Estimated Duties and Taxes PDF

Diunggah oleh

Dianne Bernadeth Cos-agon0 penilaian0% menganggap dokumen ini bermanfaat (0 suara)

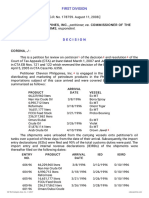

204 tayangan1 halamanThis document contains a computation of duties and taxes for an imported used automobile consigned to an individual in Qatar. It lists the customs value, depreciated cost, dutiable value in USD and PHP. It then calculates the customs duty, taxable value, landed cost, ad valorem tax, VAT base, VAT, and total duties and taxes to be paid, which amounts to 818,313 PHP.

Deskripsi Asli:

Judul Asli

Estimated Duties and Taxes.pdf

Hak Cipta

© © All Rights Reserved

Format Tersedia

PDF, TXT atau baca online dari Scribd

Bagikan dokumen Ini

Apakah menurut Anda dokumen ini bermanfaat?

Apakah konten ini tidak pantas?

Laporkan Dokumen IniThis document contains a computation of duties and taxes for an imported used automobile consigned to an individual in Qatar. It lists the customs value, depreciated cost, dutiable value in USD and PHP. It then calculates the customs duty, taxable value, landed cost, ad valorem tax, VAT base, VAT, and total duties and taxes to be paid, which amounts to 818,313 PHP.

Hak Cipta:

© All Rights Reserved

Format Tersedia

Unduh sebagai PDF, TXT atau baca online dari Scribd

0 penilaian0% menganggap dokumen ini bermanfaat (0 suara)

204 tayangan1 halamanEstimated Duties and Taxes PDF

Diunggah oleh

Dianne Bernadeth Cos-agonThis document contains a computation of duties and taxes for an imported used automobile consigned to an individual in Qatar. It lists the customs value, depreciated cost, dutiable value in USD and PHP. It then calculates the customs duty, taxable value, landed cost, ad valorem tax, VAT base, VAT, and total duties and taxes to be paid, which amounts to 818,313 PHP.

Hak Cipta:

© All Rights Reserved

Format Tersedia

Unduh sebagai PDF, TXT atau baca online dari Scribd

Anda di halaman 1dari 1

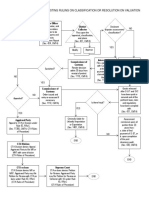

For Used Automobile Consigned to Individuals

Value in Qatari Riyal based on

137,000.00 pricelist for similar vehicles in Qatar

Customs Value (FOB/FCA) USD 37,627.05 Value in USD

Depreciated Value in USD, Max of

Depreciated Cost USD 18,813.53 50% deduction from FOB Value

Freight 1,000.00 CMO 22-2007

Insurance 1,505.08 CMO 22-2007

Dutiable Value in USD USD 21,318.61 = sum of FOB, FRT, and Ins

Prevailing Exchange Rate 51 USD TO PESO

Dutiable Value in PHP ₱ 1,087,248.96 = DV in USD x E/R

1.) 20%- 10-seater and above

Rate of Customs Duty 30% 2.) 30%- 9- seater and below

Customs Duty ₱ 326,174.69 DV in Php x Rate of Customs Duty

COMPUTATION OF TAXABLE VALUE

Dutiable Value ₱ 1,087,248.96 up

Customs Duty ₱ 326,174.69 up

= DV x .00125 (applicable only for

Bank Charges - Letter of Credit Transactions)

Brokerage Fee 6,409.06 CAO 1-2001

Arrastre 4,307.00 AR for 20' footer (new)

Wharfage 519.35 WD for 20' footer

Customs Doc Stamp 265 FIXED

Import Processing Fee 1000 CAO 2-2001

= sum of all the above (from DV to

Landed Cost ₱ 1,425,924.06 IPF)

Ad valorem Tax ₱ 285,184.81 R.R. 5-2018

VAT Base ₱ 1,711,108.87

Rate of Value Added Tax 12%

Value Added Tax ₱ 205,333.06

COMPUTATION OF TOTAL DUTIES

AND TAXES TO BE PAID

Customs Duty ₱ 326,175 up

Value-Added Tax ₱ 205,333 up

Advalorem Tax ₱ 285,185 up

Import Processing Fee ₱ 1,000 up

Container Security Fee ₱ 255

Customs Doc Stamp ₱ 265

CP Fee ₱ 100 fixed

TOTAL ₱ 818,313

Anda mungkin juga menyukai

- INSTRUCTION: Select The Correct Answer For Each of The Following Questions. Mark Only One Answer For Each Item by 1X40 40 Points Multiple ChoiceDokumen5 halamanINSTRUCTION: Select The Correct Answer For Each of The Following Questions. Mark Only One Answer For Each Item by 1X40 40 Points Multiple ChoiceCherry GalosmoBelum ada peringkat

