Accounting For Goodwill

Diunggah oleh

naega nuguJudul Asli

Hak Cipta

Format Tersedia

Bagikan dokumen Ini

Apakah menurut Anda dokumen ini bermanfaat?

Apakah konten ini tidak pantas?

Laporkan Dokumen IniHak Cipta:

Format Tersedia

Accounting For Goodwill

Diunggah oleh

naega nuguHak Cipta:

Format Tersedia

Accounting for Goodwill

Perbedaan perlakuan dalam Italian GAAP vs US GAAP:

• Italian GAAP

requires goodwill to be amortised over a period that must not exceed, and generally equals,

20 years

• US GAAP (berdasarkan FAS 142 th 2001)

demand goodwill not to be amortised but to be tested for impairment at least yearly, basing

the test on group’s reporting units

January 1, 2002

Telecom Italia adopted FAS 142 since then ceased to amortise goodwill.

Four impairment tests:

1. June 2002: transition test

memeriksa efektivitas reporting units yang berhubungan dengan alokasi goodwill dan

impairment test:

1. Wireline reporting units

2. Wireless reporting units

3. Internet and media, including:

• Directories, Directory assistance and Business Information units

activities related telephone directory drawing up and publishing;

• Information Technology market unit internet service provider;

• Buffetti retail franchise chain selling business periodicals and office

supplies

2. December 31, 2002: first annual impairment test

Instead of pure discounted cash flow value estimates, semua reporting units yang termasuk

ke dalam segmen internet and media dinilai dengan kombinasi market multiples, dihitung

dengan basis of similar recent transactions, dan discounted cash flow

Hasilnya FV dari Directories, Directory Assistance and Business Information units

dibawah carrying amount

Second step menghitung nilai goodwill. Dengan cara:

• Mencari fair values dari seluruh asset yang dimiliki reporting unit dihitung dengan

metode market multiples

• selisih reporting unit fair value dan jumlah (sum) fair value seluruh asset reporting

unit nilai goodwill

• Telecom Italia determined an impairment loss of 3,352 euro million.

Hasil akan sedikit berbeda apabila menggunakan metode dalam IFRS

• consist of the first step only (IAS 36)

• once stated that the fair value of Directories, Directory Assistance and Business

Information unit was below its carrying amount impairment loss

July 2003: signals of impairment di reporting units Entel Chile and Buffetti

• Terlibat dalam proses restrukturisasi

• both units’ fair value resulted to be below the respective carrying value

• Impairment loss 264 euro million for Entel Chile and 395 euro million for Buffetti

• 3. December 31, 2003: second annual impairment test.

• Seluruh reporting units dinilai berdasarkan discounted cash flow method tidak

terdapat impairment loss

• Test kedua dan ketiga menunjukkan bahwa metode akuntansi baru, melalui tes non-

amortisasi dan penurunan nilai (impairment), memberikan evaluasi atas goodwill

superior dalam kebenaran dan kehati-hatian, meskipun lebih bervariasi.

Balance sheets comparative analysis: US GAAP vs Italian GAAP

• higher value of intangible assets is basically due to recognition and fair value

accounting of the assets acquired in the merger between Olivetti and Old Telecom

Italia

• extra disclosure of intangible assets for 12.5 out of 13.9 euro billion of discrepancy

on intangible assets

• The merger made indeed goodwill to increase of 12.5 euro billion. These, reduced by

impairment losses occurred in 2002 and 2003, which have not been accounted for in

Italian GAAP balance sheet, explain the 10.7 euro billion difference.

Discrepancy in stockholders’ equity

Different procedures in accounting for the merger also represent the main reason for

stockholders’ equity increase. Although few other smaller transactions played their role,

most of the origin of the almost 19 euro billion of discrepancy in equity is due to fair value

accounting of newly issued shares, which have been distributed to Telecom Italia

shareholders after the merger.

