XLCapital NewsAlert 11july2008 1

Diunggah oleh

ResearchOracleJudul Asli

Hak Cipta

Format Tersedia

Bagikan dokumen Ini

Apakah menurut Anda dokumen ini bermanfaat?

Apakah konten ini tidak pantas?

Laporkan Dokumen IniHak Cipta:

Format Tersedia

XLCapital NewsAlert 11july2008 1

Diunggah oleh

ResearchOracleHak Cipta:

Format Tersedia

Tel.

+44 (0)20 7232 3090 Traded on

AIM, London

Fax +44 (0)20 7232 3099 Stock Exchange

www.iirgroup.com Regulated and

LSE: IIR authorised by

XL Capital Ltd. 11 July 2008

Company News Alert

Significant decline in NYSE common stock price on 10 July 2008

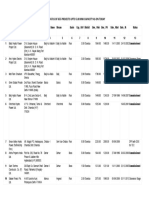

NYSE HOLD XL Capital Ltd.’s (XL Capital) NYSE common stock price declined significantly on 10 July 2008 to reach

Direct

its access

lowest price sinceto

thethe full report

mid-1990s, free aofbrief

after staging charge

recoveryat

on 08 July 2008, as fears over the

Common http://www.iirgroup.com/researchoracle/viewreport/show/20285

impact of the company’s exposure to Security Capital Assurance Ltd. (SCA) returned. In light of broad-

based weakness in global financial markets, increasing competition and softening premium rates in

Stock the insurance and reinsurance industry, and the impact of potential ratings downgrades and exposure

Ticker: XL to SCA’s losses on the company, we intend to revise our estimates and target price downwards in our

Target price: US$72.25 next update report. Therefore, we maintain our current HOLD rating for the NYSE common stock even

Current price: US$17.53 though the current price suggests a BUY.

Price change

(70.0%) We will reassess our common stock rating for XL Capital in our next full update report.

since last report:

European HOLD Although the current target price suggests a BUY rating, we maintain our current HOLD rating for the

European stock based on our fundamental outlook, and intend to reduce our target price significantly

Stock1 in our next full update report. We no longer expect a significant currency impact on the European

Ticker: XL.F common stock over our investment horizon.

Target price: €50.46

Current price: €12.21

Price change We will reassess the European stock rating for XL Capital in our next full update report.

(67.4%)

since last report:

Supervisor: Somnath Banerjee Investment horizon - short term actionable trading strategies

Analyst: Dewanshi Doshi This report addresses the needs of strategic investors with a long term investment horizon of 6-12 months. If this

Editor: Heloise Capon report is provided to you by your broker under the Global Settlement, you may now also access (free of charge) the

Global Research Director: short term trading outlook that we publish from time to time for this issuer, looking at the coming 5-30 days for

readers with a shorter trading horizon. These are available online only at www.researchoracle.com.

Satish Betadpur, CFA

Next news due: 2Q 08 results, 22

July 2008 In our 3Q 07 update report, dated 03 December 2007 we reiterated the XL Capital NYSE common

stock a BUY with a 6-12 month target price of US$72.25 indicating a potential upside of 23%.

Subsequently, in our company news alert dated 18 January 2008 we downgraded the NYSE common

stock rating to a HOLD, reflecting concerns over our fundamental outlook. Our European stock was

also rated a HOLD.

In addition to the 10.1% decline on 10 July 2008, the XL Capital NYSE common stock price has

declined 70.0% since our previous update report to close at US$17.53 on 10 July 2008, its lowest

price since the mid-1990s. Yesterday’s decline in the NYSE common stock price followed a brief

recovery on 08 July 2008, but is in line with the long term decline, both reflecting general concerns

regarding weakness in global financial markets and the impact of increasing competition and softening

premium rates in the sector, and company specific issues. As outlined in our 01 July 2008 company

news alert, Fitch Ratings’ announcement that it might downgrade some of XL Capital’s ratings if the

company fails to restore its capital base in the event of a significant charge incurred on SCA’s losses

reignited fears over XL Capital’s ongoing exposure to the bond insurer, which is at risk from its

exposure to subprime mortgage-backed bonds, and how the company might respond to the issue.

