Step 1: Basic Financial Step 1: Basic Financial Step 1: Basic Financial Step 1: Basic Financial Management Management Management Management

Diunggah oleh

Samuel Kagoru GichuruJudul Asli

Hak Cipta

Format Tersedia

Bagikan dokumen Ini

Apakah menurut Anda dokumen ini bermanfaat?

Apakah konten ini tidak pantas?

Laporkan Dokumen IniHak Cipta:

Format Tersedia

Step 1: Basic Financial Step 1: Basic Financial Step 1: Basic Financial Step 1: Basic Financial Management Management Management Management

Diunggah oleh

Samuel Kagoru GichuruHak Cipta:

Format Tersedia

Matt H.

Evans, CPA, CMA, CFM

Rt 4 Box 1154 • Salem, WV 26426 U.S.A.

Phone & Fax: 1-877-689-4097 • Email: matt@exinfm.com • www.exinfm.com

Step 1: Basic Financial

Management

Basic Financial Management is for

organizations currently not using any form of

Financial Management.

Basic Financial Management is for

organizations wanting to go beyond traditional

accounting so that real value is created when

financial decisions are made.

Basic Financial Management is the first step in

Creating Value through Excellence in Financial

Management.

My goal is to make sure that your organization has the

basic components of Financial Management. These

components include:

1. Financial Performance Evaluations

Regular evaluations of your financial performance are needed to identify weaknesses and strengths

within your organization. This evaluation process must include both internal and external benchmarks

so that you can truly gauge how well you are doing. These benchmarks must match the area being

measured and they should establish a set of standards that leads you to improved performance.

2. Cash Flow Management

Good forecasting procedures form the foundation for cash flow management. Once you have a

forecasting system in-place, you can improve how you manage cash flows. Cash flow management is

a basic element of value-creation within financial management.

3. Capital Budgeting

A standard process is needed for evaluating how you invest funds in capital assets. This process is

referred to as Capital Budgeting. Capital Budgeting includes several steps, such as incremental cost

analysis, risk assessment, and working capital provisions. Setting-up all of these steps will ensure that

your capital budgeting process is complete and creates value within your organization.

4. Cost of Capital

You need to have a realistic hurdle rate for evaluating capital projects. This hurdle rate is your cost of

capital and it represents the opportunity costs for your business. Determining the appropriate cost of

capital requires that you look at market values and financing trends. Having a cost of capital rate based

on sound economic assumptions will ensure that you are measuring investments for real value

creation. And value creation comes from your capacity to generate free cash flows.

Obviously, each organization is different and the specific components of Basic Financial

Management will vary. The overriding objective is to make sure that you have procedures in

place to build value through Financial Management. I invite you to take this first step in

creating value.

Anda mungkin juga menyukai

- Summary: Financial Intelligence: Review and Analysis of Berman and Knight's BookDari EverandSummary: Financial Intelligence: Review and Analysis of Berman and Knight's BookBelum ada peringkat

- Social Case Study Report on Rape VictimDokumen4 halamanSocial Case Study Report on Rape VictimJulius Harvey Prieto Balbas87% (76)

- Financial Management: Ariel Dizon Pineda, CPADokumen88 halamanFinancial Management: Ariel Dizon Pineda, CPARenz Fernandez100% (7)

- Internal AuditDokumen24 halamanInternal Auditibrarkhattak100% (2)

- What Are KPIs Benefits For BusinessesDokumen12 halamanWhat Are KPIs Benefits For Businessesdotnet007Belum ada peringkat

- Chapter 1 - Introduction To Managerial AccountingDokumen18 halamanChapter 1 - Introduction To Managerial AccountingEnrique Miguel Gonzalez Collado75% (4)

- The Balanced Scorecard (Review and Analysis of Kaplan and Norton's Book)Dari EverandThe Balanced Scorecard (Review and Analysis of Kaplan and Norton's Book)Penilaian: 4 dari 5 bintang4/5 (2)

- G Who Does What in Grant ManagementDokumen2 halamanG Who Does What in Grant ManagementSamuel Kagoru GichuruBelum ada peringkat

- Goals of Financial ManagementDokumen3 halamanGoals of Financial ManagementAndrea Fernandes100% (9)

- Valmeth AssDokumen20 halamanValmeth AssMark Andrei TalastasBelum ada peringkat

- Proposal For Funding of Computer Programme (NASS)Dokumen6 halamanProposal For Funding of Computer Programme (NASS)Foster Boateng67% (3)

