Capital Markets - 5/16/2008

Diunggah oleh

Russell Klusas0 penilaian0% menganggap dokumen ini bermanfaat (0 suara)

15 tayangan1 halamanMulti-family interest rates from agency lenders increased this week 10 to 20 basis points. The 10-year u.s. Treasury yield was up 8 basis points to 3. Percent from its close a week ago. Concerns about rising inflation prompted renewed speculation that interest rates may be heading up further with the Fed increasing rates later in the year.

Deskripsi Asli:

Hak Cipta

© © All Rights Reserved

Format Tersedia

PDF, TXT atau baca online dari Scribd

Bagikan dokumen Ini

Apakah menurut Anda dokumen ini bermanfaat?

Apakah konten ini tidak pantas?

Laporkan Dokumen IniMulti-family interest rates from agency lenders increased this week 10 to 20 basis points. The 10-year u.s. Treasury yield was up 8 basis points to 3. Percent from its close a week ago. Concerns about rising inflation prompted renewed speculation that interest rates may be heading up further with the Fed increasing rates later in the year.

Hak Cipta:

© All Rights Reserved

Format Tersedia

Unduh sebagai PDF, TXT atau baca online dari Scribd

0 penilaian0% menganggap dokumen ini bermanfaat (0 suara)

15 tayangan1 halamanCapital Markets - 5/16/2008

Diunggah oleh

Russell KlusasMulti-family interest rates from agency lenders increased this week 10 to 20 basis points. The 10-year u.s. Treasury yield was up 8 basis points to 3. Percent from its close a week ago. Concerns about rising inflation prompted renewed speculation that interest rates may be heading up further with the Fed increasing rates later in the year.

Hak Cipta:

© All Rights Reserved

Format Tersedia

Unduh sebagai PDF, TXT atau baca online dari Scribd

Anda di halaman 1dari 1

5-16-2008

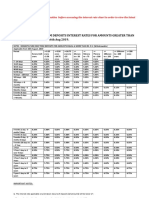

Multi-Family Loan Programs > $3 Million

Agency Lenders Portfolio Lenders*

Term Leverage Max. Interest Rates Leverage Max. Interest Rates

5 Yr. 80% 5.72% to 5.87% 75% 5.95% to 6.25%

7 Yr. 80% 5.75% to 5.90% 75% 6.40% to 6.80%

10 Yr. 80% 5.92% to 6.14% 75% 6.55% to 7.05%

15 Yr. 80% 6.36% to 6.61% 75% 6.80% to 7.30%

*Rates based on Act/360

Multi-Family Loan Programs < $3 Million

Fixed Rate Agency Lenders Portfolio Lenders*

Term Leverage Max. Interest Rates Leverage Max. Interest Rates

3 Yr. 80% 5.64% to 6.08% 75% 5.65% to 6.15%

5 Yr. 80% 5.68% to 6.06% 75% 5.95% to 6.25%

7 Yr. 80% 5.72% to 6.02% 75% 6.40% to 6.80%

10 Yr. 80% 5.89% to 6.19% 75% 6.55% to 7.05%

15 Yr. 80% 6.51% to 7.42% 75% 6.80% to 7.30%

*Rates based on Act/360

Commercial Loan Programs

Fixed Rate Portfolio Lenders* Index Rate as of 5/16/2008

Term Leverage Max. Interest Rates

5 Year Treasury: 5.87% 10-Year Treasury 3.85%

5 Yr. 75% 6.05% to 6.40% 5-Year Swap 3.89% 10-Year Swap: 4.43%

7 Yr. 75% 6.40% to 6.80% LIBOR: 2.89% Prime: 5.00%

10 Yr. 75% 6.55% to 7.05%

15 Yr. 75% 6.80% to 7.30%

Bridge

Leverage Max. Spread Over Libor

Floating

Stabilized 75% 225 to 300

Re-Position 90% 275 to 350

(*Proprietary Lenders include Banks, Life Insurance Companies and Credit Unions)

Economic Commentary

5-16-08 Multi-family interest rates from agency

lenders increased this week 10 to 20 basis points

with the larger increases for shorter term

maturities. The 10-year U.S. Treasury yield was

up 8 basis points to 3.85 percent from its close a

week ago. Swaps have changed little over the

past six weeks. Conduits are starting to emerge

with spreads typically in the 325 to 350 range

over the corresponding U.S. Treasury, indicating

a range today from 7.10 percent to 7.35 percent

for 10-year money. While the rates appear at the

high end of the market, conduits are providing

capital to secondary products in secondary

locations. Concerns about rising inflation

prompted renewed speculation that interest rates

may be heading up further with the Fed

increasing rates later in the year.

