Property Tax (Land and Building Tax) & Property Acquisition Tax

Diunggah oleh

Khairunnisa RahinaningtyasDeskripsi Asli:

Judul Asli

Hak Cipta

Format Tersedia

Bagikan dokumen Ini

Apakah menurut Anda dokumen ini bermanfaat?

Apakah konten ini tidak pantas?

Laporkan Dokumen IniHak Cipta:

Format Tersedia

Property Tax (Land and Building Tax) & Property Acquisition Tax

Diunggah oleh

Khairunnisa RahinaningtyasHak Cipta:

Format Tersedia

Khairunnisa Rahinaningtyas

16/397035/EK/20991

Meeting 8 - Chapter 7 & 8

= 0.5% x [NJKP Percentage x (NJOP – NJOPTKP)]

Property tax (Land and Building Tax) & Property Things determined tax payable; tax year is from 1 Jan

Acquisition Tax – 31 Dec, tax payable is according to the condition of

tax object on the 1st of January, are of tax payable

Law basis: Law No. 12 of 1985 (amended in 1994)

(Jakarta, other area such as city or district).

Land and Building Tax are; provide easiness and

According to article 33 paragraph 3 UUD 1945, earth,

simplicity, the availability of legal certainty,

water and natural wealth that is contained in it,

understandable and fair, avoid double taxation. The

controlled by the state and used for the prosperity of

definition of Land is, the earth surface, and everything

the society. Duty on Land and Building Right

below it. Earth surface consisting of soil, inland

Acquisition (BPHTB) is about those who obtained

waters (swamp, ponds, waters) also the sea are of

right acquisition on land and building, and have to

Indonesia. Building is a technical construction that is

submit part of economic value that is obtained to the

planted or attach permanently on the land or waters

state through payment of taxes. According to Law no.

(swimming pool, park, etc). Land & building Tax

28 of 2009, the authority to collect BPHTB is

Imposition Base, Tax Object Sales Value (NJOP) is

assigned to local government. Tax tariffs is in the

the average price that is obtained from the economic

amount of 5%.

transaction, if there is not economic transaction,

NJOP is determined from the comparison of price and BPHTB = [Acquisition Cost of Tax Object (NPOP) x

other object that is a kind, or new acquisition value, NPOPTKP] x 5%

or replacement of NJOP.

The law basis for land and building rights Law No. 21

Tax tariff that is charged upon the tax object is in the of 1997 and Law No. 28 of 2007. Land and building

amount of 0.5%. Tax bases are; NJOP, the amount of rights is in the scope of the self-assessment system, in

NJOP is set every 3 years by Head Office Region of which the taxpayers calculate and pay his tax by

Directorate General of Taxation in the name of himself. The tax rate imposed is 5% out of the value

Ministry of Finance considering local government’s of acquisition of a taxable object (NPOKP). The non-

opinion, basis of tax calculation is set as low as taxable value of acquisition (NPOKP) is set at the

possible of 20% and as high as 100% from NJOP, the maximum of Rp60.000.000, and minimum of

amount of percentage is being set according to Rp300.000.000.

government regulation (PP) considering the condition

There are certain exceptions, which are for land title

of national economic.

registrar/notary public, head of office in charge of

Land and Building Tax = Tax Tariff x Taxable Sales state auction service, and head of defense office.

Value (NJKP)

Anda mungkin juga menyukai

- Land and Building TaxDokumen3 halamanLand and Building TaxavianaBelum ada peringkat

- Indonesian Taxation: for Academics and Foreign Business Practitioners Doing Business in IndonesiaDari EverandIndonesian Taxation: for Academics and Foreign Business Practitioners Doing Business in IndonesiaBelum ada peringkat

- Valution and Taxation - TocDokumen21 halamanValution and Taxation - Tocraymondzikusooka10Belum ada peringkat

- Chapter 11 TAXDokumen10 halamanChapter 11 TAXnewa944Belum ada peringkat

- PBB - Taxflash - EnglishDokumen17 halamanPBB - Taxflash - EnglishMadhan Way ZainBelum ada peringkat

- BPHTB: Land and Building Tax On Plantation, Forestry and Mining (PBB P3) andDokumen28 halamanBPHTB: Land and Building Tax On Plantation, Forestry and Mining (PBB P3) andandi priatamaBelum ada peringkat

