Declaration and Payment of Dividend

Diunggah oleh

ChandreshDeskripsi Asli:

Judul Asli

Hak Cipta

Format Tersedia

Bagikan dokumen Ini

Apakah menurut Anda dokumen ini bermanfaat?

Apakah konten ini tidak pantas?

Laporkan Dokumen IniHak Cipta:

Format Tersedia

Declaration and Payment of Dividend

Diunggah oleh

ChandreshHak Cipta:

Format Tersedia

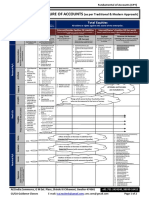

1 Declaration and Payment of Dividend

General Meaning of Term Dividend

Dividend is any sum payable as interest on loan or as share of profit to shareholders in

a business of a company or a profit of a company to the creditors of the ruined

property or as an individual’ share of it.

There are basically two kind of Dividends

Share of Profit

Dividend

Residuary at the

time of Winding

up

Section

Declaration of Dividend

123

Dividend Shall be paid out of

Depreciation to be calculated as

Current year profit after the depreciation

per Schedule II as per CAct 2013

Previous Year Profits but after Depreciation

Money provided by Government for payment of dividend in pursuance of a

guarantee given by that Government.

Company may transfer any portion or percentage of its profit to Reserves.

However, transfer is not a mandatory.

Declaration of Dividend out of Reserves (Important)

As per Rule 3 of the Companies (Declaration and Payment of Dividend) Rules, 2014,

when there is inadequacy or absence of profits in any year, a company may declare

dividend out of free reserves. However, the following conditions to be satisfied,

The Rate of Dividend = Dividend shall not exceed the average of past three

declared dividends. (if first year, this rule shall not apply)

Maximum Amount to be Drawn = Amount shall not exceed 1/10th of Paid up

share Capital + Free Reserves.

The Amount must be first used to set of current year losses.

After Dividend Paid the Balance Reserves shall be > 15% of Paid up Capital as

appearing in last audited Balance Sheet.

1

The above Provisions are not applicable to the Government Companies where

entire Capital is held by either CG or SG or one or more of them.

Shriganesh Hegde Ullane: CA Jnaan www.cajnaan.blogspot.com

Section

Deposit of the Dividend Amount

123(4)

The dividend declared must be deposited in a Scheduled Bank in separate account,

within 5 Days from the date of declaration of the dividend.

(This provision shall not apply to Government Companies)

Section

Payment of the Dividend

123(5)

Dividend shall be Payable in cash, cheque, warrant or any other E-Payment.

Dividend shall be payable only to registered share holder or his order or his

banker.

Company can capitalize the profit or reserves for issuing fully paid Bonus

shares.

Section

Prohibition of Declaration of the Dividend

123(6)

When Company cannot propose Dividend?

If the company contravenes any provisions of below sections it cannot propose

dividend until such failure continues.

Section 73: Prohibition on acceptance of Deposit from Public

Section 74: Repayment of Deposits accepted

Section

Interim Dividend

2(35)

As per Section 2(35), “dividend includes interim dividend”

Board of Directors of a company may declare interim dividend during any

financial year out of the surplus in the profit and loss account.

In case of loss, the rate shall not be higher than average rate of dividend

declared in immediate 3 preceding years.

Other provisions like, depositing the amount shall continue to apply here also.

Section Keeping in abeyance the dividend, bonus or rights issue if registration of shares are

126 pending

If any instrument of transfer of shares delivered to the company but shares not

registered yet, then

Transfer the dividend in relation to such shares to the Unpaid Dividend

Account. If registered shareholder (Transferor) has given written consent to

transfer the dividend amount to transferee then it can be transferred to his

account instead of Unpaid Dividend Account.

The offers of Rights issue (Section 62) or Bonus issue (Section 123(5)) shall be

kept under abeyance until shares are registered.

Section

Unpaid Dividend Account

124

2

Though Section 124 of Companies act. 2013 applies to Unpaid Dividend Account this

section has not been notified yet. Section 205A of Companies act, 1956 shall continue

to apply to this topic.

