General Schedule of Features and Charges (GSFC) : For Retail Current Accounts (W.e.f. 1st July, 2017)

Diunggah oleh

hareesh008Deskripsi Asli:

Judul Asli

Hak Cipta

Format Tersedia

Bagikan dokumen Ini

Apakah menurut Anda dokumen ini bermanfaat?

Apakah konten ini tidak pantas?

Laporkan Dokumen IniHak Cipta:

Format Tersedia

General Schedule of Features and Charges (GSFC) : For Retail Current Accounts (W.e.f. 1st July, 2017)

Diunggah oleh

hareesh008Hak Cipta:

Format Tersedia

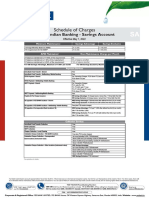

General Schedule of Features and Charges (GSFC)

For Retail Current Accounts (w.e.f. 1st July, 2017)

Particulars

Product Name Neo## Edge Pro Elite Ace

10,000 25,000 50,000 100,000 250,000

Remittances / Payments

1/1000 NIL Charges up to 25 DD/ BC NIL Charges up to 50 DD/ BC NIL Charges up to 100 DD/ BC

Payable at Branch Locations * NIL Charges - Unlimited

Demand Draft/ Banker’s (Min 40 Max 5000) thereafter Std Chrgs p.m.; thereafter Std Chrgs p.m.; thereafter Std Chrgs

Cheque Payable at Non- branch 2/1000 NIL Charges upto 10L p.m.; Nil Charges up to 30L p.m.;

(Min 40 Max 5000) * * * thereafter Std Chrgs thereafter Std Chrgs

Locations

Through Branch 2 - 5 L: 25/ txn; * * NIL Charges NIL Charges NIL Charges

RTGS

Through Net Banking > 5 L: 50/ txn NIL Charges NIL Charges NIL Charges NIL Charges NIL Charges

Through Branch Upto 10K: 2.5/txn; * * Nil Charges NIL Charges NIL Charges

NEFT**

Through Net Banking >10K to 2L: 5/ txn; >2L: 25/ txn NIL Charges Nil Charges Nil Charges NIL Charges NIL Charges

Upto Rs.100000: Rs. 5 / txn;

IMPS Rs.100001 to * * * NIL Charges NIL Charges

Rs. 200000: Rs. 15 / txn

Fund Transfer Branch & Net Banking Nil NIL Charges Nil Charges Nil Charges Nil Charges Nil Charges

Default Cheque Book is Upto 500 leaves/p.m.- 2/leaf.; Nil Charges for 1st Chq Book NIL Charges upto 50 cheque NIL Charges upto 200 cheque NIL Charges upto 300 cheque

Cheque Book Nil Charges

Payable At-par Only Above 500 leaves/p.m.- 3/ leaf (25 leaves); then Std Charges leaves p.m.; then Std Charges leaves p.m.; then Std Charges leaves p.m.; then Std Charges

Receipts/ Collections:

Local Clearing Cheque Nil NIL Charges NIL Charges NIL Charges NIL Charges NIL Charges

Drawn at Kotak Branch <10K: 50/Chq; 10K -1L: <10K: 50/Chq; 10K-1L: 25/Chq;

Out-station Cheque * NIL Charges NIL Charges NIL Charges

Locations 100/Chq; >1L: 150/Chq >1L: NIL Charges

(Cheques drawn on non-

Drawn at Kotak Non - <10K: 50/Chq; 10K -1L: <10K: 50/Chq; 10K-1L: 25/Chq; <10K: 50/Chq; 10K-1L: 25/Chq; <10K: 50/Chq; 10K-1L: 25/Chq; <10K: 50/Chq; 10K-1L: 25/Chq;

speed clearing branches) *

branch Locations 100/Chq; >1L: 150/Chq >1L: NIL Charges >1L: NIL Charges >1L: NIL Charges >1L: NIL Charges

Out-station Cheque

(Cheques drawn on speed Nil NIL Charges NIL Charges NIL Charges NIL Charges NIL Charges

clearing branches)

RTGS Inward Nil NIL Charges NIL Charges NIL Charges NIL Charges NIL Charges

NEFT Inward Nil NIL Charges NIL Charges NIL Charges NIL Charges NIL Charges

Fund Transfer Inward Nil NIL Charges NIL Charges NIL Charges NIL Charges NIL Charges

Home Banking:

Cheque/DD - 75/Request NIL Charges up to 8 request p.m. NIL Charges upto 12 request NIL Charges upto 15 request p.m.