- Financial Analysis of Skillmart International CollegeDokumen21 halamanFinancial Analysis of Skillmart International CollegeTadele DandenaBelum ada peringkat

- Sakolsky Ron Seizing AirwavesDokumen219 halamanSakolsky Ron Seizing AirwavesPalin WonBelum ada peringkat

- PWC Strategic Internal AuditDokumen24 halamanPWC Strategic Internal AuditJohanxx Kristanto100% (1)

- Cash Flow Analysis, Target Cost, Variable CostDokumen29 halamanCash Flow Analysis, Target Cost, Variable CostitsmenatoyBelum ada peringkat

- Integrating GrammarDokumen8 halamanIntegrating GrammarMaría Perez CastañoBelum ada peringkat

- Metabical Positioning and CommunicationDokumen15 halamanMetabical Positioning and CommunicationJSheikh100% (2)

- The 4 Perspectives of The Balanced ScorecardDokumen6 halamanThe 4 Perspectives of The Balanced Scorecardnivedita patilBelum ada peringkat

- Active LearningDokumen84 halamanActive Learningolijayp100% (1)

- Valuing Family Businesses: Key Methods and ConsiderationsDokumen31 halamanValuing Family Businesses: Key Methods and ConsiderationsPankajBelum ada peringkat

- CA en FA Strategies For Optimizing Your Cash ManagementDokumen12 halamanCA en FA Strategies For Optimizing Your Cash ManagementDaniel AhijadoBelum ada peringkat

- Managing The Finances of The Enterprise What Is Finance? People Seem To Either Love or Hate Finance, But The Fact IsDokumen8 halamanManaging The Finances of The Enterprise What Is Finance? People Seem To Either Love or Hate Finance, But The Fact IsDavy RoseBelum ada peringkat

- Cash Management Technioques - H.O. AraghoDokumen11 halamanCash Management Technioques - H.O. AraghoKABIRADOBelum ada peringkat

- VALUATION METHODS GUIDEDokumen8 halamanVALUATION METHODS GUIDEMarvic CabangunayBelum ada peringkat

- Balanced Scorecard ExplainedDokumen33 halamanBalanced Scorecard Explainedshahzad2689100% (2)

- The Discrimination ModelDokumen16 halamanThe Discrimination ModelSiti MuslihaBelum ada peringkat

- 317 Midterm QuizDokumen5 halaman317 Midterm QuizNikoruBelum ada peringkat

- Edukasyon Sa Pagpapakatao (Esp) Monitoring and Evaluation Tool For Department Heads/Chairmen/CoordinatorsDokumen3 halamanEdukasyon Sa Pagpapakatao (Esp) Monitoring and Evaluation Tool For Department Heads/Chairmen/CoordinatorsPrincis CianoBelum ada peringkat

- Valuation Concepts and Methods Course OutlineDokumen4 halamanValuation Concepts and Methods Course OutlineMark AdrianBelum ada peringkat

- Information For Prospective Clients: Matt H. Evans, CPA, CMA, CFMDokumen9 halamanInformation For Prospective Clients: Matt H. Evans, CPA, CMA, CFMAlif Rachmad Haidar SabiafzahBelum ada peringkat

- Financial Analysis Techniques & Tools Which Are Designed For Analyzing The Market & Invest Right Way For Maximized ProfitDokumen3 halamanFinancial Analysis Techniques & Tools Which Are Designed For Analyzing The Market & Invest Right Way For Maximized ProfitDr.Mohammad Wahid Abdullah KhanBelum ada peringkat

- Latest Tools for Maximizing Financial ManagementDokumen33 halamanLatest Tools for Maximizing Financial ManagementUmar SulemanBelum ada peringkat

- Service Outputs inDokumen2 halamanService Outputs inIsfandiyer SmithBelum ada peringkat

- Understand Finance to Make Better Business DecisionsDokumen5 halamanUnderstand Finance to Make Better Business Decisionskazi A.R RafiBelum ada peringkat

- Business Finance Assignment..1Dokumen10 halamanBusiness Finance Assignment..1Mohsin IqbalBelum ada peringkat

- Cost Control and Reduction in Mineral Water PlantDokumen56 halamanCost Control and Reduction in Mineral Water PlantManohar Nagilla60% (5)

- BSBFIM601 Powerpoint PresentationDokumen94 halamanBSBFIM601 Powerpoint PresentationJazzBelum ada peringkat

