In RM Million Unless Otherwise Stated: 2018 Mfrs

Diunggah oleh

Tikah Zai0 penilaian0% menganggap dokumen ini bermanfaat (0 suara)

11 tayangan4 halamanannual

Judul Asli

ar2017

Hak Cipta

© © All Rights Reserved

Format Tersedia

DOCX, PDF, TXT atau baca online dari Scribd

Bagikan dokumen Ini

Apakah menurut Anda dokumen ini bermanfaat?

Apakah konten ini tidak pantas?

Laporkan Dokumen Iniannual

Hak Cipta:

© All Rights Reserved

Format Tersedia

Unduh sebagai DOCX, PDF, TXT atau baca online dari Scribd

0 penilaian0% menganggap dokumen ini bermanfaat (0 suara)

11 tayangan4 halamanIn RM Million Unless Otherwise Stated: 2018 Mfrs

Diunggah oleh

Tikah Zaiannual

Hak Cipta:

© All Rights Reserved

Format Tersedia

Unduh sebagai DOCX, PDF, TXT atau baca online dari Scribd

Anda di halaman 1dari 4

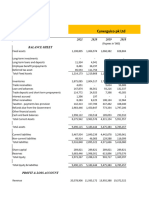

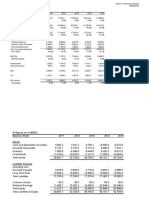

In RM million unless otherwise 2018 2017 2016 2015 2014

stated MFRS MFRS MFRS FRS FRS

RESULTS

Continuing operations

Revenue 7,417.6 7,249.3 11,739.3 11,541.5 11,910.6

Profit before interest and taxation 1,380.6 1,401.4 1,459.6 1,237.6 1,921.5

Net foreign currency translation 318.3 (273.8) (328.5) (732.5) (16.1)

(loss)/gain on foreign currency

denominated borrowings

Net interest expenses (128.2) (144.6) (165.3) (188.7) (234.6)

Profit before taxation 1,570.7 983.0 965.8 316.4 1,670.8

Taxation (334.0) (292.7) (319.5) (261.6) (408.4)

Profit for the financial year from 1,236.7 690.3 646.3 54.8 1,262.4

continuing operations

Discontinued operations

Profit for the financial year from 1,831.6 75.8 - - 2,127.3

discontinued operations

Profit for the financial year 3,068.3 766.1 646.3 54.8 3,389.7

Attributable to:

Owners of the parent 3,060.5 743.2 629.7 51.9 3,373.0

Non-controlling interests 7.8 22.9 16.6 2.9 16.7

ASSETS1

Property, plant and equipment 8,411.2 10,086.9 9,999.3 9,765.5 6,410.0

Investments in associates 2,491.1 1,121.1 937.5 812.7 886.9

Other non-current assets 616.6 781.7 767.7 699.0 648.7

11,518.9 11,989.7 11,704.5 11,277.2 7,945.6

Current assets 5,223.7 6,035.0 5,851.6 5,171.3 7,386.0

16,742.6 18,024.7 17,556.1 116,448.5 15,331.6

EQUITY AND LIABILITIES

Share capital 786.7 783.8 646.2 645.9 645.0

Reserves 8,369.6 6,673.6 6,491.9 6,423.1 5,391.8

9,156.3 7,457.4 7,138.1 7,069.0 6,036.8

Non-controlling interests 259.4 261.3 278.9 274.1 196.3

Total equity 9,415.7 7,718.7 7,417.0 7,343.1 6,233.1

Non-current liabilities 5,508.5 6,666.4 6,314.7 7,240.1 5,601.7

Current liabilities 1,818.4 3,639.6 3,824.4 1,865.3 3,496.8

Total liabilities 7,326.9 10,306.0 10,139.1 9,105.4 9,098.5

16,742.6 18,024.7 17,556.1 16,448.5 15,331.6

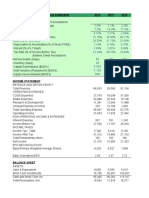

Net operating profit after tax 1,545.0 917.8 812.4 266.0 1,709.6

("NOPAT")

Average shareholders' equity 8,306.9 7,297.8 7,103.6 7,628.3 9,843.7

Average capital employed2 16,140.1 16,335.6 15,802.9 16,432.4 18,322.9

FINANCIAL STATISTICS

Basic earnings per share (sen) 48.70 11.82 9.99 0.82 52.93

Dividend per share (sen) 20.5 9.5 8.0 9.0 20.0

Net assets per share (sen) 146 119 114 112 95

Return on average shareholders’ 36.84 10.18 8.86 0.68 34.27

equity (%)