In view of softening premium rates in the industry and weakness in global financial markets, in

addition to the impact of the potential ratings downgrades and exposure to SCA’s losses, we intend to

revise our estimates and target prices downwards when we come to revalue the stock in our next full

update report. Therefore, we maintain our HOLD rating for the NYSE common stock although the

current target price suggests a BUY.

Page 1

Anda mungkin juga menyukai

- WNS NewsAlert 11july2008 1Dokumen1 halamanWNS NewsAlert 11july2008 1ResearchOracleBelum ada peringkat

- SouthernCopper NewsAlert 11jul2008 1Dokumen1 halamanSouthernCopper NewsAlert 11jul2008 1ResearchOracleBelum ada peringkat

- SMIC 1Q08Update 11july2008 1Dokumen1 halamanSMIC 1Q08Update 11july2008 1ResearchOracleBelum ada peringkat

- GrupoAeroCentroNorte NewsAlert 11july2008 1Dokumen1 halamanGrupoAeroCentroNorte NewsAlert 11july2008 1ResearchOracleBelum ada peringkat

- Advantest NewsAlert 11july2008 1Dokumen1 halamanAdvantest NewsAlert 11july2008 1ResearchOracleBelum ada peringkat

- Repsol 1Q08Update 11jul2008 1Dokumen1 halamanRepsol 1Q08Update 11jul2008 1ResearchOracleBelum ada peringkat

- O2Micro 1Q08Update 11july2008 1Dokumen1 halamanO2Micro 1Q08Update 11july2008 1ResearchOracleBelum ada peringkat

- Infosys 1Q09Alert 11july2008 1Dokumen1 halamanInfosys 1Q09Alert 11july2008 1ResearchOracleBelum ada peringkat

- Noble 1Q08Update 11jul2008 1Dokumen1 halamanNoble 1Q08Update 11jul2008 1ResearchOracleBelum ada peringkat

- Nissan 4QANDFY2008Update 11jul08 1Dokumen1 halamanNissan 4QANDFY2008Update 11jul08 1ResearchOracleBelum ada peringkat

- Covidien 2q08update 11jul08 1Dokumen1 halamanCovidien 2q08update 11jul08 1ResearchOracleBelum ada peringkat

- FocusMedia 1Q08Update 11july2008 1Dokumen1 halamanFocusMedia 1Q08Update 11july2008 1ResearchOracleBelum ada peringkat

- NTT FY2008Update 10july2008 1Dokumen1 halamanNTT FY2008Update 10july2008 1ResearchOracleBelum ada peringkat

- UnileverPLC 1Q08Update 10jul08 1Dokumen1 halamanUnileverPLC 1Q08Update 10jul08 1ResearchOracleBelum ada peringkat

- ACE 1Q08Update 11jul2008 1Dokumen1 halamanACE 1Q08Update 11jul2008 1ResearchOracleBelum ada peringkat

- Baidu 1Q08Update 10july2008 1Dokumen1 halamanBaidu 1Q08Update 10july2008 1ResearchOracleBelum ada peringkat

- Roundup 10 July 2008Dokumen2 halamanRoundup 10 July 2008ResearchOracleBelum ada peringkat

- UnileverNV 1Q08Update 10jul08 1Dokumen1 halamanUnileverNV 1Q08Update 10jul08 1ResearchOracleBelum ada peringkat

- Companhia de Bebidas Das Americas 1Q08Update 10jul08 1Dokumen1 halamanCompanhia de Bebidas Das Americas 1Q08Update 10jul08 1ResearchOracleBelum ada peringkat

- SiliconwarePrecisionIndustries 1Q08Update 10july2008 1Dokumen1 halamanSiliconwarePrecisionIndustries 1Q08Update 10july2008 1ResearchOracleBelum ada peringkat

- NationalGrid FY2008Update 10july2008 1Dokumen1 halamanNationalGrid FY2008Update 10july2008 1ResearchOracleBelum ada peringkat

- TokioMarine (Formerlymillea) FY2008Update 10july2008 1Dokumen1 halamanTokioMarine (Formerlymillea) FY2008Update 10july2008 1ResearchOracleBelum ada peringkat

- Mitsui FY2008Update 10july08 1Dokumen1 halamanMitsui FY2008Update 10july08 1ResearchOracleBelum ada peringkat

- BancoBradesco 1Q08Update 10jul2008 1Dokumen1 halamanBancoBradesco 1Q08Update 10jul2008 1ResearchOracleBelum ada peringkat

