April-07 Q 3

Diunggah oleh

Sarika ThoratDeskripsi Asli:

Judul Asli

Hak Cipta

Format Tersedia

Bagikan dokumen Ini

Apakah menurut Anda dokumen ini bermanfaat?

Apakah konten ini tidak pantas?

Laporkan Dokumen IniHak Cipta:

Format Tersedia

April-07 Q 3

Diunggah oleh

Sarika ThoratHak Cipta:

Format Tersedia

Q.3 ( C ) Explain “statutory” & “non statutory audit”.

Ans : STATUTORY AUDIT -

When audit is compulsory for an enterprise by law it is called as “Statutory

Audit”. Such audit is carried out by a third party or person who is duly

competent for this purpose. Hence, it is also called as External Audit. Only a

person who possess the prescribed qualifications and who is wholly

independent of the client is deemed to be competent. Statutory audit is of

great value to the person associated with the enterprise. In case of a joint

stock company, it is impossible for shareholders to verify the representations

made by the management in the financial statements i.e. in case of statutory

audit the external auditor is responsible and he has to report to the

shareholders. They can only depend on the auditor for his expert opinion.

Statutory audit is conducted by a competent person and hence it is also

beneficial for the creditors, bankers, government departments and investors.

In case of public sector a compulsory audit is necessary to safeguard the

interests of the public against frauds and scams. The object of Statutory

Audit, as laid down in the statute, is to examine the books of accounts and

report whether or not the financial statements show a ‘true and fair view’ if

the state of the company at the end of the financial year ended on that date.

NON STATUTORY AUDIT -

When audit is compulsory for an enterprise by law it is called as “Non -

Statutory Audit”. It is also called as Internal Audit. No specific qualification is

prescribed as such to carry out the non statutory audit or internal audit. It is

carried out by the employees of the company. Non - Statutory Audit provide

consulting service for improving the effectiveness of risk management,

control and governance process. Therefore Non -Statutory Audit as a

consultancy service, is expected to provide inputs to the formulation and

implementation of strategies. As an assurance service it conduct strategy

audit and review management decisions. In case of the Non - Statutory Audit

the internal auditor is responsible and he has to report to the management.

The techniques and methods of auditing are the same as in external

auditing. But the main aim of conducting Non - Statutory Audit is to just

ensure that there is proper compliance with policies, rules and regulations

and procedures of the enterprise such as good business practices, GAAP,

laws of the land and government regulations.

OR

Q.3 (D) What are the special liability has been imposed by the Companies

Act,1956 on the company auditor.

Ans : Under the Companies Act,1956 an auditor may be subjected to Civil &

Criminal liabilities. Civil Liabilities in the Companies Act :

The civil liability arises when it is proved that the company has suffered

losses as a result of the failure of the auditor to conduct his audit with due

care and skill.

I. Misfeasance ( Section 543) – It is simple procedure under the act for

bringing an action against persons associated with promoter or

management of a company under winding up. An auditor is covered

within the scope of the liability as an officer of the company, pursuant to

the definition of officer given in Section 2(3) of the Act. The charge of

misfeasance which simply means breach of trust or negligence in the

performance of duties can be framed against the auditor, if it appears

that he has misapplied, or retained or become liable or accountable for,

any money or property of the company, or has been guilty of any

misfeasance or breach of trust in relation to the company.

II. Violation of the requirements of Section 227 and 229 – Under

Section 223 of the act and auditor is liable to penalty of Rs.1000 for willful

default in complying with the requirements of Sections 227 and 229 of the

companies act in regard to making of the auditors report or signing or

authentication of any document of the company.

III. Misstatement in Prospectus – The auditor is liable to such person who

may have prescribed to the shares or debentures of the company on the

faith of his report incorporated in the prospectus issued by a company

and have suffered loss due to existence of untrue statement in the report.

Criminal Liabilities in the Companies Act :

I. Fraud and Deception – Section 539 of the act prescribes severe

criminal penalties in fraudulent falsification of books is carried out by the

auditor. An auditor may be held liable if he has destroyed, mutilated,

altered, falsified, secreted any books, acts or fraudulent entry in any

register, books or account or document belonging to the company.

II. Offence in relation to the company – An auditor as an officer, is liable

to be prosecuted under Section 545 of the Act if he as a past pr present

auditor, has been guilty of offence in relation to the company.