- Apo Fruits Corporation v. Land Bank of The Philippines (Digest)Dokumen2 halamanApo Fruits Corporation v. Land Bank of The Philippines (Digest)Tini Guanio100% (3)

- Real Property Tax Class ProjectDokumen59 halamanReal Property Tax Class ProjectEuodia HodeshBelum ada peringkat

- 225 1417 1 PBDokumen12 halaman225 1417 1 PBnknknknBelum ada peringkat

- Guide Notes On Local Government TaxationDokumen36 halamanGuide Notes On Local Government TaxationAlexine Ali BangcolaBelum ada peringkat

- Eka Sri Sunarti FHUI - 2012Dokumen34 halamanEka Sri Sunarti FHUI - 2012Amen JvnBelum ada peringkat

- Income TaxDokumen7 halamanIncome Taxbienxbien25Belum ada peringkat

- CHAPTER 1 and 2Dokumen45 halamanCHAPTER 1 and 2Josua PranataBelum ada peringkat

- Chapter 11 TAXDokumen12 halamanChapter 11 TAXTeps RaccaBelum ada peringkat

- Kadaster Perpajakan PBB Sektor Pertambangan PPt-Tamer-25120701Dokumen23 halamanKadaster Perpajakan PBB Sektor Pertambangan PPt-Tamer-25120701Wichi LuthfinaBelum ada peringkat

- Day 15 PDFDokumen324 halamanDay 15 PDFLGCDD region 10Belum ada peringkat

- (RPT) Mamalateo. Reviewer On TaxationDokumen16 halaman(RPT) Mamalateo. Reviewer On TaxationRoldan Giorgio P. PantojaBelum ada peringkat

- Land Admn and Management Property TaxationDokumen4 halamanLand Admn and Management Property TaxationsammiemeshBelum ada peringkat

- LGC of Quezon City Vs - Bayan Tel.Dokumen2 halamanLGC of Quezon City Vs - Bayan Tel.george almedaBelum ada peringkat

- Discussion Guide LTD 2019 To 2020 For StudentsDokumen71 halamanDiscussion Guide LTD 2019 To 2020 For StudentsVal Sanchez100% (1)

- Chapter 11 TaxDokumen12 halamanChapter 11 TaxTeps RaccaBelum ada peringkat

- 2297 7125 1 SMDokumen13 halaman2297 7125 1 SMIka Permata SariBelum ada peringkat

- Doctrines in Taxation Imprescriptibility of TaxesDokumen6 halamanDoctrines in Taxation Imprescriptibility of TaxesKeith CamachoBelum ada peringkat

- Fundamental Principles Governing Real Property TaxationDokumen5 halamanFundamental Principles Governing Real Property TaxationgraceBelum ada peringkat

- Smart Communications Vs City of DavaoDokumen1 halamanSmart Communications Vs City of DavaoPilyang SweetBelum ada peringkat

- Relations Between Land Act and RTCP in ZweDokumen5 halamanRelations Between Land Act and RTCP in Zwehurungwere3Belum ada peringkat

- Sources of Revenues and To Levy Taxes, Fees and Charges Subject To Such Guidelines and Limitations As The CongressDokumen3 halamanSources of Revenues and To Levy Taxes, Fees and Charges Subject To Such Guidelines and Limitations As The CongressJunivenReyUmadhayBelum ada peringkat

- Problems and Prospects of Land Fees Administration in Rivers State, NigeriaDokumen9 halamanProblems and Prospects of Land Fees Administration in Rivers State, NigeriaOpata OpataBelum ada peringkat

- The Local Treasury Operations Manual: Book 5Dokumen46 halamanThe Local Treasury Operations Manual: Book 5Isaac100% (2)

- Tax Chapter 5 Draft IIDokumen88 halamanTax Chapter 5 Draft IIRuiz, CherryjaneBelum ada peringkat

- Mactan-Cebu International Airport Authority (Mciaa), Petitioner, vs. City of Lapu-Lapu and Elena T. Pacaldo, RespondentsDokumen19 halamanMactan-Cebu International Airport Authority (Mciaa), Petitioner, vs. City of Lapu-Lapu and Elena T. Pacaldo, Respondentsmaica_prudenteBelum ada peringkat

- Discussion Guide LTD TitlingDokumen41 halamanDiscussion Guide LTD TitlingHanna Liia GeniloBelum ada peringkat

