2010-05-28 072307 Arnsparger

Diunggah oleh

Kailash Kumar0 penilaian0% menganggap dokumen ini bermanfaat (0 suara)

4 tayangan2 halamanbbb

Judul Asli

2010-05-28_072307_arnsparger

Hak Cipta

© © All Rights Reserved

Format Tersedia

DOC, PDF, TXT atau baca online dari Scribd

Bagikan dokumen Ini

Apakah menurut Anda dokumen ini bermanfaat?

Apakah konten ini tidak pantas?

Laporkan Dokumen Inibbb

Hak Cipta:

© All Rights Reserved

Format Tersedia

Unduh sebagai DOC, PDF, TXT atau baca online dari Scribd

0 penilaian0% menganggap dokumen ini bermanfaat (0 suara)

4 tayangan2 halaman2010-05-28 072307 Arnsparger

Diunggah oleh

Kailash Kumarbbb

Hak Cipta:

© All Rights Reserved

Format Tersedia

Unduh sebagai DOC, PDF, TXT atau baca online dari Scribd

Anda di halaman 1dari 2

p align="left">The following information about the payroll for the week ended December

30 was</p><p align="left">obtained from the records of Arnsparger Equipment

Co.:</p><p align="left">Salaries: Deductions:</p><p align="left">Sales salaries

$244,000 Income tax withheld $ 88,704</p><p align="left">Warehouse salaries 135,000

Social security tax withheld 27,216</p><p align="left">Office salaries _1_2_5__,0_0_0_

Medicare tax withheld 7,560</p><p align="left">$__5__0__4____,0__0__0__ U.S.

savings bonds 11,088</p><p align="left">Group insurance ___9__,0_7_2_</p><p

align="left">__$1____4__3__,6__4__0__</p><p align="left">Tax rates

assumed:</p><p align="left">Social security, 6% on first $100,000 of employee annual

earnings</p><p align="left">Medicare, 1.5%</p><p align="left">State unemployment

(employer only), 4.2%</p><p align="left">Federal unemployment (employer only),

0.8%</p><strong><p align="left">Instructions</p></strong><p align="left">1.

Assuming that the payroll for the last week of the year is to be paid on December

31,</p><p align="left">journalize the following entries:</p><p align="left">a.

December 30, to record the payroll.</p><p align="left">b. December 30, to record the

employer's payroll taxes on the payroll to be paid on</p><p align="left">December 31.

Of the total payroll for the last week of the year, $25,000 is subject</p><p

align="left">to unemployment compensation taxes.</p><p align="left">2. Assuming that

the payroll for the last week of the year is to be paid on January 5</p><p align="left">of

the following fiscal year, journalize the following entries:</p><p align="left">a.

December 30, to record the payroll.</p><p align="left">b. January 5, to record the

employer's payroll taxes on the payroll to be paid on</p><p>January 5.</p>

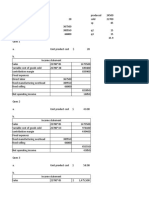

1. a. Dec. 30 Sales Salaries Expense.......................................... 244,000

Warehouse Salaries Expense................................ 135,000

Office Salaries Expense........................................ 125,000

Employees Income Tax Payable.....................

Social Security Tax Payable...........................

Medicare Tax Payable.....................................

Bond Deductions Payable...............................

Group Insurance Payable...............................

Salaries Payable..............................................

360,360

b. Dec. 30 Payroll Tax Expense.............................................. 36,026

Social Security Tax Payable...........................

Medicare Tax Payable.....................................

State Unemployment Tax Payable.................

Federal Unemployment Tax Payable............

1

$25,000 × 4.2%

2

$25,000 × 0.8%

2. a. Dec. 30 Sales Salaries Expense.......................................... 244,000

Warehouse Salaries Expense................................ 135,000

Office Salaries Expense........................................ 125,000

Employees Income Tax Payable.....................

Social Security Tax Payable...........................

3

30,240

Medicare Tax Payable.....................................

Bond Deductions Payable...............................

Group Insurance Payable...............................

Salaries Payable..............................................

357,336

3

$504,000 × 6%

4

$504,000 × 1.5%

b. Jan. 5 Payroll Tax Expense.............................................. 63,000

Social Security Tax Payable...........................

Medicare Tax Payable.....................................

State Unemployment Tax Payable.................

21,1685

Federal Unemployment Tax Payable............

