CGS Schedule

Diunggah oleh

MariaCarlaMañago0 penilaian0% menganggap dokumen ini bermanfaat (0 suara)

50 tayangan6 halamanCost of Goods Sold schedule

Hak Cipta

© © All Rights Reserved

Format Tersedia

DOCX, PDF, TXT atau baca online dari Scribd

Bagikan dokumen Ini

Apakah menurut Anda dokumen ini bermanfaat?

Apakah konten ini tidak pantas?

Laporkan Dokumen IniCost of Goods Sold schedule

Hak Cipta:

© All Rights Reserved

Format Tersedia

Unduh sebagai DOCX, PDF, TXT atau baca online dari Scribd

0 penilaian0% menganggap dokumen ini bermanfaat (0 suara)

50 tayangan6 halamanCGS Schedule

Diunggah oleh

MariaCarlaMañagoCost of Goods Sold schedule

Hak Cipta:

© All Rights Reserved

Format Tersedia

Unduh sebagai DOCX, PDF, TXT atau baca online dari Scribd

Anda di halaman 1dari 6

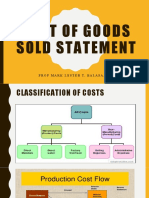

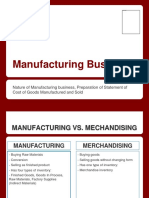

Pro-forma Income Statement Pro-forma Cost of Goods Sold Schedule

___________ Company COST OF GOODS SOLD SCHEDULE

INCOME STATEMENT

For the year ended December 31, 2017 Beginning raw materials P xxx

Net purchases

Sales P xxx Purchases P xxx

Cost of goods sold xxx Purchase returns and (xx)

Gross profit xxx allowances

Other income xxx Purchase discounts (xx)

Total income P xxx Freight-in xxx xxx

Expenses: Raw materials available for use P xxx

Distribution costs P xxx Ending raw materials (xx)

Administrative expenses xxx Raw materials used P xxx

Other expenses xxx Direct labor xxx

Finance cost xxx (xx) Factory overhead xxx

Income before tax P xxx Total manufacturing cost P xxx

Income tax expense (xx) Beginning goods in process xxx

Net income P xxx Total cost of goods sold in process P xxx

Ending goods in process (xx)

Cost of goods manufactured P xxx

Ending finished goods (xx)

Cost of goods sold P xxx

A Company COST OF GOODS SOLD SCHEDULE

INCOME STATEMENT

For the year ended December 31, 2017 Beginning raw materials P 25,000

Net purchases

Sales (53,000 units @ P75) P 3,975,000 Purchases P 1,500,000

Cost of goods sold (53,000 units 2,650,000 Purchase returns and (10,000)

@ P50) allowances

Gross profit P 1,325,000 Purchase discounts (15,000)

Other income 10,000 Freight-in 30,000 1,505,000

Total income P 1,335,000 Raw materials available for use P 1,530,000

Expenses: Ending raw materials (30,000)

Distribution costs P 250,000 Raw materials used P 1,500,000

Administrative expenses 900,000 Direct labor 1,000,000

Other expenses 5,000 Factory overhead 500,000

Finance cost 100,000 (1,255,000) Total manufacturing cost P 3,000,000

Income before tax P 80,000 Beginning goods in process 250,000

Income tax expense (24,000) Total cost of goods sold in process P 3,250,000

Net income P 56,000 Ending goods in process (300,000)

Cost of goods manufactured P 2,950,000

Ending finished goods (300,000)

Cost of goods sold P 2,650,000

Names: ____________________________________________________________________________

____________________________________________________________________________

FUNDAMENTALS OF FINANCIAL REPORTING

Income Statement

Directions: The following tables present a business’ Schedule of Cost of Goods Sold and Income Statement.

Supply the figures and/or account titles required as indicated by the underlines. Observe the proper

alignment of digits, use of Peso sign, and single or double ruling.