III. False Statement , etc. – Section 638 of the Act, the auditor is liable to

criminal prosecution if he, in any return, certificate, balance sheet,

prospectus, statement or other document makes a statement which is

false in any material particular, knowing it to be material, is punishable

with imprisonment for a term which may extend to two years and also

with a fine.

Anda mungkin juga menyukai

- How I LAWFULLY Claimed 4 Houses Free and Clear RevisedDokumen63 halamanHow I LAWFULLY Claimed 4 Houses Free and Clear RevisedmaryBelum ada peringkat

- ACP Vs CPG Vs CSPDokumen4 halamanACP Vs CPG Vs CSPMatthew Henry Regalado100% (1)

- Cathay Pacific Airways v. VasquezDokumen3 halamanCathay Pacific Airways v. VasquezAmber Anca100% (1)

- Written Arguments Filed in Case of Religious and Charitable Inam LandDokumen54 halamanWritten Arguments Filed in Case of Religious and Charitable Inam LandSridhara babu. N - ಶ್ರೀಧರ ಬಾಬು. ಎನ್Belum ada peringkat

- Direct and Indirect TaxesDokumen17 halamanDirect and Indirect Taxeskchehria100% (6)

- Testate Estate of Amos G. BellisDokumen5 halamanTestate Estate of Amos G. BellisSee GeeBelum ada peringkat

- Torts Exam NotesDokumen130 halamanTorts Exam NotesobaahemaegcoBelum ada peringkat

- Meaning of Misstatement of ProspectusDokumen15 halamanMeaning of Misstatement of ProspectusShobha MohandasBelum ada peringkat

- Salonga vs. Warner Barnes and Co.Dokumen4 halamanSalonga vs. Warner Barnes and Co.Teoti Navarro ReyesBelum ada peringkat

- 1040 Exam Prep Module XI: Circular 230 and AMTDari Everand1040 Exam Prep Module XI: Circular 230 and AMTPenilaian: 1 dari 5 bintang1/5 (1)

- Pantranco V NLRCDokumen2 halamanPantranco V NLRCasdgafsdgadfg0% (1)

- Consensual vs Real ContractsDokumen59 halamanConsensual vs Real ContractstagteamBelum ada peringkat

- Auditors LiabilityDokumen2 halamanAuditors Liabilitycessd3Belum ada peringkat

- Sales-Oesmer Vs Paraiso - Heirs of BionaDokumen4 halamanSales-Oesmer Vs Paraiso - Heirs of BionaMariaAyraCelinaBatacanBelum ada peringkat

- Liabilities of AuditorDokumen39 halamanLiabilities of AuditorMenuka SiwaBelum ada peringkat

- Chapter 08 Auditor's Legal LiabilityDokumen20 halamanChapter 08 Auditor's Legal LiabilityRichard de LeonBelum ada peringkat

- Essential Features of the Torrens Land Registration SystemDokumen39 halamanEssential Features of the Torrens Land Registration SystemNathan NakibingeBelum ada peringkat

- 10 - Liabilities of The AuditorDokumen8 halaman10 - Liabilities of The AuditorRavi RothiBelum ada peringkat

- University of Jahangir Nagar Institute of Business AdministrationDokumen6 halamanUniversity of Jahangir Nagar Institute of Business Administrationtabassum tasnim SinthyBelum ada peringkat

- A 6.4 Audit Unit 4Dokumen11 halamanA 6.4 Audit Unit 4Gaurav MahajanBelum ada peringkat

- Liabilities of An Auditor For Negligence and MisfeasanceDokumen3 halamanLiabilities of An Auditor For Negligence and Misfeasancejamila fatima100% (2)

- Liabilities of Company AuditorDokumen12 halamanLiabilities of Company AuditorMalavika V Kumar100% (3)

- Audit Part 2 29Dokumen5 halamanAudit Part 2 29Anshul RathiBelum ada peringkat

- 3 Advance AuditDokumen4 halaman3 Advance AuditKRISHNA Dev shuklaBelum ada peringkat

- Corporate Project 1234Dokumen16 halamanCorporate Project 1234Qadir JavedBelum ada peringkat

- Auditor's Powers, Duties and Liabilities under Companies Act 2013Dokumen7 halamanAuditor's Powers, Duties and Liabilities under Companies Act 2013Laalithya GowdaBelum ada peringkat