Shriganesh Hegde Ullane: CA Jnaan www.cajnaan.blogspot.com

If any dividend declared by the company is not been paid or claimed within 30

Days from the date of declaration to shareholders then within 7 days from the

expiry of said 30 days company shall transfer the unpaid dividend to a special

account called “Unpaid Dividend Account of ____Co.” to be created in

Scheduled Bank

If the company fails to transfer such an amount after 7th day from 30th day

then it must pay an interest at the rate of 12% per annum of the said unpaid

balance. Such amount shall ensure the benefit to the shareholders in the

proportion of amount remaining unpaid to them.

If any amount deposited in Unpaid Dividend Account remain unpaid for 7

years from the date of transfer, it shall be transferred to Investor Education

and Protection Fund.

If company fails to comply with any provisions of this section Penalty shall be

Rs. 5000/day until such failure continues. (To both Company and officer in

default)

Company Adhara Ltd. has declared the dividend on 1st April 2017.

It must deposit the amount in special account within 5 Days, that is before

6th of April as per section 123(4)

If any unpaid dividend up to 30th April 2017 then the amount must be

transferred to a special account in called “Unpaid Dividend Account of

Adhara Ltd” within 7 days of 30th April that is 7th May 2017.

If Adhara Ltd fails to deposit Rs. 5 lakhs on 7th it shall pay an interest at the

rate of 12% on Rs. 5 Lakhs until the amount is deposited.

If any amount in “Unpaid Dividend Account of Adhara Ltd” unpaid for 7 years

it must be transferred to Investor Education and Protection Fund.

Investor Education & Protection Fund (Section 205C of the Companies Act, 1956)

Purpose: Fund shall be utilized for promotion of investor’s awareness and protection

of the interests of investors.

The amounts credited in IE&P Fund:

Amounts in the unpaid dividend accounts of companies

The application moneys received by companies for allotment of any securities

and due for refund

Matured deposits with companies

Matured debentures with companies

3 The interest accrued on the amounts referred to in (a) to (d) as above.

Grants and donations given to the Fund by the Central Government, State

Governments, companies or any other institutions for the purposes of the

Fund

Shriganesh Hegde Ullane: CA Jnaan www.cajnaan.blogspot.com

The interest or other income received out of the investments made from the

Fund.

Payment of Interest out of Capital (Section 208 of Companies Act, 1956)

When: Where any shares in a company are issued for the purpose of raising money to

defray the expenses of the construction of any work or building, or the provision of

any plant, which cannot be made profitable for a lengthy period.

Pay the interest on the amount of Share Capital being paid for the time period.

Charge the amount paid as interest to capital as cost of construction of the

work or the building.

Authorization by Articles of association or special resolution is needed in

addition to Central Government permission (must).

Central government may initiate enquiry and enquiry charges to be met by the

company.

The maximum rate of interest shall be 4% or as may be decided by central

government and time period also approved by CG.

Section

Punishment for failure to distribute dividends

127

Type of contravention Penalties

• Directors who are knowingly part of

contravention shall be subject

imprisonment up to 2 years

Dividend declared but not paid within 30

days • Fine of Rs.1,000-00/day

• Company shall be liable to pay

interest at the rate of 18% per annum

during the period of defaults.

No Penalties in the following Cases:

Where the dividend could not be paid by reason of the operation of any law

Where a shareholder has given directions to the company regarding the payment

of the dividend and those directions cannot be complied with and the same has

been communicated to him.

Where there is a dispute regarding the right to receive the dividend

Where the dividend has been lawfully adjusted by the company against any sum

due to it from the shareholder.

Where for any other reason, the failure to pay the dividend or to post the

warrant within the period under this section was not due to any default on the

part of the company.

If the dividend payable by Nidhi Company to members is Rs.100 or less per member,

4 then it would be sufficient if advertisement is given in one local newspaper and

published in company’s notice board for at least 3 months

Shriganesh Hegde Ullane: CA Jnaan www.cajnaan.blogspot.com

Quick Summary and Practice Manual Questions topics

Dividend may be paid by Current year or preceding year profit after depreciation

or any amount granted by government to pay as dividend.

Any percentage of profit may be transferred by Company to its reserves.

Conditions to pay dividend out of Free Reserves (Rule 3 of Co.(D&PD) Rules 2014)

• Rate of dividend: Maximum of Average of past 3 years dividends

• Reserves withdrawn must be < than 1/10th of Capital + Free Reserves.

