RENT, DIVIDEND, AND OTHER INCOME DETAILS

Diunggah oleh

Lhorene Hope Dueñas0 penilaian0% menganggap dokumen ini bermanfaat (0 suara)

12 tayangan1 halamanThis document summarizes various types of income and applicable tax rates in the Philippines:

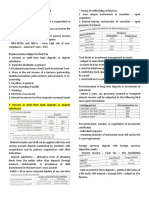

Rent income includes current rent payments, advance rent payments, interest, taxes, and insurance premiums paid by tenants. Dividend income from domestic and foreign corporations is taxed at varying rates depending on the entity paying the dividends. Other income includes recoveries of bad debts, tax refunds, prizes and awards, 13th month pay and benefits up to 82,000 pesos, as well as gains from the sale of bonds or shares in mutual funds. The document also provides a formula for allocating unidentified gross income between domestic and foreign sources.

Deskripsi Asli:

Judul Asli

binsoiiiii tax.docx 2.docx

Hak Cipta

© © All Rights Reserved

Format Tersedia

DOCX, PDF, TXT atau baca online dari Scribd

Bagikan dokumen Ini

Apakah menurut Anda dokumen ini bermanfaat?

Apakah konten ini tidak pantas?

Laporkan Dokumen IniThis document summarizes various types of income and applicable tax rates in the Philippines:

Rent income includes current rent payments, advance rent payments, interest, taxes, and insurance premiums paid by tenants. Dividend income from domestic and foreign corporations is taxed at varying rates depending on the entity paying the dividends. Other income includes recoveries of bad debts, tax refunds, prizes and awards, 13th month pay and benefits up to 82,000 pesos, as well as gains from the sale of bonds or shares in mutual funds. The document also provides a formula for allocating unidentified gross income between domestic and foreign sources.

Hak Cipta:

© All Rights Reserved

Format Tersedia

Unduh sebagai DOCX, PDF, TXT atau baca online dari Scribd

0 penilaian0% menganggap dokumen ini bermanfaat (0 suara)

12 tayangan1 halamanRENT, DIVIDEND, AND OTHER INCOME DETAILS

Diunggah oleh

Lhorene Hope DueñasThis document summarizes various types of income and applicable tax rates in the Philippines:

Rent income includes current rent payments, advance rent payments, interest, taxes, and insurance premiums paid by tenants. Dividend income from domestic and foreign corporations is taxed at varying rates depending on the entity paying the dividends. Other income includes recoveries of bad debts, tax refunds, prizes and awards, 13th month pay and benefits up to 82,000 pesos, as well as gains from the sale of bonds or shares in mutual funds. The document also provides a formula for allocating unidentified gross income between domestic and foreign sources.

Hak Cipta:

© All Rights Reserved

Format Tersedia

Unduh sebagai DOCX, PDF, TXT atau baca online dari Scribd

Anda di halaman 1dari 1

RENT INCOME DIVIDEND INCOME

*Received from DOMESTIC

Includes:

CORPORATION, received by: OTHER INCOME

*Current rent/lease payment

-domestic corp.- tax-exempt

*Advance rent payment or security * Derived by foreign government

-Resident Foreign Corp-tax exempt

deposit w/o restriction(period * Derived by Government

-NRFC- 15%

actually received) * Prizes and Awards

-RC, NRC, RA- 10%

*Interest, taxes, insurance premium -religious, charitable, scientific,

-NRA-EBT- 20%

*Income from leasehold educational, artistic, literary, or civic

-NRA-NEBT- 25%

improvement achievement

* Prizes and Awards in sport competition

*Received from RESIDENT FOREIGN

* 13th month pay and other benefit- not

CORPORATION, received:

exceed 82,000

-individual taxpayer- Basic Tax

* GSIS, SSS, Medicare ,other contribution

-corporate entity- 30%

OTHER INCOME * Gains from sale of Bonds, debentures or

other certificate of indebtedness

*Recovery of Bad Debts written- *Received from NRFC, received by:

* Gains from redemption of shares in

off -individual taxpayer- Basic tax

mutual funds

*Tax Refund: -corporate entity- 30%

*Received by MWE- not earning other

-tax paid is treated as deductible income

expense

Allocation of unidentified Gross Income

Income Identified GI (Philippines)

from w/in the = X Unidentified GI

Philippines Identified GI (World)

Anda mungkin juga menyukai

- Chapter 4 Income TaxDokumen1 halamanChapter 4 Income TaxLhorene Hope DueñasBelum ada peringkat

- Benefits Amounting To Php90,000: Taxable Income: Individuals Earning Purely Compensation IncomeDokumen10 halamanBenefits Amounting To Php90,000: Taxable Income: Individuals Earning Purely Compensation IncomejenicaBelum ada peringkat

- ACTAX-3153-N002-Intro To Income Taxation PDFDokumen5 halamanACTAX-3153-N002-Intro To Income Taxation PDFJwyneth Royce DenolanBelum ada peringkat

- Rule:: Revenue From Sales Revenue From ProfessionDokumen2 halamanRule:: Revenue From Sales Revenue From Profession在于在Belum ada peringkat

- Binsooiiii Tax 7 PangitDokumen1 halamanBinsooiiii Tax 7 PangitLhorene Hope DueñasBelum ada peringkat

- Tax Calculator 2010 11Dokumen2 halamanTax Calculator 2010 11Sanjay DasBelum ada peringkat

- TAX 1 - Gross ProfitDokumen3 halamanTAX 1 - Gross ProfitPacaña, Vincent Michael M.Belum ada peringkat

- Lesson 3 - CopopopopopDokumen2 halamanLesson 3 - Copopopopop在于在Belum ada peringkat

- Selling Government Property - Sources and Contributions of Other Government Agencies - DonationsDokumen10 halamanSelling Government Property - Sources and Contributions of Other Government Agencies - Donationsela kikayBelum ada peringkat

- Topic: Regular Income Tax - Gross Income Aljon J. Roque, CPA, MBADokumen3 halamanTopic: Regular Income Tax - Gross Income Aljon J. Roque, CPA, MBAJhon Ariel JulatonBelum ada peringkat

- FINAL TAX (General Rule: Applies To PASSIVE INCOME Earned WITHIN PH)Dokumen9 halamanFINAL TAX (General Rule: Applies To PASSIVE INCOME Earned WITHIN PH)Royce DenolanBelum ada peringkat

- Direct Taxation Mujtaba Zaidi Deduction and Collection of Tax at SourceDokumen20 halamanDirect Taxation Mujtaba Zaidi Deduction and Collection of Tax at SourceManohar LalBelum ada peringkat

- Exclusions From Gross IncomeDokumen2 halamanExclusions From Gross IncomeNoroBelum ada peringkat

- Tax Notes On Passive IncomeDokumen4 halamanTax Notes On Passive IncomeMaria Anna M LegaspiBelum ada peringkat

- Chapter 5: Final Income Taxation Final Withholding SystemDokumen4 halamanChapter 5: Final Income Taxation Final Withholding SystemHanz RecitasBelum ada peringkat

- Tax Implications of Various Types of IncomeDokumen23 halamanTax Implications of Various Types of IncomeButch MaatBelum ada peringkat

- Chapter 9 Term PaperDokumen3 halamanChapter 9 Term PaperMardy TarrozaBelum ada peringkat

- Individual Income Tax (Summary)Dokumen12 halamanIndividual Income Tax (Summary)Random VidsBelum ada peringkat

- Taxation of Regular Income SourcesDokumen8 halamanTaxation of Regular Income SourcesAlyssa BerangberangBelum ada peringkat

- All TaxesDokumen9 halamanAll TaxesJv FerminBelum ada peringkat

- INCOME TAXATION ExclusionsDokumen2 halamanINCOME TAXATION ExclusionsPepe FrogBelum ada peringkat