5

$504,000 × 4.2%

6

$504,000 × 0.8%

Anda mungkin juga menyukai

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeDari EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifePenilaian: 4 dari 5 bintang4/5 (5794)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreDari EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You ArePenilaian: 4 dari 5 bintang4/5 (1090)

- Never Split the Difference: Negotiating As If Your Life Depended On ItDari EverandNever Split the Difference: Negotiating As If Your Life Depended On ItPenilaian: 4.5 dari 5 bintang4.5/5 (838)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceDari EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RacePenilaian: 4 dari 5 bintang4/5 (895)

- Grit: The Power of Passion and PerseveranceDari EverandGrit: The Power of Passion and PerseverancePenilaian: 4 dari 5 bintang4/5 (588)

- Shoe Dog: A Memoir by the Creator of NikeDari EverandShoe Dog: A Memoir by the Creator of NikePenilaian: 4.5 dari 5 bintang4.5/5 (537)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersDari EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersPenilaian: 4.5 dari 5 bintang4.5/5 (344)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureDari EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FuturePenilaian: 4.5 dari 5 bintang4.5/5 (474)

- Her Body and Other Parties: StoriesDari EverandHer Body and Other Parties: StoriesPenilaian: 4 dari 5 bintang4/5 (821)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)Dari EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Penilaian: 4.5 dari 5 bintang4.5/5 (121)

- The Emperor of All Maladies: A Biography of CancerDari EverandThe Emperor of All Maladies: A Biography of CancerPenilaian: 4.5 dari 5 bintang4.5/5 (271)

- The Little Book of Hygge: Danish Secrets to Happy LivingDari EverandThe Little Book of Hygge: Danish Secrets to Happy LivingPenilaian: 3.5 dari 5 bintang3.5/5 (400)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyDari EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyPenilaian: 3.5 dari 5 bintang3.5/5 (2259)

- The Yellow House: A Memoir (2019 National Book Award Winner)Dari EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Penilaian: 4 dari 5 bintang4/5 (98)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaDari EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaPenilaian: 4.5 dari 5 bintang4.5/5 (266)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryDari EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryPenilaian: 3.5 dari 5 bintang3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnDari EverandTeam of Rivals: The Political Genius of Abraham LincolnPenilaian: 4.5 dari 5 bintang4.5/5 (234)

- On January 1, 20X5, Pirate Company Acquired All of The Outstanding Stock of Ship Inc.,Norwegian Company, ADokumen17 halamanOn January 1, 20X5, Pirate Company Acquired All of The Outstanding Stock of Ship Inc.,Norwegian Company, AKailash KumarBelum ada peringkat

- On Fire: The (Burning) Case for a Green New DealDari EverandOn Fire: The (Burning) Case for a Green New DealPenilaian: 4 dari 5 bintang4/5 (73)

- Prince Corporation Acquired 100 Percent of Sword CompanyDokumen2 halamanPrince Corporation Acquired 100 Percent of Sword CompanyKailash Kumar50% (2)

- The Unwinding: An Inner History of the New AmericaDari EverandThe Unwinding: An Inner History of the New AmericaPenilaian: 4 dari 5 bintang4/5 (45)

- Jennys FroyoDokumen16 halamanJennys FroyoKailash Kumar100% (2)

- Silven Industries, Which Manufactures and Sells A Highly Successful Line of Summer Lotions and Insect RepellentsDokumen5 halamanSilven Industries, Which Manufactures and Sells A Highly Successful Line of Summer Lotions and Insect RepellentsKailash KumarBelum ada peringkat

- Is A Construction Company Specializing in Custom PatiosDokumen8 halamanIs A Construction Company Specializing in Custom PatiosKailash KumarBelum ada peringkat

- The Alphabetical Listing Below Includes All of The Adjusted Account Balances of Battle CreekDokumen4 halamanThe Alphabetical Listing Below Includes All of The Adjusted Account Balances of Battle CreekKailash KumarBelum ada peringkat

- Rise of ISIS: A Threat We Can't IgnoreDari EverandRise of ISIS: A Threat We Can't IgnorePenilaian: 3.5 dari 5 bintang3.5/5 (137)

- IRS-Service Look Up MBS by Cusip October 2007Dokumen163 halamanIRS-Service Look Up MBS by Cusip October 2007tsherwood100% (1)

- (Identifying The Appropriate Net Asset Classification) For Each of The Following Transactions, Identify The Net Asset Classification (Dokumen4 halaman(Identifying The Appropriate Net Asset Classification) For Each of The Following Transactions, Identify The Net Asset Classification (Kailash KumarBelum ada peringkat

- Napa Tours Co. Is A Travel Agency. The Nine Transactions Recorded by NapaDokumen2 halamanNapa Tours Co. Is A Travel Agency. The Nine Transactions Recorded by NapaKailash KumarBelum ada peringkat