(1) The concentration of discrepancies between two balance sheets on intangible assets and

on stockholders’ equity consistent with accounting evolution process. As a matter of fact,

considering that the leading goal of the process is a better description of the actual firm

value, it can be stated that:

• The asset has the main purpose to provide information concerning the nature

of firm’s cash sources and their potential value, including intangible asset.

Inability of historical cost to provide correct information about the actual

value of this asset represented the problem to be solved by the new

accounting practice. Impact on intangible assets value was strongly expected,

and it looks consistent with the evolution process described.

• liabilities and stockholders’ equity aimed at reporting for values of all

financial claims held mainly by shareholders and debtholders. BV of equity

most of time turns out to be far different from its real value, shift to fair value

accounting was supposed to have a relevant impact on equity value.

Increase in the two mentioned parameters can be noticed with reference to:

• such discrepancy in assets mainly due to utilisation of purchase method while

accounting for the business combination, and thus taking into account the whole

acquired company.

• the overall value of the company’s activities is made far more transparent thanks to

the recognition of all identifiable assets inside goodwill.

Comparison between purchase accounting according to Italian GAAP and US GAAP

The right column shows Telecom Italia 2003 intangible assets as reported in US GAAP

balance sheet (see Table VII).

The left column shows how the same balance sheet would be if the Olivetti-Old Telecom

Italia merger and few other transactions would have been still accounted for under

purchase method, but according to Italian GAAP, that is, without recognising identifiable

intangible assets and separating them from goodwill.

Discrepancy between book value and market value of equity

The superior correctness of US GAAP representation is strongly supported by the fact that

the book value of equity calculated according to US GAAP, which would change very slightly

by moving to IFRSs, is really close to the company market capitalisation, with a divergence

of less that 3 percent, or a M/BV of equity ratio of 0.97.

Conclusions

Berdasarkan analisis yang telah dilakukan dapat disimpulkan bahwa:

• Accounting representation berdasarkan US GAAP lebih unggul dalam correctness

dan tranparancy

• Tidak ada perubahan yang relevan pada hasil observasi mengenai prudence dan

timeliness

Detailed calculation of carrying values of identified intangibles assets acquired by Olivetti

through the merger

Similarities between IFRSs and US GAAP concerning accounting for intangibles allow to

extend such result to IFRSs themselves.

Anda mungkin juga menyukai

- Analyzing Firm Distress and Credit SourcesDokumen4 halamanAnalyzing Firm Distress and Credit Sourcesnaega nuguBelum ada peringkat

- Sedang Prestige Resort Apologizes for Poor ServiceDokumen7 halamanSedang Prestige Resort Apologizes for Poor Servicenaega nuguBelum ada peringkat

- Pertemuan 9 - The Risk Management Framework in The Implementing Good Corporate GovernanceDokumen100 halamanPertemuan 9 - The Risk Management Framework in The Implementing Good Corporate Governancenaega nuguBelum ada peringkat

- Liabilities and Owner's EquityDokumen1 halamanLiabilities and Owner's Equitynaega nuguBelum ada peringkat

- Value relevance of asset revaluation reserves across countriesDokumen1 halamanValue relevance of asset revaluation reserves across countriesnaega nuguBelum ada peringkat

- Measurement issues for auditorsDokumen1 halamanMeasurement issues for auditorsnaega nuguBelum ada peringkat

- Classification of Financial Instruments With Characteristic of Both Debt and Equity - Evidence Concerning Convertible RDokumen1 halamanClassification of Financial Instruments With Characteristic of Both Debt and Equity - Evidence Concerning Convertible Rnaega nuguBelum ada peringkat

- Conceptual FrameworkDokumen1 halamanConceptual Frameworknaega nuguBelum ada peringkat

- Measurement issues for auditorsDokumen1 halamanMeasurement issues for auditorsnaega nuguBelum ada peringkat

- Liabilities and Owner's EquityDokumen1 halamanLiabilities and Owner's Equitynaega nuguBelum ada peringkat

