IT Return IT1 2674182

Diunggah oleh

Asfandyar Janjua0 penilaian0% menganggap dokumen ini bermanfaat (0 suara)

157 tayangan2 halamanRETURN OF TOTAL INCOME / STATEMENT OF FINAL TAXATION Ndeg 20090000000296011 3142865 NTN Reg / Inc No. 0066482 2009 Tax Year Res. Status Resident Revised Ndeg 107900 Year Ending 30-06-2009.

Deskripsi Asli:

Judul Asli

IT-Return-IT1-2674182[1]

Hak Cipta

© Attribution Non-Commercial (BY-NC)

Format Tersedia

PDF, TXT atau baca online dari Scribd

Bagikan dokumen Ini

Apakah menurut Anda dokumen ini bermanfaat?

Apakah konten ini tidak pantas?

Laporkan Dokumen IniRETURN OF TOTAL INCOME / STATEMENT OF FINAL TAXATION Ndeg 20090000000296011 3142865 NTN Reg / Inc No. 0066482 2009 Tax Year Res. Status Resident Revised Ndeg 107900 Year Ending 30-06-2009.

Hak Cipta:

Attribution Non-Commercial (BY-NC)

Format Tersedia

Unduh sebagai PDF, TXT atau baca online dari Scribd

0 penilaian0% menganggap dokumen ini bermanfaat (0 suara)

157 tayangan2 halamanIT Return IT1 2674182

Diunggah oleh

Asfandyar JanjuaRETURN OF TOTAL INCOME / STATEMENT OF FINAL TAXATION Ndeg 20090000000296011 3142865 NTN Reg / Inc No. 0066482 2009 Tax Year Res. Status Resident Revised Ndeg 107900 Year Ending 30-06-2009.

Hak Cipta:

Attribution Non-Commercial (BY-NC)

