Stellar Show To Continue

Diunggah oleh

ravi285Judul Asli

Hak Cipta

Format Tersedia

Bagikan dokumen Ini

Apakah menurut Anda dokumen ini bermanfaat?

Apakah konten ini tidak pantas?

Laporkan Dokumen IniHak Cipta:

Format Tersedia

Stellar Show To Continue

Diunggah oleh

ravi285Hak Cipta:

Format Tersedia

HEG

India Equity Research | Metals & Mining

March 12, 2018

Management Meet Update Emkay

Your success is our success

©

Refer to important disclosures at the end of this report

CMP Target Price

Stellar show to continue Rs 2,700

as of (March 12, 2018)

NA

12 months

Rating Upside

NOT RATED (■) (100.0) %

Change in Estimates

We recently met the HEG Ltd management to understand the recent developments in the

EPS Chg FY18E/FY19E (%) NA

Graphite Electrode (GE) industry and to gain insights into the company. We foresee further

scope for improvement. Target Price change (%) NA

Target Period (Months) 12

There have been certain concerns surrounding sustainability of GE demand and higher

Previous Reco NR

prices. We understand that demand will continue to be strong and supply will remain tight,

Emkay vs Consensus

supporting strength in prices.

EPS Estimates

HEG’s debt has dropped to Rs2bn, which is likely to be NIL in Q4FY18 itself. The company FY18E FY19E

has been evaluating capacity expansion by 20ktpa depending on Needle Coke availability.

Emkay - -

Growth and diversification are also options for cash usage.

Consensus - -

Technology deterrence, physical set-up barrier and limited Needle Coke supply will restrict Mean Consensus TP (12M) Rs 3,622

any new capacity addition at least for next 2-3 years. Therefore, we believe both offtake Stock Details

and realization will continue to be robust and sustainable for the next few years.

Bloomberg Code HEG IN

Face Value (Rs) 10

Strength to continue in GE pricing

Shares outstanding (mn) 40

GE prices have been strong and this strength is likely to continue for at least 2-3 years. There 52 Week H/L 3,147 / 212

have been some concerns about the sustainability of the GE prices though. We understand

M Cap (Rs bn/USD bn) 108 / 1.66

that the strength in GE prices will stay intact for the following reasons: A) China’s gradual shift

Daily Avg Volume (nos.) 667,120

towards EAF route of steelmaking - from ~15%, proportion of EAF route is likely to rise to

~26%, which translates into ~60-70 mt steel. For this, additional electrode requirement will be Daily Avg Turnover (US$ mn) 26.9

~120-140 kt in Chinese domestic market. This means that there won’t be any exports by

Shareholding Pattern Dec '17

China, which will continue to support GE prices, B) Restricted technology transfer: being an

Promoters 61.0%

oligopolistic industry, technology transfer for GE has been restricted. Also, equipment

sourcing will be very difficult for any new entrant. In all probability, only existing players can FIIs 3.1%

think of expansion, if at all any, C) Limited supply of Needle Coke: the crucial raw material, to DIIs 12.0%

produce USP grade GE, is not abundantly available. Though ConocoPhillips is expanding it Public and Others 23.9%

Needle Coke capacity by 75kt, this won’t move the needle much. Thus, without enough

Needle Coke availability, GE capacity cannot be enhanced. Price Performance

(%) 1M 3M 6M 12M

HEG has ~Rs2bn debt, which is likely to be NIL in Q4FY18 itself. The company has also been

Absolute (10) 37 285 1,120

evaluating various options, including organic/inorganic growth, diversification etc. With better

Rel. to Nifty (9) 35 273 946

cash flows, the company has also paid higher interim dividend (Rs30/share).

Relative price chart

Valuation 3075 Rs % 1070

We understand that earnings improvement will continue, March being the first month of new 2500 854

and higher prices. Even though Needle Coke prices rise, the spread will still be much 1925 638

favorable. We expect further upside from the current level. 1350 422

Financial Snapshot (Consolidated) 775 206

200 -10

(Rs mn) FY13 FY14 FY15 FY16 FY17 Mar-17 May-17 Jul-17 Sep-17 Nov-17 Jan-18 Mar-18

Revenue 16,290 14,668 12,365 8,590 8,531 HEG (LHS) Rel to Nifty (RHS)

Source: Bloomberg

EBITDA 2,931 2,460 1,816 1,364 807

EBITDA Margin (%) 18.0 16.8 14.7 15.9 9.5 This report is solely produced by Emkay Global. The

following person(s) are responsible for the

APAT 1,610 1,120 390 (75) (494) production of the recommendation:

EPS (Rs) 40.3 28.0 9.8 (1.9) (12.4) Goutam Chakraborty

EPS (% chg) 3.8 (30.4) (65.2) (119.2) 0.0 goutam.chakraborty@emkayglobal.com

ROE (%) 17.9 11.5 3.9 (0.7) (5.3) +91 22 66121275

P/E (x) 67.0 96.3 276.8 (1,442.5) (218.4) Varun Singh

EV/EBITDA (x) 40.4 46.4 62.7 82.0 138.3 varun.singh@emkayglobal.com

P/BV (x) 11.4 10.8 10.6 10.8 12.4 91 22 66121244

Source: Company, Emkay Research

Emkay Research is also available on www.emkayglobal.com, Bloomberg EMKAY<GO>, Reuters and DOWJONES. DBS Bank Ltd, DBS Vickers Securities (Singapore) Pte Ltd,its respective connected and associated corporations and affiliates are the distributors of the research reports, please refer

to the last page of the report on Restrictions on Distribution. In Singapore, this research report or research analyses may only be distributed to Institutional Investors,Expert Investors or Accredited Investors as defined in the Securities and Futures Act, Chapter 289 of Singapore

ED: HEMANT MARADIA SA: DHANANJAY SINHA

HEG (HEG IN) India Equity Research | Management Meet Update

Technology restriction + physical set-up barriers = strong moat

The technology of making GE in India was brought into India from the US and German

companies. The possibility of fresh technology transfer happening is limited now. As far as the

physical set-up is concerned, graphetization needs a 20 feet bunker and other furnaces. This

set-up can't be replicated easily. Also, equipment required for the physical set-up is not available

easily, as the requirements are highly customized. Last equipment was supplied almost 40 years

back when the last GE plant was set up in India. Also, capex requirement are significant. Hence,

the most likely expansion can only be done by the existing players.

Not enough Needle Coke to support GE expansion

It takes 2-3 years to respond to Needle Coke demand expansion. ConocoPhillips is planning to

add 75kt Needle Coke capacity through a brownfield expansion. But, this won’t move the needle

much. Converting CPC and CTP into Needle Coke is a lengthy process. Also, technology

involved in converting CTP into Needle Coke is closely guarded.

Valuation

After a strong rally, at the CMP of Rs2,700, the consensus values HEG at 8.1xFY20E EPS and

5.5xFY20EV/EBITDA. Further, HEG’s Q3FY18 performance showed a significant improvement

on a yoy basis based on the steep rise in GE prices. We believe that earnings growth will improve

further, factoring in the lag impact of higher GE prices.