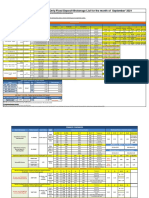

Recent Transactions

One Stop Hubbard Ridge Highly Hills National City

Retail Multi-residential Multi-residential Single Tenant

Lake Forest, CA Garland, TX Bonne Terra, MO Southfield, MI

$6,000,000 $4,200,000 $3,500,000 $3,450,000

4.374% Interest rate 5.7% Interest rate 5.95% Interest rate 5.85% Interest rate

30-yr. Amortiz./10-yr. Term 30-yr. Amortiz./5-yr. Term 30-yr. Amortiz./7-yr. Term 30-yr. Amortiz./10-yr. Term

Terms, rates and conditions subject to change. www.MMCapCorp.com

Anda mungkin juga menyukai

- The Mathematics of Financial Models: Solving Real-World Problems with Quantitative MethodsDari EverandThe Mathematics of Financial Models: Solving Real-World Problems with Quantitative MethodsBelum ada peringkat

- What The Banks Ask & Why: Everything You Need to Know before Applying for a Mortgage If You're Self-Employed or Have a Complex IncomeDari EverandWhat The Banks Ask & Why: Everything You Need to Know before Applying for a Mortgage If You're Self-Employed or Have a Complex IncomeBelum ada peringkat

- CapAlertPDF 072508Dokumen1 halamanCapAlertPDF 072508Russell KlusasBelum ada peringkat

- Multi-Family Loan Programs $3 MillionDokumen1 halamanMulti-Family Loan Programs $3 MillionRussell KlusasBelum ada peringkat

- Capital Alert - 7/12/2008Dokumen1 halamanCapital Alert - 7/12/2008Russell KlusasBelum ada peringkat

- Capital Markets - 4/18/2008Dokumen1 halamanCapital Markets - 4/18/2008Russell KlusasBelum ada peringkat

- Capital Markets - 4/25/2008Dokumen1 halamanCapital Markets - 4/25/2008Russell KlusasBelum ada peringkat

- Capital Alert - 7/3/2008Dokumen1 halamanCapital Alert - 7/3/2008Russell KlusasBelum ada peringkat

- Capital Markets - 8/15/2008Dokumen2 halamanCapital Markets - 8/15/2008Russell KlusasBelum ada peringkat

- Capital Markets - 6/30/2008Dokumen1 halamanCapital Markets - 6/30/2008Russell KlusasBelum ada peringkat

- Capital Alert - 8/29/2008Dokumen1 halamanCapital Alert - 8/29/2008Russell KlusasBelum ada peringkat

- Capital Alert 6/13/2008Dokumen1 halamanCapital Alert 6/13/2008Russell KlusasBelum ada peringkat

- Capital Alert - 5/30/2008Dokumen1 halamanCapital Alert - 5/30/2008Russell KlusasBelum ada peringkat

- Capital Alert - 6/20/2008Dokumen1 halamanCapital Alert - 6/20/2008Russell KlusasBelum ada peringkat

- Capital Alert - 8/22/2008Dokumen1 halamanCapital Alert - 8/22/2008Russell KlusasBelum ada peringkat

- Capital Alert - 2/1/2008Dokumen1 halamanCapital Alert - 2/1/2008Russell KlusasBelum ada peringkat

- Website Disclosure Effective 05 Apr 2024Dokumen4 halamanWebsite Disclosure Effective 05 Apr 2024Ab CdBelum ada peringkat

- Interest Rates For Fixed DepositsDokumen2 halamanInterest Rates For Fixed Depositssasi 'sBelum ada peringkat

- Interest Rates For Fixed DepositsDokumen2 halamanInterest Rates For Fixed Depositssaurav katarukaBelum ada peringkat

- Capital Markets - 3/14/2008Dokumen2 halamanCapital Markets - 3/14/2008Russell KlusasBelum ada peringkat

- Website Disclosure Effective 02nd May 2023Dokumen3 halamanWebsite Disclosure Effective 02nd May 2023Prathamesh PatikBelum ada peringkat

- Website Disclosure EffectiveDokumen3 halamanWebsite Disclosure EffectiveHimanshu MilanBelum ada peringkat

