Idfc Long Term Infrastructure Bonds

Diunggah oleh

naav_adnaavDeskripsi Asli:

Hak Cipta

Format Tersedia

Bagikan dokumen Ini

Apakah menurut Anda dokumen ini bermanfaat?

Apakah konten ini tidak pantas?

Laporkan Dokumen IniHak Cipta:

Format Tersedia

Idfc Long Term Infrastructure Bonds

Diunggah oleh

naav_adnaavHak Cipta:

Format Tersedia

IDFC LONG TERM INFRASTRUCTURE BONDS

Issue Size Rs 3,400 crores

There is no minimum issue size

Rating “LAAA” (ICRA) with stable outlook and is the highest credit quality

rating assigned by ICRA

Security Fully secured with first pari passu floating charge over secured assets

and first fixed pari pasu charge over specified immovable properties of

the Company

Bond Face value & issue Rs 5,000/- per bond

price

Subscription amount

Minimum Rs 10,000 or 2 bonds. The bonds can be of the same series or two bonds

across different series.

Maximum No Limit *

Tax Benefit Under Section 80CCF of the Income Tax Act the amount, not exceeding

Rs. 20,000 per annum, paid or deposited as subscription to long-term

infrastructure bonds during the previous year relevant to the

assessment year beginning April 01, 2011 shall be deducted in

computing the taxable income.

This is over and above the Rs 1,00,000 tax benefit available under

section 80C, 80CCC & 80CCD read with section 80CCE

Who can apply Resident individual or HUF

Investor should provide PAN Number and Demat Account No

Maturity / redemption 10 years from the deemed date of allotment

Lock In period 5 years from the deemed date of allotment

Buyback 5 years + 1 day from the deemed date of allotment

Listing NSE & BSE

Loan against Bonds Bonds cannot be pledged or hypothecated for obtaining loans during

the lock in period

Issue opens September 30, 2010

Issue Closes October 18, 2010

Application forms Application Forms will be available in IDFC office in Mumbai, Chennai,

availability New Delhi, Bengaluru. Application forms will also be available with

Lead Managers & Lead Brokers.

Lead Managers Citibank, Enam, Kotak , IDFC Capital

Lead Brokers Kotak Securities, Enam Securities, Sharekhan, JM Financial services,

ICICI Securities, RR Equity, SMC Global, Bajaj Capital, Almondz

Securities, HDFC Securities, Karvy, NJ Invest India

Registrars Karvy

Debenture Trustee IDBI Trusteeship

Bankers HDFC, ICICI, Kotak Mahindra, IDBI, Citibank, Axis, IndusInd, Dhanlaxmi

* Please see tax benefit

SPECIFIC TERMS FOR EACH SERIES OF BONDS UNDER THE FIRST TRANCHE

Series 1 2 3 4

Face Value Rs 5000 per bond

Minimum n Two Bonds and in multiples of one Bond thereafter.

umber of B For the purpose of fulfilling the requirement of minimum subscription of two Bond

onds per ap s, an Applicant may choose to apply for two Bonds of the same series or two Bond

plication* s across different series.

Terms of Pa Full amount with the Application Form

yment

Interest pay Annual Cumulative Annual Cumulative

ment

Interest Ra 8.00% p.a. N.A. 7.50% p.a. N.A.

te

Maturity Am Rs. 5,000 Rs. 10,800 Rs. 5,000 Rs. 10,310

ount per Bo

nd

Maturity 10 years from the Deemed Date of Allotment

Yield on Ma 8.0% 8.0% compounded a 7.50% 7.50% compounded

turity nnually annually

Buyback Fa N.A. N.A. Yes Yes

cility

Yield on Bu N.A. N.A. 7.50% 7.50% compounded

yback annually

Buyback Am N.A. N.A. Rs. 5,000/- Rs. 7,180/-

ount per Bond per Bond

Buyback Da N.A. N.A. Date falling five ye Date falling five ye

te ars and one day fro ars and one day fro

m the Deemed Date m the Deemed Date

of Allotment of Allotment

Buyback Int N.A. N.A. The period beginnin The period beginnin

imation Per g not before nine m g not before nine m

iod onths prior to the B onths prior to the B

uyback Date and en uyback Date and en

ding not later than ding not later than

six months prior to six months prior to

the Buyback Date. the Buyback Date

TAX ADJUSTED YIELD TO INVESTORs

Tax Rates (%) Series 1 (%) Series 2 (%) Series 3** (%) Series 4**(%)