- GrupoAeroPacifico NewsAlert 10july2008 1Dokumen1 halamanGrupoAeroPacifico NewsAlert 10july2008 1ResearchOracleBelum ada peringkat

- AngiotechPharmaceuticalInc NewsAlert 10jul08 1Dokumen1 halamanAngiotechPharmaceuticalInc NewsAlert 10jul08 1ResearchOracleBelum ada peringkat

- EnduranceSpecialty NewsAlert 10july2008 1Dokumen1 halamanEnduranceSpecialty NewsAlert 10july2008 1ResearchOracleBelum ada peringkat

- XLCapital NewsAlert 09july2008 1Dokumen1 halamanXLCapital NewsAlert 09july2008 1ResearchOracleBelum ada peringkat

- Votorantim Celolose 1Q08Update 09jul08 1Dokumen1 halamanVotorantim Celolose 1Q08Update 09jul08 1ResearchOracleBelum ada peringkat

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeDari EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifePenilaian: 4 dari 5 bintang4/5 (5783)

- The Yellow House: A Memoir (2019 National Book Award Winner)Dari EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Penilaian: 4 dari 5 bintang4/5 (98)

- Never Split the Difference: Negotiating As If Your Life Depended On ItDari EverandNever Split the Difference: Negotiating As If Your Life Depended On ItPenilaian: 4.5 dari 5 bintang4.5/5 (838)

- Shoe Dog: A Memoir by the Creator of NikeDari EverandShoe Dog: A Memoir by the Creator of NikePenilaian: 4.5 dari 5 bintang4.5/5 (537)

- The Emperor of All Maladies: A Biography of CancerDari EverandThe Emperor of All Maladies: A Biography of CancerPenilaian: 4.5 dari 5 bintang4.5/5 (271)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceDari EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RacePenilaian: 4 dari 5 bintang4/5 (890)

- The Little Book of Hygge: Danish Secrets to Happy LivingDari EverandThe Little Book of Hygge: Danish Secrets to Happy LivingPenilaian: 3.5 dari 5 bintang3.5/5 (399)

- Team of Rivals: The Political Genius of Abraham LincolnDari EverandTeam of Rivals: The Political Genius of Abraham LincolnPenilaian: 4.5 dari 5 bintang4.5/5 (234)

- Grit: The Power of Passion and PerseveranceDari EverandGrit: The Power of Passion and PerseverancePenilaian: 4 dari 5 bintang4/5 (587)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaDari EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaPenilaian: 4.5 dari 5 bintang4.5/5 (265)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryDari EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryPenilaian: 3.5 dari 5 bintang3.5/5 (231)

- On Fire: The (Burning) Case for a Green New DealDari EverandOn Fire: The (Burning) Case for a Green New DealPenilaian: 4 dari 5 bintang4/5 (72)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureDari EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FuturePenilaian: 4.5 dari 5 bintang4.5/5 (474)

- Rise of ISIS: A Threat We Can't IgnoreDari EverandRise of ISIS: A Threat We Can't IgnorePenilaian: 3.5 dari 5 bintang3.5/5 (137)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersDari EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersPenilaian: 4.5 dari 5 bintang4.5/5 (344)

- The Unwinding: An Inner History of the New AmericaDari EverandThe Unwinding: An Inner History of the New AmericaPenilaian: 4 dari 5 bintang4/5 (45)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyDari EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyPenilaian: 3.5 dari 5 bintang3.5/5 (2219)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreDari EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You ArePenilaian: 4 dari 5 bintang4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)Dari EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Penilaian: 4.5 dari 5 bintang4.5/5 (119)

- Her Body and Other Parties: StoriesDari EverandHer Body and Other Parties: StoriesPenilaian: 4 dari 5 bintang4/5 (821)

- Invoice Inv0006: Er. Mohamed Irshadh P MDokumen1 halamanInvoice Inv0006: Er. Mohamed Irshadh P Mmanoj100% (1)

- Eating Disorder Diagnostic CriteriaDokumen66 halamanEating Disorder Diagnostic CriteriaShannen FernandezBelum ada peringkat

- Ausensi (2020) A New Resultative Construction in SpanishDokumen29 halamanAusensi (2020) A New Resultative Construction in SpanishcfmaBelum ada peringkat