SCHEDULE OF COST OF GOODS SOLD

Beginning raw materials ₱15,000

Net purchases

Purchases ₱1,255,000

Purchase returns and allowances 90,000

Purchase discounts (2% of purchases) (1) ____________

Freight-in 30,000 (2) _ _ __________

Raw materials available for use (3)_______________

Ending raw materials 212,265

Raw materials used (4)_______________

Direct labor 1,200,000

Factory overhead 600,000

(5) ______________________________ (6)_______________

Beginning goods in process 150,000

Total cost of goods sold in process (7)_______________

Ending goods in process 190,000

(8) ______________________________ (9)_______________

Beginning finished goods 450,000

(10) ______________________________ (11)______________

Ending finished goods 500,000

(12) ______________________________ (13)______________

(14)____________________________________________

_______________________________________________

_______________________________________________

Sales (60,000 units @ P100) (15) _____________________

(16) _____________________________ (13)_____________________

Gross profit (17)_____________________

Other income 25,000

Total income ₱3,342,365.00

Expenses:

Distribution costs ₱500,000.00

Administrative expenses 1,100,000.00

Other expenses 10,000.00

Finance cost 180,000.00 (18)___________________

Income before tax ₱1,522,365

Income tax expense (30%) (19)___________________

(20) _____________________________ P 1,086,655.50

Name of organization: Bazinga Manufacturing Corporation

Period ended: December 31, 2017

Anda mungkin juga menyukai

- ACCY112 Tut1 WIN 2022Dokumen20 halamanACCY112 Tut1 WIN 2022Laiba RazaBelum ada peringkat

- Cost Sheet BAFDokumen16 halamanCost Sheet BAFShaji KuttyBelum ada peringkat

- Mod7 Part 2 Manufacturing OperationsDokumen24 halamanMod7 Part 2 Manufacturing Operationsmarjorie magsinoBelum ada peringkat

- Banitog, Brigitte C. BSA 211Dokumen8 halamanBanitog, Brigitte C. BSA 211MyunimintBelum ada peringkat

- Chargeable ExpensesDokumen33 halamanChargeable ExpensesMahmud MugdhoBelum ada peringkat

- Cost Accounting PDFDokumen22 halamanCost Accounting PDFLaiba Javed Javed IqbalBelum ada peringkat

- Cost Accounting TutorialDokumen49 halamanCost Accounting TutorialpreciousegualanBelum ada peringkat

- Manufacturing - Actual Costing - JBJDokumen9 halamanManufacturing - Actual Costing - JBJAlexis Jaina TinaanBelum ada peringkat

- CMA - Volume 1Dokumen181 halamanCMA - Volume 1Abdul QaviBelum ada peringkat

- Cost Lectures DR - Mohiy SamyDokumen12 halamanCost Lectures DR - Mohiy SamyEiad WaleedBelum ada peringkat

- Cost of Goods Sold StatementDokumen18 halamanCost of Goods Sold StatementCherrylane EdicaBelum ada peringkat

- Fma Assignment 3Dokumen5 halamanFma Assignment 3Abdul AhmedBelum ada peringkat

- 5.5 Manufacturing AccountsDokumen6 halaman5.5 Manufacturing AccountsZaynab ChowdhuryBelum ada peringkat

- Manufacturing Accounts 2020-2 PDFDokumen15 halamanManufacturing Accounts 2020-2 PDFAlvin K. JohnsonBelum ada peringkat

- Manufacturing OperationsDokumen14 halamanManufacturing OperationsGet BurnBelum ada peringkat

- Sample Problems With AnswerDokumen7 halamanSample Problems With AnswerCatherine OrdoBelum ada peringkat

- Sample Problems With AnswerDokumen7 halamanSample Problems With AnswerCatherine OrdoBelum ada peringkat

- Manufacturing AccountsDokumen18 halamanManufacturing AccountsJONATHAN SINKALABelum ada peringkat