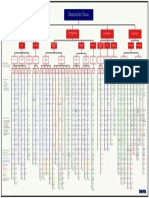

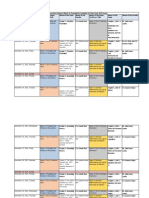

Exhibit 1: Peer Valuation

P/E (x) EV/EBITDA (x) ROE (%)

Company

CY17 CY18E CY19E CY17 CY18E CY19E CY17 CY18E CY19E

Domestic

HEG 13.05 8.96 8.13 8.6 6.0 5.5 62.3 61.0 49.0

Graphite India 17.42 10.24 8.63 11.6 6.9 6.1 34.2 43.1 39.7

International

SGL Carbon SE na 107.3 43.4 23.1 18.7 14.4 8.0 3.4 7.8

Tokai Carbon Co 9.9 8.6 8.4 6.5 5.7 5.6 23.6 21.9 19.5

Showa Denko KK 10.8 9.2 9.4 5.8 5.5 5.8 17.6 18.1 18.4

Nippon Carbon Co 10.7 12.3 9.2 7.3 6.2 6.2 Na Na Na

Source: Bloomberg, Emkay Research; For domestic companies CY17=FY18

Emkay Research is also available on www.emkayglobal.com, Bloomberg EMKAY<GO>, Reuters and DOWJONES. DBS Bank Ltd, DBS Vickers Securities (Singapore) Pte Ltd,its respective connected and associated corporations and affiliates are the distributors of the research reports, please refer to the

last page of the report on Restrictions on Distribution. In Singapore, this research report or research analyses may only be distributed to Institutional Investors,Expert Investors or Accredited Investors as defined in the Securities and Futures Act, Chapter 289 of Singapore

ED: HEMANT MARADIA SA: DHANANJAY SINHA March 12, 2018 | 2

HEG (HEG IN) India Equity Research | Management Meet Update

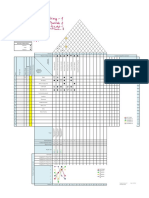

Exhibit 2: Quarterly result

(Rs mn) Q3FY17 Q2FY18 Q3FY18 YoY (%) QoQ (%) YTDFY18 YTDFY17 YoY (%)

Revenue 2,421 4,095 8,427 248.1 105.8 14,576 5,953 144.9

Expenditure (2,129) (2,198) (2,852) 34.0 29.7 (6,870) (5,443) 26.2

as % of sales 88.0 53.7 33.8 47.1 91.4

Consumption of RM (1,121) (1,222) (1,145) 2.2 (6.2) (3,320) (3,054) 8.7

as % of sales 46.3 29.8 13.6 22.8 51.3

Employee Cost (143) (170) (331) 131.1 95.2 (640) (422) 51.4

as % of sales 5.9 4.1 3.9 4.4 7.1

Other expenditure (865) (807) (1,375) 59.0 70.5 (2,910) (1,967) 48.0

as % of sales 35.7 19.7 16.3 20.0 33.0

EBITDA 292 1,897 5,575 1,811.9 193.8 7,706 510 1,410.4

Depreciation (183) (182) (189) 3.1 3.8 (549) (557) (1.5)

EBIT 108 1,715 5,386 4,868.8 214.0 7,158 (47) NA

Other Income 15 26 53 255.7 107.8 86 61 40.0

Interest (138) (129) (127) (8.3) (2.0) (388) (423)

PBT (15) 1,611 5,312 NA 229.7 6,856 (408) NA

Total Tax (17) (475) (1,891) 11,293.4 298.3 (2,382) (47) 4,936.2

Adjusted PAT (32) 1,137 3,421 NA 201.0 4,473 (456) NA

(Profit)/loss from JV's/Ass/MI - - - - -

Adj. PAT after MI (32) 1,137 3,421 NA 201.0 4,473 (456) NA

Extra ordinary items - - - - -

Reported PAT (31.60) 1,136.60 3,421.10 NA 201.0 4,473 (456) NA

Reported EPS (0.79) 28.44 85.61 NA 201.0 111.9 (11.4) NA

Margins (%) (bps) (bps) (bps)

EBIDTA 12.0 46.3 66.2 +5411 bps +1983 bps 52.9 8.6 +4430 bps

EBIT 4.5 41.9 63.9 +5944 bps +2203 bps 49.1 (0.8) NA

EBT (0.6) 39.3 63.0 NA +2369 bps 47.0 (6.9) NA

PAT (1.3) 27.8 40.6 NA +1284 bps 30.7 (7.7) NA

Effective Tax rate (110.7) 29.5 35.6 NA +614 bps 34.7 (11.6) NA

Source: Company, Emkay Research

Emkay Research is also available on www.emkayglobal.com, Bloomberg EMKAY<GO>, Reuters and DOWJONES. DBS Bank Ltd, DBS Vickers Securities (Singapore) Pte Ltd,its respective connected and associated corporations and affiliates are the distributors of the research reports, please refer to the

last page of the report on Restrictions on Distribution. In Singapore, this research report or research analyses may only be distributed to Institutional Investors,Expert Investors or Accredited Investors as defined in the Securities and Futures Act, Chapter 289 of Singapore

ED: HEMANT MARADIA SA: DHANANJAY SINHA March 12, 2018 | 3

HEG (HEG IN) India Equity Research | Management Meet Update

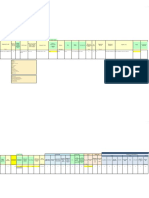

Key Financials (Consolidated)

Income Statement

Y/E Mar (Rs mn) FY13 FY14 FY15 FY16 FY17

Revenue 16,290 14,668 12,365 8,590 8,531

Expenditure 13,359 12,208 10,549 7,226 7,724

EBITDA 2,931 2,460 1,816 1,364 807

Depreciation 626 727 754 793 739

EBIT 2,305 1,733 1,063 571 67

Other Income 136 218 152 41 71

Interest expenses 636 723 771 603 547

PBT 1,805 1,228 443 9 (408)

Tax 195 108 53 84 86

Extraordinary Items (552) 0 0 0 0

Minority Int./Income from Assoc. 0 0 0 0 0

Reported Net Income 1,058 1,120 390 (75) (494)

Adjusted PAT 1,610 1,120 390 (75) (494)

Balance Sheet

Y/E Mar (Rs mn) FY13 FY14 FY15 FY16 FY17

Equity share capital 399 400 400 400 400

Reserves & surplus 9,051 9,600 9,741 9,569 8,298

Net worth 9,451 9,999 10,140 9,968 8,698

Minority Interest 0 0 0 0 0

Loan Funds 12,196 8,355 8,293 6,311 6,315

Net deferred tax liability 814 920 973 992 609

Total Liabilities 22,461 19,275 19,407 17,271 15,622

Net block 7,393 9,406 9,065 9,328 8,850

Investment 1,522 2,018 2,246 2,237 2,602

Current Assets 15,937 12,447 10,073 7,705 7,022

Cash & bank balance 147 121 41 51 83

Other Current Assets 766 414 206 80 691

Current liabilities & Provision 4,537 5,783 3,055 2,293 2,904

Net current assets 11,400 6,664 7,018 5,412 4,118

Misc. exp 0 0 0 0 0

Total Assets 22,461 19,275 19,407 17,271 15,621

Cash Flow

Y/E Mar (Rs mn) FY13 FY14 FY15 FY16 FY17

PBT (Ex-Other income) (NI+Dep) 1,253 974 443 10 (336)

Other Non-Cash items (31) 164 (86) 67 42

Chg in working cap (1,137) 1,883 2,048 1,201 672

Operating Cashflow 1,152 7,733 2,651 2,493 1,629

Capital expenditure (1,469) (2,681) (341) (292) (15)

Free Cash Flow (317) 5,052 2,310 2,201 1,615

Investments 0 (274) (516) 1 (60)

Other Investing Cash Flow 0 0 0 0 0

Investing Cashflow (1,448) (2,938) (826) (288) (73)

Equity Capital Raised 0 0 0 0 0

Loans Taken / (Repaid) 1,272 (3,818) (1,103) (1,592) (978)

Dividend paid (incl tax) (374) (281) (144) 0 0

Other Financing Cash Flow 0 0 0 0 0

Financing Cashflow 262 (4,821) (1,904) (2,195) (1,526)