Format Tersedia

Unduh sebagai PDF, TXT atau baca online dari Scribd

Anda di halaman 1dari 2

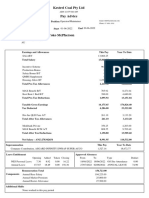

RETURN OF TOTAL INCOME/STATEMENT OF FINAL TAXATION IT-1

UNDER THE INCOME TAX ORDINANCE, 2001 (FOR COMPANY) N° 20090000000296011

NTN 3142865

1 Taxpayer Name GUMCORP (PRIVATE) LIMITED

Reg/Inc No. 0066482

2 Business Name GUMCORP (PVT.) LTD. Tax Year 2009

3 Business Address 250 / 24, KORANGI INDUSTRIAL AREA, KARACHI Res. Status Resident

4 Principal Activity MANUFACTURE OF OTHER FOOD PRODUCTS N.E.C. Code 107900 Revised N°

5 Representative NTN Name OMAIR KHURSHID ALLAWALA Year Ending 30-06-2009 Assessed N°

6 NTN Top 10 Share Holder's Name Percentage Capital NTN Top 10 Share Holder's Name Percentage Capital

0302832 OMAIR KHURSHID 0.0404 50,000

0730364 OWAIS KHURSHID ALLAWALA 99.9596 123,850,000

Total 100% 123,900,000

Item Code Amount Liabilities Code Amount

7 Net Sales 3101 917,783,894 93 Capital 8699 151,884,655

8 . Gross Domestic Sales 31011 370,194,819 94 . Paid-up Capital 8621 123,900,000

9 . Domestic Commission/Brokerage 31021 95 . Reserves 8641

10 . Gross Exports 31012 547,589,075 96 . Accumulated Profits 8661 27,984,655

97 . Surplus on Revaluation 8671

11 . Foreign Commission/Brokerage 31022

98 Long Term Liabilities 8799 76,670,951

12 . Rebates/Duty Drawbacks 3107

99 . Long Term Loans 8701 60,905,676

13 Cost of Sales 3116 740,208,562

100 . Deferred Liabilities 8711 15,765,275

14 . Local Raw Material/ Components 310411 101,641,229

101 Current Liabilities 8899 342,276,728

15 . Imported Raw Material/ Components 310421 618,564,369

102 . Trade & Other Payables 8801 60,491,263

16 . Salaries,Wages 311101 10,182,179

103 . Short Term Loans 8821 281,785,465

17 . Power 311102 6,896,348 104 Other Liabilities 8901

18 . Fuel 311103 5,644,583 105 Total Capital & Liabilities 8999 570,832,334

19 . Stores/Spares 311106 5,408,424 Assets Code Amount

20 . Insurance 311107 1,533,462 106 Fixed Assets 8199 273,629,608

21 . Repair & Maintenance 311108 107 . Land 8101 57,030,837

22 . Other Expenses 311118 7,376,954 108 . Building 8111 33,403,151

109 . Plant & Machinery 812101 140,862,135

23 . Accounting Amortization 3114

110 . Capital Work-in-Progress 8181 32,219,479

24 . Accounting Depreciation 3115 17,378,034

111 . Motor Vehicles 8131 5,572,180

25 . Opening Stock 3117 99,781,973 112 . Office Equipment 812109 2,984,769

26 . Finished Goods Purchases (Local) 310412 113 . Furniture & Fixtures 812103 1,557,057

27 . Finished Goods Purchases (Imports) 310422 114 Current Assets 8299 295,261,651

28 . Closing Stock 3118 134,198,993 115 . Investments 8251 7,721,843

29 Gross Profit/ (Loss) 3119 177,575,332 116 . Cash & Cash Equivalents 8201 11,475,177

30 Gross Receipts 3139 117 . Stock in Trade/Stores/Spares 8221 134,227,492

118 . Trade Receivables 8231 105,494,092

31 . Markup/Interest (for Financial Institutions) 31311

119 . Advances/Deposits/Prepayments/Other Receivables 8241 36,343,047

32 . Leasing 31312 120 Intangible assets 8401 1,941,075

33 . Oil & Gas Exploration 31313 121 Other Assets 8402

34 . Telecommunication 31314 122 Total Assets 8499 570,832,334

35 . 31315 Sr Source Code Receipt/Value Rate Code Tax Due

Insurance

36 . 3135 Total 545,028,000 6599 5,450,280

Accounting Gain on Disposal of Intangibles

37 . 3136 123 Imports 64011 5 65011

Accounting Gain on Disposal of Assets

38 . 3131 124 64012 1 65012

Other Revenues/ Fee/ Charges for Services etc.

39 Management,Administrative,Selling & Financial expenses 3189 126,326,650 125 64013 2 65013

40 . Rent/ Rates/ Taxes 3141 871,161 126 64014 65014

41 . 3144 12,451,682 127 64015 0.5 65015

Salaries & Wages

42 . Travelling/ Conveyance 3145 4,235,602 128 Insurance/Re-insurance (Non 315901 315902

Resident)

43 . Electricity/ Water/ Gas 3148 344,649

44 . 3154 1,038,581 129 Media Services Payments 316001 10 316002

Communication Charges received By Non-Res

45 . Repairs & Maintenance 3153 510,318 130 Gas Consump. by CNG Station 64021 4 65021

46 . Stationery/ Office Supplies 3155 308,588 131 Royalties/Fees 640511 15 650511

47 . Advertisement/ Publicity/ Promotion 3157 5,216,877 132 640512 650512

48 . Insurance 3159 554,931 133 Contracts (Non-Resident) 640521 6 650521

49 . Professional Charges 3160 2,131,606

134 Supply of Goods 640611 3.50 650611

50 . Profits on Debts (Markup/Interest) 3161 34,188,786

135 640612 1.50 650612

51 . Donations 3163 2,100,000

136 640613 650613

52 . Directors Fee 3177

137 640614 1 650614

53 . Workers Profit Participation Fund 3179 2,755,306

138 Contracts (Resident) 640631 6 650631

54 . Loss on Disposal of Intangibles 3185

139 640632 650632

55 . Loss on Disposal of Assets 3186 5,771,742

140 Exports/ Indenting 64071 545,028,000 1 65071 5,450,280

56 . Accounting Amortization 3187 215,675

141 Comm./Export Services 64072 0.75 65072

57 . Accounting Depreciation 3188 3,066,710

142 64073 0.5 65073

58 . Bad Debts Provision 31811

143 64076 65076

59 . Obsolete Stocks/Stores/Spares Provision 31812

144 Foreign Indenting Commission 64075 5 65075

60 . Diminution in Value of Investments Provision 31813

145 Property Income 64081 65081

61 . Bad Debts Written Off 31821 88,820

146 Prizes 64091 10 65091

62 . Obsolete Stocks/Stores/Spares Written Off 31822

147 Winnings 64092 20 65092

63 . Selling expenses(Freight outwards etc.) 31080 47,557,484

148 Petroleum Commission 64101 10 65101

64 . Others 3170 2,918,132

149 Brokerage/Commission 64121 10 65121

65 Net Profit/ (Loss) 3190 51,248,682

150 Advertising Commission 64122 5 65122

151 Goods Transport Vehicles 64141 65141

Signatures

Sr Items Code Amount Sr Source Code Receipt/Value Rate Code Tax Due

66 Inadmissible Expenses 3191 20,749,305 Total 9202

67 . Tax Gain on disposal of Intangibles 319135 152 Property Income Not Subject to 210101 920235

