March Salary PDF

Diunggah oleh

omkassJudul Asli

Hak Cipta

Format Tersedia

Bagikan dokumen Ini

Apakah menurut Anda dokumen ini bermanfaat?

Apakah konten ini tidak pantas?

Laporkan Dokumen IniHak Cipta:

Format Tersedia

March Salary PDF

Diunggah oleh

omkassHak Cipta:

Format Tersedia

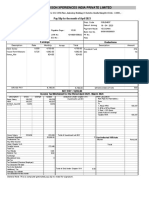

Infinx Services Pvt Ltd

Pay Slip for the month of March-2018

Employee Code : INFX01575 Payable Days : 31.00

Name : Mr. Omkar Sakharam Kotwadekar LWP : 0.00

Department : Pre-Authorization Mahape Arrear Days : 0.00

Designation : Pre Auth Analyst Bank Ac No. : '309002610621 (RATNAKAR BANK LIMITED)

PAN : BWKPK5618K PF No. : MH/42842/MH/42842/4425

Esi No. : 3413635153 UAN No. : 100944954723

Date Of Joining : 23 Sep 2016 Old Employee Id : N1065

Earnings Deductions

Description Rate Monthly Arrear Total Description Amount

Consolidated Salary 9056.00 9056.00 0.00 9056.00 PF 1087.00

HRA 453.00 453.00 0.00 453.00 PROF. TAX 300.00

Education Allowance 200.00 200.00 0.00 200.00

Conveyance Allowance 1600.00 1600.00 0.00 1600.00

PLVP 1800.00 0.00 1800.00

Special Allowance 9863.00 9863.00 0.00 9863.00

Variable 3000.00 0.00 3000.00

GROSS EARNINGS 21172.00 25972.00 0.00 25972.00 GROSS DEDUCTIONS 1387.00

Net Pay : 24,585.00

Net Pay in words : INR Twenty Four Thousand Five Hundred Eighty Five Only

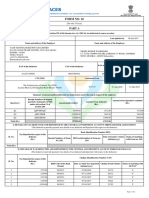

Income Tax Worksheet for the Period April 2017 - March 2018(Confirmed Investments)

Description Gross Exempt Taxable Deduction Under Chapter VI-A Taxable HRA Calculation(NON-METRO)

Consolidated Salary 100160.00 0.00 100160.00 Investments u/s 80C Exempted Qualifying Rent Paid 0.00

HRA 9330.00 0.00 9330.00 PROVIDENT FUND 12021.00 150000.00 From 01/04/2017

Education Allowance 2400.00 0.00 2400.00 To 31/03/2018

Conveyance Allowance 19200.00 19067.00 133.00 1. Actual HRA 0.00

Bonus 4689.00 0.00 4689.00 2. 40% or 50% of Basic 0.00

PLVP 18900.00 0.00 18900.00 3. Rent - 10% Basic 0.00

Overtime 1700.00 0.00 1700.00 Least of above is exempt 0.00

Special Allowance 110630.00 0.00 110630.00 Taxable HRA 9330.00

Variable 36765.00 0.00 36765.00

Attendance Reward 750.00 0.00 750.00

Referral Reward 2000.00 0.00 2000.00 TDS Deducted Monthly

Shift Allowance 4500.00 0.00 4500.00 Month Amount

Canteen Allowance 2000.00 0.00 2000.00 April-2017 0.00

May-2017 0.00

June-2017 0.00

July-2017 0.00

Gross 313024.00 19067.00 293957.00 Total of Investments u/s 80C 12021.00 150000.00 August-2017 0.00

Deductions U/S 80C 12021.00 150000.00 September-2017 0.00

Previous Employer Taxable Income 0.00 Total of Ded Under Chapter VI-A 12021.00 150000.00 October-2017 0.00