Return on average capital 9.57 5.62 5.14 1.62 9.33

employed (%)

Net debt/Equity(%)3 26.37 78.07 76.25 68.75 58.57

SHARE PERFORMANCE

Market share price (RM):

– Highest 4.88 4.81 5.04 5.28 5.36

– Lowest 4.31 4.21 3.70 3.91 4.09

– Closing 4.54 4.45 4.34 4.06 5.25

Trading volume (million) 1,032 1,111 1,584 1,200 1,563

Market capitalisation 28,531.2 27,963.2 27,290.8 25,664.7 33,366.0

1 The Assets of FY2016 include Assets of disposal

group held for sale.

2 Average capital employed comprises shareholders’

equity, non-controlling interests, long term liabilities,

short term borrowings and deferred taxation.

3 Net debt represents total borrowings less short

term funds, deposits with financial institutions and .

cash and bank balances.

In conjunction with the adoption of Malaysia

Financial Reporting Standards (“MFRS”) framework

by the Group, the above information from FY2015 to

FY2018 have been prepared in accordance with

MFRS, whereas information on FY2014 has been

prepared in accordance with Financial Reporting

Standards (“FRS”).

Disclaimer | Contact Us

Copyright © 2018 IOI Corporation Berhad (9027-W). All rights reserved.

Anda mungkin juga menyukai

- Business Valuation: Shriyan Gattani REGISTER NO. 1720233 5 Bba BDokumen7 halamanBusiness Valuation: Shriyan Gattani REGISTER NO. 1720233 5 Bba BShriyan GattaniBelum ada peringkat

- Adidas Chartgenerator ArDokumen2 halamanAdidas Chartgenerator ArTrần Thuỳ NgânBelum ada peringkat

- Consolidated Statements of Income and Other Comprehensive Income (In Million Rupiah) Description 2021 2020 2019 2018 2017Dokumen4 halamanConsolidated Statements of Income and Other Comprehensive Income (In Million Rupiah) Description 2021 2020 2019 2018 2017Ferial FerniawanBelum ada peringkat

- Financial Ratios v3Dokumen18 halamanFinancial Ratios v3Amichai GravesBelum ada peringkat

- BF1 Package Ratios ForecastingDokumen16 halamanBF1 Package Ratios ForecastingBilal Javed JafraniBelum ada peringkat

- Ratio Analysis of Engro Vs NestleDokumen24 halamanRatio Analysis of Engro Vs NestleMuhammad SalmanBelum ada peringkat

- Uts Comprehensive Case PT WikaDokumen7 halamanUts Comprehensive Case PT WikaFerial FerniawanBelum ada peringkat

- Ten Year Financial Summary PDFDokumen2 halamanTen Year Financial Summary PDFTushar GoelBelum ada peringkat

- Prospective Analysis 2Dokumen7 halamanProspective Analysis 2MAYANK JAINBelum ada peringkat

- Quarterly Update: First Half 2014 ResultsDokumen4 halamanQuarterly Update: First Half 2014 ResultssapigagahBelum ada peringkat

- DR Reddy Lab 5 Year DataDokumen4 halamanDR Reddy Lab 5 Year Datashishir5087Belum ada peringkat

- M Saeed 20-26 ProjectDokumen30 halamanM Saeed 20-26 ProjectMohammed Saeed 20-26Belum ada peringkat

- DataDokumen11 halamanDataA30Yash YellewarBelum ada peringkat

- Prospective Analysis - FinalDokumen7 halamanProspective Analysis - Finalsanjana jainBelum ada peringkat

- Infosys Consolidated Financial Statements 03.2017Dokumen12 halamanInfosys Consolidated Financial Statements 03.2017Anonymous 1cmtBqBelum ada peringkat

- Prospective Analysis - FinalDokumen7 halamanProspective Analysis - FinalMAYANK JAINBelum ada peringkat

- PV OIl Financial Spreadsheet AnalysisDokumen32 halamanPV OIl Financial Spreadsheet AnalysisNguyễn Minh ThànhBelum ada peringkat

- Horizontal and VerticalDokumen16 halamanHorizontal and VerticalFadzir AmirBelum ada peringkat