- Certificate of Origin: Group IVDokumen16 halamanCertificate of Origin: Group IVTravis OpizBelum ada peringkat

- Goods Subject For Consumption Under Formal Entry ProcessDokumen13 halamanGoods Subject For Consumption Under Formal Entry ProcessElaine Antonette RositaBelum ada peringkat

- Tariff ClassificationDokumen50 halamanTariff ClassificationguerradhonaelizaBelum ada peringkat

- Ra 8181Dokumen5 halamanRa 8181Cons BaraguirBelum ada peringkat

- Computation of Excise TaxDokumen4 halamanComputation of Excise TaxMax IIIBelum ada peringkat

- CusdecFinalSAD 3CNA1600007 PDFDokumen6 halamanCusdecFinalSAD 3CNA1600007 PDFMhean Samson BermejoBelum ada peringkat

- Custom DutiesDokumen5 halamanCustom DutiesJoey WassigBelum ada peringkat

- IV. Tariff and Customs Code of 1978, As AmendedDokumen57 halamanIV. Tariff and Customs Code of 1978, As AmendedCarrie CrossBelum ada peringkat

- Guide For Business: Using The First Protocol: Go To For More InformationDokumen24 halamanGuide For Business: Using The First Protocol: Go To For More InformationTravis OpizBelum ada peringkat

- Lecture Notes (Sec. 801-813)Dokumen3 halamanLecture Notes (Sec. 801-813)Roselle BautroBelum ada peringkat

- Rule of CEPTDokumen8 halamanRule of CEPTCalvin KleinBelum ada peringkat

- Procedure - Section711 - Rev2 - 28july 2020Dokumen3 halamanProcedure - Section711 - Rev2 - 28july 2020AceBelum ada peringkat

- A Primer On The AhtnDokumen5 halamanA Primer On The AhtnJun M. AbenojarBelum ada peringkat

- Computation PDFDokumen10 halamanComputation PDFghag22909947Belum ada peringkat

- Ra 9135Dokumen20 halamanRa 9135Daley CatugdaBelum ada peringkat

- CMTA Disputing Assessment or ClassificationDokumen1 halamanCMTA Disputing Assessment or ClassificationWorstWitch TalaBelum ada peringkat

- Incoterms Rule - TM 3Dokumen75 halamanIncoterms Rule - TM 3Krizha WatanabeBelum ada peringkat

- CL DAY 03 - FOR PRINTING Advance Ruling and Other CMTA ProvDokumen5 halamanCL DAY 03 - FOR PRINTING Advance Ruling and Other CMTA ProvRenee LaagBelum ada peringkat

- Cao-01-2019 Post Clearance Audit and Prior Disclosure ProgramDokumen32 halamanCao-01-2019 Post Clearance Audit and Prior Disclosure Programlaila ursabiaBelum ada peringkat

- CPD Faqs V3 080817 - JMSDokumen21 halamanCPD Faqs V3 080817 - JMSKatherineBelum ada peringkat

- Assignment - ETHICS AND STANDARDS OF THE CUSTOMS BROKERAGEDokumen6 halamanAssignment - ETHICS AND STANDARDS OF THE CUSTOMS BROKERAGEcris addunBelum ada peringkat

- Course OutlineDokumen2 halamanCourse OutlineTravis OpizBelum ada peringkat

- Entry Lodgement and Cargo Clearance Process PDFDokumen36 halamanEntry Lodgement and Cargo Clearance Process PDFHiro TanamotoBelum ada peringkat

- Entry Lodgement and Cargo Clearance ProcessDokumen36 halamanEntry Lodgement and Cargo Clearance ProcessNina Bianca Espino100% (1)

- Prelim Exam Tm3 Summer ClassDokumen4 halamanPrelim Exam Tm3 Summer ClassPrincess Mendoza SolatorioBelum ada peringkat

- CDP Long QuizDokumen26 halamanCDP Long QuizElaine Antonette RositaBelum ada peringkat

- Incoterms ExplainedDokumen2 halamanIncoterms Explainedpram006Belum ada peringkat

