Final Page 15

Diunggah oleh

Hatake Kakashi0 penilaian0% menganggap dokumen ini bermanfaat (0 suara)

382 tayangan1 halamanThe document analyzes inventory and related accounts for X Company as of December 31, 200X. It lists 25 items related to inventory, including raw materials, labor costs, transportation costs, taxes, and overheads. It also shows audit adjustments and how certain costs relate to other accounts like interest expense, input VAT, and selling/administrative expenses. The total inventory per client is $3,814,840 but after audit adjustments of $1,147,040 the audited total is $2,667,800.

Deskripsi Asli:

Audit solution

Hak Cipta

© © All Rights Reserved

Format Tersedia

PDF, TXT atau baca online dari Scribd

Bagikan dokumen Ini

Apakah menurut Anda dokumen ini bermanfaat?

Apakah konten ini tidak pantas?

Laporkan Dokumen IniThe document analyzes inventory and related accounts for X Company as of December 31, 200X. It lists 25 items related to inventory, including raw materials, labor costs, transportation costs, taxes, and overheads. It also shows audit adjustments and how certain costs relate to other accounts like interest expense, input VAT, and selling/administrative expenses. The total inventory per client is $3,814,840 but after audit adjustments of $1,147,040 the audited total is $2,667,800.

Hak Cipta:

© All Rights Reserved

Format Tersedia

Unduh sebagai PDF, TXT atau baca online dari Scribd

0 penilaian0% menganggap dokumen ini bermanfaat (0 suara)

382 tayangan1 halamanFinal Page 15

Diunggah oleh

Hatake KakashiThe document analyzes inventory and related accounts for X Company as of December 31, 200X. It lists 25 items related to inventory, including raw materials, labor costs, transportation costs, taxes, and overheads. It also shows audit adjustments and how certain costs relate to other accounts like interest expense, input VAT, and selling/administrative expenses. The total inventory per client is $3,814,840 but after audit adjustments of $1,147,040 the audited total is $2,667,800.

Hak Cipta:

© All Rights Reserved

Format Tersedia

Unduh sebagai PDF, TXT atau baca online dari Scribd

Anda di halaman 1dari 1

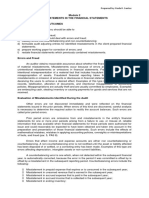

X Company

Analysis of Inventory and Related Accounts

December 31, 200X

INVENTORY OTHER RELATED ACCOUNTS

Audit

Per Client Adjustments Per Audit Account Title Amount

Particulars Dr(Cr) Dr(Cr) Dr(Cr) Debit Credit

1 Supplier's gross price for raw materials, P150,000 150,000.00 - 150,000.00

2 Materials purchased from another supplier on extended credit amounting to P570,000. The price to 570,000.00

be paid under normal

(20,000.00)

credit term550,000.00

is P550,000. Interest Expense 20,000.00

3 Invoice price of raw materials purchased amounting to P180,000. Quantity discounts of 10,5 are allowed

180,000.00

by supplier. - 180,000.00

4 Materials purchased from a supplier amounting to P616,000, inclusive of 12% VAT. The company is616,000.00

VAT registered and(66,000.00)

can claim this as

550,000.00

an input VAT.

Input Vat 66,000.00

5 Materials purchased from a supplier amounting to P515,000, inclusive of nonrecoverable purchases 515,000.00

tax of P15,000 515,000.00

6 Costs of transporting raw materials to the business premises, P5,000. 5,000.00 5,000.00

7 Import duties paid to authorities on import of raw materials to be used during the manufacturing process,

25,000.00P25,000. 25,000.00

8 Labor costs directly incurred in the processing of raw materials, P420,000 420,000.00 420,000.00

9 Normal amount of wasted labor, P57,000. 57,000.00 57,000.00

10 Abnormal amounts of wasted labor, P69,000. 69,000.00 (69,000.00) - Other Expense 69,000.00

11 Variable costs (electricity) incurred in the processing of raw materials, P10,000. 10,000.00 10,000.00

12 Costs of transporting goods to customers on sale, P2,500. 2,500.00 (2,500.00) - Delivery Expense 2,500.00

13 Non-recoverable purchase taxes charged to customers on sale, P12,000. 12,000.00 (12,000.00) - Taxes and Licenses 12,000.00