Net chg in cash (34) (26) (80) 10 31

Opening cash position 180 147 121 41 51

Closing cash position 147 121 41 51 83

Source: Company, Emkay Research

Emkay Research is also available on www.emkayglobal.com, Bloomberg EMKAY<GO>, Reuters and DOWJONES. DBS Bank Ltd, DBS Vickers Securities (Singapore) Pte Ltd,its respective connected and associated corporations and affiliates are the distributors of the research reports, please refer to the

last page of the report on Restrictions on Distribution. In Singapore, this research report or research analyses may only be distributed to Institutional Investors,Expert Investors or Accredited Investors as defined in the Securities and Futures Act, Chapter 289 of Singapore

ED: HEMANT MARADIA SA: DHANANJAY SINHA March 12, 2018 | 4

HEG (HEG IN) India Equity Research | Management Meet Update

Key Ratios

Profitability (%) FY13 FY14 FY15 FY16 FY17

EBITDA Margin 18.0 16.8 14.7 15.9 9.5

EBIT Margin 14.1 11.8 8.6 6.7 0.8

Effective Tax Rate 10.8 8.8 12.0 895.7 (21.0)

Net Margin 9.9 7.6 3.2 (0.9) (5.8)

ROCE 11.3 9.3 6.3 3.3 0.8

ROE 17.9 11.5 3.9 (0.7) (5.3)

RoIC 12.7 10.0 6.6 3.7 0.5

Per Share Data (Rs) FY13 FY14 FY15 FY16 FY17

EPS 40.3 28.0 9.8 (1.9) (12.4)

CEPS 56.0 46.2 28.6 18.0 6.1

BVPS 236.5 250.2 253.7 249.4 217.7

DPS 8.0 5.0 8.0 8.0 8.0

Valuations (x) FY13 FY14 FY15 FY16 FY17

PER 67.0 96.3 276.8 (1,442.5) (218.4)

P/CEPS 48.2 58.4 94.4 150.2 440.4

P/BV 11.4 10.8 10.6 10.8 12.4

EV / Sales 7.3 7.8 9.2 13.0 13.1

EV / EBITDA 40.4 46.4 62.7 82.0 138.3

Dividend Yield (%) 0.3 0.2 0.3 0.3 0.3

Gearing Ratio (x) FY13 FY14 FY15 FY16 FY17

Net Debt/ Equity 1.1 0.6 0.6 0.4 0.4

Net Debt/EBIDTA 3.6 2.5 3.3 2.9 4.5

Working Cap Cycle (days) 252.1 162.8 206.0 227.8 172.7

Growth (%) FY13 FY14 FY15 FY16 FY17

Revenue 14.4 (10.0) (15.7) (30.5) (0.7)

EBITDA 21.2 (16.1) (26.2) (24.9) (40.9)

EBIT 25.3 (24.8) (38.7) (46.2) (88.2)

PAT 69.8 5.9 (65.2) (119.2) 0.0

Quarterly (Rs mn) Q1FY17 Q2FY17 Q3FY17 Q4FY17 Q1FY18

Revenue 1,632 1,901 2,421 2,578 2,054

EBITDA 32 187 292 296 234

EBITDA Margin (%) 1.9 9.8 12.0 11.5 11.4

PAT (289) (135) (32) (39) (84)

EPS (Rs) (7.2) (3.4) (0.8) (1.0) (2.1)

Source: Company, Emkay Research

Shareholding Pattern (%) Dec-16 Mar-17 Jun-17 Sep-17 Dec-17

Promoters 58.8 58.8 58.8 61.0 61.0

FIIs 0.7 0.7 0.9 2.7 3.1

DIIs 10.5 10.5 10.5 12.1 12.0

Public and Others 30.0 30.1 29.8 24.2 23.9

Source: Capitaline

Emkay Research is also available on www.emkayglobal.com, Bloomberg EMKAY<GO>, Reuters and DOWJONES. DBS Bank Ltd, DBS Vickers Securities (Singapore) Pte Ltd,its respective connected and associated corporations and affiliates are the distributors of the research reports, please refer to the

last page of the report on Restrictions on Distribution. In Singapore, this research report or research analyses may only be distributed to Institutional Investors,Expert Investors or Accredited Investors as defined in the Securities and Futures Act, Chapter 289 of Singapore

ED: HEMANT MARADIA SA: DHANANJAY SINHA March 12, 2018 | 5

HEG (HEG IN) India Equity Research | Management Meet Update

Emkay Rating Distribution

BUY Expected total return (%) (Stock price appreciation and dividend yield) of over 25% within the next 12-18 months.

ACCUMULATE Expected total return (%) (Stock price appreciation and dividend yield) of over 10% within the next 12-18 months.

HOLD Expected total return (%) (Stock price appreciation and dividend yield) of upto 10% within the next 12-18 months.

REDUCE Expected total return (%) (Stock price depreciation) of upto (-) 10% within the next 12-18 months.

SELL The stock is believed to underperform the broad market indices or its related universe within the next 12-18 months.

Completed Date:

Dissemination Date:

Sources for all charts and tables are Emkay Research unless otherwise specified.

GENERAL DISCLOSURE/DISCLAIMER BY EMKAY GLOBAL FINANCIAL SERVICES LIMITED (EGFSL):

Emkay Global Financial Services Limited (CIN-L67120MH1995PLC084899) and its affiliates are a full-service, brokerage, investment banking, investment

management and financing group. Emkay Global Financial Services Limited (EGFSL) along with its affiliates are participants in virtually all securities trading

markets in India. EGFSL was established in 1995 and is one of India's leading brokerage and distribution house. EGFSL is a corporate trading member of

Bombay Stock Exchange Limited (BSE), National Stock Exchange of India Limited (NSE), MCX Stock Exchange Limited (MCX-SX). EGFSL along with its

subsidiaries offers the most comprehensive avenues for investments and is engaged in the businesses including stock broking (Institutional and retail),

merchant banking, commodity broking, depository participant, portfolio management, insurance broking and services rendered in connection with

distribution of primary market issues and financial products like mutual funds, fixed deposits. Details of associates are available on our website i.e.

www.emkayglobal.com

EGFSL is registered as Research Analyst with SEBI bearing registration Number INH000000354 as per SEBI (Research Analysts) Regulations, 2014.

EGFSL hereby declares that it has not defaulted with any stock exchange nor its activities were suspended by any stock exchange with whom it is registered

in last five years, except that NSE had disabled EGFSL from trading on October 05, October 08 and October 09, 2012 for a manifest error resulting into a

bonafide erroneous trade on October 05, 2012. However, SEBI and Stock Exchanges have conducted the routine inspection and based on their

observations have issued advice letters or levied minor penalty on EGFSL for certain operational deviations in ordinary/routine course of business. EGFSL

has not been debarred from doing business by any Stock Exchange / SEBI or any other authorities; nor has its certificate of registration been cancelled

by SEBI at any point of time.

EGFSL offers research services to clients as well as prospects. The analyst for this report certifies that all of the views expressed in this report accurately

reflect his or her personal views about the subject company or companies and its or their securities, and no part of his or her compensation was, is or will

be, directly or indirectly related to specific recommendations or views expressed in this report.