- ZMIDTAXDokumen4 halamanZMIDTAXtaudvejBelum ada peringkat

- Income TaxDokumen4 halamanIncome TaxAisaia Jay ToralBelum ada peringkat

- Exempt: BMBE, Enterrises Enjoying Tax Holiday Incentives Under CREATE LawDokumen5 halamanExempt: BMBE, Enterrises Enjoying Tax Holiday Incentives Under CREATE LawPaula Mae DacanayBelum ada peringkat

- It 23-24Dokumen5 halamanIt 23-24Alok G ShindeBelum ada peringkat

- Chapter 7 - I. Income From Property DefinedDokumen4 halamanChapter 7 - I. Income From Property DefinedvashdanqueBelum ada peringkat

- Module 7Dokumen5 halamanModule 7Marklein DumangengBelum ada peringkat

- Module 9 Inclusions and Exclusions From Gross IncomeDokumen10 halamanModule 9 Inclusions and Exclusions From Gross IncomeKurt CyrilBelum ada peringkat

- Chapter 13 REGULAR ALLOWABLE ITEMIZED DEDUCTIONSDokumen3 halamanChapter 13 REGULAR ALLOWABLE ITEMIZED DEDUCTIONSAlyssa BerangberangBelum ada peringkat

- I. VAT: Zero Rated ExemptDokumen6 halamanI. VAT: Zero Rated ExemptHiền nguyễn thuBelum ada peringkat

- Tax RatesDokumen37 halamanTax RatesMelanie OngBelum ada peringkat

- Visit To File Your Income Tax Return: S.NO. Particulars Amount (In RS.)Dokumen4 halamanVisit To File Your Income Tax Return: S.NO. Particulars Amount (In RS.)Sandeep SinghBelum ada peringkat

- Taxation of Life Insurance ProceedsDokumen8 halamanTaxation of Life Insurance ProceedsRagnar LothbrokBelum ada peringkat

- Taxation of Residual Income: Cma K.R. RamprakashDokumen25 halamanTaxation of Residual Income: Cma K.R. RamprakashShriya JoseincheckalBelum ada peringkat

- TaxpayerDokumen70 halamanTaxpayerAlbert Alcantara BernardoBelum ada peringkat

- AUSTRALIAN TAXATION - Parteng ApatDokumen1 halamanAUSTRALIAN TAXATION - Parteng ApatVero EntertainmentBelum ada peringkat

- C9 Inclusion To Gross IncomeDokumen22 halamanC9 Inclusion To Gross IncomeSUBA, Michagail D.Belum ada peringkat

- Taxes Payable - Personal: Summary of Federal Tax Calculation Special CalculationsDokumen1 halamanTaxes Payable - Personal: Summary of Federal Tax Calculation Special CalculationsarianxxxBelum ada peringkat

- New Income Tax Calculator for Old & New Tax Regime for Salaried EmployeeDokumen4 halamanNew Income Tax Calculator for Old & New Tax Regime for Salaried EmployeeKiran KumarBelum ada peringkat

- Items of Gross Income Subject To RegularDokumen2 halamanItems of Gross Income Subject To Regularhannah drew ovejasBelum ada peringkat

- Week 3 TaxDokumen4 halamanWeek 3 TaxslncrochetBelum ada peringkat

- Cannot Be Used by Nra-Etb & Taxpayers Mandated To Use Itemized DeductionsDokumen3 halamanCannot Be Used by Nra-Etb & Taxpayers Mandated To Use Itemized DeductionsAreel GalvanBelum ada peringkat

- Income from Other Sources GuideDokumen7 halamanIncome from Other Sources GuideChiranjeevi Revalpalli RBelum ada peringkat