- Understanding Real Estate TaxationDokumen4 halamanUnderstanding Real Estate TaxationCashmoney AlaskaBelum ada peringkat

- Scope of The BclteDokumen74 halamanScope of The BclteGreg Marilyn100% (3)

- Tax General PrinciplesDokumen17 halamanTax General Principlessunem blackBelum ada peringkat

- Hand Book of Revenue DepartmentDokumen8 halamanHand Book of Revenue Departmentmuzammil hassanBelum ada peringkat

- Tax Updates by Atty. LumberaDokumen68 halamanTax Updates by Atty. Lumberaavery03Belum ada peringkat

- LAND BANK Vs SORIANODokumen2 halamanLAND BANK Vs SORIANONorway AlaroBelum ada peringkat

- Taxation Law 2007 Bar Question and AnswerDokumen12 halamanTaxation Law 2007 Bar Question and AnswerHenry M. Macatuno Jr.Belum ada peringkat

- Admin Cases Set 2Dokumen34 halamanAdmin Cases Set 2Kelvin ZabatBelum ada peringkat

- CH 16Dokumen38 halamanCH 16tomas PenuelaBelum ada peringkat

- Tax Avoidance and Tax EvasionDokumen2 halamanTax Avoidance and Tax EvasionLex DgtBelum ada peringkat

- City of Pasig v. RepublicDokumen13 halamanCity of Pasig v. RepublicErl RoseteBelum ada peringkat

- Recent Cases On Beneficial UseDokumen13 halamanRecent Cases On Beneficial UseLeighBelum ada peringkat

- Tax Updates by Atty. LumberaDokumen67 halamanTax Updates by Atty. Lumberacupido88Belum ada peringkat

- Local Government Taxation PDFDokumen16 halamanLocal Government Taxation PDFSani BautisTaBelum ada peringkat

- Ms - Swapnil Kumar, Executive Student (2008-09), IMT GhaziabadDokumen47 halamanMs - Swapnil Kumar, Executive Student (2008-09), IMT Ghaziabadswapnil_2009100% (2)

- Percentage TaxDokumen31 halamanPercentage TaxMichael Dave ClarionBelum ada peringkat

- Real Property TaxationDokumen12 halamanReal Property TaxationJasper AlonBelum ada peringkat

- Problems and Prospects of Land Fees Administration in Rivers State, NigeriaDokumen15 halamanProblems and Prospects of Land Fees Administration in Rivers State, NigeriaOpata OpataBelum ada peringkat

- Land Laws:: Dr. Eng. Shireen Y. Ismael 5Dokumen33 halamanLand Laws:: Dr. Eng. Shireen Y. Ismael 5Alan KhaleelBelum ada peringkat

- The National Government, Which Historically Merely Delegated To Local Governments The Power To TaxDokumen37 halamanThe National Government, Which Historically Merely Delegated To Local Governments The Power To Taxlleiryc7Belum ada peringkat

- Unit 1Dokumen24 halamanUnit 1Jyoti SaharanBelum ada peringkat

- Tax PracticeDokumen55 halamanTax PracticejaejaejiajiaBelum ada peringkat

- City of Lapu-Lapu v. PEZADokumen67 halamanCity of Lapu-Lapu v. PEZACk Bongalos AdolfoBelum ada peringkat

- 01 IMF - Taxing Immovable Property - 2013 15Dokumen1 halaman01 IMF - Taxing Immovable Property - 2013 15Dimitris ArgyriouBelum ada peringkat

- Tanggung Jawab Camat Sebagai Ppat Sementara Dalam Hal Menandatangani Akta Jual Beli (Contoh Kasus Nomor PUTUSAN 44/PDT.G/2014/PN KWG)Dokumen25 halamanTanggung Jawab Camat Sebagai Ppat Sementara Dalam Hal Menandatangani Akta Jual Beli (Contoh Kasus Nomor PUTUSAN 44/PDT.G/2014/PN KWG)ita marbawiBelum ada peringkat

- Wanna Be Yes ItlingDokumen43 halamanWanna Be Yes ItlingJoyce LapuzBelum ada peringkat

- 90-17 Cpar - Local Government TaxesDokumen37 halaman90-17 Cpar - Local Government TaxesJellah NavarroBelum ada peringkat

- Customer Profitability AnalysisDokumen1 halamanCustomer Profitability AnalysisKhairunnisa RahinaningtyasBelum ada peringkat