- 6 - Audit of Limited CompaniesDokumen16 halaman6 - Audit of Limited CompaniesBhagaban DasBelum ada peringkat

- Complete Guide About Auditor Appointment PDFDokumen6 halamanComplete Guide About Auditor Appointment PDFshreya charmiBelum ada peringkat

- Auditing ChapterDokumen9 halamanAuditing ChapterWania HaqBelum ada peringkat

- Role of AuditorDokumen5 halamanRole of AuditorHusnainShahid100% (1)

- Liabilities of An AuditorDokumen17 halamanLiabilities of An AuditorSangeetha RadhakrishnanBelum ada peringkat

- Role of AuditorDokumen6 halamanRole of AuditorSwastik GroverBelum ada peringkat

- Chapter 7 Audit & AssuranceDokumen30 halamanChapter 7 Audit & AssuranceKhairul Fahmi0% (2)

- Role of Auditor With-In A Company: AuditDokumen6 halamanRole of Auditor With-In A Company: AuditUniq ManjuBelum ada peringkat

- Role of auditors in light of Satyam scamDokumen11 halamanRole of auditors in light of Satyam scamshankar_iyer83Belum ada peringkat

- Who Is An Auditor?: 1. Provide An Audit ReportDokumen4 halamanWho Is An Auditor?: 1. Provide An Audit ReportTalmeez Fatima Talmeez FatimaBelum ada peringkat

- Auditor Liability and Litigation RisksDokumen6 halamanAuditor Liability and Litigation RisksHilda MuchunkuBelum ada peringkat

- Piercing corporate veil under statutory provisionsDokumen5 halamanPiercing corporate veil under statutory provisionsShubhanjaliBelum ada peringkat

- Audit Theory Isa 250 QuicknotesDokumen1 halamanAudit Theory Isa 250 Quicknotesmarckfelipe8Belum ada peringkat

- Liability of Auditors To Third Party in IndiaDokumen4 halamanLiability of Auditors To Third Party in IndiaVinamra AgrawalBelum ada peringkat

- Civil Liabilities of An AuditorDokumen5 halamanCivil Liabilities of An AuditorSyed Sulman SheraziBelum ada peringkat

- Auditor's Legal LiabilityDokumen6 halamanAuditor's Legal LiabilityMarconni B. AndresBelum ada peringkat

- AUDITING UNIT-3Dokumen11 halamanAUDITING UNIT-3swethaswetty06Belum ada peringkat

- 20034ipcc Paper6 Vol3 cp7 PDFDokumen42 halaman20034ipcc Paper6 Vol3 cp7 PDFDhananjaySinghRajpootBelum ada peringkat

- Illegal Acts: I. Illegal Acts by Clients A. Illegal Acts DefinedDokumen3 halamanIllegal Acts: I. Illegal Acts by Clients A. Illegal Acts Definedwaiting4yBelum ada peringkat

- 4 JawapanDokumen5 halaman4 JawapanNad Adenan100% (1)

- Principles of Auditing IDokumen23 halamanPrinciples of Auditing IJude OkoliBelum ada peringkat

- CL Kaush PrintDokumen9 halamanCL Kaush PrintWork 2018Belum ada peringkat

- Jahanavi-Deo.-Guest-Teacher-Comm.-LIABILITIES-OF-AN-AUDITORDokumen11 halamanJahanavi-Deo.-Guest-Teacher-Comm.-LIABILITIES-OF-AN-AUDITORdevs2devilsBelum ada peringkat

- BE Module 5Dokumen5 halamanBE Module 5Thanmayi VanteruBelum ada peringkat

- Unit 14 - Liabilities of Auditor PDFDokumen14 halamanUnit 14 - Liabilities of Auditor PDFShivam AroraBelum ada peringkat

- Faculty of Law: Jamia Millia IslamiaDokumen20 halamanFaculty of Law: Jamia Millia IslamiaShimran ZamanBelum ada peringkat

- Regulation of The AuditorDokumen20 halamanRegulation of The AuditorPhebieon MukwenhaBelum ada peringkat

- Discuss The Qualifications and Disqualifications of Auditor of The CompanyDokumen9 halamanDiscuss The Qualifications and Disqualifications of Auditor of The CompanyDebabrata DasBelum ada peringkat

- Liabilities of An AuditorDokumen4 halamanLiabilities of An AuditorAbhimanyu SethBelum ada peringkat