• First set off current year losses if any

• After withdrawal Balance in reserve > 15% of opening paid up capital

These rules not applicable to Government Companies.

Dividend declared (Section 123(4)) must be deposited within 5 days in Bank.

If company not repaid deposits or prohibited to accept deposit (Section 73&74)

then no dividend can be paid until mistake continues.

Interim dividend (Sec 2(35)) in loss possible but Rate< Average of last 3 years.

Keeping abeyance of dividend in case shares not registered (Sec 126) and transfer

to unpaid dividends account to be constituted under section 205A of Co. act

1956. However if transferor given written instruction amount may be transferred

to Transferee.

Any amount declared not paid within 30days transferred to UD Account within 7

days and not paid within 7 years from there then to IE&P Fund (section 205C).

(Penalty 5000/day)

Amounts in IE& P Fund are unpaid dividend, share money, matured debenture,

matured deposits, interests such amounts, Government grants.

Company can pay interest on Paid up capital raised for some capital expenses,

such interest may be capitalized. Prior approval of CG, AOA and Special

Resolution needed. Maximum rate shall be 4% or as decided by CG.

Punishments (Section 127) 2 years imprisonment, 1000/day penalty, 18% interest

No Penalty if, operation of law, consent from shareholder, adjusted against any

dues, no defaults from company.

Practice Manual Questions topics

The interest payable by the company in case of contravention of nonpayment of

dividend within 30 days is maximum 18%. Even though member may have

demanded higher interest.

Final Dividend is declared by BOD and approved by Members in general meeting.

Directors cannot divert the amount declared as dividend for any other

investment and defer the payment beyond 30 days. It amounts to contravention

under section 127.

5 The dividend amount may be adjusted against any sum payable by the members.

BOD can declare interim dividends.

Shriganesh Hegde Ullane: CA Jnaan www.cajnaan.blogspot.com

Anda mungkin juga menyukai

- Notes To Interim Finacial StatementsDokumen7 halamanNotes To Interim Finacial StatementsJhoanna Marie Manuel-AbelBelum ada peringkat

- Tax AmnestyDokumen25 halamanTax AmnestyCali Shandy H.Belum ada peringkat

- Dlsu v. Dlsu Empl Assoc., G.R. No. 109002. April 12, 2000Dokumen8 halamanDlsu v. Dlsu Empl Assoc., G.R. No. 109002. April 12, 2000EuniceD.PiladorBelum ada peringkat

- Commercial Law Review Digest CompilationDokumen18 halamanCommercial Law Review Digest CompilationKarmaranthBelum ada peringkat

- Court Decision on Tax Assessment AppealDokumen35 halamanCourt Decision on Tax Assessment Appealaudreydql5Belum ada peringkat

- Boston Beer-Is Greater Growth PossibleDokumen5 halamanBoston Beer-Is Greater Growth PossibleAlrifai Ziad AhmedBelum ada peringkat

- Regulations for online ATP system and printing requirementsDokumen5 halamanRegulations for online ATP system and printing requirementsJA LogsBelum ada peringkat

- Tax Updates Under CREATE LawDokumen4 halamanTax Updates Under CREATE LawSandy ArticaBelum ada peringkat

- Certificate of Live Birth CarlosinigoDokumen2 halamanCertificate of Live Birth CarlosinigozzzzzBelum ada peringkat

- MC2021-001 2020 Ipp GP&SGDokumen47 halamanMC2021-001 2020 Ipp GP&SGRaffy BelloBelum ada peringkat

- Group 6 - Case 2 - UnionDokumen21 halamanGroup 6 - Case 2 - UnionKristofferson AustriaBelum ada peringkat

- Tax Review DoctrinesDokumen18 halamanTax Review DoctrinesGrace Robes HicbanBelum ada peringkat

- Obillos Vs Commissioner of Internal RevenueDokumen6 halamanObillos Vs Commissioner of Internal RevenueRoizki Edward MarquezBelum ada peringkat

- Mergers and acquisitions: strategies for growthDokumen8 halamanMergers and acquisitions: strategies for growthFabiano CardileBelum ada peringkat