- Chapter 8Dokumen6 halamanChapter 8Mariel AbionBelum ada peringkat

- CPAR Deductions (Batch 92) - HandoutDokumen30 halamanCPAR Deductions (Batch 92) - HandoutaudreyBelum ada peringkat

- Chapter 5 - Final Income TaxationDokumen3 halamanChapter 5 - Final Income Taxationclaritaquijano526Belum ada peringkat

- May 2022 Deductions ExplainedDokumen29 halamanMay 2022 Deductions ExplainedJohnallenson DacosinBelum ada peringkat

- Shareholder-Manager Remuneration and Tax PlanningDokumen9 halamanShareholder-Manager Remuneration and Tax PlanningMichael KemifieldBelum ada peringkat

- Pagatpat, Aischelle Mhae RDokumen4 halamanPagatpat, Aischelle Mhae RElleBelum ada peringkat

- Inctax Lecture Notes Froup 2 and 6Dokumen27 halamanInctax Lecture Notes Froup 2 and 6KrizahMarieCaballeroBelum ada peringkat

- Income Taxation Lesson 3Dokumen6 halamanIncome Taxation Lesson 3DYLANBelum ada peringkat

- Regular Income Tax CharacteristicsDokumen12 halamanRegular Income Tax CharacteristicsMa. Alessandra BautistaBelum ada peringkat

- CH 5 Final Income TaxationDokumen19 halamanCH 5 Final Income TaxationGabriel Trinidad SonielBelum ada peringkat

- Understanding Regular Income TaxDokumen2 halamanUnderstanding Regular Income Taxace zeroBelum ada peringkat

- MasterSheet04 IFB SirTariqTunio FinalDokumen2 halamanMasterSheet04 IFB SirTariqTunio FinalKamran MehboobBelum ada peringkat

- Notes:: Deduction Individuals Estates Trusts Corp. PartnershipsDokumen19 halamanNotes:: Deduction Individuals Estates Trusts Corp. PartnershipsDamdam AlunanBelum ada peringkat

- Business Tax SQE Notes HngortDokumen9 halamanBusiness Tax SQE Notes HngortShalene ArudchelvanBelum ada peringkat

- 17 - Corporation TaxDokumen7 halaman17 - Corporation Taxayushagarwal23Belum ada peringkat

- 1040 Exam Prep Module IV: Items Excluded from Gross IncomeDari Everand1040 Exam Prep Module IV: Items Excluded from Gross IncomeBelum ada peringkat

- Flexible BudgetDokumen2 halamanFlexible BudgetLhorene Hope DueñasBelum ada peringkat

- Variance AnalysisDokumen3 halamanVariance AnalysisLhorene Hope DueñasBelum ada peringkat

- Manufacturing Cycle EfficiencyDokumen1 halamanManufacturing Cycle EfficiencyLhorene Hope DueñasBelum ada peringkat

- Standard Costing 1.1Dokumen3 halamanStandard Costing 1.1Lhorene Hope DueñasBelum ada peringkat

- Variance Costing and Activity Based Cotsing Test PrepDokumen3 halamanVariance Costing and Activity Based Cotsing Test PrepLhorene Hope DueñasBelum ada peringkat

- Standard Costing Test PrepDokumen3 halamanStandard Costing Test PrepLhorene Hope DueñasBelum ada peringkat

- Price Variance: W CompanyDokumen2 halamanPrice Variance: W CompanyLhorene Hope DueñasBelum ada peringkat

- Activity Based Costing TestbankDokumen7 halamanActivity Based Costing TestbankLhorene Hope DueñasBelum ada peringkat

- Standard CostingDokumen1 halamanStandard CostingLhorene Hope DueñasBelum ada peringkat

- Variance Analysis and ABCDokumen3 halamanVariance Analysis and ABCLhorene Hope DueñasBelum ada peringkat

- Standard Costing and Flexible Budget 10Dokumen5 halamanStandard Costing and Flexible Budget 10Lhorene Hope DueñasBelum ada peringkat

