Aeps XML H-H Specification Version 1.2

Diunggah oleh

Krishna TelgaveJudul Asli

Hak Cipta

Format Tersedia

Bagikan dokumen Ini

Apakah menurut Anda dokumen ini bermanfaat?

Apakah konten ini tidak pantas?

Laporkan Dokumen IniHak Cipta:

Format Tersedia

Aeps XML H-H Specification Version 1.2

Diunggah oleh

Krishna TelgaveHak Cipta:

Format Tersedia

AEPS XML H-H SPECIFICATION

Table of Contents

Table of Contents

Table of Contents _____________________________________________________________________________________________ 1

Introduction____________________________________________________________________________________ 3

1.1 Executive Summary ____________________________________________________________________________________3

1.2 Audience _________________________________________________________________________________________________3

1.3 Document Details ______________________________________________________________________________________3

AEPS Transactions on NPCI Network ______________________________________________________ 4

2.1 Architecture Diagram _________________________________________________________________________________4

2.2 Transaction Timeout Parameters ___________________________________________________________________4

Message Format _______________________________________________________________________________ 5

3.1 Authentication Transaction __________________________________________________________________________6

3.2 BFD transaction ________________________________________________________________________________________7

3.3 Demographic transaction _____________________________________________________________________________8

Data Element Definition _____________________________________________________________________ 9

Settlement and Reconciliation ___________________________________________________________ 18

References ____________________________________________________________________________________ 18

Sample Message Dumps ___________________________________________________________________ 18

NPCI AEPS (XML based) Interface Specification

NPCI © 2011 Confidential Page 1

Table of Contents

Documents Details

Author

Gaurav Garg

Initial Publish Date

10, Jan 2014

Version

1.2

Total Page number

Document classification

Confidential

Document History

Date Version Change

12/7/2013 1.0 Initial Draft Version 12/7/2013

14/8/2013 1.0 Addition of OTP service as separate service 14/8/2013

20/09/2013 1.1 Changes in MCC, Message Dumps 20/09/2013

Changes as per UIDAI Specs aadhaar_kyc_api_1_0_final.pdf

Additional Response Codes added.

10/01/2014 1.2 Response Message tag added to allow banks to see the reason 10/01/2014

for failure. Can be ignored by bank.

e-KYC and OTP transactions removed as separate specifications

are available.

Prepared By: Date

Gaurav Garg

Date

Reviewed By:

Suchet Shenoy

Approved By: Date

Sateesh Palagiri

NPCI AEPS (XML based) Interface Specification

NPCI 2011 Confidential Page 2

Introduction

Introduction

1.1 Executive Summary

National Payments Corporation of India (NPCI) is formed as an umbrella institution for all the retail payments

systems in the country. The core objective is to consolidate and integrate the multiple systems with varying

service levels into nation-wide uniform and standard business process for all retail payment systems. The other

objective was to facilitate an affordable payment mechanism to benefit the common man across the country

and help financial inclusion. Vision and formation of NPCI is backed by the regulator and Indian Banks

Association (IBA). NPCI has defined business lines to process in country interbank transactions for ATM, POS,

24x7 Remittance, ACH and CTS.

Government of India has initiated Unique Identification Project for citizens of India. It is envisaged to use the

UID schema and infrastructure for the financial inclusion in India. To enable the customers to use AADHAAR for

the financial transaction across the payment networks in the country, NPCI proposes to facilitate routing of

transactions to the central id repository of UIDAI for user authentication through a single interface.

This interface document is targeted to achieve inter-operability between banks for Aadhaar based payment

transactions. NPCI shall allow banks to connect using this interface. It is also possible that banks may position

their respective financial inclusion service provider to connect on their behalf to NPCI central infrastructure with

the respective member bank.

With the Introduction of XML it will be easy for the banks to formulate messages as compared to the complexity

involved in the formation of ISO 8583 message.

1.2 Audience

This document is a property of NPCI and should be not be circulated to external party without prior approvals

of NPCI management team.

This document will be circulated to NPCI management team, Technical Advisor Committee, Business user group

formed from member banks.

1.3 Document Details

Document defines the Interface Specifications between the Originator bank, NPCI and UIDAI for Authentication,

Best Finger Detection (BFD), Demographic Transaction and e-KYC.

NPCI AEPS (XML based) Interface Specification

NPCI © 2011 Confidential Page 3

AEPS Transactions on NPCI Network

AEPS Transactions on NPCI Network

Transactions will be supported by NPCI AEPS system as follows:

1. AEPS Authentication - Onus

2. Best Finger Detection (BFD) Transaction

3. Demographic Based Transaction

4. e-KYC (refer: e-KYC Interface Specification Version 1.3)

5. OTP (refer: e-KYC Interface Specification Version 1.3)

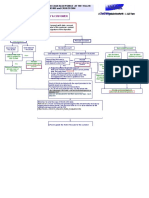

2.1 Architecture Diagram

(I) AEPS Intra-Bank Transaction Flow (Authentication, BFD, Demographic, e-KYC, OTP )

Figure 1

2.2 Transaction Timeout Parameters

1. The Timeout parameter between NPCI and UIDAI server is 10 seconds i.e. NPCI will wait for 10 seconds for

the response from UIDAI server after sending a request. After 10 seconds a declined response will be sent

back to the Acquirer system.

2. The Timeout parameter between Issuer switch and NPCI is 20 seconds i.e. after 20 seconds a declined

response will be sent back to the Acquirer system by NPCI.

3. The Timeout parameter on the Acquirer switch should be around 30 seconds i.e. if the Acquirer system

doesn’t receive response from NPCI, Acquirer system should send a declined response to the Originating

channel.

NPCI AEPS (XML based) Interface Specification

NPCI 2011 Confidential Page 4

Message Format

4. The Timeout parameter on the Originating channel should be around 90 seconds i.e. if the Originating

system doesn’t receive response from Acquirer system, Originating channel should decline the transaction

and show appropriate message to the operator.

Message Format

This section deals with Request and Response Message in accordance to the transaction type which needs to be

followed by bank.

