TataCommunication 4Q08AndFY2008Update 09july2008 1

Diunggah oleh

ResearchOracleJudul Asli

Hak Cipta

Format Tersedia

Bagikan dokumen Ini

Apakah menurut Anda dokumen ini bermanfaat?

Apakah konten ini tidak pantas?

Laporkan Dokumen IniHak Cipta:

Format Tersedia

TataCommunication 4Q08AndFY2008Update 09july2008 1

Diunggah oleh

ResearchOracleHak Cipta:

Format Tersedia

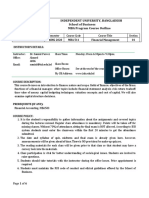

Tel.

+44 (0)20 7232 3090 Traded on

AIM, London

Fax +44 (0)20 7232 3099 Stock Exchange

www.iirgroup.com Regulated and

LSE: IIR authorised by

Tata Communications Limited 09 July 2008

Update Report – 4Q 08 Results

Bandwidth capacity glut to result in pricing pressure

Common HOLD Direct access

Fundamental to indicates

research the full report

a 7% upside infree of charge

the common stock overatthe next 6-12 months. We

have calculated the target price based on fundamental factors, using a weighted average of target

Stock http://www.iirgroup.com/researchoracle/viewreport/show/20256

prices obtained by using DCF and SOTP valuation methods.

Ticker: TATA.BO

Target price: INR399.84

Current price: INR373.50 We reiterate the common stock a HOLD with a 6-12 month target price of INR399.84 per share.

ADR BUY The ADR is expected to appreciate by approximately 24% over the next 6-12 months. Approximately

17 percentage points of this upside is attributable purely due to the anticipated appreciation of the

Indian rupee against the US dollar over the same period. We have taken a 6-12 month investment

horizon for this company as we anticipate a significant positive currency impact on the ADR in the next

6-12 months1

Ticker: TCL

Target price: US$22.21

We upgrade the ADR (1 ADR = 2 common shares) from a HOLD to a BUY with a 6-12 month target

Current price: US$17.95

price of US$22.21.

Analyst Jinesh Joshi Investment horizon - short term actionable trading strategies

Editor: Shem Pennant This report addresses the needs of strategic investors with a long term investment horizon of 6-12 months.

Global Research Director: If this report is provided to you by your broker under the Global Settlement, you may now also access (free of

Satish Betadpur, CFA charge) the short term trading outlook that we publish from time to time for this issuer, looking at the

coming 5-30 days for readers with a shorter trading horizon. These are available on-line only at

www.researchoracle.com.

Next news due:

1Q 09 results, July 2008

Report summary

Tata Communications Limited’s (TCL) standalone net sales, EBITDA and adjusted2 net income were

significantly below our estimates in 4Q 08. Margins were below our expectations due to higher than

expected network costs, operating & other expenses and salaries & related cost as a percentage of

total income. Taking into account the 4Q 08 performance, we have revised our FY 2009 and FY 2010

sales estimates downwards. Going forward, we have lowered our EBITDA and operating profit

estimates for FY 2008 and FY 2009 as we expect network costs as a percentage of total income to

increase over the next two years. Furthermore we do not expect Tyco Inc and Teleglobe Global Network

(TCL’s subsidiaries) to be earnings accretive in the near term. In addition, due to the lack of clarity (in

terms of timeline) over the auction of wireless broadband spectrum we do not expect WiMax to

contribute meaningfully in the immediate future and as a result our model does not factor in revenues

derived explicitly from WiMax. Moreover, if the regulatory hassles for asset value unlocking (especially

for real estate) continue (land bank divestment still under the scanner of government) we expect the

market to discount for illiquidity. However, we believe the market has already priced in these factors

and the stock currently trades close to its fair value and as a result we maintain our HOLD rating on

the common stock

Currency impact for US investors:

The impact by itself of the anticipated currency movements on the ADR (now US$17.95), without

considering changes in the share price, is positive and is expected to be:

Over 6 months: US$19.40

Over 12 months: US$20.75

Page 1 Refer to page 5 for footnotes

Anda mungkin juga menyukai

- Shoe Dog: A Memoir by the Creator of NikeDari EverandShoe Dog: A Memoir by the Creator of NikePenilaian: 4.5 dari 5 bintang4.5/5 (537)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeDari EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifePenilaian: 4 dari 5 bintang4/5 (5794)

