Solution - 13.52 PDF

Diunggah oleh

sanJudul Asli

Hak Cipta

Format Tersedia

Bagikan dokumen Ini

Apakah menurut Anda dokumen ini bermanfaat?

Apakah konten ini tidak pantas?

Laporkan Dokumen IniHak Cipta:

Format Tersedia

Solution - 13.52 PDF

Diunggah oleh

sanHak Cipta:

Format Tersedia

SOLUTION: 13-52

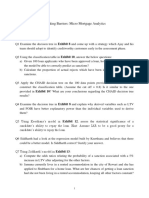

1. Yes, Air Comfort Division should institute the 5% price reduction on its air

conditioner units because net income would increase by $264,000. Supporting

calculations follow:

Before 5% After 5%

Price Reduction Price Reduction

Total

Per Total Per Total Difference

Unit (in thousands) Unit (in thousands) (in thousands)

Sales revenue $800 $12,000 $760 $13,224.0 $1,224.0

Variable costs:

Compressor $140 $ 2,100 $140 $ 2,436.0 $ 336.0

Other direct material 74 1,110 74 1,287.6 177.6

Direct labor 60 900 60 1,044.0 144.0

Variable overhead 90 1,350 90 1,566.0 216.0

Variable selling 36 540 36 626.4 86.4

Total variable costs $400 $ 6,000 $400 $ 6,960.0 $ 960.0

Contribution margin $400 $ 6,000 $360 $ 6,264.0 $ 264.0

Summarized presentation:

Contribution margin of sales increase ($360 2,400) $864,000

Loss in contribution margin on original volume arising from

decrease in selling price ($40 15,000) 600,000

Increase in net income before taxes $264,000

2. No, the Compressor Division should not sell all 17,400 units to the Air Comfort

Division for $100 each. If the Compressor Division does sell all 17,400 units to Air

Comfort, Compressor will only be able to sell 57,600 units to outside customers

instead of 64,000 units due to the capacity restrictions. This would decrease the

Compressor Division’s net income before taxes by $71,000. Compressor Division

would be willing to accept any orders from Air Comfort above the 64,000 unit level

at $100 per unit because there would be a positive contribution margin of $43 per

unit. Supporting calculations follow.

Outside Air Comfort

Sales Sales

Selling price ............................................................................... $200 $100

Variable costs:

Direct material .......................................................................... 24 $ 21

Direct labor .............................................................................. 16 16

Variable overhead .......................................................... 20 20

Variable selling expenses ...................................................... 12 —

Total variable costs ................................................................ $ 72 $ 57

Contribution margin .................................................................. $128 $ 43

Capacity calculation in units:

Total capacity ............................................................................................ 75,000

Sales to Air Comfort ................................................................................. 17,400

Balance .................................................................................................. 57,600

Projected sales to outsiders .................................................................... 64,000

Lost sales to outsiders ............................................................................. 6,400

Solution:

Contribution from sales to Air Comfort ($43 17,400) .......................... $748,200

Loss in contribution from loss of sales to outsiders ($128 6,400) .... 819,200

Decrease in net income before taxes ...................................................... $ 71,000

3. Yes, it would be in the best interests of Continental Industries for the Compressor

Division to sell the units to the Air Comfort Division at $100 each. The net

advantage to Continental Industries is $625,000 as shown in the following analysis.

The net advantage is the result of the cost savings from purchasing the

compressor unit internally and the contribution margin lost from the 6,400 units

that the Compressor Division otherwise would sell to outside customers.

Cost savings by using compressor unit from Compressor Division:

Air Comfort Division’s outside purchase price .................................... $ 140

Compressor Division’s variable cost to produce (see req. 2). ............ 57

Savings per unit ....................................................................................... $ 83

x Number of units................................................................................ x 17,400

Total cost savings .................................................................................... $1,444,200

Compressor Division’s loss in contribution from loss

of sales to outsiders (see req. 2): $128 6,400 ................................. 819,200

Increase in net income before taxes for Continental Industries .......... $ 625,000

4. As the answers to requirements (2) and (3) show, $100 is not a goal-congruent

transfer price. Although a transfer is in the best interests of Continental Industries

as a whole, a transfer of $100 will not be perceived by the Compressor Division’s

management as in that division’s best interests.