Professional Tax 2500.00 November-2017 0.00

Under Chapter VI-A 12021.00 December-2017 0.00

Any Other Income 0.00 January-2018 0.00

Taxable Income 279440.00 February-2018 0.00

Total Tax 0.00 March-2018 0.00

Marginal Relief 0.00 Tax Deducted on Perq. 0.00

Tax Rebate 0.00 Total 0.00

Surcharge 0.00

Tax Due 0.00

Educational Cess 0.00

Net Tax 0.00

Tax Deducted (Previous Employer) 0.00

Tax Deducted on Perq. 0.00

Tax Deducted on Any Other Income. 0.00

Tax Deducted Till Date 0.00

Tax to be Deducted 0.00

Tax/Month 0.00 Total of Any Other Income 0.00

Tax on Non-Recurring Earnings 0.00

Tax Credit Amount (87A) 2500.00

Tax Deduction for this month 0.00

..................................................... Cut Here .....................................................

Personal Note: This is a system generated payslip, does not require any signature.

Anda mungkin juga menyukai

- CRM Services Payslip for September 2021Dokumen1 halamanCRM Services Payslip for September 2021Phagun BehlBelum ada peringkat

- Dec07 PDFDokumen1 halamanDec07 PDFomkassBelum ada peringkat

- SRL Limited: Payslip For The Month of JANUARY 2019Dokumen1 halamanSRL Limited: Payslip For The Month of JANUARY 2019Giri PriyaBelum ada peringkat

- Chola Business Services Pay SlipDokumen3 halamanChola Business Services Pay SlipsathyaBelum ada peringkat

- PayslipSalary Slips - 10-2020 PDFDokumen1 halamanPayslipSalary Slips - 10-2020 PDFSukant ChampatiBelum ada peringkat

- October 2022: Employee Details Payment & Leave Details Location DetailsDokumen1 halamanOctober 2022: Employee Details Payment & Leave Details Location DetailsPritam GoswamiBelum ada peringkat

- CRM Services India Private Limited: Earnings DeductionsDokumen1 halamanCRM Services India Private Limited: Earnings DeductionsInnama SayedBelum ada peringkat

- Deductions (B) Earnings (A) : Print Date: 03.11.2019, Print Time: 20:51:14Dokumen1 halamanDeductions (B) Earnings (A) : Print Date: 03.11.2019, Print Time: 20:51:14Fire SuperstarBelum ada peringkat

- March PDFDokumen1 halamanMarch PDFRBelum ada peringkat

- Neofalcon Life Science Salary SlipsDokumen3 halamanNeofalcon Life Science Salary SlipsVanmatheBelum ada peringkat

- PavanDokumen1 halamanPavanPavan KumarBelum ada peringkat

- BGCC M01495Dokumen2 halamanBGCC M01495RAJKUMAR CHATTERJEE. (RAJA.)Belum ada peringkat

- Form 1Dokumen1 halamanForm 1Ganesh DasaraBelum ada peringkat

- Fe96beed 7a5b 4d7b A5cc C38eecd2b38dDokumen1 halamanFe96beed 7a5b 4d7b A5cc C38eecd2b38dChandan ShahBelum ada peringkat

- CRM INDIA SERVICES PVT LTD PAYSLIPDokumen2 halamanCRM INDIA SERVICES PVT LTD PAYSLIPParveen SainiBelum ada peringkat

- PayslipSalary Slips - 9-2020 PDFDokumen1 halamanPayslipSalary Slips - 9-2020 PDFSukant ChampatiBelum ada peringkat

- MAHARASHTRA POWER Salary Slip and Form 16 Summary for Pramod PuriDokumen1 halamanMAHARASHTRA POWER Salary Slip and Form 16 Summary for Pramod Puripravin_3781Belum ada peringkat

- SlipDokumen5 halamanSlipHiten kaneshriyaBelum ada peringkat

- February 2023 PayslipDokumen1 halamanFebruary 2023 PayslipPritam GoswamiBelum ada peringkat

- Amit JiDokumen1 halamanAmit JiRohit RajBelum ada peringkat

- Payslip - 2019 08 31 - ID 40025704Dokumen1 halamanPayslip - 2019 08 31 - ID 40025704R KBelum ada peringkat

- Aapt Outsourcing Solutions Pvt. LTD.: Payslip For The Month of April 2022Dokumen1 halamanAapt Outsourcing Solutions Pvt. LTD.: Payslip For The Month of April 2022ayush bhatnagarBelum ada peringkat