14 Non-recoverable sales taxes, P14,440. 14,440.00 (14,440.00) - Taxes and Licenses 14,440.00

15 Commission payable to salesmen on the sale of the goods, P14,500. 14,500.00 (14,500.00) - Selling and Administrative Expense 14,500.00

16 Provisions for bad and doubtful debt in relation to trade receivables, P56,000 56,000.00 (56,000.00) - Doubtful Account Expense 56,000.00

17 Costs of the accounts department, P140,000. 140,000.00 (140,000.00) - Selling and Administrative Expense 140,000.00

18 Head office costs relating to the overall management of the business, P234,000. 234,000.00 (234,000.00) - Selling and Administrative Expense 234,000.00

19 Borrowing cost incurred on inventories that takes substantial amount of time to create, P122,000.122,000.00 122,000.00

20 Storage cost for a maturing product, P56,000. 56,000.00 56,000.00

21 Selling costs, P45,600. 45,600.00 (45,600.00) - Selling and Administrative Expense 45,600.00

22 Non-production overheads cost of designing products for specific customers, P10,000. 10,000.00 10,000.00

23 Storage cost of finished goods, P23,000. 23,000.00 (23,000.00) - Storage Cost 23,000.00

24 Fixed administration costs/ overheads (rent for office), P450,000. 450,000.00 (450,000.00) - Selling and Administrative Expense 450,000.00

25 Insurance on in transit inventories, P17,800. 17,800.00 17,800.00

3,814,840.00 (1,147,040.00) 2,667,800.00 1,147,040.00 -

No. 1 No. 2 No. 3

15

Anda mungkin juga menyukai

- Answer Key - Chapter 5 - 2020 EditionDokumen37 halamanAnswer Key - Chapter 5 - 2020 EditionDaniel DialinoBelum ada peringkat

- Advanced Financial Accounting and Reporting 14 - NGAS: Straight Problems Problem 1Dokumen6 halamanAdvanced Financial Accounting and Reporting 14 - NGAS: Straight Problems Problem 1Jem ValmonteBelum ada peringkat

- ACP 311 My Test Bank Problem SolvingDokumen22 halamanACP 311 My Test Bank Problem SolvingJamaica DavidBelum ada peringkat

- Problem 1: 105,000 - Correct AnswerDokumen1 halamanProblem 1: 105,000 - Correct AnswerSophia MilletBelum ada peringkat

- Accountants in The Academe: Embracing The Changing and Challenging TimesDokumen12 halamanAccountants in The Academe: Embracing The Changing and Challenging TimesLorie Anne ValleBelum ada peringkat

- 01 PartnershipDokumen6 halaman01 Partnershipdom baldemorBelum ada peringkat

- Long Examination Cash Set ADokumen3 halamanLong Examination Cash Set AprechuteBelum ada peringkat

- Chapter15 - Answer PDFDokumen14 halamanChapter15 - Answer PDFAvon Jade RamosBelum ada peringkat

- Partnership MidtermDokumen10 halamanPartnership MidtermJoanna Caballero100% (1)

- Partnership FormationDokumen13 halamanPartnership FormationGround ZeroBelum ada peringkat

- Documento - MX Ap Receivables Quizzer QDokumen10 halamanDocumento - MX Ap Receivables Quizzer QMiel Viason CañeteBelum ada peringkat

- CAE 10 CG Strategic Cost ManagementDokumen23 halamanCAE 10 CG Strategic Cost ManagementAmie Jane MirandaBelum ada peringkat

- Seatwork: PAGE 173 - Case # 2 A. If Gonzales Wants To Provide The Presentation and CPA's Report For General Use byDokumen4 halamanSeatwork: PAGE 173 - Case # 2 A. If Gonzales Wants To Provide The Presentation and CPA's Report For General Use byNikky Bless LeonarBelum ada peringkat