Cheque Pick-up/DD Delivery/ (Max 1/Day) thereafter Std Charges

On Call Requests Cash - < 2L: 200/Request; * * p.m. (Max 1/Day) thereafter (Max 1/Day) thereafter

Cash Pick-up or Delivery + Registration Fee Rs.250 p.a.

2-5L: 400/Request Std Charges Std Charges

Beat Service Cheque Pick-up 500 p.m. 300 p.m. 300 p.m. NIL Charges NIL Charges NIL Charges

Cash Deposit & Withdrawal:

NIL Charges upto 5 times of NIL Charges upto 5 times of NIL Charges upto 5 times of NIL Charges upto 8 times of

NIL Charges upto 2L p.m.; prev month's avg credit prev month's avg credit prev month's avg credit prev month's avg credit

At Home Branch Location @ 3/1000 thereafter Std Chrgs balance or 4L whichever is balance or 5L whichever is balance or 10L whichever is balance or 25 L whichever is

Cash Deposits higher; thereafter Std Chrgs higher; thereafter Std Chrgs higher; thereafter Std Chrgs higher; thereafter Std Chrgs

At Non - home Branch NIL Charges upto 20K per NIL Charges upto 50K per NIL Charges upto 1L per NIL Charges upto 3L per NIL Charges upto 5L per

4.5/1000 Min 50 per txn

Location month; thereafter std charges month; thereafter std charges month; thereafter std charges month; thereafter std charges month; thereafter std charges

From Home Branch Location Nil NIL Charges NIL Charges NIL Charges NIL Charges NIL Charges

Cash Withdrawal From Non - home Branch NIL Charges upto 10K per day; NIL Charges upto 25K per day; NIL Charges upto 50K per day; NIL Charges upto 1L per day; NIL Charges upto 2.5L per day;

2/1000 Min 50 per txn

Location thereafter std charges thereafter std charges thereafter std charges thereafter std charges thereafter std charges

Automated Teller Machine (ATM):

Non Financial Txn Nil NIL Charges NIL Charges NIL Charges NIL Charges NIL Charges

Kotak ATMs

Cash Withdrawal Nil NIL Charges NIL Charges NIL Charges NIL Charges NIL Charges

Other Bank’s VISA ATMs - Non Financial Txn 8.50 per txn NIL charges upto 5 txn p.m ;

* * thereafter std charges NIL Charges NIL Charges

Domestic Cash Withdrawal 20 per txn

+ Other Bank’s VISA ATMs - Non Financial Txn 25 per txn

* * * * *

International Cash Withdrawal 150 per txn

ATM Txns Declined <> Insufficient Funds 25 per txn * * * * *

Debit Card: d:

Issuance Fee 250 p.a. NIL Charges NIL Charges NIL Charges NIL Charges NIL Charges

NIL Charges for 1st Year NIL Charges for 1st Year NIL Charges for 1st Year

Annual Fee (Business Gold) 250 p.a. * *

Primary Card thereafter Std Chrgs thereafter Std Chrgs thereafter Std Chrgs

NIL Charges for 1st Year

Annual Fee (Business Platinum) 750 p.a. * * * * thereafter 250/ Year

Issuance Fee 250 * * * * *

Add-on Card NIL Charges for 1st Year

Annual Fee 250 p.a. * * * *

thereafter Std Chrgs

Lost Card 200 * * * * *

Card Replacement

Damaged Card Nil NIL Charges NIL Charges NIL Charges NIL Charges NIL Charges

Other Charges:

Account Related

If AQB < 50% of the

1200 1500 2500 5000 8000

Non maintenance required Product AQB

AQB Non - maintenance <>

charges per quarter If AQB >=50% but < 100%

750 900 1500 3000 5000

of the required Product AQB

- <30 Days: Nil; 31 - 181 Days: <30 Days: Nil; 31 - 181 Days: <30 Days: Nil; 31 - 181 Days: <30 Days: Nil; 31 - 181 Days: <30 Days: Nil; 31 -181 Days:

Account Closure Charges

750; >181 Days: Nil 900; >181 Days: Nil 1500; >181 Days: Nil 3000; >181 Days: Nil 5000; >181 Days: Nil