- CG - 3 PDFDokumen2 halamanCG - 3 PDFKhairunnisa RahinaningtyasBelum ada peringkat

- CG - 4 PDFDokumen3 halamanCG - 4 PDFKhairunnisa RahinaningtyasBelum ada peringkat

- Types of Taxes and The Jurisdiction That Uses Them: Chapter 1 Section 2Dokumen1 halamanTypes of Taxes and The Jurisdiction That Uses Them: Chapter 1 Section 2Khairunnisa RahinaningtyasBelum ada peringkat

- Indonesia Corporate Governance Manual: IFC Advisory Services in IndonesiaDokumen2 halamanIndonesia Corporate Governance Manual: IFC Advisory Services in IndonesiaKhairunnisa RahinaningtyasBelum ada peringkat

- Week 7Dokumen1 halamanWeek 7Khairunnisa RahinaningtyasBelum ada peringkat

- Dangdut Soul: Who Are 'The People' in Indonesian Popular Music?Dokumen2 halamanDangdut Soul: Who Are 'The People' in Indonesian Popular Music?Khairunnisa RahinaningtyasBelum ada peringkat

- Khairunnisa Rahinaningtyas - 397035: PolygamyDokumen1 halamanKhairunnisa Rahinaningtyas - 397035: PolygamyKhairunnisa RahinaningtyasBelum ada peringkat

- Diversity in Compliance: Yogyakarta Chinese and The New Order Assimilation PolicyDokumen2 halamanDiversity in Compliance: Yogyakarta Chinese and The New Order Assimilation PolicyKhairunnisa Rahinaningtyas100% (1)

- Offer Letter SampleDokumen2 halamanOffer Letter SampleAmit SinghBelum ada peringkat

- Azure InvoiceDokumen2 halamanAzure InvoiceAnkit SambhareBelum ada peringkat

- C7021-22-2717923 30-03-2023 30-03-2023 Sold by (Pharmacy) Bill To / Ship To (Patient) Healthsaverz Medical LLP UshaDokumen1 halamanC7021-22-2717923 30-03-2023 30-03-2023 Sold by (Pharmacy) Bill To / Ship To (Patient) Healthsaverz Medical LLP UshaViraj DobriyalBelum ada peringkat

- Innoprint Inti Perkasa, PT - PO00122117Dokumen1 halamanInnoprint Inti Perkasa, PT - PO00122117mario gultomBelum ada peringkat

- Windhoek Gymnasium 2022 School Fees Final Web Upload 01Dokumen3 halamanWindhoek Gymnasium 2022 School Fees Final Web Upload 01Janet NdakalakoBelum ada peringkat

- Sap Fico TutorialDokumen29 halamanSap Fico Tutorialkmurali321Belum ada peringkat

- New Disbursement VoucherDokumen1 halamanNew Disbursement VoucherMarjorie MalionesBelum ada peringkat

- Salary SlipDokumen2 halamanSalary SlipRuchi SinglaBelum ada peringkat

- 2.5 Cash Books: Two Column Cash BookDokumen6 halaman2.5 Cash Books: Two Column Cash Bookwilliam koechBelum ada peringkat

- Postpaid Monthly Statement: This Month's SummaryDokumen4 halamanPostpaid Monthly Statement: This Month's SummaryJinesh JadavBelum ada peringkat

- 68125672575bdf96fc857f403531f1c9-copyDokumen9 halaman68125672575bdf96fc857f403531f1c9-copyyour unreal0% (1)

- AXIS BANK Statement For February 2021-1Dokumen5 halamanAXIS BANK Statement For February 2021-1Vijay ShanigarapuBelum ada peringkat

- A5 - ICQ Control Activities - DisbursementsDokumen4 halamanA5 - ICQ Control Activities - DisbursementsReihannah Paguital-MagnoBelum ada peringkat

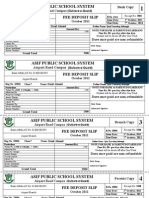

- Asif Public School System: Fee Deposit SlipDokumen1 halamanAsif Public School System: Fee Deposit SlipIrfan YousafBelum ada peringkat

- Release Strategy For Multiple Countries With Respective CurrencyDokumen7 halamanRelease Strategy For Multiple Countries With Respective CurrencySrinivas VemulapalliBelum ada peringkat