- .Manufacturing Accounts 1707462151000Dokumen5 halaman.Manufacturing Accounts 1707462151000noahtarus21Belum ada peringkat

- 1.1 Exercises - Cost Accounting, Cost Concepts, Understanding and Classifying CostsDokumen8 halaman1.1 Exercises - Cost Accounting, Cost Concepts, Understanding and Classifying CostsMeg sharkBelum ada peringkat

- Illustration Questions 7Dokumen3 halamanIllustration Questions 7mohammedahalys100% (1)

- Group AssignmentDokumen7 halamanGroup Assignmentsaidkhatib368Belum ada peringkat

- Unit Costing and Cost SheetDokumen15 halamanUnit Costing and Cost SheetAyush100% (1)

- Manufacturing BusinessDokumen18 halamanManufacturing BusinessJeon JeonBelum ada peringkat

- Solution Cost SheetDokumen54 halamanSolution Cost SheetAniket Vangule0% (1)

- CMA Vol IDokumen218 halamanCMA Vol Isyed saqib AliBelum ada peringkat

- AA025 Chapter AT2Dokumen1 halamanAA025 Chapter AT2norismah isaBelum ada peringkat

- Chapter 14Dokumen22 halamanChapter 14Dan ChuaBelum ada peringkat

- Cost Accounting: Ex 2-7 Statement of Cost of Goods ManufacturedDokumen8 halamanCost Accounting: Ex 2-7 Statement of Cost of Goods Manufacturedatiq76Belum ada peringkat

- CH - 3 Cost AccountingDokumen23 halamanCH - 3 Cost AccountingKhushali OzaBelum ada peringkat

- Product CostDokumen10 halamanProduct CostApple BaldemoroBelum ada peringkat

- Business IncomeDokumen8 halamanBusiness IncomeMoon Kim100% (1)

- Batch 18 1st Preboard (P1)Dokumen14 halamanBatch 18 1st Preboard (P1)Jericho PedragosaBelum ada peringkat

- Cost Sheet HandoutDokumen7 halamanCost Sheet HandoutSidhant AirenBelum ada peringkat

- Juarez, Jenny Brozas - Activity 1 MidtermDokumen19 halamanJuarez, Jenny Brozas - Activity 1 MidtermJenny Brozas JuarezBelum ada peringkat

- The Schedule of Cost of Goods ManufacturedDokumen4 halamanThe Schedule of Cost of Goods ManufacturedPrecious CodringtonBelum ada peringkat

- Handout No. 2Dokumen4 halamanHandout No. 2Gertim CondezBelum ada peringkat

- Normal CostingDokumen3 halamanNormal Costingrose llar67% (3)

- Income StatementDokumen20 halamanIncome StatementJasmine HaliliBelum ada peringkat

- Chapter 1 ExercisesDokumen18 halamanChapter 1 ExercisesJenny Brozas JuarezBelum ada peringkat

- Pengelompokan BiayaDokumen17 halamanPengelompokan BiayaMaya BangunBelum ada peringkat

- Chapter 3 Cost Accounting CycleDokumen11 halamanChapter 3 Cost Accounting CycleSteffany RoqueBelum ada peringkat

- Homework Chapter 2 - Phuong AnhDokumen5 halamanHomework Chapter 2 - Phuong AnhNguyễn Ánh NgọcBelum ada peringkat

- Quiz Feb24Dokumen5 halamanQuiz Feb24E RDBelum ada peringkat

- A2 Accounting Revision KitDokumen135 halamanA2 Accounting Revision KitWaniya AmirBelum ada peringkat

- SWU 2018 Presentation ABM 002 Merchandising PDFDokumen33 halamanSWU 2018 Presentation ABM 002 Merchandising PDFAngel AlgabreBelum ada peringkat

- Variable & Absorption Costing LectureDokumen11 halamanVariable & Absorption Costing LectureElisha Dhowry PascualBelum ada peringkat