Cheque Returns <>

Nil charges upto 3 p.m.; Nil charges upto 5 p.m.; Nil charges upto 10 p.m.;

Local 100 per Cheque * *

Cheques Deposited & thereafter Std Charges thereafter Std Charges thereafter Std Charges

Returned (Outward) 100 per Cheque + 50 per Cheque + 50 per Cheque + 50 per Cheque +

Out-station Corr Bank Chrgs * * Corr Bank Chrgs Corr Bank Chrgs Corr Bank Chrgs

Upto 3 returns -

Cheques Issued and Financial Reasons 350/instance; 4th return * * * * *

Returned (Inward) & onward 750/instance

ECS returns NIL Charges NIL Charges NIL Charges NIL Charges NIL Charges

Technical Reasons Nil

SMS Alerts & Updates

Balance (Daily/Weekly), SMS - 25 per Quarter

* * * NIL Charges NIL Charges

Txn & Value Added Alerts Email - NIL Charges

Phone Banking

IVR Assisted Nil NIL Charges NIL Charges NIL Charges NIL Charges NIL Charges

Phone Banking

Agent Assisted 25 per Call NIL Charges NIL Charges NIL Charges NIL Charges NIL Charges

Charges Common for All Products

Account Statements

Monthly Physical/ Email Physical - 75/quarter;

NIL Charges NIL Charges NIL Charges NIL Charges NIL Charges

Email - Nil Charges

Physical 300 per Quarter * * * * *

Weekly

By Email Nil NIL Charges NIL Charges NIL Charges NIL Charges NIL Charges

Daily By Email Only Nil NIL Charges NIL Charges NIL Charges NIL Charges NIL Charges

Through Net Banking : NIL Charges

Annual Combined

Through Branch : `85, * * * * *

Statement (Physical)

Through Phone Banking : `110

NetBanking transactions are Free: -

No Charges for undertaking NetBanking transaction of RTGS & NEFT payments / Fund Transfer / Annual Combined statement requests / online tax payment (e-Tax)

Particulars Standard Charges (in `) Product Level Free Limits & Charges (in `)

Product Name Neo## Edge Pro Elite Ace

Average Quarterly Balance (AQB) in ` 10,000 25,000 50,000 100,000 250,000

<90 Days: 100 * * * * *

At Branch/ Phone Banking 91-365 Days: 200 * * * * *

Ad - hoc Statements Request >365 Days: 1000 * * * * *

On Net Banking/ ATM 50 * * * * *

On Mobile Banking Nil (by email only) NIL Charges NIL Charges NIL Charges NIL Charges NIL Charges

Standing Instruction

Set-up 100 * * * * *

Execution Nil NIL Charges NIL Charges NIL Charges NIL Charges NIL Charges

Amendment 25 * * * * *

Failure <> 100 * * * * *

Statement/ Certificate / Report Issuance

Balance Statement Other than 31st March 100 * * * * *

Interest Statement Duplicate Only 100 * * * * *

TDS Certificate Duplicate Only 200 * * * * *

Confidential Report 500 * * * * *

Paid Cheque Report Nil NIL Charges Nil Charges NIL Charges NIL Charges NIL Charges

Signature Verification 100 * * * * *

Photo Attestation 300 * * * * *

Solvency Certificate 10,000 * * * * *

Credit Confirmation 500 * * * * *

Address Confirmation 100 * * * * *

Foreign Currency Payments & Collections

DD Issuance ~ 500 * * * * *

DD Cancellation ~ 500 * * * * *

DD Revalidation 500 * * * * *

Corr Bank Chrgs Borne

250 * * * * *

by Beneficiary

TT Transfer ~

Corr Bank Chrgs Not Borne

1000 * * * * *

by Beneficiary

Cheque Collection~ 500 * * * * *

Cheque Deposited

1000 * * * * *

and Returned ~ <>

Cheque Issued and

Financial Reasons 1000 * * * * *

Returned ~ <>

Cheque Issued and

Technical Reasons Nil NIL Charges NIL Charges NIL Charges NIL Charges NIL Charges

Returned <>

Miscellaneous Charges

Includes RTGS/NEFT (through NIL Charges upto 50 Txn NIL Chargesupto 75 Txn NIL Charges upto 125 Txn NIL Charges upto 200 Txn NIL Charges upto 400 Txn