WHT

68 . Tax Gain on disposal of Assets 319136 -5,706,742

153 Purchase of Locally Produced Edible 310431 920208

69 . Other Inadmissible Expenses 319198 26,456,047 Oil

70 Admissible Deductions 3192 34,142,513 154 Services rendered/ contracts 210102 1 920236

executed outside Pakistan

71 . Tax Amortization 319287 339,758

155 Total of Final & Fixed Tax 545,028,000 94592 5,450,280

72 . Tax Depreciation 319288 33,455,375 5,450,280

156 Tax Paid/ Deducted 94591

73 . Other Admissible Deductions 319298 347,380 157 Tax Payable/ Refundable to be transferred to Net Tax Payable 6699 0

74 Income/(Loss) relating to receipts sbj to Final/Fixed tax 3199 31,027,819 @ 35

158 Gross Tax 9201 2,003,937

75 Loss for the year surrendered to Holding Company 3901 159 Tax Reductions, Credits & Averaging 9249 0

76 Loss acquired from Subsidiary Company and Adjusted 3902 160 Business Turnover 310101

77 Brought Fwd. Loss Adjs./(Loss for the year Carry Fwd.) 3990

161 Minimum Tax 920201 0

Sr Items Code Amount 162 Mimimum Tax Exemptions/ Reductions 9217 0

78 Total Income/ (Loss) 9099 6,827,655

163 Adjustment of Minimum Tax 9497 0

79 . 3999 6,827,655 164 Final Tax on Business Turnover 6598 5,450,280

Business Income/(Loss)

80 . 4999 165 Net Minimum Tax payable 9203 0

Capital Gains

166 Net Tax (Including Payable from Column 27 of Annex C-1) 9299 3,106,059

81 . Other Sources Inc / (Loss) 5999

167 Tax Already Paid Including Adjustments 9499 19,652,248

82 . Foreign Income/ (Loss) 6399

168 Net Tax Payable 9999 0

83 Deductible Allowances 9139 1,102,122

169 Total Tax Paid Along With Return u/s 137 (a+b+c) 9471 0

84 . Zakat 9121

85 . 9122 1,102,122

Workers Welfare Fund

170 Net Tax Refundable; may be credited to my bank account as under: 9999 -16,546,189

86 . Charitable Donations Admissible for Straight Dedc. 9124

87 Taxable Income/ (Loss) 9199 5,725,533 171 Bank HABIB BANK LIMITED

172 City KARACHI

88 Exempt Income 6199

173 Branch Name & Code HBL PLAZA BRANCH, KARACHI

89 . Property Income 6102

174 A/C Number 7900221403

90 . Business Income 6103

91 . Capital Gains 6104

92 . Other Sources Inc / (Loss) 6105

I, Omair Khurshid Allawala holder of CNIC 42301-6955462-5 , in my capacity as Principal Officer / Trustee /

Representative (as defined in section 172 of the Income Tax Ordinance, 2001) of the Taxpayer named above, do solemnly declare that to the best of

my knowledge and belief the information given in this Return/Statement u/s 115(4) is correct, complete and in accordance with the provisions of the

Income Tax Ordinance, 2001, Income Tax Rules, 2002, and the Companies Ordinance 1984.

Date : 25/01/2010 (dd/mm/yyyy) Signatures

[ RTO-I KARACHI Status: Submitted (25/01/2010 ) UID: 9799907031565 ]

[ eFBR Portal ] Attached:- Annex A, Annex C, Audited Account File

ITRROA-002009-2674182

Anda mungkin juga menyukai

- Final End-April Exchequer StatementDokumen5 halamanFinal End-April Exchequer StatementPolitics.ieBelum ada peringkat

- Mehak Bluntly MediaDokumen18 halamanMehak Bluntly Mediahimanshu sagarBelum ada peringkat

- Balance Sheet 08 09Dokumen1 halamanBalance Sheet 08 09Kunal SharmaBelum ada peringkat