- WNS NewsAlert 11july2008 1Dokumen1 halamanWNS NewsAlert 11july2008 1ResearchOracleBelum ada peringkat

- ACE 1Q08Update 11jul2008 1Dokumen1 halamanACE 1Q08Update 11jul2008 1ResearchOracleBelum ada peringkat

- GrupoAeroCentroNorte NewsAlert 11july2008 1Dokumen1 halamanGrupoAeroCentroNorte NewsAlert 11july2008 1ResearchOracleBelum ada peringkat

- Roundup 10 July 2008Dokumen2 halamanRoundup 10 July 2008ResearchOracleBelum ada peringkat

- UnileverNV 1Q08Update 10jul08 1Dokumen1 halamanUnileverNV 1Q08Update 10jul08 1ResearchOracleBelum ada peringkat

- EnduranceSpecialty NewsAlert 10july2008 1Dokumen1 halamanEnduranceSpecialty NewsAlert 10july2008 1ResearchOracleBelum ada peringkat

- Sappi 2Q08Update 09july2008 1Dokumen1 halamanSappi 2Q08Update 09july2008 1ResearchOracleBelum ada peringkat

- ChinaEastern FY2007Update 09july2008 1Dokumen1 halamanChinaEastern FY2007Update 09july2008 1ResearchOracleBelum ada peringkat

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceDari EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RacePenilaian: 4 dari 5 bintang4/5 (895)

- The Yellow House: A Memoir (2019 National Book Award Winner)Dari EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Penilaian: 4 dari 5 bintang4/5 (98)

- Grit: The Power of Passion and PerseveranceDari EverandGrit: The Power of Passion and PerseverancePenilaian: 4 dari 5 bintang4/5 (588)

- The Little Book of Hygge: Danish Secrets to Happy LivingDari EverandThe Little Book of Hygge: Danish Secrets to Happy LivingPenilaian: 3.5 dari 5 bintang3.5/5 (400)

- The Emperor of All Maladies: A Biography of CancerDari EverandThe Emperor of All Maladies: A Biography of CancerPenilaian: 4.5 dari 5 bintang4.5/5 (271)

- Never Split the Difference: Negotiating As If Your Life Depended On ItDari EverandNever Split the Difference: Negotiating As If Your Life Depended On ItPenilaian: 4.5 dari 5 bintang4.5/5 (838)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyDari EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyPenilaian: 3.5 dari 5 bintang3.5/5 (2259)

- On Fire: The (Burning) Case for a Green New DealDari EverandOn Fire: The (Burning) Case for a Green New DealPenilaian: 4 dari 5 bintang4/5 (74)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureDari EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FuturePenilaian: 4.5 dari 5 bintang4.5/5 (474)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryDari EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryPenilaian: 3.5 dari 5 bintang3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnDari EverandTeam of Rivals: The Political Genius of Abraham LincolnPenilaian: 4.5 dari 5 bintang4.5/5 (234)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaDari EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaPenilaian: 4.5 dari 5 bintang4.5/5 (266)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersDari EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersPenilaian: 4.5 dari 5 bintang4.5/5 (345)

- The Unwinding: An Inner History of the New AmericaDari EverandThe Unwinding: An Inner History of the New AmericaPenilaian: 4 dari 5 bintang4/5 (45)

- Rise of ISIS: A Threat We Can't IgnoreDari EverandRise of ISIS: A Threat We Can't IgnorePenilaian: 3.5 dari 5 bintang3.5/5 (137)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreDari EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You ArePenilaian: 4 dari 5 bintang4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)Dari EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Penilaian: 4.5 dari 5 bintang4.5/5 (121)

- Her Body and Other Parties: StoriesDari EverandHer Body and Other Parties: StoriesPenilaian: 4 dari 5 bintang4/5 (821)

- IAS 33 Earnings Per Share: (Conceptual Framework and Standards)Dokumen8 halamanIAS 33 Earnings Per Share: (Conceptual Framework and Standards)Joyce ManaloBelum ada peringkat

- CIMA F2 Course Notes PDFDokumen293 halamanCIMA F2 Course Notes PDFganBelum ada peringkat