- Classification of Financial Instruments With Characteristic of Both Debt and Equity - Evidence Concerning Convertible RDokumen1 halamanClassification of Financial Instruments With Characteristic of Both Debt and Equity - Evidence Concerning Convertible Rnaega nuguBelum ada peringkat

- Future economic benefits: potential measures and recognitionDokumen1 halamanFuture economic benefits: potential measures and recognitionnaega nuguBelum ada peringkat

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeDari EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifePenilaian: 4 dari 5 bintang4/5 (5783)

- The Yellow House: A Memoir (2019 National Book Award Winner)Dari EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Penilaian: 4 dari 5 bintang4/5 (98)

- Never Split the Difference: Negotiating As If Your Life Depended On ItDari EverandNever Split the Difference: Negotiating As If Your Life Depended On ItPenilaian: 4.5 dari 5 bintang4.5/5 (838)

- Shoe Dog: A Memoir by the Creator of NikeDari EverandShoe Dog: A Memoir by the Creator of NikePenilaian: 4.5 dari 5 bintang4.5/5 (537)

- The Emperor of All Maladies: A Biography of CancerDari EverandThe Emperor of All Maladies: A Biography of CancerPenilaian: 4.5 dari 5 bintang4.5/5 (271)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceDari EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RacePenilaian: 4 dari 5 bintang4/5 (890)

- The Little Book of Hygge: Danish Secrets to Happy LivingDari EverandThe Little Book of Hygge: Danish Secrets to Happy LivingPenilaian: 3.5 dari 5 bintang3.5/5 (399)

- Team of Rivals: The Political Genius of Abraham LincolnDari EverandTeam of Rivals: The Political Genius of Abraham LincolnPenilaian: 4.5 dari 5 bintang4.5/5 (234)

- Grit: The Power of Passion and PerseveranceDari EverandGrit: The Power of Passion and PerseverancePenilaian: 4 dari 5 bintang4/5 (587)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaDari EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaPenilaian: 4.5 dari 5 bintang4.5/5 (265)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryDari EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryPenilaian: 3.5 dari 5 bintang3.5/5 (231)

- On Fire: The (Burning) Case for a Green New DealDari EverandOn Fire: The (Burning) Case for a Green New DealPenilaian: 4 dari 5 bintang4/5 (72)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureDari EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FuturePenilaian: 4.5 dari 5 bintang4.5/5 (474)

- Rise of ISIS: A Threat We Can't IgnoreDari EverandRise of ISIS: A Threat We Can't IgnorePenilaian: 3.5 dari 5 bintang3.5/5 (137)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersDari EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersPenilaian: 4.5 dari 5 bintang4.5/5 (344)

- The Unwinding: An Inner History of the New AmericaDari EverandThe Unwinding: An Inner History of the New AmericaPenilaian: 4 dari 5 bintang4/5 (45)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyDari EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyPenilaian: 3.5 dari 5 bintang3.5/5 (2219)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreDari EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You ArePenilaian: 4 dari 5 bintang4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)Dari EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Penilaian: 4.5 dari 5 bintang4.5/5 (119)

- Her Body and Other Parties: StoriesDari EverandHer Body and Other Parties: StoriesPenilaian: 4 dari 5 bintang4/5 (821)

- 020-500-Summary of Control WeaknessesDokumen5 halaman020-500-Summary of Control WeaknessesKris Anne SamudioBelum ada peringkat

- ch03 SolDokumen12 halamanch03 SolJohn Nigz PayeeBelum ada peringkat

- Sales journal summaryDokumen9 halamanSales journal summarySalwa Anisa0% (1)

- AC2102 - Management Accounting Environment - Review Class - Answer KeyDokumen9 halamanAC2102 - Management Accounting Environment - Review Class - Answer KeyJona FranciscoBelum ada peringkat

- AuditingDokumen8 halamanAuditingShahadath HossenBelum ada peringkat

- Martin Corporat-WPS OfficeDokumen3 halamanMartin Corporat-WPS Officelaica valderasBelum ada peringkat