- Class 9 Maths Olympiad Achievers Previous Years Papers With SolutionsDokumen7 halamanClass 9 Maths Olympiad Achievers Previous Years Papers With Solutionskj100% (2)

- Voiceless Alveolar Affricate TsDokumen78 halamanVoiceless Alveolar Affricate TsZomiLinguisticsBelum ada peringkat

- NQC User ManualDokumen6 halamanNQC User ManualgarneliBelum ada peringkat

- Costco Case StudyDokumen3 halamanCostco Case StudyMaong LakiBelum ada peringkat

- List/Status of 655 Projects Upto 5.00 MW Capacity As On TodayDokumen45 halamanList/Status of 655 Projects Upto 5.00 MW Capacity As On Todayganvaqqqzz21Belum ada peringkat

- GeM Bidding 2920423 - 2Dokumen4 halamanGeM Bidding 2920423 - 2Sulvine CharlieBelum ada peringkat

- Training of Local Government Personnel PHDokumen5 halamanTraining of Local Government Personnel PHThea ConsBelum ada peringkat

- 9 Specific Relief Act, 1877Dokumen20 halaman9 Specific Relief Act, 1877mostafa faisalBelum ada peringkat

- HPS Perhitungan Rencana Anggaran Biaya Pengadaan Hardware: No. Item Uraian Jumlah SATUANDokumen2 halamanHPS Perhitungan Rencana Anggaran Biaya Pengadaan Hardware: No. Item Uraian Jumlah SATUANYanto AstriBelum ada peringkat

- Garner Fructis ShampooDokumen3 halamanGarner Fructis Shampooyogesh0794Belum ada peringkat

- Best Safety Practices in The Philippine Construction PDFDokumen16 halamanBest Safety Practices in The Philippine Construction PDFDione Klarisse GuevaraBelum ada peringkat

- Installation, Operation and Maintenance Instructions Stainless Steel, Liquid Ring Vacuum PumpsDokumen28 halamanInstallation, Operation and Maintenance Instructions Stainless Steel, Liquid Ring Vacuum PumpspinplataBelum ada peringkat

- The Scavenger's Handbook v1 SmallerDokumen33 halamanThe Scavenger's Handbook v1 SmallerBeto TBelum ada peringkat

- Week 1 ITM 410Dokumen76 halamanWeek 1 ITM 410Awesom QuenzBelum ada peringkat

- Cambridge IGCSE: 0500/12 First Language EnglishDokumen16 halamanCambridge IGCSE: 0500/12 First Language EnglishJonathan ChuBelum ada peringkat

- Carbon Footprint AnalysisDokumen18 halamanCarbon Footprint AnalysisAndres AndradeBelum ada peringkat

- Official Website of the Department of Homeland Security STEM OPT ExtensionDokumen1 halamanOfficial Website of the Department of Homeland Security STEM OPT ExtensionTanishq SankaBelum ada peringkat

- XSI Public Indices Ocean Freight - January 2021Dokumen7 halamanXSI Public Indices Ocean Freight - January 2021spyros_peiraiasBelum ada peringkat

- ACCOUNTING FOR SPECIAL EDUCATION FUNDSDokumen12 halamanACCOUNTING FOR SPECIAL EDUCATION FUNDSIrdo KwanBelum ada peringkat

- Web Design Course PPTX Diana OpreaDokumen17 halamanWeb Design Course PPTX Diana Opreaapi-275378856Belum ada peringkat

- Commissioning GuideDokumen78 halamanCommissioning GuideNabilBouabanaBelum ada peringkat

- Message and Responses From TaoshobuddhaDokumen4 halamanMessage and Responses From TaoshobuddhaTaoshobuddhaBelum ada peringkat

- Epq JDokumen4 halamanEpq JMatilde CaraballoBelum ada peringkat

- Diaz, Rony V. - at War's End An ElegyDokumen6 halamanDiaz, Rony V. - at War's End An ElegyIan Rosales CasocotBelum ada peringkat

- Lec 1 Modified 19 2 04102022 101842amDokumen63 halamanLec 1 Modified 19 2 04102022 101842amnimra nazimBelum ada peringkat

- Adult Education and Training in Europe 2020 21Dokumen224 halamanAdult Education and Training in Europe 2020 21Măndița BaiasBelum ada peringkat

- UNIMED Past Questions-1Dokumen6 halamanUNIMED Past Questions-1snazzyBelum ada peringkat