- Sanchit Sinha - 119240 - Assignsubmission - File - Polar - Sports - ASG2a - Spreadsheet - Study - Group - 1 - DEMDokumen16 halamanSanchit Sinha - 119240 - Assignsubmission - File - Polar - Sports - ASG2a - Spreadsheet - Study - Group - 1 - DEMAman KumarBelum ada peringkat

- Standalone Financial Results, Limited Review Report For December 31, 2016 (Result)Dokumen3 halamanStandalone Financial Results, Limited Review Report For December 31, 2016 (Result)Shyam SunderBelum ada peringkat

- Kci-Ufr Q3fy11Dokumen1 halamanKci-Ufr Q3fy11Shashi PandeyBelum ada peringkat

- Srinivas Vutukuri AY 2021-2022: Computation of Income (ITR4)Dokumen3 halamanSrinivas Vutukuri AY 2021-2022: Computation of Income (ITR4)forty oneBelum ada peringkat

- NuPetCo Slides - DahliaDokumen24 halamanNuPetCo Slides - Dahliacik bungaBelum ada peringkat

- Paiya SittappaDokumen1 halamanPaiya SittappaRagu NathenBelum ada peringkat

- DTC Proforma Invoice (6) .PDF 6794Dokumen1 halamanDTC Proforma Invoice (6) .PDF 6794AshokBelum ada peringkat

- Yy Yy Yyy YyDokumen11 halamanYy Yy Yyy YyMurali ChandrapalBelum ada peringkat

- Earnings Deductions: Nett PayDokumen1 halamanEarnings Deductions: Nett PayThe Sims InvestmentBelum ada peringkat

- Your Pay Advice For Pay Ending 30 09 2022Dokumen2 halamanYour Pay Advice For Pay Ending 30 09 2022iqbal.shahid0374Belum ada peringkat

- Tirecity - XLS092 XLS ENGDokumen6 halamanTirecity - XLS092 XLS ENGpp ppBelum ada peringkat

- Praktikum FinancialDokumen22 halamanPraktikum Financiallisa amaliaBelum ada peringkat

- Vitrox q22011Dokumen10 halamanVitrox q22011Dennis AngBelum ada peringkat

- PT Inti Agri ResourcestbkDokumen2 halamanPT Inti Agri ResourcestbkmeilindaBelum ada peringkat

- INVOICEDokumen2 halamanINVOICEkalair motorsBelum ada peringkat

- Commitment: To CareDokumen100 halamanCommitment: To Carea769Belum ada peringkat

- Vinodbhia Kenya - Freight - PNGDokumen1 halamanVinodbhia Kenya - Freight - PNGVikki PatelBelum ada peringkat

- Ruksar ZabiDokumen2 halamanRuksar ZabiMAA DURGA TVSBelum ada peringkat

- Balance Sheet As at 31St March, 2009: DirectorDokumen4 halamanBalance Sheet As at 31St March, 2009: Directormj1990Belum ada peringkat

- Montales. Jason - Assignment 4B Module 4Dokumen3 halamanMontales. Jason - Assignment 4B Module 4Jason C. MontalesBelum ada peringkat

- Job Card Preinvoice: Billing To SHIP TO / Place of SupplyDokumen3 halamanJob Card Preinvoice: Billing To SHIP TO / Place of Supplywm. mfcskhairBelum ada peringkat

- KRA202310990621Dokumen1 halamanKRA202310990621spandyno1Belum ada peringkat

- Sun Pharma Ratio LALITDokumen6 halamanSun Pharma Ratio LALITLalit RoyBelum ada peringkat

- Block 4 Al-Karam, Square LIAQUATABAD, KARACHI, Karachi Central Liaquatabad Town Muhammad UsmanDokumen5 halamanBlock 4 Al-Karam, Square LIAQUATABAD, KARACHI, Karachi Central Liaquatabad Town Muhammad Usmanfabiha khanBelum ada peringkat

- Cipla P& LDokumen2 halamanCipla P& LNEHA LALBelum ada peringkat

- Bill No. 001Dokumen1 halamanBill No. 001vishwajeetBelum ada peringkat

- Payslip 75116420200501Dokumen2 halamanPayslip 75116420200501Rudy IskandarBelum ada peringkat

- Howe Engineering Projects India PVT LTD: Earnings Amount Deductions Amount Perks/Other income/Exempton/RebatesDokumen1 halamanHowe Engineering Projects India PVT LTD: Earnings Amount Deductions Amount Perks/Other income/Exempton/RebatesSumantrra ChattopadhyayBelum ada peringkat