- Flexible BudgetDokumen4 halamanFlexible BudgetLhorene Hope Dueñas100% (1)

- Variance 1Dokumen2 halamanVariance 1Lhorene Hope DueñasBelum ada peringkat

- Classic Company Manufacturing Cost Variance AnalysisDokumen2 halamanClassic Company Manufacturing Cost Variance AnalysisLhorene Hope Dueñas100% (1)

- Flexible Budget and VarianceDokumen8 halamanFlexible Budget and VarianceLhorene Hope DueñasBelum ada peringkat

- Flexible Budget and Activity Based Costing Test BankDokumen2 halamanFlexible Budget and Activity Based Costing Test BankLhorene Hope DueñasBelum ada peringkat

- Standrad Costing 2.1Dokumen2 halamanStandrad Costing 2.1Lhorene Hope DueñasBelum ada peringkat

- Activity Based Costing Test PrepationDokumen5 halamanActivity Based Costing Test PrepationLhorene Hope DueñasBelum ada peringkat

- Standard Costing Ang Variance AnalysisDokumen3 halamanStandard Costing Ang Variance AnalysisLhorene Hope DueñasBelum ada peringkat

- Flexible Budgetand Activity Based CostingDokumen13 halamanFlexible Budgetand Activity Based CostingLhorene Hope DueñasBelum ada peringkat

- Ais Nats CHPTR 1Dokumen3 halamanAis Nats CHPTR 1Lhorene Hope DueñasBelum ada peringkat

- Essay on Activity-Based Costing for Ingersol DraperiesDokumen13 halamanEssay on Activity-Based Costing for Ingersol DraperiesLhorene Hope DueñasBelum ada peringkat

- Ais Nats CHPTR 1Dokumen3 halamanAis Nats CHPTR 1Lhorene Hope DueñasBelum ada peringkat

- ABC and Flexible BudgetDokumen6 halamanABC and Flexible BudgetLhorene Hope DueñasBelum ada peringkat

- Chapter1 AIS FinalDokumen3 halamanChapter1 AIS FinalLhorene Hope DueñasBelum ada peringkat

- English Grammar and Correct Usage Part 2 2 PDFDokumen3 halamanEnglish Grammar and Correct Usage Part 2 2 PDFLhorene Hope DueñasBelum ada peringkat

- ABC and Standard CostingDokumen6 halamanABC and Standard CostingLhorene Hope DueñasBelum ada peringkat

- This Part Shows The Step-By-Step-Process Followed by The Business in Connection With Its Sales and DisbursementDokumen11 halamanThis Part Shows The Step-By-Step-Process Followed by The Business in Connection With Its Sales and DisbursementLhorene Hope DueñasBelum ada peringkat

- Chapter1 AIS FinalDokumen3 halamanChapter1 AIS FinalLhorene Hope DueñasBelum ada peringkat

- English Grammar and Correct Usage Part 3Dokumen3 halamanEnglish Grammar and Correct Usage Part 3Lhorene Hope DueñasBelum ada peringkat

- Revenue Reconigtion Principle - ExamplesDokumen4 halamanRevenue Reconigtion Principle - Examplesmazjoa100% (1)

- Mini CaseDokumen18 halamanMini CaseZeeshan Iqbal0% (1)

- Calculate Arb's investment income from Tee CorpDokumen7 halamanCalculate Arb's investment income from Tee CorpYOHANNES WIBOWOBelum ada peringkat

- Pradhan Mantri Jan Dhan YojanaDokumen30 halamanPradhan Mantri Jan Dhan YojanaKirti Chotwani100% (1)

- What Dubai Silicon Oasis DSO Free Zone OffersDokumen3 halamanWhat Dubai Silicon Oasis DSO Free Zone OffersKommu RohithBelum ada peringkat

- Department of Labor: DekalbDokumen58 halamanDepartment of Labor: DekalbUSA_DepartmentOfLabor50% (2)