Other disclosures by Emkay Global Financial Services Limited (Research Entity) and its Research Analyst under SEBI (Research Analyst) Regulations,

2014 with reference to the subject company(s) covered in this report

EGFSL and/or its affiliates may seek investment banking or other business from the company or companies that are the subject of this material. Our

salespeople, traders, and other professionals may provide oral or written market commentary or trading strategies to our clients that reflect opinions that

are contrary to the opinions expressed herein, and our proprietary trading and investing businesses may make investment decisions that may be

inconsistent with the recommendations expressed herein. In reviewing these materials, you should be aware that any or all of the foregoing, among other

things, may give rise to real or potential conflicts of interest including but not limited to those stated herein. Additionally, other important information

regarding our relationships with the company or companies that are the subject of this material is provided herein. This report is not directed to, or intended

for distribution to or use by, any person or entity who is a citizen or resident of or located in any locality, state, country or other jurisdiction where such

distribution, publication, availability or use would be contrary to law or regulation or which would subject EGFSL or its group companies to any registration

or licensing requirement within such jurisdiction. Specifically, this document does not constitute an offer to or solicitation to any U.S. person for the purchase

or sale of any financial instrument or as an official confirmation of any transaction to any U.S. person. Unless otherwise stated, this message should not

be construed as official confirmation of any transaction. No part of this document may be used by private customers in United Kingdom. All material

presented in this report, unless specifically indicated otherwise, is under copyright to Emkay. None of the material, nor its content, nor any copy of it, may

be altered in any way, transmitted to, copied or distributed to any other party, without the prior express written permission of EGFSL . All trademarks,

service marks and logos used in this report are trademarks or registered trademarks of EGFSL or its Group Companies. The information contained herein

is not intended for publication or distribution or circulation in any manner whatsoever and any unauthorized reading, dissemination, distribution or copying

of this communication is prohibited unless otherwise expressly authorized. Please ensure that you have read “Risk Disclosure Document for Capital Market

and Derivatives Segments” as prescribed by Securities and Exchange Board of India before investing in Indian Securities Market. In so far as this report

includes current or historic information, it is believed to be reliable, although its accuracy and completeness cannot be guaranteed.

This publication has not been reviewed or authorized by any regulatory authority. There is no planned schedule or frequency for updating research

publication relating to any issuer.

Please contact the primary analyst for valuation methodologies and assumptions associated with the covered companies or price targets

Disclaimer for U.S. persons only: This research report is a product of Emkay Global Financial Services Limited (Emkay), which is the employer of the

research analyst(s) who has prepared the research report. The research analyst(s) preparing the research report is/are resident outside the United States

(U.S.) and are not associated persons of any U.S. regulated broker-dealer and therefore the analyst(s) is/are not subject to supervision by a U.S. broker-

dealer, and is/are not required to satisfy the regulatory licensing requirements of Financial Institutions Regulatory Authority (FINRA) or required to otherwise

comply with U.S. rules or regulations regarding, among other things, communications with a subject company, public appearances and trading securities

held by a research analyst account. This report is intended for distribution to "Major Institutional Investors" as defined by Rule 15a-6(b)(4) of the U.S.

Securities and Exchange Act, 1934 (the Exchange Act) and interpretations thereof by U.S. Securities and Exchange Commission (SEC) in reliance on

Rule 15a 6(a)(2). If the recipient of this report is not a Major Institutional Investor as specified above, then it should not act upon this report and return the

same to the sender. Further, this report may not be copied, duplicated and/or transmitted onward to any U.S. person, which is not the Major Institutional

Investor. In reliance on the exemption from registration provided by Rule 15a-6 of the Exchange Act and interpretations thereof by the SEC in order to

conduct certain business with Major Institutional Investors.

Emkay Research is also available on www.emkayglobal.com, Bloomberg EMKAY<GO>, Reuters and DOWJONES. DBS Bank Ltd, DBS Vickers Securities (Singapore) Pte Ltd,its respective connected and associated corporations and affiliates are the distributors of the research reports, please refer to the

last page of the report on Restrictions on Distribution. In Singapore, this research report or research analyses may only be distributed to Institutional Investors,Expert Investors or Accredited Investors as defined in the Securities and Futures Act, Chapter 289 of Singapore

ED: HEMANT MARADIA SA: DHANANJAY SINHA March 12, 2018 | 6

HEG (HEG IN) India Equity Research | Management Meet Update

GENERAL DISCLOSURE/DISCLAIMER BY DBS BANK LTD AS DISTRIBUTOR OF THE RESEARCH REPORT

This report is solely intended for the clients of DBS Bank Ltd,its respective connected and associated corporations and affiliates only and no part of this

document may be (i) copied, photocopied or duplicated in any form or by any means or (ii) redistributed without the prior written consent of DBS Bank Ltd.

The research set out in this report is based on information obtained from sources believed to be reliable, but we (which collectively refers to DBS Bank

Ltd, its respective connected and associated corporations, affiliates and their respective directors, officers, employees and agents (collectively, the “DBS

Group”) have not conducted due diligence on any of the companies, verified any information or sources or taken into account any other factors which we

may consider to be relevant or appropriate in preparing the research. Accordingly, we do not make any representation or warranty as to the accuracy,

completeness or correctness of the research set out in this report. Opinions expressed are subject to change without notice. This research is prepared for

general circulation. Any recommendation contained in this document does not have regard to the specific investment objectives, financial situation and

the particular needs of any specific addressee. This document is for the information of addressees only and is not to be taken in substitution for the

exercise of judgement by addressees, who should obtain separate independent legal or financial advice. The DBS Group accepts no liability whatsoever

for any direct, indirect and/or consequential loss (including any claims for loss of profit) arising from any use of and/or reliance upon this document and/or

further communication given in relation to this document. This document is not to be construed as an offer or a solicitation of an offer to buy or sell any

securities. The DBS Group, along with its affiliates and/or persons associated with any of them may from time to time have interests in the securities

mentioned in this document. The DBS Group, may have positions in, and may effect transactions in securities mentioned herein and may also perform or

seek to perform broking, investment banking and other banking services for these companies. Any valuations, opinions, estimates, forecasts, ratings or

risk assessments herein constitutes a judgment as of the date of this report, and there can be no assurance that future results or events will be consistent

with any such valuations, opinions, estimates, forecasts, ratings or risk assessments. The information in this document is subject to change without notice,

its accuracy is not guaranteed, it may be incomplete or condensed, it may not contain all material information concerning the company (or companies)

referred to in this report and the DBS Group is under no obligation to update the information in this report. This publication has not been reviewed or

authorized by any regulatory authority in Singapore, Hong Kong or elsewhere. There is no planned schedule or frequency for updating research publication

relating to any issuer.

The valuations, opinions, estimates, forecasts, ratings or risk assessments described in this report were based upon a number of estimates and

assumptions and are inherently subject to significant uncertainties and contingencies. It can be expected that one or more of the estimates on which the

valuations, opinions, estimates, forecasts, ratings or risk assessments were based will not materialize or will vary significantly from actual results.

Therefore, the inclusion of the valuations, opinions, estimates, forecasts, ratings or risk assessments described herein IS NOT TO BE RELIED UPON as

a representation and/or warranty by the DBS Group (and/or any persons associated with the aforesaid entities), that: (a) such valuations, opinions,

estimates, forecasts, ratings or risk assessments or their underlying assumptions will be achieved, and (b) there is any assurance that future results or

events will be consistent with any such valuations, opinions, estimates, forecasts, ratings or risk assessments stated therein. Please contact the primary

analyst for valuation methodologies and assumptions associated with the covered companies or price targets. Any assumptions made in this report that

refers to commodities, are for the purposes of making forecasts for the company (or companies) mentioned herein. They are not to be construed as

recommendations to trade in the physical commodity or in the futures contract relating to the commodity referred to in this report.

DBSVUSA, a US-registered broker-dealer, does not have its own investment banking or research department, has not participated in any public offering

of securities as a manager or co-manager or in any other investment banking transaction in the past twelve months and does not engage in market-

making.