- DEDUCTIONS FROM INCOMEDokumen12 halamanDEDUCTIONS FROM INCOMEVillage GourmetBelum ada peringkat

- AT&T Acquisition of NCR - Lys&VincentDokumen26 halamanAT&T Acquisition of NCR - Lys&VincentAfiq Fozi100% (1)

- AM No 00-8-10-SC - Rehab RulesDokumen20 halamanAM No 00-8-10-SC - Rehab RulesJacinto Jr JameroBelum ada peringkat

- Fundamentals of Foreign Investments: FDI vs FIIDokumen4 halamanFundamentals of Foreign Investments: FDI vs FIIVIPUL ThakurBelum ada peringkat

- Philippine Tax Law Changes SummaryDokumen13 halamanPhilippine Tax Law Changes SummarykeyelBelum ada peringkat

- Shareholder Wealth MaximizationDokumen2 halamanShareholder Wealth MaximizationNitanshu ChavdaBelum ada peringkat

- Consolidated Tax 1 SyllabusDokumen10 halamanConsolidated Tax 1 SyllabusChuck NorrisBelum ada peringkat

- Expropriation in EuropeDokumen31 halamanExpropriation in EuropeCentar za ustavne i upravne studije100% (1)

- Central Textile Mills v. National Wages CommissionDokumen7 halamanCentral Textile Mills v. National Wages CommissionMelissa AdajarBelum ada peringkat

- Philippine Cooperative Code of 2008 (RA 9520) : Title of The ActDokumen34 halamanPhilippine Cooperative Code of 2008 (RA 9520) : Title of The ActErica UyBelum ada peringkat

- Group 8 DSIMGTS Case Analysis 1 PDFDokumen6 halamanGroup 8 DSIMGTS Case Analysis 1 PDFBanana QBelum ada peringkat

- 1 - 9. The Nature of Corporate GovernanceDokumen13 halaman1 - 9. The Nature of Corporate GovernanceyesbudBelum ada peringkat

- The Corporation Code of The PhilippinesDokumen98 halamanThe Corporation Code of The PhilippinesJ Velasco PeraltaBelum ada peringkat

- EQUIPMENT SALE DEEDDokumen1 halamanEQUIPMENT SALE DEEDjhon smithBelum ada peringkat

- Domondon Tax Notes PDFDokumen79 halamanDomondon Tax Notes PDFMae SalinoBelum ada peringkat

- Taxation LawDokumen4 halamanTaxation LawtynajoydelossantosBelum ada peringkat

- Case DigestDokumen6 halamanCase DigestAngelica CanivelBelum ada peringkat

- Management v. LaborDokumen25 halamanManagement v. LaborApril Enrile-MorenoBelum ada peringkat

- Fong V Duenas GR No. 185592, 15 June 2015Dokumen25 halamanFong V Duenas GR No. 185592, 15 June 2015Alyssa Mari ReyesBelum ada peringkat

- Corporation: Advantages DisadvantagesDokumen27 halamanCorporation: Advantages DisadvantagesRoy Kenneth LingatBelum ada peringkat

- 2016OpinionNo16-05 (On Delinquent Shares and Sale)Dokumen8 halaman2016OpinionNo16-05 (On Delinquent Shares and Sale)dppascuaBelum ada peringkat

- II. Tax RemediesDokumen2 halamanII. Tax Remediesggg10Belum ada peringkat

- Group1 Law ProjectDokumen16 halamanGroup1 Law ProjectSumeru HosihiBelum ada peringkat

- Commercial Law 1 Case DigestDokumen13 halamanCommercial Law 1 Case DigestIra CabelloBelum ada peringkat

- BBC Dividends from Unrealized Asset AppreciationDokumen1 halamanBBC Dividends from Unrealized Asset Appreciationvmanalo16Belum ada peringkat

- THE CITY OF DAVAO, REPRESENTED BY THE CITY TREASURER OF DAVAO CITY, Petitioner, v.THE INTESTATE ESTATE OF AMADO S. DALISAY, REPRESENTED BY SPECIAL ADMINISTRATOR ATTY. NICASIO B. PADERNA, Respondent.Dokumen8 halamanTHE CITY OF DAVAO, REPRESENTED BY THE CITY TREASURER OF DAVAO CITY, Petitioner, v.THE INTESTATE ESTATE OF AMADO S. DALISAY, REPRESENTED BY SPECIAL ADMINISTRATOR ATTY. NICASIO B. PADERNA, Respondent.Pame PameBelum ada peringkat

