Tax 1 Syllabus-A PDF

Diunggah oleh

blimjuco0 penilaian0% menganggap dokumen ini bermanfaat (0 suara)

25 tayangan15 halamanJudul Asli

TAX 1 SYLLABUS-A.pdf

Hak Cipta

© © All Rights Reserved

Format Tersedia

PDF atau baca online dari Scribd

Bagikan dokumen Ini

Apakah menurut Anda dokumen ini bermanfaat?

Apakah konten ini tidak pantas?

Laporkan Dokumen IniHak Cipta:

© All Rights Reserved

Format Tersedia

Unduh sebagai PDF atau baca online dari Scribd

0 penilaian0% menganggap dokumen ini bermanfaat (0 suara)

25 tayangan15 halamanTax 1 Syllabus-A PDF

Diunggah oleh

blimjucoHak Cipta:

© All Rights Reserved

Format Tersedia

Unduh sebagai PDF atau baca online dari Scribd

Anda di halaman 1dari 15

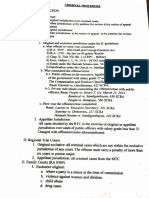

SYLLABUS IN TAXATION [

(REVISED BY 2016-2017)

GENERAL PRINCIPLES &

INCOME TAXATION (tor updating wih RA 10965 provisions)

A. General Principies of Taxation

1. Concept Underlying Basis2 and Purpose

Taxation, Taxes Defined

Attributes or Characteristics of Taxes

1) Cebu Portland Cement v, CTA, L-29059, 15 Dec 1987, 156 SCRA 535 (Lifeblood of the

Governmen:)

‘

4)_-Mun. of Makati v. CA, et al, L-89898, 01 Oct 1990, 190 SCRA 206 (Exempt from execution)

CIR. Algue, Inc etal, L-28896, 17 Feb 1988, 158 SCRA 9 (Lifeblood Theory; Rationale is

Symolotic Raleionship; timeliness of assessment / collection; effect of warrant of distraint &

levy; deductibility of promotional expense)3

igs Bank v. CA etal, 330 SCRA S07, 12 Apr 2000 (Mutual Observance of

is for refund due to losses, how to prove entitlement) 4

2. Principles of a Sound Tax System

Fiscal Adequacy

‘Theoretical justice

Administrative Feasibility

Will the non-obse:vance of these principles invalidate the tax law? No, unless

other inherent and constitutional limitations are infringed.

3. Scope of axation

No attribute of sovereignty is more pervading, unlimited, plenary,

‘comprehensive and supreme

What isthe concept cf taration? I: cam be viewed in two ways, namely@a) asa power to tax and (b) asthe act

‘or process by which taxing power ic exercised

What isthe theory or underiying besis of taxation? It is @ necessity without which no government could exist

revenues collected are incended to finance government and its

Anda mungkin juga menyukai

- Gabrito V CADokumen6 halamanGabrito V CAblimjucoBelum ada peringkat

- Tax 1 Syllabus-A PDFDokumen15 halamanTax 1 Syllabus-A PDFblimjucoBelum ada peringkat

- 6th Central Pay Commission Salary CalculatorDokumen15 halaman6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- Demande de Conversion de Certificat de Vaccination en Cle85188dDokumen2 halamanDemande de Conversion de Certificat de Vaccination en Cle85188dblimjucoBelum ada peringkat

- Tax 1 Syllabus-A PDFDokumen15 halamanTax 1 Syllabus-A PDFblimjucoBelum ada peringkat

- Tax I Syllabus-B PDFDokumen9 halamanTax I Syllabus-B PDFblimjucoBelum ada peringkat

- Colinares Vs PeopleDokumen2 halamanColinares Vs PeopleblimjucoBelum ada peringkat

- Mariano V ReyesDokumen13 halamanMariano V ReyesblimjucoBelum ada peringkat

- Reviewer in Local Government (Law On Public Corporation) : Fall in L (Aw) Ve.Dokumen41 halamanReviewer in Local Government (Law On Public Corporation) : Fall in L (Aw) Ve.blimjucoBelum ada peringkat

- Tax 1 Syllabus-ADokumen15 halamanTax 1 Syllabus-AblimjucoBelum ada peringkat

- Chapter 5 CharterpartiesDokumen24 halamanChapter 5 Charterpartiesblimjuco100% (3)

- Tax I Syllabus-B PDFDokumen9 halamanTax I Syllabus-B PDFblimjucoBelum ada peringkat

- Holiday Gift TagDokumen1 halamanHoliday Gift TagblimjucoBelum ada peringkat

- Charter PartyDokumen4 halamanCharter Partyjcfish07Belum ada peringkat

- Chapter 5 CharterpartiesDokumen24 halamanChapter 5 Charterpartiesblimjuco100% (3)