ANALYST CERTIFICATION BY EMKAY GLOBAL FINANCIAL SERVICES LIMITED (EGFSL)

The research analyst(s) primarily responsible for the content of this research report, in part or in whole, certifies that the views about the companies and

their securities expressed in this report accurately reflect his/her personal views. The analyst(s) also certifies that no part of his/her compensation was, is,

or will be, directly or indirectly, related to specific recommendations or views expressed in the report. The research analyst (s) primarily responsible of the

content of this research report, in part or in whole, certifies that he or his associate1 does not serve as an officer, director or employee of the issuer or the

new listing applicant (which includes in the case of a real estate investment trust, an officer of the management company of the real estate investment

trust; and in the case of any other entity, an officer or its equivalent counterparty of the entity who is responsible for the management of the issuer or the

new listing applicant). The research analyst(s) primarily responsible for the content of this research report or his associate does not have financial interests2

in relation to an issuer or a new listing applicant that the analyst reviews. EGFSL has procedures in place to eliminate, avoid and manage any potential

conflicts of interests that may arise in connection with the production of research reports. The research analyst(s) responsible for this report operates as

part of a separate and independent team to the investment banking function of the EGFSL and procedures are in place to ensure that confidential

information held by either the research or investment banking function is handled appropriately. There is no direct link of EGFSL compensation to any

specific investment banking function of the EGFSL.

1

An associate is defined as (i) the spouse, or any minor child (natural or adopted) or minor step-child, of the analyst; (ii) the trustee of a trust of which the analyst, his spouse,

minor child (natural or adopted) or minor step-child, is a beneficiary or discretionary object; or (iii) another person accustomed or obliged to act in accordance with the directions

or instructions of the analyst.

2

Financial interest is defined as interest that are commonly known financial interest, such as investment in the securities in respect of an issuer or a new listing applicant, or

financial accommodation arrangement between the issuer or the new listing applicant and the firm or analysis. This term does not include commercial lending conducted at the

arm’s length, or investments in any collective investment scheme other than an issuer or new listing applicant notwithstanding the fact that the scheme has investments in

securities in respect of an issuer or a new listing applicant.

Emkay Research is also available on www.emkayglobal.com, Bloomberg EMKAY<GO>, Reuters and DOWJONES. DBS Bank Ltd, DBS Vickers Securities (Singapore) Pte Ltd,its respective connected and associated corporations and affiliates are the distributors of the research reports, please refer to the

last page of the report on Restrictions on Distribution. In Singapore, this research report or research analyses may only be distributed to Institutional Investors,Expert Investors or Accredited Investors as defined in the Securities and Futures Act, Chapter 289 of Singapore

ED: HEMANT MARADIA SA: DHANANJAY SINHA March 12, 2018 | 7

HEG (HEG IN) India Equity Research | Management Meet Update

COMPANY-SPECIFIC / REGULATORY DISCLOSURES BY EMKAY GLOBAL FINANCIAL SERVICES LIMITED (EGFSL):

Disclosures by Emkay Global Financial Services Limited (Research Entity) and its Research Analyst under SEBI (Research Analyst) Regulations, 2014

with reference to the subject company(s) covered in this report-:

1. EGFSL, its subsidiaries and/or other affiliates do not have a proprietary position in the securities recommended in this report as of March 12, 2018

2. EGFSL, and/or Research Analyst does not market make in equity securities of the issuer(s) or company(ies) mentioned in this Research Report

Disclosure of previous investment recommendation produced:

3. EGFSL may have published other investment recommendations in respect of the same securities / instruments recommended in this research

report during the preceding 12 months. Please contact the primary analyst listed in the first page of this report to view previous investment

recommendations published by EGFSL in the preceding 12 months.

4. EGFSL , its subsidiaries and/or other affiliates and Research Analyst or his/her relative’s does not have any material conflict of interest in the

securities recommended in this report as of March 12, 2018.

5. EGFSL, its subsidiaries and/or other affiliates and Research Analyst or his/her relative’s does not have actual/beneficial ownership of 1% or more

securities of the subject company at the end of the month immediately preceding the March 12, 2018

6. EGFSL, its subsidiaries and/or other affiliates and Research Analyst have not received any compensation in whatever form including

compensation for investment banking or merchant banking or brokerage services or for products or services other than investment banking or

merchant banking or brokerage services from securities recommended in this report (subject company) in the past 12 months.

7. EGFSL, its subsidiaries and/or other affiliates and/or and Research Analyst have not received any compensation or other benefits from securities

recommended in this report (subject company) or third party in connection with the research report.

8. Securities recommended in this report (Subject Company) has not been client of EGFSL, its subsidiaries and/or other affiliates and/or and

Research Analyst during twelve months preceding the March 12, 2018

Emkay Research is also available on www.emkayglobal.com, Bloomberg EMKAY<GO>, Reuters and DOWJONES. DBS Bank Ltd, DBS Vickers Securities (Singapore) Pte Ltd,its respective connected and associated corporations and affiliates are the distributors of the research reports, please refer to the

last page of the report on Restrictions on Distribution. In Singapore, this research report or research analyses may only be distributed to Institutional Investors,Expert Investors or Accredited Investors as defined in the Securities and Futures Act, Chapter 289 of Singapore

ED: HEMANT MARADIA SA: DHANANJAY SINHA March 12, 2018 | 8

HEG (HEG IN) India Equity Research | Management Meet Update

COMPANY-SPECIFIC / REGULATORY DISCLOSURES BY DBS BANK LTD AS DISTRIBUTOR OF THE RESEARCH REPORT

1. DBS Bank Ltd., DBS HK, DBS Vickers Securities (Singapore) Pte Ltd (“DBSVS”), DBSV HK or their subsidiaries and/or other affiliates do not have a

proprietary position in the securities recommended in this report as of 31 Jan 2018.

2. Neither DBS Bank Ltd, DBS HK nor DBSV HK market makes in equity securities of the issuer(s) or company(ies) mentioned in this Research Report.

Compensation for investment banking services:

3. DBSVUSA, does not have its own investment banking or research department, nor has it participated in any public offering of securities as a manager

or co-manager or in any other investment banking transaction in the past twelve months. Any US persons wishing to obtain further information, including

any clarification on disclosures in this disclaimer, or to effect a transaction in any security discussed in this document should contact DBSVUSA

exclusively.

Disclosure of previous investment recommendation produced:

4. DBS Bank Ltd. DBS Vickers Securities (Singapore) Pte Ltd (“DBSVS”), their subsidiaries and/or other affiliates may have published other investment

recommendations in respect of the same securities / instruments recommended in this research report during the preceding 12 months. Please contact

the primary analyst listed in the first page of this report to view previous investment recommendations published by DBS Bank Ltd. DBS Vickers Securities

(Singapore) Pte Ltd (“DBSVS”), their subsidiaries and/or other affiliates in the preceding 12 months.

RESTRICTIONS ON DISTRIBUTION

General This report is not directed to, or intended for distribution to or use by, any person or entity who is a citizen or resident of or

located in any locality, state, country or other jurisdiction where such distribution, publication, availability or use would be

contrary to law or regulation.

Australia This report is not for distribution into Australia.

Hong Kong This report is not for distribution into Hong Kong.

Indonesia This report is being distributed in Indonesia by PT DBS Vickers Sekuritas Indonesia.

Malaysia This report is not for distribution into Malaysia.

Singapore This report is distributed in Singapore by DBS Bank Ltd (Company Regn. No. 16800306E) or DBSVS (Company Regn. No.

1860024G) both of which are Exempt Financial Advisers as defined in the Financial Advisers Act and regulated by the Monetary

Authority of Singapore. DBS Bank Ltd and/or DBSVS, may distribute reports produced by its respective foreign entities,

affiliates or other foreign research houses pursuant to an agreement under Regulation 32C of the financial Advisers

Regulations. Singapore recipients should contact DBS Bank Ltd at 6327 2288 for matters arising from, or in connection with

the report.

Thailand This report is being distributed in Thailand by DBS Vickers Securities (Thailand) Co Ltd.