- Value Added Tax2Dokumen28 halamanValue Added Tax2biburaBelum ada peringkat

- TaxRev - Accenture v. CIR DigestDokumen16 halamanTaxRev - Accenture v. CIR DigestKarla Marie TumulakBelum ada peringkat

- Cir Vs Fortune Tobacco Corporation (July 21 2008)Dokumen26 halamanCir Vs Fortune Tobacco Corporation (July 21 2008)Jay TabuzoBelum ada peringkat

- Taxa 1Dokumen17 halamanTaxa 1Cheenee Nuestro SantiagoBelum ada peringkat

- SEC Form SampleDokumen3 halamanSEC Form SampleBrandon Beach100% (1)

- Week 3 Asset Based Valuation Part 2 MG3Dokumen26 halamanWeek 3 Asset Based Valuation Part 2 MG3VENICE MARIE ARROYOBelum ada peringkat

- Degayo V MagbanuaDokumen2 halamanDegayo V MagbanuaCarl LawsonBelum ada peringkat

- Partnerships Formation - RevisedDokumen10 halamanPartnerships Formation - RevisedBerhanu ShancoBelum ada peringkat

- G.R. No. 160556Dokumen7 halamanG.R. No. 160556Cid Benedict PabalanBelum ada peringkat

- Cir V ManningDokumen12 halamanCir V Manningnia_artemis3414Belum ada peringkat

- Retirement PayDokumen36 halamanRetirement PayEngelov AngtonivichBelum ada peringkat

- Practice Test - Financial ManagementDokumen6 halamanPractice Test - Financial Managementelongoria278100% (1)

- National Exchange Co Vs DexterDokumen2 halamanNational Exchange Co Vs DexterQueenie SabladaBelum ada peringkat

- BAR POINTERS FOR REVIEW 2019 MERCANTILE HBPDokumen79 halamanBAR POINTERS FOR REVIEW 2019 MERCANTILE HBPMark Jason Crece AnteBelum ada peringkat

- CASE DOCTRINE Labor ReviewDokumen22 halamanCASE DOCTRINE Labor Reviewnahjassi mangateBelum ada peringkat

- Labor HomeworkDokumen67 halamanLabor HomeworkIris Jiana Sta MariaBelum ada peringkat

- Dividend & Accounts of ComplanyDokumen38 halamanDividend & Accounts of ComplanySrikant0% (1)

- Divisible Profit: DividendDokumen10 halamanDivisible Profit: Dividendsameerkhan855Belum ada peringkat

- Dividend DistributionDokumen24 halamanDividend DistributionSai PhaniBelum ada peringkat

- Dividend Under Companies Act 2013Dokumen12 halamanDividend Under Companies Act 2013Abhinay KumarBelum ada peringkat

- Jain Gyan BookDokumen41 halamanJain Gyan BookChandreshBelum ada peringkat

- Chapter 11 Audit Report SummaryDokumen14 halamanChapter 11 Audit Report SummaryChandreshBelum ada peringkat

- Study material on accounts for not-for-profit organisationsDokumen40 halamanStudy material on accounts for not-for-profit organisationsdher1234Belum ada peringkat

- Accounting Plus One Chap 12 15 HsehereDokumen20 halamanAccounting Plus One Chap 12 15 HsehereChandreshBelum ada peringkat

- 36 Nature of Accounts As Per Traditional Modern ApproachDokumen2 halaman36 Nature of Accounts As Per Traditional Modern ApproachChandresh100% (1)

- Ipcc Acc 28 Sep 2015 PDFDokumen16 halamanIpcc Acc 28 Sep 2015 PDFChandreshBelum ada peringkat

- Getting Started PDFDokumen14 halamanGetting Started PDFCeliz MedinaBelum ada peringkat

- Accounting for Not-for-Profit OrganisationsDokumen4 halamanAccounting for Not-for-Profit OrganisationsChandreshBelum ada peringkat