- Pacific Grove Spice CompanyDokumen3 halamanPacific Grove Spice CompanyLaura JavelaBelum ada peringkat

- Equity Research Is The Study of A Business and ItsDokumen32 halamanEquity Research Is The Study of A Business and ItsSanju JageBelum ada peringkat

- Marks & Spencer PLCDokumen7 halamanMarks & Spencer PLCMoona AwanBelum ada peringkat

- Burton Sensors SheetDokumen128 halamanBurton Sensors Sheetchirag shah17% (6)

- Analisis Lap KeuDokumen10 halamanAnalisis Lap KeuAna BaenaBelum ada peringkat

- LDG - Financial TemplateDokumen20 halamanLDG - Financial TemplateQuan LeBelum ada peringkat

- Income Statement and Balance Sheet AnalysisDokumen10 halamanIncome Statement and Balance Sheet AnalysisKi KiBelum ada peringkat

- Financial Statement AnalysisDokumen28 halamanFinancial Statement AnalysissanyaBelum ada peringkat

- AIRTHREAD ACQUISITION Revenue and Expense ProjectionsDokumen24 halamanAIRTHREAD ACQUISITION Revenue and Expense ProjectionsHimanshu AgrawalBelum ada peringkat

- Financial Analysis of Pakistan Cables: Submitted To: Sir Shahbaz 9/10/2014Dokumen25 halamanFinancial Analysis of Pakistan Cables: Submitted To: Sir Shahbaz 9/10/2014Ali RazaBelum ada peringkat

- FIN506 Weekly Assignment SolutionsDokumen3 halamanFIN506 Weekly Assignment SolutionsAhmed HassaanBelum ada peringkat

- D489 Abhishek JSWphase 2Dokumen44 halamanD489 Abhishek JSWphase 2Yash KalaBelum ada peringkat

- Particulars 2018-19 2017-18 Liquidity AnalysisDokumen10 halamanParticulars 2018-19 2017-18 Liquidity AnalysisIvy MajiBelum ada peringkat

- Wooly Cox Limited: Common Size Balance Sheet Description/Year 15-MarDokumen12 halamanWooly Cox Limited: Common Size Balance Sheet Description/Year 15-Marmahiyuvi mahiyuviBelum ada peringkat

- FinShiksha Maruti Suzuki UnsolvedDokumen12 halamanFinShiksha Maruti Suzuki UnsolvedGANESH JAINBelum ada peringkat

- Burton ExcelDokumen128 halamanBurton ExcelJaydeep SheteBelum ada peringkat

- Fadm Project 3Dokumen11 halamanFadm Project 3Vimal AgrawalBelum ada peringkat

- ExecutivesummaryDokumen4 halamanExecutivesummaryMayurBelum ada peringkat

- Purchases / Average Payables Revenue / Average Total AssetsDokumen7 halamanPurchases / Average Payables Revenue / Average Total AssetstannuBelum ada peringkat

- 02 04 EndDokumen6 halaman02 04 EndnehaBelum ada peringkat

- Altagas Green Exhibits With All InfoDokumen4 halamanAltagas Green Exhibits With All InfoArjun NairBelum ada peringkat

- Ratio Analysis of TATA MOTORSDokumen8 halamanRatio Analysis of TATA MOTORSmr_anderson47100% (8)

- Kohinoor Chemical Company LTD.: Horizontal AnalysisDokumen19 halamanKohinoor Chemical Company LTD.: Horizontal AnalysisShehreen ArnaBelum ada peringkat

- Tutorial 2 QuestionsDokumen4 halamanTutorial 2 Questionsguan junyanBelum ada peringkat

- Apollo TyresDokumen4 halamanApollo TyresGokulKumarBelum ada peringkat

- Period Ended 2/1/2020 2/2/2019 2/3/2018: Diluted Shares OutstandingDokumen4 halamanPeriod Ended 2/1/2020 2/2/2019 2/3/2018: Diluted Shares Outstandingso_levictorBelum ada peringkat

- IMT CeresDokumen5 halamanIMT CeresSukanya SahaBelum ada peringkat

- Jollibee Financials Show Rising Revenues and ProfitsDokumen4 halamanJollibee Financials Show Rising Revenues and ProfitsKevin CeladaBelum ada peringkat

- 17020841116Dokumen13 halaman17020841116Khushboo RajBelum ada peringkat

- FMA Project (ITC Valuation DCF)Dokumen40 halamanFMA Project (ITC Valuation DCF)Vishal NigamBelum ada peringkat