- 110773Dokumen6 halaman110773asheesh kumarBelum ada peringkat

- April 21 PayslipDokumen1 halamanApril 21 PayslipStephen SBelum ada peringkat

- ITR FormDokumen9 halamanITR FormAbdul WajidBelum ada peringkat

- Pay Slip - 604316 - May-22Dokumen1 halamanPay Slip - 604316 - May-22ArchanaBelum ada peringkat

- Sahrudaya Health Care Private Limited: Pay Slip For The Month of May-2022Dokumen1 halamanSahrudaya Health Care Private Limited: Pay Slip For The Month of May-2022Rohit raagBelum ada peringkat

- Payslip Jun PDFDokumen1 halamanPayslip Jun PDFtrack ViewBelum ada peringkat

- Salary - APRIL2022 2Dokumen1 halamanSalary - APRIL2022 2katihariBelum ada peringkat

- Durga Malleswara RaoDokumen1 halamanDurga Malleswara RaoRajesh pvkBelum ada peringkat

- Abfpw1788f 2017-18 PDFDokumen2 halamanAbfpw1788f 2017-18 PDFNikhil121314Belum ada peringkat

- FAMS BETTER LIFE LLP PAY SLIP FOR OCT 2021Dokumen1 halamanFAMS BETTER LIFE LLP PAY SLIP FOR OCT 2021shreyas kotiBelum ada peringkat

- Payslip Feb 2023Dokumen1 halamanPayslip Feb 2023love entertainmentBelum ada peringkat

- Storeworks Chennai Salary Slip December 2021Dokumen1 halamanStoreworks Chennai Salary Slip December 2021ZeenatBelum ada peringkat

- DDICGDIAP72DINOV22Dokumen1 halamanDDICGDIAP72DINOV22raghav bharadwajBelum ada peringkat

- AUGUST PayslipDokumen1 halamanAUGUST PayslipRakesh MandalBelum ada peringkat

- Name: Swati Acharya Emp ID: 49447 - FS Grade: C1 Designation: Senior ConsultantDokumen16 halamanName: Swati Acharya Emp ID: 49447 - FS Grade: C1 Designation: Senior ConsultantashivaramakrishnaBelum ada peringkat

- Bharti AXA Life Insurance Employee PayslipDokumen1 halamanBharti AXA Life Insurance Employee PayslipJoginderBelum ada peringkat

- Payslip Oct2022Dokumen1 halamanPayslip Oct2022Raut AbhimanBelum ada peringkat

- Government of Tamil Nadu: District Officer, Fire and RescueDokumen2 halamanGovernment of Tamil Nadu: District Officer, Fire and RescueDhanushya SargunanBelum ada peringkat

- Serv Let ControllerDokumen1 halamanServ Let ControllerParas PareekBelum ada peringkat

- Senthil Vel - June 2023 - Salary SlipDokumen1 halamanSenthil Vel - June 2023 - Salary SlipJenish Christin rajBelum ada peringkat

- Manthan Aug NewDokumen1 halamanManthan Aug NewManthan ShahBelum ada peringkat

- Salary Slip A12Dokumen1 halamanSalary Slip A12Pritam GoswamiBelum ada peringkat

- WebPay 4.2 title for Gi Staffing Services Pvt. Ltd. November 2021 payslipDokumen1 halamanWebPay 4.2 title for Gi Staffing Services Pvt. Ltd. November 2021 payslipmahendraBelum ada peringkat

- Pay Slip for Vishal GuptaDokumen1 halamanPay Slip for Vishal GuptavishalBelum ada peringkat

- Aug - 23 Salary SlipDokumen1 halamanAug - 23 Salary SlipBack-End MarketingBelum ada peringkat

- Payslip Lyka Labs-Ramjeet PalDokumen1 halamanPayslip Lyka Labs-Ramjeet PalPankaj PandeyBelum ada peringkat

- PDF 979868730130323Dokumen1 halamanPDF 979868730130323Abhilash Bhavan SasiBelum ada peringkat