Bulk Transaction charges Branch),Local/outstation clearing, 10 per Txn

p.m;thereafter std charges p.m;thereafter std charges p.m;thereafter std charges p.m;thereafter std charges p.m;thereafter std charges

Cash deposit/withdrawal,FT

ATM/ Phone/ Net Banking

PIN Regeneration 50 * * * * *

(only if sent through courier)

DD/BC Cancellation /

100 * * * * *

Revalidation

Financial Reasons 300 * * * * *

Fund Transfer Return <>

Technical Reasons Nil NIL Charges NIL Charges NIL Charges NIL Charges NIL Charges

Through Net Banking Nil NIL Charges NIL Charges NIL Charges NIL Charges NIL Charges

Online Tax Payment (E Tax)

Through Branch 100 per request * * * * *

Cheque Purchase Charges 0.5/1000 per Day * * * * *

Travelers Cheque

1% of TC Amount * * * * *

Encashment ~

TOD Charges 500 * * * * *

Stop Payment Individual or Range 100 * * * * *

Mandate Registration Charges

50 * * * * NIL Charges

(Per Instance)

Activation of

Nil NIL Charges NIL Charges NIL Charges NIL Charges NIL Charges

inoperative Account

Record retrieval charges 100 / Request * * * * *

GST on Foreign Currency Conversion Charges (FCY) ~

Value of purchase or sale Value on which GST rate

of Foreign Currency will be applicable

Up to 1,00,000 1% of the gross amount of currency

exchanges or minimum of ` 250/-

Above ` 1,00,000/- 1000 + 0.50% of the gross amount

to ` 10,00,000/- of currency exchanged less 1,00,000

Rs.5500/- + 0.10% of the gross amount

Above `.10,00,000/- of currency exchanges less 10,00,000

subject to maximum of Rs.60,000/-

Please Note:

1

Classic Card will not be available to customers whose Current Account has been opened with Kotak Bank post 20th Dec,2011. Charges against Classic Card will be same as that of Business Gold

Coin Deposit charges : "Nil Charges" upto deposit value of Rs 50 ; Beyond Rs 50 per instance, 5% on amount deposited will be charged. Low Denomination Charges : 0.5% of the value above Rs 5000 deposit per instance ; Only Rs 10 and Rs 20 notes will be considered.

Non financial Txn under debit card section includes Balance enquiry , Mini Statement & PIN Change.

* Indicates Standard Charges are Applicable

Abbreviations Used: For all value figures L = Lakhs & K - Thousand; Prev = Previous; Chq = Cheque; Std = Standard; Chrg = Charge; Txn= Transaction; p.m.=per month; p..a.= per annum; Avg= Average;FCY= Foreign ,FT = Fund Transfer

Currency; Corr = Correspondent; TOD = Temporary Overdraft; w/o = without

"NIL Charges" are not applicable for Current Accounts Maintaining Less than 75% of the Required Product AQB:

Product wise limits offered on various transactions and services with "NIL Charges" shall be applicable only if the Average Quarterly Balance (AQB) maintained in the account in that quarter is atleast 75% of the product AQB; else standard charges shall apply as per

the GSFC in effect. Additionally, AQB non-maintenance charge will also be applicable as mentioned in GSFC.

**Indo - Nepal Remittance Scheme (NEFT Charges):

- If beneficiary maintains an account with Nepal SBI Bank Ltd (NSBL): Rs 25 per txn (incl all taxes)

- If beneficiary does not maintain an account with Nepal SBI Bank Ltd (NSBL): Upto Rs 5000 - Rs 75 per txn & beyond Rs 5000 - Rs 100 per txn (incl all taxes)

# Applicable for all transactions which involve foreign currency conversion. This charge is applicable from May 16, 2008 as per the CBDT Circular

~ Any purchase / sale of foreign exchange will attract GST on the gross amount of currency exchanged as per GST on Foreign Currency Conversion Charges (FCY) table above

Please note any rejections in applications made through ASBA mode due to insufficient funds will attract charges of Rs 300/- per rejection.

## Neo Current Account is available in select locations only.

@ Nil charges Cash Deposit Limits & Cash Handling Charges for OD Accounts:

Nil charges at Home Branch Location Only: Home branch location is defined as all the branches belonging to the same clearing zone in which the account is opened.