- Balance Sheet As at 31St March, 2010 Amount Amount 2009-2010 2008-2009 Rs. P. Rs. P. Sources of FundsDokumen4 halamanBalance Sheet As at 31St March, 2010 Amount Amount 2009-2010 2008-2009 Rs. P. Rs. P. Sources of FundsCA Saurav Kumar AgrawalBelum ada peringkat

- Jamuna Bank LTD: Daily Statement of AffairsDokumen3 halamanJamuna Bank LTD: Daily Statement of AffairsArman Hossain WarsiBelum ada peringkat

- Rangpur Foundry LimitedDokumen10 halamanRangpur Foundry Limitedanup dasBelum ada peringkat

- Worldscope Full Company Report Acc LimitedDokumen20 halamanWorldscope Full Company Report Acc LimitedAnkit LunawatBelum ada peringkat

- Ascon 1000Hrs Engine Service Quotation PDFDokumen1 halamanAscon 1000Hrs Engine Service Quotation PDFBalraj BawaBelum ada peringkat

- Stanley Gibbons Group PLCDokumen2 halamanStanley Gibbons Group PLCImran WarsiBelum ada peringkat

- Standalone Financial Results, Limited Review Report For December 31, 2016 (Result)Dokumen4 halamanStandalone Financial Results, Limited Review Report For December 31, 2016 (Result)Shyam SunderBelum ada peringkat

- Published Results 31 March 2010Dokumen2 halamanPublished Results 31 March 2010Ravi ChaturvediBelum ada peringkat

- 1433 EstimateDokumen2 halaman1433 Estimatesnss.fmBelum ada peringkat

- R K S Infra Computation 2022Dokumen4 halamanR K S Infra Computation 2022birpal singhBelum ada peringkat

- Akash Cost AssignmentDokumen10 halamanAkash Cost AssignmentAkash HedaooBelum ada peringkat

- Tire City-Spread SheetDokumen6 halamanTire City-Spread SheetVibhusha SinghBelum ada peringkat

- Kalol Indian Farmers Fertiliser Co-Operative Limited Pay SlipDokumen1 halamanKalol Indian Farmers Fertiliser Co-Operative Limited Pay SlipSHAILESH PATELBelum ada peringkat

- Akhila SALE INVOICEDokumen2 halamanAkhila SALE INVOICEameenskollam716Belum ada peringkat

- Service Estimate: CustomerDokumen2 halamanService Estimate: CustomerazharBelum ada peringkat

- Catersis Traves Ltd-2017 1Dokumen16 halamanCatersis Traves Ltd-2017 1YenBelum ada peringkat

- ASTRAL RECORDS - EditedDokumen11 halamanASTRAL RECORDS - EditedNarinderBelum ada peringkat

- Exercise (11) : Answer: A. Net Profit RM1,793 B. RM63,340Dokumen3 halamanExercise (11) : Answer: A. Net Profit RM1,793 B. RM63,340S1X 32 許詠棋 KohYongKeeBelum ada peringkat

- Interim Report 2010Dokumen38 halamanInterim Report 2010YennyBelum ada peringkat

- Job Card PreinvoiceDokumen3 halamanJob Card Preinvoicewm. mfcskhairBelum ada peringkat

- Good Stock Return GR0124000173Dokumen2 halamanGood Stock Return GR0124000173manoj kushwahaBelum ada peringkat

- Indian Oil Corporation Limited: Supplier ConsigneeDokumen1 halamanIndian Oil Corporation Limited: Supplier ConsigneeDiwakar MinzBelum ada peringkat

- RFL 3rd Quarter 2017 FinalDokumen4 halamanRFL 3rd Quarter 2017 Finalanup dasBelum ada peringkat

- Please Send Me HackDokumen3 halamanPlease Send Me Hackgaurav.verma17Belum ada peringkat

- PayslipDokumen1 halamanPayslipjohn lerry loberioBelum ada peringkat

- Seward Neighborhood Group Other Financial Information: 12/31/2007 12/31/08 12/31/09 ShowsDokumen12 halamanSeward Neighborhood Group Other Financial Information: 12/31/2007 12/31/08 12/31/09 ShowssewardpBelum ada peringkat

- Your Pay Advice For Pay Ending 30 06 2022Dokumen2 halamanYour Pay Advice For Pay Ending 30 06 2022iqbal.shahid0374Belum ada peringkat

- Profit LossDokumen1 halamanProfit Lossx.tv211Belum ada peringkat

- Business Result Elementary - Student's Book Audio ScriptsDokumen16 halamanBusiness Result Elementary - Student's Book Audio ScriptsAcademia TworiversBelum ada peringkat