1. NPCI will form the final auth xml request by encoding the encrypted data received from bank.

2. For Demographic based transaction only <uses> tag will vary based on the scenario.

NPCI AEPS (XML based) Interface Specification

NPCI © 2011 Confidential Page 5

Message Format

3.1 Authentication Transaction

Authentication Request Authentication Response

<Request_auth> <Response_auth>

<TransactionInfo> <TransactionInfo>

<Pan></Pan> <Pan></Pan>

<Proc_Code></Proc_Code> <Proc_Code></Proc_Code>

<Transm_Date_time></ Transm_Date_time > <Transm_Date_time></ Transm_Date_time >

<Stan></Stan> <Stan></Stan>

<Local_Trans_Time></Local_Trans_Time> <Local_Trans_Time></Local_Trans_Time>

<Local_date></Local_date> <Local_date></Local_date>

<Mcc></Mcc> <AcqId></AcqId>

<Pos_entry_mode></Pos_entry_mode> <RRN></ RRN>

<Pos_code></Pos_code> <ResponseCode></ResponseCode>

<AcqId></AcqId> <ResponseMsg></ResponseMsg>

<RRN></ RRN> <CA_Tid></CA_Tid>

<CA_Tid></CA_Tid> <CA_ID></CA_ID>

<CA_ID></CA_ID> <CA_TA></CA_TA>

<CA_TA></CA_TA> </TransactionInfo>

</TransactionInfo> <AuthRes ret=”y|n” code=”” txn=”” err=”” ts=”” info=””>

<Auth uid=”” tid=”” ac=”” sa=”” ver=”” txn=”” lk=””> </AuthRes>

<Uses pi=”” pa=”” pfa=”” bio=”” bt=”” pin=”” otp=””/> </Response_auth>

<Tkn type=”” value=””/>

<Meta udc=”” fdc=”” idc=”” pip=”” lot=”G|P” lov=””/>

<Skey ci=”” ki=””>encrypted and encoded session

key</Skey>

<Data type=”X|P”>encrypted & encoded PID

block</Data>

<Hmac>SHA-256 Hash of Pid block, encrypted and then

encoded</Hmac>

</Auth>

</Request_auth>

NPCI AEPS (XML based) Interface Specification

NPCI 2011 Confidential Page 6

Message Format

3.2 BFD transaction

BFD Request BFD Response

<Request_bfd> <Response_bfd>

<TransactionInfo> <TransactionInfo>

<Pan></Pan> <Pan></Pan>

<Proc_Code></Proc_Code> <Proc_Code></Proc_Code>

<Transm_Date_time></ Transm_Date_time > <Transm_Date_time></ Transm_Date_time >

<Stan></Stan> <Stan></Stan>

<Local_Trans_Time></Local_Trans_Time> <Local_Trans_Time></Local_Trans_Time>

<Local_date></Local_date> <Local_date></Local_date>

<Mcc></Mcc> <AcqId></AcqId>

<Pos_entry_mode></Pos_entry_mode> <RRN></ RRN>

<Pos_code></Pos_code> <ResponseCode></ResponseCode>

<AcqId></AcqId> <ResponseMsg></ResponseMsg>

<RRN></RRN> <CA_Tid></CA_Tid>

<CA_Tid></CA_Tid> <CA_ID></CA_ID>

<CA_ID></CA_ID> <CA_TA></CA_TA>

<CA_TA></CA_TA> </TransactionInfo>

</TransactionInfo> <BfdRes code=”” txn=”” err=”” ts=”” actn=”” msg=””>

<Bfd uid=”” tid=”” ac=”” sa=”” ver=”” txn=”” lk=””> <Ranks>

<Meta udc=”” fdc=”” pip=”” lot=”G|P” lov=””/> <Rank pos=”” val=””/>

<Skey ci=”” ki=””>encrypted and encoded session </Ranks>

key</Skey> </BfdRes>

<Data type=”X|P”>encrypted RBD block</Data> </Response_bfd>

<Hmac>SHA-256 Hash of RBD block, encrypted and then

encoded </Hmac>

</Bfd>

</Request_bfd>

NPCI AEPS (XML based) Interface Specification

NPCI © 2011 Confidential Page 7

Message Format

3.3 Demographic transaction

Demographic Request Demographic Response

<Request_demo> <Response_demo>

<TransactionInfo> <TransactionInfo>

<Pan></Pan> <Pan></Pan>

<Proc_Code></Proc_Code> <Proc_Code></Proc_Code>

<Transm_Date_time></ Transm_Date_time > <Transm_Date_time></ Transm_Date_time >

<Stan></Stan> <Stan></Stan>

<Local_Trans_Time></Local_Trans_Time> <Local_Trans_Time></Local_Trans_Time>

<Local_date></Local_date> <Local_date></Local_date>

<Mcc></Mcc> <AcqId></AcqId>

<Pos_entry_mode></Pos_entry_mode> <RRN></ RRN>

<Pos_code></Pos_code> <ResponseCode></ResponseCode>

<AcqId></AcqId> <ResponseMsg></ResponseMsg>

<RRN></ RRN> <CA_Tid></CA_Tid>

<CA_Tid></CA_Tid> <CA_ID></CA_ID>

<CA_ID></CA_ID> <CA_TA></CA_TA>

<CA_TA></CA_TA> </TransactionInfo>

</TransactionInfo> <AuthRes ret=”y|n” code=”” txn=”” err=”” ts=””

<Auth uid=”” tid=”” ac=”” sa=”” ver=”” txn=”” lk=””> info=””>

<Uses pi=”” pa=”” pfa=”” bio=”” bt=”” pin=”” otp=””/> </AuthRes>

<Tkn type=”” value=””/> </Response_demo>

<Meta udc=”” fdc=”” idc=”” pip=”” lot=”G|P” lov=””/>

<Skey ci=”” ki=””>encrypted and encoded session

key</Skey>

<Data type=”X|P”>encrypted & encoded PID

block</Data>

<Hmac>SHA-256 Hash of Pid block, encrypted and then

encoded</Hmac>

</Auth>

</Request_demo>

NPCI AEPS (XML based) Interface Specification

NPCI 2011 Confidential Page 8

Data Element Definition

Data Element Definition

Elements Description

Request Primary Root Element of the input XML request.

(Mandatory)

Transactioninfo Attributes

(Mandatory) PAN: Aadhaar Number of the resident (mandatory)

Format: LLVAR

Type n..19

PAN must be populated with the combination of IIN and the resident Aadhaar

number.

B B B B B B I U U U U U U U U U U U U

1 2 3 4 5 6 7 8 9 10 11 12 13 14 15 16 17 18 19

B – Acquirer ID/IIN : for Authentication, Demographic, BFD services

I – Indicator for UID – valid value 0 for AEPS.

U – Unique Identification Number of customer issued by UIDAI

Note: As for non-banking entities IIN is not issues, they must use Acquirer ID for

the first 6 digit of PAN.

Proc_Code: Processing Code (mandatory)

Format: Fixed

Type:n6

A series of digits that describes the type of transaction and the accounts affected

by the transaction.