- Tax I Syllabus-B PDFDokumen9 halamanTax I Syllabus-B PDFblimjucoBelum ada peringkat

- OBLIGATIONS TITLEDokumen105 halamanOBLIGATIONS TITLEEmerson L. Macapagal84% (19)

- Tax 1 Syllabus-A PDFDokumen15 halamanTax 1 Syllabus-A PDFblimjucoBelum ada peringkat

- CrimPro SyllabusDokumen8 halamanCrimPro SyllabusblimjucoBelum ada peringkat

- LEGRESDokumen128 halamanLEGRESblimjucoBelum ada peringkat

- Tax I Syllabus-B PDFDokumen9 halamanTax I Syllabus-B PDFblimjucoBelum ada peringkat

- Rule 113 - Warrantless arrests and seizure of evidenceDokumen36 halamanRule 113 - Warrantless arrests and seizure of evidenceblimjucoBelum ada peringkat

- LEGRES - FlattenedDokumen2 halamanLEGRES - FlattenedblimjucoBelum ada peringkat

- SC rules on unjust vexation and kidnapping casesDokumen2 halamanSC rules on unjust vexation and kidnapping casesblimjucoBelum ada peringkat

- Part 5Dokumen2 halamanPart 5blimjucoBelum ada peringkat

- Part 4Dokumen2 halamanPart 4blimjucoBelum ada peringkat

- Part 2Dokumen2 halamanPart 2blimjucoBelum ada peringkat

- Gsis SSS Philhealth Pag-Ibig (HDMF) : ER EE XPTDokumen2 halamanGsis SSS Philhealth Pag-Ibig (HDMF) : ER EE XPTblimjucoBelum ada peringkat

- Contributions/ Fees 1. EE's Contribution: Members Who Can AffordDokumen2 halamanContributions/ Fees 1. EE's Contribution: Members Who Can AffordblimjucoBelum ada peringkat

- Shoe Dog: A Memoir by the Creator of NikeDari EverandShoe Dog: A Memoir by the Creator of NikePenilaian: 4.5 dari 5 bintang4.5/5 (537)

- Grit: The Power of Passion and PerseveranceDari EverandGrit: The Power of Passion and PerseverancePenilaian: 4 dari 5 bintang4/5 (587)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceDari EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RacePenilaian: 4 dari 5 bintang4/5 (890)

- The Yellow House: A Memoir (2019 National Book Award Winner)Dari EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Penilaian: 4 dari 5 bintang4/5 (98)

- The Little Book of Hygge: Danish Secrets to Happy LivingDari EverandThe Little Book of Hygge: Danish Secrets to Happy LivingPenilaian: 3.5 dari 5 bintang3.5/5 (399)

- On Fire: The (Burning) Case for a Green New DealDari EverandOn Fire: The (Burning) Case for a Green New DealPenilaian: 4 dari 5 bintang4/5 (73)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeDari EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifePenilaian: 4 dari 5 bintang4/5 (5794)

- Never Split the Difference: Negotiating As If Your Life Depended On ItDari EverandNever Split the Difference: Negotiating As If Your Life Depended On ItPenilaian: 4.5 dari 5 bintang4.5/5 (838)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureDari EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FuturePenilaian: 4.5 dari 5 bintang4.5/5 (474)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryDari EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryPenilaian: 3.5 dari 5 bintang3.5/5 (231)

- The Emperor of All Maladies: A Biography of CancerDari EverandThe Emperor of All Maladies: A Biography of CancerPenilaian: 4.5 dari 5 bintang4.5/5 (271)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreDari EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You ArePenilaian: 4 dari 5 bintang4/5 (1090)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyDari EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyPenilaian: 3.5 dari 5 bintang3.5/5 (2219)

- Team of Rivals: The Political Genius of Abraham LincolnDari EverandTeam of Rivals: The Political Genius of Abraham LincolnPenilaian: 4.5 dari 5 bintang4.5/5 (234)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersDari EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersPenilaian: 4.5 dari 5 bintang4.5/5 (344)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaDari EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaPenilaian: 4.5 dari 5 bintang4.5/5 (265)

- Rise of ISIS: A Threat We Can't IgnoreDari EverandRise of ISIS: A Threat We Can't IgnorePenilaian: 3.5 dari 5 bintang3.5/5 (137)

- The Unwinding: An Inner History of the New AmericaDari EverandThe Unwinding: An Inner History of the New AmericaPenilaian: 4 dari 5 bintang4/5 (45)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)Dari EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Penilaian: 4.5 dari 5 bintang4.5/5 (119)

- Her Body and Other Parties: StoriesDari EverandHer Body and Other Parties: StoriesPenilaian: 4 dari 5 bintang4/5 (821)