For CA with OD facility - 2 times of previous month’s Avg OD Utilization or Avg Debit Balance.

Charges applicable :

Rs 3/1000 of cash deposited and part thereof + Service Tax as applicable.

*Nil charges on Transaction and Value added SMSalerts to the customers who have subscribed for Daily/Weekly balance alert facility.

*Alerts that have been mandated by RBI as well as alerts which are deemed appropriate by the Bank, will be sent without any charges, even if Daily/Weekly Balance SMS alerts facility has not been subscribed.

GTA Pro, GTA Elite and GTA ACE products would follow the transaction banking related features and charges of the underlying generic products namely Pro, Elite and ACE.

For more details related to Trade Service charges refer the Trade GSFC respectively.

Service Charges to Account Holders in Rural / Semi-urban locations:

Classic Current Account is available in Rural / Semi-urban branches with reduced AQB requirement of Rs 10,000. The features offered and charges applicable shall be the same as Pro Current Account (except for Home Banking Service which is

offered only at select locations).

Kotak Synergy Current Account is available to customers of other businesses within the group, same features & charges as Edge Current Account are applicable at a reduced AQB of Rs 10,000. Features & charges as Pro Current Account are offered at NIL AQB

for all below mentioned acccounts, except Home Banking services which will be offered at standard charges plus registration fee of Rs 250/- per annum for these customers.

Product Name Business Group Product Name Business Group

Retail Overdraft Account Business Banking Group Business Finance Current Account Business Banking Group

Kotak Logistics Overdraft Account Commercial Vehicles Finance Division Business Current Account Personal Loan Division

Business Plus Current Account Home Finance Division Agri Finance Overdraft Account Agri Finance Division

The Bank will charge cross-currency mark-up of 3.5% on foreign currency transactions carried out on Debit Cards. The exchange rate used will be the VISA/Master Card wholesale exchange rate prevailing at the time of transaction.

'<> Indicates penalty charges

Charges are exclusive of the Goods and Service Tax (GST).

With effect from July 1, 2017 the effective Goods and Service tax rate will be 18% on taxable value. The GST rate is subject to change from time to time.

The above charges are applicable for all states other than Jammu & Kashmir. GST is applicable in the state of Jammu & Kashmir. For charges applicable to Jammu & Kashmir, please contact the respective Branch Manager.

All charges are subject to revision with an intimation of 30 days to account holders. Closure of account due to revision of charges will not be subject to account closure charges.

Anda mungkin juga menyukai

- Kotak Bank General Accounts and ChargesDokumen5 halamanKotak Bank General Accounts and ChargesCraig DsouzaBelum ada peringkat

- Ca GSFC Wef 1st Sep18Dokumen5 halamanCa GSFC Wef 1st Sep18SandeepBelum ada peringkat

- CA Start Up GSFC Wef 01st September 2023Dokumen5 halamanCA Start Up GSFC Wef 01st September 2023Ankit VishwakarmaBelum ada peringkat

- GSFC Revision For Current Account Elegance 1 July 2019Dokumen1 halamanGSFC Revision For Current Account Elegance 1 July 2019Kim Jong YungBelum ada peringkat

- JIFI Charges PDFDokumen2 halamanJIFI Charges PDFRamesh SinghBelum ada peringkat

- GSFC MpowerDokumen2 halamanGSFC Mpowerneerajsibgh434Belum ada peringkat

- Service Charges and Fees For Current Account Advantage Effective July 01 2022Dokumen2 halamanService Charges and Fees For Current Account Advantage Effective July 01 2022rupak.album.03Belum ada peringkat

- CABCA_SOC_July 22 (1) (1)Dokumen2 halamanCABCA_SOC_July 22 (1) (1)anjumBelum ada peringkat

- Current account schedule of charges comparisonDokumen3 halamanCurrent account schedule of charges comparisonfatrag amloBelum ada peringkat

- Gib Savings Account Wef 01may2022Dokumen3 halamanGib Savings Account Wef 01may2022Ankur VermaBelum ada peringkat

- CURRENT ACCOUNT SCHARGESDokumen3 halamanCURRENT ACCOUNT SCHARGESm.khurana093425Belum ada peringkat

- Burgundy Fees and Charges 14 08Dokumen8 halamanBurgundy Fees and Charges 14 08ShipaBelum ada peringkat