- Role of Auditors - Price Water House in Light of Satyam ScamDokumen19 halamanRole of Auditors - Price Water House in Light of Satyam ScamSneha Sachdev0% (1)

- AuditingDokumen17 halamanAuditingkhadeejaahmed0402Belum ada peringkat

- 75358cajournal August2023 9Dokumen3 halaman75358cajournal August2023 9S M SHEKARBelum ada peringkat

- Appointment and Position of Auditors: Corporate Law-IiDokumen12 halamanAppointment and Position of Auditors: Corporate Law-Iivinay sharmaBelum ada peringkat

- company law assignmentDokumen9 halamancompany law assignmentrohanjaiswal290301Belum ada peringkat

- Liabilty of AuditorDokumen6 halamanLiabilty of AuditorKetan BhoirBelum ada peringkat

- Auditors and Companies ActDokumen8 halamanAuditors and Companies ActTHATOBelum ada peringkat

- Internal Audit Statutory Audit 1) AppointmentDokumen3 halamanInternal Audit Statutory Audit 1) AppointmentSamiksha AngreBelum ada peringkat

- Guide to Overseeing State ContractsDokumen14 halamanGuide to Overseeing State ContractsCARLOS ORDOÑEZBelum ada peringkat

- S I A (SIA) 8 T I A E: Tandard On Nternal Udit Erms of Nternal Udit NgagementDokumen6 halamanS I A (SIA) 8 T I A E: Tandard On Nternal Udit Erms of Nternal Udit NgagementDivine Epie Ngol'esuehBelum ada peringkat

- AuditorsDokumen11 halamanAuditorsVasundhara GuptaBelum ada peringkat

- 11 Auditor's Legal LiabilityDokumen28 halaman11 Auditor's Legal LiabilityKristine MontenegroBelum ada peringkat

- Corporate Tax RulesDokumen8 halamanCorporate Tax RulesSarika ThoratBelum ada peringkat

- Corporate Tax RulesDokumen8 halamanCorporate Tax RulesSarika ThoratBelum ada peringkat

- Strategic ManagementDokumen5 halamanStrategic ManagementSarika ThoratBelum ada peringkat

- 11 Chapter5 PDFDokumen30 halaman11 Chapter5 PDFBirat SharmaBelum ada peringkat

- Working Capital and Analysis of Financial ManagementDokumen103 halamanWorking Capital and Analysis of Financial Managementjkgunjal100% (3)

- EDUnits 1 To 3Dokumen16 halamanEDUnits 1 To 3Sarika ThoratBelum ada peringkat

- Management Training & DevelopmentDokumen9 halamanManagement Training & DevelopmentSarika ThoratBelum ada peringkat

- Fundamental AnalysisDokumen12 halamanFundamental AnalysisSarika ThoratBelum ada peringkat

- Central Sales TaxDokumen22 halamanCentral Sales TaxSarika ThoratBelum ada peringkat

- National News MagazineDokumen1 halamanNational News MagazineSarika ThoratBelum ada peringkat

- Value Added TaxDokumen6 halamanValue Added TaxSarika ThoratBelum ada peringkat

- SSRN Id1996670Dokumen17 halamanSSRN Id1996670Sarika ThoratBelum ada peringkat

- MBA Assignment Topics Dec 2013Dokumen13 halamanMBA Assignment Topics Dec 2013Sarika ThoratBelum ada peringkat

- Accounting QualityDokumen11 halamanAccounting QualitySarika ThoratBelum ada peringkat

- 5 Desg 05-2 Stocks DDMDokumen19 halaman5 Desg 05-2 Stocks DDMSarika ThoratBelum ada peringkat

- MBA Assignment Topics Dec 2013Dokumen13 halamanMBA Assignment Topics Dec 2013Sarika ThoratBelum ada peringkat

- Introduction To Security Valuation: A SummaryDokumen28 halamanIntroduction To Security Valuation: A SummarySarika ThoratBelum ada peringkat

- FSDokumen5 halamanFSSarika ThoratBelum ada peringkat

- 55 Valuation of SecuritiesDokumen24 halaman55 Valuation of SecuritiesSarika ThoratBelum ada peringkat

- IndexDokumen1 halamanIndexSarika ThoratBelum ada peringkat

- Capacity PlannigDokumen13 halamanCapacity Plannigvijayalakshmis76Belum ada peringkat