- Tel No: 022-4215 9068Dokumen3 halamanTel No: 022-4215 9068mamatha niranjanBelum ada peringkat

- Administrative Office: ' Mahaveer ', Shree Shahu Market Yard, Kolhapur - 416 008Dokumen3 halamanAdministrative Office: ' Mahaveer ', Shree Shahu Market Yard, Kolhapur - 416 008gmatweakBelum ada peringkat

- Term Deposit Rate Sheet: ShajarDokumen1 halamanTerm Deposit Rate Sheet: ShajarchqaiserBelum ada peringkat

- Capital Markets - 3/07/2008Dokumen1 halamanCapital Markets - 3/07/2008Russell KlusasBelum ada peringkat

- Website Disclosure Effective 03 Feb 2024Dokumen3 halamanWebsite Disclosure Effective 03 Feb 2024abhishek sharmaBelum ada peringkat

- Capital Markets - 2/29/2008Dokumen1 halamanCapital Markets - 2/29/2008Russell KlusasBelum ada peringkat

- Interest Rates On FDR: Monthly Benefit PlanDokumen2 halamanInterest Rates On FDR: Monthly Benefit Planmushfik arafatBelum ada peringkat

- Interest Rates For Fixed DepositsDokumen2 halamanInterest Rates For Fixed DepositsV NaveenBelum ada peringkat

- Cho RM 73 2020-21Dokumen1 halamanCho RM 73 2020-21Steve WozniakBelum ada peringkat

- Website Disclosure Effective 30 Nov 2023Dokumen3 halamanWebsite Disclosure Effective 30 Nov 2023bggbggBelum ada peringkat

- Interest Rates For Fixed DepositsDokumen2 halamanInterest Rates For Fixed DepositsY_AZBelum ada peringkat

- HDFC RatesDokumen4 halamanHDFC RatesdesikanttBelum ada peringkat

- Capital Markets - 4/11/2008Dokumen1 halamanCapital Markets - 4/11/2008Russell KlusasBelum ada peringkat

- Interest Rates On Domestic Recurring Deposit: WWW - Utkarsh.bankDokumen1 halamanInterest Rates On Domestic Recurring Deposit: WWW - Utkarsh.bankSusovan DasBelum ada peringkat

- HDFC Deposit FormDokumen4 halamanHDFC Deposit FormnaguficoBelum ada peringkat

- Yield CurveDokumen3 halamanYield CurveRochelle Anne OpinaldoBelum ada peringkat

- Bank A: Housing Loan Property Equity LoanDokumen6 halamanBank A: Housing Loan Property Equity LoanRaesa BadelBelum ada peringkat

- Rates of Return On PLSDeposits OtherDepositsDokumen2 halamanRates of Return On PLSDeposits OtherDepositsranamkhan553Belum ada peringkat

- Interest Rates On Deposits Above Rs 2 Crs Wef 09082023Dokumen5 halamanInterest Rates On Deposits Above Rs 2 Crs Wef 09082023Mohammed Eidrees RazaBelum ada peringkat

- Effective Annualized Rate of Return - Resident-NRO TD 1-09-2023Dokumen1 halamanEffective Annualized Rate of Return - Resident-NRO TD 1-09-2023Arun sharmaBelum ada peringkat

- Yes Bank FD Rates - 5.6.21Dokumen1 halamanYes Bank FD Rates - 5.6.21Chandan SahaBelum ada peringkat

- Rights of BusinessDokumen2 halamanRights of BusinessHimanshu MilanBelum ada peringkat

- Interest Rates For Fixed DepositsDokumen2 halamanInterest Rates For Fixed DepositsRaghav sharmaBelum ada peringkat

- Interest Rate RetailDokumen6 halamanInterest Rate RetailRavie S DhamaBelum ada peringkat

- Screenshot 2023-07-02 at 11.14.42 PMDokumen6 halamanScreenshot 2023-07-02 at 11.14.42 PMUttam JaiswalBelum ada peringkat

- Week 2 Practice Questions SolutionDokumen8 halamanWeek 2 Practice Questions SolutionCaroline FrisciliaBelum ada peringkat

- Interest Rates For Fixed DepositsDokumen2 halamanInterest Rates For Fixed DepositsD SunilBelum ada peringkat

- FD Leaflet - A5 - 13 Dec 23Dokumen2 halamanFD Leaflet - A5 - 13 Dec 23Shaily SinhaBelum ada peringkat

