Prepare Income Statement and Balance Sheet For 5 Years

Diunggah oleh

muhammad farhanJudul Asli

Hak Cipta

Format Tersedia

Bagikan dokumen Ini

Apakah menurut Anda dokumen ini bermanfaat?

Apakah konten ini tidak pantas?

Laporkan Dokumen IniHak Cipta:

Format Tersedia

Prepare Income Statement and Balance Sheet For 5 Years

Diunggah oleh

muhammad farhanHak Cipta:

Format Tersedia

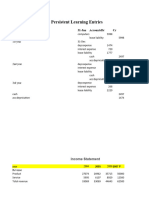

Prepare Income statement and Balanc

Sales Growth 15%

Current asset/Sales 20%

Current Liabilities/Sales 12%

Net fixed assset/sales 55%

cost of goods sold /sales 50%

depreciation rate 12%

interest rate on debt 10%

interest rate on cash and marketable securiries 15%

tax rate 40%

divident pay out ratio 30%

year 2013 2014 2015 2016

Income Statement

Sales 3000 3450 3968 4563

Cost of goods sold -800 -1725 -1984 -2281

Interest payment on debt -56 -45 -45 -45

Interest earned on cash and marketable securities 14 58 122 185

depreciation -225 -313 -377 -464

profit before tax 1933 1426 1684 1957

taxes -551 -570 -674 -783

Profit after tax 1382 855 1011 1174

dividend -287 -257 -303 -352

retained earnings 1095 599 707 822

Balance Sheet

Cash and Marketable securities 150 625 1007 1453

current assets 550 690 793.5 912.525

fixed assets

at cost 2400 2810 3472 4263

depreciation -600 -913 -1290 -1754

net fixed assets 1800 1897.5 2182.125 2509.444

Total assets 2500 3213 3982 4875

current liabilities 300 414 476.1 547.515

debt 450 450 450 450

stock 650 650 650 650

accumulated retained earnings 1100 1699 2406 3228

Total Liabilies and equity 2500 3213 3982 4875

statement and Balance sheet for 5 years

2017 2018

5247 6034

-2624 -3017

-45 -45

257 342

-568 -692

2267 2621

-907 -1048

1360 1573

-408 -472

952 1101

1975 2580

1049.404 1206.814

5208 6333

-2322 -3014

2885.86 3318.739

5910 7105

629.6423 724.0886

450 450

650 650

4180 5281

5910 7105

Anda mungkin juga menyukai

- United States Census Figures Back to 1630Dari EverandUnited States Census Figures Back to 1630Belum ada peringkat

- Lecture 6 (05-10-2020) 1-10 To 2-30Dokumen2 halamanLecture 6 (05-10-2020) 1-10 To 2-30Mahmood AhmadBelum ada peringkat

- Financial Statements: Income StatementDokumen10 halamanFinancial Statements: Income StatementAbdul wahabBelum ada peringkat

- New Model of NetflixDokumen17 halamanNew Model of NetflixPencil ArtistBelum ada peringkat

- FM Assignment 02Dokumen1 halamanFM Assignment 02Sufyan SarwarBelum ada peringkat

- Balance Sheet: Total Equity and LiabilitiesDokumen11 halamanBalance Sheet: Total Equity and LiabilitiesSamarth LahotiBelum ada peringkat

- QUIZ 2 Sufyan Sarwar 02-112192-060Dokumen1 halamanQUIZ 2 Sufyan Sarwar 02-112192-060Sufyan SarwarBelum ada peringkat

- Persistent Learning Case SolutionDokumen7 halamanPersistent Learning Case SolutionKamran Ali AbbasiBelum ada peringkat

- Senior High School S.Y. 2019-2020Dokumen4 halamanSenior High School S.Y. 2019-2020Cy Dollete-Suarez100% (1)

- Chapt 17-18 Suyanto - DDokumen8 halamanChapt 17-18 Suyanto - DZephyrBelum ada peringkat

- Project 1 - Match My Doll Clothing Line: WC Assumption: 2010 2011 2012 2013 2014 2015Dokumen4 halamanProject 1 - Match My Doll Clothing Line: WC Assumption: 2010 2011 2012 2013 2014 2015rohitBelum ada peringkat