It consists of three, two-digit sub fields:

Digit 1 and 2: Transaction Code

01 Cash withdrawal

10 Biometric Verification (UID Biometric data verification/Authentication) for ONUS

21 Deposits

31 Balance inquiry

90 Fund Transfer with DE 120-tag 001-45

11 Best Finger Detection

12 Demographic Authentication

NPCI AEPS (XML based) Interface Specification

NPCI © 2011 Confidential Page 9

Data Element Definition

Elements Description

Digit 3 and 4: From Account Type*

00 Unspecified/unknown

10 Savings

20 Checking

30 Credit card

Digit 5 and 6: To Account Number*

00 Unspecified/unknown

10 Savings

20 Checking

30 Credit card

Transm_Date_time: Transmission Date (mandatory)

Format: Fixed

Type: n10 MMDDhhmmss

It is the date and time when a transaction request was transmitted by a processing

entity. It is represented in GMT/UTC.

Stan: System Trace Audit Number (mandatory)

Format: Fixed

Type: n6

It is the unique identifier assigned to each transaction by the acquirer bank switch.

It must be different for every transaction even for multiple set of transactions

originated at the same time

Local_Trans_Time : Local Transaction Time (mandatory)

Format: Fixed -hhmmss

Type: n6

Local Transaction Time will be passed in the XML Request message. The local time at

which the transaction began from initiated device location. When a request

originates from bank; it is assumed that the content of this attribute is the terminal

local time.

NPCI AEPS (XML based) Interface Specification

NPCI 2011 Confidential Page 10

Data Element Definition

Elements Description

Local_date : Local Date (mandatory)

Format: Fixed - MMDD

Type: n4

Date, Local Transaction is the local month and day on which Transaction takes place

at the point of service. It is the same to be printed on receipt.

Mcc : Merchant Category Code (mandatory)

Format: Fixed

Type: n4

Description: Contains a 4 digit code describing a merchant’s type of business

Refer to ISO 18245 for list of MCC.

Pos_entry_mode : Point of Service Entry Mode (mandatory)

Format: Fixed

Type: n3

Description: The code describes the way how PAN and PIN are entered at a touch

point.

Data element consists of two sub-fields:

PAN Entry Mode

01 Manual

02 Magnetic stripe read.

05 ICC.

90 Full and unaltered magnetic stripe read (enables CVV validation).

PIN Entry Mode

0 Unspecified.

1 PIN entry capability (OTP transaction)

2 No PIN entry capability.

6 PIN pad inoperative.

9 Reserved for private use (Biometric entry capability)

NPCI AEPS (XML based) Interface Specification

NPCI © 2011 Confidential Page 11

Data Element Definition

Elements Description

Pos_code : Point of Service Condition Code (mandatory)

Format: Fixed

Type: n2

Description: Two-digit code indicating conditions at touch point:

00 Normal

01 Customer not present.

02 Unattended terminal (CAT, ADM)

03 Merchant suspicious.

05 Customer present, card not present.

AcqId : Acquirer ID (mandatory)

Format: LLVAR

Type: n..11

Identifies the acquiring institution from where the request has been initiated.

This ID will be allotted by NPCI.

RRN : Retrieval Request Number (mandatory)

Format: Fixed

Type: an12

The reference, assigned by the acquirer, to identify a transaction uniquely. It remains

unchanged for all messages throughout the life of a transaction and is used for

matching original message with reversal and/or store/forward messages.

The standard format of RRN is as follows: YDDDHHSSSSSS

Y – Year (last digit of current year)

DDD – Julian date of transaction

HH – Hour of transaction (‘HH’ should be derived from Local_Trans_Time .)

SSSSSS – STAN (same as STAN passed in kyc Request)

ResponseCode: Response Code (mandatory in Response)

Format: Fixed

Type: an2

Denotes the status of the transaction with appropriate response codes.

NPCI AEPS (XML based) Interface Specification

NPCI 2011 Confidential Page 12

Data Element Definition

Elements Description

NPCI UIDAI

Sr.

Error Error Description

No.

Code Code

1 00 - Successful Transaction

NPCI doesn’t get any response from Issuer after sending the

2 91 -

request

3 92 - Invalid IIN entered at Terminal (IIN not present in routing table)

Correct Aadhaar No. and correct IIN entered at terminal (IIN

4 52 - present in routing table). Account number is not present in CBS.

Transaction declined by Issuer.

Insufficient Fund available in Resident’s account. Transaction

5 51 -

declined by Issuer.

Account blocked by Issuer/Regulator for AML or any other

6 57 -

appropriate reasons

7 AY - Aggregate of all credits in a financial year exceed Rs 1 Lakh

Aggregate of all withdrawals and transfers in a month exceeds

8 AM -

Rs. 10,000

9 AB - Account Balance exceeds rupees fifty thousand

10 M4 - Remittance from/to Foreign/NRE Accounts

Transaction amount exceeded limit, transaction is declined by

11 UW -

Issuer.

Net Debit Cap limit is exhausted for member bank. Transaction is

12 M6 -

declined by NPCI.

User should be allowed to re- enter his/her personal information

13 U1 100 attributes like name, lname, gender, dob, dobt, age, phone, email

whichever is used for authentication in application

14 U2 200 Address attribute of demographic details does not match

15 U3 300 Biometric data did not match

16 U4 500 Encryption of session key is invalid

17 U5 510 Invalid Auth XML format / Invalid BFD XML format

18 U6 520 Invalid device

19 U7 530 Invalid authenticator code /AUA code

20 U8 540 Invalid Auth XML version/ Invalid BFD XML version

21 U9 550 Invalid “Uses” element attribute

22 UA 700 Invalid demographic data

NPCI AEPS (XML based) Interface Specification

NPCI © 2011 Confidential Page 13

Data Element Definition

Elements Description

23 UB 710 Missing “Pi” data as specified in “Uses”

24 UC 720 Missing “Pa” data as specified in “Uses

25 UD 730 Missing PIN data as specified in “Uses”

26 UE 999 Unknown error

27 UF 740 Missing OTP data as specified in “Uses”

Invalid biometric data. AUA to review biometric device used and

28 UG 800

whether templates are ISO complaint

29 UH 810 Missing biometric data as specified in “Uses”

Time Out for the request sent to UIDAI from NPCI beyond 10

30 UI -

seconds (like response not received for Authentication Request

31 UJ 721 Missing "Pfa" data as specified in "Uses" element

32 UK 820 Missing or empty value for "bt" attribute in "Uses" element

33 UL 821 Invalid value in the "bt" attribute of "Uses" element

No auth factors found in auth request. This corresponds to

34 UM 901 scenario wherein all the 3 factors - Pin, Demo and Bios - are not

present in Auth request

Invalid "dob" value in "Pi" element. Invalid dates are one which

are not of the format YYYY or YYYY-MM-DD, or have a year value

35 UN 902 such that residents age is less than 0 or more than 150 years, or

contains value which cannot be parsed e.g. alphabetic strings,

invalid dates such as 31-Feb, etc

Invalid "mv" value in "Pi" element. This error is returned if mv

36 UO 910

value is not a numeric value or is not in the allowed range.