30.9 13.89 12.06 17.19 15.74

20.6 11.57 10.52 13.41 12.57

10.3 9.64 9.18 10.23 9.86

**Assuming Buyback of the Bonds on the Buyback Date.

Anda mungkin juga menyukai

- Chapter 10 Determination of Vat Still DueDokumen29 halamanChapter 10 Determination of Vat Still DueChristian Pelimco100% (1)

- GSECL Annual ReportDokumen65 halamanGSECL Annual ReportArun NairBelum ada peringkat

- Reviewed 2012-01, Barangay Tax Ordinance (Local Revenue Code)Dokumen7 halamanReviewed 2012-01, Barangay Tax Ordinance (Local Revenue Code)Jessie Serdeño75% (4)

- IDFC BondDokumen3 halamanIDFC BondKeisham BabitaBelum ada peringkat

- DEL L&T Infrastructure BondDokumen3 halamanDEL L&T Infrastructure Bondpoly899Belum ada peringkat

- The IssueDokumen8 halamanThe IssuessfinservBelum ada peringkat

- LT Infrastructure FinanceLtd 2011B Series Tranche 1Dokumen2 halamanLT Infrastructure FinanceLtd 2011B Series Tranche 1priya thackerBelum ada peringkat

- LT Infrastructure Final Product NoteDokumen1 halamanLT Infrastructure Final Product NoteChandra Mohan SBelum ada peringkat

- FAQ For Bond IssueDokumen6 halamanFAQ For Bond IssueNatarajan AgoramBelum ada peringkat

- Srei Infrastructure Infrastructure Finance Limited Term SheetDokumen3 halamanSrei Infrastructure Infrastructure Finance Limited Term Sheetamanjeet singhBelum ada peringkat

- Press Release: L&T Infrastructure Finance Company LimitedDokumen4 halamanPress Release: L&T Infrastructure Finance Company Limitedjignesh_vaderaBelum ada peringkat

- Sovereign Gold Bond: August 2020Dokumen7 halamanSovereign Gold Bond: August 2020Chintan SardaBelum ada peringkat

- BondsDokumen19 halamanBondsSam SamBelum ada peringkat

- Trust Deposit Jan09Dokumen5 halamanTrust Deposit Jan09mayurdjBelum ada peringkat

- Indiabulls Commercial Credit Limited - One Pager - Mar 2023Dokumen1 halamanIndiabulls Commercial Credit Limited - One Pager - Mar 2023RASHVIBelum ada peringkat

- AU Bank MITC ConditionsDokumen11 halamanAU Bank MITC Conditionswestm4248Belum ada peringkat

- Case Study - RamDokumen5 halamanCase Study - RamswathyBelum ada peringkat

- 04-Jan-2019 25-Jan-2019: Mahindra & Mahindra Financial Services LimitedDokumen3 halaman04-Jan-2019 25-Jan-2019: Mahindra & Mahindra Financial Services Limitedkishore13Belum ada peringkat

- Question No. 3: Step 1. Determining Cash Inflow and Cash OutflowDokumen10 halamanQuestion No. 3: Step 1. Determining Cash Inflow and Cash OutflowNAVNIT CHOUDHARYBelum ada peringkat

- PNB Fixed Deposit FormDokumen6 halamanPNB Fixed Deposit FormKaushal DidwaniaBelum ada peringkat

- Indiabulls Commercial Credit LTD: Stock Price & Q4 Results of Indiabulls Commercial Credit Limited - HDFC SecuritiesDokumen7 halamanIndiabulls Commercial Credit LTD: Stock Price & Q4 Results of Indiabulls Commercial Credit Limited - HDFC SecuritiesHDFC SecuritiesBelum ada peringkat

- How Certificates of Deposit (CD) Work?: Treasury Bills and Dated SecuritiesDokumen11 halamanHow Certificates of Deposit (CD) Work?: Treasury Bills and Dated SecuritiesyadavgunwalBelum ada peringkat

- National Saving CenterDokumen4 halamanNational Saving CenterMariyam TajamalBelum ada peringkat