- MBA, M.SC., Software Technology, M.SC Network, MLISc.Dokumen2 halamanMBA, M.SC., Software Technology, M.SC Network, MLISc.Giri KanyakumariBelum ada peringkat

- WWW - Psnacet.edu - in Courses MBA Financial Services 10g2wygDokumen6 halamanWWW - Psnacet.edu - in Courses MBA Financial Services 10g2wygVeena SoniBelum ada peringkat

- Article-Takeover Code 1997Dokumen12 halamanArticle-Takeover Code 1997Sunny SharmaBelum ada peringkat

- Role of Strategic LeadershipDokumen18 halamanRole of Strategic Leadershipaddicted2knowledgeBelum ada peringkat

- 483 Primer V3Dokumen27 halaman483 Primer V3Naureen AhmedBelum ada peringkat

- Fundamental AnalysisDokumen12 halamanFundamental AnalysisSarika ThoratBelum ada peringkat

- A Note On Earnings Forecast Source SuperiorityDokumen14 halamanA Note On Earnings Forecast Source SuperioritySarika ThoratBelum ada peringkat

- 5 Desg 05-2 Stocks DDMDokumen19 halaman5 Desg 05-2 Stocks DDMSarika ThoratBelum ada peringkat

- Temporary Order Establishing A Receivership For Bay View Nursing and Rehabilitation CenterDokumen11 halamanTemporary Order Establishing A Receivership For Bay View Nursing and Rehabilitation CenterinforumdocsBelum ada peringkat

- Tripartite AgreementDokumen7 halamanTripartite AgreementPedro DoricoBelum ada peringkat

- Conveyance Deed: The Party of The First Part: VendorDokumen28 halamanConveyance Deed: The Party of The First Part: VendornmmmBelum ada peringkat

- Franchise Agreement Details Samjang Food IncDokumen3 halamanFranchise Agreement Details Samjang Food IncEngr RicardoBelum ada peringkat

- law chapter 10 power point teacher versionDokumen22 halamanlaw chapter 10 power point teacher versionDavidBelum ada peringkat

- Sempron, Joesil Dianne C. Midterms: Conflict of LawsDokumen7 halamanSempron, Joesil Dianne C. Midterms: Conflict of LawsJoesil Dianne SempronBelum ada peringkat

- Letter of Credit SampleDokumen4 halamanLetter of Credit SampleJasonry BolongaitaBelum ada peringkat

- CHAPTER 3, Section 2: Obligations With A PeriodDokumen16 halamanCHAPTER 3, Section 2: Obligations With A PeriodSergio ConjugalBelum ada peringkat

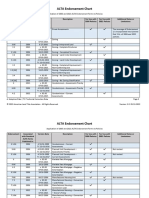

- ALTA Endorsement Chart V 02.0 05-12-2022Dokumen11 halamanALTA Endorsement Chart V 02.0 05-12-2022Robert CastilloBelum ada peringkat

- 4788 - Volume - 1 PDFDokumen331 halaman4788 - Volume - 1 PDFAnonymous ziKTLimBelum ada peringkat

- 2 Inter - Law - 100A - Que - PaperDokumen9 halaman2 Inter - Law - 100A - Que - PaperDarshita JainBelum ada peringkat

- Offences Relating to Property ExplainedDokumen5 halamanOffences Relating to Property ExplainedSurya ShreeBelum ada peringkat

- Registration of Real Property PDFDokumen7 halamanRegistration of Real Property PDFachillestenBelum ada peringkat

- Natural and Moral Obligations in Civil LawDokumen5 halamanNatural and Moral Obligations in Civil LawFloramae PasculadoBelum ada peringkat

- Business Law RND Term NotesDokumen6 halamanBusiness Law RND Term NotesGarima SambarwalBelum ada peringkat

- Q and A Recto LawDokumen2 halamanQ and A Recto LawJona ReyesBelum ada peringkat

- Essential elements of tort lawDokumen2 halamanEssential elements of tort lawAmit TiwariBelum ada peringkat

- Business LawDokumen19 halamanBusiness LawRizia Feh Eustaquio100% (2)

- Labour Law-2 Prashant Verma 2016 Ballb 98Dokumen10 halamanLabour Law-2 Prashant Verma 2016 Ballb 98Digpal MoryaBelum ada peringkat