Invalid "mv" value in "Pfa" element .This error is returned if mv

37 UP 911

value is not a numeric value or is not in the allowed range.

38 UQ 912 Invalid "ms" value in "Pa" (If match strategy other than E is used)

39 UR 913 Both Pa and Pfa are present (Pa and Pfa are mutually exclusive)

40 US 930 Technical error category 1 (Related to ABIS interactions)

Technical error category 2 (Internal to auth server such as

41 UT 931

Database server down, etc.)

Technical error category 3 (Error if audit XML could not be

42 UU 932 published to audit queue, or if audit XML could not be

constructed)

Unsupported option (At present, this error is returned if OTP is

43 UV 980

used which is yet to be implemented)

44 UY 511 Invalid PID XML format / Invalid RBD XML

45 UZ 940 Unauthorized ASA channel

46 U0 941 Unspecified ASA channel

NPCI AEPS (XML based) Interface Specification

NPCI 2011 Confidential Page 14

Data Element Definition

Elements Description

Request expired (“Pid->ts” or “Rbd->ts” value is older than N

47 V0 561

hours where N is a configured threshold in authentication server)

Timestamp value is future time (value specified “Pid->ts” or

48 V1 562 “Rbd->ts” is ahead of authentication server time beyond

acceptable threshold)

Duplicate request (this error occurs when exactly same

49 V2 563

authentication request was re-sent by AUA)

50 V3 564 HMAC Validation failed

51 V4 565 License key has expired

52 V5 566 Invalid license key

Invalid input (this error occurs when some unsupported

53 V6 567 characters were found in Indian language values, “lname” or

“lav”)

54 V7 568 Unsupported language

55 V8 569 Digital signature verification failed

Invalid key info in digital signature (this means that certificate

used for signing the Authentication request or BFD request is not

56 V9 570

valid – it is either expired, or does not belong to the AUA or is not

created by a well-known Certification Authority)

PIN Requires reset (this error will be returned if resident is using

57 VA 571

the default PIN which needs to be reset before usage)

Invalid biometric position (This error is returned if biometric

position value - “pos” attribute in “Bio” element - is not

58 VB 572

applicable for a given biometric type - “type” attribute in “Bio”

element.)

59 VC 573 Pi usage not allowed as per license

60 VD 574 Pa usage not allowed as per license

61 VE 575 Pfa usage not allowed as per license

62 VF 576 FMR usage not allowed as per license

63 VG 577 FIR usage not allowed as per license

64 VH 578 IIR usage not allowed as per license

65 VI 579 OTP usage not allowed as per license

66 VJ 580 PIN usage not allowed as per license

67 VK 581 Fuzzy Matching usage not allowed as per license

68 VL 582 Local language usage not allowed as per license

69 VM 934 Technical error category 4

70 VN 935 Technical error category 5

71 VO 936 Technical error category 6

72 VP 937 Technical error category 7

73 VQ 938 Technical error category 8

74 VR 939 Technical error category 9

75 VS 811 Missing biometric data in CIDR for given AADHAAR

NPCI AEPS (XML based) Interface Specification

NPCI © 2011 Confidential Page 15

Data Element Definition

Elements Description

76 VT 501 Invalid certificate identifier in “ci” attribute of “Skey”.

Invalid encryption of Pid in authentication transaction / Invalid

77 VU 502

encryption of Rbd in BFD transaction

78 VV 503 Invalid encryption of Hmac

79 VW 542 AUA not authorized for ASA.

80 VX 543 Sub-AUA not associated with “AUA”

81 VY 541 Invalid PID XML version/ Invalid BFD XML version

82 VZ 311 Duplicate Irises used.

83 W0 312 FMR and FIR cannot be used in same transaction

84 W1 313 Single FIR record contains more than one finger

85 W2 314 Number of FMR/FIR should not exceed 10

86 W3 315 Number of IIR should not exceed 2

87 W4 504 Session key re-initiation required due to expiry or key out of sync

88 W5 812 Best finger detection not done

89 W6 310 Duplicate fingers used

90 W7 584 Invalid Pin code in Meta element

91 W8 585 Invalid Geo code in Meta element

92 W9 400 "OTP" validation failed

93 X0 401 "Tkn" validation failed

94 X1 505 Synchronized Skey usage is not allowed

95 X2 521 Invalid Finger device

96 X3 522 Invalid Iris device

97 X4 700 Invalid demographic data

98 X5 583 Best finger detection not allowed as per license

99 20 - Error code not defined by UIDAI & not present at NPCI

100 X6 993 Technical error category 3

Aadhaar number status is either lost, deceased etc. and currently

101 X7 997

not active.

If client level validations are done then Aadhaar number does not

102 X8 998

exist in CIDR.

103 54 - Validity of customer’s card has expired.

104 36 - Customers card has been marked as Lost/Stolen by Issuer bank

105 41 - Customers card has been restricted by Issuer bank

106 20 - Format Error

NPCI AEPS (XML based) Interface Specification

NPCI 2011 Confidential Page 16

Data Element Definition

Elements Description

ResponseMsg: Response Message (mandatory in Response)

Format: Variable

Type: an..80

Mandatory element in the response.

CA_Tid : Terminal Identification (mandatory)

Format: Fixed

Type: n8

It should carry value “public” in the request for all transactions originated from a

device unregistered at UIDAI data base. For devices recognized by UIDAI, this code

will be allotted by UIDAI the data element is mandatory.

NOTE: ‘ public’ must be left padded with two spaces making it 8 digit value.

CA_ID : Card Acceptor Identification Code (mandatory)

Format: Fixed

Type: ans15

This is a unique code for the device assigned within the Bank domain.

Character 1-15 Unique Device Code, first 3 digits should have Bank code and last 12

digits should be Unique terminal code allotted to every device by the bank. If the

terminal code is less than 15 digits, the terminal code should be left padded with

zeros to make it 15 digits.

CA_TA : Terminal Address (mandatory)

Format: Fixed

Type: an40

The name and location of the acceptor (Touch Point) where the Request has been

initiated.

Character 1-23 Merchant Name &Address / Bank Correspondent Name &Address

Character 24-36 City Name

Character 37-38 State

Character 39-40 Country Code (IN)

NPCI AEPS (XML based) Interface Specification

NPCI © 2011 Confidential Page 17

Settlement and Reconciliation

Settlement and Reconciliation

Settlement of these transactions will be performed in the NPCI Dispute Management System and Daily

Settlement Report will be provided to member banks. Switching Fee will be applicable as per the guidance.

Please refer to AEPS Dispute & Settlement Handling Guidelines for detailed information on settlement &

Reconciliation.