- ATH Case CalculationDokumen4 halamanATH Case CalculationsasBelum ada peringkat

- Hinopak MotorsDokumen8 halamanHinopak MotorsShamsuddin SoomroBelum ada peringkat

- JP Morgan Financial StatementsDokumen8 halamanJP Morgan Financial StatementsTamar PirtskhalaishviliBelum ada peringkat

- Ratios HW 1 Template-5 Version 1Dokumen14 halamanRatios HW 1 Template-5 Version 1api-506813505Belum ada peringkat

- Model 2 TDokumen6 halamanModel 2 TVidhi PatelBelum ada peringkat

- S BqFC2 - T5KgahQtv8 SXQ - Module 3 7 iMBA Example LBO TypeDokumen8 halamanS BqFC2 - T5KgahQtv8 SXQ - Module 3 7 iMBA Example LBO TypeharshBelum ada peringkat

- Petron Corp - Financial Analysis From 2014 - 2018Dokumen4 halamanPetron Corp - Financial Analysis From 2014 - 2018Neil Nadua100% (1)

- John M CaseDokumen10 halamanJohn M Caseadrian_simm100% (1)

- Group 14 - Bata ValuationDokumen43 halamanGroup 14 - Bata ValuationSUBHADEEP GUHA-DM 20DM218Belum ada peringkat

- Global Paint Coating Market Report 1Dokumen1 halamanGlobal Paint Coating Market Report 1Yidan ZhengBelum ada peringkat

- Cost AssignmentDokumen16 halamanCost Assignmentmuhammad salmanBelum ada peringkat

- Drreddy - Ratio AnalysisDokumen8 halamanDrreddy - Ratio AnalysisNavneet SharmaBelum ada peringkat

- Nike AdidasDokumen8 halamanNike AdidasJaime Andres PazBelum ada peringkat

- Alok Indsutry: Notes Consolidated Figures in Rs. Crores / View StandaloneDokumen7 halamanAlok Indsutry: Notes Consolidated Figures in Rs. Crores / View StandaloneJatin NandaBelum ada peringkat

- Fin3320 Excelproject sp16 TravuobrileDokumen9 halamanFin3320 Excelproject sp16 Travuobrileapi-363907405Belum ada peringkat

- Module-10 Additional Material FSA Template - Session-11 vrTcbcH4leDokumen6 halamanModule-10 Additional Material FSA Template - Session-11 vrTcbcH4leBhavya PatelBelum ada peringkat

- Investment (Valuation of Stock)Dokumen9 halamanInvestment (Valuation of Stock)Lim JaehwanBelum ada peringkat

- 5 EstadosDokumen15 halaman5 EstadosHenryRuizBelum ada peringkat

- Exhibit 1: Income Taxes 227.6 319.3 465.0 49.9Dokumen11 halamanExhibit 1: Income Taxes 227.6 319.3 465.0 49.9rendy mangunsongBelum ada peringkat

- DCF Model TemplateDokumen20 halamanDCF Model TemplatenishantBelum ada peringkat

- Amazon SCM Finance DataDokumen2 halamanAmazon SCM Finance DataSagar KansalBelum ada peringkat

- 1.0 Background: World Class PartnersDokumen6 halaman1.0 Background: World Class PartnersQueenee GuilingBelum ada peringkat

- Tata MotorsDokumen24 halamanTata MotorsApurvAdarshBelum ada peringkat

- HCL - Praphul Gupta (JL18FS039)Dokumen18 halamanHCL - Praphul Gupta (JL18FS039)Akshay Yadav Student, Jaipuria Lucknow100% (1)

- Attock CementDokumen18 halamanAttock CementDeepak MatlaniBelum ada peringkat

- Butler Lumber in Excel BS and IsDokumen1 halamanButler Lumber in Excel BS and IsborgyambuloBelum ada peringkat

- Mary AmDokumen86 halamanMary AmmaryamkaramyarBelum ada peringkat

- 2004 2005 2006 2007 Share Capital and Reserves: Fixed Assets - Property, Plant and EquipmentDokumen10 halaman2004 2005 2006 2007 Share Capital and Reserves: Fixed Assets - Property, Plant and Equipmentshabbir270Belum ada peringkat