- Chapter 1 - Managerial Accounting PowerPointDokumen28 halamanChapter 1 - Managerial Accounting PowerPointOmar Bani-KhalafBelum ada peringkat

- Value Drivers and KPIsDokumen12 halamanValue Drivers and KPIsJAN PAOLO LUMPAZBelum ada peringkat

- Final ProjectDokumen38 halamanFinal ProjectJenny JohnsonBelum ada peringkat

- FinancialPerformaceTools April 2020Dokumen7 halamanFinancialPerformaceTools April 2020Jason RecanaBelum ada peringkat

- Need & Importance of Financial ManagementDokumen10 halamanNeed & Importance of Financial ManagementrubanchristopherBelum ada peringkat

- Introduction To Financial Management - Docx SufDokumen16 halamanIntroduction To Financial Management - Docx SufAnonymous 3dM58DTfBelum ada peringkat

- HRM HBL PakistanDokumen13 halamanHRM HBL PakistanNabeel RazzaqBelum ada peringkat

- Cash Management: Reported By: Josephine P. JimenezDokumen21 halamanCash Management: Reported By: Josephine P. JimenezPYNJIMENEZBelum ada peringkat

- What Are The Responsibilities of Managerial AccountantsDokumen2 halamanWhat Are The Responsibilities of Managerial AccountantsSamantha AngBelum ada peringkat

- 0111070113MFC14401CR163Value Based Management (VBM) 3-Value Based Management (VBM)Dokumen62 halaman0111070113MFC14401CR163Value Based Management (VBM) 3-Value Based Management (VBM)I MBelum ada peringkat

- Functional Department of The OrganizationDokumen9 halamanFunctional Department of The OrganizationHai HelloBelum ada peringkat

- Buyer 3Dokumen3 halamanBuyer 3Arjit GuptaBelum ada peringkat

- ORGANIZATION AND MANAGEMENT ACTIVITIESDokumen117 halamanORGANIZATION AND MANAGEMENT ACTIVITIESGeet NarulaBelum ada peringkat

- Is It Wise To Challenge The Usefulness of Cost andDokumen3 halamanIs It Wise To Challenge The Usefulness of Cost andMomoh PessimaBelum ada peringkat

- Curs 1-5 InvestopediaDokumen25 halamanCurs 1-5 InvestopediasdasdfaBelum ada peringkat

- Cash Flow Analysis, Target Cost, Variable Cost PDFDokumen29 halamanCash Flow Analysis, Target Cost, Variable Cost PDFitsmenatoyBelum ada peringkat

- Kaku GagagaDokumen2 halamanKaku GagagaLysterh FuentesBelum ada peringkat

- Faca ShristiDokumen11 halamanFaca Shristishristi BaglaBelum ada peringkat

- Cash Flow Basics: Track Inflows & OutflowsDokumen12 halamanCash Flow Basics: Track Inflows & OutflowsMARY IRISH FAITH PATAJOBelum ada peringkat

- Financial ManagementDokumen20 halamanFinancial ManagementMulugetaTBelum ada peringkat

- Financial Management FortunateDokumen4 halamanFinancial Management FortunateAtwine AbertsonBelum ada peringkat

- Financial AnalysisDokumen4 halamanFinancial AnalysisdeepshrmBelum ada peringkat

- Roomi Associates BrochureDokumen7 halamanRoomi Associates BrochureMehmood Ul HassanBelum ada peringkat

- Project BDokumen4 halamanProject Bivyjoycevillanueva51Belum ada peringkat

- 7.1.1 Record Keeping: It Is Necessary To Have Good Records For Effective Control and For Tax PurposesDokumen9 halaman7.1.1 Record Keeping: It Is Necessary To Have Good Records For Effective Control and For Tax PurposesTarekegnBelum ada peringkat

- WorkingCapitalManagementFINAL (April 2020)Dokumen16 halamanWorkingCapitalManagementFINAL (April 2020)Jason RecanaBelum ada peringkat

- Financial Statements and Decision MakingDokumen4 halamanFinancial Statements and Decision Makingzizi018Belum ada peringkat

- Financial Management GuideDokumen100 halamanFinancial Management Guidekunal roxBelum ada peringkat

- Assignment of Financial ManagementDokumen7 halamanAssignment of Financial Managementhyder imamBelum ada peringkat

- Business Performance Measurement U2Dokumen27 halamanBusiness Performance Measurement U2AkshayBelum ada peringkat