References

UIDAI released Documents which needs to be referred for Encryption Logics and parameters are explained

which need to be passed while forming the Auth message based on Transaction

aadhaar_authentication_api_1_6

aadhaar_otp_request_api_1_5

aadhaar_BFD_request_api_1_6

Sample Message Dumps

1. Sample Authentication Transaction

<Request_auth>

<TransactionInfo>

<Pan>607066*********2521</Pan>

<Proc_Code>100000</Proc_Code>

<Transm_Date_time>0726094813</ Transm_Date_time >

<Stan>206661</Stan>

<Local_Trans_Time>151813</Local_Trans_Time>

<Local_date> 0726< /Local_date>

<Mcc>6012</Mcc>

<Pos_entry_mode>019</Pos_entry_mode>

<Pos_code>05</Pos_code>

<AcqId>200002 </AcqId>

<RRN>320715206661</ RRN>

<CA_Tid> public</CA_Tid>

<CA_ID>UCO000000006000</CA_ID>

<CA_TA>CSB, NERUL MUMBAI MHIN</CA_TA>

</TransactionInfo>

NPCI AEPS (XML based) Interface Specification

NPCI 2011 Confidential Page 18

Sample Message Dumps

<Auth uid=”xxxxxxxxxxxxxx” tid=”public” ac=”STGAND0001” sa=”STGAND0001” ver=”1.6” txn=”206661”

lk="xxxxxxxxxxxxxxxxxxxxxxxx”>

<Uses pi=”n” pa=”n” pfa=”n” bio=”y” bt=”FMR” pin=”n” otp=”n”/>

<Tkn type=”” value=””/> -----------------------------no need to pass

<Meta udc=”UCO000000006000” fdc=”NC” idc=”NC” pip=”61.246.255.104” lot=”P” lov=”582101”/>

<Skey ci=”20151110">xxxxxxxxxxxxxxxxxxxxxxxxx</Skey>

<Data type=”P”>xxxxxxxxxxxxxxxxxxxxxxxxx</Data>

<Hmac>xxxxxxxxxxxxxxxxxxxx</Hmac>

</Auth>

</Request_auth>

===================================================================================================

<Response_auth>

<TransactionInfo>

<Pan>607066*********2521</Pan>

<Proc_Code>100000</Proc_Code>

<Transm_Date_time>0726094813</ Transm_Date_time >

<Stan>206661</Stan>

<Local_Trans_Time>151813</Local_Trans_Time>

<Local_date> 0726 /Local_date>

<AcqId>200002 </AcqId>

<RRN>320715206661</ RRN>

<Responsecode>00</Responsecode>

<ResponseMsg>Successful</ResponseMsg>

<CA_Tid> public</CA_Tid>

<CA_ID>UCO000000006000</CA_ID>

<CA_TA>CSB, NERUL MUMBAI MHIN</CA_TA>

</TransactionInfo>

<AuthRes ret=”y” code=”5b5b358eeda841178e6fc1767a8889c2” txn=”206661” ts=”2013-07-29T17:52:58.416+05:30”

info=”018135079812146d886e50bede5ea318e1490e84de6bec697ed7b694961ddeba3d917d5f5a33ab5f6aed0395d2bc0

a4e5df61d92441ea8d77b0952c01bc8aa8bde0100002000000”>

</AuthRes>

</Response_auth>

2. Sample BFD Transaction

NPCI AEPS (XML based) Interface Specification

NPCI © 2011 Confidential Page 19

Sample Message Dumps

<Request_bfd>

<TransactionInfo>

<Pan>607066*********2521</Pan>

<Proc_Code>110000</Proc_Code>

<Transm_Date_time>0726094813</ Transm_Date_time >

<Stan>206661</Stan>

<Local_Trans_Time>151813</Local_Trans_Time>

<Local_date> 0726 /Local_date>

<Mcc>6012</Mcc>

<Pos_entry_mode>019</Pos_entry_mode>

<Pos_code>05</Pos_code>

<AcqId>200002 </AcqId>

<RRN>320715206661</ RRN>

<CA_Tid> public</CA_Tid>

<CA_ID>UCO000000006000</CA_ID>

<CA_TA>CSB, NERUL MUMBAI MHIN</CA_TA>

</TransactionInfo>

<Bfd uid=”xxxxxxxxxxxxxx” tid=”public” ac=”STGCORPBNK” sa=”STGCORPBNK” ver=”1.6"txn=”206661”

lk=”xxxxxxxxxxxxxxxxxxxxxxxxxxxxxxx”>

<Meta udc=”UCO000000006000” fdc=”INTF88INN” pip=”NA” lot=”P” lov=”560064”/>

<Skey ci=”20151110” >xxxxxxxxxxxxxxxxxxxxxxxxxxxxxxx</Skey>

<Data type=”P”>xxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxx</Data>

<Hmac>xxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxx</Hmac>

</Bfd>

</Request_bfd>

==================================================================================================

<Response_bfd>

<TransactionInfo>

<Pan>607066*********2521</Pan>

<Proc_Code>110000</Proc_Code>

<Transm_Date_time>07260 94813</ Transm_Date_time >

<Stan>206661</Stan>

<Local_Trans_Time>151813</Local_Trans_Time>

<Local_date> 0726 /Local_date>

<AcqId>200002 </AcqId>

<RRN>320715206661</ RRN>

<Responsecode>00</Responsecode>

<ResponseMsg>Successful</ResponseMsg>

NPCI AEPS (XML based) Interface Specification

NPCI 2011 Confidential Page 20

Sample Message Dumps

<CA_Tid> public</CA_Tid>

<CA_ID>UCO000000006000</CA_ID>

<CA_TA>CSB, NERUL MUMBAI MHIN</CA_TA>

</TransactionInfo>

<BfdRes code=”” txn=”206661” ts=”2013-07-29T17:52:58.416+05:30” actn=”00” msg=”No action necessary”>

<Ranks>

<Rank pos="RIGHT_INDEX" val="-1"/><Rank pos="LEFT_MIDDLE" val="7"/><Rank pos="LEFT_THUMB" val="6"/><Rank

pos="LEFT_RING" val="5"/><Rank pos="RIGHT_LITTLE" val="8"/><Rank pos="RIGHT_RING"

val="4"/><Rankpos="RIGHT_MIDDLE" val="3"/><Rank pos="RIGHT_THUMB" val="2"/><Rank pos="LEFT_LITTLE"

val="9"/><Rank pos="LEFT_INDEX" val="11"/>

</Ranks>

</BfdRes>

</Response_bfd>

3. Sample Demographic Transaction

<Request_demo>

<TransactionInfo>

<Pan>6070950xxxxxxxxxx49</Pan>

<Proc_Code>120000</Proc_Code>

<Transm_Date_time>1226061400</Transm_Date_time>

<Stan>000539</Stan>

<Local_Trans_Time>114400</Local_Trans_Time>

<Local_date>1226</Local_date>

<Mcc>6012</Mcc>

<Pos_entry_mode>010</Pos_entry_mode>

<Pos_code>05</Pos_code>

<AcqId>200000</AcqId>

<RRN>336011000539</RRN>

<CA_Tid> public</CA_Tid>

<CA_ID>IDD919999999999</CA_ID>

<CA_TA>IDBIBANK C.B.D BELAPUR NAVI MUMBAI MHIN</CA_TA>

</TransactionInfo><Auth uid="xxxxxxxxxx49" tid="public" ac="STGGGGG001" sa="STGGGGG001" ver="1.6" txn="000539"

lk=" xxxxxxxxxxxxxxxxxxxxxxxxx ">

<Meta udc="IDD919999999999" fdc="NC" idc="NC" pip="192.168.141.9" lot="P" lov="400614" />