- What Is InfinitiDokumen4 halamanWhat Is Infinitisu maiyahBelum ada peringkat

- Rashmi 2MDokumen1 halamanRashmi 2MRobert OtienoBelum ada peringkat

- PO SavingsDokumen8 halamanPO Savingsamrish_ydsBelum ada peringkat

- RevisionInterestRates CircularDokumen4 halamanRevisionInterestRates CircularNishantBelum ada peringkat

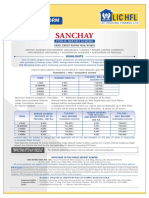

- LIC Housing Finance LTD FDDokumen6 halamanLIC Housing Finance LTD FDBiswa Jyoti GuptaBelum ada peringkat

- Gurpreet Case Study - Only AnswersDokumen12 halamanGurpreet Case Study - Only Answerspooja katariya0% (1)

- PD Interest RateDokumen2 halamanPD Interest RatecraftylandofficialBelum ada peringkat

- Bond ValuationDokumen26 halamanBond ValuationSANJAY ANANDANBelum ada peringkat

- PDS Personal Financing-I Programme TawarruqDokumen6 halamanPDS Personal Financing-I Programme Tawarruq2023259044Belum ada peringkat

- Features of ICICI Pru Guaranteed Income For Tomorrow: What Are Benefits of This Policy?Dokumen3 halamanFeatures of ICICI Pru Guaranteed Income For Tomorrow: What Are Benefits of This Policy?Meenu SinghBelum ada peringkat

- Tax Planning With Reference To Managerial DecisionsDokumen22 halamanTax Planning With Reference To Managerial DecisionsdharuvBelum ada peringkat

- Personalised Proposal For Securing Your Guaranteed Income NeedsDokumen6 halamanPersonalised Proposal For Securing Your Guaranteed Income NeedsSirshajit SanfuiBelum ada peringkat

- Efsl-7028011153 NCD Oct23Dokumen1 halamanEfsl-7028011153 NCD Oct23chandraprakash sharmaBelum ada peringkat

- Wa0004.Dokumen7 halamanWa0004.manoranjanthakur1979Belum ada peringkat

- Pinnacle Brochure 21oct09Dokumen8 halamanPinnacle Brochure 21oct09neha-bothra-1107Belum ada peringkat

- ICICI Guaranteed BenifitsDokumen3 halamanICICI Guaranteed BenifitsNaveen SettyBelum ada peringkat

- KFD New07112023153153412 E28Dokumen5 halamanKFD New07112023153153412 E28Mayur NagdiveBelum ada peringkat

- Illustration 2Dokumen7 halamanIllustration 2muks.jags.2023Belum ada peringkat

- Personalised Proposal For Securing Your Guaranteed Income NeedsDokumen6 halamanPersonalised Proposal For Securing Your Guaranteed Income NeedsSirshajit SanfuiBelum ada peringkat

- Life Link Pension SP LeafletDokumen2 halamanLife Link Pension SP LeafletSarvesh MishraBelum ada peringkat

- Valuation of Bonds NumericalsDokumen30 halamanValuation of Bonds NumericalsankitBelum ada peringkat

- Individual Car Loan Agreement SampleDokumen32 halamanIndividual Car Loan Agreement Sampleey019.aaBelum ada peringkat

- KFD New18032024162138470 E28Dokumen5 halamanKFD New18032024162138470 E28Suraj BhasmeBelum ada peringkat

- IBS Session 1 With SolutionDokumen16 halamanIBS Session 1 With SolutionMOHD SHARIQUE ZAMABelum ada peringkat

- Features of ICICI Pru Guaranteed Income For Tomorrow: What Are Benefits of This Policy?Dokumen3 halamanFeatures of ICICI Pru Guaranteed Income For Tomorrow: What Are Benefits of This Policy?ShreyaBelum ada peringkat

- 4906-ICICI Pru-Lakshya-Gold Plan-One Pager-27DecDokumen2 halaman4906-ICICI Pru-Lakshya-Gold Plan-One Pager-27DecMehul Bajaj100% (1)

- Question Set TVMDokumen17 halamanQuestion Set TVMAnju VijayBelum ada peringkat

- KSLP Presentation For Daughter 3-12-2021Dokumen12 halamanKSLP Presentation For Daughter 3-12-2021hardik ParikhBelum ada peringkat