- KELMNN00106EA001Dokumen3 halamanKELMNN00106EA001joyce magpayoBelum ada peringkat

- 4 - T-4 Import ClearanceDokumen13 halaman4 - T-4 Import ClearanceKesTerJeeeBelum ada peringkat

- CustomsDokumen27 halamanCustomslorennethBelum ada peringkat

- Tax 2. Q&A Compilation (R.A. 9135, 8751, 8752 & 8800)Dokumen13 halamanTax 2. Q&A Compilation (R.A. 9135, 8751, 8752 & 8800)pa3ciaBelum ada peringkat

- Ethics SaDokumen10 halamanEthics SaJes MinBelum ada peringkat

- Import Clearance and FormalitiesDokumen32 halamanImport Clearance and FormalitiesJhecyl Ann BasagreBelum ada peringkat

- Customs Clearance Lecture 8 - Tentative Release, PMS, SCDokumen32 halamanCustoms Clearance Lecture 8 - Tentative Release, PMS, SCHarrenBelum ada peringkat

- Challenges That Customs Brokers/Processors Encounter in Processing Import Entry in Manila International Container PortDokumen9 halamanChallenges That Customs Brokers/Processors Encounter in Processing Import Entry in Manila International Container PortTravis OpizBelum ada peringkat

- Ra10863 CmtaDokumen64 halamanRa10863 CmtaMuy OrdoBelum ada peringkat

- CDP Day 01 Import Clearance PDFDokumen4 halamanCDP Day 01 Import Clearance PDFRBT BoysBelum ada peringkat

- LPU Presentation (CMTA, Feb 15, 2012)Dokumen25 halamanLPU Presentation (CMTA, Feb 15, 2012)Jico Valguna BoneoBelum ada peringkat

- Administrative LawsDokumen20 halamanAdministrative LawsTravis OpizBelum ada peringkat

- CL Day 01 Tutorial Material PDFDokumen7 halamanCL Day 01 Tutorial Material PDFRBT BoysBelum ada peringkat

- Tarrifs and Customs CodeDokumen75 halamanTarrifs and Customs CodeCid Benedict PabalanBelum ada peringkat

- RA 8751 Countervailing LawDokumen6 halamanRA 8751 Countervailing LawAgnus SiorBelum ada peringkat

- Free Zones and TransitDokumen8 halamanFree Zones and TransitCelestino Sabela Peralta Jr.Belum ada peringkat

- Tariff Commission FAQsDokumen7 halamanTariff Commission FAQsFrancisJosefTomotorgoGoingoBelum ada peringkat

- Schedule of Import Export Arrastre and Wharfage ChargesDokumen1 halamanSchedule of Import Export Arrastre and Wharfage Chargessieuihm67% (3)

- Advance RulingDokumen4 halamanAdvance RulingmarlynBelum ada peringkat

- Tariff Competency Exam - Post-Test 7Dokumen4 halamanTariff Competency Exam - Post-Test 7Jimenez C. Shainah MarieBelum ada peringkat

- 11-T-11 Admin & Judicial ProceduresDokumen22 halaman11-T-11 Admin & Judicial ProceduresCherrylyn CaliwanBelum ada peringkat

- RA 7916 - The Special Economic Zone Act of 1995 (IRR)Dokumen23 halamanRA 7916 - The Special Economic Zone Act of 1995 (IRR)Jen AnchetaBelum ada peringkat

- Request For Release Under Tentative AssessmentDokumen1 halamanRequest For Release Under Tentative AssessmentRusiel PanchoBelum ada peringkat

- CDP LONG QUIZ - With AnswersDokumen28 halamanCDP LONG QUIZ - With AnswersElaine Antonette RositaBelum ada peringkat

- Units of Measurement - Conversion ChartDokumen1 halamanUnits of Measurement - Conversion ChartTravis OpizBelum ada peringkat

- 1 CV Handbook Final Nov 2012Dokumen140 halaman1 CV Handbook Final Nov 2012Thomas KidandoBelum ada peringkat

- Dutiable FreightDokumen40 halamanDutiable FreightShamilleBelum ada peringkat

- BOC CMO 32-2017 Reactivation of The Post Clearance Audit Group of The Bureau of CustomsDokumen3 halamanBOC CMO 32-2017 Reactivation of The Post Clearance Audit Group of The Bureau of CustomsPortCalls100% (2)