- Additional Information Adidas Ar20Dokumen9 halamanAdditional Information Adidas Ar20LT COL VIKRAM SINGH EPGDIB 2021-22Belum ada peringkat

- Apollo Tyres ProjectDokumen10 halamanApollo Tyres ProjectChetanBelum ada peringkat

- Analisa SahamDokumen10 halamanAnalisa SahamGede AriantaBelum ada peringkat

- Key Ratios 5yrs 3yrs Latest: Sales Other Income Total Income Total Expenditure Ebit Interest Tax Net ProfitDokumen2 halamanKey Ratios 5yrs 3yrs Latest: Sales Other Income Total Income Total Expenditure Ebit Interest Tax Net ProfitmohithBelum ada peringkat

- Chenab Limited Income Statement: Rupees in ThousandDokumen14 halamanChenab Limited Income Statement: Rupees in ThousandAsad AliBelum ada peringkat

- Afsr Projet (Shell) Final - 20p00053Dokumen48 halamanAfsr Projet (Shell) Final - 20p00053Halimah SheikhBelum ada peringkat

- Shree Cement DCF ValuationDokumen71 halamanShree Cement DCF ValuationPrabhdeep DadyalBelum ada peringkat

- Ambev Tabelas 4TRI16Dokumen82 halamanAmbev Tabelas 4TRI16Deyverson CostaBelum ada peringkat

- Wipro's Financial Performance Over 5 YearsDokumen9 halamanWipro's Financial Performance Over 5 Yearshitesh rathodBelum ada peringkat

- Principles of Cash Flow Valuation: An Integrated Market-Based ApproachDari EverandPrinciples of Cash Flow Valuation: An Integrated Market-Based ApproachPenilaian: 3 dari 5 bintang3/5 (3)

- List of Key Financial Ratios: Formulas and Calculation Examples Defined for Different Types of Profitability Ratios and the Other Most Important Financial RatiosDari EverandList of Key Financial Ratios: Formulas and Calculation Examples Defined for Different Types of Profitability Ratios and the Other Most Important Financial RatiosBelum ada peringkat

- Securities Operations: A Guide to Trade and Position ManagementDari EverandSecurities Operations: A Guide to Trade and Position ManagementPenilaian: 4 dari 5 bintang4/5 (3)

- LN08 Smart3075419 12 FI C08Dokumen35 halamanLN08 Smart3075419 12 FI C08trevorsum123Belum ada peringkat

- After Transform Into Log NPL and DerDokumen3 halamanAfter Transform Into Log NPL and DerTikah ZaiBelum ada peringkat

- Chapter 11Dokumen49 halamanChapter 11Tikah ZaiBelum ada peringkat

- Raw Data Islamic Bank Capital StructureDokumen10 halamanRaw Data Islamic Bank Capital StructureTikah ZaiBelum ada peringkat

- Impact of Systemic Risks On Islamic Banks PerformanceDokumen10 halamanImpact of Systemic Risks On Islamic Banks PerformanceTikah ZaiBelum ada peringkat

- In RM Million Unless Otherwise Stated: 2018 MfrsDokumen4 halamanIn RM Million Unless Otherwise Stated: 2018 MfrsTikah ZaiBelum ada peringkat

- 5 Year Financial PlanDokumen29 halaman5 Year Financial PlanFrankieBelum ada peringkat

- Rogue Trader WarrantDokumen8 halamanRogue Trader Warrantlocke_dragnarok100% (2)

- Team Project Unit 2 ToysDokumen4 halamanTeam Project Unit 2 ToysTikah ZaiBelum ada peringkat

- Oral TestDokumen1 halamanOral TestTikah ZaiBelum ada peringkat

- Excel Group Assignment FIN661Dokumen11 halamanExcel Group Assignment FIN661Tikah ZaiBelum ada peringkat

- Ar 2017Dokumen288 halamanAr 2017noniemoklasBelum ada peringkat

- Business Plan Karimi-Lake ToursDokumen25 halamanBusiness Plan Karimi-Lake ToursJoseph IbukahBelum ada peringkat

- MODULE IN Special Topics in Finance CORRESPONDENCEDokumen78 halamanMODULE IN Special Topics in Finance CORRESPONDENCETaylor Tomlinson100% (12)