<Skey ci="20151110"> xxxxxxxxxxxxxxxxxxxxxxxxx </Skey>

<Uses otp="n" pin="n" pi="y" pa="n" pfa="n" bio="n" />

<Data type="X"> xxxxxxxxxxxxxxxxxxxxxxxxx </Hmac></Auth></Request_demo>

NPCI AEPS (XML based) Interface Specification

NPCI © 2011 Confidential Page 21

Sample Message Dumps

==================================================================================================

<Response_demo>

<TransactionInfo>

<Pan>6070950xxxxxxxx49</Pan>

<Proc_Code>120000</Proc_Code>

<Transm_Date_time>1226061400</Transm_Date_time>

<Stan>000539</Stan>

<Local_Trans_Time>114400</Local_Trans_Time>

<Local_date>1226</Local_date>

<AcqId>200035</AcqId>

<RRN>336011000539</RRN>

<ResponseCode>00</ResponseCode>

<ResponseMsg>Successful</ResponseMsg>

<CA_Tid> public</CA_Tid>

<CA_ID>IDD919999999999</CA_ID>

<CA_TA>IDBIBANK C.B.D BELAPUR NAVI MUMBAI MHIN</CA_TA>

</TransactionInfo>

<AuthRes ret="y" code="03bd3c2e8f344d91bb554892e7052702" txn="000539"

info="01a02ab898e48c7ad66b0bd6d976d236ccd93c340826a1578651685c151865882c63af88988e17b86b21572449d276

87ed9d86ceb8b7003c25ec77c52f84bf9f15190000000000" ts="2013-12-26T11:44:06.189+05:30"/>

</Response_demo>

NPCI AEPS (XML based) Interface Specification

NPCI 2011 Confidential Page 22

Anda mungkin juga menyukai

- NACH File Process For BanksDokumen24 halamanNACH File Process For BanksvigneshBelum ada peringkat

- DDS File Format & ArchitectureDokumen14 halamanDDS File Format & ArchitectureSalmanFatehAliBelum ada peringkat

- Short CircuitDokumen4 halamanShort CircuitShashi NaganurBelum ada peringkat

- PCC SoW GHB v2.0Dokumen14 halamanPCC SoW GHB v2.0jch bpcBelum ada peringkat

- BASE24 DR With AutoTMF and RDF WhitepaperDokumen38 halamanBASE24 DR With AutoTMF and RDF WhitepaperMohan RajBelum ada peringkat

- 3.11 Changes To Visa Settlement Service Reporting For Load and Reload TransactionsDokumen15 halaman3.11 Changes To Visa Settlement Service Reporting For Load and Reload TransactionsYasir RoniBelum ada peringkat

- Mosque BOQDokumen17 halamanMosque BOQHossam Al-Dein Mostafa HelmyBelum ada peringkat

- ISO 8583 A Layman's GuideDokumen7 halamanISO 8583 A Layman's GuideFaisal BasraBelum ada peringkat

- RRBs IN AEPSDokumen20 halamanRRBs IN AEPSKáúśtúbhÇóólBelum ada peringkat

- TM1600 ManualDokumen28 halamanTM1600 ManualedgarcooBelum ada peringkat

- AEPS Interface Specifications Version 5.2 - 20042018 PDFDokumen100 halamanAEPS Interface Specifications Version 5.2 - 20042018 PDFKiran Dummy100% (1)

- Jcard Internals PDFDokumen27 halamanJcard Internals PDFAshu ChaudharyBelum ada peringkat

- 0412 - Dispute Resolution Form - FraudDokumen3 halaman0412 - Dispute Resolution Form - FraudKrishna TelgaveBelum ada peringkat

- L P - The Dear Departed-Drama-10thDokumen5 halamanL P - The Dear Departed-Drama-10thVritika Shorie100% (2)

- BPC - ER - A1N0170 - Acleda - Fraud Managent v1.0Dokumen54 halamanBPC - ER - A1N0170 - Acleda - Fraud Managent v1.0jch bpcBelum ada peringkat

- Risk and Compliance Framework - v2 - July20Dokumen25 halamanRisk and Compliance Framework - v2 - July20hospetBelum ada peringkat

- PRIME Issuer Transactions V1.1Dokumen44 halamanPRIME Issuer Transactions V1.1Sivakumar VeerapillaiBelum ada peringkat

- IMPS ReconciliationDokumen6 halamanIMPS ReconciliationAmey More100% (1)

- UPI QR Code AcceptanceDokumen22 halamanUPI QR Code AcceptanceIssaBelum ada peringkat

- Transaction Acceptance Device Guide TADG V3 - 1 - November - 2016 PDFDokumen272 halamanTransaction Acceptance Device Guide TADG V3 - 1 - November - 2016 PDFNirvana Munar MenesesBelum ada peringkat

- JposDokumen53 halamanJposRafael Balest100% (1)

- UPI For Businesses BrochureDokumen8 halamanUPI For Businesses BrochuretyagigaBelum ada peringkat

- Case - Study On Recruitment and SelectionDokumen29 halamanCase - Study On Recruitment and SelectionDonasian Mbonea Elisante Mjema100% (1)

- Cybersecurity ComplianceDokumen11 halamanCybersecurity Compliancetrial lang100% (1)

- Clear 2 PayDokumen2 halamanClear 2 PayJyoti KumarBelum ada peringkat

- Mastercard's 8-Digit BIN and 11-Digit Account Range Mandate FAQDokumen10 halamanMastercard's 8-Digit BIN and 11-Digit Account Range Mandate FAQKrishna TelgaveBelum ada peringkat

- UPI Certification Cases V2 7 - v17 P1Dokumen424 halamanUPI Certification Cases V2 7 - v17 P1Krishna TelgaveBelum ada peringkat

- Netc PG V1 7 170118Dokumen154 halamanNetc PG V1 7 170118PravinBelum ada peringkat