- Corporate finance defined and analyzedDokumen9 halamanCorporate finance defined and analyzedPrakash KumarBelum ada peringkat

- Group 2 FinmanDokumen5 halamanGroup 2 FinmanFire burnBelum ada peringkat

- BSC Management System SummaryDokumen18 halamanBSC Management System SummarySaurabh Kumar TiwariBelum ada peringkat

- The Following Proof Comes From Conversations That I Had Last Week With Mr. Erhard Schmidt and It Is As FollowsDokumen4 halamanThe Following Proof Comes From Conversations That I Had Last Week With Mr. Erhard Schmidt and It Is As FollowsSamuel Kagoru GichuruBelum ada peringkat

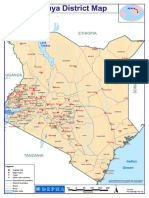

- Map DistrictsDokumen1 halamanMap DistrictsSamuel Kagoru GichuruBelum ada peringkat

- Curlik and Shors 2012 Training Your BrainDokumen9 halamanCurlik and Shors 2012 Training Your BrainSamuel Kagoru GichuruBelum ada peringkat

- Acheiving Shared Prosperity in KenyaDokumen170 halamanAcheiving Shared Prosperity in KenyaSamuel Kagoru GichuruBelum ada peringkat

- Worm - Education and Health Externalities in Kenya ResearchDokumen64 halamanWorm - Education and Health Externalities in Kenya ResearchSamuel Kagoru GichuruBelum ada peringkat

- G Risk RegisterDokumen3 halamanG Risk RegisterSamuel Kagoru GichuruBelum ada peringkat

- Hotsoapbook2 PDFDokumen52 halamanHotsoapbook2 PDFrosa tirandaBelum ada peringkat

- Disability Inclusion Resource ListDokumen4 halamanDisability Inclusion Resource ListSamuel Kagoru GichuruBelum ada peringkat

- 3 D Mind Maps Placing Young Children in The Centre of Their Own LearningDokumen6 halaman3 D Mind Maps Placing Young Children in The Centre of Their Own LearningSamuel Kagoru GichuruBelum ada peringkat

- Funding Grid ToolDokumen3 halamanFunding Grid ToolSamuel Kagoru GichuruBelum ada peringkat

- A Manager's Financial Management Checklist: Accounting RecordsDokumen1 halamanA Manager's Financial Management Checklist: Accounting RecordsSamuel Kagoru GichuruBelum ada peringkat

- Orientation To A Rights Based ApproachDokumen6 halamanOrientation To A Rights Based ApproachSamuel Kagoru GichuruBelum ada peringkat

- Capital StructureDokumen2 halamanCapital StructureAmitMittalBelum ada peringkat

- Microsoft Excel Sheet For Calculating (Money) Future & Present Value, Amortization Table, Present Value, Power of Compounding, EMI Calculation, MortgageDokumen7 halamanMicrosoft Excel Sheet For Calculating (Money) Future & Present Value, Amortization Table, Present Value, Power of Compounding, EMI Calculation, MortgageVikas Acharya100% (1)

- Dont Ask Dont Get Full SessionDokumen11 halamanDont Ask Dont Get Full SessionSamuel Kagoru GichuruBelum ada peringkat

- Gender Analysis ToolsDokumen13 halamanGender Analysis ToolsSamuel Kagoru GichuruBelum ada peringkat

- Unaids Best Practice - The MediaDokumen75 halamanUnaids Best Practice - The MediaSamuel Kagoru GichuruBelum ada peringkat

- Funding Grid ToolDokumen3 halamanFunding Grid ToolSamuel Kagoru GichuruBelum ada peringkat

- Mango's Risk Register: How To Use This RegisterDokumen3 halamanMango's Risk Register: How To Use This RegisterSamuel Kagoru GichuruBelum ada peringkat

- The Future of Copyright and The Artist-Record Label RelationshipDokumen158 halamanThe Future of Copyright and The Artist-Record Label RelationshipSamuel Kagoru GichuruBelum ada peringkat

- New Work Declaration Form - MSCK PDFDokumen2 halamanNew Work Declaration Form - MSCK PDFSamuel Kagoru GichuruBelum ada peringkat

- UNAIDS BEST PRACTICE Stigma and DescriminationDokumen73 halamanUNAIDS BEST PRACTICE Stigma and DescriminationSamuel Kagoru GichuruBelum ada peringkat