- Paper - 2: Strategic Financial Management Questions Future ContractDokumen24 halamanPaper - 2: Strategic Financial Management Questions Future ContractRaul KarkyBelum ada peringkat

- Edelweiss Tokio Life - GCAP - : OverviewDokumen2 halamanEdelweiss Tokio Life - GCAP - : OverviewarunBelum ada peringkat

- Sanchay Public Deposit FormDokumen6 halamanSanchay Public Deposit Formmanoj barokaBelum ada peringkat

- IPru Easy Retirement Leaflet PDFDokumen6 halamanIPru Easy Retirement Leaflet PDFRameshBelum ada peringkat

- SHRIRAM NCD-Issue-Structures-DETAILS PDFDokumen5 halamanSHRIRAM NCD-Issue-Structures-DETAILS PDFDeepakBelum ada peringkat

- NRI TD and RD Account Opening FormDokumen2 halamanNRI TD and RD Account Opening FormVishnu M JBelum ada peringkat

- KFD New20012024140359061 E35Dokumen17 halamanKFD New20012024140359061 E35msaurabh9142Belum ada peringkat

- RevisionInterestRates CircularDokumen5 halamanRevisionInterestRates CircularPrashantGuptaBelum ada peringkat

- NRI News Letter From SBI Thiruvananthapuram Circle : E Turning Indian TaxationDokumen7 halamanNRI News Letter From SBI Thiruvananthapuram Circle : E Turning Indian TaxationSherinWorinBelum ada peringkat

- What The Banks Ask & Why: Everything You Need to Know before Applying for a Mortgage If You're Self-Employed or Have a Complex IncomeDari EverandWhat The Banks Ask & Why: Everything You Need to Know before Applying for a Mortgage If You're Self-Employed or Have a Complex IncomeBelum ada peringkat

- Let For Profit: A Guide for the Novice Buy to Let InvestorDari EverandLet For Profit: A Guide for the Novice Buy to Let InvestorBelum ada peringkat

- Act With AmendmentDokumen134 halamanAct With AmendmentSowjanya BondaBelum ada peringkat

- WWW - Upsc.gov - in ExamsDokumen1 halamanWWW - Upsc.gov - in ExamsSudhansu Sekhar PandaBelum ada peringkat

- BrochureDokumen6 halamanBrochureAbhishek RaiBelum ada peringkat

- General Studies Previous Paper 1993Dokumen15 halamanGeneral Studies Previous Paper 1993pratyoBelum ada peringkat

- What Is The Syllabus For UPSC CSAT 2013Dokumen5 halamanWhat Is The Syllabus For UPSC CSAT 2013naav_adnaavBelum ada peringkat

- ElectionDokumen12 halamanElectionnaav_adnaavBelum ada peringkat

- SpecimenDokumen1 halamanSpecimenSanjay KumarBelum ada peringkat

- Essay Guidelines 2014Dokumen3 halamanEssay Guidelines 2014naav_adnaavBelum ada peringkat

- Readme FirstDokumen1 halamanReadme Firstnaav_adnaavBelum ada peringkat

- Expected Questions From Books & Authors 2014 - Gr8AmbitionZDokumen5 halamanExpected Questions From Books & Authors 2014 - Gr8AmbitionZnaav_adnaavBelum ada peringkat

- IGNOU - School of Social Sciences (SOSS) - Programmes - Distance - Master of Arts (Economics) (MEC)Dokumen4 halamanIGNOU - School of Social Sciences (SOSS) - Programmes - Distance - Master of Arts (Economics) (MEC)naav_adnaavBelum ada peringkat

- Rice Appe Recipe - Idli Recipes, Dosa Recipes - by Tarla Dalal - TarladalalDokumen2 halamanRice Appe Recipe - Idli Recipes, Dosa Recipes - by Tarla Dalal - Tarladalalnaav_adnaavBelum ada peringkat

- A Panther in Life - TehelkaDokumen2 halamanA Panther in Life - Tehelkanaav_adnaavBelum ada peringkat

- Civil Services Examination, 2011Dokumen34 halamanCivil Services Examination, 2011Mahesh ChowdaryBelum ada peringkat

- UGC NET Economics SyllabusDokumen16 halamanUGC NET Economics SyllabusugcnetworkBelum ada peringkat

- UP Congress Alliance Beni Prasad VermaDokumen7 halamanUP Congress Alliance Beni Prasad Vermanaav_adnaavBelum ada peringkat