Anda mungkin juga menyukai

- The Yellow House: A Memoir (2019 National Book Award Winner)Dari EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Penilaian: 4 dari 5 bintang4/5 (98)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceDari EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RacePenilaian: 4 dari 5 bintang4/5 (895)

- Chapter 2 Strategy, Organization Design and EffectivenessDokumen20 halamanChapter 2 Strategy, Organization Design and EffectivenessNeach Gaoil100% (2)

- Microeconomics Practice Problem Set #3: TC (Q) 20q TC (Q) 20q P (Q) 200 - QDokumen3 halamanMicroeconomics Practice Problem Set #3: TC (Q) 20q TC (Q) 20q P (Q) 200 - QsanBelum ada peringkat

- Retail MGMT InformationDokumen21 halamanRetail MGMT InformationsanBelum ada peringkat

- Innovation-Oriented Operations Strategy Typology and Stage-Based ModelDokumen15 halamanInnovation-Oriented Operations Strategy Typology and Stage-Based ModelsanBelum ada peringkat

- Impacts of GSTDokumen41 halamanImpacts of GSTsanBelum ada peringkat

- Daft OT11e PPT Ch01Dokumen18 halamanDaft OT11e PPT Ch01Jason Higgins100% (1)

- Corporate StrategyDokumen35 halamanCorporate StrategyAnonymous 5GHZXlBelum ada peringkat

- Contract Management For Procurement and Materials ManagementDokumen37 halamanContract Management For Procurement and Materials ManagementsanBelum ada peringkat

- The Internet Media Utterz, Mocospace, Twango, Mosh: and InteractiveDokumen32 halamanThe Internet Media Utterz, Mocospace, Twango, Mosh: and InteractivesanBelum ada peringkat

- Chapter 16Dokumen34 halamanChapter 16sanBelum ada peringkat

- Session 15 Role of Leadership in Managing ProjectsDokumen17 halamanSession 15 Role of Leadership in Managing ProjectssanBelum ada peringkat

- The Effectiveness of The Promotional Program: MeasuringDokumen30 halamanThe Effectiveness of The Promotional Program: MeasuringWendy Priscilia ManayangBelum ada peringkat

- Chapter 18Dokumen30 halamanChapter 18sanBelum ada peringkat

- Stress: A Demand On Mind and BodyDokumen13 halamanStress: A Demand On Mind and BodysanBelum ada peringkat

- Sessions 1-5Dokumen91 halamanSessions 1-5sanBelum ada peringkat

- Aftermarket - MFCW Caselet - Mwr2019 - 24jul19-Release1.0 - 10aug19 - Mwrcal19 - 391Dokumen6 halamanAftermarket - MFCW Caselet - Mwr2019 - 24jul19-Release1.0 - 10aug19 - Mwrcal19 - 391sanBelum ada peringkat

- Public Relations, Publicity, and Corporate Advertising: Mcgraw-Hill/IrwinDokumen50 halamanPublic Relations, Publicity, and Corporate Advertising: Mcgraw-Hill/IrwinJericho ManiegoBelum ada peringkat

- Chapter 16Dokumen34 halamanChapter 16sanBelum ada peringkat

- Sales & Distribution TextDokumen16 halamanSales & Distribution Textchandankbanerje7785100% (1)

- You Either Disrupt Your Own Company, or Someone Else Will!Dokumen6 halamanYou Either Disrupt Your Own Company, or Someone Else Will!sanBelum ada peringkat

- The Internet Media Utterz, Mocospace, Twango, Mosh: and InteractiveDokumen32 halamanThe Internet Media Utterz, Mocospace, Twango, Mosh: and InteractivesanBelum ada peringkat

- Innovation and Change: Organization Theory and DesignDokumen23 halamanInnovation and Change: Organization Theory and Designsan100% (1)