- Harnessing Technology Creating A Less Cash Society: Connect With UsDokumen32 halamanHarnessing Technology Creating A Less Cash Society: Connect With UsPunyabrata Ghatak100% (1)

- ArticleforPaymentsSystemsMagazine-13 11 05Dokumen14 halamanArticleforPaymentsSystemsMagazine-13 11 05Syed RazviBelum ada peringkat

- E-KYC Interface Specification Version 1.3Dokumen24 halamanE-KYC Interface Specification Version 1.3Krishna TelgaveBelum ada peringkat

- (Advances in Biochemical Engineering - Biotechnology 119) Takayuki Nishizaka (Auth.), Isao Endo, Teruyuki Nagamune (Eds.) - Nano - Micro Biotechnology (2010, Springer-Verlag Berlin Heidelberg) PDFDokumen271 halaman(Advances in Biochemical Engineering - Biotechnology 119) Takayuki Nishizaka (Auth.), Isao Endo, Teruyuki Nagamune (Eds.) - Nano - Micro Biotechnology (2010, Springer-Verlag Berlin Heidelberg) PDFAlejandra EscalonaBelum ada peringkat

- EMV CPS v1.1Dokumen104 halamanEMV CPS v1.1Hafedh Trimeche67% (3)

- Upi Certification Zone - User Manual For Banks : Document IdDokumen13 halamanUpi Certification Zone - User Manual For Banks : Document IdAmarjit Singh100% (1)

- EMV v4.3 Book 3 Application Specification 20120607062110791Dokumen230 halamanEMV v4.3 Book 3 Application Specification 20120607062110791Nadjib MammeriBelum ada peringkat

- RBI's Account Aggregator frameworkDokumen7 halamanRBI's Account Aggregator frameworkFrancis NeyyanBelum ada peringkat

- Transaction Processing Rules PDFDokumen313 halamanTransaction Processing Rules PDFDipanwita BhuyanBelum ada peringkat

- AEPS Interface Specification v2.7 PDFDokumen55 halamanAEPS Interface Specification v2.7 PDFSanjeev PaulBelum ada peringkat

- Procedural Guidelines AePS V2.0 PDFDokumen50 halamanProcedural Guidelines AePS V2.0 PDFRK CISABelum ada peringkat

- e-KYC and New Investor Process FlowDokumen32 halamane-KYC and New Investor Process FlowSneha Abhash SinghBelum ada peringkat

- UPI GuidelinesDokumen31 halamanUPI Guidelinespradyumna sisodiaBelum ada peringkat

- Sarvatra ISO 8583 Interface v1 - 1Dokumen29 halamanSarvatra ISO 8583 Interface v1 - 1santoshBelum ada peringkat

- Mobile Payment Service Enables 24/7 Fund Transfers via Mobile NumberDokumen10 halamanMobile Payment Service Enables 24/7 Fund Transfers via Mobile NumberRitesh KumarBelum ada peringkat

- NachDokumen8 halamanNachS GanesanBelum ada peringkat

- Procedural Guidelines1Dokumen69 halamanProcedural Guidelines1sburugulaBelum ada peringkat

- SOP BC Interoperability - Interface SpecificationsDokumen90 halamanSOP BC Interoperability - Interface SpecificationsutnfrbaBelum ada peringkat

- Ekyc PDFDokumen4 halamanEkyc PDFSandeep KumarBelum ada peringkat

- NPCI Magazine - TXN NXT Vol 2 - CollateralDokumen76 halamanNPCI Magazine - TXN NXT Vol 2 - CollateraldupeshBelum ada peringkat

- Cisp What To Do If CompromisedDokumen60 halamanCisp What To Do If CompromisedkcchenBelum ada peringkat

- TPD SWO IntegrationDokumen32 halamanTPD SWO Integrationmevrick_guyBelum ada peringkat

- National Payments Corporation of India NACH Project: June, 2020Dokumen10 halamanNational Payments Corporation of India NACH Project: June, 2020Karan Panchal100% (2)

- B2C API New VersionDokumen18 halamanB2C API New VersionAristote EngudiBelum ada peringkat

- Annexure - NACH Procedural Guidelines V 3.1Dokumen158 halamanAnnexure - NACH Procedural Guidelines V 3.1Pratim MajumderBelum ada peringkat

- Branch InterfaceDokumen81 halamanBranch Interfacemevrick_guy100% (1)

- Eracom HSMDokumen43 halamanEracom HSMEngineerrBelum ada peringkat

- TEUSERDokumen98 halamanTEUSERdsr_ecBelum ada peringkat

- Process of Cash AcceptanceDokumen5 halamanProcess of Cash AcceptanceJayakrishnaraj AJDBelum ada peringkat

- DigitalPaymentBook PDFDokumen76 halamanDigitalPaymentBook PDFShachi RaiBelum ada peringkat

- Paynimo IntegrationDocument v3.8Dokumen26 halamanPaynimo IntegrationDocument v3.8Ramsundhar Madhavan0% (1)

- UAEFTS P2P Payment FileDokumen45 halamanUAEFTS P2P Payment FileSalmanFatehAli0% (1)

- 80 Byte Population Guide - v15.94Dokumen216 halaman80 Byte Population Guide - v15.94HMBelum ada peringkat

- IMPS FAQsBankers PDFDokumen5 halamanIMPS FAQsBankers PDFAccounting & TaxationBelum ada peringkat

- RBI guidelines on inoperative savings accountsDokumen1 halamanRBI guidelines on inoperative savings accountsmkumar.itBelum ada peringkat

- How To Understand Payment Industry in BrazilDokumen32 halamanHow To Understand Payment Industry in BrazilVictor SantosBelum ada peringkat

- Aadhaar E-KYC-User Manual For Kiosk Ver 1.0Dokumen13 halamanAadhaar E-KYC-User Manual For Kiosk Ver 1.0Arjun NandaBelum ada peringkat

- 10 .Upi Oc 61Dokumen1 halaman10 .Upi Oc 61aloomatarBelum ada peringkat

- Guide To Payment Services in SLDokumen86 halamanGuide To Payment Services in SLTharuka WijesingheBelum ada peringkat

- Ethoca Merchant Data Provision API Integration Guide V 3.0.1 (February 13, 2019)Dokumen13 halamanEthoca Merchant Data Provision API Integration Guide V 3.0.1 (February 13, 2019)NastasVasileBelum ada peringkat

- Client Server Architecture A Complete Guide - 2020 EditionDari EverandClient Server Architecture A Complete Guide - 2020 EditionBelum ada peringkat

- 0682a Dispute Resolution Management Case Filing Form SMS Linked Case FilingDokumen1 halaman0682a Dispute Resolution Management Case Filing Form SMS Linked Case FilingKrishna TelgaveBelum ada peringkat

- CoreBDS Version1.1Dokumen10 halamanCoreBDS Version1.1Krishna TelgaveBelum ada peringkat