- B. Cross-Functional: Bài 01: Introduction To Business ProcessesDokumen81 halamanB. Cross-Functional: Bài 01: Introduction To Business ProcessesTrương Quốc PhongBelum ada peringkat

- Opening Day Balance SheetDokumen1 halamanOpening Day Balance SheetKristina HurelychBelum ada peringkat

- Financial Analysis ProjectDokumen21 halamanFinancial Analysis Projectapi-464140568Belum ada peringkat

- Chapter 18Dokumen27 halamanChapter 18Dr Bhadrappa HaralayyaBelum ada peringkat

- Project Report On Working Capital ManagementDokumen76 halamanProject Report On Working Capital ManagementVikas Dalvi100% (1)

- 47556238-6404-4a0a-b914-b45f674ba6d1Dokumen6 halaman47556238-6404-4a0a-b914-b45f674ba6d1dilip kumarBelum ada peringkat

- Business Plan TemplateDokumen19 halamanBusiness Plan Templateloganathan89Belum ada peringkat

- ADVACC Corporate LiquidationDokumen4 halamanADVACC Corporate LiquidationKim Nicole ReyesBelum ada peringkat

- CA Inter FM ECO Question BankDokumen495 halamanCA Inter FM ECO Question BankHarshit BahetyBelum ada peringkat

- Financial Accounting The Impact On Decision Makers 10th Edition Porter Solutions ManualDokumen41 halamanFinancial Accounting The Impact On Decision Makers 10th Edition Porter Solutions Manualhildabacvvz100% (27)

- American Home Products EssayDokumen7 halamanAmerican Home Products EssayYanbin CaoBelum ada peringkat

- Simple Asset Purchase AgreementDokumen6 halamanSimple Asset Purchase AgreementFashan PathiBelum ada peringkat

- Solved Problems: OlutionDokumen5 halamanSolved Problems: OlutionSavoir PenBelum ada peringkat

- Business Finance: Introduction To Financial ManagementDokumen20 halamanBusiness Finance: Introduction To Financial Managementjean.marie arceliBelum ada peringkat

- Review of Financial StatementDokumen20 halamanReview of Financial StatementFebBelum ada peringkat

- Group - I Paper - 1 Accounting V2 Chapter 6Dokumen34 halamanGroup - I Paper - 1 Accounting V2 Chapter 6shadowbig535Belum ada peringkat

- Guide to Oil, Gas & Mining Interview QuestionsDokumen34 halamanGuide to Oil, Gas & Mining Interview QuestionsalexBelum ada peringkat

- Understanding Key Concepts of Equity FinancingDokumen34 halamanUnderstanding Key Concepts of Equity FinancingCzarina Panganiban100% (1)

- Indus Motor Ratio AnalysisDokumen4 halamanIndus Motor Ratio AnalysisNabil QaziBelum ada peringkat

- Australia's Trade and Financial FlowsDokumen7 halamanAustralia's Trade and Financial Flowsatiggy05Belum ada peringkat

- Introduction to Accounting and Business Chapter 1Dokumen51 halamanIntroduction to Accounting and Business Chapter 1Gelyn Cruz50% (2)

- Annual Enterprise Survey 2021 Financial Year Provisional 1Dokumen3 halamanAnnual Enterprise Survey 2021 Financial Year Provisional 1Harden CraterBelum ada peringkat

- Lesson 1: Lesson 5:: Asian Institute of Computer StudiesDokumen28 halamanLesson 1: Lesson 5:: Asian Institute of Computer StudiesCarmelo Justin Bagunu AllauiganBelum ada peringkat

- IPSAS in Your Pocket August 2015Dokumen59 halamanIPSAS in Your Pocket August 2015Yohana MonicaBelum ada peringkat

- Investment Analysis - Sadhana Nitro Chem (30 Bagger Stock) - Candor InvestingDokumen18 halamanInvestment Analysis - Sadhana Nitro Chem (30 Bagger Stock) - Candor InvestingSam vermBelum ada peringkat

- Sears Vs Walmart - ExcelDokumen11 halamanSears Vs Walmart - ExcelTamas OberoiBelum ada peringkat

- FM2 Cheat Sheet From CREsDokumen2 halamanFM2 Cheat Sheet From CREstrijtkaBelum ada peringkat

- FAR22 Share-Based Payments - With AnsDokumen8 halamanFAR22 Share-Based Payments - With AnsAJ Cresmundo29% (7)