- (REPUBLIC ACT NO. 10863, May 30, 2016) : An Act Modernizing The Customs and Tariff AdministrationDokumen135 halaman(REPUBLIC ACT NO. 10863, May 30, 2016) : An Act Modernizing The Customs and Tariff AdministrationelCrisBelum ada peringkat

- RA 9280 Customs Broker Act of 2004Dokumen12 halamanRA 9280 Customs Broker Act of 2004Roy GonzaBelum ada peringkat

- Estimated Duties and Taxes - Beneco Water TurbinesDokumen1 halamanEstimated Duties and Taxes - Beneco Water TurbinesDianne Bernadeth Cos-agonBelum ada peringkat

- Case Study Topics5and6Dokumen11 halamanCase Study Topics5and6team podivBelum ada peringkat

- Tappa Vs BacusDokumen10 halamanTappa Vs BacusDianne Bernadeth Cos-agonBelum ada peringkat

- Po Vs PoDokumen23 halamanPo Vs PoDianne Bernadeth Cos-agonBelum ada peringkat

- G.R. No. 210435 People Vs SONNY RAMOS y BUENAFLORDokumen9 halamanG.R. No. 210435 People Vs SONNY RAMOS y BUENAFLORDianne Bernadeth Cos-agonBelum ada peringkat

- Submission of E-Mail Addresses and Mobile Numbers (For Corporations)Dokumen1 halamanSubmission of E-Mail Addresses and Mobile Numbers (For Corporations)Dianne Bernadeth Cos-agonBelum ada peringkat

- People vs. MERVIN GAHIDokumen11 halamanPeople vs. MERVIN GAHIDianne Bernadeth Cos-agonBelum ada peringkat

- Accretion (Along Rivers, Creeks, ETC) : 1. ApplicantDokumen2 halamanAccretion (Along Rivers, Creeks, ETC) : 1. ApplicantDianne Bernadeth Cos-agonBelum ada peringkat

- Rule 41 Section 1: No Appeal Shall Be Taken From: 8 Ddidaset-Ows An Order of Execution Is Not Appealable, Except: 6 VcestiDokumen1 halamanRule 41 Section 1: No Appeal Shall Be Taken From: 8 Ddidaset-Ows An Order of Execution Is Not Appealable, Except: 6 VcestiDianne Bernadeth Cos-agonBelum ada peringkat

- Due Process Ichong v. HernandezDokumen6 halamanDue Process Ichong v. HernandezDianne Bernadeth Cos-agonBelum ada peringkat

- CivRev BAR Q 1Dokumen2 halamanCivRev BAR Q 1Dianne Bernadeth Cos-agonBelum ada peringkat

- Nego Case Digests For CommrevDokumen22 halamanNego Case Digests For CommrevDianne Bernadeth Cos-agonBelum ada peringkat

- 46 - Gandionco v. PeñarandaDokumen1 halaman46 - Gandionco v. PeñarandaDianne Bernadeth Cos-agonBelum ada peringkat

- Estimated Duties and Taxes - Beneco Water TurbinesDokumen1 halamanEstimated Duties and Taxes - Beneco Water TurbinesDianne Bernadeth Cos-agonBelum ada peringkat

- Vda Dela Rosa vs. Heirs of RustiaDokumen3 halamanVda Dela Rosa vs. Heirs of RustiaDianne Bernadeth Cos-agon100% (1)

- PROPERTY - Quintos v. NicolasDokumen2 halamanPROPERTY - Quintos v. NicolasDianne Bernadeth Cos-agonBelum ada peringkat

- PROPERTY Calanasan v. Spouses DoloritoDokumen1 halamanPROPERTY Calanasan v. Spouses DoloritoDianne Bernadeth Cos-agonBelum ada peringkat

- PROPERTY - Department of Education v. Tuliao, G.R. No. 205664, June 9, 2014Dokumen2 halamanPROPERTY - Department of Education v. Tuliao, G.R. No. 205664, June 9, 2014Dianne Bernadeth Cos-agonBelum ada peringkat

- PROPERTY - Abejaron v. NabasaDokumen2 halamanPROPERTY - Abejaron v. NabasaDianne Bernadeth Cos-agon100% (1)

- PROPERTY - Serg's Products, Inc. v. PCI Leasing and Finance, IncDokumen1 halamanPROPERTY - Serg's Products, Inc. v. PCI Leasing and Finance, IncDianne Bernadeth Cos-agonBelum ada peringkat

- Martinez v. MartinezDokumen2 halamanMartinez v. MartinezDianne Bernadeth Cos-agonBelum ada peringkat