- Break Even AnalysisDokumen1 halamanBreak Even AnalysissanBelum ada peringkat

- Strategic Brand Management Chapter 02Dokumen30 halamanStrategic Brand Management Chapter 02Bilawal Shabbir60% (5)

- Team 3 Presentation On A&d Tech CaseDokumen6 halamanTeam 3 Presentation On A&d Tech CasesanBelum ada peringkat

- New Product Forecasting: The Bass ModelDokumen4 halamanNew Product Forecasting: The Bass ModelsanBelum ada peringkat

- Case QuestionsDokumen2 halamanCase Questionssan75% (4)

- Case QuestionsDokumen2 halamanCase Questionssan75% (4)

- Team Roles in A NutshellDokumen2 halamanTeam Roles in A NutshellsanBelum ada peringkat

- De Bono Six Thinking HatsDokumen3 halamanDe Bono Six Thinking HatssanBelum ada peringkat

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeDari EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifePenilaian: 4 dari 5 bintang4/5 (5794)

- The Little Book of Hygge: Danish Secrets to Happy LivingDari EverandThe Little Book of Hygge: Danish Secrets to Happy LivingPenilaian: 3.5 dari 5 bintang3.5/5 (399)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaDari EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaPenilaian: 4.5 dari 5 bintang4.5/5 (266)

- Shoe Dog: A Memoir by the Creator of NikeDari EverandShoe Dog: A Memoir by the Creator of NikePenilaian: 4.5 dari 5 bintang4.5/5 (537)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureDari EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FuturePenilaian: 4.5 dari 5 bintang4.5/5 (474)

- Never Split the Difference: Negotiating As If Your Life Depended On ItDari EverandNever Split the Difference: Negotiating As If Your Life Depended On ItPenilaian: 4.5 dari 5 bintang4.5/5 (838)

- Grit: The Power of Passion and PerseveranceDari EverandGrit: The Power of Passion and PerseverancePenilaian: 4 dari 5 bintang4/5 (588)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryDari EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryPenilaian: 3.5 dari 5 bintang3.5/5 (231)

- The Emperor of All Maladies: A Biography of CancerDari EverandThe Emperor of All Maladies: A Biography of CancerPenilaian: 4.5 dari 5 bintang4.5/5 (271)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyDari EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyPenilaian: 3.5 dari 5 bintang3.5/5 (2259)

- On Fire: The (Burning) Case for a Green New DealDari EverandOn Fire: The (Burning) Case for a Green New DealPenilaian: 4 dari 5 bintang4/5 (73)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersDari EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersPenilaian: 4.5 dari 5 bintang4.5/5 (344)

- Rise of ISIS: A Threat We Can't IgnoreDari EverandRise of ISIS: A Threat We Can't IgnorePenilaian: 3.5 dari 5 bintang3.5/5 (137)

- Team of Rivals: The Political Genius of Abraham LincolnDari EverandTeam of Rivals: The Political Genius of Abraham LincolnPenilaian: 4.5 dari 5 bintang4.5/5 (234)

- The Unwinding: An Inner History of the New AmericaDari EverandThe Unwinding: An Inner History of the New AmericaPenilaian: 4 dari 5 bintang4/5 (45)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreDari EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You ArePenilaian: 4 dari 5 bintang4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)Dari EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Penilaian: 4.5 dari 5 bintang4.5/5 (121)

- Her Body and Other Parties: StoriesDari EverandHer Body and Other Parties: StoriesPenilaian: 4 dari 5 bintang4/5 (821)

- Retail Store Operations Reliance Retail LTD: Summer Project/Internship ReportDokumen48 halamanRetail Store Operations Reliance Retail LTD: Summer Project/Internship ReportRaviRamchandaniBelum ada peringkat

- Solutions ArtLog Edition9Dokumen15 halamanSolutions ArtLog Edition9scottstellBelum ada peringkat

- Part 3 Toeic WritingDokumen33 halamanPart 3 Toeic WritingNguyen Thi Kim ThoaBelum ada peringkat

- GL 003 14 Code of Good Practice For Life InsuranceDokumen19 halamanGL 003 14 Code of Good Practice For Life InsuranceAdrian BehBelum ada peringkat