United Kingdom This report is disseminated in the United Kingdom by DBS Vickers Securities (UK) Ltd, ("DBSVUK"). DBSVUK is authorised

and regulated by the Financial Conduct Authority in the United Kingdom.

In respect of the United Kingdom, this report is solely intended for the clients of DBSVUK, its respective connected and

associated corporations and affiliates only and no part of this document may be (i) copied, photocopied or duplicated in any

form or by any means or (ii) redistributed without the prior written consent of DBSVUK. This communication is directed at

persons having professional experience in matters relating to investments. Any investment activity following from this

communication will only be engaged in with such persons. Persons who do not have professional experience in matters relating

to investments should not rely on this communication.

Dubai International This research report is being distributed by DBS Bank Ltd., (DIFC Branch) having its office at PO Box 506538, 3rd Floor,

Financial Centre Building 3, East Wing, Gate Precinct, Dubai International Financial Centre (DIFC), Dubai, United Arab Emirates. DBS Bank

Ltd., (DIFC Branch) is regulated by The Dubai Financial Services Authority. This research report is intended only for

professional clients (as defined in the DFSA rulebook) and no other person may act upon it.

United Arab Emirates This report is provided by DBS Bank Ltd (Company Regn. No. 196800306E) which is an Exempt Financial Adviser as defined

in the Financial Advisers Act and regulated by the Monetary Authority of Singapore. This report is for information purposes

only and should not be relied upon or acted on by the recipient or considered as a solicitation or inducement to buy or sell any

financial product. It does not constitute a personal recommendation or take into account the particular investment objectives,

financial situation, or needs of individual clients. You should contact your relationship manager or investment adviser if you

need advice on the merits of buying, selling or holding a particular investment. You should note that the information in this

report may be out of date and it is not represented or warranted to be accurate, timely or complete. This report or any portion

thereof may not be reprinted, sold or redistributed without our written consent.

United States DBSVUSA did not participate in its preparation. The research analyst(s) named on this report are not registered as research

analysts with FINRA and are not associated persons of DBSVUSA. The research analyst(s) are not subject to FINRA Rule

2241 restrictions on analyst compensation, communications with a subject company, public appearances and trading securities

held by a research analyst. This report is being distributed in the United States by DBSVUSA, which accepts responsibility for

its contents. This report may only be distributed to Major U.S. Institutional Investors (as defined in SEC Rule 15a-6) and to

such other institutional investors and qualified persons as DBSVUSA may authorize. Any U.S. person receiving this report

who wishes to effect transactions in any securities referred to herein should contact DBSVUSA directly and not its affiliate.

In any other jurisdictions, except if otherwise restricted by laws or regulations, this report is intended only for qualified,

Other jurisdictions

professional, institutional or sophisticated investors as defined in the laws and regulations of such jurisdictions.

Emkay Global Financial Services Ltd.

CIN - L67120MH1995PLC084899

7th Floor, The Ruby, Senapati Bapat Marg, Dadar - West, Mumbai - 400028. India

Tel: +91 22 66121212 Fax: +91 22 66121299 Web: www.emkayglobal.com

Emkay Research is also available on www.emkayglobal.com, Bloomberg EMKAY<GO>, Reuters and DOWJONES. DBS Bank Ltd, DBS Vickers Securities (Singapore) Pte Ltd,its respective connected and associated corporations and affiliates are the distributors of the research reports, please refer to the

last page of the report on Restrictions on Distribution. In Singapore, this research report or research analyses may only be distributed to Institutional Investors,Expert Investors or Accredited Investors as defined in the Securities and Futures Act, Chapter 289 of Singapore

ED: HEMANT MARADIA SA: DHANANJAY SINHA March 12, 2018 | 9

HEG (HEG IN) India Equity Research | Management Meet Update

SINGAPORE

DBS Bank Ltd

Contact: Janice Chua

12 Marina Boulevard, Marina Bay Financial Centre Tower 3

Singapore 018982

Tel. 65-6878 8888

Fax: 65 65353 418

e-mail: equityresearch@dbs.com

Company Regn. No. 196800306E

THAILAND

DBS Vickers Securities (Thailand) Co Ltd

Contact: Chanpen Sirithanarattanakul

989 Siam Piwat Tower Building,

9th, 14th-15th Floor

Rama 1 Road, Pathumwan,

Nagkok Thailand 10330

Tel. 66 2 857 7831

Fax: 66 2 658 1269

e-mail: research@th.dbs.com

Company Regn. No 0105539127012

Securities and Exchange Commission, Thailand

INDONESIA

PT DBS Vickers Sekuritas (Indonesia)

Contact: Maynard Priajaya Arif

DBS Bank Tower

Ciputra World 1, 32/F

JI. Prof. Dr. Satrio Kav. 3-5

Jakarta 12940, Indonesia

Tel. 62 21 3003 4900

Fax: 62 21 3003 4943

e-mail: research@id.dbsvickers.com

Emkay Research is also available on www.emkayglobal.com, Bloomberg EMKAY<GO>, Reuters and DOWJONES. DBS Bank Ltd, DBS Vickers Securities (Singapore) Pte Ltd,its respective connected and associated corporations and affiliates are the distributors of the research reports, please refer to the

last page of the report on Restrictions on Distribution. In Singapore, this research report or research analyses may only be distributed to Institutional Investors,Expert Investors or Accredited Investors as defined in the Securities and Futures Act, Chapter 289 of Singapore

ED: HEMANT MARADIA SA: DHANANJAY SINHA March 12, 2018| 10

HEG (HEG IN) India Equity Research | Management Meet Update

Goutam Chakraborty, MSc (Agri Eco), PGDFM

goutam.chakraborty@emkayglobal.com

+91 22 66121275

Emkay Research is also available on www.emkayglobal.com, Bloomberg EMKAY<GO>, Reuters and DOWJONES. DBS Bank Ltd, DBS Vickers Securities (Singapore) Pte Ltd,its respective connected and associated corporations and affiliates are the distributors of the research reports, please refer to the

last page of the report on Restrictions on Distribution. In Singapore, this research report or research analyses may only be distributed to Institutional Investors,Expert Investors or Accredited Investors as defined in the Securities and Futures Act, Chapter 289 of Singapore

ED: HEMANT MARADIA SA: DHANANJAY SINHA March 12, 2018| 11

Anda mungkin juga menyukai

- Value-Map TM DeloitteDokumen1 halamanValue-Map TM DeloitteHugo SalazarBelum ada peringkat

- Base Enterprise Value Map PDFDokumen1 halamanBase Enterprise Value Map PDFjvr001100% (1)

- The Seven Seals of Revelation and The SevenDokumen14 halamanThe Seven Seals of Revelation and The Sevenyulamula100% (2)

- Value Stream Improvement Plan TemplateDokumen4 halamanValue Stream Improvement Plan TemplatemilandivacBelum ada peringkat

- Vedic Astrology OverviewDokumen1 halamanVedic Astrology Overviewhuman999100% (8)

- QC Staff Rizqi FatullohDokumen11 halamanQC Staff Rizqi FatullohRizqiBelum ada peringkat

- Product Marketing ElementsDokumen1 halamanProduct Marketing ElementsUmut GürkanBelum ada peringkat

- American Literature TimelineDokumen2 halamanAmerican Literature TimelineJoanna Dandasan100% (1)

- CAN Slim Method To Pick StocksDokumen1 halamanCAN Slim Method To Pick StocksSiddhartha Goenka33% (3)

- Lim vs. CA DigestDokumen2 halamanLim vs. CA Digestsamme1010100% (1)

- Palo Alto Firewall VirtualizationDokumen394 halamanPalo Alto Firewall VirtualizationRyanb378Belum ada peringkat