- PI Industries April 2020 Pay SlipDokumen1 halamanPI Industries April 2020 Pay SlipRahul mishraBelum ada peringkat

- ITR-4 Acknowledgement for AY 2021-22Dokumen1 halamanITR-4 Acknowledgement for AY 2021-22Aditya Adi SinghBelum ada peringkat

- Form16 Fiserv 2018-19Dokumen8 halamanForm16 Fiserv 2018-19SiddharthBelum ada peringkat

- SRS Business Solutions (India) PVT - LTD: Attendance Details ValueDokumen1 halamanSRS Business Solutions (India) PVT - LTD: Attendance Details ValueraghavaBelum ada peringkat

- AISATS Payslip April 2023Dokumen1 halamanAISATS Payslip April 2023Sahil shahBelum ada peringkat

- 375 - Salary Slip July 2018 PDFDokumen1 halaman375 - Salary Slip July 2018 PDFAnkit SolankiBelum ada peringkat

- PDF 472850270150723Dokumen1 halamanPDF 472850270150723Pijush SinhaBelum ada peringkat

- Fidelis Corporate Solutions Private Limited: Payslip For The Month of May 2022Dokumen2 halamanFidelis Corporate Solutions Private Limited: Payslip For The Month of May 2022Dominic angelesBelum ada peringkat

- ACK158216300200523Dokumen1 halamanACK158216300200523Ritu RajBelum ada peringkat

- Form PDFDokumen2 halamanForm PDFSuresh DoosaBelum ada peringkat

- Nov 2017Dokumen1 halamanNov 2017omkassBelum ada peringkat

- April2018 PDFDokumen1 halamanApril2018 PDFomkassBelum ada peringkat

- October07 PDFDokumen1 halamanOctober07 PDFomkassBelum ada peringkat

- April2018 PDFDokumen1 halamanApril2018 PDFomkassBelum ada peringkat

- Mar18 PDFDokumen1 halamanMar18 PDFomkassBelum ada peringkat

- Mar18 PDFDokumen1 halamanMar18 PDFomkassBelum ada peringkat

- April2018 PDFDokumen1 halamanApril2018 PDFomkassBelum ada peringkat

- April2018 PDFDokumen1 halamanApril2018 PDFomkassBelum ada peringkat

- Jan18 PDFDokumen1 halamanJan18 PDFomkassBelum ada peringkat

- April2018 PDFDokumen1 halamanApril2018 PDFomkassBelum ada peringkat

- Feb2018 PDFDokumen1 halamanFeb2018 PDFomkass100% (1)

- April2018 PDFDokumen1 halamanApril2018 PDFomkassBelum ada peringkat

- Jan18 PDFDokumen1 halamanJan18 PDFomkassBelum ada peringkat

- April2018 PDFDokumen1 halamanApril2018 PDFomkassBelum ada peringkat

- October07 PDFDokumen1 halamanOctober07 PDFomkassBelum ada peringkat

- April2018 PDFDokumen1 halamanApril2018 PDFomkassBelum ada peringkat

- Feb2018 PDFDokumen1 halamanFeb2018 PDFomkass100% (1)

- Mar18 PDFDokumen1 halamanMar18 PDFomkassBelum ada peringkat

- April2018 PDFDokumen1 halamanApril2018 PDFomkassBelum ada peringkat

- April2018 PDFDokumen1 halamanApril2018 PDFomkassBelum ada peringkat

- Mar18 PDFDokumen1 halamanMar18 PDFomkassBelum ada peringkat

- April2018 PDFDokumen1 halamanApril2018 PDFomkassBelum ada peringkat

- Income Taxes For Individuals CA5109 Income Taxation Prepared By: Joseph Angelo B. OgrimenDokumen18 halamanIncome Taxes For Individuals CA5109 Income Taxation Prepared By: Joseph Angelo B. Ogrimenlayla scotBelum ada peringkat

- (ACCLIME) Quick Guide - Vietnam Capital Gains 2023Dokumen1 halaman(ACCLIME) Quick Guide - Vietnam Capital Gains 2023Khoi NguyenBelum ada peringkat