- Panasonic Communications Imaging Corp. v. CIRDokumen3 halamanPanasonic Communications Imaging Corp. v. CIRAbigayle RecioBelum ada peringkat

- 01.04.2022 To 20.02.2023Dokumen22 halaman01.04.2022 To 20.02.2023PrashantBelum ada peringkat

- Phil Geothermal V CIR GR 154028 July 29, 2005Dokumen1 halamanPhil Geothermal V CIR GR 154028 July 29, 2005katentom-1Belum ada peringkat

- BIR Ruling No. 051 2000 PDFDokumen3 halamanBIR Ruling No. 051 2000 PDFVina CeeBelum ada peringkat

- Summary of Withholding Tax Rates PDFDokumen18 halamanSummary of Withholding Tax Rates PDFPopy AkterBelum ada peringkat

- Sample PayrollDokumen6 halamanSample PayrollDeborah Fajardo ManabatBelum ada peringkat

- 47-Article Text-521-1-10-20221208Dokumen6 halaman47-Article Text-521-1-10-20221208Henry DP SinagaBelum ada peringkat

- Obligation SlipDokumen130 halamanObligation SlipMelizen Leones AddunBelum ada peringkat

- InvoiceDokumen4 halamanInvoiceMohamed ElshahidiBelum ada peringkat

- Eps-Topik Test Fee PDFDokumen1 halamanEps-Topik Test Fee PDFarshe khanBelum ada peringkat

- Possible Q&ADokumen22 halamanPossible Q&AmarkespinoBelum ada peringkat

- Percentage Tax Return: BIR Form NoDokumen2 halamanPercentage Tax Return: BIR Form NoLele CaparasBelum ada peringkat

- A New Look at Indirect Taxation in Developing Countries: University of TorontoDokumen11 halamanA New Look at Indirect Taxation in Developing Countries: University of TorontoKatindig CarlBelum ada peringkat

- No 3, Simpang 370-81, Kelas C Jalan Muara, Kampong Sungai Tilong Brunei Muara BC3315 Brunei DarussalamDokumen2 halamanNo 3, Simpang 370-81, Kelas C Jalan Muara, Kampong Sungai Tilong Brunei Muara BC3315 Brunei DarussalamEddy MisuariBelum ada peringkat

- Questions On Imprest SysyemDokumen3 halamanQuestions On Imprest Sysyemyuvita prasadBelum ada peringkat

- You Need a Budget: The Proven System for Breaking the Paycheck-to-Paycheck Cycle, Getting Out of Debt, and Living the Life You WantDari EverandYou Need a Budget: The Proven System for Breaking the Paycheck-to-Paycheck Cycle, Getting Out of Debt, and Living the Life You WantPenilaian: 4 dari 5 bintang4/5 (104)

- The Black Girl's Guide to Financial Freedom: Build Wealth, Retire Early, and Live the Life of Your DreamsDari EverandThe Black Girl's Guide to Financial Freedom: Build Wealth, Retire Early, and Live the Life of Your DreamsBelum ada peringkat

- How To Budget And Manage Your Money In 7 Simple StepsDari EverandHow To Budget And Manage Your Money In 7 Simple StepsPenilaian: 5 dari 5 bintang5/5 (4)

- The Best Team Wins: The New Science of High PerformanceDari EverandThe Best Team Wins: The New Science of High PerformancePenilaian: 4.5 dari 5 bintang4.5/5 (31)

- Small Business Taxes: The Most Complete and Updated Guide with Tips and Tax Loopholes You Need to Know to Avoid IRS Penalties and Save MoneyDari EverandSmall Business Taxes: The Most Complete and Updated Guide with Tips and Tax Loopholes You Need to Know to Avoid IRS Penalties and Save MoneyBelum ada peringkat

- Financial Literacy for All: Disrupting Struggle, Advancing Financial Freedom, and Building a New American Middle ClassDari EverandFinancial Literacy for All: Disrupting Struggle, Advancing Financial Freedom, and Building a New American Middle ClassBelum ada peringkat

- How to get US Bank Account for Non US ResidentDari EverandHow to get US Bank Account for Non US ResidentPenilaian: 5 dari 5 bintang5/5 (1)

- Tax-Free Wealth: How to Build Massive Wealth by Permanently Lowering Your TaxesDari EverandTax-Free Wealth: How to Build Massive Wealth by Permanently Lowering Your TaxesBelum ada peringkat