- Lecture 2 Answer 2 1564205851105Dokumen8 halamanLecture 2 Answer 2 1564205851105Trinesh BhargavaBelum ada peringkat

- Bookcvv 1Dokumen10 halamanBookcvv 1Rafidul IslamBelum ada peringkat

- Biocon Valuation - Nov 2020Dokumen35 halamanBiocon Valuation - Nov 2020Deepak SaxenaBelum ada peringkat

- Fundamental AnalysisDokumen4 halamanFundamental AnalysisMuhammad AkmalBelum ada peringkat

- Analysis IncDokumen44 halamanAnalysis IncAakash KapoorBelum ada peringkat

- Financial Statements Vodafone Idea LimitedDokumen6 halamanFinancial Statements Vodafone Idea LimitedRamit SinghBelum ada peringkat

- ATTOCK CEMENT Report by Faiza SiddiqueDokumen26 halamanATTOCK CEMENT Report by Faiza SiddiqueEkta IoBMBelum ada peringkat

- RatiosDokumen30 halamanRatiosJatin NandaBelum ada peringkat

- Wipro Financial Statements v1.0Dokumen38 halamanWipro Financial Statements v1.0AnanthkrishnanBelum ada peringkat

- Consolidated Steels LTD As On 31/12/1982: Balance Sheet ofDokumen9 halamanConsolidated Steels LTD As On 31/12/1982: Balance Sheet oftrivedinaveenBelum ada peringkat

- Colgate DCF ModelDokumen19 halamanColgate DCF Modelshubham9308Belum ada peringkat

- Nyse Phi 2019Dokumen53 halamanNyse Phi 2019Veronica RiveraBelum ada peringkat

- Performance at A GlanceDokumen7 halamanPerformance at A GlanceLima MustaryBelum ada peringkat

- Key Ratios 5yrs 3yrs Latest: Sales Other Income Total Income Total Expenditure Ebit Interest Tax Net ProfitDokumen2 halamanKey Ratios 5yrs 3yrs Latest: Sales Other Income Total Income Total Expenditure Ebit Interest Tax Net ProfitmohithBelum ada peringkat

- CCS Data Technologies (Pty) LTD - Extract From Annual Financial Statements 2023Dokumen13 halamanCCS Data Technologies (Pty) LTD - Extract From Annual Financial Statements 2023queenntsoane04Belum ada peringkat

- FM 2Dokumen21 halamanFM 2hooriya naseemBelum ada peringkat

- F4 13 TH SepDokumen30 halamanF4 13 TH SepAlkish AlexBelum ada peringkat

- Total Operating Expenses Operating Income or Loss: BreakdownDokumen9 halamanTotal Operating Expenses Operating Income or Loss: BreakdownAhmed EzzBelum ada peringkat

- ORACEL - Unnati Tandon (JL18FS060)Dokumen16 halamanORACEL - Unnati Tandon (JL18FS060)Akshay Yadav Student, Jaipuria LucknowBelum ada peringkat

- Indus Dyeing & Manufacturing Co. LTD: Horizontal Analysis of Financial StatementsDokumen12 halamanIndus Dyeing & Manufacturing Co. LTD: Horizontal Analysis of Financial StatementsSaad NaeemBelum ada peringkat

- Case StudyDokumen4 halamanCase Studymuhammad farhanBelum ada peringkat

- Advertisement No. 05/ 2020: Khyber Pakhtunkhwa Public Service CommissionDokumen3 halamanAdvertisement No. 05/ 2020: Khyber Pakhtunkhwa Public Service Commissionmuhammad farhanBelum ada peringkat

- Accessing EbooksDokumen1 halamanAccessing EbooksHashim KhanBelum ada peringkat

- Khyber Pakhtunkhwa Public Service Commission: Dvertisement ODokumen10 halamanKhyber Pakhtunkhwa Public Service Commission: Dvertisement OMuhammad wasimBelum ada peringkat