- Whispering-Air Is Selling A New Model of High-Efficiency Air ConditionerDokumen2 halamanWhispering-Air Is Selling A New Model of High-Efficiency Air ConditionerKailash KumarBelum ada peringkat

- On April 1, 2018, Intel Issued $1,600,000 of 12% Face Value Bonds For $1,703,411.40.Dokumen3 halamanOn April 1, 2018, Intel Issued $1,600,000 of 12% Face Value Bonds For $1,703,411.40.Kailash KumarBelum ada peringkat

- Alpha Corporation Issued 2,500 Shares of $4 Par Value Common Stock.Dokumen1 halamanAlpha Corporation Issued 2,500 Shares of $4 Par Value Common Stock.Kailash KumarBelum ada peringkat

- Fernandez Corp. Invested Its Excess Cash in Available-For-Sale Securities During 2014.Dokumen3 halamanFernandez Corp. Invested Its Excess Cash in Available-For-Sale Securities During 2014.Kailash KumarBelum ada peringkat

- Crane Inc. Entered Into A Contract To Deliver One of Its Specialty Mowers To Kickapoo Landscaping CoDokumen1 halamanCrane Inc. Entered Into A Contract To Deliver One of Its Specialty Mowers To Kickapoo Landscaping CoKailash KumarBelum ada peringkat

- Thompson Industrial Products Inc Is A DiversifiedDokumen4 halamanThompson Industrial Products Inc Is A DiversifiedKailash KumarBelum ada peringkat

- Pastore Drycleaners Has Capacity To Clean UpDokumen4 halamanPastore Drycleaners Has Capacity To Clean UpKailash KumarBelum ada peringkat

- Schrand Corporation PurchaseDokumen1 halamanSchrand Corporation PurchaseKailash KumarBelum ada peringkat

- Adjusting Entry Pracyice Perry Company PaidDokumen1 halamanAdjusting Entry Pracyice Perry Company PaidKailash KumarBelum ada peringkat

- Crane Inc. Entered Into A Contract To Deliver One of Its Specialty Mowers To Kickapoo Landscaping CoDokumen2 halamanCrane Inc. Entered Into A Contract To Deliver One of Its Specialty Mowers To Kickapoo Landscaping CoKailash KumarBelum ada peringkat

- Periodic Inventory Three MethodsDokumen2 halamanPeriodic Inventory Three MethodsKailash KumarBelum ada peringkat

- O-Level Accounting Paper 2 Topical and yDokumen343 halamanO-Level Accounting Paper 2 Topical and yKailash Kumar100% (3)

- Kristen Lu Purchased A Used Automobile ForDokumen1 halamanKristen Lu Purchased A Used Automobile ForKailash KumarBelum ada peringkat

- Paragraph Blue Corporation Acquired Controlling Ownership of Sentence Skyler Corporation On December 31, 20X3, and A Consolidated Balance Sheet Was Prepared Immediately.Dokumen2 halamanParagraph Blue Corporation Acquired Controlling Ownership of Sentence Skyler Corporation On December 31, 20X3, and A Consolidated Balance Sheet Was Prepared Immediately.Kailash KumarBelum ada peringkat

- Industry Volume and Market Share Missing DataDokumen1 halamanIndustry Volume and Market Share Missing DataKailash KumarBelum ada peringkat

- Tristar Production Company Began Operations On SeptemberDokumen2 halamanTristar Production Company Began Operations On SeptemberKailash KumarBelum ada peringkat

- La Femme Accessories Inc Produces Womens HandbagsDokumen1 halamanLa Femme Accessories Inc Produces Womens HandbagsKailash KumarBelum ada peringkat

- Bracey Company Manufactures and Sells One ProductDokumen2 halamanBracey Company Manufactures and Sells One ProductKailash KumarBelum ada peringkat

- Diamond Hardware Uses The Periodic Inventory SystemDokumen7 halamanDiamond Hardware Uses The Periodic Inventory SystemKailash KumarBelum ada peringkat

- Turcotte Corp Reported The Following Revenues and Cost of Goods Sodl AmountsDokumen1 halamanTurcotte Corp Reported The Following Revenues and Cost of Goods Sodl AmountsKailash KumarBelum ada peringkat

- Bethany's Bicycle CorporationDokumen15 halamanBethany's Bicycle CorporationKailash Kumar100% (2)

- James Kimberley President of National Motors Receives A BonusDokumen1 halamanJames Kimberley President of National Motors Receives A BonusKailash KumarBelum ada peringkat