- Aia Engineering PDFDokumen10 halamanAia Engineering PDFravi285Belum ada peringkat

- Raymond Initiating CoverageDokumen20 halamanRaymond Initiating Coveragenarayanan_rBelum ada peringkat

- Study GuideDokumen2 halamanStudy GuideEmeli ReynosoBelum ada peringkat

- August & September Monthly Collection, Grade 1Dari EverandAugust & September Monthly Collection, Grade 1Belum ada peringkat

- Case Study No. 11 - Hydroelectric Power Plant in The PhilippinesDokumen26 halamanCase Study No. 11 - Hydroelectric Power Plant in The PhilippinespicefeatiBelum ada peringkat

- Austin's Cover Letter Example - Cultivated CultureDokumen1 halamanAustin's Cover Letter Example - Cultivated CultureYash SBelum ada peringkat

- Chugging Along: Reliance IndustriesDokumen12 halamanChugging Along: Reliance IndustriesAshokBelum ada peringkat

- Emkay-Eicher Motors Company Update - Feb 19Dokumen13 halamanEmkay-Eicher Motors Company Update - Feb 19Blue RunnerBelum ada peringkat

- DH 847Dokumen13 halamanDH 847rishab agarwalBelum ada peringkat

- Dixon 1QFY22 Result Update - OthersDokumen14 halamanDixon 1QFY22 Result Update - OthersjoycoolBelum ada peringkat

- Power Finance Corporation 18 08 2021 EmkayDokumen10 halamanPower Finance Corporation 18 08 2021 EmkayPavanBelum ada peringkat

- Horlicks Buy Provides Upsides: Hindustan UnileverDokumen12 halamanHorlicks Buy Provides Upsides: Hindustan UnileversheetalBelum ada peringkat

- Margin Concerns Should Take Precedence Over Improved OutlookDokumen15 halamanMargin Concerns Should Take Precedence Over Improved Outlookashok yadavBelum ada peringkat

- Pain Not Coming To An End Cut To Reduce: Bharti AirtelDokumen17 halamanPain Not Coming To An End Cut To Reduce: Bharti AirtelAshokBelum ada peringkat

- Care Ratings-Paints Industry Analysis-2017Dokumen12 halamanCare Ratings-Paints Industry Analysis-2017rchawdhry123Belum ada peringkat

- United Breweries Q4FY21 Result Update - OthersDokumen10 halamanUnited Breweries Q4FY21 Result Update - OthersYash MehtaBelum ada peringkat

- Basf Buy Emkay 06.10.17Dokumen28 halamanBasf Buy Emkay 06.10.17Harshal PatilBelum ada peringkat

- Whirlpool Q3FY21 Result Update - OthersDokumen11 halamanWhirlpool Q3FY21 Result Update - OthersRanjan BeheraBelum ada peringkat

- Emkay - Shriram City Union Finance - Errclub - Refer To Important Disclosures at The End of This Report Weak Asset Quality Weighs On EarningsDokumen6 halamanEmkay - Shriram City Union Finance - Errclub - Refer To Important Disclosures at The End of This Report Weak Asset Quality Weighs On EarningsRonak JajooBelum ada peringkat

- Edelweiss Financial Services Initiating Coverage Scaling New Heights Buy Target Rs 280Dokumen19 halamanEdelweiss Financial Services Initiating Coverage Scaling New Heights Buy Target Rs 280chatuuuu123Belum ada peringkat

- Real Estate Asset Sale To Accelerate Retailization: L&T Finance HoldingsDokumen4 halamanReal Estate Asset Sale To Accelerate Retailization: L&T Finance HoldingsAshwet JadhavBelum ada peringkat

- Berger Paints (India) Limited 21 QuarterUpdateDokumen7 halamanBerger Paints (India) Limited 21 QuarterUpdatevikasaggarwal01Belum ada peringkat

- A3 Story Draft - Aditya Pradana Rev 3Dokumen1 halamanA3 Story Draft - Aditya Pradana Rev 3aditya pradanaBelum ada peringkat

- Semiconductor Sector Update: Kick Starting The NKEA-15/10/2010Dokumen2 halamanSemiconductor Sector Update: Kick Starting The NKEA-15/10/2010Rhb InvestBelum ada peringkat

- Psms Mablay Worksheet For Promotion 2023Dokumen1 halamanPsms Mablay Worksheet For Promotion 2023ODPDABelum ada peringkat

- ApPipes EMDokumen13 halamanApPipes EMdarshanmadeBelum ada peringkat

- PSSG Almazan Worksheet For Promotion 2023Dokumen1 halamanPSSG Almazan Worksheet For Promotion 2023ODPDABelum ada peringkat

- Weekly Mutual Fund Update 9th June 2019Dokumen5 halamanWeekly Mutual Fund Update 9th June 2019Aslam HossainBelum ada peringkat

- Mah Sing Group Berhad :getting Stronger-27/08/2010Dokumen4 halamanMah Sing Group Berhad :getting Stronger-27/08/2010Rhb InvestBelum ada peringkat

- QFD: House of Quality: Project: Revision: DateDokumen1 halamanQFD: House of Quality: Project: Revision: DateME20M015 Jaspreet SinghBelum ada peringkat

- Cumberland Report and Accounts 2022Dokumen73 halamanCumberland Report and Accounts 2022Bikash sharmaBelum ada peringkat

- Emkey On Shriram FinanceDokumen18 halamanEmkey On Shriram FinanceamsukdBelum ada peringkat

- 2021 Audit QPR - Client and Engagement Colombia 29.03.2021Dokumen22 halaman2021 Audit QPR - Client and Engagement Colombia 29.03.2021alejandraBelum ada peringkat

- QFD: House of Quality: Project: Revision: DateDokumen5 halamanQFD: House of Quality: Project: Revision: Datevictor herreraBelum ada peringkat

- 7 Steps of QC Problem Solving - Detached Brackets Rev 06Dokumen74 halaman7 Steps of QC Problem Solving - Detached Brackets Rev 06Enrique Rosales ContrerasBelum ada peringkat

- 12 - Dec2020 - YCP Quality Dashboard (Latest)Dokumen6 halaman12 - Dec2020 - YCP Quality Dashboard (Latest)guillaumenzi195Belum ada peringkat

- JK Cement: Key Financial Highlights (2018-19)Dokumen1 halamanJK Cement: Key Financial Highlights (2018-19)KpBelum ada peringkat

- Sample Expense ReportDokumen1 halamanSample Expense Reportmharaynel.afableBelum ada peringkat

- Eastern Pacific Industrial Corporation Berhad: No Surprises - 27/04/2010Dokumen3 halamanEastern Pacific Industrial Corporation Berhad: No Surprises - 27/04/2010Rhb InvestBelum ada peringkat

- KML BSC Monthly Template EN v3Dokumen3 halamanKML BSC Monthly Template EN v3Rinny Heryadi HadjohBelum ada peringkat

- PM One Page FlowchartDokumen1 halamanPM One Page FlowchartbenBelum ada peringkat

- Axiata Group Berhad: Improvements Gaining Momentum - 31/5/2010Dokumen5 halamanAxiata Group Berhad: Improvements Gaining Momentum - 31/5/2010Rhb InvestBelum ada peringkat

- Periodic Table of Advertising and MarketingDokumen1 halamanPeriodic Table of Advertising and MarketingEddy SenjayaBelum ada peringkat

- October AccomplishmentDokumen17 halamanOctober AccomplishmentReyma GalingganaBelum ada peringkat

- Exhaust Riser ExtendedDokumen4 halamanExhaust Riser ExtendedVassilisStratisBelum ada peringkat

- Evaluation Sheet FormDokumen1 halamanEvaluation Sheet FormKhaled RamzyBelum ada peringkat