- Assets Liabilities and EquityDokumen2 halamanAssets Liabilities and EquityArian Amurao50% (2)

- Accounting Policies, Changes in Accounting Estimates and ErrorsDokumen6 halamanAccounting Policies, Changes in Accounting Estimates and ErrorsGlen JavellanaBelum ada peringkat

- Special TransactionsDokumen5 halamanSpecial TransactionsJehannahBarat100% (1)

- Practice Set PSA 200Dokumen5 halamanPractice Set PSA 200Krystalah CañizaresBelum ada peringkat

- ApabkakakaDokumen2 halamanApabkakakaDania Sekar WuryandariBelum ada peringkat

- Illustration: Formation of Partnership Valuation of Capital A BDokumen2 halamanIllustration: Formation of Partnership Valuation of Capital A BArian AmuraoBelum ada peringkat

- Module 3 - Inventory (Student's File) - 5Dokumen212 halamanModule 3 - Inventory (Student's File) - 5JOSCEL SYJONGTIANBelum ada peringkat

- Ira Shalini M. YbañezDokumen5 halamanIra Shalini M. YbañezIra YbanezBelum ada peringkat

- Since Accountancy Is A Quota CourseDokumen1 halamanSince Accountancy Is A Quota Courselindsay boncodinBelum ada peringkat

- Quiz 2 - Audit Cash - 5ae63b1cb41c4b23e6070f657ddaDokumen8 halamanQuiz 2 - Audit Cash - 5ae63b1cb41c4b23e6070f657ddaAlexBelum ada peringkat

- AC - Acctg Gov Quiz 01Dokumen2 halamanAC - Acctg Gov Quiz 01Erjohn PapaBelum ada peringkat

- Receivable ManagementDokumen2 halamanReceivable ManagementJoey WassigBelum ada peringkat

- Applied Auditing Review Course Pre-Board - FinalDokumen13 halamanApplied Auditing Review Course Pre-Board - FinalROMAR A. PIGABelum ada peringkat

- Janet Wooster Owns A Retail Store That Sells New andDokumen2 halamanJanet Wooster Owns A Retail Store That Sells New andAmit PandeyBelum ada peringkat

- LagunaDokumen8 halamanLagunarandom17341Belum ada peringkat

- Audit Theory Case AnalysisDokumen2 halamanAudit Theory Case AnalysisSheila Mary GregorioBelum ada peringkat

- RRLDokumen3 halamanRRLlena cpaBelum ada peringkat

- Section 1-4 EncodedDokumen570 halamanSection 1-4 EncodedPremiu rayaBelum ada peringkat

- Problem 17-1, ContinuedDokumen6 halamanProblem 17-1, ContinuedJohn Carlo D MedallaBelum ada peringkat

- 17002Dokumen2 halaman17002Alvin YercBelum ada peringkat

- Fourth Year - Bsa: University of Makati Set BDokumen11 halamanFourth Year - Bsa: University of Makati Set BYedam BangBelum ada peringkat

- Chapter 16Dokumen12 halamanChapter 16WesBelum ada peringkat

- WP2001 Oldiem & Associates: Client: Da'Lore Collections Audit For Years Ending: December 31, 2013 and 2012Dokumen6 halamanWP2001 Oldiem & Associates: Client: Da'Lore Collections Audit For Years Ending: December 31, 2013 and 2012Ken CosaBelum ada peringkat

- Academic Performance of BSA Students and Their Qualifying Examination Result Correlational StudyDokumen17 halamanAcademic Performance of BSA Students and Their Qualifying Examination Result Correlational Studykarl cruzBelum ada peringkat

- AudcisDokumen6 halamanAudcisJessa May MendozaBelum ada peringkat

- Psa 610 Using The Work of Internal Auditors: RequirementsDokumen2 halamanPsa 610 Using The Work of Internal Auditors: RequirementsJJ LongnoBelum ada peringkat

- Problem 1: Finals - ReceivablesDokumen4 halamanProblem 1: Finals - ReceivablesLeslie Beltran ChiangBelum ada peringkat