- Alok Kumar Singh Section C WAC I 3Dokumen7 halamanAlok Kumar Singh Section C WAC I 3Alok SinghBelum ada peringkat

- Articles of Partnership ExampleDokumen4 halamanArticles of Partnership ExamplePiaMarielVillafloresBelum ada peringkat

- Introduction To Business-to-Business Marketing: Vitale A ND Gig LieranoDokumen18 halamanIntroduction To Business-to-Business Marketing: Vitale A ND Gig LieranoMaria ZakirBelum ada peringkat

- 5S TrainingDokumen81 halaman5S Trainingamresh kumar tiwari100% (1)

- 01 Pengantar SCMDokumen46 halaman01 Pengantar SCMAdit K. BagaskoroBelum ada peringkat

- Anubrat ProjectDokumen80 halamanAnubrat ProjectManpreet S BhownBelum ada peringkat

- 1.introduction To Operations Management PDFDokumen7 halaman1.introduction To Operations Management PDFEmmanuel Okena67% (3)

- Customer SQ - Satisfaction - LoyaltyDokumen15 halamanCustomer SQ - Satisfaction - LoyaltyjessiephamBelum ada peringkat

- Multinational Accounting: Issues in Financial Reporting and Translation of Foreign Entity StatementsDokumen36 halamanMultinational Accounting: Issues in Financial Reporting and Translation of Foreign Entity StatementsahmedBelum ada peringkat

- ExerciseQuestions SolutionDokumen11 halamanExerciseQuestions SolutionMaria Zakir100% (2)

- Ifrs 5Dokumen2 halamanIfrs 5Foititika.netBelum ada peringkat

- History of HeinekenDokumen9 halamanHistory of Heinekenrully1234Belum ada peringkat

- 10 Steps To Starting A Business in Ho Chi Minh CityDokumen5 halaman10 Steps To Starting A Business in Ho Chi Minh CityRahul PatilBelum ada peringkat

- Freight Charge Notice: To: Garment 10 CorporationDokumen4 halamanFreight Charge Notice: To: Garment 10 CorporationThuy HoangBelum ada peringkat

- PARCOR-SIMILARITIESDokumen2 halamanPARCOR-SIMILARITIESHoney Lizette SunthornBelum ada peringkat

- MalluDokumen176 halamanMalluMallappaBelum ada peringkat

- Catalogue For BSI Standards PDFDokumen40 halamanCatalogue For BSI Standards PDFPaul TurnerBelum ada peringkat

- Lexis® Gift VouchersDokumen1 halamanLexis® Gift VouchersNURUL IZZA HUSINBelum ada peringkat

- 703 07s 05 SCMDokumen12 halaman703 07s 05 SCMDiana Leonita FajriBelum ada peringkat

- MBA Project Report On Dividend PolicyDokumen67 halamanMBA Project Report On Dividend PolicyMohit Kumar33% (3)

- Design Failure Mode and Effects Analysis: Design Information DFMEA InformationDokumen11 halamanDesign Failure Mode and Effects Analysis: Design Information DFMEA InformationMani Rathinam Rajamani0% (1)

- Stefan CraciunDokumen9 halamanStefan CraciunRizzy PopBelum ada peringkat

- G2 Group5 FMCG Products Fair & Lovely - Ver1.1Dokumen20 halamanG2 Group5 FMCG Products Fair & Lovely - Ver1.1intesharmemonBelum ada peringkat

- CS 214 - Chapter 6: Architectural DesignDokumen31 halamanCS 214 - Chapter 6: Architectural DesignAriel Anthony Fernando GaciloBelum ada peringkat

- 1LPS 3 BoQ TemplateDokumen369 halaman1LPS 3 BoQ TemplateAbdulrahman AlkilaniBelum ada peringkat

- 01 Activity 1 - ARG: Facility Management Concepcion, Stephanie Kyle S. BM303Dokumen2 halaman01 Activity 1 - ARG: Facility Management Concepcion, Stephanie Kyle S. BM303Stephanie Kyle Concepcion100% (3)