- Current Account Schedule of ChargesDokumen3 halamanCurrent Account Schedule of ChargesRkBelum ada peringkat

- Burgundy Fees and Charges 01042023Dokumen7 halamanBurgundy Fees and Charges 01042023Nagaraj VukkadapuBelum ada peringkat

- GSFC Kotak811 Apr17Dokumen1 halamanGSFC Kotak811 Apr17karthip08Belum ada peringkat

- Regular Savings SOC 2023Dokumen2 halamanRegular Savings SOC 2023megha90909Belum ada peringkat

- Axis Bank - Transaction Banking Schedule of Charges - Current Accounts (Value Based Schemes) (W.E.F. April 1, 2018)Dokumen2 halamanAxis Bank - Transaction Banking Schedule of Charges - Current Accounts (Value Based Schemes) (W.E.F. April 1, 2018)venkatesh19701100% (1)

- Burgundy Fees and Charges As On 2019 09Dokumen7 halamanBurgundy Fees and Charges As On 2019 09Shivanshu SinghBelum ada peringkat

- Chartered Accountant 2 0Dokumen3 halamanChartered Accountant 2 0RkBelum ada peringkat

- Schedule of Benefits & Charges Abacus Digital Savings AccountDokumen3 halamanSchedule of Benefits & Charges Abacus Digital Savings AccountDeepak ThakurBelum ada peringkat

- 811 - Kotak Mahindra BankDokumen5 halaman811 - Kotak Mahindra BankVivek EadaraBelum ada peringkat

- Digital Savings Account Effective July 2021Dokumen3 halamanDigital Savings Account Effective July 2021Nikhil KumarBelum ada peringkat

- Service Charges and Fees of Current Account For Arthiyas 21102020Dokumen2 halamanService Charges and Fees of Current Account For Arthiyas 21102020joyfulsenthilBelum ada peringkat

- Sba 2 0 Ivy PDFDokumen2 halamanSba 2 0 Ivy PDFChandan SahBelum ada peringkat

- Service Charges and Fees For Current Account Club 50 Effective July 01 2022Dokumen2 halamanService Charges and Fees For Current Account Club 50 Effective July 01 2022Nitin BBelum ada peringkat

- Value Based Schedule of Charges For Current Account 01112020Dokumen2 halamanValue Based Schedule of Charges For Current Account 01112020J ABelum ada peringkat

- Wholesale Banking Products: Schedule of Charges - Current Accounts (Value Based Schemes) (W.e.f. November 01, 2021)Dokumen2 halamanWholesale Banking Products: Schedule of Charges - Current Accounts (Value Based Schemes) (W.e.f. November 01, 2021)J ABelum ada peringkat

- SOC-DCB-Classic-Current-AccountDokumen4 halamanSOC-DCB-Classic-Current-AccountpanditipabmaBelum ada peringkat

- Indus Freedom February2017Dokumen1 halamanIndus Freedom February2017HeartKiller LaxmanBelum ada peringkat

- Lesson Plan Kangaroo Mother CarDokumen1 halamanLesson Plan Kangaroo Mother CarhanishanandBelum ada peringkat

- Casil Soc 01 07 23Dokumen2 halamanCasil Soc 01 07 23rishisiliveri95Belum ada peringkat

- SCHEDULE OF CHARGES JUL-SEP 2021Dokumen2 halamanSCHEDULE OF CHARGES JUL-SEP 2021Textro VertBelum ada peringkat

- Indus Infotech December292017Dokumen1 halamanIndus Infotech December292017Harssh S ShrivastavaBelum ada peringkat

- SOC DCB Privilege Current AccountDokumen4 halamanSOC DCB Privilege Current Accountsunilverma202320Belum ada peringkat

- SOC DCB Privilege Savings AccountDokumen4 halamanSOC DCB Privilege Savings AccountBVS NAGABABUBelum ada peringkat

- Proposition Edge Business Prime Business Exclusive BusinessDokumen1 halamanProposition Edge Business Prime Business Exclusive Businesskazaalite1008Belum ada peringkat

- Schedule of Service Charges for TASC AccountsDokumen4 halamanSchedule of Service Charges for TASC AccountsSathishraam CPBelum ada peringkat

- For Customer ReferenceDokumen4 halamanFor Customer ReferenceMaheshkumar AmulaBelum ada peringkat