- 7 GyakorlatDokumen75 halaman7 GyakorlatDavid IlosvayBelum ada peringkat

- Restatement of Financial StatementsDokumen21 halamanRestatement of Financial StatementsUtban AshabBelum ada peringkat

- HOBADokumen9 halamanHOBAJulie Mae Caling MalitBelum ada peringkat

- Aud Plan 123Dokumen7 halamanAud Plan 123Mary GarciaBelum ada peringkat

- Butler Lumber - Pro Forma - Balance and Income StatementDokumen4 halamanButler Lumber - Pro Forma - Balance and Income StatementJack Benjamin80% (5)

- Introduction To Managerial Accounting & Cost ConceptsDokumen51 halamanIntroduction To Managerial Accounting & Cost ConceptsSandra LangBelum ada peringkat

- Parle AuditDokumen46 halamanParle AuditMukesh Manwani100% (1)

- Jam Althea O. Agner Prelec Output 1Dokumen3 halamanJam Althea O. Agner Prelec Output 1JAM ALTHEA AGNERBelum ada peringkat

- W4 TaxesDokumen35 halamanW4 TaxesVanessa LeeBelum ada peringkat

- Accounting Theory 7th Edition Godfrey PDFDokumen7 halamanAccounting Theory 7th Edition Godfrey PDFNova TheresiaBelum ada peringkat

- Avator Steel Board Meeting MinutesDokumen2 halamanAvator Steel Board Meeting MinutesTAX O WORLDBelum ada peringkat

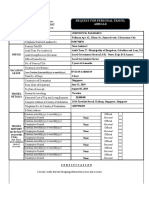

- Request For Personal Travel Abroad: Commonwealth Avenue, Quezon CityDokumen5 halamanRequest For Personal Travel Abroad: Commonwealth Avenue, Quezon CityJonson PalmaresBelum ada peringkat

- Variance Costing and Activity Based Cotsing Test PrepDokumen3 halamanVariance Costing and Activity Based Cotsing Test PrepLhorene Hope DueñasBelum ada peringkat

- Essentials of Accounting For Governmental and Not For Profit Organizations 13th Edition Ebook PDFDokumen41 halamanEssentials of Accounting For Governmental and Not For Profit Organizations 13th Edition Ebook PDFkaty.wilkins325100% (32)

- Auditing Notes For Pre Mid Exam A.Y. 15/16 Audit Revenue CycleDokumen6 halamanAuditing Notes For Pre Mid Exam A.Y. 15/16 Audit Revenue CycleSherlock HolmesBelum ada peringkat

- Bandi: Bandi - Staff.fe - Uns.ac - Id Atau 3/10/2018Dokumen44 halamanBandi: Bandi - Staff.fe - Uns.ac - Id Atau 3/10/2018luxion botBelum ada peringkat

- Kunjaw Medika Adijaya 2021Dokumen35 halamanKunjaw Medika Adijaya 2021NahmaKids100% (1)

- DELSE ManageProRateVATDokumen30 halamanDELSE ManageProRateVATeduardo monsaludBelum ada peringkat

- Guru Kirpa ArtsDokumen8 halamanGuru Kirpa ArtsMeenu MittalBelum ada peringkat

- Sap Fi Transaction Codes List IDokumen10 halamanSap Fi Transaction Codes List IJose Luis GonzalezBelum ada peringkat

- Deferred TaxDokumen3 halamanDeferred Taxমোঃ মাহফুজুর রহমান রাকিবBelum ada peringkat

- Financial Statement Analysis and Security ValuationDokumen3 halamanFinancial Statement Analysis and Security Valuationmadhumitha_vaniBelum ada peringkat

- Effect of Assignment On Consolidated Balance Sheet at Acquisition FileDokumen13 halamanEffect of Assignment On Consolidated Balance Sheet at Acquisition FileAbel ReginaldoBelum ada peringkat

- Unit I - Audit of Investment Property - Final - t31314Dokumen11 halamanUnit I - Audit of Investment Property - Final - t31314Jake Bundok50% (2)