- Practical Accounting 1 Theory of AccountsDokumen5 halamanPractical Accounting 1 Theory of AccountsHerald SisanteBelum ada peringkat

- 5th Semester SyllabusDokumen2 halaman5th Semester Syllabuspalak aroraBelum ada peringkat

- Acct224 Samuel TanDokumen4 halamanAcct224 Samuel TanSonia NgBelum ada peringkat

- Corp Fin Test 2 PDFDokumen9 halamanCorp Fin Test 2 PDFT Surya Kandhaswamy100% (2)

- Chapter 9. CH 09-10 Build A Model: Growth SalesDokumen6 halamanChapter 9. CH 09-10 Build A Model: Growth SalesMatt SlowickBelum ada peringkat

- Home Office PDFDokumen59 halamanHome Office PDF수지Belum ada peringkat

- AAA Exam Kit NotesDokumen21 halamanAAA Exam Kit NotesSheda AshrafBelum ada peringkat

- IMT PatanjaliDokumen4 halamanIMT PatanjalisquyenBelum ada peringkat

- ACT1205 App Aud2 Topic Outline Updated 01152021Dokumen2 halamanACT1205 App Aud2 Topic Outline Updated 01152021Kj TaccabanBelum ada peringkat

- Account StatementDokumen12 halamanAccount StatementbadramostuBelum ada peringkat

- MBA Project On Working CapitalDokumen57 halamanMBA Project On Working CapitalVijai PillarsettiBelum ada peringkat

- Chapter 10 Investments in Debt SecuritiesDokumen15 halamanChapter 10 Investments in Debt SecuritiesGlydel B. MatayaBelum ada peringkat

- Chapter 6 Accounting Concepts and PrinciplesDokumen39 halamanChapter 6 Accounting Concepts and PrinciplesCharlyn galahanBelum ada peringkat

- Managerial Accounting: Topic 3 Manufacturing Costs - Hilton 12thDokumen37 halamanManagerial Accounting: Topic 3 Manufacturing Costs - Hilton 12thنور عفيفه100% (1)

- Meaning of Winding UpDokumen17 halamanMeaning of Winding UpAkash ChechiBelum ada peringkat

- Worksheet 1.3 Introducing Trail BalancesDokumen3 halamanWorksheet 1.3 Introducing Trail Balancesaysilislam528Belum ada peringkat

- Dillard R WK #7 Assignment Chapter 7Dokumen2 halamanDillard R WK #7 Assignment Chapter 7Rdillard12100% (1)

- Cash Flow Forecast, Cost-Benefit Evaluation TechniquesDokumen15 halamanCash Flow Forecast, Cost-Benefit Evaluation Techniqueswaqar chBelum ada peringkat

- Pertemuan 1 - Shareholder EquityDokumen11 halamanPertemuan 1 - Shareholder EquityIvonie NursalimBelum ada peringkat

- AssignmentDokumen2 halamanAssignmentAisha FajardoBelum ada peringkat

- Merchandising Bus Prub Periodic MethodDokumen2 halamanMerchandising Bus Prub Periodic MethodChristopher Keith BernidoBelum ada peringkat

- (Corporate Finance) SUMMARY OF EXERCISES PDFDokumen9 halaman(Corporate Finance) SUMMARY OF EXERCISES PDFneda ajaminBelum ada peringkat

- M2:L1 - Notes Receivable Enrichment ActivityDokumen6 halamanM2:L1 - Notes Receivable Enrichment ActivityDarlene VillaflorBelum ada peringkat

- Barclays State of The Industry March 2019Dokumen198 halamanBarclays State of The Industry March 2019Divyansh GuptaBelum ada peringkat

- Deutsche BankDokumen14 halamanDeutsche Bankayaan40000Belum ada peringkat

- Learning Objective 17-1: Chapter 17 Financial Statement AnalysisDokumen55 halamanLearning Objective 17-1: Chapter 17 Financial Statement AnalysisMarqaz MarqazBelum ada peringkat

- Mba511 Spring 2020Dokumen6 halamanMba511 Spring 2020Kazi MostakimBelum ada peringkat

- S4H-BPD-FICO-Financial and Management ReportingDokumen13 halamanS4H-BPD-FICO-Financial and Management ReportingPradeep Reddy FICOBelum ada peringkat