- Short Sales 101 For Sellers Revised 033011Dokumen18 halamanShort Sales 101 For Sellers Revised 033011Russ IrizarryBelum ada peringkat

- AOM To Carrington & Power of AttorneyDokumen5 halamanAOM To Carrington & Power of AttorneyIsabel SantamariaBelum ada peringkat

- Statement of Axis Account No:923010024537354 For The Period (From: 15-05-2023 To: 16-06-2023)Dokumen2 halamanStatement of Axis Account No:923010024537354 For The Period (From: 15-05-2023 To: 16-06-2023)PRAMOD KUMARBelum ada peringkat

- Sample HouseDokumen1 halamanSample HouseDavid PylypBelum ada peringkat

- Retirement PlanDokumen11 halamanRetirement PlanReign Ashley RamizaresBelum ada peringkat

- MCUS B0034 Full Doc Processing Checklist NRDokumen3 halamanMCUS B0034 Full Doc Processing Checklist NRScott RoyvalBelum ada peringkat

- Real Estate Principles Real Estate: An Introduction To The ProfessionDokumen13 halamanReal Estate Principles Real Estate: An Introduction To The Professiondenden007Belum ada peringkat

- A Guide To Help You Successfully Originate A New Loan in Encompass360Dokumen51 halamanA Guide To Help You Successfully Originate A New Loan in Encompass360Liang Wang100% (1)

- 2021 Tax Return Documents (DE CARVALHO COSTA RAF - Client Copy) PDFDokumen45 halaman2021 Tax Return Documents (DE CARVALHO COSTA RAF - Client Copy) PDFRafael CarvalhoBelum ada peringkat

- GM Default - 240308 - 182301Dokumen8 halamanGM Default - 240308 - 182301Raghu DattaBelum ada peringkat

- Chapter 11 - Credit Risk ManagementDokumen57 halamanChapter 11 - Credit Risk ManagementVishwajit GoudBelum ada peringkat

- Bank Statement RequirementDokumen1 halamanBank Statement Requirementmohammad moradiBelum ada peringkat

- NPS Calculator Free Download ExcelDokumen7 halamanNPS Calculator Free Download Excelgroup 19Belum ada peringkat

- Transmittal Letter Blank 2022Dokumen3 halamanTransmittal Letter Blank 2022Likey PromiseBelum ada peringkat

- Allen Hennessey CEO of Federal Trustee Services and Mortgage Claim Center Outreach Actually Loses Against ForeclosureDokumen2 halamanAllen Hennessey CEO of Federal Trustee Services and Mortgage Claim Center Outreach Actually Loses Against ForeclosureSapphragetteCityBelum ada peringkat

- Jeevan Labh Plan Licindiagov - inDokumen5 halamanJeevan Labh Plan Licindiagov - inSampiBelum ada peringkat

- 18 TH Legal Notice AAADokumen16 halaman18 TH Legal Notice AAALeo ManiBelum ada peringkat

- Account History Report2Dokumen2 halamanAccount History Report2PrintMASS BestBelum ada peringkat

- Unec 1681379813Dokumen9 halamanUnec 1681379813Elgün AbdullayevBelum ada peringkat

- Ipru Pension 10 Year X 2 LacDokumen5 halamanIpru Pension 10 Year X 2 LacHK Option LearnBelum ada peringkat

- P P FAQsDokumen3 halamanP P FAQshamza khanBelum ada peringkat

- PropertyDetails 5610 King James Ave LeesburgDokumen4 halamanPropertyDetails 5610 King James Ave LeesburgJohn Corl BeronBelum ada peringkat

- 6.) Maglaque vs. Planters Development BankDokumen1 halaman6.) Maglaque vs. Planters Development BankMartin RegalaBelum ada peringkat

- The Time Value of Money: All Rights ReservedDokumen55 halamanThe Time Value of Money: All Rights ReservedNad AdenanBelum ada peringkat

- Banking SectorDokumen14 halamanBanking SectorakashBelum ada peringkat

- Unit 3.1 An Escape From PovertyDokumen1 halamanUnit 3.1 An Escape From PovertyLuciana LefterBelum ada peringkat

- F M4 V3 KJZ Ci TZ 3 VD UDokumen3 halamanF M4 V3 KJZ Ci TZ 3 VD UMahidhar RemataBelum ada peringkat

- Consumer Satisfaction.098Dokumen73 halamanConsumer Satisfaction.098Rahul SinghBelum ada peringkat

- Casil Soc 01 07 23Dokumen2 halamanCasil Soc 01 07 23rishisiliveri95Belum ada peringkat