- Commerce-Hsc-Book-Keeping-Accountancy 12th PDFDokumen14 halamanCommerce-Hsc-Book-Keeping-Accountancy 12th PDFadarshkumar120475% (4)

- Accounting For Not-for-Profit Organisation: Business. Normally, TDokumen63 halamanAccounting For Not-for-Profit Organisation: Business. Normally, TVinit MathurBelum ada peringkat

- Financial ReportingDokumen21 halamanFinancial ReportingChandreshBelum ada peringkat

- Accounting For Non-Profit Organization: Presenting by Mohammed Nasih B.MDokumen8 halamanAccounting For Non-Profit Organization: Presenting by Mohammed Nasih B.MChandreshBelum ada peringkat

- Debenture Accounting PDFDokumen75 halamanDebenture Accounting PDFMuhammad Faran KhanBelum ada peringkat

- Afa 3Dokumen6 halamanAfa 3ChandreshBelum ada peringkat

- Retirement and Death of A PartnerDokumen25 halamanRetirement and Death of A PartnerChandreshBelum ada peringkat

- 5 6154602304541556832Dokumen30 halaman5 6154602304541556832ChandreshBelum ada peringkat

- Mikavukasaragod AccountancyDokumen62 halamanMikavukasaragod AccountancyChandreshBelum ada peringkat

- BrochureDokumen2 halamanBrochureChandreshBelum ada peringkat

- Amalgamtion Sumit SardaDokumen29 halamanAmalgamtion Sumit SardaChandreshBelum ada peringkat

- SQP Acct Xii 2009 PDFDokumen50 halamanSQP Acct Xii 2009 PDFChandreshBelum ada peringkat

- Hsslive XII Accountancy Ch1 Not For Profit OrganizationDokumen4 halamanHsslive XII Accountancy Ch1 Not For Profit OrganizationChandreshBelum ada peringkat

- Hsslive-Chapter 2 Theory Base of Acc 1Dokumen5 halamanHsslive-Chapter 2 Theory Base of Acc 1ChandreshBelum ada peringkat

- Hsslive-Chapter 12 Not For Profit OrganisationsDokumen7 halamanHsslive-Chapter 12 Not For Profit OrganisationsChandreshBelum ada peringkat

- 5 6154602304541556832Dokumen30 halaman5 6154602304541556832ChandreshBelum ada peringkat

- Accountancy Ebook - Class 12 - Part 1 PDFDokumen130 halamanAccountancy Ebook - Class 12 - Part 1 PDFChandreshBelum ada peringkat

- 3.5 Days ScheduleDokumen1 halaman3.5 Days ScheduleChandreshBelum ada peringkat

- As-1 and As-2 Summary NotesDokumen7 halamanAs-1 and As-2 Summary NotesChandreshBelum ada peringkat

- Joint Venture Accounting MethodsDokumen17 halamanJoint Venture Accounting MethodsChandreshBelum ada peringkat

- 22 Introduction To Company PDFDokumen14 halaman22 Introduction To Company PDFChandreshBelum ada peringkat

- Con Law II Notes & CasesDokumen71 halamanCon Law II Notes & CasesKunal Patel100% (1)

- NSTP OR RA 9163: A Brief History of the National Service Training Program ActDokumen26 halamanNSTP OR RA 9163: A Brief History of the National Service Training Program ActCathlyn Joy LepalamBelum ada peringkat

- (Pitt Illuminations) Paula C. Park - Intercolonial Intimacies - Relinking Latin - o America To The Philippines, 1898-1964 (2022, University of Pittsburgh Press) - Libgen - LiDokumen257 halaman(Pitt Illuminations) Paula C. Park - Intercolonial Intimacies - Relinking Latin - o America To The Philippines, 1898-1964 (2022, University of Pittsburgh Press) - Libgen - LiAli KulezBelum ada peringkat

- Combat Action Badge Orders PDFDokumen2 halamanCombat Action Badge Orders PDFTamikaBelum ada peringkat

- Tarzi Akbar... Ideology of Modernization Iin AfghanistanDokumen25 halamanTarzi Akbar... Ideology of Modernization Iin AfghanistanFayyaz AliBelum ada peringkat

- (Dragonlance Alt History) Age of The White HourglassDokumen11 halaman(Dragonlance Alt History) Age of The White HourglassWill HarperBelum ada peringkat