- AssignmentDokumen6 halamanAssignmentIryne Kim PalatanBelum ada peringkat

- AccountingDokumen3 halamanAccountingrenoBelum ada peringkat

- AFAR - Corp LiqDokumen1 halamanAFAR - Corp LiqJoanna Rose Deciar0% (1)

- Bsa 7Dokumen2 halamanBsa 7Gray JavierBelum ada peringkat

- Intermacc Inventories and Bio Assets Postlec WaDokumen2 halamanIntermacc Inventories and Bio Assets Postlec WaClarice Awa-aoBelum ada peringkat

- Buang Ang TaxDokumen17 halamanBuang Ang TaxEdeksupligBelum ada peringkat

- Far FeDokumen9 halamanFar FeMark Domingo Mendoza100% (1)

- MQ 1 Receivables and InventoryDokumen4 halamanMQ 1 Receivables and Inventorymarygraceomac100% (2)

- Defined Benefit Pension Plan of The McDonald CompanyDokumen1 halamanDefined Benefit Pension Plan of The McDonald CompanyQueen ValleBelum ada peringkat

- Assignment 3.2 Inventory CutoffDokumen3 halamanAssignment 3.2 Inventory CutoffHannah NolongBelum ada peringkat

- Nepomuceno, Henry James B. - Ast Quiz 5Dokumen2 halamanNepomuceno, Henry James B. - Ast Quiz 5Mitch Tokong MinglanaBelum ada peringkat

- Module 2 MISSTATEMENTS IN THE FINANCIAL STATEMENTSDokumen7 halamanModule 2 MISSTATEMENTS IN THE FINANCIAL STATEMENTSNiño Mendoza MabatoBelum ada peringkat

- Answered - BCD Company Offer Its Investors Option - BartlebyDokumen1 halamanAnswered - BCD Company Offer Its Investors Option - BartlebyTrisha AgraamBelum ada peringkat

- Finals Quiz 2 Buscom Version 2Dokumen3 halamanFinals Quiz 2 Buscom Version 2Kristina Angelina ReyesBelum ada peringkat

- ASSIGNMENT 411 - Audit of FS PresentationDokumen4 halamanASSIGNMENT 411 - Audit of FS PresentationWam OwnBelum ada peringkat

- Manatad - Accounting 14NDokumen5 halamanManatad - Accounting 14NJullie Carmelle ChattoBelum ada peringkat

- Cost Accounting WorksheetDokumen2 halamanCost Accounting WorksheetLEON JOAQUIN VALDEZBelum ada peringkat

- Module 2Dokumen11 halamanModule 2Deanne LumakangBelum ada peringkat

- AP InventoriesDokumen7 halamanAP InventorieswingBelum ada peringkat

- RKB Comprehensive ProblemDokumen1 halamanRKB Comprehensive ProblemJanelle AñoverBelum ada peringkat

- Quizlet PDFDokumen12 halamanQuizlet PDFHatake KakashiBelum ada peringkat

- Psa 540 Audit of Accounting EstimatesDokumen1 halamanPsa 540 Audit of Accounting EstimatesHatake KakashiBelum ada peringkat

- Quiz LetDokumen3 halamanQuiz LetHatake KakashiBelum ada peringkat

- 520Dokumen41 halaman520Hatake KakashiBelum ada peringkat

- 520-FinalllDokumen38 halaman520-FinalllHatake KakashiBelum ada peringkat

- 706 PDFDokumen1 halaman706 PDFHatake KakashiBelum ada peringkat

- Best Practices of The Commission On AuditDokumen1 halamanBest Practices of The Commission On AuditHatake KakashiBelum ada peringkat

- Compensation Before AssignmentDokumen3 halamanCompensation Before AssignmentHatake KakashiBelum ada peringkat

- 1 June 29 8 2 July 2,4,6 24 3 July 9,11,13 24 4 July 16, 18, 19, 20, & 21 36 5 July 23-28 44 6 July 30-August 4 44 7 August 6-11 44 8 9 10 224 HrsDokumen1 halaman1 June 29 8 2 July 2,4,6 24 3 July 9,11,13 24 4 July 16, 18, 19, 20, & 21 36 5 July 23-28 44 6 July 30-August 4 44 7 August 6-11 44 8 9 10 224 HrsHatake KakashiBelum ada peringkat