- Tax Strategies: The Essential Guide to All Things Taxes, Learn the Secrets and Expert Tips to Understanding and Filing Your Taxes Like a ProDari EverandTax Strategies: The Essential Guide to All Things Taxes, Learn the Secrets and Expert Tips to Understanding and Filing Your Taxes Like a ProPenilaian: 4.5 dari 5 bintang4.5/5 (43)

- Budget Management for Beginners: Proven Strategies to Revamp Business & Personal Finance Habits. Stop Living Paycheck to Paycheck, Get Out of Debt, and Save Money for Financial Freedom.Dari EverandBudget Management for Beginners: Proven Strategies to Revamp Business & Personal Finance Habits. Stop Living Paycheck to Paycheck, Get Out of Debt, and Save Money for Financial Freedom.Penilaian: 5 dari 5 bintang5/5 (89)

- How to Pay Zero Taxes, 2020-2021: Your Guide to Every Tax Break the IRS AllowsDari EverandHow to Pay Zero Taxes, 2020-2021: Your Guide to Every Tax Break the IRS AllowsBelum ada peringkat

- Make Sure It's Deductible: Little-Known Tax Tips for Your Canadian Small Business, Fifth EditionDari EverandMake Sure It's Deductible: Little-Known Tax Tips for Your Canadian Small Business, Fifth EditionBelum ada peringkat

- The Panama Papers: Breaking the Story of How the Rich and Powerful Hide Their MoneyDari EverandThe Panama Papers: Breaking the Story of How the Rich and Powerful Hide Their MoneyPenilaian: 4 dari 5 bintang4/5 (52)

- Bookkeeping: Step by Step Guide to Bookkeeping Principles & Basic Bookkeeping for Small BusinessDari EverandBookkeeping: Step by Step Guide to Bookkeeping Principles & Basic Bookkeeping for Small BusinessPenilaian: 5 dari 5 bintang5/5 (5)

- Taxes for Small Businesses QuickStart Guide: Understanding Taxes for Your Sole Proprietorship, StartUp & LLCDari EverandTaxes for Small Businesses QuickStart Guide: Understanding Taxes for Your Sole Proprietorship, StartUp & LLCPenilaian: 4 dari 5 bintang4/5 (5)

- The 30-Day Money Cleanse: Take Control of Your Finances, Manage Your Spending, and De-Stress Your Money for Good (Personal Finance and Budgeting Self-Help Book)Dari EverandThe 30-Day Money Cleanse: Take Control of Your Finances, Manage Your Spending, and De-Stress Your Money for Good (Personal Finance and Budgeting Self-Help Book)Penilaian: 3.5 dari 5 bintang3.5/5 (9)

- What Your CPA Isn't Telling You: Life-Changing Tax StrategiesDari EverandWhat Your CPA Isn't Telling You: Life-Changing Tax StrategiesPenilaian: 4 dari 5 bintang4/5 (9)

- Basic Python in Finance: How to Implement Financial Trading Strategies and Analysis using PythonDari EverandBasic Python in Finance: How to Implement Financial Trading Strategies and Analysis using PythonPenilaian: 5 dari 5 bintang5/5 (9)

- CDL Study Guide 2022-2023: Everything You Need to Pass Your Exam with Flying Colors on the First Try. Theory, Q&A, Explanations + 13 Interactive TestsDari EverandCDL Study Guide 2022-2023: Everything You Need to Pass Your Exam with Flying Colors on the First Try. Theory, Q&A, Explanations + 13 Interactive TestsPenilaian: 4 dari 5 bintang4/5 (4)

- Founding Finance: How Debt, Speculation, Foreclosures, Protests, and Crackdowns Made Us a NationDari EverandFounding Finance: How Debt, Speculation, Foreclosures, Protests, and Crackdowns Made Us a NationBelum ada peringkat

- Personal Finance for Beginners - A Simple Guide to Take Control of Your Financial SituationDari EverandPersonal Finance for Beginners - A Simple Guide to Take Control of Your Financial SituationPenilaian: 4.5 dari 5 bintang4.5/5 (18)

- Swot analysis in 4 steps: How to use the SWOT matrix to make a difference in career and businessDari EverandSwot analysis in 4 steps: How to use the SWOT matrix to make a difference in career and businessPenilaian: 4.5 dari 5 bintang4.5/5 (4)