- IIFL Associate FD List September'2021Dokumen4 halamanIIFL Associate FD List September'2021BHARAT SBelum ada peringkat

- RevisionInterestRates CircularDokumen4 halamanRevisionInterestRates CircularNishantBelum ada peringkat

- BankingDokumen4 halamanBankingBhavin GhoniyaBelum ada peringkat

- RevisionInterestRates CircularDokumen5 halamanRevisionInterestRates CircularPrashantGuptaBelum ada peringkat

- Bank A: Housing Loan Property Equity LoanDokumen5 halamanBank A: Housing Loan Property Equity LoanRaesa BadelBelum ada peringkat

- Interest Rate Idfc BankDokumen4 halamanInterest Rate Idfc BankDesikanBelum ada peringkat

- Fixed Term Deposits Schemes-2Dokumen7 halamanFixed Term Deposits Schemes-2Akshay KumarBelum ada peringkat

- (Effective January 09, 2019) : Interest Rates On Deposits - Domestic, NRE, NRO - Rs. 1 Crore To 25 CroreDokumen1 halaman(Effective January 09, 2019) : Interest Rates On Deposits - Domestic, NRE, NRO - Rs. 1 Crore To 25 Crorekidwhokids sBelum ada peringkat

- Interest RatesDokumen5 halamanInterest Ratesagupta_16Belum ada peringkat

- Loan RatesDokumen1 halamanLoan RatesAndrew ChambersBelum ada peringkat

- Capital Markets - 8/15/2008Dokumen2 halamanCapital Markets - 8/15/2008Russell KlusasBelum ada peringkat

- Capital Alert - 8/22/2008Dokumen1 halamanCapital Alert - 8/22/2008Russell KlusasBelum ada peringkat

- Capital Alert - 8/29/2008Dokumen1 halamanCapital Alert - 8/29/2008Russell KlusasBelum ada peringkat

- Milwaukee - Office - 8/7/08Dokumen4 halamanMilwaukee - Office - 8/7/08Russell KlusasBelum ada peringkat

- Chicago - Southwest Submarket - Retail - 1/1/2008Dokumen2 halamanChicago - Southwest Submarket - Retail - 1/1/2008Russell KlusasBelum ada peringkat

- Milwaukee - Retail Construction - 4/1/2008Dokumen3 halamanMilwaukee - Retail Construction - 4/1/2008Russell Klusas100% (1)

- DesMoines Submarket - Retail - 10/1/2007Dokumen2 halamanDesMoines Submarket - Retail - 10/1/2007Russell KlusasBelum ada peringkat

- Chicago - Industrial - 1/1/2008Dokumen1 halamanChicago - Industrial - 1/1/2008Russell KlusasBelum ada peringkat

- Chicago - South Submarket - Retail - 7/1/2007Dokumen2 halamanChicago - South Submarket - Retail - 7/1/2007Russell KlusasBelum ada peringkat

- Milwaukee - Retail - 4/1/2008Dokumen4 halamanMilwaukee - Retail - 4/1/2008Russell KlusasBelum ada peringkat

- Evansville - Apartment - 1/1/2008Dokumen2 halamanEvansville - Apartment - 1/1/2008Russell KlusasBelum ada peringkat

- Chicago - Near West Submarket - Retail - 7/1/2007Dokumen2 halamanChicago - Near West Submarket - Retail - 7/1/2007Russell KlusasBelum ada peringkat

- Milwaukee - South Milwaukee County Submarket - Retail - 10/1/2007Dokumen2 halamanMilwaukee - South Milwaukee County Submarket - Retail - 10/1/2007Russell KlusasBelum ada peringkat

- Indianapolis - Retail - 4/1/2008Dokumen4 halamanIndianapolis - Retail - 4/1/2008Russell Klusas100% (1)

- Chicago - Retail - 4/1/2008Dokumen4 halamanChicago - Retail - 4/1/2008Russell KlusasBelum ada peringkat

- Indianapolis - Apartment - Construction - 4/1/2008Dokumen3 halamanIndianapolis - Apartment - Construction - 4/1/2008Russell Klusas100% (1)

- Perspectives in Modelling of PricingDokumen52 halamanPerspectives in Modelling of Pricingnil_parkarBelum ada peringkat

- FX Swap BasisDokumen6 halamanFX Swap BasisMo LiBelum ada peringkat

- This Study Resource WasDokumen9 halamanThis Study Resource WasVishalBelum ada peringkat