- Integral University, Lucknow Department of Commerce and Business Management Study and Evaluation Scheme Program: BBA Retail Management Semester-IIIDokumen8 halamanIntegral University, Lucknow Department of Commerce and Business Management Study and Evaluation Scheme Program: BBA Retail Management Semester-IIIsaurabhsonaBelum ada peringkat

- HF Future Fund Launches August 2022Dokumen1 halamanHF Future Fund Launches August 2022markus.henry94Belum ada peringkat

- AA IT 8 Quarter Program PlansDokumen1 halamanAA IT 8 Quarter Program PlansShobhit DayalBelum ada peringkat

- 2021 Business PerformanceDokumen22 halaman2021 Business PerformanceSebastian SinclairBelum ada peringkat

- At Least 30% Are Women Involved in The M & EDokumen10 halamanAt Least 30% Are Women Involved in The M & EleahtabsBelum ada peringkat

- Q 1 PropertyDokumen1 halamanQ 1 PropertyMichael CorpusBelum ada peringkat

- Nazara Technologies: A Perspective Unlisted FinancialsDokumen4 halamanNazara Technologies: A Perspective Unlisted FinancialsTushar GargBelum ada peringkat

- Tanjong PLC :awaiting The Next Rerating Catalyst - 13/04/2010Dokumen5 halamanTanjong PLC :awaiting The Next Rerating Catalyst - 13/04/2010Rhb InvestBelum ada peringkat

- Underpass Cibadak Plan ProfileDokumen1 halamanUnderpass Cibadak Plan ProfilearashBelum ada peringkat

- Electrical Schematics - Cargo Vocacionais 2014Dokumen39 halamanElectrical Schematics - Cargo Vocacionais 2014MarcioMartinhoFerreiraBelum ada peringkat

- Result Update & Investor Presentation For June 30, 2016 (Company Update)Dokumen61 halamanResult Update & Investor Presentation For June 30, 2016 (Company Update)Shyam SunderBelum ada peringkat

- Auto 03jun16 MoslDokumen4 halamanAuto 03jun16 Moslravi285Belum ada peringkat

- Standalone Financial Results, Form A, Auditors Report, Result Presentation For March 31, 2016 (Result)Dokumen31 halamanStandalone Financial Results, Form A, Auditors Report, Result Presentation For March 31, 2016 (Result)Shyam SunderBelum ada peringkat

- Presentation On The Composite Scheme of Arrangement (Corp. Action)Dokumen30 halamanPresentation On The Composite Scheme of Arrangement (Corp. Action)Shyam SunderBelum ada peringkat

- Investor Presentation For June 30, 2016 (Company Update)Dokumen31 halamanInvestor Presentation For June 30, 2016 (Company Update)Shyam SunderBelum ada peringkat

- Presentation - FY 2016-17: Q1 (Company Update)Dokumen16 halamanPresentation - FY 2016-17: Q1 (Company Update)Shyam SunderBelum ada peringkat

- Investor Presentation - Q1 FY 17 (Company Update)Dokumen31 halamanInvestor Presentation - Q1 FY 17 (Company Update)Shyam SunderBelum ada peringkat

- Revised Presentation (Company Update)Dokumen83 halamanRevised Presentation (Company Update)Shyam SunderBelum ada peringkat

- Veto SME IER Base Jan2013Dokumen20 halamanVeto SME IER Base Jan2013ravi285Belum ada peringkat

- Results Press Release For June 30, 2016 (Result)Dokumen18 halamanResults Press Release For June 30, 2016 (Result)Shyam SunderBelum ada peringkat

- Investor Presentation (Company Update)Dokumen19 halamanInvestor Presentation (Company Update)Shyam SunderBelum ada peringkat

- Investor Presentation For June 30, 2016 (Company Update)Dokumen17 halamanInvestor Presentation For June 30, 2016 (Company Update)Shyam SunderBelum ada peringkat

- TRFDokumen23 halamanTRFravi285Belum ada peringkat

- LSAP 423 Tech Data 25kVA-40KVA - 3PH 400VDokumen1 halamanLSAP 423 Tech Data 25kVA-40KVA - 3PH 400Vrooies13Belum ada peringkat

- Cambridge IGCSE: 0450/11 Business StudiesDokumen12 halamanCambridge IGCSE: 0450/11 Business StudiesGodfreyFrankMwakalingaBelum ada peringkat

- Hireena Essay AnsDokumen2 halamanHireena Essay AnsTasniiem ChandraaBelum ada peringkat

- Chapter 1-The Indian Contract Act, 1872, Unit 1-Nature of ContractsDokumen10 halamanChapter 1-The Indian Contract Act, 1872, Unit 1-Nature of ContractsALANKRIT TRIPATHIBelum ada peringkat

- (Salim Ross) PUA 524 - Introduction To Law and The Legal System (Mid Term)Dokumen4 halaman(Salim Ross) PUA 524 - Introduction To Law and The Legal System (Mid Term)Salim RossBelum ada peringkat

- Atlanta Pipes and FittingsDokumen2 halamanAtlanta Pipes and Fittingsotadoyreychie31Belum ada peringkat

- Henderson PresentationDokumen17 halamanHenderson Presentationapi-577539297Belum ada peringkat

- 1.an Overview On Membrane Strategies For Rare Earths Extraction and Separation - 2017Dokumen36 halaman1.an Overview On Membrane Strategies For Rare Earths Extraction and Separation - 2017Vasile AlexandraBelum ada peringkat

- School readiness assessmentDokumen10 halamanSchool readiness assessmentJave Gene De AquinoBelum ada peringkat

- Genigraphics Poster Template 36x48aDokumen1 halamanGenigraphics Poster Template 36x48aMenrie Elle ArabosBelum ada peringkat

- Hope 03 21 22Dokumen3 halamanHope 03 21 22Shaina AgravanteBelum ada peringkat

- Food 8 - Part 2Dokumen7 halamanFood 8 - Part 2Mónica MaiaBelum ada peringkat

- User Manual: C43J890DK C43J892DK C49J890DK C49J892DKDokumen58 halamanUser Manual: C43J890DK C43J892DK C49J890DK C49J892DKGeorge FiruțăBelum ada peringkat

- Lesson Plan 160205 Jelly Snake PracticalDokumen7 halamanLesson Plan 160205 Jelly Snake Practicalapi-309206763Belum ada peringkat

- Chapter 12Dokumen52 halamanChapter 12Mr SaemBelum ada peringkat

- Aemses Sof Be LCP 2021 2022Dokumen16 halamanAemses Sof Be LCP 2021 2022ROMEO SANTILLANBelum ada peringkat

- Rostam's Seven LaboursDokumen3 halamanRostam's Seven LaboursArifin SohagBelum ada peringkat

- Stress-Busting Plan for Life's ChallengesDokumen3 halamanStress-Busting Plan for Life's Challengesliera sicadBelum ada peringkat

- Case Study On Global Branding - DuluxDokumen18 halamanCase Study On Global Branding - DuluxAakriti NegiBelum ada peringkat

- DX DiagDokumen42 halamanDX DiagVinvin PatrimonioBelum ada peringkat

- Female and Male Hacker Conferences Attendees: Their Autism-Spectrum Quotient (AQ) Scores and Self-Reported Adulthood ExperiencesDokumen25 halamanFemale and Male Hacker Conferences Attendees: Their Autism-Spectrum Quotient (AQ) Scores and Self-Reported Adulthood Experiencesanon_9874302Belum ada peringkat

- Macbeth Introduction0Dokumen40 halamanMacbeth Introduction0MohammedelamineBelum ada peringkat

- ICS Technical College Prospectus 2024 Edition 1Dokumen36 halamanICS Technical College Prospectus 2024 Edition 1samuel287kalumeBelum ada peringkat