- Unaids Best Practice FbosDokumen77 halamanUnaids Best Practice FbosSamuel Kagoru GichuruBelum ada peringkat

- Non Disclosure AgreementDokumen6 halamanNon Disclosure AgreementSamuel Kagoru GichuruBelum ada peringkat

- Tips For Submitting A Winning AbstractFINALDokumen4 halamanTips For Submitting A Winning AbstractFINALSamuel Kagoru GichuruBelum ada peringkat

- BOC.5 Dangers of A 360 Deal V4 - 082514 PDFDokumen15 halamanBOC.5 Dangers of A 360 Deal V4 - 082514 PDFSamuel Kagoru GichuruBelum ada peringkat

- Basics of A Reording Contract - PDF 2Dokumen3 halamanBasics of A Reording Contract - PDF 2Samuel Kagoru GichuruBelum ada peringkat

- Wound Healing (BOOK 71P)Dokumen71 halamanWound Healing (BOOK 71P)Ahmed KhairyBelum ada peringkat

- Great Mobile Application Requirement Document: 7 Steps To Write ADokumen11 halamanGreat Mobile Application Requirement Document: 7 Steps To Write AgpchariBelum ada peringkat

- MOTOR INSURANCE TITLEDokumen5 halamanMOTOR INSURANCE TITLEVara PrasadBelum ada peringkat

- Shaft-Hub Couplings With Polygonal Profiles - Citarella-Gerbino2001Dokumen8 halamanShaft-Hub Couplings With Polygonal Profiles - Citarella-Gerbino2001sosu_sorin3904Belum ada peringkat

- Us Aers Roadmap Noncontrolling Interest 2019 PDFDokumen194 halamanUs Aers Roadmap Noncontrolling Interest 2019 PDFUlii PntBelum ada peringkat

- Physics 401 Assignment # Retarded Potentials Solutions:: Wed. 15 Mar. 2006 - Finish by Wed. 22 MarDokumen3 halamanPhysics 401 Assignment # Retarded Potentials Solutions:: Wed. 15 Mar. 2006 - Finish by Wed. 22 MarSruti SatyasmitaBelum ada peringkat

- Tangina Tapos NadenDokumen7 halamanTangina Tapos NadenJamesCubeBelum ada peringkat

- Cronograma Ingles I v2Dokumen1 halamanCronograma Ingles I v2Ariana GarciaBelum ada peringkat

- Notes On Statement AssumptionDokumen5 halamanNotes On Statement Assumptionsangamesh mbBelum ada peringkat

- Unit 11 LeadershipDokumen4 halamanUnit 11 LeadershipMarijana DragašBelum ada peringkat

- DU - BSC (H) CS BookletDokumen121 halamanDU - BSC (H) CS BookletNagendra DuhanBelum ada peringkat

- Masala Kitchen Menus: Chowpatty ChatDokumen6 halamanMasala Kitchen Menus: Chowpatty ChatAlex ShparberBelum ada peringkat

- TemplateDokumen1 halamanTemplatemaheshqwBelum ada peringkat

- Bluetooth Mobile Based College CampusDokumen12 halamanBluetooth Mobile Based College CampusPruthviraj NayakBelum ada peringkat

- Miranda V AgDokumen3 halamanMiranda V AgCARLO JOSE BACTOLBelum ada peringkat

- Identifying States of Matter LessonDokumen2 halamanIdentifying States of Matter LessonRaul OrcigaBelum ada peringkat

- Listening LP1Dokumen6 halamanListening LP1Zee KimBelum ada peringkat

- Giles. Saint Bede, The Complete Works of Venerable Bede. 1843. Vol. 8.Dokumen471 halamanGiles. Saint Bede, The Complete Works of Venerable Bede. 1843. Vol. 8.Patrologia Latina, Graeca et Orientalis100% (1)

- New Manual of Fiber Science Revised (Tet)Dokumen43 halamanNew Manual of Fiber Science Revised (Tet)RAZA Khn100% (1)

- Simon Baumberg - Prokaryotic Gene ExpressionDokumen348 halamanSimon Baumberg - Prokaryotic Gene ExpressionBodhi Dharma0% (1)

- ProbabilityDokumen2 halamanProbabilityMickey WongBelum ada peringkat

- Coek - Info Anesthesia and Analgesia in ReptilesDokumen20 halamanCoek - Info Anesthesia and Analgesia in ReptilesVanessa AskjBelum ada peringkat