- Cost Acctg-Ch1&2Dokumen5 halamanCost Acctg-Ch1&2JACQUELYN PABLITOBelum ada peringkat

- Activity 1: Answer and ExplanationsDokumen23 halamanActivity 1: Answer and ExplanationsCatherine OrdoBelum ada peringkat

- Introduction To Cost AccountingDokumen5 halamanIntroduction To Cost AccountingDaniel Jackson100% (1)

- Business Finance Assignment 2Dokumen6 halamanBusiness Finance Assignment 2Muhammad Ali KhanBelum ada peringkat

- AEC 105 Prelim Study Notes 2 PDFDokumen4 halamanAEC 105 Prelim Study Notes 2 PDFlist2lessBelum ada peringkat

- Cost System - Provides Updated Information About ManufacturingDokumen8 halamanCost System - Provides Updated Information About ManufacturingNiccoRobDeCastroBelum ada peringkat

- Sujide, Kendrew Statement of Comprehensive IncomeDokumen5 halamanSujide, Kendrew Statement of Comprehensive IncomeKendrew SujideBelum ada peringkat

- Marginal & Absorption Feb 20-19 PDFDokumen12 halamanMarginal & Absorption Feb 20-19 PDFhamza khanBelum ada peringkat

- Manufacturing Account NotesDokumen7 halamanManufacturing Account Notesdayna davisBelum ada peringkat

- Stages of Test ConstructionDokumen31 halamanStages of Test ConstructionMariaCarlaMañagoBelum ada peringkat

- Gross IncomeDokumen32 halamanGross IncomeMariaCarlaMañagoBelum ada peringkat

- Internal External Internal ExternalDokumen3 halamanInternal External Internal ExternalMariaCarlaMañagoBelum ada peringkat

- Quality Control ElementsDokumen53 halamanQuality Control ElementsMariaCarlaMañagoBelum ada peringkat

- Government BudgetingDokumen6 halamanGovernment BudgetingMariaCarlaMañago100% (1)

- Areas of Management Advisory ServicesDokumen37 halamanAreas of Management Advisory ServicesMariaCarlaMañago0% (1)

- Outline GAMDokumen3 halamanOutline GAMMariaCarlaMañagoBelum ada peringkat

- Chart of AccountsDokumen8 halamanChart of AccountsMariaCarlaMañagoBelum ada peringkat

- Budgeting Quiz BeeDokumen27 halamanBudgeting Quiz BeeMariaCarlaMañagoBelum ada peringkat

- Introduction To Law: The General Nature of LawDokumen12 halamanIntroduction To Law: The General Nature of LawMariaCarlaMañagoBelum ada peringkat

- Elective Affinities by René MagritteDokumen1 halamanElective Affinities by René MagritteMariaCarlaMañagoBelum ada peringkat

- Macroeconomic Development of CyprusDokumen19 halamanMacroeconomic Development of CyprusMariaCarlaMañagoBelum ada peringkat

- The Great Chain of BeingDokumen2 halamanThe Great Chain of BeingMariaCarlaMañagoBelum ada peringkat

- Applied Physics (PHY-102) Course OutlineDokumen3 halamanApplied Physics (PHY-102) Course OutlineMuhammad RafayBelum ada peringkat

- Technical Data Sheet TR24-3-T USDokumen2 halamanTechnical Data Sheet TR24-3-T USDiogo CBelum ada peringkat

- TMPRO CASABE 1318 Ecopetrol Full ReportDokumen55 halamanTMPRO CASABE 1318 Ecopetrol Full ReportDiego CastilloBelum ada peringkat

- T-Tess Six Educator StandardsDokumen1 halamanT-Tess Six Educator Standardsapi-351054075100% (1)

- Le Chatelier's Principle Virtual LabDokumen8 halamanLe Chatelier's Principle Virtual Lab2018dgscmtBelum ada peringkat