- DCB Benefit Savings AccountDokumen2 halamanDCB Benefit Savings AccountDesikanBelum ada peringkat

- Indus Business Account SOC 30.07.2020Dokumen1 halamanIndus Business Account SOC 30.07.2020Rameshchandra SolankiBelum ada peringkat

- Super Advantage SOCDokumen3 halamanSuper Advantage SOCdip45150Belum ada peringkat

- Schedule of Charges 01 12 2020Dokumen24 halamanSchedule of Charges 01 12 2020Marlboro RedBelum ada peringkat

- General Charges of Kotak BankDokumen2 halamanGeneral Charges of Kotak BankSarafraj BegBelum ada peringkat

- SOC DCB Premium Savings AccountDokumen4 halamanSOC DCB Premium Savings Accountmadddy7012Belum ada peringkat

- Sba 2.0Dokumen1 halamanSba 2.0Operation BluepayBelum ada peringkat

- Savings Accounts: Cash Deposit Limit at Branch - Free Value OR Instance Per MonthDokumen2 halamanSavings Accounts: Cash Deposit Limit at Branch - Free Value OR Instance Per MonthSiddhant GaurBelum ada peringkat

- Schedule of Charges For Nri Accounts PrimeDokumen4 halamanSchedule of Charges For Nri Accounts PrimeSonam SharmaBelum ada peringkat

- Wealth CA Schedule of ChargesDokumen6 halamanWealth CA Schedule of ChargesSayan Kumar PatiBelum ada peringkat

- Schedule of Benefits and Fees For DCB Privilege Savings AccountDokumen4 halamanSchedule of Benefits and Fees For DCB Privilege Savings AccountYusuf KhanBelum ada peringkat

- Comparison of Standard Chartered Bank With Citibank and HSBCDokumen5 halamanComparison of Standard Chartered Bank With Citibank and HSBCarpit_tBelum ada peringkat

- Schedule of Business Bank Account ChargesDokumen2 halamanSchedule of Business Bank Account ChargesJella RamakrishnaBelum ada peringkat

- Cir Letter 8089-1Dokumen21 halamanCir Letter 8089-1Salim MD SalimBelum ada peringkat

- SOC Next Gen Savings AccountDokumen2 halamanSOC Next Gen Savings AccountSUBHRAKANTA DASBelum ada peringkat

- Savings Accounts: Cash Deposit Limit at Branch - Free Value OR Instance Per MonthDokumen2 halamanSavings Accounts: Cash Deposit Limit at Branch - Free Value OR Instance Per MonthSiddhant GaurBelum ada peringkat

- IDFC Bank AQB/AMB account charges and features comparisonDokumen4 halamanIDFC Bank AQB/AMB account charges and features comparisongaurav_p_9Belum ada peringkat

- HSBC Retail Business Banking: Transaction TypeDokumen2 halamanHSBC Retail Business Banking: Transaction TypeDanish MohammedBelum ada peringkat

- Axis Bank Service ChargesDokumen4 halamanAxis Bank Service ChargesRanjith MeelaBelum ada peringkat

- SOC Savings AdityaDokumen2 halamanSOC Savings AdityaDenny PjBelum ada peringkat

- Basic and Classic Savings Account Effective September 2020Dokumen3 halamanBasic and Classic Savings Account Effective September 2020moviejunk97Belum ada peringkat

- Book 1Dokumen2 halamanBook 1hareesh008Belum ada peringkat

- Financial Market AnalysisDokumen21 halamanFinancial Market Analysishareesh008Belum ada peringkat

- QuestionnaireDokumen5 halamanQuestionnairehareesh008Belum ada peringkat

- Currency Currency Futures & Options at NSE 27th 27th MAY 2011Dokumen3 halamanCurrency Currency Futures & Options at NSE 27th 27th MAY 2011hareesh008Belum ada peringkat

- QuestinnnDokumen2 halamanQuestinnnhareesh008Belum ada peringkat

- QuestinnnDokumen2 halamanQuestinnnhareesh008Belum ada peringkat

- 0003007793-Student Letter of Offer - Riki IrawanDokumen21 halaman0003007793-Student Letter of Offer - Riki IrawanARGO SEJATI GROUPBelum ada peringkat