- PARTNERSHIP ACCOUNTING EXAM REVIEWDokumen26 halamanPARTNERSHIP ACCOUNTING EXAM REVIEWIts meh Sushi50% (2)

- Standard Notes To Form No. 3CD (Revised 2019) CleanDokumen8 halamanStandard Notes To Form No. 3CD (Revised 2019) CleanRahul LaddhaBelum ada peringkat

- Payables Finance Technique GuideDokumen18 halamanPayables Finance Technique GuideMaharaniBelum ada peringkat

- Assignment 2: What Do You Mean by Portfolio Investment Process, How Does Is Co Relate With Fundamental Analysis?Dokumen2 halamanAssignment 2: What Do You Mean by Portfolio Investment Process, How Does Is Co Relate With Fundamental Analysis?Naveen RecizBelum ada peringkat

- Made By:-Sarthak Gupta Group No: - 1080zDokumen22 halamanMade By:-Sarthak Gupta Group No: - 1080zSimranAhluwaliaBelum ada peringkat

- ISO 9004:2018 focuses on organizational successDokumen3 halamanISO 9004:2018 focuses on organizational successAmit PaulBelum ada peringkat

- Aadfi Rates BDC Amongst The Best Performing African Development Finance Institutions in AfricaDokumen1 halamanAadfi Rates BDC Amongst The Best Performing African Development Finance Institutions in AfricaLesego MoabiBelum ada peringkat

- NMIMS TRIMESTER VI - BRAND MANAGEMENT HISTORYDokumen46 halamanNMIMS TRIMESTER VI - BRAND MANAGEMENT HISTORYPayal AroraBelum ada peringkat

- AAPL DCF ValuationDokumen12 halamanAAPL DCF ValuationthesaneinvestorBelum ada peringkat

- Partnership and Corp Liquid TestbankDokumen288 halamanPartnership and Corp Liquid TestbankWendelyn Tutor80% (5)

- EntrepreneurshipDokumen64 halamanEntrepreneurshipWacks Venzon79% (19)

- C01 Exam Practice KitDokumen240 halamanC01 Exam Practice Kitlesego100% (2)

- International Taxation OutlineDokumen138 halamanInternational Taxation OutlineMa FajardoBelum ada peringkat

- Aizenman y Marion - 1999Dokumen23 halamanAizenman y Marion - 1999Esteban LeguizamónBelum ada peringkat

- Inner Circle Trader Ict Forex Ict NotesDokumen110 halamanInner Circle Trader Ict Forex Ict NotesBurak AtlıBelum ada peringkat

- Air France Case StudyDokumen7 halamanAir France Case StudyKrishnaprasad ChenniyangirinathanBelum ada peringkat

- AEO Programs Handbook - 0 PDFDokumen52 halamanAEO Programs Handbook - 0 PDFAsni IbrahimBelum ada peringkat

- Employee Benefits Whitepaper BambooHRDokumen17 halamanEmployee Benefits Whitepaper BambooHRMuhammad SaadBelum ada peringkat

- How To Win The BSGDokumen29 halamanHow To Win The BSGβασιλης παυλος αρακας100% (1)

- Commodity Trading: An OverviewDokumen15 halamanCommodity Trading: An OverviewvijayxkumarBelum ada peringkat

- Ts Grewal Solutions For Class 11 Account Chapter 8 MinDokumen80 halamanTs Grewal Solutions For Class 11 Account Chapter 8 MinHardik SehrawatBelum ada peringkat

- Audit Report BDODokumen18 halamanAudit Report BDO16110121Belum ada peringkat

- Medanit Sisay Tesfaye PDF Th...Dokumen71 halamanMedanit Sisay Tesfaye PDF Th...Tesfahun GetachewBelum ada peringkat

- Capital Structure of DR Reddy's LaboratoriesDokumen11 halamanCapital Structure of DR Reddy's LaboratoriesNikhil KumarBelum ada peringkat