- Grounds For DisbarmentDokumen1 halamanGrounds For Disbarmentjojazz74Belum ada peringkat

- Chapter III Workload of A Lawyer V2Dokumen8 halamanChapter III Workload of A Lawyer V2Anonymous DeTLIOzu100% (1)

- The Seventh Day Adventists - Sunday Study in CultsDokumen30 halamanThe Seventh Day Adventists - Sunday Study in CultssirjsslutBelum ada peringkat

- MSDM Internasional: Ethics and Social Responsibility Case A New Concern For Human Resource ManagersDokumen8 halamanMSDM Internasional: Ethics and Social Responsibility Case A New Concern For Human Resource Managerselisa kemalaBelum ada peringkat

- Soco v. MilitanteDokumen2 halamanSoco v. MilitanteBeeya Echauz50% (2)

- Senate of The Philippines v. Ermita (2006) - G.R. No. 169777Dokumen16 halamanSenate of The Philippines v. Ermita (2006) - G.R. No. 169777delayinggratification100% (1)

- Let's - Go - 4 - Final 2.0Dokumen4 halamanLet's - Go - 4 - Final 2.0mophasmas00Belum ada peringkat

- 07-22-2016 ECF 612 USA V RYAN PAYNE - OBJECTION To 291, 589 Report and Recommendation by Ryan W. PayneDokumen14 halaman07-22-2016 ECF 612 USA V RYAN PAYNE - OBJECTION To 291, 589 Report and Recommendation by Ryan W. PayneJack RyanBelum ada peringkat

- Ong vs. SocorroDokumen4 halamanOng vs. SocorroTin LicoBelum ada peringkat

- "When Reality Strikes" (Grade 9)Dokumen4 halaman"When Reality Strikes" (Grade 9)Jeffrey De ChavezBelum ada peringkat

- The Bordeuri Samaj of Sri Sri Maa Kamakhya V Riju Prasad Sarma Ors 747 406187Dokumen11 halamanThe Bordeuri Samaj of Sri Sri Maa Kamakhya V Riju Prasad Sarma Ors 747 406187SAURAV law feedBelum ada peringkat

- Conrad 1Dokumen15 halamanConrad 1newnomiBelum ada peringkat

- Yamane vs. BA LepantoDokumen32 halamanYamane vs. BA LepantoAlthea Angela GarciaBelum ada peringkat

- Philippine Enlightenment Period Lesson PlanDokumen3 halamanPhilippine Enlightenment Period Lesson PlanHentiboiBelum ada peringkat

- OP 2009 USSR OrdDokumen127 halamanOP 2009 USSR Ordjbart252100% (5)

- Criminal Law Assignment 2Dokumen13 halamanCriminal Law Assignment 2Ideaholic Creative LabBelum ada peringkat

- American Airlines, Inc. Et Al v. Central Intelligence Agency Et Al - Document No. 1Dokumen29 halamanAmerican Airlines, Inc. Et Al v. Central Intelligence Agency Et Al - Document No. 1Justia.com100% (1)

- Appl. Under Sec.10 CPC - For Stay of Suit 2021Dokumen9 halamanAppl. Under Sec.10 CPC - For Stay of Suit 2021divyasri bodapatiBelum ada peringkat

- Easement Contract SampleDokumen3 halamanEasement Contract SampleEkie GonzagaBelum ada peringkat

- SPM TRIAL 2007 English Paper 2Dokumen19 halamanSPM TRIAL 2007 English Paper 2Raymond Cheang Chee-CheongBelum ada peringkat

- Access To Public Records in NevadaDokumen32 halamanAccess To Public Records in NevadaLas Vegas Review-JournalBelum ada peringkat

- Ra 9829Dokumen21 halamanRa 9829JayMichaelAquinoMarquezBelum ada peringkat

- (Promulgated June 21, 1988) : Code of Professional ResponsibilityDokumen2 halaman(Promulgated June 21, 1988) : Code of Professional ResponsibilityNadine Reyna CantosBelum ada peringkat

- Jurisprudence - Use of SurnamesDokumen10 halamanJurisprudence - Use of SurnamesGean CabreraBelum ada peringkat