- Chapter Nineteen: Dividends and Dividend PolicyDokumen29 halamanChapter Nineteen: Dividends and Dividend PolicyNano GowthamBelum ada peringkat

- Practical Applications of The Petroleum Resources Management SystemDokumen1 halamanPractical Applications of The Petroleum Resources Management Systemabnou_223943920Belum ada peringkat

- The Terminology of ContractsDokumen12 halamanThe Terminology of ContractsLya HellenBelum ada peringkat

- Final Ac Problem1Dokumen12 halamanFinal Ac Problem1Pratap NavayanBelum ada peringkat

- Eighty-Three Years Of: ProfitabilityDokumen117 halamanEighty-Three Years Of: ProfitabilityChristopher MoonBelum ada peringkat

- CE Electrical Transfer & PromotionDokumen5 halamanCE Electrical Transfer & PromotionBala SubramanianBelum ada peringkat

- Ajay Kumar SethyDokumen96 halamanAjay Kumar SethyShakti MohapatraBelum ada peringkat

- Marketing Mix PDFDokumen2 halamanMarketing Mix PDFDulanji Imethya YapaBelum ada peringkat

- Fundamentals of Product and Service Costing: Mcgraw-Hill/IrwinDokumen17 halamanFundamentals of Product and Service Costing: Mcgraw-Hill/IrwinMarie Frances SaysonBelum ada peringkat

- Portfolio - Md. Fahad HossainDokumen22 halamanPortfolio - Md. Fahad HossainHossain FahadBelum ada peringkat

- Notes of MGL EconomicsDokumen45 halamanNotes of MGL Economicsmohanraokp2279100% (1)

- Dove Real Beauty Sketches Case Studies DciNDDNDokumen3 halamanDove Real Beauty Sketches Case Studies DciNDDNRatih HadiantiniBelum ada peringkat

- Eric Khrom of Khrom Capital 2012 Q3 LetterDokumen5 halamanEric Khrom of Khrom Capital 2012 Q3 LetterallaboutvalueBelum ada peringkat

- Building A Better Quiznos - Written ReportDokumen12 halamanBuilding A Better Quiznos - Written Reportapi-300185048Belum ada peringkat

- PPM BluePrintDokumen163 halamanPPM BluePrintSanjay Govil67% (3)

- PDFDokumen162 halamanPDFAlen Matthew AndradeBelum ada peringkat

- Businessware Technologies - Adempiere PresentationDokumen32 halamanBusinessware Technologies - Adempiere Presentationsyedasim66Belum ada peringkat

- 260CT Revision NotesDokumen30 halaman260CT Revision NotesSalman Fazal100% (4)

- Extract of Annual Return 2019 20Dokumen47 halamanExtract of Annual Return 2019 20ajaykumarbmsitBelum ada peringkat

- Company ProfileDokumen8 halamanCompany ProfileVĩnh NguyễnBelum ada peringkat

- Stock Market Math - Essential FormulasDokumen319 halamanStock Market Math - Essential Formulasనా పేరు శశి100% (1)

- Postal Services HistoryDokumen13 halamanPostal Services HistoryAnonymous Ndp7rXBelum ada peringkat

- A1-Cash and Cash Equivalents - 041210Dokumen28 halamanA1-Cash and Cash Equivalents - 041210MRinaldiAuliaBelum ada peringkat

- 07jul2016Dokumen3 halaman07jul2016enjay_578Belum ada peringkat

- Panasonic Communications Imaging Corporation of The Philippines vs. Commissioner of Internal Revenue, 612 SCRA 18, February 08, 2010Dokumen2 halamanPanasonic Communications Imaging Corporation of The Philippines vs. Commissioner of Internal Revenue, 612 SCRA 18, February 08, 2010idolbondoc100% (1)

- Pineda Vs Court of AppealsDokumen12 halamanPineda Vs Court of AppealsKalvin OctaBelum ada peringkat

- 07 - Crafting Business ModelsDokumen7 halaman07 - Crafting Business ModelsKamran MirzaBelum ada peringkat

- Introduction To Mutual Fund and Its Variousaspects.: SharesDokumen2 halamanIntroduction To Mutual Fund and Its Variousaspects.: Sharesindu9sriBelum ada peringkat

- Women's Entrepreneurship by Bharat Popat and Harsha Popat AhmedabadDokumen3 halamanWomen's Entrepreneurship by Bharat Popat and Harsha Popat AhmedabadBharat PopatBelum ada peringkat