- Luzon Hydro Corporation vs. CIRDokumen2 halamanLuzon Hydro Corporation vs. CIRDianne Bernadeth Cos-agon100% (1)

- People vs. JaurigueDokumen2 halamanPeople vs. JaurigueDianne Bernadeth Cos-agonBelum ada peringkat

- How To Apply For Pag IBIG Housing Loan in 2019 - 8 StepsDokumen48 halamanHow To Apply For Pag IBIG Housing Loan in 2019 - 8 StepsJhanese Bastes SarigumbaBelum ada peringkat

- AHOLD CaseDokumen20 halamanAHOLD Caseakashh200875% (4)

- SLAuS 700 PDFDokumen9 halamanSLAuS 700 PDFnaveen pragash100% (1)

- RMC 35-2011 DigestDokumen1 halamanRMC 35-2011 DigestA CybaBelum ada peringkat

- Marketing Analytics: Assignment 3: Discriminant AnalysisDokumen13 halamanMarketing Analytics: Assignment 3: Discriminant AnalysisHarsh ShuklaBelum ada peringkat

- ReceiptDokumen2 halamanReceiptshaikh rehmanBelum ada peringkat

- Case Study Presentation On Industrial RelationDokumen9 halamanCase Study Presentation On Industrial Relationrglaae100% (1)

- Strategic Management ReportDokumen33 halamanStrategic Management ReportLuxme PokhrelBelum ada peringkat

- Compendium of GOs For Epc in AP PDFDokumen444 halamanCompendium of GOs For Epc in AP PDFPavan CCDMC100% (1)

- 15.910 Draft SyllabusDokumen10 halaman15.910 Draft SyllabusSaharBelum ada peringkat

- "Role of Performance ManagementDokumen104 halaman"Role of Performance ManagementSanjay NgarBelum ada peringkat

- Meetings For Merger & DemergerDokumen4 halamanMeetings For Merger & Demergerjinesh331Belum ada peringkat

- FABM2 (QUIZ 2) November 09, 2020 Ian BregueraDokumen2 halamanFABM2 (QUIZ 2) November 09, 2020 Ian Breguerafennie ilinah molinaBelum ada peringkat

- Totality Rule-Kinds of ActionsDokumen8 halamanTotality Rule-Kinds of ActionsAisha TejadaBelum ada peringkat

- Sub ContractingDokumen19 halamanSub ContractingPRABESH GAJUREL0% (1)

- Pom Question and AnswersDokumen20 halamanPom Question and AnswersAavula sanjay reddyBelum ada peringkat

- Preparing Financial StatementsDokumen14 halamanPreparing Financial StatementsAUDITOR97Belum ada peringkat

- AccountingDokumen336 halamanAccountingVenkat GV100% (2)

- Mitel SemiconductorDokumen14 halamanMitel Semiconductorkomaltagra100% (1)

- E-Directory:: 2022 Patna Branch of ICAI (CIRC) As On 01/01/2022Dokumen345 halamanE-Directory:: 2022 Patna Branch of ICAI (CIRC) As On 01/01/2022Rekha MeghaniBelum ada peringkat

- 20140625Dokumen24 halaman20140625កំពូលបុរសឯកាBelum ada peringkat

- Aki Insurance Industry Report 2009Dokumen40 halamanAki Insurance Industry Report 2009cimcim0812Belum ada peringkat

- Executive Summary (Sample)Dokumen4 halamanExecutive Summary (Sample)celfa29100% (2)

- Price Determination For AutomobilesDokumen11 halamanPrice Determination For AutomobilesAbubakarBelum ada peringkat

- Sale Catalog - 2012 Heatwave Featuring The Elite of CrasdaleDokumen121 halamanSale Catalog - 2012 Heatwave Featuring The Elite of CrasdaleHolstein PlazaBelum ada peringkat

- Internship Ahsan AkhterDokumen42 halamanInternship Ahsan Akhterinzamamalam515Belum ada peringkat

- Maximo Change Management Quick Reference Guide v1.0Dokumen5 halamanMaximo Change Management Quick Reference Guide v1.0ajayc50Belum ada peringkat

- Erp Modules HRDokumen12 halamanErp Modules HRJigisha TiwaryBelum ada peringkat

- Nerolac KartikDokumen70 halamanNerolac Kartikkunal77787Belum ada peringkat

- Kudos - 4 21 14Dokumen1 halamanKudos - 4 21 14Stephanie Rose GliddenBelum ada peringkat