- DataDokumen35 halamanDatanaav_adnaavBelum ada peringkat

- Accounting For Merchandising Businesses Chp. 6 Group 4 FIXDokumen78 halamanAccounting For Merchandising Businesses Chp. 6 Group 4 FIXboba milk100% (1)

- Session 9 - Partnerships (Compatibility Mode) PDFDokumen21 halamanSession 9 - Partnerships (Compatibility Mode) PDFKirondeBelum ada peringkat

- Compre 3 Business Law and TaxationDokumen10 halamanCompre 3 Business Law and TaxationMary Alyssa Claire Capate IIBelum ada peringkat

- Blo 2206 Taxation Law Sem 2Dokumen6 halamanBlo 2206 Taxation Law Sem 2Suetyen YeeBelum ada peringkat

- Dizon V CTA G.R. No. 140944 April 30, 2008Dokumen11 halamanDizon V CTA G.R. No. 140944 April 30, 2008Emil BautistaBelum ada peringkat

- RR 6-2024Dokumen2 halamanRR 6-2024Lady Lynn PosadasBelum ada peringkat

- MP Singh - The Federal SchemeDokumen19 halamanMP Singh - The Federal SchemeHaley MazBelum ada peringkat

- Local Government Reviewer PDFDokumen54 halamanLocal Government Reviewer PDFWelbert Samarita100% (1)

- Inv 219074387Dokumen2 halamanInv 219074387Mohd Jaffer ShareefBelum ada peringkat

- Sa Lesson13Dokumen1 halamanSa Lesson13api-263754616Belum ada peringkat

- History of BurgerDokumen81 halamanHistory of BurgerbeverlyconcesaBelum ada peringkat

- Legal Aspects Handouts (Prelim)Dokumen10 halamanLegal Aspects Handouts (Prelim)MARITONI MEDALLABelum ada peringkat

- Lsat Sample Questions Template 3Dokumen60 halamanLsat Sample Questions Template 3satyam patidarBelum ada peringkat

- p9 SlutsDokumen1 halamanp9 Slutsyonah olupauBelum ada peringkat

- Bureau of Internal RevenueDokumen3 halamanBureau of Internal RevenueReymund S BumanglagBelum ada peringkat

- Lesson 1 Business EthicsDokumen21 halamanLesson 1 Business EthicsRiel Marc AliñaboBelum ada peringkat

- Meralco Vs YatcoDokumen4 halamanMeralco Vs YatcoArkhaye SalvatoreBelum ada peringkat

- QTDokumen13 halamanQTJESTONI RAMOSBelum ada peringkat

- Ir3 GuideDokumen66 halamanIr3 GuideSusana SembranoBelum ada peringkat

- 16.9 Trần Nguyễn Ngọc Trang- Gdcn HCMDokumen9 halaman16.9 Trần Nguyễn Ngọc Trang- Gdcn HCMTrương Hữu QuangBelum ada peringkat

- CH 05 Financial AccountingDokumen5 halamanCH 05 Financial AccountingkashifBelum ada peringkat

- Vishal Shimpi: Hotel Bandra MetroDokumen3 halamanVishal Shimpi: Hotel Bandra MetroNikhil BaviskarBelum ada peringkat

- Taxation 1 I. Multiple Choice Questions (Two Points Each) DIRECTIONS: Choose The Letter of The CORRECT Answer. Strictly NO ERASURES AllowedDokumen5 halamanTaxation 1 I. Multiple Choice Questions (Two Points Each) DIRECTIONS: Choose The Letter of The CORRECT Answer. Strictly NO ERASURES AllowedleahabelloBelum ada peringkat

- BIR Issuances From March 27 To April 14, 2023Dokumen34 halamanBIR Issuances From March 27 To April 14, 2023PaulBelum ada peringkat

- Robert Kiyosaki - Rich Dad ScamsDokumen76 halamanRobert Kiyosaki - Rich Dad ScamsAlyssa Aban0% (1)

- Jaipur Airport TenderDokumen19 halamanJaipur Airport TenderRafikul RahemanBelum ada peringkat

- Chapter 1 General Principles of TaxationDokumen4 halamanChapter 1 General Principles of TaxationAngelie Elizaga SuarezBelum ada peringkat