- Model TB-16Dokumen20 halamanModel TB-16xuanphuong2710Belum ada peringkat

- Ubi Caritas Guitar Solo Arrangement by Patrick Glenn BalanzaDokumen8 halamanUbi Caritas Guitar Solo Arrangement by Patrick Glenn BalanzaPatrick Glenn BalanzaBelum ada peringkat

- SEC CS Spice Money LTDDokumen2 halamanSEC CS Spice Money LTDJulian SofiaBelum ada peringkat

- Pest of Field Crops and Management PracticalDokumen44 halamanPest of Field Crops and Management PracticalNirmala RameshBelum ada peringkat

- Taylor Et Al v. Acxiom Corporation Et Al - Document No. 91Dokumen40 halamanTaylor Et Al v. Acxiom Corporation Et Al - Document No. 91Justia.comBelum ada peringkat

- 3M 309 MSDSDokumen6 halaman3M 309 MSDSLe Tan HoaBelum ada peringkat

- Vernacular ArchitectureDokumen4 halamanVernacular ArchitectureSakthiPriya NacchinarkiniyanBelum ada peringkat

- Sistine Chapel Ceiling Lesson PlanDokumen28 halamanSistine Chapel Ceiling Lesson PlannivamBelum ada peringkat

- Resume NetezaDokumen5 halamanResume Netezahi4149Belum ada peringkat

- Digital SLR AstrophotographyDokumen366 halamanDigital SLR AstrophotographyPier Paolo GiacomoniBelum ada peringkat

- Electric Vehicles PresentationDokumen10 halamanElectric Vehicles PresentationVIBHU CHANDRANSH BHANOT100% (1)

- Why File A Ucc1Dokumen10 halamanWhy File A Ucc1kbarn389100% (4)

- Migne. Patrologiae Cursus Completus: Series Latina. 1800. Volume 51.Dokumen516 halamanMigne. Patrologiae Cursus Completus: Series Latina. 1800. Volume 51.Patrologia Latina, Graeca et OrientalisBelum ada peringkat

- The Grass Rink Summer Final 2019Dokumen9 halamanThe Grass Rink Summer Final 2019api-241553699Belum ada peringkat

- A Review of Mechanism Used in Laparoscopic Surgical InstrumentsDokumen15 halamanA Review of Mechanism Used in Laparoscopic Surgical InstrumentswafasahilahBelum ada peringkat

- Distribution BoardDokumen7 halamanDistribution BoardmuralichandrasekarBelum ada peringkat

- ATADU2002 DatasheetDokumen3 halamanATADU2002 DatasheethindBelum ada peringkat

- 21st CENTURY TECHNOLOGIES - PROMISES AND PERILS OF A DYNAMIC FUTUREDokumen170 halaman21st CENTURY TECHNOLOGIES - PROMISES AND PERILS OF A DYNAMIC FUTUREpragya89Belum ada peringkat

- FSM Syllabus20071228 1Dokumen3 halamanFSM Syllabus20071228 1Institute of Fengshui BaziBelum ada peringkat

- Corvina PRIMEDokumen28 halamanCorvina PRIMEMillerIndigoBelum ada peringkat

- PCI Bridge ManualDokumen34 halamanPCI Bridge ManualEm MarBelum ada peringkat

- Alpha Sexual Power Vol 1Dokumen95 halamanAlpha Sexual Power Vol 1Joel Lopez100% (1)

- N50-200H-CC Operation and Maintenance Manual 961220 Bytes 01Dokumen94 halamanN50-200H-CC Operation and Maintenance Manual 961220 Bytes 01ANDRESBelum ada peringkat

- Holiday AssignmentDokumen18 halamanHoliday AssignmentAadhitya PranavBelum ada peringkat

- Benko Gambit-Jacobs and Kinsman, 1999Dokumen163 halamanBenko Gambit-Jacobs and Kinsman, 1999johnson Greker100% (3)