q6 Costing Today PaperDokumen2 halamanQ6 Costing Today PaperAhmed Raza MirBelum ada peringkat

- Corporate Dividend Policy InsightsDokumen7 halamanCorporate Dividend Policy InsightsAhmed Raza MirBelum ada peringkat

- Share-Based Payment: IFRS Standard 2Dokumen42 halamanShare-Based Payment: IFRS Standard 2Teja JurakBelum ada peringkat

- PracticeDokumen6 halamanPracticeAhmed Raza MirBelum ada peringkat

- Section F - QuestionsDokumen2 halamanSection F - QuestionsAhmed Raza MirBelum ada peringkat

- AssertionsDokumen2 halamanAssertionsAhmed Raza MirBelum ada peringkat

- Section e - QuestionsDokumen4 halamanSection e - QuestionsAhmed Raza MirBelum ada peringkat

- Section F - AnswersDokumen9 halamanSection F - AnswersAhmed Raza MirBelum ada peringkat