- Chapter 1 Company Profile 1 Chapter 2 Weekly Progress Report 3 Chapter 3 Reaction To My OJT Experience 5 Chapter 4 Pertinent Documents8 8Dokumen1 halamanChapter 1 Company Profile 1 Chapter 2 Weekly Progress Report 3 Chapter 3 Reaction To My OJT Experience 5 Chapter 4 Pertinent Documents8 8Hatake KakashiBelum ada peringkat

- Week No. Dates Covered No. of Hours Remarks Actual Budget VarianceDokumen1 halamanWeek No. Dates Covered No. of Hours Remarks Actual Budget VarianceHatake KakashiBelum ada peringkat

- Week No. Dates Covered No. of Hours Remarks Actual Budget VarianceDokumen1 halamanWeek No. Dates Covered No. of Hours Remarks Actual Budget VarianceHatake KakashiBelum ada peringkat

- FinmanDokumen4 halamanFinmanHatake KakashiBelum ada peringkat

- Fair Value of Consideration (Cash) NCI As Proportion of Identifiable Assets Previously Held Interest Minus Net Assets Acquired GoodwillDokumen2 halamanFair Value of Consideration (Cash) NCI As Proportion of Identifiable Assets Previously Held Interest Minus Net Assets Acquired GoodwillHatake KakashiBelum ada peringkat

- Theoretical FrameworkDokumen6 halamanTheoretical FrameworkHatake KakashiBelum ada peringkat

- Group 10Dokumen10 halamanGroup 10Hatake KakashiBelum ada peringkat

- 5 Elements of Design: - Line - Color - Form and - Texture - SpaceDokumen6 halaman5 Elements of Design: - Line - Color - Form and - Texture - SpaceHatake KakashiBelum ada peringkat

- Quiz LetDokumen29 halamanQuiz LetHatake KakashiBelum ada peringkat

- AC 517 Special Topics in Finance Topics: I. Financial Planning and ForecastingDokumen4 halamanAC 517 Special Topics in Finance Topics: I. Financial Planning and ForecastingHatake KakashiBelum ada peringkat

- Gold and InflationDokumen25 halamanGold and InflationRaghu.GBelum ada peringkat

- SBI Clerk Prelims Previous Year Paper 2018Dokumen14 halamanSBI Clerk Prelims Previous Year Paper 2018Caroline JuliyatBelum ada peringkat

- The United States Edition of Marketing Management, 14e. 1-1Dokumen133 halamanThe United States Edition of Marketing Management, 14e. 1-1Tauhid Ahmed BappyBelum ada peringkat

- Mock Meeting Perhentian Kecil IslandDokumen3 halamanMock Meeting Perhentian Kecil IslandMezz ShiemaBelum ada peringkat

- Assertive Populism Od Dravidian PartiesDokumen21 halamanAssertive Populism Od Dravidian PartiesVeeramani ManiBelum ada peringkat

- Industriya NG AsukalDokumen12 halamanIndustriya NG AsukalJhamela Ann ElesterioBelum ada peringkat

- Sustainability in The Built Environment Factors AnDokumen7 halamanSustainability in The Built Environment Factors AnGeorges DoungalaBelum ada peringkat

- Hhse - JSJ Ozark Bank GarnishmentDokumen38 halamanHhse - JSJ Ozark Bank GarnishmentYTOLeaderBelum ada peringkat

- Franklin 2018 SIP-PresentationDokumen24 halamanFranklin 2018 SIP-PresentationRajat GuptaBelum ada peringkat

- SGS Secured in TJ 5601 22084 Electric Original ReportDokumen10 halamanSGS Secured in TJ 5601 22084 Electric Original ReportUsman NadeemBelum ada peringkat

- Udai Pareek Scal For SES RuralDokumen3 halamanUdai Pareek Scal For SES Ruralopyadav544100% (1)