- Accessing EbooksDokumen1 halamanAccessing EbooksHashim KhanBelum ada peringkat

- Q.1 Discuss How Foreign Policy Analysis Has Evolved As An Independent Field of Study? How Is It Relevant To States?Dokumen10 halamanQ.1 Discuss How Foreign Policy Analysis Has Evolved As An Independent Field of Study? How Is It Relevant To States?muhammad farhanBelum ada peringkat

- General Methods of TeachingDokumen6 halamanGeneral Methods of Teachingmuhammad farhanBelum ada peringkat

- Resume 012Dokumen1 halamanResume 012ArunBelum ada peringkat

- Read More Details About This MCQDokumen14 halamanRead More Details About This MCQmuhammad farhanBelum ada peringkat

- FPSC Patrol Officer Solved Past Papers: Babar Ali TanoliDokumen8 halamanFPSC Patrol Officer Solved Past Papers: Babar Ali Tanolimuhammad farhanBelum ada peringkat

- Process Costing FIFO ER PDFDokumen13 halamanProcess Costing FIFO ER PDFJason CariñoBelum ada peringkat

- Learn Urdu BasicsDokumen19 halamanLearn Urdu BasicsnuupadhyBelum ada peringkat

- EnglishDokumen1 halamanEnglishmuhammad farhanBelum ada peringkat

- MathhhhhhDokumen14 halamanMathhhhhhmuhammad farhanBelum ada peringkat

- 07-09-2020 CHKDokumen1 halaman07-09-2020 CHKmuhammad farhanBelum ada peringkat

- Sadiq Group of Companies Chicks Delivery ReportDokumen3 halamanSadiq Group of Companies Chicks Delivery Reportmuhammad farhanBelum ada peringkat

- 07-09-2020 CHKDokumen1 halaman07-09-2020 CHKmuhammad farhanBelum ada peringkat

- Final Term Exam International ManagementDokumen4 halamanFinal Term Exam International Managementmuhammad farhanBelum ada peringkat

- Mid Term Exam International ManagmentDokumen5 halamanMid Term Exam International Managmentmuhammad farhanBelum ada peringkat

- Sadiq Group of Companies Chicks Delivery ReportDokumen3 halamanSadiq Group of Companies Chicks Delivery Reportmuhammad farhanBelum ada peringkat

- Class Wise Course Allocation Autumn 2020Dokumen3 halamanClass Wise Course Allocation Autumn 2020muhammad farhanBelum ada peringkat

- 05-09-2020 CHKDokumen2 halaman05-09-2020 CHKmuhammad farhanBelum ada peringkat

- 3 Strategic ManagementDokumen13 halaman3 Strategic ManagementHamza RajpootBelum ada peringkat

- Chapter 1: Globalization and International BusinessDokumen18 halamanChapter 1: Globalization and International BusinessRahul Singh RajputBelum ada peringkat

- General KnowledgeDokumen26 halamanGeneral KnowledgesheenBelum ada peringkat

- Human Resource ManagementDokumen12 halamanHuman Resource Managementmuhammad farhanBelum ada peringkat

- CSS Solved Every Day Science Past Papers - 1994 To 2013Dokumen111 halamanCSS Solved Every Day Science Past Papers - 1994 To 2013Javed AhmedBelum ada peringkat

- Solved Current Affairs MCQS From 1988 To 2013 PDFDokumen26 halamanSolved Current Affairs MCQS From 1988 To 2013 PDFbilalmpddBelum ada peringkat

- General Ability Every Day Science Mcqs PPSC Exam PDFDokumen41 halamanGeneral Ability Every Day Science Mcqs PPSC Exam PDFzuhaibBelum ada peringkat

- General Knowldg About PakistanDokumen3 halamanGeneral Knowldg About PakistanNoor AhmedBelum ada peringkat

- Flashwire Asia QuarterlyDokumen5 halamanFlashwire Asia QuarterlyJack Hyunsoo KimBelum ada peringkat

- Read This First - High ProbabilityDokumen5 halamanRead This First - High ProbabilitySanthosh InigoeBelum ada peringkat