- 139a081220 VBASS At-a-GlanceDokumen1 halaman139a081220 VBASS At-a-GlanceKrishna TelgaveBelum ada peringkat

- 1185 Dispute Resolution Form PreCompliance ComplianceDokumen2 halaman1185 Dispute Resolution Form PreCompliance ComplianceKrishna TelgaveBelum ada peringkat

- AFA Relaxation SmallvalueDokumen2 halamanAFA Relaxation SmallvalueKrishna TelgaveBelum ada peringkat

- Aadhaar Registered Devices 2 0 09112016 PDFDokumen24 halamanAadhaar Registered Devices 2 0 09112016 PDFM KeerthanaBelum ada peringkat

- Fss SD Aeps TSP Interface XML V 1.4Dokumen55 halamanFss SD Aeps TSP Interface XML V 1.4Krishna TelgaveBelum ada peringkat

- MATM Test Plan DevDokumen241 halamanMATM Test Plan DevKrishna TelgaveBelum ada peringkat

- Frequently Asked Questions (FAQ's) : (As Per Section 2 (2) of The JJ (C&PC) Act, 2015)Dokumen12 halamanFrequently Asked Questions (FAQ's) : (As Per Section 2 (2) of The JJ (C&PC) Act, 2015)jannat00795Belum ada peringkat

- FAQ For ISO 20022 March 6Dokumen33 halamanFAQ For ISO 20022 March 6Krishna TelgaveBelum ada peringkat

- HPY NSDL POS Interface V1.0Dokumen43 halamanHPY NSDL POS Interface V1.0Krishna TelgaveBelum ada peringkat

- MPOS-Windows-SDK Programming Manual V1.5Dokumen22 halamanMPOS-Windows-SDK Programming Manual V1.5Krishna TelgaveBelum ada peringkat

- E-TICKET DETAILSDokumen3 halamanE-TICKET DETAILSKrishna TelgaveBelum ada peringkat

- Swasthya Kavach BrochureDokumen2 halamanSwasthya Kavach BrochureKrishna TelgaveBelum ada peringkat

- IRCTC Ticket Refund RulesDokumen12 halamanIRCTC Ticket Refund RulespolypolyyBelum ada peringkat

- 09 Chapter 03 PDFDokumen70 halaman09 Chapter 03 PDFKrishna TelgaveBelum ada peringkat

- CyberplatDokumen18 halamanCyberplatKrishna TelgaveBelum ada peringkat

- Rbs Datalink File Spec Iso8583 Format 9Dokumen15 halamanRbs Datalink File Spec Iso8583 Format 9Krishna TelgaveBelum ada peringkat

- The Bouncy Castle FIPS Java APIDokumen97 halamanThe Bouncy Castle FIPS Java APIKrishna TelgaveBelum ada peringkat

- AUA Go Live Checklist: SR No Activities AUADokumen1 halamanAUA Go Live Checklist: SR No Activities AUAKrishna TelgaveBelum ada peringkat

- Aadhaar Authentication Api 2 0 PDFDokumen36 halamanAadhaar Authentication Api 2 0 PDFKrishna TelgaveBelum ada peringkat

- Aadhaar Ekyc Api 2 0Dokumen16 halamanAadhaar Ekyc Api 2 0Krishna TelgaveBelum ada peringkat

- Bill of Materials for Gate ValveDokumen6 halamanBill of Materials for Gate Valveflasher_for_nokiaBelum ada peringkat

- Owner's Manual Safety Instructions Operating InstructionsDokumen16 halamanOwner's Manual Safety Instructions Operating InstructionsKevin CharlesBelum ada peringkat

- 2017-12-25 17:27:54Dokumen3 halaman2017-12-25 17:27:54Raghman JrBelum ada peringkat

- Bendix King Avionics SystemDokumen45 halamanBendix King Avionics SystemJavierBelum ada peringkat

- Mansoura University B07 Plumbing SubmittalDokumen139 halamanMansoura University B07 Plumbing SubmittalEslam MamdouhBelum ada peringkat

- The Changing Face of The NewsDokumen2 halamanThe Changing Face of The NewsYanaBelum ada peringkat

- Essays On AerodynamicsDokumen423 halamanEssays On AerodynamicsVyssion100% (1)

- Turan Balik - ResumeDokumen3 halamanTuran Balik - Resumeapi-250561031Belum ada peringkat

- 1 - Censorship Lesson Plan F451Dokumen4 halaman1 - Censorship Lesson Plan F451Julia MaturoBelum ada peringkat

- Mdoc ManualDokumen99 halamanMdoc ManualAlejandro PetaloniBelum ada peringkat

- Anshul BhelDokumen96 halamanAnshul BhelMessieurs Avinash PurohitBelum ada peringkat

- General DataDokumen8 halamanGeneral DataGurvinderpal Singh MultaniBelum ada peringkat

- Flow Through a Convergent-Divergent Duct ExperimentDokumen4 halamanFlow Through a Convergent-Divergent Duct ExperimentfongBelum ada peringkat

- BP Inv Interim ReportDokumen47 halamanBP Inv Interim Reportkhashi110Belum ada peringkat

- Dell Wireless Card Guide AddendumDokumen6 halamanDell Wireless Card Guide AddendumwazupecBelum ada peringkat

- 107-b00 - Manual OperacionDokumen12 halaman107-b00 - Manual OperacionJuan David Triana SalazarBelum ada peringkat

- Calculation Framework GuideDokumen126 halamanCalculation Framework GuidedeeptiakkaBelum ada peringkat

- Preliminary Hazard Identification: Session 3Dokumen19 halamanPreliminary Hazard Identification: Session 3Isabela AlvesBelum ada peringkat

- Data TP7CDokumen1 halamanData TP7CAkin Passuni CoriBelum ada peringkat

- Evadeee ReadmeDokumen11 halamanEvadeee Readmecostelmarian2Belum ada peringkat

- Southwire Mining Product CatalogDokumen32 halamanSouthwire Mining Product Catalogvcontrerasj72Belum ada peringkat

- Paytm Details - HistoryDokumen12 halamanPaytm Details - HistorySachin PoddarBelum ada peringkat

- Medium Voltage Surge Arresters Catalog HG 31.1 2017 Low Resolution PDFDokumen79 halamanMedium Voltage Surge Arresters Catalog HG 31.1 2017 Low Resolution PDFAnkur_soniBelum ada peringkat

- Patient in The Institute of Therapy and Rehabilitation of Pondok Pesantren Ibadurrahman Tenggarong Seberang)Dokumen10 halamanPatient in The Institute of Therapy and Rehabilitation of Pondok Pesantren Ibadurrahman Tenggarong Seberang)Fitri AzizaBelum ada peringkat