- Company Analysis - Applied Valuation by Rajat JhinganDokumen13 halamanCompany Analysis - Applied Valuation by Rajat Jhinganrajat_marsBelum ada peringkat

- Maruti SuzukiDokumen17 halamanMaruti SuzukiPriyanka Vaghasiya0% (1)

- 3.1.2 Exceptions To Prior Notice of The Assessment. - Pursuant To Section 228 of The Tax CodeDokumen4 halaman3.1.2 Exceptions To Prior Notice of The Assessment. - Pursuant To Section 228 of The Tax CodeLab Lee0% (1)

- Informal Sectors in The Economy: Pertinent IssuesDokumen145 halamanInformal Sectors in The Economy: Pertinent IssuesshanBelum ada peringkat

- Nabl 500Dokumen142 halamanNabl 500Vinay SimhaBelum ada peringkat

- Some of The Most Important Theories of Business CyDokumen24 halamanSome of The Most Important Theories of Business CyAqib ArshadBelum ada peringkat

- Hubungan Pola Asuh Ibu Dengan Kejadian Stunting Anak Usia 12-59 BulanDokumen6 halamanHubungan Pola Asuh Ibu Dengan Kejadian Stunting Anak Usia 12-59 BulanMuhammad ZahranBelum ada peringkat

- SWIFT Trade Finance Messages and Anticipated Changes 2015Dokumen20 halamanSWIFT Trade Finance Messages and Anticipated Changes 2015Zayd Iskandar Dzolkarnain Al-HadramiBelum ada peringkat

- Apply Online Pradhan Mantri Awas Yojana (PMAY) Gramin (Application Form 2017) Using Pmaymis - Housing For All 2022 Scheme - PM Jan Dhan Yojana PDFDokumen103 halamanApply Online Pradhan Mantri Awas Yojana (PMAY) Gramin (Application Form 2017) Using Pmaymis - Housing For All 2022 Scheme - PM Jan Dhan Yojana PDFAnonymous dxsNnL6S8h0% (1)

- Chapter 2Dokumen18 halamanChapter 2FakeMe12Belum ada peringkat

- Fdi Inflows Into India and Their Impact On Select Economic Variables Using Multiple Regression ModelDokumen15 halamanFdi Inflows Into India and Their Impact On Select Economic Variables Using Multiple Regression ModelAnonymous CwJeBCAXpBelum ada peringkat

- CV Santosh KulkarniDokumen2 halamanCV Santosh KulkarniMandar GanbavaleBelum ada peringkat

- Effect of Vishal Mega Mart On Traditional RetailingDokumen7 halamanEffect of Vishal Mega Mart On Traditional RetailingAnuradha KathaitBelum ada peringkat

- Economic Development Complete NotesDokumen36 halamanEconomic Development Complete Notessajad ahmadBelum ada peringkat

- Reliability Evaluation of Grid-Connected Photovoltaic Power SystemsDokumen32 halamanReliability Evaluation of Grid-Connected Photovoltaic Power Systemssamsai88850% (2)

- Informal Childcare Has Negative Effects On Child DevelopmentDokumen3 halamanInformal Childcare Has Negative Effects On Child DevelopmentJotham DiggaBelum ada peringkat

- The Impact of Globalisation On SMDokumen25 halamanThe Impact of Globalisation On SMDaniel TaylorBelum ada peringkat

- Team Energy Corporation, V. Cir G.R. No. 197770, March 14, 2018 Cir V. Covanta Energy Philippine Holdings, Inc., G.R. No. 203160, January 24, 2018Dokumen5 halamanTeam Energy Corporation, V. Cir G.R. No. 197770, March 14, 2018 Cir V. Covanta Energy Philippine Holdings, Inc., G.R. No. 203160, January 24, 2018Raymarc Elizer AsuncionBelum ada peringkat

- IS-LM: An Explanation - John Hicks - Journal of Post Keynesian Economic - 1980Dokumen16 halamanIS-LM: An Explanation - John Hicks - Journal of Post Keynesian Economic - 1980tprug100% (2)