- Role of HR in M&ADokumen36 halamanRole of HR in M&Amintimanali50% (2)

- Tutorial 1.solutionsDokumen5 halamanTutorial 1.solutionsabcsingBelum ada peringkat

- Fins2624 NotesDokumen3 halamanFins2624 NotesKevin YuBelum ada peringkat

- Strategic Financial Management: Syllabus and IntroductionDokumen15 halamanStrategic Financial Management: Syllabus and IntroductionFaizan AnisBelum ada peringkat

- Price ForcastDokumen38 halamanPrice ForcastLalit GoyalBelum ada peringkat

- Canara Bank - SWOT AnalysisDokumen2 halamanCanara Bank - SWOT AnalysisManasa4329Belum ada peringkat

- Bsa 6Dokumen3 halamanBsa 6Gray JavierBelum ada peringkat

- Amtrak Case Study Executive SummaryDokumen1 halamanAmtrak Case Study Executive SummaryNatasha Suddhi0% (2)

- Wendy's Financial StatementsDokumen12 halamanWendy's Financial StatementsShekinah Ruth TenaBelum ada peringkat

- Junior TalkDokumen83 halamanJunior TalkMartin Quang NguyenBelum ada peringkat

- Chapter 06 QuestionsDokumen22 halamanChapter 06 QuestionsPhương NguyễnBelum ada peringkat

- Elon Musk, SEC Reach Agreement Over Tesla CEO's Twitter UseDokumen5 halamanElon Musk, SEC Reach Agreement Over Tesla CEO's Twitter UseCNBC.comBelum ada peringkat

- Project Synopsis Of"financial Performance AnalysisDokumen5 halamanProject Synopsis Of"financial Performance AnalysisRashmi Ranjan Panigrahi100% (3)

- CH23 - Transactional Approach and CFExercises and SolutionsDokumen6 halamanCH23 - Transactional Approach and CFExercises and SolutionsHossein ParvardehBelum ada peringkat

- Bma Wealth Creators LimitedDokumen5 halamanBma Wealth Creators LimitedSourav SenguptaBelum ada peringkat

- Demat AccountDokumen72 halamanDemat AccountAnkit MehraBelum ada peringkat

- Baring Bank CaseDokumen3 halamanBaring Bank Casefeno andrianaryBelum ada peringkat

- Upside Capture Ratio Downside Capture Ratio Capture RatioDokumen10 halamanUpside Capture Ratio Downside Capture Ratio Capture RatioAlisha ChopraBelum ada peringkat

- Business Failure, Reorganization, and LiquidationDokumen12 halamanBusiness Failure, Reorganization, and LiquidationApril BoreresBelum ada peringkat

- Mock Exam of Partnership AccountingDokumen12 halamanMock Exam of Partnership AccountingArcely Gundran100% (1)

- Astro Electronics Corp. vs. Philippine Export and Foreign Loan Guarantee Corporation, G.R. No. 136729, September 23, 2003Dokumen3 halamanAstro Electronics Corp. vs. Philippine Export and Foreign Loan Guarantee Corporation, G.R. No. 136729, September 23, 2003Fides DamascoBelum ada peringkat

- ITI Multi Cap Fund SIDDokumen48 halamanITI Multi Cap Fund SIDRAHULBelum ada peringkat

- AcctgDokumen1 halamanAcctgCherry Rago - AlajidBelum ada peringkat

- Forex Scalping - R Forex Scalping - Rapidapid ForexDokumen116 halamanForex Scalping - R Forex Scalping - Rapidapid ForexAlex Franklin100% (4)

- Republic of The Philippines Citibank, N.A. and Bank of America, S.T. & N.A.Dokumen14 halamanRepublic of The Philippines Citibank, N.A. and Bank of America, S.T. & N.A.CristineBelum ada peringkat

- Diploma in Corporate Finance SyllabusDokumen18 halamanDiploma in Corporate Finance Syllabuscima2k15Belum ada peringkat

- Impairment of AssetsDokumen21 halamanImpairment of AssetsSteffanie Granada50% (2)

- Radio One - For ClassDokumen26 halamanRadio One - For ClassRicha ChauhanBelum ada peringkat