- Hull OFOD10e MultipleChoice Questions and Answers Ch07Dokumen7 halamanHull OFOD10e MultipleChoice Questions and Answers Ch07Kevin Molly KamrathBelum ada peringkat

- Original Complaint in Annie Bell Adams, Et Al. vs. Bank of America, Et Al, 12 Civ. 7461Dokumen51 halamanOriginal Complaint in Annie Bell Adams, Et Al. vs. Bank of America, Et Al, 12 Civ. 7461John Walter Sharbrough, IIIBelum ada peringkat

- Afg RRPDokumen44 halamanAfg RRPmahmood_shoukat7657Belum ada peringkat

- November 2021 Professional Examination Financial Management (Paper 2.4) Chief Examiner'S Report, Questions & Marking SchemeDokumen19 halamanNovember 2021 Professional Examination Financial Management (Paper 2.4) Chief Examiner'S Report, Questions & Marking SchemeAsaamah John AsumyusiaBelum ada peringkat

- International Financial Management Canadian Perspectives 2Nd Edition Eun Test Bank Full Chapter PDFDokumen33 halamanInternational Financial Management Canadian Perspectives 2Nd Edition Eun Test Bank Full Chapter PDFPatriciaSimonrdio100% (10)

- The 25 Biggest Corporate Scandals of All TimeDokumen4 halamanThe 25 Biggest Corporate Scandals of All TimeFab FiveBelum ada peringkat

- 1Dokumen6 halaman1sufyanbutt0070% (1)

- 17 F F6 Vietnam Tax FCT Answers For Multiple Choice Questions 2015 Exam enDokumen15 halaman17 F F6 Vietnam Tax FCT Answers For Multiple Choice Questions 2015 Exam endomBelum ada peringkat

- Cme Otc-IrsDokumen17 halamanCme Otc-IrsjohndwilsonBelum ada peringkat

- Bank Fund Assignment 2Dokumen19 halamanBank Fund Assignment 2Habiba EshaBelum ada peringkat

- Risk Management: An Introduction To Financial Engineering: Mcgraw-Hill/IrwinDokumen29 halamanRisk Management: An Introduction To Financial Engineering: Mcgraw-Hill/IrwinSeptian AbdiansyahBelum ada peringkat

- A User's Guide To SOFR: The Alternative Reference Rates Committee April 2019Dokumen21 halamanA User's Guide To SOFR: The Alternative Reference Rates Committee April 2019rmf89Belum ada peringkat

- CS SOFR Transition Guide Q3 2019Dokumen25 halamanCS SOFR Transition Guide Q3 2019sajivshrivBelum ada peringkat

- Econometrie VarianteDokumen311 halamanEconometrie VarianteDaniela FrumusachiBelum ada peringkat

- Inverse Floater Valuation ParametersDokumen20 halamanInverse Floater Valuation ParametersNishant KumarBelum ada peringkat

- Lecture Note 06 - Forward and Futures On BondsDokumen55 halamanLecture Note 06 - Forward and Futures On Bondsben tenBelum ada peringkat

- Foreign Exchange ManagementDokumen152 halamanForeign Exchange Managementhimanshugupta6Belum ada peringkat

- Sallie Mae TCPA Arbitration Affidavit Carl O CannonDokumen26 halamanSallie Mae TCPA Arbitration Affidavit Carl O CannonghostgripBelum ada peringkat

- End Term ACF 2021 Set 2Dokumen2 halamanEnd Term ACF 2021 Set 2pranita mundraBelum ada peringkat

- 025 PamDokumen139 halaman025 PamNam Do HoangBelum ada peringkat

- Quiz Chap 14Dokumen6 halamanQuiz Chap 14Lan Hương VũBelum ada peringkat

- PA 131 Chapter 3Dokumen17 halamanPA 131 Chapter 3Joey MalongBelum ada peringkat

- Chap 014Dokumen15 halamanChap 014Jitendra PatelBelum ada peringkat

- Goldman Funds SicavDokumen658 halamanGoldman Funds SicavThanh NguyenBelum ada peringkat

- Final Report On Axis BankDokumen77 halamanFinal Report On Axis BankManjeet Choudhary100% (1)

- Swap Market ExercisesDokumen37 halamanSwap Market ExercisesVan Anh LeBelum ada peringkat

- Ey Iif Global Risk Survey V FinalDokumen52 halamanEy Iif Global Risk Survey V Finalbildyosta sapparBelum ada peringkat