- Ebiz 03BusinessModelsDokumen25 halamanEbiz 03BusinessModelsmuhammadhanif456Belum ada peringkat

- NBFC Es2020Dokumen23 halamanNBFC Es2020Aditya GuptaBelum ada peringkat

- BudgetDokumen59 halamanBudgetKiritBelum ada peringkat

- INFRA MANAGED SERVICESDokumen6 halamanINFRA MANAGED SERVICESMuhammad Zhafran AlivaBelum ada peringkat

- Manage Cash Flow with a Two-Column Cash BookDokumen5 halamanManage Cash Flow with a Two-Column Cash BookAdika Denish0% (1)

- Juniper Cloud Fundamentals (JCF)Dokumen2 halamanJuniper Cloud Fundamentals (JCF)MateiBelum ada peringkat

- INS 21 Flash CardsDokumen34 halamanINS 21 Flash CardsSheetal Rout100% (2)

- JS Bank ReportDokumen85 halamanJS Bank Reportaamnah104100% (4)

- Pay Rates 24Dokumen3 halamanPay Rates 24Mohammad Tayyab KhanBelum ada peringkat

- Hospital TeamDokumen4 halamanHospital TeamSauciuc Corina100% (2)

- tpdv100 Trading Places International Brendan Bucks OfferDokumen2 halamantpdv100 Trading Places International Brendan Bucks Offerapi-232026023Belum ada peringkat

- 2016 NEHCC Program GuideDokumen20 halaman2016 NEHCC Program GuideTom MeyerBelum ada peringkat

- Lecture2 Connecting and Communicating OnlineDokumen42 halamanLecture2 Connecting and Communicating OnlineMei Mei100% (2)

- Brkcol 2385Dokumen88 halamanBrkcol 2385FredBelum ada peringkat

- Life Insurance ProductsDokumen6 halamanLife Insurance ProductsBharani GogulaBelum ada peringkat

- Designing Cisco Enterprise Networks v1.0 (300-420) : Exam DescriptionDokumen3 halamanDesigning Cisco Enterprise Networks v1.0 (300-420) : Exam DescriptionInkyBelum ada peringkat

- Monash Uni - Transport and Traffic Eng. Practice Class - Motorway Ramp MeteringDokumen4 halamanMonash Uni - Transport and Traffic Eng. Practice Class - Motorway Ramp MeteringDeepak Kumar JangraBelum ada peringkat

- Updated HBL-Gauri-AqsaDokumen6 halamanUpdated HBL-Gauri-AqsaAbdul Moiz YousfaniBelum ada peringkat

- IG210-1 Wire Transfer Instructions USDDokumen1 halamanIG210-1 Wire Transfer Instructions USDMope SASBelum ada peringkat

- Activities of Lic AgentsDokumen10 halamanActivities of Lic Agentssamir249Belum ada peringkat

- Entrepreneurship Wk. 7: LessonDokumen4 halamanEntrepreneurship Wk. 7: LessonJerome Benipayo78% (9)

- Quiz Questions Risk and Insurance MGTDokumen4 halamanQuiz Questions Risk and Insurance MGTShashi Kumar C GBelum ada peringkat

- Apply for IndusInd Bank Credit CardDokumen2 halamanApply for IndusInd Bank Credit CardPrashant TambeBelum ada peringkat

- Audit Chapter 14Dokumen36 halamanAudit Chapter 14Arfini LestariBelum ada peringkat

- DDDDDokumen7 halamanDDDDShrajith A NatarajanBelum ada peringkat

- Effective Small Business Management 10th Edition Scarborough Test BankDokumen31 halamanEffective Small Business Management 10th Edition Scarborough Test Bankreginagwyn0157y100% (30)

- Sample Correspondent AccountDokumen1 halamanSample Correspondent AccountheopssBelum ada peringkat

- 12th HSC Bookkeeping Project On A Report On Adjustments in Partnership Final AccountsDokumen8 halaman12th HSC Bookkeeping Project On A Report On Adjustments in Partnership Final AccountsKushal Khandelwal71% (7)

- What Is PLMN, EPLMN, HPLMN, UPLMN, OPLMN, IPLMN, EHPLMN, EPLMNDokumen5 halamanWhat Is PLMN, EPLMN, HPLMN, UPLMN, OPLMN, IPLMN, EHPLMN, EPLMNGhazwan SalihBelum ada peringkat