- Evolution of Philippine: AtionDokumen15 halamanEvolution of Philippine: AtionRosabel Yanong TiguianBelum ada peringkat

- Practice Test Chapter 3 With AnswersDokumen8 halamanPractice Test Chapter 3 With AnswersDimpZ Patel100% (1)

- Cir Vs Algue, Inc. GR No. L-28896 February 7, 1996Dokumen2 halamanCir Vs Algue, Inc. GR No. L-28896 February 7, 1996ian ballartaBelum ada peringkat

- Ohio Charitable Trust Act Information SheetDokumen1 halamanOhio Charitable Trust Act Information SheetMary GallagherBelum ada peringkat

- Earning Rate Amount (RS.) Deductions Amount (RS.)Dokumen2 halamanEarning Rate Amount (RS.) Deductions Amount (RS.)Ajay KharwarBelum ada peringkat

- Form 12BB Tax Deduction ClaimsDokumen2 halamanForm 12BB Tax Deduction ClaimsAlka Joshi0% (1)

- Dec 2022Dokumen1 halamanDec 2022n1234567890987654321Belum ada peringkat

- AVERAGEDokumen4 halamanAVERAGEClyde RamosBelum ada peringkat

- Ella Lyman Cabot Trust Application for Project FundingDokumen2 halamanElla Lyman Cabot Trust Application for Project FundingAdeyemi Oluwaseun JohnBelum ada peringkat

- Bir Annual Income Tax ReturnDokumen5 halamanBir Annual Income Tax ReturnAldwin MamiitBelum ada peringkat

- PWC GM Folio IrelandDokumen40 halamanPWC GM Folio IrelandM Nasir ArifBelum ada peringkat

- 2018 03 31 12 23 14 702 - 1958189601Dokumen5 halaman2018 03 31 12 23 14 702 - 1958189601Kethavarapu RamjiBelum ada peringkat

- Mobil V City Treasurer of MakatiDokumen2 halamanMobil V City Treasurer of MakatiReena MaBelum ada peringkat

- Quiz Accounting For Income TaxDokumen5 halamanQuiz Accounting For Income TaxCmBelum ada peringkat

- Median Household IncomeDokumen5 halamanMedian Household IncomeStephan LewisBelum ada peringkat

- Tax Return 2021Dokumen4 halamanTax Return 2021Adam Clifton100% (4)

- Transfer and Business TaxationDokumen4 halamanTransfer and Business TaxationKhai Supleo PabelicoBelum ada peringkat

- Inbutax 4Dokumen4 halamanInbutax 4Kim Edward TenorioBelum ada peringkat

- Salary Slip (00856333 April, 2019)Dokumen1 halamanSalary Slip (00856333 April, 2019)AurangzebBelum ada peringkat

- Kslu Question PaperDokumen4 halamanKslu Question Paperanand121988Belum ada peringkat

- Scope of Total Income and Residential StatusDokumen3 halamanScope of Total Income and Residential StatusSandeep SinghBelum ada peringkat

- Interest 234 ABCDokumen5 halamanInterest 234 ABCJitendra VernekarBelum ada peringkat

- 1701 Mixed TemplateDokumen11 halaman1701 Mixed TemplateDaniel B. MalillinBelum ada peringkat

- TAX 1 Mini Digest Part 2Dokumen6 halamanTAX 1 Mini Digest Part 2Lilu BalgosBelum ada peringkat

- PASEO REALTY TAX REFUND DENIEDDokumen2 halamanPASEO REALTY TAX REFUND DENIEDRalph VelosoBelum ada peringkat

- Chapter 4 - Income Taxes Problems Luzon CorporationDokumen8 halamanChapter 4 - Income Taxes Problems Luzon CorporationJohanna Raissa CapadaBelum ada peringkat

- Alternative Minimum Tax-IndividualsDokumen2 halamanAlternative Minimum Tax-IndividualsBenjamín Varela UmbralBelum ada peringkat

- W-8BEN: Vinicius Nascimento BittencourtDokumen1 halamanW-8BEN: Vinicius Nascimento BittencourtVinicius Nascimento BittencourtBelum ada peringkat